Companies seeking sustainable growth cannot rely solely on instinct. That’s why knowing how to choose the right CFO services matters more than ever.

Besides, firms with fewer than 20 employees spend more per employee on tax compliance than larger firms. Additionally, a well-chosen CFO service provides strategic insights and future-focused financial planning to support long-term success.

Understanding the Role of CFO Services in Sustainable Growth

To know how to select the right CFO services, it’s crucial to understand what CFO services involve.

Defining CFO Services and Their Scope

When you choose the right CFO services, you engage professionals who deliver various strategic CFO services. This will include financial strategy development, forecasting, budgeting, cash flow, risk management, cost control, and M&A support.

This comprehensive scope empowers you to benefit from sustainable growth with CFO services. An external CFO integrates these functions without the cost of a full-time executive.

How CFO Services Support Business Accounting and Operations

Here’s how choosing the right CFO services enables robust support for your accounting processes and operational efficiencies, aligning financial operations with strategic goals.

- Accurate Record-Keeping: CFO services establish standardized protocols for bookkeeping, reconciliation, and transaction logging.

- Cash Flow Management: They implement tools and processes to monitor inflows and outflows.

- Routine Operational Tasks: Through technology integration, CFOs often introduce automation for recurring operations, like AP, payroll processing, and monthly close.

- Reporting and Compliance: CFO Services creates comprehensive, timely reports for management, investors, and regulators.

- Strengthen Internal Controls: They also assess risk and implement internal checks like division of duties, oversight mechanisms, and authorization workflows.

- Strategic Operational Planning: CFO services bridge daily operations with broader strategic objectives like scaling, expansion, or mergers.

The Link Between CFO Services and Accurate Financial Statements

Next, we examine how choosing the right CFO services directly enhances the precision of your financial statements.

So, the main thing is that with the right CFO, you secure experts who apply precision across your financial records. They also ensure your balance sheets, income statements, and cash flow statements reflect true business performance.

Moreover, these service boosts financial accuracy by managing reconciliations, reviewing journal entries, and validating data. This clarity empowers you with credible insights for sustainable growth with CFO services.

Why Internal Controls Matter for Long-Term Success

Let’s explore how choosing the right CFO services ensures robust internal controls.

You can choose the right CFO services with effective internal controls.

- Protects physical and financial resources from theft or misuse.

- Identify and correct inaccuracies quickly, ensuring financial integrity.

- Support accurate financial statements, helping sustainable growth, and investor trust.

- Ensure following with laws and standards like Sarbanes‑Oxley and GAO frameworks.

- Build confidence for long‑term planning, expansion, and capital‑raise readiness.

The Role of Modeling and Forecasting in Growth Planning

Many business leaders today say that accurate forecasting is essential for strategic decision‑making. So, when you choose CFO services, modeling and forecasting empower growth planning by:

- Estimates income to support budgeting and capital‑raising decisions.

- Model best‑and worst‑case outcomes for informed strategic choices.

- Align investments with areas offering the highest returns for long‑term growth.

- Provide clear, data‑driven forecasts that attract funding.

- Support decisions on scaling, new markets, and M&A readiness.

Key Factors to Consider When Choosing CFO Services

After understanding the role of CFO services, the next step is to assess their industry experience and relevant case studies.

Industry Experience and Relevant Case Studies

It’s important to understand industry variation. Because financial frameworks, compliance norms, and performance indicators vary across sectors. For example:

- In tech startups, CFOs must comply with SaaS revenue recognition standards (ASC 606).

- While manufacturing CFOs manage complex inventory accounting and operational efficiencies.

- Service-based firms focus on labor and overhead efficiency; product businesses optimize supply chain and material costs.

- Seasonal retailers require different cash flow forecasting than subscription-model firms with recurring revenues.

When evaluating CFO services, you need to review examples that demonstrate:

- CFO services that guided a company through annual growth.

- Documented support in preparing a business for successful debt financing.

- Instances where the CFO expert has improved gross margins by implementing cost-control policies.

