As the fiscal year draws to a close, businesses face the critical task of finalizing their financial records. Notably, 82% of small businesses experience cash flow problems, often due to inefficient year-end accounts management.

Practical strategies for closing year-end accounts payable and receivable are essential to ensure financial stability and prepare for the upcoming fiscal year.

Why Closing Out Year-End Accounts Payable and Receivable Matters

Closing out year-end accounts payable and receivable is crucial for maintaining accurate financial records and ensuring a healthy cash flow. This process reflects the company’s financial health and sets the stage for the upcoming fiscal year.

Understanding the significance of this task can lead to more efficient financial management and strategic planning.

Ensuring Accurate Financial Records for Year-End Reporting

Accurate financial records are the backbone of any successful business. By meticulously closing out year-end accounts payable and receivable, companies can ensure that all transactions are recorded in the correct fiscal period.

This precision is essential for compliance with accounting standards and for providing stakeholders with an accurate picture of the company’s financial position. Recording revenues and expenditures in the correct fiscal year is critical to accurate fiscal year-end reports and financial statements.

Improving Cash Flow Year-End

Effective cash flow management is vital, especially as the fiscal year concludes. Businesses can optimize their cash flow by promptly settling accounts payable and diligently collecting accounts receivable.

This practice ensures the company has sufficient liquidity to meet its obligations and invest in growth opportunities. Furthermore, verifying that transactions on all funds are recorded accurately and timely is important to maintain a healthy cash flow.

Reducing the Risk of Overdue Liabilities and Receivables

Timely closing accounts payable and receivable reduces the risk of overdue liabilities and uncollected receivables. This proactive approach minimizes potential financial losses and maintains strong relationships with vendors and customers. U.S. companies’ average accounts receivable turnover ratio is approximately 7.8 times per year.

Streamlining Accounting Processes for the New Fiscal Year

A thorough year-end closing simplifies the transition into the new fiscal year. It allows accounting teams to start with a clean slate, free from unresolved transactions. This streamlining leads to more efficient financial operations and reduces the workload in the subsequent year.

Enhancing Business Stability and Financial Health

Ultimately, closing out year-end accounts payable and receivable contributes to a business’s overall stability and financial health. It provides a clear financial picture, enabling informed decision-making and strategic planning. Furthermore, proper year-end accounting practices are essential for maintaining financial stability.

Diligently closing out year-end accounts payable and receivable is a fundamental practice that ensures accurate financial records, optimizes cash flow, reduces financial risks, streamlines accounting processes, and enhances overall business stability.

Steps to Closing Out Year-End Accounts Payable

Effectively closing out year-end accounts payable is essential for maintaining accurate financial records and ensuring a smooth transition into the new fiscal year. By following a structured approach, businesses can minimize errors and enhance economic stability.

1. Reconcile All Outstanding Invoices and Payments

Begin by thoroughly reviewing all outstanding invoices and payments. Ensure that every invoice received matches the corresponding purchase order and delivery receipt. This reconciliation process helps identify discrepancies, such as duplicate payments or missed invoices, which can lead to financial inaccuracies.

2. Confirm Vendor Balances and Adjust as Needed

Next, verify the balances with each vendor. Communicate with vendors to confirm that their records align with yours. Address any discrepancies promptly to prevent future disputes.

Maintaining accurate vendor balances ensures that your accounts payable reflect actual liabilities. Also, emphasize confirming vendor balances to maintain financial accuracy.

3. Process Final Payments to Avoid Carrying Over Debts

Subsequently, process all pending payments before the fiscal year ends. Settling these debts prevents them from continuing into the new year, which can complicate financial statements and budgeting. Timely payment fosters good vendor relationships and may lead to favorable credit terms.

4. Review and Adjust Accounts for Financial Accuracy

After processing payments, review your accounts payable ledger for accuracy. Look for any anomalies, such as negative balances or unrecorded transactions. Make necessary adjustments to correct these issues. Accurate accounts payable records are vital for reliable financial reporting and analysis.

5. Verify Compliance with Vendor Terms and Agreements

Finally, ensure that all payments and transactions comply with the terms and agreements established with vendors. This includes adhering to payment schedules, discount terms, and other contractual obligations. Compliance not only avoids potential legal issues but also strengthens vendor relationships.

Steps for Closing Out Year-End Accounts Receivable

Effectively closing out year-end accounts receivable is essential for maintaining accurate financial records and ensuring a healthy cash flow. Following a structured approach, businesses can optimize their financial position as they transition into the new fiscal year.

1. Review Aging Reports and Outstanding Receivables

Begin by examining the accounts receivable aging report to identify outstanding invoices. This report categorizes receivables based on the time they have been fantastic, helping prioritize collection efforts.

