Effective financial forecasting is essential for informed decision-making and strategic planning in a modern business environment. By analyzing historical data and current market trends, businesses can anticipate future economic conditions, enabling them to allocate resources efficiently and mitigate potential risks.

Developing accurate financial forecasts demands specialized expertise and a deep understanding of economic dynamics, which SMEs often lack internally.

In such cases, engaging an outsourced CFO is a strategic solution. An outsourced CFO brings a wealth of experience and specialized knowledge, offering objective insights that can enhance the accuracy of financial forecasts.

What Is Financial Forecasting?

Understanding financial forecasting is crucial for effective business planning. It enables companies to anticipate future economic performance and make informed decisions. According to the National Center for Education Statistics, ensuring the accuracy of essential data is critical for increasing forecast reliability.

Definition and Purpose of Financial Forecasting

Financial forecasting, different than budgeting, involves analyzing historical and current trends to estimate a company’s future economic outcomes. This process examines revenue, expenses, and cash flow to predict financial health. Businesses can set realistic goals and allocate resources efficiently by leveraging past performance and market conditions.

Why Financial Forecasting Is Essential for Business Growth

Accurate financial forecasting is vital for several reasons:

- Informed Decision-Making: Provides insights into potential risks and opportunities, guiding strategic choices.

- Resource Allocation: Helps budget and ensure funds are directed toward growth initiatives.

- Investor Confidence: Demonstrates a clear financial plan, attracting potential investors.

Moreover, financial forecasting allows businesses to anticipate market changes and adjust strategies proactively, fostering sustainable growth.

Key Financial Forecasting Methods

Understanding financial forecasting requires exploring its methods, broadly categorized into quantitative and qualitative approaches, each with distinct advantages.

Quantitative Forecasting Methods

Quantitative methods utilize numerical data and statistical techniques to forecast financial outcomes. They are particularly effective when ample historical data is available. Key quantitative methods include:

- Trend analysis examines historical data to identify consistent patterns or trends that are projected into the future.

- Regression analysis assesses the relationship between dependent and independent variables to predict future financial metrics.

- Time series analysis analyzes data points collected or recorded at specific intervals to forecast future values.

Qualitative Forecasting Methods

In contrast, qualitative methods rely on expert judgment and non-numerical data, making them valuable when historical data is scarce or when forecasting new ventures. Notable qualitative methods include:

- Expert opinion gathers insights from individuals with extensive experience or specialized knowledge in a particular industry.

- Market research involves conducting surveys and focus groups to gauge consumer behavior and market trends.

- The Delphi method relies on a panel of experts to achieve a consensus forecast.

Cash Flow Forecasting

Cash flow forecasting focuses on estimating the inflow and outflow of cash over a specific period. Research shows that around 80% of small businesses struggle with cash flow issues at some point, emphasizing the importance of this technique.

This method helps businesses:

- Anticipate cash shortages and plan accordingly.

- Make informed decisions about investments and expenses.

- Maintain financial stability during unpredictable market conditions.

For instance, cash flow projections help identify funding needs and align them with business operations, ensuring uninterrupted workflows.

Sales Forecasting

Sales forecasting estimates future sales volumes and revenue based on historical data, market analysis, and sales trends. According to the SBA, 66% of small business owners expect revenue increases, and more than half plan to expand their business, highlighting the importance of accurate sales forecasting.

Businesses use sales forecasts to:

- Allocate resources effectively.

- Develop realistic revenue targets.

- Plan marketing and operational strategies.

This technique proves especially useful during growth periods or when launching new products. Incorporating sales trends ensures alignment with market demands.

Budgeting and Forecasting for Expenses

Budgeting involves setting financial limits, while forecasting predicts how these budgets align with actual performance. Integrating these tools allows companies to:

- Adjust expense allocations in real time.

- Identify cost-saving opportunities.

- Enhance overall financial planning and forecasting.

How an Outsourced CFO Improves Financial Forecasting

Understanding how an outsourced CFO adds value to financial forecasting can significantly benefit businesses. By bringing expertise, advanced tools, and an external perspective, an outsourced CFO refines forecasting processes to ensure accuracy and strategic alignment.

Providing Expertise in Data Analysis and Trend Identification

An outsourced CFO specializes in analyzing vast amounts of financial data. This expertise enables businesses to:

- Detect trends that influence revenue and expenses.

- Identify potential risks and opportunities early.

- Create actionable financial forecasts based on robust analysis.

For instance, an outsourced CFO dives deeper into market patterns and internal metrics instead of relying on fundamental trend analysis, ensuring comprehensive and realistic projections. Their skill set often surpasses in-house teams, especially in SMEs.

