When business owners consider hiring an outsourced accounting service, understanding the strategic payoff is essential. In 2021, 62% of SMEs relied on in-house accountants, a number that has been steadily declining since then.

When you hire an outsourced accounting service, you gain expert oversight without the full-time salary burden. Outsourced teams handle everything from outsourced bookkeeping and AP/AR to payroll and tax-ready financials, delivering accuracy and timeliness.

What Is an Outsourced Accounting Service?

Outsourced accounting involves partnering with an external provider to manage your financial operations. This model provides expert bookkeeping, reporting, and advisory services without the overhead of full-time in-house staff.

Core Functions Provided

Outsourced accounting teams handle tasks like:

- Bookkeeping & reconciliations

- Accounts payable/receivable

- Payroll processing

- Monthly/quarterly financial reporting

- Tax-ready statement preparation

- CFO-level advisory on cash flow, forecasting, and strategy

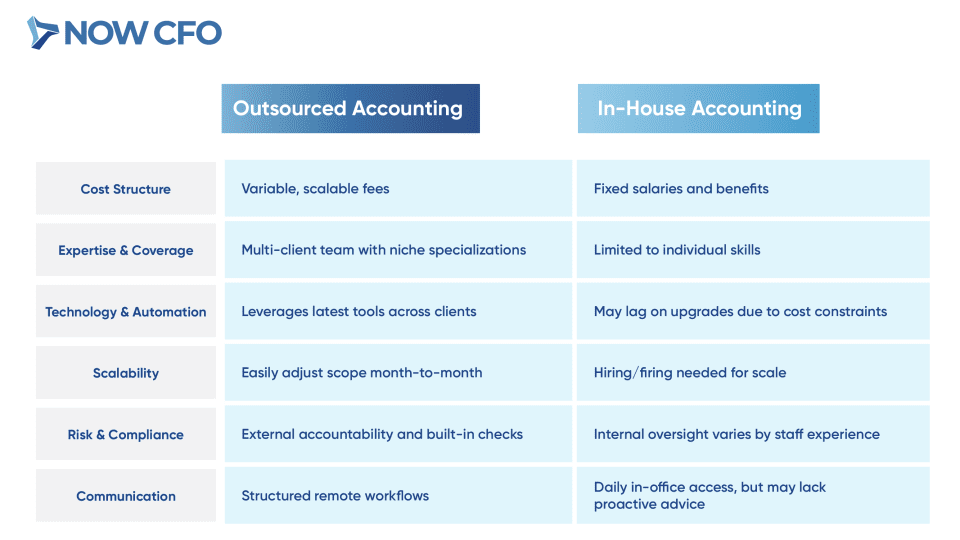

Differences From In-House Accountants

Outsourced firms and in-house accountants each serve crucial roles, but vary significantly:

What Types of Businesses Benefit

Many company types thrive from outsourcing accounting.

- Early-stage startups with limited budgets and no internal finance hires

- Growing SMBs scaling operations and needing better financial visibility

- Seasonal businesses with fluctuating workloads

- M&A or fundraising candidates requiring clean, audit-ready books

- Companies lacking internal expertise, avoiding errors and penalties

- Firms aiming to reduce headcount costs while improving control

Signs It’s Time to Hire an Outsourced Accounting Service

Recognizing these warning signs helps business owners transition from reactive accounting to proactive strategy.

Your Books Are Always Behind or Inaccurate

If your financial records lag or contain errors, cash flow forecasts suffer, and so do decision-making. Falling behind on reconciling accounts triggers inaccurate performance snapshots, risking poor planning or missed revenue.

You’re Spending Too Much Time on Accounting Tasks

Spending excessive hours on bank reconciliations, payroll, or invoicing pulls you away from strategic roles. That’s where a remote accounting service comes in. By handling repetitive accounting chores, you are freed to focus on scaling operations or improving small business accounting solutions.

You’re Scaling Quickly and Need Financial Clarity

Rapid revenue or headcount growth without solid financial tracking causes blind spots. When your team expands quarter-over-quarter, forecasting and budgeting suffer.

Hiring an outsourced accounting provider ensures accurate scaling metrics, improved cash burn analysis, and financial insights that support operational decisions. This shift gives you both clarity and confidence during high-growth phases.

You’re Preparing for Fundraising or M&A

Due diligence demands spotless, credible accounts. Investors and acquirers require clean financials going back at least 2–3 years. Companies often discover errors during due diligence, potential deal killers.

By bringing on an outsourced accounting service, you get audit-ready books, polished financial statements, and proactive advice on documentation and compliance. Whether you’re exploring when to outsource accounting or planning funding rounds, expert accounting support clears the path to capital and negotiation leverage.

You Lack Internal Accounting Expertise

Cash flow modeling, tax planning, and inventory automation require qualified experts. However, hiring a full-time accountant or CFO with those capabilities may exceed budget constraints.

