Understanding the difference between bookkeeping and accounting is vital for financial clarity and business growth. Bookkeeping ensures the disciplined capture of every transaction, while accounting transforms that data into strategic insight.

Many SME owners find themselves overwhelmed by financial terminology, with 60% reporting low confidence in their accounting knowledge. Through precise record-keeping, SMEs gain reliable financial records, clean ledgers, and accurate financial statements.

What Is Bookkeeping?

Bookkeeping is the structured process of recording a business’s financial transactions, including sales, purchases, receipts, and payments. It organizes this data in a general ledger for easy tracking and reporting, forming the foundation for accurate accounting.

Definition of Bookkeeping

Bookkeeping records every financial transaction, profit, expense, invoice, and receipt in journals or digital ledgers. This consistent tracking of financial records ensures clarity in the general ledger.

Many U.S. businesses are SME, emphasizing how nearly every enterprise relies on precise bookkeeping for basic operation and tax compliance. Additionally, about 38% of SMEs use specialized software to automate recordkeeping, enhancing accuracy and efficiency.

Core Bookkeeping Tasks (Recording Transactions, Managing Ledgers)

By accurately recording transactions into journals or software. Consistent transaction entry supports reliable financial statements, strengthening overall accounting integrity. Many SMEs use some form of digital bookkeeping, highlighting that most rely on technology rather than manual methods.

The Role of Debits, Credits, and Double-Entry

Accurate bookkeeping depends on structured processes:

- Debits: Increase asset or expense accounts, decrease liability or equity accounts. That precise categorization supports organized financial records and enhances general ledger reliability.

- Credits: Increase liability or equity accounts, decrease asset or expense accounts. That balance ensures each transaction reflects both sides of an exchange.

- Double-Entry: Every transaction records both debit and credit entries to maintain equilibrium. The IRS system follows this method rigidly, assigning unique journal numbers for cross-referencing and error reversal (irs.gov).

Tools and Software Commonly Used by Bookkeepers

Reliable tools support daily bookkeeping operations, supporting data integrity before accountants begin their strategic evaluations.

- QuickBooks and Peachtree

- Electronic Accounting Software

- Cloud-Based Platforms

- Spreadsheet Programs (Excel, Google Sheets)

- Bank Integration Tools

Why Bookkeeping Is Essential for Small Businesses

SMEs rely on precise bookkeeping to maintain financial clarity and reliable reporting. Recording transactions accurately drives financial records.

Moreover, accurate ledgers improve tax preparation accuracy, reduce audit risks, and support better budgeting and forecasting. Solid bookkeeping also directly impacts small business survival.

What is Accounting?

Accounting summarizes, analyzes, and interprets financial data to support business decision-making and ensure regulatory compliance. It transforms raw financial records into meaningful insights through financial statements, budgeting, and forecasting.

Definition of Accounting

Accountants create financial statements, such as balance sheets, P&L, and cash flows, to inform decision-makers, regulators, and potential investors. Strong bookkeeping supports the accounting process by feeding accurate data into strategic analysis.

Additionally, accounting supports business operations by enabling adequate budgeting, forecasting, and timely tax preparation. By transforming data into actionable insights, accounting helps bookkeeping ensure organized inputs and maximizes strategic value.

Core Accounting Functions (Analysis, Reporting, Compliance)

Clarity from bookkeeping evolves into a meaningful strategy through accounting.

- Analysis: Evaluates financial data to support budgeting and forecasting, assess performance, and inform decisions.

- Reporting: Compiles data into financial statements, balance sheets, P&L, and cash flow, ensuring transparency for stakeholders and regulators.

- Compliance: Follows tax laws and financial regulations. Accurate tax preparation relies on structured reporting and audit-ready documentation to avoid penalties.

The Role of Accountants in Financial Strategy

Precise bookkeeping provides essential inputs, and accounting shapes those inputs into a strategic direction.

- Accountants guide business growth by crafting budgets, forecasts, and long-term financial plans that steer decisions.

- Analysts use historical data to model future outcomes, enabling smarter allocation of resources and better budgeting.