Knowledge of SEC Compliance and Reporting Requirements

Proper SEC compliance knowledge is vital to maintain credibility and avoid costly penalties. In FY 2023, the SEC filed 784 enforcement actions, an 8% rise from the prior year. The table below shows how CFO services support these critical areas.

| SEC Compliance Area | CFO Services Requirements |

| Forcing Action Awareness | Prevents fines by staying alert to enforcement trends |

| Recordkeeping Requirements | Robust policies meet federal recordkeeping mandates |

| Timely Filing Discipline | When you choose the right CFO services, you support compliance and reduce legal exposure |

| SOZ Readiness | They implement SOX-compliant internal controls and align strict corporate governance standards |

| Cybersecurity Compliance | Integrates the SEC’s cybersecurity disclosure rules |

| Risk Management | Monitor changing rules and coordinate with legal teams. |

Proficiency in Annual Operating Plans and Budget Management

When you look for the right CFO services, you secure experts who:

- Build detailed yearly plans that match your business growth and funding goals.

- Keep your budgeting flexible by updating it regularly instead of once a year.

- Watch expenses closely and compare them to your budget to catch problems early.

- Track performance using clear dashboards that show how you’re doing against budget goals.

- Get ready for investors by showing strong, honest financial plans that match your business goals.

Capability in Bookkeeping and Payroll Services Integration

Always choose the right CFO services, their expertise in integrating bookkeeping and payroll services becomes key for scalable operations. These services connect payroll systems with accounting ledgers, processing transactions consistently and accurately.

It also supports regulatory compliance by maintaining accurate payroll tax records and audit trails. Moreover, by outsourcing this function, businesses often see a reduction in administrative workload.

Support for Audit Preparation and Capital Raise Readiness

There are tons of benefits of CFO services when you make the right choice:

- They enforce systematic recordkeeping that matches auditor requirements.

- CFO services streamline audits by aligning with external auditors on scope, evidence, and execution.

- Uncover gaps in internal control or financial reporting.

- They refine financial statements, forecasts, and notes.

- Integrates capital planning with operations.

Matching CFO Services to Your Business Growth Stage

Now that we’ve covered the major evaluation criteria for CFO services, let’s apply this insight to different phases of your business lifecycle.

Choosing CFO Services for Startups and Early-Stage Companies

82% of startups fail due to poor cash flow management, underscoring the impact of a CFO’s financial oversight.

When you choose the right CFO services for startups and early‑stage companies, you gain financial leadership that:

- Sets clear spending targets while aligning with strategic development goals.

- Introduces simple but effective controls to safeguard assets.

- Creates clean, credible statements and forecasts for pitches.

- Delivers CFO-level insight without the cost of hiring full-time leadership.

Selecting CFO Support for Scaling Businesses

You need to choose the right CFO services for scaling businesses to ensure you gain financial guidance that:

- Strengthens financial infrastructure.

- Implements scalable reporting.

- Enhances Cash Flow management.

- Facilitates cost scalability.

- Prepares for series A/B rounds.

- Integrates with ERP systems.

Aligning CFO Services with Mergers & Acquisitions Strategies

With the right choice, you’ll get sustainable growth with CFO services. These experts shape acquisitions by evaluating value, modeling synergies, and forecasting outcomes. They also manage the due diligence process thoroughly.

Critically, these services avoid deal risks by validating pricing assumptions and avoiding overvaluation. All the while, they also develop accurate post-merger forecasts. Also, they work to capture the intended value of the deal.

Adapting CFO Support for Established Enterprises

As businesses mature, their financial demands become more complex. Therefore, you’ll require CFO services that can scale systems, improve visibility, and support enterprise-level strategy.

- Optimize cost centers to reduce waste and manage spending.

- Integrate ERP and BI tools for complete financial visibility.

- Produce financial reports for boards and executive leadership.

- Guide multi-market compliance and regulatory challenges.

- Use predictive analytics to support strategic investments.

Leveraging CFO Services for Market Expansion

By hiring CFO services, you gain professionals who systematically assess market opportunities. They also optimize expansion strategy and align your finances with growth ambitions.

Moreover, they conduct revenue forecasts tailored to new geographies or segments. Meanwhile, they evaluate pricing dynamics and ensure capital allocation aligns with expansion costs from marketing to logistics.

