Amid growing complexity in financial operations, many businesses are overwhelmed by in-house accounting demands. As of 2024, 30% of companies outsource their accounting to access agility and expertise.

What is an Outsourced Accounting Service?

Outsourced accounting services are utilized when businesses delegate finance and bookkeeping tasks to external firms or professionals rather than handling them in-house. These providers manage business accounting, payroll, tax prep, bank reconciliations, and financial reporting, acting as an on-demand accounting department.

How Outsourced Accounting Differs from Traditional In-House Teams

Companies hire full-time accountants in a traditional in-house model, building internal infrastructure and handling recruitment, training, and benefits. With outsourced accounting, business owners can access high-level expertise on a scalable basis, paying only for the needed services.

Firms benefit from automated processes, real-time dashboards, and enhanced compliance intelligence without overhead burdens. This difference highlights why hiring an outsourced accounting service rather than investing in a budget-draining internal team is wise.

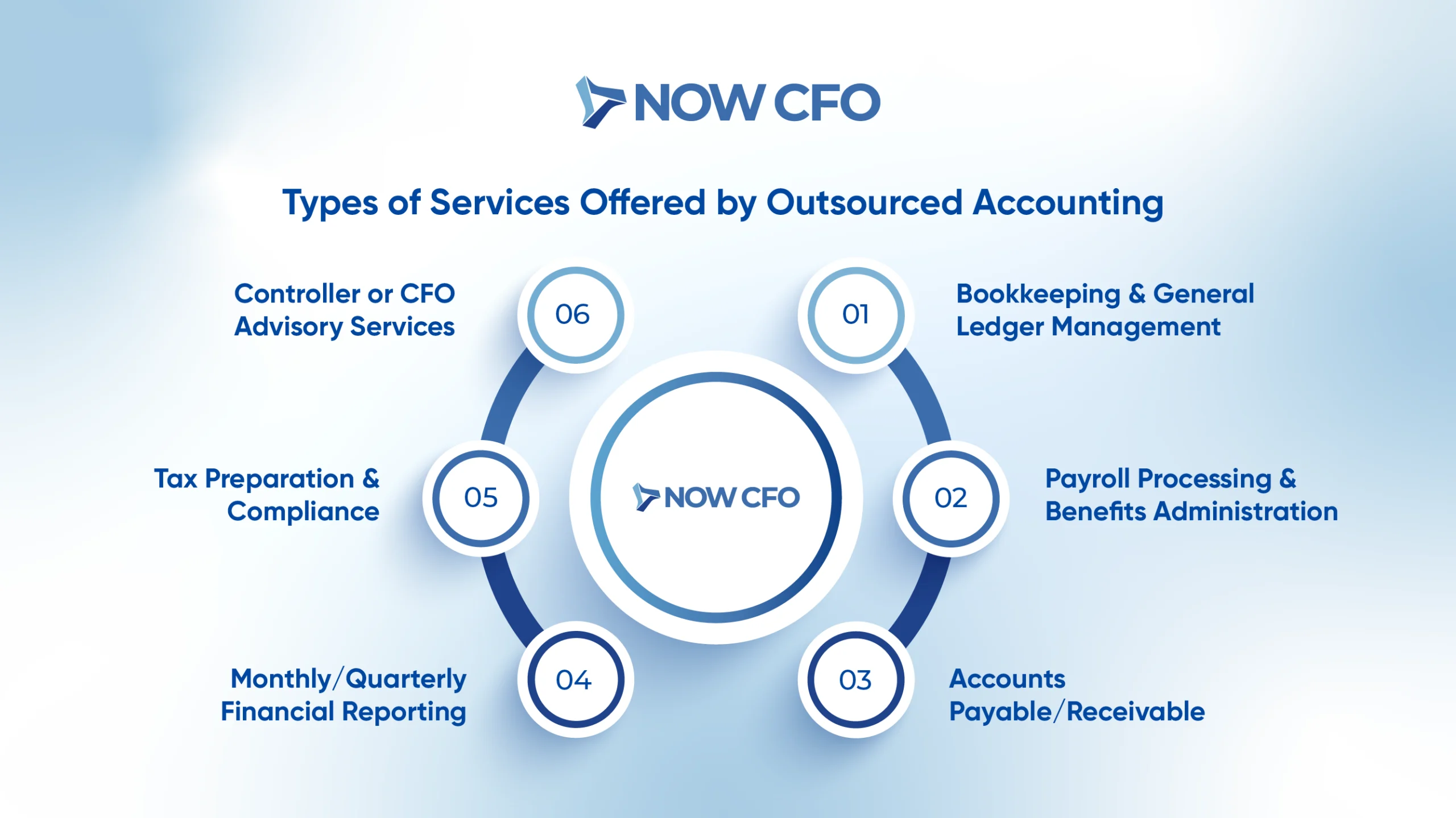

Types of Services Offered by Outsourced Accounting

Most outsourced providers bundle key accounting services tailored to each client’s needs. Shared services typically include:

Financial Benefits of Hiring an Outsourced Accounting Service

Lower Overhead and Payroll Costs

Outsourced accounting eliminates the need for full-time hires, reducing costs for salaries, benefits, training, and office space. Companies can scale finance support on demand, substituting fixed overhead with variables, aligned to business activity.

Predictable and Scalable Pricing

Outsourced providers offer pricing models that make budgeting predictable. Businesses avoid unexpected costs associated with overtime, turnover, or training needs.

As companies grow or scale back, they can seamlessly upgrade or downgrade services without salary adjustments, ensuring they only pay for what they need. This drives cost-effective financial services for businesses and supports small business accounting scalability.

Avoiding Costly Accounting Errors

Common safeguards include:

- Multiple-level review processes

- Month-end reconciliations

- Software-backed error detection

- Regular audit-prep procedures

Improved Cash Flow Visibility

An outsourced partner enhances cash flow management through timely reporting and forecasting tools. Access to cloud-based dashboards allows decision-makers to react proactively.

With better visibility, businesses optimize payables, receivables, and working capital levels, empowering real-time insights, fostering strategic benefits, and more informed executive decision-making.

Key improvements include:

- Weekly cash flow snapshots

- Rolling 13-week cash forecasts

- Alerts on liquidity risks

- Scalable financial insights

Learn More: Hire an outsourced accounting service for your business

Operational Benefits of Outsourced Accounting

Outsourced accounting benefits extend beyond finance, boosting efficiency, talent access, and leadership bandwidth while integrating tech-smart tools.

Faster Month-End Close and Reporting

Outsourced providers streamline accounts reconciliation and financial close processes using standardized workflows and automation. This reduces cycle time dramatically, letting companies finalize monthly books within days instead of weeks.

Access to Top Accounting Professionals

Outsourcing gives you immediate access to experienced professional CFOs, controllers, and accountants. Benefits include:

- Specialized expertise across industries.

- Senior-level advisory on strategy, taxes, and compliance.

- Cross-company best practices from diverse clients.

- Continuity and depth, avoiding disruption if staff leave.

Integration of Cloud-Based Tools and Systems

Outsourced accounting partners use advanced cloud-based tools to connect accounting platforms, CRMs, and banks. They implement scalable accounting systems with real-time data, secure remote access, and automated workflows.

This integration empowers business leaders with synchronized financial data, enabling strategic benefits through a virtual accounting service model.

Reduced Time Burden for Leadership

Delegating accounting to experts frees executives to focus on growth, operations, and strategy. With regular, accurate financial reports, leadership spends less time reviewing internal statements and more time driving value. Indeed, outsourcing enhances efficiency while boosting leadership focus.

Strategic Benefits of Outsourced Accounting

Building on efficiency and expertise, outsourced accounting services extend into strategic growth avenues, empowering businesses with timely insights, expert support, and scalable frameworks tailored to evolving needs.

Real-Time Insights for Better Decision-Making

When you outsource, you access live financial dashboards and actionable analytics. These capabilities transform financial data into strategic tools, fueling predictive decision-making and operational agility.

- Instant revenue vs. budget comparisons

- Variance alerts for fast response

- KPI trend tracking across cash flow, margins, and growth

Support During Fundraising, Audits, or Tax Season

Outsourced accounting teams bolster critical financial milestones with deeper resources and experience:

Outsourced Accounting Team in Key Financial Events

Fundraising Preparation

- Compiles investor-ready financial reports

- Model projections for valuation discussions

- Ensure GAAP/IFRS compliance for due diligence

Audit Readiness

- Maintain reconciliation documentation

- Provide organized trial balances

- Liaise with external auditors

Tax Season Efficiency

- Prepare accurate tax schedules

- Integrate real-time data to meet deadlines

- Leverage tax credits and opportunities

Scalable Solutions That Grow with Your Business

Outsourced accounting adapts alongside your business, expanding services as transaction volumes rise or scaling back in slower periods. There’s no need for hiring sprees; your virtual accounting service flexes with demand.

Proactive Financial Strategy Support from Experts

Beyond bookkeeping, outsourced teams often include advisors who help shape financial strategy. They suggest budgeting frameworks, growth capital planning, margin optimization tactics, and risk mitigation.