- Accountants often lead the planning of yearly budgets, explain how the business is doing financially to company leaders, and help guide financial decisions.

Accounting Deliverables: Balance Sheets, P&L, Cash Flow Statements

Accurate bookkeeping lays the groundwork for meaningful strategy.

- Balance Sheets: Offer a snapshot of assets, liabilities, and equity at a specific moment. Small businesses use them to assess financial health and make strategic comparisons.

- Profit & Loss (P&L) Statements: These reports detail revenue, expenses, and net income over a period. They support budgeting and forecasting by pinpointing profit trends and operational efficiency.

- Cash Flow Statements: Track cash inflows and outflows from operations, investments, and financing. This is critical for managing liquidity and making informed financial decisions.

Why Accounting Goes Beyond Record-Keeping

Accounting ensures financial statements reflect actual business performance. Relying on precise bookkeeping as input, accountants derive insights from organized data to guide decision-making.

SMEs often engage professionals for strategy and tax compliance; record-keeping time burdens account for significant portions of the workload. This makes having an accounting expert a necessity and a time-saving solution.

Key Differences Between Bookkeeping and Accounting

Precision in bookkeeping supplies the accurate data that accountants transform into strategic value.

Key Differences Between Bookkeeping & Accounting

- Day-to-Day Tasks vs. Strategic Oversight

- Data Entry vs. Data Analysis

- Historical Records vs. Forward-Looking Planning

- Compliance Support vs. Strategic Guidance

- Skill Sets and Qualifications Compared

Day-to-Day Tasks vs. Strategic Oversight

Understanding how daily financial activities differ from long-term planning helps clarify the roles of bookkeeping and accounting in business operations.

| Daily Transaction Tasks | Strategic Financial Oversight |

| Recording every sale, payment, and expense into the ledger | Analyzing ledger data to guide budgeting and forecasting, business planning, and performance evaluation |

| Handling AR/AP, invoicing, and reconciliation | Communicating financial health via reports to stakeholders, aligning with long-term growth strategies |

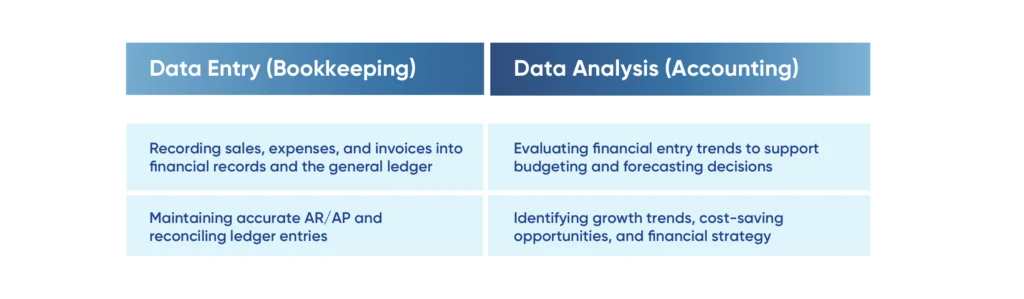

Data Entry vs. Data Analysis

Reliable and accurate bookkeeping enables accountants to apply strategy and insight.

Historical Records vs. Forward-Looking Planning

Differentiating between tracking past transactions and planning shows the distinct focus areas of bookkeeping and accounting functions.

| Historical Records (Bookkeeping) | Forward‑Looking Planning (Accounting) |

| Maintains precise records of past transactions, assets, liabilities, revenue, expenses, and invoice history | Uses recorded data to create budgets, budgeting, and forecasting |

| Ensures the accuracy of financial statements and audit readiness | Applies trend analysis and projections to inform growth strategy and resource allocation |

Compliance Support vs. Strategic Guidance

Accounting goes far beyond record-keeping. It ensures compliance support, meets legal and tax requirements, and safeguards business integrity. Active compliance reduces the risk of penalties and instills confidence with regulators.

At the same time, accounting delivers strategic guidance, plans budgets, forecasts cash flow, and advises on growth decisions. It uses accurate bookkeeping data to shape financial strategy and enable informed action.