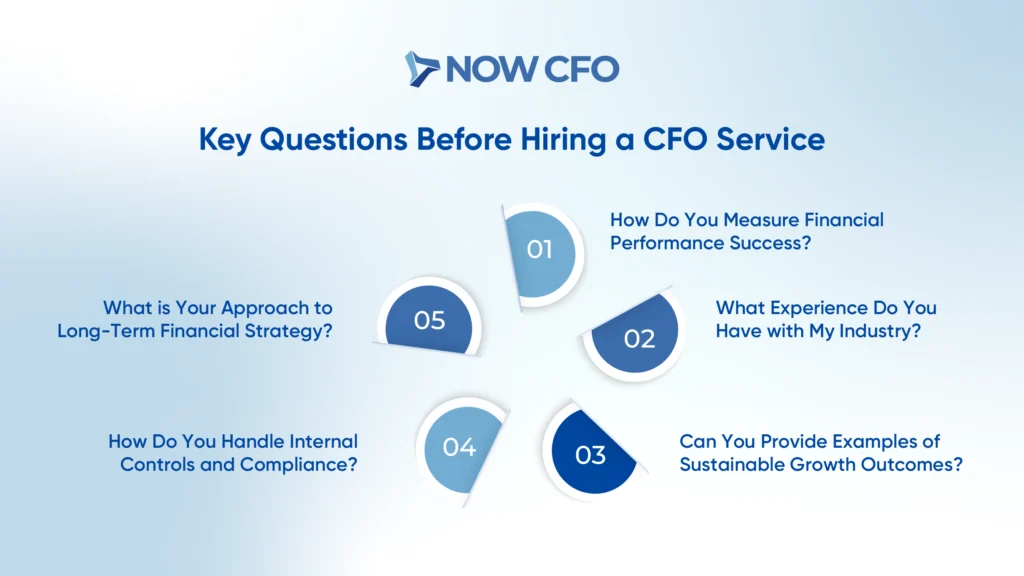

Questions to Ask Before Hiring a CFO Service Provider

Let’s walk through the specific steps you should expect a CFO service to take when measuring your financial performance.

How Do You Measure Financial Performance Success?

Before you hire, you need to know certain CFO service selection criteria:

- They set measurable goals like liquidity ratios, profitability margins, and return on investment.

- Also, compiles current assets, liabilities, revenue, and costs to create a reliable starting point for measurement.

- Can also calculate metrics like operating margin and ROI to assess efficiency, liquidity, and investment returns.

- They track metrics like tracing 12‑month performance to reveal patterns.

- Revise performance measures as your strategy evolves.

What Experience Do You Have with My Industry?

With the right CFO services, you ensure your financial partner understands your industry’s financial flow.

List of core evaluation steps:

- Ask for industry-specific case studies.

- Assess the relevance of past roles.

- Request tailored scenarios.

- Validate through references.

How Do You Handle Internal Controls and Compliance?

If you have the right expert, you secure professionals who will add robust internal controls across your business. They align with recognized frameworks like the U.S. GAO’s Green Book and COSO.

Additionally, this will help to design a process that secures your operations, reporting, and compliance. Also, these services implement preventative controls, perform regular testing and monitoring, and adapt policies as regulations evolve.

What is Your Approach to Long-Term Financial Strategy?

When you choose the right CFO services, expect them to:

- Multi‑Year Financial Goals: Produce strategic plans that align with sustainable growth targets.

- Align With Strategic Planning: Use frameworks proven to deliver long-term value, innovation, governance, and resilience.

- Define Success Metrics: Incorporate ESG, operational efficiency, and innovation into financial performance measures.

- Maintain Agile Planning: Update forecasts regularly to reflect shifts in market, funding, or regulatory environments.

- Align Resource Allocation with Strategy: Allocate capital thoughtfully to R&D, expansion, and capabilities.

