Nearly 50% of businesses fail within their first five years due to poor financial management and a lack of forecasting or capital planning. Therefore, evaluating the CFO service vs an in‑house CFO decision becomes crucial for founders seeking stability and agility.

Right financial leadership helps drive cash flow optimization, strategic growth, and investor preparedness. A clear understanding of in‑house CFO, outsourced CFO services, and the long-tail question enables leaders to create the strongest path forward. In this article, we will understand CFO Service Vs In-House CFO and which fits your business.

Understanding the Role of a CFO

A business’s financial health depends on accounting accuracy and strategic direction. From forecasting and risk management to guiding capital strategy and enabling growth, the CFO bridges finance with executive leadership.

What Does a CFO Do?

The CFO delivers accurate, timely financial insight and ensures fiscal integrity across all operations. They oversee accounting systems, budgeting, internal controls, and reporting.

Here’s a quick bulleted breakdown of CFO tasks:

- Manages accounting, budgeting, and reporting systems.

- Oversees internal control, financial strategy, and resource optimization.

- Serves as a trusted advisor to executives and boards on financial planning and risk.

- Central to operational efficiency and strategic decision-making.

The CFO’s Strategic and Operational Responsibilities

It’s essential to examine the strategic and operational responsibilities CFOs manage daily.

- Sets budgets, forecasts performance, and aligns financial roadmaps with strategic goals.

- They oversee regulatory compliance, safeguard internal controls, and mitigate financial risks in operations.

- CFOs engage with investors, boards, and the C‑suite.

- They monitor liquidity, cash flow, and expense management.

Why Businesses Need CFO Leadership Today

CFO ensures companies thrive even in times of uncertainty.

- Align financial plans with fast‑evolving market and policy shifts.

- Install forecasting tools and systems to anticipate trends proactively.

- Build cash preservation frameworks, extend financial runway, and ready companies for growth or fundraising.

This leadership differentiates enterprises that survive from those positioned to scale. It’s often delivered through outsourced CFO services.

CFOs as Drivers of Growth and Stability

CFOs are key to a company’s growth and stability by aligning financial strategies with overarching business goals. They are critical in optimizing capital allocation, identifying growth opportunities, and mitigating financial risks.

Whether it’s M&A activity, expanding into new markets, or restructuring operations, CFOs ensure that growth initiatives are financially and strategically sound. At the same time, they establish robust controls and forecasting systems to maintain stability.

The Evolving CFO Role in Modern Companies

As the business evolves, CFO shift from a financial gatekeeper to a strategic partner.

- Guides the adoption of AI, automation, and analytics to optimize financial operations.

- Oversees ESG, IT investments, and cross-functional strategy.

- Collaborates directly with CEOs to shape long-term business direction and investor relations.

- Uses real-time financial data to inform agile, risk-aware decisions across departments.

- Builds scalable systems and processes to adapt to evolving market and organizational needs.

What are CFO Services?

CFO services refer to the specialized financial leadership and strategic guidance. These services support businesses in financial planning, forecasting, risk management, and long-term growth strategy.

Definition and Overview of Outsourced CFO Services

An outsourced CFO service delivers high-level financial leadership to businesses without requiring the cost or commitment of a full-time executive. These experts bring valuable experience in strategic planning, budgeting, and financial oversight.

By outsourcing, companies gain access to deep financial expertise at a fraction of the cost of hiring in-house. In fact, over 37% of U.S. SMEs outsource finance and accounting functions to improve efficiency and decision-making.

Types of CFO Services (Fractional, Virtual, Outsourced)

Businesses today can choose from various CFO service models based on their operational needs, growth stage, and financial complexity.

- Fractional: Businesses hire part-time, experienced CFOs who provide strategic financial oversight as needed.

- Virtual: A virtual CFO operates remotely using cloud systems to perform budgeting, forecasting, and financial advice on demand.

- Outsourced: Businesses engage external CFO professionals for comprehensive financial management, from reporting to strategic planning and risk mitigation.

Key Functions Performed by CFO Service Providers

CFO service providers take on core financial responsibilities that directly impact a business’s stability and growth. These professionals bring specialized expertise to support decision-making and ensure financial clarity across the organization.

- Drive financial planning and forecasting.

- Strengthen internal controls and risk management.

- Report to stakeholders and support strategic decisions.

Benefits of Using CFO Services for SMBs and Startups

Small businesses and startups often face resource limitations that make full-time financial leadership difficult to justify. CFO services bridge this gap by offering access to expert guidance tailored to a company’s current stage and future vision.

- Equip businesses with premium financial leadership at a fraction of the cost.