Skill Sets and Qualifications Compared

Accounting goes far beyond record-keeping. It ensures compliance support, meets legal and tax requirements, and safeguards business integrity. Active compliance reduces the risk of penalties and instills confidence with regulators.

At the same time, accounting delivers strategic guidance, plans budgets, forecasts cash flow, and advises on growth decisions. It uses accurate bookkeeping data to shape financial strategy and enable informed action.

How Bookkeeping and Accounting Work Together

Bookkeeping and accounting are interconnected functions. Accurate data entry forms the foundation for an insightful financial strategy. The difference between bookkeeping and accounting lies in their roles.

Bookkeeping as the Foundation for Accounting

Accurate bookkeeping establishes organized ledgers and up-to-date financial records.

Clear record maintenance supports:

- Timely and accurate reporting

- Responsible tax preparation and compliance

- Effective budgeting and forecasting

Moreover, SME owners spend substantial time organizing and entering tax-related receipts, highlighting how foundational bookkeeping drives subsequent accounting efficiency.

Ensuring Accurate Financial Reporting

Accurate financial reporting depends on careful bookkeeping practices that feed reliable data into the accounting process.

- Consistent Ledger Reconciliation: Verifies all expenses, revenues, and liabilities to produce trustworthy financial statements.

- Audit‑Ready Record Maintenance: Applies organized records to support compliance and reduce the risk of audit penalties.

- Error Identification and Correction: Bookkeeping identifies differences like duplicate or misposted entries.

- Timely Report Preparation: Organized entries allow for prompt delivery of financial statements.

Supporting Tax Preparation and Compliance

Precise bookkeeping lays the groundwork for strategic accounting, defining the difference between bookkeeping and accounting through dependable data.

- Records of receipts, invoices, and expenses support tax filing and audit readiness.

- Organized bookkeeping simplifies tax planning and compliance efforts.

- Audit-ready financial records reduce risk and support accurate reporting.

Improving Budgeting and Forecasting Accuracy

Effective budgeting and forecasting rely on accurate, up-to-date financial data, something only precise bookkeeping can provide. Bookkeeping ensures accountants have a reliable foundation for modeling future cash flow, revenue projections, and expense planning.

Moreover, bookkeeping focuses on capturing real-time data, while accounting uses that information to build financial forecasts and strategic budgets. When both functions align, businesses can plan confidently and respond proactively to financial trends.

Helping Businesses Make Informed Financial Decisions

Well-maintained bookkeeping ensures accurate inputs for accounting to translate into strategy and insight.

- Accountants analyze ledger data to recommend where to invest or cut costs for optimal returns.

- Historical expense data supports informed pricing models that improve profit margins and responsiveness to market fluctuations.

- Analysis of financial records enables businesses to adapt decisions based on broader economic shifts and forecasted risks.

Benefits of Outsourcing Bookkeeping and Accounting for Small Businesses

Outsourcing bookkeeping and accounting allows SMEs to access professional expertise without the cost of full-time staff. It strengthens the difference between bookkeeping and accounting by ensuring both functions are handled with precision.

Saving Time and Reducing Errors

Outsourcing simplifies financial operations by removing manual workload, allowing SMEs to operate more efficiently and reduce risk through professional accuracy.

- Outsourced services reduce time and cost.

- Delegating routine tasks such as accounts payable, receivable, and reconciliations frees up business focus and improves accuracy.

- Outsourced financial reporting improves accuracy, supporting clearer insights and better business decisions.

Gaining Access to Professional Expertise

Outsourcing brings specialized financial knowledge and analytical strength, which might be unaffordable in-house. Cost savings also drive outsourcing. Accessing skilled professionals enhances the accuracy of financial records and supports budgeting and forecasting.

Lower Costs Compared to Hiring Full-Time Staff

When outsourcing replaces full-time staffing, precise financial records become more affordable. Bookkeeping remains accurate and efficient, while outsourced accounting adds strategic value without inflating costs.

- Outsourcing financial services can save businesses on direct accounting costs, reducing payroll and software overhead.

- Companies typically avoid investing in full-time salaries, benefits, training, and licensing, achieving scalability while controlling expenses.

