Utilizing accounting software is a significant timesaver and efficiency booster. Accounting software can easily record and categorize financial transactions, create invoices, assist in the collections process, aid payroll procedures, and generate reports that are key to maintaining financial visibility. With a myriad of options on the market, the difficult decision is not whether or not to use accounting software, but rather which software to adopt. The best software fit will depend on the industry, size, and goals of the business. Here, we’ll address some of the key questions to consider when a business is evaluating accounting software and ERPs to implement.

First Things First—ERP or Accounting Software?

The main difference between an Enterprise Resource Planning system (ERP) and accounting software is the overall functionality each can provide for the business. The latter focuses on supporting the main tasks of an accounting department, including areas such as:

- Accounts receivable

- Accounts payable

- General ledger management

- Financial reporting

- Bank management

- Revenue recording and tracking

Accounting software may be the first system to be implemented in a small business, as many systems are not cost prohibitive, and can organize a business’ financials in the early stages to promote growth.

On the other hand, an ERP system will always include the same features as accounting software, as well as additional tools for managing and integrating aspects of the business across multiple departments. This can include:

- Inventory tracking

- Warehouse management

- Customer relationship management

- Human resources

- Ecommerce

- Supply chain

- Manufacturing

An ERP is a fully integrated, comprehensive, end-to-end solution that helps to manage nearly every aspect of a business. While small businesses may start with only basic accounting software, an ERP may replace the accounting software as the business grows more complex. An ERP may also be a better fit early on for businesses within certain industries, such as manufacturing, healthcare, or construction.

Conducting some initial research regarding the features and services that your business needs can help you determine if you should shop for an ERP as opposed to a more basic accounting software.

How is the Customer Service?

Reliable accounting software should be backed up by robust customer service, especially when considering the challenges that implementing a new software can present. In fact, 68% of consumers are willing to pay more for a software if the brand is known to have excellent customer service.

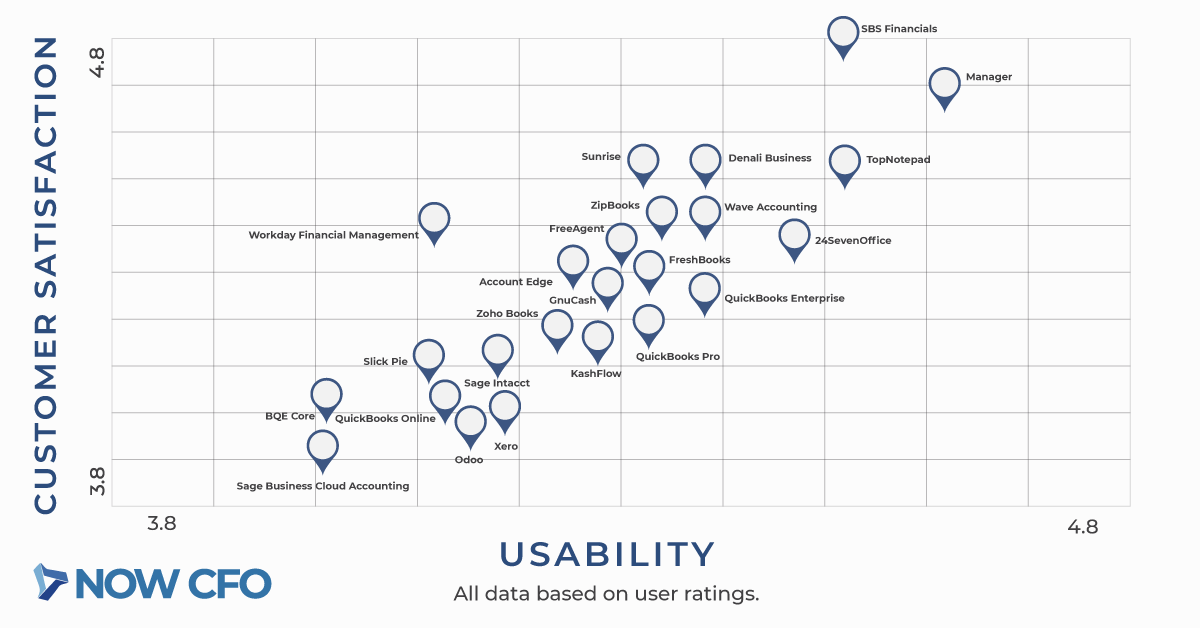

Before selecting a system, it’s important to conduct research by reading online reviews and customer testimonials. You may also want to find out the company’s support hours, average wait time, communication channels, and support team location.

Is the System Cloud-Based or Desktop?

Cloud-based versus desktop software is often the deciding factor for accounting software. Cloud accounting software is completely online, eliminating the worry of losing data in the case of a computer crash, and providing convenience to an increasingly remote workforce. This is also beneficial for businesses provide services to multiple clients, as information can be accessed from anywhere. 82% of small businesses currently use cloud-based accounting software.

Desktop accounting software must be downloaded to the computer and manually updated and backed up. Though cloud-based is generally the more popular option, desktop software offers the benefit of one flat fee upfront as opposed to a monthly subscription cost.

What are the Key Features?

Ultimately, the best software fit will depend on the accounting needs of the business. Before settling on a software, it may be beneficial to create a list of must-have features that will best serve the business. Consider if your business needs, for example, the ability to generate customer invoices, make vendor payments, reconcile accounts, or allow your team to log in and access data from multiple locations.

Does it Fit the Budget?

Typically, the more features the accounting system offers, the more expensive it will be. Additionally, an ERP will almost always outprice software exclusively for accounting. Conducting a price comparison is essential before settling on a software. Look into hidden costs, such as additional fees per user or for add-ons, as well as the pricing model. Another factor to consider is whether or not a feature you need most is unlimited or costs per use, such as invoice generation.

How User-Friendly is the System?

Finally, perhaps the most important factor when choosing an accounting software is whether or not you will actually be able to use it! Customer reviews and testimonials will similarly allow you to evaluate user-friendliness. Many accounting systems offer free trials and demonstrations which are worth exploring to determine if your team will be able to fully utilize the software and its features. Additionally, if the software offers implementation support, the time spent in the learning curve will be greatly reduced.