In 2023, the BLS noted 1.6 million accounting and auditing jobs, with incomes averaging over $81,000/year, a steep price for startups. Instead, an outsourced vs in-house accounting decision leans toward outsourced: you access top-tier expertise.

You’ve Had Errors in Taxes or Compliance

Mistakes in tax returns or compliance filings can lead to fines, penalties, or audits. On average, businesses spend hundreds of hours each year and incur significant expenses just to meet regulatory compliance requirements.

Outsourced accounting firms specialize in up-to-date tax laws and internal controls. They build audit-ready processes and proactively correct discrepancies, mitigating risk and protecting your business.

Benefits of Hiring an Outsourced Accounting Service

Partnering with an outsourced accounting provider can bring measurable gains without overloading your budget.

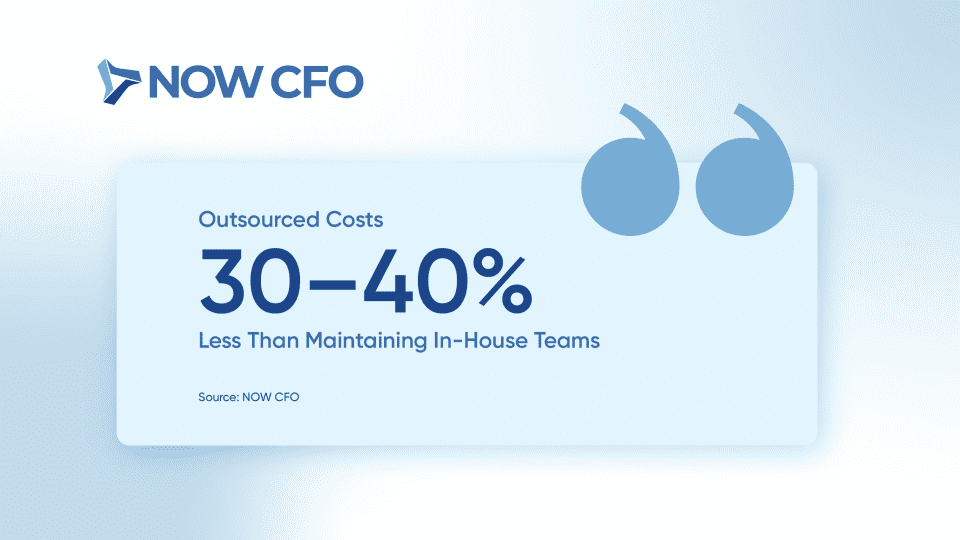

Lower Operational Costs

Outsourced models often cost 30–40% less than maintaining an in-house team. You avoid salaries, benefits, office space, and software expenses. You pay only for the services you need.

Source: NOW CFO

- Eliminate healthcare, payroll taxes, and recruitment fees

- No overhead for software licenses or office equipment

- Adjust services monthly as your needs change

Access to Experienced Professionals

Outsourced providers assemble cross-functional teams that include CPAs, controllers, and finance specialists. Unlike a single in-house hire, these experts bring diverse niches, from tax compliance to cash flow management.

Faster Reporting and Close Cycles

Outsourced accounting firms streamline month-end and quarterly closings using efficient processes and seasoned staff. This speed clarifies performance tracking and financial forecasting, essential during growth phases or pre-investment, and accelerates visibility and action when hiring an outsourced accounting service.

Flexibility to Scale Services

Outsourced teams adjust support based on seasonal demands or market conditions. Whether you need quarterly tax prep or project-based advisory, your scope adapts monthly, and no hiring or layoffs are required.

Technology and Automation Integration

Outsourced firms invest in cloud-based ERP, AI-driven reconciliation, and automation tools, and include software costs in their fees. They implement bots and OCR tech to reduce manual data entry errors significantly.

- Automate bank feeds, invoices, and reconciliation

- Provide real-time dashboards with key metrics

- Ensure cybersecurity and compliance via vendor-grade protocols

When is the Right Time Based on Business Stage?

Tailoring the decision to hire an outsourced accounting service by stage ensures you’re not paying for capabilities you don’t yet need. Below, we match business stage with optimal accounting support.

Early-Stage Startups

In the earliest phase, startups focus on product-market fit yet must manage cash flow. With limited resources and no full-time financial team, outsourcing delivers financial discipline and accuracy.

Over 66% of SMEs outsource, including bookkeeping, to stay lean. By bringing a virtual accounting team onboard early, founders can access timely financial reports, streamlined expense tracking, and better investor transparency without full-time overhead.

Growth-Stage Companies

As sales and headcount ramp up, complexity stretches in-house capabilities. You may need remote accounting services and small business accounting solutions to interpret P&L variances, model cash requirements, or prepare for new funding.

A study shows that 37% of businesses outsource accounting during growth, delivering expertise and lightening internal load. With outsourced partners, you gain monthly forecasts, budgeting support, and strategic analysis, allowing leadership to spend less time on reconciliation and more on growth.

