Growing businesses often hit a point where financial complexity outpaces existing resources. When transaction volumes surge, regulatory requirements multiply, and reporting demands intensify.

According to the BLS, around 76% of establishments founded in 2021 survived their first year, underscoring the role of financial controls. Yet many founders wonder when to hire outsourced accounting services.

Recognizing the Signs You’ve Outgrown In-House Accounting

As your company scales, early warning signs reveal the need for external accounting help. Monitoring these indicators enables you to address issues before they hinder growth.

Your Books are Consistently Behind or Inaccurate

When ledgers fall weeks behind and reconciliations pile up, decision-makers lack reliable data. Inaccurate records lead to cash-flow surprises and compliance risks. Outsourcing brings systematic processes that restore accuracy and timeliness, directly addressing signs you need outsourced accounting.

You’re Relying Too Heavily on One Person For all Financial Tasks

Centralizing all finance functions, bookkeeping, payroll, and invoicing one individual creates a single point of failure. If that person is unavailable or lacks specialized skills, critical tasks stall. Outsourced teams distribute responsibilities across experts in tax, compliance, and forecasting, eliminating bottlenecks.

You Lack Visibility in Your Financial Performance

Sparse or outdated metrics make strategic planning nearly impossible. Without clear KPIs, you react to issues instead of anticipating them. Outsourced accounting delivers standardized dashboards, rolling forecasts, and variance analyses. With routine reports, you gain the foresight needed to optimize pricing, manage costs, and plan investments.

Your Business is Scaling Faster Than Your Accounting Team

When growth accelerates, existing staff struggle to keep pace.

Outsourced teams adapt instantly:

- Scale transaction processing during peak periods

- Integrate new revenue streams and cost centers seamlessly

- Provide interim support for software migrations or audits

- Maintain accuracy without long-term hires

Operational Triggers that Signal the Need for Help

As operations advance, your company encounters pivotal moments. Spotting these signals early allows you to act swiftly and keep your finance processes aligned with your growth.

Over 37% of SME outsource business processes, including accounting, to access specialized expertise without hiring in-house.

You’re Expanding to New Markets or Product Lines

When entering new markets or introducing product lines, financial complexity increases rapidly. Scaling operations often requires multi-currency management, tax compliance across jurisdictions, inventory tracking, and localized reporting. These demands typically strain in-house capabilities.

External accounting services offer specialist support in cross-border compliance, revenue recognition rules, and inventory costing. When expanding, it’s necessary to manage regulatory differences, cost structures, and financial risk.

Partnering with outsourced teams lets you adopt scalable accounting services that grow with your business. Companies often outsource their accounting to support expansion, tap specialized expertise that prevents compliance missteps, and maintain precise performance tracking.

You’ve Raised Capital or Secured Funding

After funding infusions, you face heightened financial accountability and reporting expectations. In-house teams often lack the bandwidth or expertise to manage investor reporting, covenant monitoring, and compliance obligations.

Outsourced accounting ensures structured financial governance and investor confidence by:

- Implementing GAAP-compliant financial statements

- Delivering regular board or investor reporting packages

- Monitoring debt covenants and liquidity ratios

- Supporting audits or due diligence for future rounds

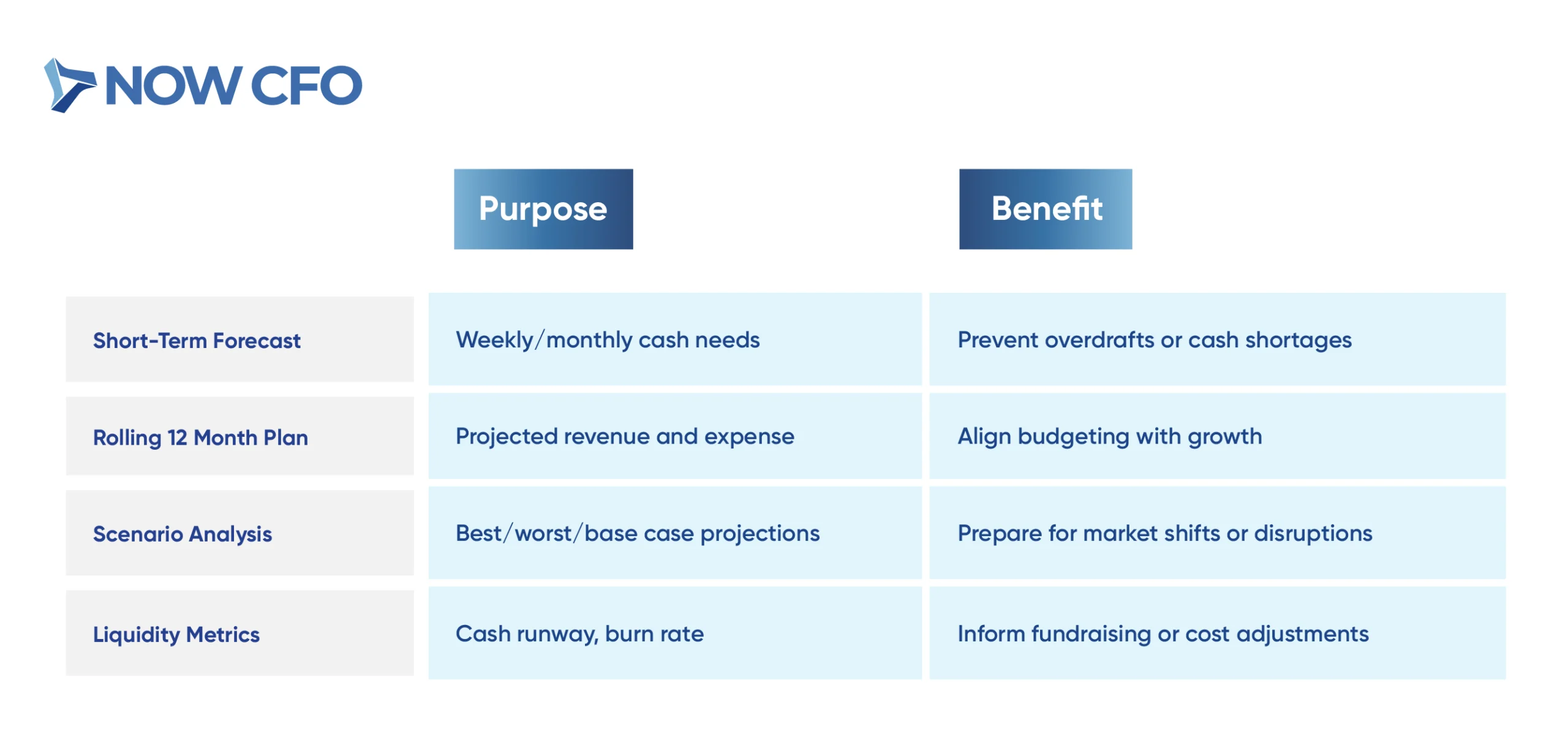

You Need Better Cash Flow Management and Forecasting

When your business moves beyond reactive bookkeeping, proactive financial planning becomes crucial. Lack of cash flow visibility can stall operations, affect payroll, or jeopardize capital access.

Outsourced accounting offers robust tools and processes: dashboards, rolling forecasts, scenario models, and variance analysis. These capabilities directly support better decision-making.

You’re Preparing for an Audit or Acquisition

When your business heads toward an audit or acquisition, transparency, accuracy, and documentation become non-negotiable. Internal systems that were adequate during early growth may prove insufficient under rigorous scrutiny.

Outsourced accounting ensures readiness through:

- GAAP-standardized financial statements

- Well-organized audit trails and ledgers

- Segregation of duties and documented internal controls

- Timely preparation of schedules (e.g. fixed assets, cap table, debt schedules)

Common Scenarios Where Outsourced Accounting Makes Sense

As situations evolve, business conditions clearly indicate the need for external accounting.

When Outsourced Accounting Makes Sense

Your Startup Doesn’t Have the Budget for a Full-Time Accountant

Tight startup budgets often cannot justify hiring a full-time accountant. When resources are limited, outsourcing delivers expert support without full-time payroll.

Outsourced accounting allows you to pay per service only when needed. You gain access to professionals working remotely, often via scalable accounting services models.