2. Send Final Payment Reminders to Customers

Next, final payment reminders will be issued for customers with overdue accounts. Clear communication can prompt payments and reduce the risk of bad debts. Furthermore, consistent customer follow-up is important to ensure timely collections.

3. Write Off Uncollectible Accounts if Necessary

After exhausting all collection efforts, assess whether certain accounts should be written off as bad debts. Writing off uncollectible accounts ensures that your financial statements accurately reflect receivables.

4. Reconcile Receivables with Bank Deposits

Subsequently, reconcile accounts receivable records with bank deposits to ensure all received payments are accurately recorded. This process helps identify discrepancies and ensures that your financial records are complete. Organizations using automation in accounts payable report a 60% reduction in invoice processing costs.

5. Update Customer Records for Future Accuracy

Finally, customer records should be updated to reflect the current status of their accounts. Accurate records facilitate future transactions and help maintain strong customer relationships. Also, keeping customer records current ensures efficient accounts receivable management.

Best Practices for Streamlining Year-End Accounts Management

Implementing best practices for streamlining year-end accounts management is essential for maintaining financial accuracy and efficiency.

1. Implement Clear Policies for End-of-Year Transactions

Establishing well-defined policies for end-of-year transactions is crucial. These policies should outline procedures for processing invoices, payments, and adjustments during the closing period. Clear guidelines help prevent errors and ensure consistency in financial reporting.

2. Organize Records for Easy Access and Review

Maintaining organized financial records is vital for efficient year-end accounts management. Proper organization facilitates quick access to necessary documents during year-end audits and reviews.

3. Automate Accounts Payable and Receivable Processes

Automation of accounts payable and receivable processes can significantly enhance efficiency. Automated systems reduce manual errors, speed up transaction processing, and provide real-time financial data.

Companies automating their accounts payable processes can reduce invoice processing costs by 81% and shorten processing times by 73%.

4. Schedule Regular Reviews to Avoid Last-Minute Rushes

Regularly reviewing financial statements and transactions throughout the year prevents the accumulation of errors and discrepancies. Scheduled reviews allow for timely corrections and reduce the pressure during the year-end closing process.

5. Maintain Consistent Communication with Vendors and Customers

Effective communication with vendors and customers ensures that all transactions are accurately recorded and any issues are promptly addressed. Consistent communication helps resolve discrepancies and maintain strong business relationships.

Improving Cash Flow Through Efficient Year-End Processes

Enhancing cash flow through efficient year-end processes is vital for a company’s financial health. Businesses can optimize their liquidity and prepare for the upcoming fiscal year by implementing strategic measures.

1. Accelerate Collections to Boost Year-End Cash Flow

Promptly collecting outstanding receivables is crucial. Implementing strategies such as offering early payment discounts or sending timely reminders can encourage customers to settle their accounts sooner.

2. Negotiate Extended Payment Terms to Reduce Outflow

Engaging with suppliers to negotiate extended payment terms can effectively manage cash outflows. This approach allows businesses to retain cash longer, improving liquidity during critical periods.

3. Balance Cash Flow with Strategic Payments and Collections

Maintaining a balance between incoming and outgoing cash flows is essential. Prioritizing payments and strategically scheduling them can prevent cash shortages. Also, businesses need to monitor cash flow closely to ensure financial stability.

4. Monitor Cash Flow Metrics for Future Planning

Regularly tracking key cash flow metrics provides insights into financial performance. Metrics such as the cash conversion cycle and operating cash flow ratio help identify areas for improvement.

5. Implement Cash Flow Forecasting for Next Fiscal Year

Developing detailed cash flow forecasts helps anticipate future financial needs. Accurate forecasting enables proactive decision-making and resource allocation. A survey by PwC revealed that 79% of CFOs consider cash flow forecasting critical for managing liquidity and making informed business decisions.

By adopting these strategies, businesses can improve their cash flow during year-end, ensuring financial stability and readiness for the upcoming fiscal year.