- SMEs and startups tap into expert financial strategy without needing to build a full team.

- Outsourced CFOs bring deep experience in compliance, financial forecasting, and risk management, enhancing business agility.

- CFO services scale with growth, supporting fundraising, budgeting, and expansion initiatives.

Limitations of Outsourced CFO Services

While outsourced CFO services offer flexibility and cost-efficiency, they can also present limitations.

- Providers may lack a deep understanding of internal culture and day‑to‑day operations.

- Shared or part‑time arrangements can delay critical decision‑making.

- External CFOs may not always have the authority or visibility to influence internal teams.

What Is an In-House CFO?

An in-house CFO is a full-time executive who works directly within a company to oversee all financial operations. This CFO role offers deep integration into the business, enabling real-time decision-making, long-term planning, and hands-on leadership over the finance team.

Definition and Role of a Full-Time CFO

An in-house CFO is a permanent executive within the organization who holds a key role on the C-suite leadership team. They manage core financial operations, including budgeting, compliance, capital planning, and risk assessment.

Beyond daily financial oversight, a full-time CFO provides valuable institutional knowledge that supports long-term strategy. Their constant presence ensures rapid responsiveness and stronger cultural integration across the business.

Core Responsibilities and Daily Functions

An in-house CFO’s core responsibilities span strategic leadership and hands-on financial management, ensuring stability and growth.

- Drive budgeting and forecasting to support strategic decision-making.

- Monitor liquidity, optimize investment decisions, and secure funding when needed.

- Adhere to financial standards such as GAAP and SOX.

- Establish frameworks to safeguard assets and mitigate financial risks.

- Present financial insights, support strategic planning, and align fiscal actions with business objectives.

Strategic Advantages of Having an In-House CFO

In‑house CFOs develop an intimate understanding of company culture, history, and dynamics, enhancing strategic alignment. Embedded within the executive team, an in‑house CFO responds swiftly to shifting priorities.

In-house CFOs also owns outcomes directly, and support robust in‑house CFO responsibilities such as compliance, risk management, and stakeholder engagement. Moreover, permanent placement ensures continuity in financial planning and regulatory.

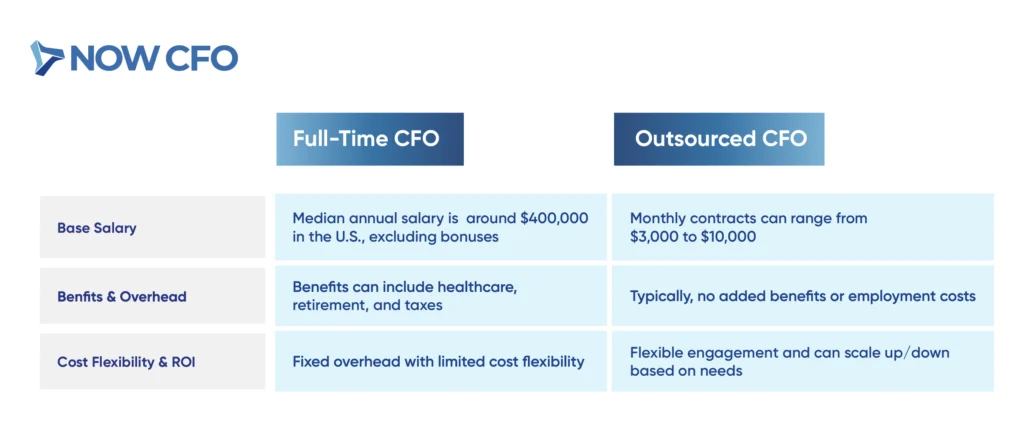

Costs and Compensation of Hiring a CFO

Understanding the costs of hiring a CFO is essential for comparing long-term financial commitments against the flexibility of outsourced alternatives.

Limitations of Relying Solely on an In-House CFO

Despite their advantages, there are clear limitations to relying solely on an in-house CFO.

- In‑house CFOs excel in core financial functions but can lack expertise in niche areas like tax strategy, risk mitigation, or industry‑specific regulation.

- Relying on a single full‑time CFO risks disruption if they exit.

- Full‑time CFOs carry significant salary, benefits, and overhead costs.

CFO Services vs In-House CFO: Key Differences

Outsourced CFO services provide scalable support tailored to evolving business needs, often at a fraction of the cost of a full-time executive. An in-house CFO offers deeper cultural alignment, constant availability, and direct leadership influence.

Cost Comparison and ROI

Hiring an in‑house CFO typically costs organizations around $400,000 plus benefits annually. In contrast, outsourced CFO services range from $3,000 to $10,000 per month.