When budget is limited:

- Avoid full-time salary, benefits, and recruitment

- Access experienced professionals remotely

- Scale support up or down based on need

- Pay only for services required

Your Business is Experiencing Rapid Seasonal Fluctuations

Seasonal swings in revenue or expenses can overwhelm lean finance functions. Businesses dependent on holiday seasons or cyclical demand face unpredictable cash flow, staffing needs, and reporting volumes. In these cases, in-house bookkeeping often falls behind.

By bringing in outsourced accounting, you gain agility. Providers adjust capacity during spikes, manage payroll surges, and align reporting cycles with seasonal peaks. This support ensures timely billing, accurate reconciliation, and efficient close processes even during volatile periods.

You’re Switching Accounting Software or Systems

Transitioning to new accounting platforms or ERP systems presents complex data migration, process redesign, and training demands. In-house teams often lack the expertise or bandwidth to manage this without disrupting operations.

An outsourced accounting team brings structured change management; handling chart of accounts alignment, historical data mapping, vendor/customer record migration, and reporting redesign. They minimize downtime, ensure data accuracy, and train internal users.

You Need Expertise in GAAP, Tax Strategy, or Regulatory Compliance

When compliance demands grow, in-house staff lack specific knowledge. To avoid risk, access to specialized expertise is essential.

An outsourced accounting team offers:

- GAAP-compliant financial statements

- Strategic tax planning and optimized liabilities

- Knowledge of regulatory frameworks (e.g. state, IRS, industry)

- Support for audit inquiries and tax filing accuracy

Benefits of Making the Switch at the Right Time

Switching to outsourced accounting at the right moment ensures your finance operations support growth without delay. It positions your business to benefit from precision, expertise, and fiscal discipline.

Improved Financial Accuracy and Timeliness

When your books fall behind or errors multiply, it’s a clear sign your business need outsourced accounting services. Outsourcing brings dedicated professionals who process transactions in real time and deliver clean financial statements on schedule.

Incorrect or delayed reporting can damage credibility and decision-making. A GAO report noted that improper payments in FY 2023 were $236 billion, underlining the consequences of financial inaccuracy.

With outsourced teams, you achieve:

- Timely month-end closes

- Accurate ledgers and reconciliations

- Reduced risk of tax or regulatory mistakes

- Reliable data for decision-making

Access to a Full Team of Accounting Experts

Outsourcing accounting grants access to a multidisciplinary team that handles bookkeeping, tax strategy, forecasting, and compliance. You benefit from combined expertise without hiring multiple specialists.

This team-based model eliminates single-person risk and aligns with growth stages. Experts stay current on GAAP rules, regulatory changes, and best practices, ensuring your reporting meets professional quality.

Cost Savings Compared to Hiring Internally

Budget-conscious businesses often hesitate to build internal accounting capacity. Outsourced services convert fixed overhead into variable cost, so you pay only for what you need when you need it.

| Cost Category | In-House Hiring | Outsourced Accounting |

|---|---|---|

| Salary + Benefits | Full compensation, training, vacation | Service-based pricing |

| Infrastructure, software | Add office space, software licenses, hardware | Included in provider fees |

| Fluctuating demand | Underutilized during slow periods | Scale up/down easily |

| Training & Continuing Ed | Ongoing investment to maintain skills | Included via provider’s expert team |

Scalability Without Hiring New Full-Time Staff

As transaction volume grows or complexity increases, outsourced accounting scales effortlessly. Providers absorb seasonal spikes, new projects, or rapid growth without requiring permanent hires. 40% of companies choose outsourcing specifically for scalability and flexibility.

This flexibility allows you to access additional bookkeeping, forecasting, or compliance support as needed. Outsourced services adjust to your business cycle, aligning cost and effort with demand.

How Outsourced Accounting Aligns with Your Growth Stage

Your finance needs evolve as your business scales, and knowing when to engage outsourced support ensures smooth, adaptive financial management.

Early-Stage: Focused on Bookkeeping and Compliance

At the early stage, precision in recordkeeping and adherence to regulations are critical. Outsourced accounting solidifies your foundation by maintaining accurate bookkeeping, managing payroll and tax filings, and ensuring compliance from day one. This structured support allows you to focus on launching growth initiatives.

