A cashflow forecast is a comprehensive financial model used to tracks a business’ access to cash. The model shows where your inflows and outflows of cash will be going for the next 13 weeks. The main goal of a cashflow forecast is to assist with managing liquidity within an organization, ensuring that the business has the necessary cash to meet its obligations, such as payroll and bills, to avoid funding options. Your forecast will be more accurate in the first several weeks than it will be near the end of the forecast.

To keep everything up to date, the forecast should be updated weekly. A cashflow forecast can help you determine how to move forward with your business. You can use your forecast make the best decisions for your company and its finances. There are several guidelines to follow when assessing your cashflow in order to make smarter business decisions and increase financial visibility:

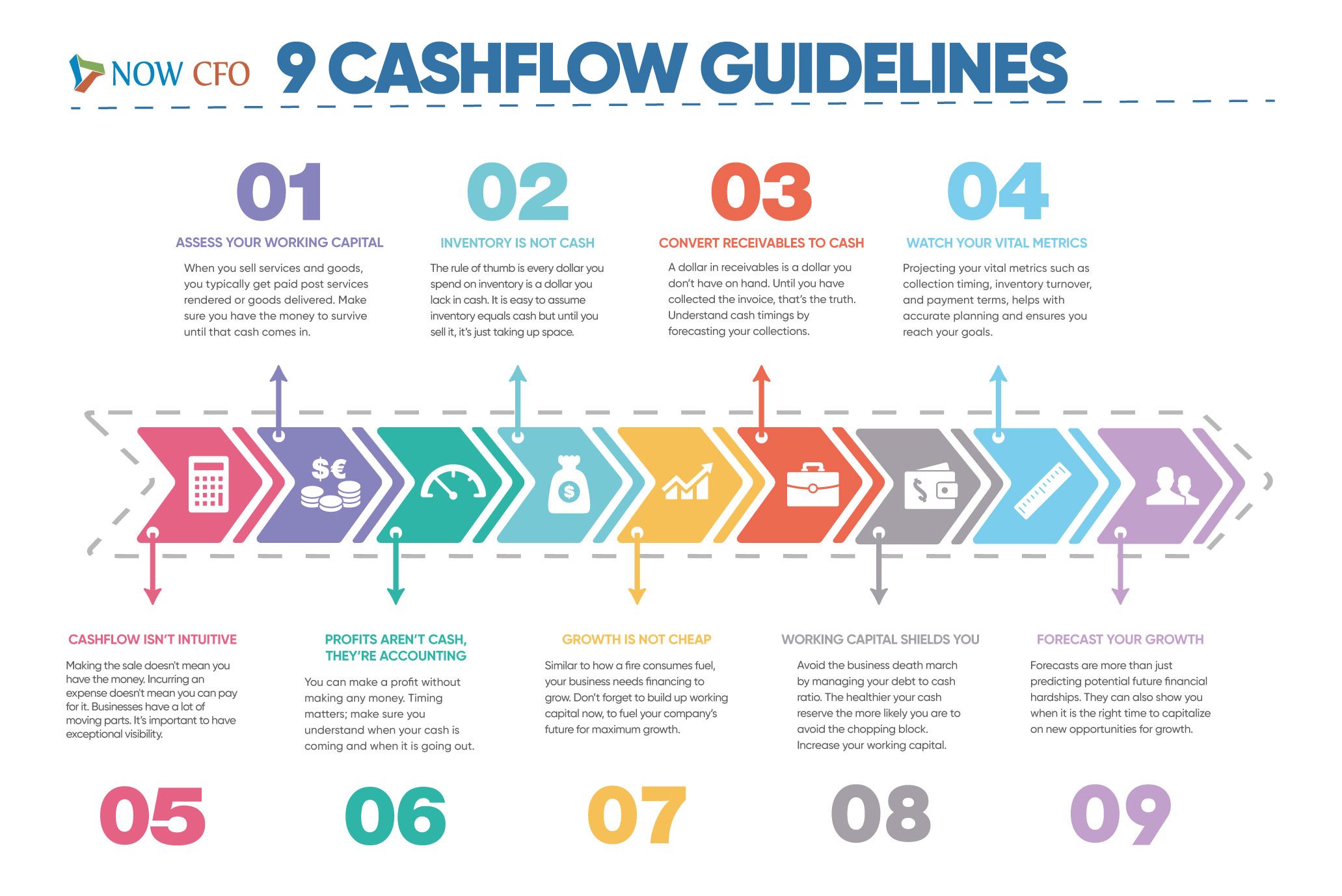

1. ASSESS YOUR WORKING CAPITAL

When you sell services and goods, you typically get paid post services rendered or goods delivered. Make sure you have the money to survive until that cash comes in. Cash in is more difficult to time accurately since the business essentially must guess or estimate when their clients/customers will pay them.

The cashflow forecast will track your inflows and outflows, which is crucial to understanding your breakeven point and modifying your business plan to accommodate the new economic landscape. It will also account for any existing debt you have and any interest payments on that debt. This allows for short-term liquidity planning and long-term budgeting.

2. INVENTORY IS NOT CASH

The rule of thumb is every dollar you spend on inventory is a dollar you lack in cash. It is easy to assume inventory equals cash but until you sell it, it is just taking up space. It is important to know how much inventory you have, what the forecasted demand is, and how to balance inventory and demand.

3. CONVERT RECEIVABLES TO CASH

A dollar in receivables is a dollar you do not have on hand until you have collected the invoice. Cash in accounts receivable means less working capital. Do not be unprepared. Understand cash timings by forecasting your collections. It is important to know how many days your AR is outstanding, how fast you invoice and what your collection procedures are.

4. WATCH YOUR VITAL METRICS

Projecting your vital metrics such as collection timing, inventory turnover, and payment terms help with accurate planning, and ensures you reach your goals.

5. CASHFLOW ISN’T INTUITIVE

Making a sale does not mean you have the money. Incurring an expense does not mean you can pay for it. Simplify things by shortening your inventory cycle, tracking current and upcoming expenses, and creating accurate sales projections.

Making the sale does not mean you have the money. Incurring an expense does not mean you can pay for it. It is important to have exceptional visibility.

6. PROFITS AREN’T CASH, THEY’RE ACCOUNTING

You can make a profit without making any money. Timing matters: make sure you understand when your cash is coming and when it is going out. When you pay your bills, but your customers do not, it can affect your profits. Stay out of the red by planning to pay your bills on time, know when your customers are paying you, and keeping your cashflow projections up to date.

7. GROWTH IS NOT CHEAP

Similar to how a fire consumes fuel, your business needs financing to grow. Do not forget to build up working capital now, to fuel your company’s future for maximum growth.

The faster you grow, the more financing you need. Building your working capital to grow. Ask yourself, what is your growth equation, what are the growth goals, and will you need financing to grow.

8. WORKING CAPITAL SHIELDS YOU

Working capital is money in the bank and cash is king. Make sure your business is well defended by knowing your safety plan, days your business can last without revenue, and if you have a line of credit available.

Avoid the business death march by managing your debt to cash ratio. The healthier your cash reserve the more likely you are to avoid the chopping block. Increase your working capital.

9. FORECAST YOUR GROWTH

Cashflow forecasting is the crystal ball of business. Showing you when to be proactive in your business. Forecasts are more than just predicting potential future financial hardships. If you have passed on opportunities due to finances, experienced financial stress, or been blindsided by unforeseen complications, then this may tell you that it is the right time to capitalize on new opportunities for growth.