Customizing Forecasting Models to Fit Your Business

Every business operates uniquely, and forecasting must reflect those nuances. Outsourced CFOs tailor models based on factors such as:

- Industry-specific trends and benchmarks.

- Organizational goals and growth stages.

- Historical data and predictive analytics.

This customization ensures financial forecasts provide actionable insights, enabling businesses to effectively align resources with strategic priorities.

Enhancing Accuracy with Advanced Tools and Software

Outsourced CFOs leverage state-of-the-art forecasting tools and technologies to deliver unparalleled accuracy. These tools provide:

- Real-Time Data Analysis: Advanced software enables instant forecast updates, reflecting current market and operational conditions.

- Scenario Planning: Businesses can simulate various economic or market scenarios to assess potential outcomes and risks.

- Data Integration: Tools consolidate information from multiple sources, including accounting systems and market analytics, into unified forecasts.

For example, outsourced CFOs can provide real-time insights using cloud-based forecasting tools, enabling businesses to pivot strategies promptly.

Collaborating on Financial Strategy for Long-Term Growth

An outsourced CFO doesn’t stop at creating forecasts; they also play a strategic role in shaping the company’s financial future. Collaboration typically includes:

- Strategic Resource Allocation: Ensuring funds are directed toward areas with the highest growth potential.

- Investment Evaluation: Assessing opportunities based on forecasted returns and risks.

- Operational Efficiency: Identifying cost-saving opportunities without compromising quality.

This partnership helps businesses align financial forecasting with objectives, such as scaling back less profitable ventures and reinvesting in high-margin projects based on robust forecasts.