Growth-Stage: Strategic Forecasting and Reporting

As your company transitions into the growth phase, forecasting becomes vital. Outsourced accounting teams build customized financial models, provide variance analysis, and deliver clear performance reports. These tools empower leaders with insight into margin trends, cash flow projections, and revenue drivers.

Expansion-Stage: Audit Prep and Advanced Financial Modeling

When expanding a business, you require sophisticated financial frameworks. Outsourced accounting handles detailed audit preparation, advanced scenario modeling, GAAP-aligned reporting, and extensive documentation. This ensures readiness for due diligence and scalable complexity while maintaining control and accuracy.

Avoiding the Risks of Waiting Too Long to Outsource

Recognizing the moment your business needs outsourced accounting services helps prevent costly issues.

Compliance Issues or Late Filings

Delaying outsourcing often leads to compliance failures and late filings, resulting penalties and reputational damage. Timely tax returns, payroll filings, and regulatory reports demand consistent accuracy and deadlines.

By outsourcing, you gain:

- Professional oversight ensuring accurate, GAAP-compliant reports

- Scheduled filing reminders and expert handling of deadlines

- Reduced risk of IRS penalties or state-level violations

- Expert coordination for sales tax, payroll tax, and annual returns

Missed Growth Opportunities Due to Poor Financial Insights

When financial visibility lags, you miss critical growth insights. Delays in understanding profit margins, cost drivers, or customer profitability restrict strategic decisions.

Outsourced accounting provides:

- Real-time dashboards and KPI reporting

- Actionable insight into cash flow, margins, and trends

Burnout Among In-House Staff

When your internal team struggles under financial workloads, burnout is inevitable. Overloading staff leads to mistakes and morale decline.

Outsourced accounting alleviates pressure by distributing the workload across experts. With scalable services, you avoid overtaxing internal bookkeepers. Teams manage busy periods, audits, or demand surges without overwhelming internal resources. This structural balance ensures sustainable operations and avoids turnover caused by overwork.

Increased Risk of Fraud or Internal Error

When in-house processes remain informal or depend on one individual, risk grows.

Outsourcing helps by:

- Implementing segregation of duties across finance tasks

- Documenting workflows and audit trails systematically

- Conducting periodic reconciliation and review by independent professionals

- Enforcing standardized controls and approval chains

Why NOW CFO Is the Right Partner for Your Business

Choosing the right outsourced partner allows your financial operations to grow seamlessly. NOW CFO delivers customized solutions built around your specific business needs, combining expertise with adaptable support.

Industry-Specific Outsourced Accounting Teams

NOW CFO assembles teams with deep experience in your sector. Our specialists understand industry nuances, regulatory demands, and key performance metrics, so your financial reporting meets the highest standards.

Key features:

- Sector-tailored chart of accounts and KPIs

- Compliance with industry-specific regulations (e.g., HIPAA, SOX)

- Benchmarks drawn from similar companies

- Timely insight into cost structures and revenue drivers

Scalable Solutions from Bookkeeping to CFO Support

Whether you need basic outsourced bookkeeping for growing businesses or strategic CFO advisory, NOW CFO flexes to match demand.

Service spectrum:

- Daily bookkeeping and bank reconciliations

- Monthly management reports and variance analysis

- Cash-flow modeling and rolling forecasts

- Fractional CFO support for strategic planning

Proven Track Record with Businesses at Every Stage

Across startups, growth-stage firms, and mature enterprises, we have guided clients through fundraising, scaling, and exit events. Our case studies show average client EBITDA improvement within the first year of engagement.

Educational institutions and nonprofits also benefit from our compliance-focused services, demonstrating versatility across organizational types. Clients cite faster close cycles, cleaner audits, and more insightful forecasting as hallmarks of our partnership.

Conclusion

Knowing the right moment to transition to external support can make or break momentum. If you recognize the red flags, NOW CFO offers the expertise and flexibility you need. Our outsourced accounting services deliver industry-tailored processes, scalable bookkeeping, and CFO advisories.

Ready to transform your financial operations? Schedule a complimentary strategy session to discuss how outsourced solutions can power your next growth chapter. Empower your business with precision, insight, and agility today.