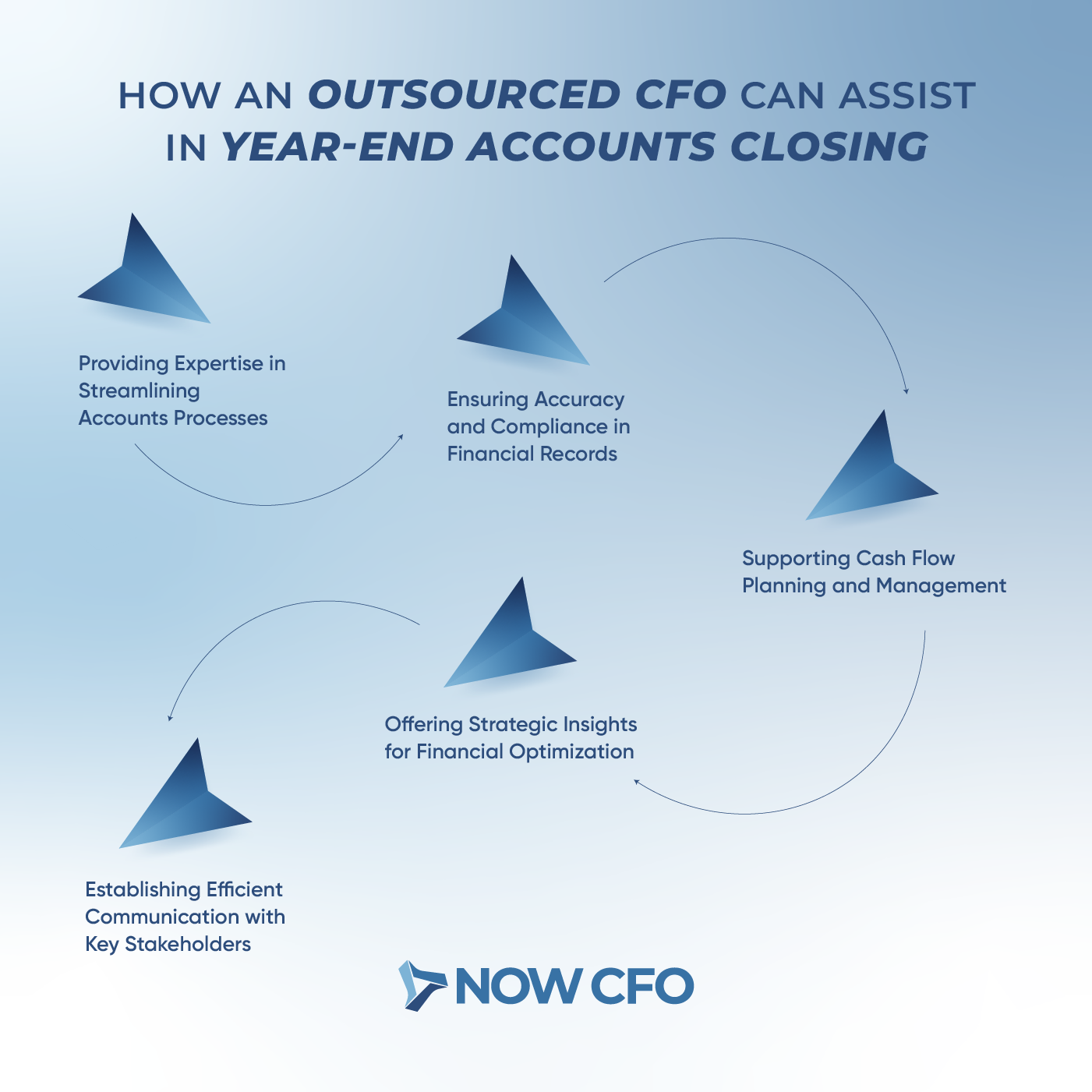

How an Outsourced CFO Can Assist in Year-End Accounts Closing

Engaging an outsourced CFO can significantly enhance the efficiency of year-end accounts closing. Their expertise and strategic approach streamline financial processes, ensuring accuracy and compliance.

Providing Expertise in Streamlining Accounts Processes

An outsourced CFO brings specialized knowledge on streamlining accounts payable and receivable workflows. They implement best practices and leverage technology to automate routine tasks, reducing errors and saving time.

Ensuring Accuracy and Compliance in Financial Records

Maintaining precise financial records is vital for compliance and informed decision-making. An outsourced CFO ensures that all transactions are recorded correctly and adhere to relevant regulations.

Supporting Cash Flow Planning and Management

Effective cash flow management is essential for business stability. An outsourced CFO analyzes cash flow patterns and develops strategies to optimize liquidity, ensuring the company can meet its obligations and invest in growth opportunities.

Offering Strategic Insights for Financial Optimization

Beyond routine tasks, an outsourced CFO provides strategic insights to enhance financial performance. They assess financial data to identify trends, opportunities, and areas for improvement, guiding the company toward its financial goals.

Establishing Efficient Communication with Key Stakeholders

Clear communication with stakeholders is crucial during the year-end closing process. An outsourced CFO acts as a liaison, ensuring all parties are informed and aligned, facilitating a smoother closing process, and fostering trust.

Conclusion

In conclusion, meticulous attention to year-end accounts payable and receivable processes is vital for maintaining accurate financial records and optimizing cash flow.

By adopting best practices and leveraging expert guidance, businesses can confidently navigate the complexities of year-end financial accuracy and management. Contact our professionals today for personalized assistance in streamlining your year-end accounts.