Besides, outsourced options offer a lower entry point while delivering strategic financial guidance. Moreover, return on investment accelerates when outsourced CFOs improve forecasts and budgeting efficiency.

Flexibility and Scalability of Services

Outsourced CFO services deliver exceptional flexibility, scaling support up or down precisely as business cycles demand. Clients access CFO-level guidance without long-term commitments, crucial when needs vary month-to-month.

Depth of Expertise and Industry Knowledge

Evaluating the depth of expertise and industry knowledge shows clear differences between outsourced and in-house CFOs. Each brings distinct strengths in skill range and specialization that impact business outcomes.

- Frequently serve multiple sectors, enabling them to import best practices and strategic insights from varied contexts.

- Regulated or technical industries gain value from outsourced CFOs with compliance, risk, and sector-specific financial modeling expertise.

- Many outsourced CFO come with decades of C‑suite experience across startup, scale‑up, and mature company phases..

- Businesses facing funding rounds, M&A, or regulatory shifts gain immediate access to experts.

Availability and Level of Involvement

Outsourced CFOs offer variable availability aligned with business cycles, but may not deliver continuous availability. Many operate on a project basis, covering key deliverables like funding preparation or month-end reviews.

On the other hand, an in‑house CFO provides constant presence. Participating in daily decision-making, immediate issue escalation, and direct team leadership.

High involvement and on-demand accessibility define in‑house CFO responsibilities. Whereas outsourced financial leadership offers flexibility, it comes with trade-offs in terms of immediacy and immersion in company dynamics.

Strategic Alignment With Business Goals

Modern CFOs increasingly position themselves as strategic partners rather than just financial record keeper. Significant alignment between financial oversight and broader business objectives enhances organizational agility.

Additionally, an in‑house CFO often delivers deeper strategic alignment with business objectives. Besides, outsourced CFO services deliver strategic alignment in defined areas but may lack the continuous involvement to ensure comprehensive alignment across evolving company goals.

Learn More: Outsourced CFO vs In-House CFO

Which Option Is Right for Your Business?

Choosing CFO services vs an in-house CFO depends on your company. Startups and SMEs can benefit from the flexibility and lower costs of an outsourced CFO. While highly regulated companies may need an in-house CFO’s constant presence and cultural integration.

Factors to Consider: Size, Stage, and Industry

Several key factors are vital in determining whether outsourced CFO services or an in-house CFO is the right choice.

- Size (Revenue and Employees): Small businesses with limited revenue often rely on lean structures.

- Stage (Startup vs Mature): Early-stage companies typically need flexibility and strategic cash-flow guidance without full-time overhead.

- Industry (Regulation and Complexity): Heavily regulated or technical sectors, like healthcare or manufacturing, benefit from deep industry knowledge of an in‑house CFO.

Questions to Ask Before Making a Decision

Asking the right questions before choosing between CFO services and an in-house CFO ensures that the decision aligns with your business’s unique needs.

- What stage is my business at?

- What are my financial priorities right now?

- How important is cultural fit and daily accessibility?

- Can we clearly define deliverables and success metrics?

- Does the candidate/service have proven experience in my industry or stage?

When CFO Services Make More Sense

Rapidly growing small businesses often lack internal capacity for complex financial leadership. Early-stage founders frequently face bandwidth constraints managing investor relations, planning fundraises, and implementing forecasting systems.

An outsourced CFO service offers timely, strategic, and cost-effective support. Real-time scenario modeling, investor-ready reporting, and systems setup become accessible without the long-term payroll burden.

When an In-House CFO is the Better Fit

An in-house CFO becomes stronger when a business requires continuous leadership, deep organizational integration, and long-term strategic alignment. Companies with complex structures or heavy regulatory requirements benefit from a dedicated executive who can manage complex compliance requirements and challenges.

Full-time CFOs also provide stability in succession planning and maintain institutional knowledge critical for growth. Their daily presence fosters cultural alignment, ensures accountability, and strengthens cross-department collaboration.

Combining Models for Maximum Impact

Organizations using hybrid operating models, combining third-party providers and in-house captives, report greater impact across business outcomes. Hybrid setups enable scalable support and deeper alignment, helping businesses adapt without sacrificing oversight.

Conclusion

Choosing between a CFO service vs in-house CFO comes down to balancing cost, flexibility, expertise, and alignment with long-term goals. For scalability, specialized insights, and freedom from full-time hiring, outsourced CFO service is better.

If your organization is weighing these options, NOW CFO offers a free tailored consultation. Reach out today to explore which path is the right fit for your company’s future.