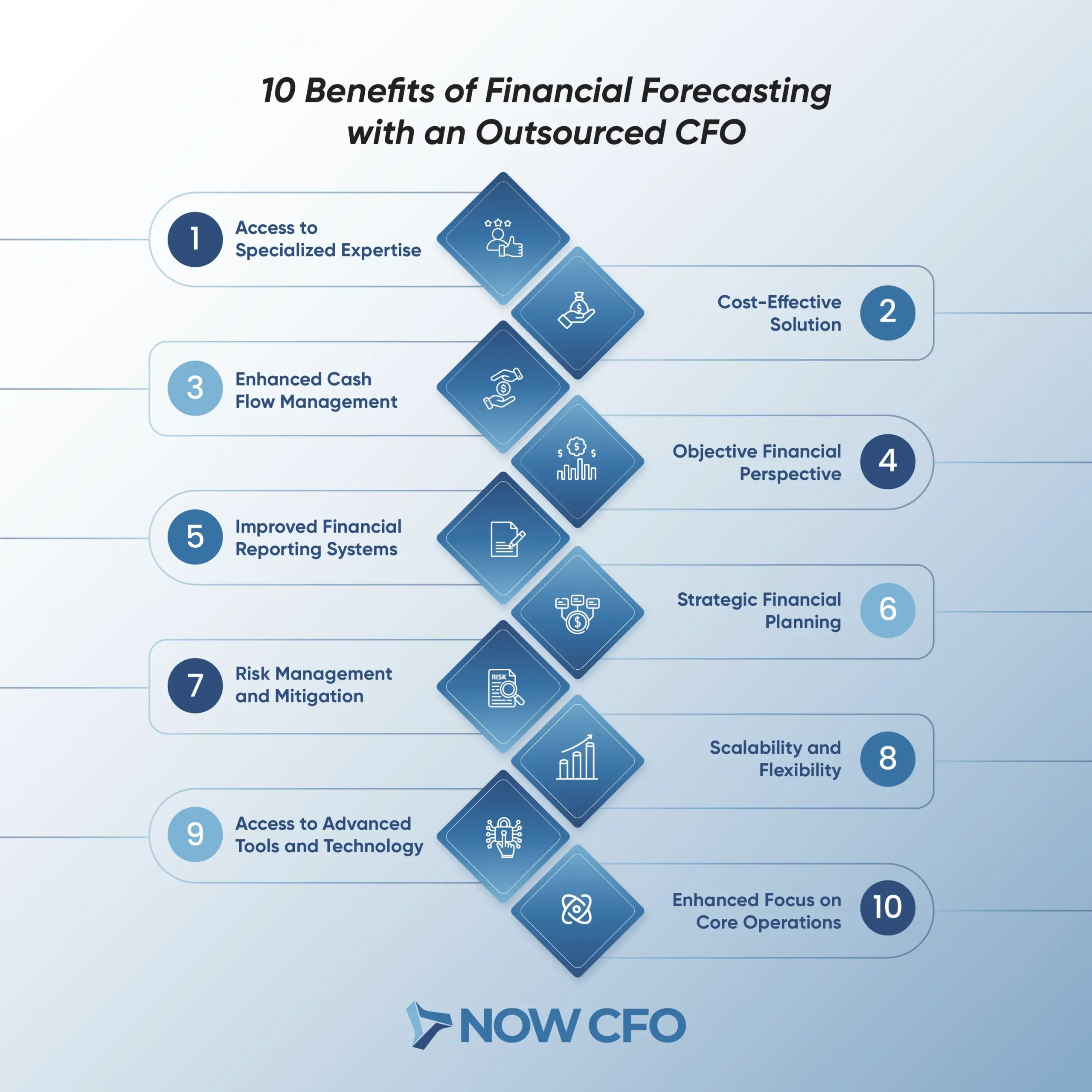

10 Benefits of Financial Forecasting with an Outsourced CFO

Shifting from the functional role of an outsourced CFO, their specific advantages in financial forecasting include delivering precise, actionable strategies tailored to unique business needs.

1. Access to Specialized Expertise

Outsourced CFOs possess deep knowledge and experience in financial forecasting methods across various industries. They understand complex financial data and apply advanced forecasting models, ensuring businesses gain accurate and reliable financial insights. This expertise is invaluable for companies without an in-house financial team capable of high-level analysis.

2. Cost-Effective Solution

SMEs often face budget constraints for forecasting. Hiring a full-time CFO with similar qualifications can be costly. Outsourced CFOs provide access to the same level of expertise at a fraction of the cost. This approach ensures businesses allocate financial resources more effectively without sacrificing quality forecasting.

3. Enhanced Cash Flow Management

Cash flow is the lifeblood of any business. Outsourced CFOs use tools to meticulously forecast cash flow, helping companies anticipate potential shortages or surpluses. They develop proactive strategies to maintain liquidity, such as timing expenditures or securing credit lines. Poor cash flow management contributes to 82% of business failures.

4. Objective Financial Perspective

One of the most significant benefits of outsourcing is having an external, unbiased viewpoint. An outsourced CFO evaluates financial data impartially, identifying risks, inefficiencies, or missed opportunities that might go unnoticed internally. This objectivity ensures that strategic decisions are based on facts rather than internal biases.

5. Improved Financial Reporting Systems

Outsourced CFOs implement comprehensive financial reporting frameworks that provide clarity and actionable insights. These systems streamline data presentation, ensuring stakeholders understand the financial position at a glance. Better reporting leads to informed decision-making, which is critical for long-term success.

6. Strategic Financial Planning

Outsourced CFOs help craft detailed financial strategies that align forecasts with long-term goals. They assess trends, industry dynamics, and internal capabilities to ensure financial objectives support broader business strategies.

7. Risk Management and Mitigation

Financial forecasting isn’t just about projections; it’s about preparedness. Outsourced CFOs excel in identifying risks that could derail financial stability. For example, they create contingency plans to counter cash flow challenges due to delayed receivables.

8. Scalability and Flexibility

Outsourced CFO services adapt to the evolving needs of businesses. During periods of rapid growth, they scale efforts to manage increased complexity in forecasting, such as integrating new revenue streams or adjusting budgets during fluctuations.

9. Access to Advanced Tools and Technology

Outsourced CFOs utilize cutting-edge tools for precision in forecasting. These technologies provide:

- Dynamic forecasting models: Predict outcomes under various scenarios.

- Automated reporting tools: Deliver insights faster and with greater accuracy.

- Real-time updates: Allow businesses to make informed decisions as conditions change.

10. Enhanced Focus on Core Operations

Delegating financial forecasting to a professional frees management to focus on operational excellence. Outsourced CFOs handle the intricacies of forecasting, enabling leaders to prioritize:

- Product innovation.

- Customer acquisition strategies.

- Building competitive advantages in the market.

This delegation ensures seamless financial planning and forecasting, empowering leadership to drive business growth.

Financial Forecasting in Action: Real-World Examples

It’s insightful to examine real-world applications when transitioning from the theoretical benefits of engaging an outsourced CFO. The following case studies illustrate how companies have leveraged financial forecasting & CFO.

Case Study 1: Global Logistics Service Provider’s Earnings Forecasting

A global logistics company specializing in transporting liquid bulk commodities faced challenges in predicting monthly profitability due to the lack of correlation between order volume and financial performance. To address this, the company implemented predictive analytics for earnings forecasting.

