Outsourced accounting offers expert financial support, scalable technology, and streamlined operations without the burden of full-time hiring. A complete cost comparison of outsourced vs. internal accounting services, including the cost-effectiveness of outsourced accounting, often highlights how outsourcing provides greater efficiency and long-term value.

Comparing Direct Vs Indirect Costs

Finance teams associate direct costs with specific tasks, such as payroll, bookkeeping, or client projects, while indirect costs support overall operations and infrastructure.

| Cost Type | In-House Accounting Examples | Outsourced Accounting Impact |

|---|---|---|

| Direct Costs | Accountant salary, transaction staffing | Staff included in flat fee |

| Indirect Costs | Office space, benefits administration, systems upkeep | Shared overhead across multiple clients |

What Small Businesses Typically Overlook

SMEs often underestimate the cost of outsourced accounting by overlooking hidden indirect expenses. They focus on salaries for in-house staff, but forget the ongoing burden of:

- Inefficiencies in training new hires

- Time managers spend overseeing the finance staff

- Software upgrades, licenses, and patches

- Benefits administration and HR overhead

The Impact of Inefficiencies on Growth

Inefficiencies of in-house accounting can slow strategic growth and consume valuable time. Common impacts include:

- Billing delays due to manual processes

- Misclassification of expenses and compliance errors

- Cash-flow forecasting inaccuracies that stall decision-making

- Resource drain as senior staff manage routine accounting tasks

Breakdown of In-House Accounting Costs

To better understand cost comparison, you need to know what internal accounting truly costs.

Salary and Benefits for Full-Time Staff

Companies hire accountants at median salaries. According to the BLS, the median annual wage for accountants and auditors was $81,680 in May 2024. On top of that, employers pay benefits that can add around 30–40% to total compensation costs.

For private industry workers, wages and salaries accounted for 70.3%, benefits 29.7%, and an average of $45.38 per hour in March 2025. Employers typically incur a total cost equal to 1.25–1.4x salary when adding benefits and employer taxes.

Hiring, Onboarding, and Training Expenses

Hiring new accounting staff carries real costs that businesses often undervalue. Beyond salary and benefits, expenses include recruitment, orientation, training materials, and productivity ramp-up.

Three key cost pillars:

- Recruiting Fees: For a CFO role with a base salary of $400K, the recruitment fee, at 30%, comes to $120K.

- Training Spend: In 2024, U.S. companies invested $98 billion in training, with per-employee training costs ranging from $398 to $1,047, with small businesses at the upper end ($1,047).

- Onboarding Inefficiency: Poor onboarding experiences cost U.S. and U.K. organizations $37 billion annually, with only 12% of hires feeling onboarding was effective.

Software, Hardware, and Office Space

Purchasing and maintaining technology, workspace, and software licenses create significant overhead. Organizations must invest in systems, secure networks, and software subscriptions with periodic updates and backups. Additional costs include physical office space, furniture, utilities, and IT support.

Outsourced providers include technology, infrastructure, and IT support in their service packages. This bundled access to enterprise-grade tools reduces overhead and often makes outsourcing more cost-effective for SMEs.

Time Spent Managing Accounting Internally

Operating in-house accounting demands managerial oversight: reviewing reports, troubleshooting errors, scheduling audits, and coordinating with HR, IT, and external consultants. Managers often don’t track their time, which remains a crucial part of internal costs.

In contrast, outsourcing financial services saves time by shifting day-to-day oversight to experienced professionals. Business leaders shift from routine financial supervision to focusing on strategic initiatives, growth planning, and revenue-driving decisions.

What You Get with Outsourced Accounting

Outsourcing lets you access specialized expertise and resources. In this section, we’ll examine the services included in outsourced packages and the value they bring to growing businesses.

Services Typically Included in Outsourced Packages

Outsourced accounting packages commonly include bookkeeping, payroll processing, tax preparation, financial reporting, and month-end close activities. Many firms also offer budgeting, forecasting, compliance support, and cash-flow analysis as part of standard plans. Small and medium businesses increasingly rely on these bundled services to reduce internal overhead.

Key benefits include:

- All primary functions under a single fee

- Elimination of piecemeal billing for accounting tasks

- Predictable budgeting aligned with the cost of outsourced accounting goals

Access To Expert CPAs, Controllers, and Technology

Outsourced accounting gives clients access to certified CPAs, experienced controllers, and advanced financial systems; firms staff teams with professionals specializing in tax, compliance, and financial strategy.