Learn More: Outsourcing accounting growth

Benefits for Startups and Small Businesses

Outsourced accounting services are especially valuable for startups and small companies. They offer flexibility, talent access, and compliance safeguards without excessive costs.

Avoid Hiring Too Early

Startups often rush to hire in-house accountants before generating consistent revenue. Outsourcing accounting provides an outsourced accounting solution that scales with your activity, so you only pay for services you need.

This approach supports cost-effective financial services for businesses in their earliest stages, enabling resources to focus on core product development and market testing—without sacrificing accounting accuracy.

Access Enterprise-Level Talent Without the Cost

Using an outsourced firm, startups gain access to senior financial talent: CFOs, controllers, or tax experts. These professionals bring strategic experience and compliance knowledge that aligns with growing business needs.

In short, you benefit from virtual accounting service expertise comparable to enterprise firms.

Flexible, Tailored Services

Outsourcing allows small businesses to customize accounting packages according to their stage and complexity:

- Modular Offerings: Bookkeeping, payroll, CFO support, tax prep; choose only what you need.

- Seasonal Scaling: Expand services during peaks or fundraising rounds, then scale down during lean periods.

- Industry-Specific Customization: Providers adapt to your sector: SaaS, retail, professional services.

Peace of Mind with Compliance and Accuracy

Ensuring compliance and precise accounting is vital for startups. Outsourced teams implement:

- Updated regulatory compliance (e.g., GAAP, IRS)

- Regular internal audits and reconciliations

- Secure financial controls preventing errors and fraud

Common Misconceptions About Outsourced Accounting

Let’s tackle the top myths surrounding outsourced accounting and why they don’t withstand scrutiny.

It’s Only for Big Companies

Many believe outsourced accounting suits large firms, but small business accounting equally benefits. Outsourced services scale with you; there is no need for full departments.

Startups, SMBs, and solopreneurs leverage virtual finance teams for part-time CFO support. 70% of businesses outsource at least one business function, demonstrating that cost-effective financial services for businesses of all sizes include outsourced accounting.

You Lose Control of Your Finances

A common worry is losing visibility, but virtual accounting service models emphasize transparency. Real-time dashboards, frequent status calls, and shared logins maintain control. You determine permissions and review cycles while benefiting from expert processes, keeping you in charge of financial direction.

They’re Not as Reliable as In-House Teams

Skeptics argue outsourcing sacrifices reliability, but providers use multi-layer quality checks and standardized protocols. Firms employ certified accountants, enforce internal audits, and follow compliance frameworks, often outperforming small in-house setups.

It’s Expensive in the Long Run

Concerns about hidden long-term fees are valid, but the benefits of outsourced accounting services outweigh the costs. Providers offer tiered, transparent pricing, and you avoid salaries, benefits, recruitment, and software expenses.

How to Maximize the Benefits of Your Outsourced Accounting Partner

To leverage the benefits, businesses must proactively manage the relationship, aligning objectives, tracking progress, and optimizing engagement.

Set Clear Goals and Expectations

Begin by jointly defining objectives, scope, and KPIs. This clarity positions both parties for success.

- Outline deliverables (monthly closings, cash flow forecasts, tax filings).

- Agree on timelines (e.g., books closed by the 5th business day).

- Define responsibilities (who handles bank reconciliations vs. who approves).

- Establish performance indicators (error rates, timeliness, communication response time).

Regularly Review Performance Metrics

Track key metrics like close cycle time, error frequency, and budget accuracy. Quarterly reviews uncover improvement areas and shape adjustments. By analyzing these metrics, you also validate ROI and reinforce the business advantages of an outsourced remote finance team.

Leverage Their Full Range of Services

Engage providers across their full capabilities to maximize value.

- CFO Advisory: Scenario planning, cash flow modeling, growth strategy.

- Tax Optimization: Exploring credits, staying compliant with evolving regulations.

- Audit Support: Year-end preparation and documentation.

- Project-Based Services: Integration, system migrations, or financial implementations.

Maintain Open Communication

Foster a partnership through scheduled updates, shared dashboards, and transparency. When priorities shift, communicate with them early so the outsourced team can adapt. This ongoing dialogue sustains trust and ensures outsourced accounting remains aligned with evolving business objectives.

Conclusion

The benefits of hiring an outsourced accounting service increase as your business grows. By outsourcing, companies avoid premature hires, eliminate administrative burdens, and gain access to enterprise-level talent.

Ready to capitalize on these advantages with NOW CFO? Request a free outsourced accounting consultation to identify cost savings and process improvements.