Challenges:

- Unpredictable monthly earnings despite consistent order volumes.

- Difficulty in aligning financial forecasts with actual performance.

Solutions Implemented:

- Predictive Analytics Model: Developed an Earnings Before Interest and Taxes (EBIT) forecasting model using historical data and statistical methods to predict future earnings.

- Data Integration: Incorporated various internal and external data sources to enhance the accuracy of forecasts.

Outcomes:

- Improved accuracy in monthly earnings predictions, leading to better financial planning.

- Enhanced strategic decision-making capabilities based on reliable financial forecasts.

This case demonstrates the effectiveness of predictive analytics in financial forecasting, enabling companies to anticipate financial performance and make informed strategic decisions.

Case Study 2: AB InBev’s Forecasting During COVID-19

In July 2021, AB InBev, the world’s largest beer company, faced the challenge of forecasting financial performance amid the uncertainties of the COVID-19 pandemic. The company needed to adapt its forecasting methods to navigate the rapidly changing environment.

Challenges:

- Unprecedented market volatility due to the pandemic.

- Disrupted supply chains and fluctuating consumer demand.

Solutions Implemented:

- Dynamic Forecasting Models: Implemented flexible forecasting models that could be adjusted in real-time as new data became available.

- Cross-functional collaboration: Engaged various departments to provide input, ensuring forecasts reflected comprehensive business insights.

Outcomes:

- Maintained operational stability by aligning production and distribution with updated forecasts.

- Informed strategic decisions that mitigated financial risks during the crisis.

This example highlights the importance of adaptable forecasting methods and cross-functional collaboration in navigating financial uncertainties during a global crisis.

How to Choose the Right Outsourced CFO for Financial Forecasting

Selecting the appropriate outsourced CFO is crucial for enhancing your company’s financial forecasting capabilities. A well-chosen interim CFO brings expertise, strategic insight, and industry-specific knowledge, directly impacting your business’s economic health and growth trajectory. Here’s a comprehensive guide to making an informed decision.

1. Look for Relevant Industry Experience

An outsourced CFO with experience in your industry understands its unique financial challenges and opportunities. This familiarity enables them to provide tailored forecasting models and strategic advice.

For instance, an interim CFO experienced in the manufacturing sector will be adept at managing supply chain costs and capital expenditures. At the same time, one in the tech industry might focus on scaling and intellectual property valuation.

2. Ensure Strong Analytical Skills and Data Proficiency

Proficiency in financial analysis is essential. The CFO should be capable of interpreting complex financial data to inform strategic decisions. This includes:

- Budgeting and Forecasting: Creating and managing budgets and offering insights into financial forecasting based on industry trends and company performance.

- Risk Management: Identifying financial risks and implementing mitigation strategies.

- Performance Metrics: Developing KPIs to monitor financial health.

3. Confirm Proven Track Record in Financial Planning

Investigate the CFO’s history of success in similar roles: request case studies or references to assess their impact on previous clients. Positive testimonials and documented achievements indicate reliability and effectiveness.

4. Consider the Ability to Offer Customized Forecasting Solutions

Your business is unique, and so are its financial forecasting & CFO needs. Ensure the outsourced CFO can develop customized solutions aligning with your goals and challenges. This includes proficiency in the latest financial software and analytics tools, which can provide more accurate forecasting and real-time insights, giving your business a competitive edge.

5. Evaluate Compatibility with Your Business Goals

Effective communication is vital. The CFO should be able to explain financial concepts clearly to non-financial stakeholders. Their working style should also align with your company’s culture to facilitate seamless collaboration.

According to Beach Fleischman, leadership and communication skills are essential for a CFO, as they need to align, motivate, and move the organization in the right direction.

Conclusion: Strengthen Your Financial Planning with an Outsourced CFO

Effective financial forecasting is a cornerstone of successful business planning. It enables organizations to anticipate future challenges, seize opportunities, and make informed decisions. Partnering with an outsourced CFO enhances this process by bringing specialized expertise, objective insights, and access to advanced forecasting tools that many businesses might not have in-house.

A fractional CFO doesn’t just provide numbers; they offer strategic value. Their contributions go beyond routine forecasting tasks, from creating tailored financial models to aligning forecasts with long-term business goals. This strategic partnership can help businesses manage cash flow, allocate resources efficiently, and prepare for growth or unforeseen risks.

In conclusion, outsourcing CFO services for financial forecasting empowers businesses to enhance their financial planning and forecasting capabilities and gain a competitive edge. If you require assistance in economic forecasting, feel free to contact our experts.