Flexibility To Scale Services Up or Down

Outsourcing accounting offers scalable service levels: you can increase support during busy seasons (e.g., tax season, audit periods), then scale back during quieter months. Providers adjust staffing and deliverable frequency without hiring or layoffs. This elasticity helps companies manage costs more precisely.

This flexibility is critical for growing organizations. It aligns finance support with seasonal cycles or shifting business needs and minimizes idle costs.

Side-by-Side Cost Comparison

With both in-house and outsourced costs defined, it’s time to compare them directly.

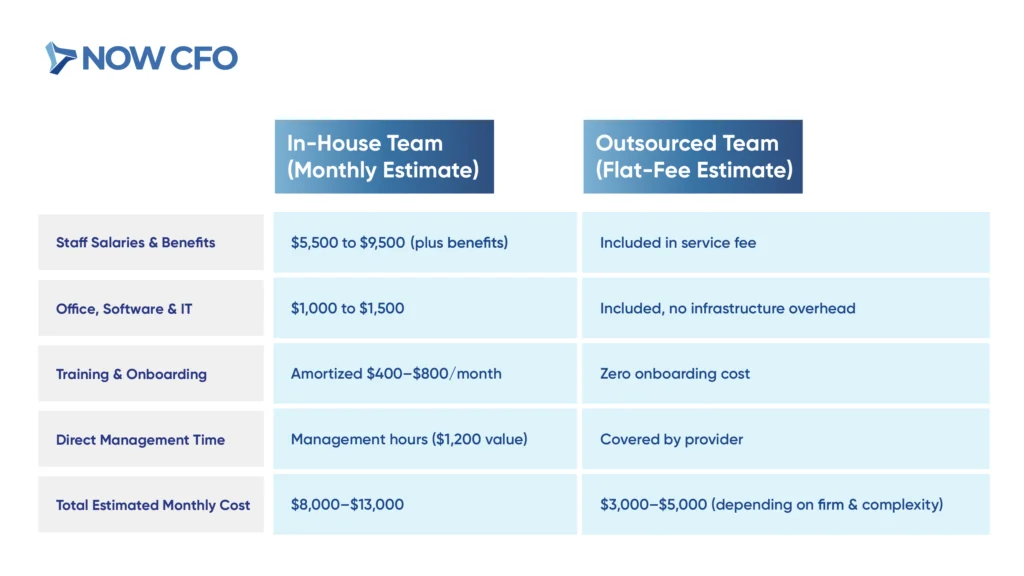

Monthly Cost of In-House Team Vs Outsourced Team

To understand whether outsourced accounting is cheaper, compare typical monthly expenses:

Short-Term Vs Long-Term Cost Advantages

Comparing short-term and long-term benefits highlights how in-house vs outsourced accounting costs evolve:

| Timeframe | In-House Team Advantages | Outsourced Team Advantages |

|---|---|---|

| Short-Term | Complete control, immediate internal accessibility | Quick deployment, fixed monthly cost, lower startup expense |

| Long-Term | Building internal competency and alignment with company culture | Consistent cost predictability, scalability, reduced turnover & training costs |

Hidden Savings with Outsourced Accounting

Cost savings often go beyond what you see on paper. Here, we’ll explore the often-overlooked financial benefits of outsourcing.

Reduced Error Rates and Penalties

Outsourced accounting reduces costly mistakes, often caused by in-house teams handling heavy workloads or lacking specialization. Nearly 59% of accountants report several monthly errors, tied to capacity constraints and regulatory complexity.

Furthermore, small businesses face stiff fines: failing to file required information returns like 1099 or W-2 can result in penalties ranging from $50 to $270 per return, depending on the delay. Outsourced teams maintain structured review processes and automation to improve accuracy, avoid submission errors, and minimize exposure to IRS audits or late-filing fines.

Better Cash Flow Management and Forecasting

Connected to error reduction, outsourcing enhances financial planning capabilities that small businesses often miss when managing accounting internally. Improved cash flow management and forecasting help leaders make timely decisions and avoid surprises.

Two key benefits:

- Proactive Forecasting Tools: Outsourced accounting delivers real-time dashboards and forecasting models. Organizations gain visibility into liquidity cycles, plan working capital needs, and prevent cash crunches.