Leveraging Technology and Cloud-Based Tools

Cloud accounting solutions provide on-demand access, secure storage, and real-time financial visibility. Many SMEs are investing in automation and digital tools, with cloud accounting identified as a vital asset for efficiency and real‑time data access.

Cloud-based tools eliminate local software dependencies, offering automatic updates, remote access, and collaborative functionality. Instantly updated, reliable financial records feed directly into strategic accounting functions.

Scalability for Growing Businesses

Outsourced bookkeeping and accounting grow adaptively with business needs. Minimizing operational stress while maximizing strategic agility.

Outsourced models can be flexible with seasonal demand or business milestones, avoiding fixed overhead tied to full-time staff. Bookkeeping remains agile and cost-effective, while accounting gets scalable reach and insight.

Choosing the Right Financial Support for Your Small Business

Proper bookkeeping and strategic accounting form a powerful alliance, but knowing when to hire a bookkeeper is a crucial step.

When to Hire a Bookkeeper

- When business complexity increases, financial tracking demands professional support.

- Dedicated support becomes essential to avoid issues if more business owners manage their books.

- Hiring often makes sense once record-keeping falls behind, invoices pile up, or cash-flow clarity diminishes.

- Tax season burdens magnify when bookkeeping lags.

When to Bring in an Accountant

Hire an accountant when your business requires more than basic financial tracking, such as strategic planning, tax optimization, or compliance with financial regulations. Accountants step in to interpret data, prepare financial statements, and provide insights.

Additionally, the role of an accountant becomes essential during audits, funding rounds, or expansion phases where financial strategy is critical. Accountant ensures that daily transactions evolve into informed decisions guided by expert analysis.

Outsourced Solutions for Small Businesses

Outsourced financial solutions offer small businesses flexible, cost-effective support across all areas of finance, from daily tasks to strategic planning.

- Bookkeeping Services: Manage daily transactions, reconcile accounts, and maintain financial records without hiring full-time in-house staff.

- Accounting Services: Deliver financial statements, strategic insights, and tax support to guide long-term planning and business decisions.

- Cloud-Based Tools Integration: Enable real-time access to general ledger updates, improving visibility and coordination with financial professionals.

- Fractional CFO Services: Provide on-demand strategic financial leadership, tailored for growth-stage businesses needing expertise without executive-level overhead.

Why NOW CFO Offers a Comprehensive Approach

NOW CFO provides a fully integrated financial solution, blending precise bookkeeping with high-level accounting strategy. Businesses gain real-time visibility, compliant record‑keeping, and actionable insights, all through a single partner.

- Full-service coverage includes bookkeeping, tax preparation, payroll, reconciliation, and financial reporting through a centralized process.

- Engagements with fractional CFOs allow flexible access to strategic expertise, capital planning, risk management, and performance reporting.

Conclusion

Grasping the fundamental difference between bookkeeping and accounting helps your business sustain precision and strategy. Bookkeeping anchors your financial foundation through consistent transaction tracking, while accounting elevates that foundation.

Ready to move from managing numbers to mastering finances? Discover how NOW CFO can enhance your financial workflows. Reach out for a free consultation and let us be the strategic partner that evolves alongside your business ambitions.

Frequently Asked Questions

Can an SME Manage Without an Accountant if it has a Bookkeeper?

While a bookkeeper handles daily financial records, an accountant provides analysis and strategy; both are essential for informed growth.

What’s the Risk of Relying Only on Bookkeeping for Financial Decisions?

Bookkeeping tracks past data without context or interpretation. Relying solely on it may lead to uninformed or risky financial choices.

When Should an SME Upgrade from Manual Bookkeeping to Software?

Once transactions increase or reporting needs grow, software helps improve accuracy and save time. It also supports better compliance and audit readiness.

Do Outsourced Bookkeeping and Accounting Services Replace In-house Staff?

Outsourcing can supplement or replace internal roles depending on business size and needs. It offers flexibility without the cost of full-time hires.

How do Bookkeeping Errors Impact Tax Reporting?

Inaccurate records can cause incorrect filings or missed deductions. These errors may result in penalties or trigger IRS audits.