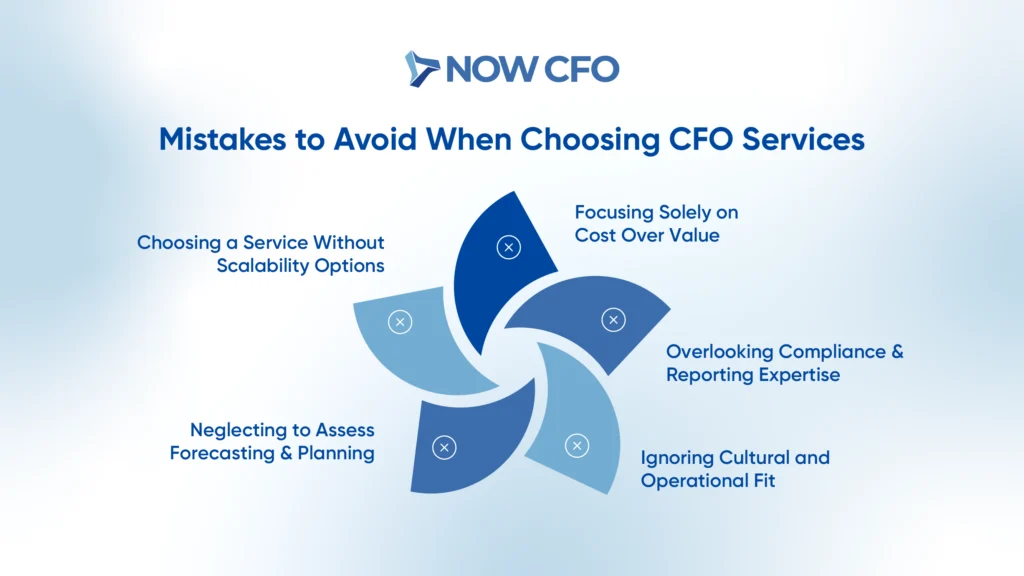

Common Mistakes to Avoid When Selecting CFO Services

A clear understanding of common missteps is essential to safeguard your financial strategy.

Focusing Solely on Cost Over Value

When you choose the right CFO services, you must avoid the trap of valuing cost over strategic impact. Because low-cost CFO options often prioritize budget, they wait to see your mileage while compromising on expertise.

Instead, leading CFO services deliver benefits that far exceed fees. This can include improved margins, stronger forecasting, risk mitigation, and compliance oversight. Additionally, 70% of businesses outsource to reduce costs.

Overlooking Compliance and Reporting Expertise

Don’t underestimate the importance of compliance and reporting expertise when hiring CFO services. Because ignoring this area can expose your business to regulatory penalties, financial restatements.

A CFO expert in compliance builds processes aligned with GAAP, SEC standards, and tax obligations. They also align financial reporting with investor expectations and regulatory mandates.

Ignoring Cultural and Operational Fit

Always be mindful of the following alignment-focused expectations:

- A CFO whose values mirror your organization, creating a clear and shared purpose.

- Your CFO should align with workflows, decision cycles, communication, and team dynamics.

- Use behavioral scenarios or value-based interviews to evaluate alignment with your corporate culture.

Neglecting to Assess Forecasting and Planning Capabilities

If your business relies on intuition, then there is a high risk of missing revenue targets. Therefore, thoughtful forecasts and adaptable plans prevent missteps by aligning strategy with market reality.

Moreover, they drive bold actions in budget adjustments, hiring decisions, and capital allocation. Besides, forecasting remains a core planning tool, essential for maintaining fiscal discipline and informed decision-making in budgets.

Choosing a Service Without Scalability Options

Are you thinking of choosing the right CFO services? Then you need to verify that they offer scalable solutions. They should also be capable of growing with your business. Because companies that fail to implement scalable financial infrastructure often hit complexity.

Besides, growth without foresight can derail even high-potential enterprises. Whereas a scalable CFO service embeds flexible structures, data systems, forecasting models, and workflows. This expands alongside revenue, headcount, or operational reach.

Conclusion

To choose the right CFO services means to select a partner who contributes to both day-to-day financial operations and your long-term vision. A strategic CFO advisor delivers far more value than cost savings alone.

If you want to take the next step, consider a free consultation at NOW CFO. You’ll get a tailored diagnostic of your financial infrastructure, or even a pilot engagement to experience the impact firsthand.