- Strategic Timing of Payments and Receipts: Providers analyze payment terms and invoice cycles to optimize timing, stretching payables carefully and accelerating receivables. It sharpens financial clarity, which is pivotal when asking how much outsourced accounting costs in comparison to the intangible benefits gained.

Opportunity Cost: Time Back to Grow Your Business

By outsourcing routine accounting functions, businesses reclaim critical leadership time. Executives and founders often spend hours resolving bookkeeping errors, preparing reports, and coordinating compliance.

When outsourced partners manage such functions, internal teams focus on strategy and value-driven projects. This shift reduces mismanagement risks and operational friction. As a result, these time savings support broader goals like fundraising, scaling operations, or entering new markets.

When Outsourced Accounting Is NOT Cheaper

While outsourcing works well for many, it’s not always the better choice. In specific scenarios, in-house accounting can be budget-friendly and efficient.

Large Enterprises with Complex, Daily Transactions

Large enterprises with high transaction volumes, multiple subsidiaries, or complex daily financial flows often find outsourced accounting less cost-effective. These businesses typically require extensive internal control, frequent internal audits, and timely intercompany reconciliations.

According to GrowthForce, maintaining a mid-market in-house finance team can cost nearly 1 million dollars annually in salary alone. Added infrastructure, benefits, and training inflate that figure further. Outsourcing such complexity may mean multiple providers, bespoke arrangements, and higher fees.

Businesses Needing Constant On-Site Financial Presence

Outsourced accounting may not be practical when companies require a consistent, on-site financial presence. Firms in regulated industries or those with complex inventory operations often need staff physically present to handle sensitive processes on-site.

Reliance on external teams can lead to communication delays, reduced real-time responsiveness, or gaps in compliance oversight. Outsourcing presents risks, including loss of control and communication barriers.

Long-Term Cost Efficiency Vs Short-Term Priorities

Connecting from on-site needs, we now explore how cost dynamics vary over time, especially when short-term needs eclipse long-term savings.

Key considerations:

- Short-Term Priority: If your business faces urgent financial challenges, it incurs higher costs in outsourcing setup fees or ramp-up periods. Internal staffing allows complete control during transitions.

- Long-Term Efficiency: Outsourced accounting helps SMEs scale services, cut onboarding and turnover costs, and ease infrastructure demands, leading to more predictable and lower overall expenses.

ROI Beyond Cost: The Strategic Benefits

When used strategically, accounting is a key driver of growth. Now, we’ll examine the added benefits of outsourcing accounting during key business events, such as audits or fundraising.

Real-Time Data and Financial Clarity

Outsourced accounting partners often provide real-time dashboards and analytics that give leaders immediate financial visibility. Companies operating in “real-time-ness” achieved 62% higher revenue growth and 97% higher profit margins than slower counterparts.

In-house accounting teams typically deliver monthly or quarterly snapshots, which miss critical trends and may delay decision-making. In contrast, outsourced providers enable real-time access to trusted data, improving financial clarity, faster course corrections, and empowering executive action.

Built-In Compliance and Tax Readiness

Connected from real-time clarity, outsourcing also embeds compliance and tax readiness into standard workflows.

Two core advantages:

- Regular Tax Filings and Updates: Outsourced teams stay current on tax codes, ensuring timely 1099s, W-2s, payroll tax filings, and information returns to reduce the risk of IRS fines ranging from $50 to $270 per late form.

- Proactive Audit Preparedness: Providers maintain audit trails, internal controls, and organized documentation. Businesses can respond quickly with accurate records when audits or regulatory reviews arise.

Support During Audits, Funding, And Scaling

Connecting from compliance benefits, outsourced accounting extends support for business milestones like audits, funding rounds, and scaling operations:

- Audit Preparedness and Support: Providers maintain clean records, prepare audit packages, and liaise with auditors.

- Investor and Lender Reporting: Outsourced teams produce professional financial statements, forecasts, and KPI dashboards that appeal to investors or lenders during funding rounds.

- Scalable Financial Oversight: As businesses grow or launch new initiatives, outsourced providers can quickly add controller-level oversight, integrated forecasting, and strategic insights.

Conclusion

Evaluating outsourced accounting costs requires more than comparing paychecks. Outsourced accounting offers predictable pricing, lower overhead, and bundled services while freeing your team to focus on strategic priorities and growth.