Mid-Market Businesses

Manual reporting strains agility once you reach mid-market, with revenue of $10M+. This trend reflects demand for standardized, scalable financial operations without hiring full-time controllers or CFOs.

Outsourced accounting provides structure: clean financial closes, compliance oversight, KPI dashboards, and advisory support. The flexibility to tier up or down aligns perfectly with questions like when to outsource accounting.

Companies Undergoing Audits or Acquisitions

You need clean and compliant records when preparing for audits, acquisitions, or fundraising rounds.

- Implement audit-ready processes and controls

- Deliver due diligence-quality documentation

- Provide CFO/advisory support during deal structuring

- Ensure regulatory and GAAP compliance

What Services Should You Expect from an Outsourced Team?

Outsourced accounting teams cover end-to-end finance functions, freeing you from detailed work while delivering strategic insights. Below are the core services included.

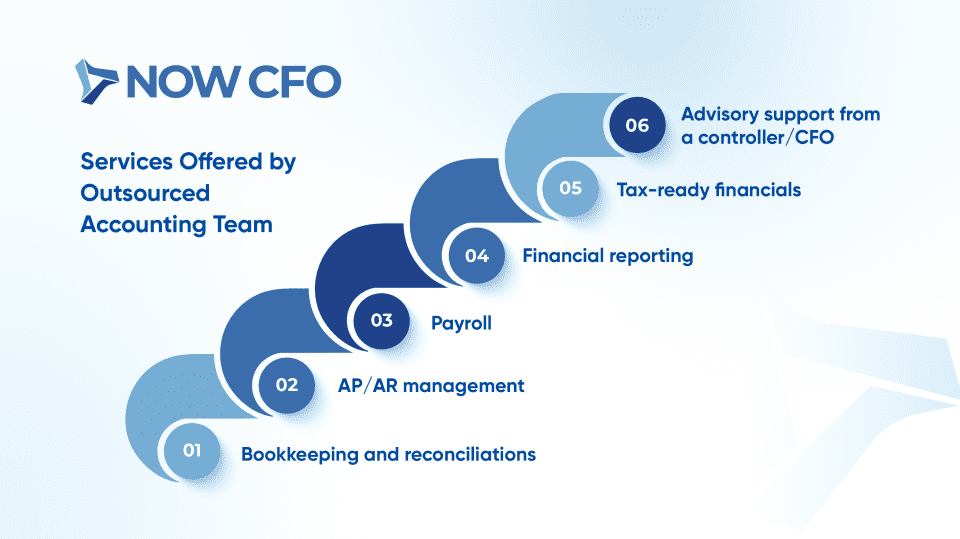

Services Offered by Outsourced Accounting Team

Bookkeeping and Reconciliations

Outsourced teams manage day-to-day entries, bank reconciliation, and expense categorization, ensuring books are always accurate and up to date. These services underpin small business accounting solutions and form the foundation for reliable financial statements.

AP/AR Management

Outsourced teams track payables and receivables, send invoices, reconcile vendor statements, and manage collections. By automating accounts payable and accounts receivable, they improve cash flow visibility, which is part of both outsourced and virtual accounting team offerings.

Payroll

Outsourced payroll ensures timely, compliant wage processing and tax filings. The IRS notes that many businesses outsource payroll to third-party providers to “meet filing deadlines and deposit requirements. This service frees you from manual payroll tracking and error risk.

Financial Reporting

Teams produce monthly, quarterly, and annual financial reports; P&L, balance sheet, and cash flow statements, aligned with GAAP. They provide actionable monthly dashboards, enabling strategic decisions and aligning with when to outsource accounting for clarity and accountability.

Tax-Ready Financials

Outsourced providers prepare clean, audit-ready records and handle tax-related adjustments. This ensures accurate filings and support during tax season, reducing errors and risk. It’s a key benefit of outsourced vs in-house accounting.

Advisory Support from a Controller/CFO

Providers often include strategic advisory services, such as forecasting, budgeting, and cash-flow modeling. This CFO-level counsel helps with growth planning, fundraising, and decision-making. It complements outsourced bookkeeping by elevating financial strategy through sound analysis.

How to Choose the Right Outsourced Accounting Partner

Selecting a provider requires careful alignment of expertise, process, and outcomes. Use the criteria below to guide your decision-making.

Questions To Ask Before Hiring

Before signing on, ask targeted questions:

- What is your experience with companies at our stage?

- Can you share references or case studies?

- Which software and automation tools do you use?

- What is your turnaround time for monthly close and reporting?

Matching Services with Your Goals

Map your needs: bookkeeping, tax compliance, advisory, and provider services. Confirm they deliver both outsourced bookkeeping and CFO-level insight if needed. Ask how they handle scale and complexity. Aligning expectations upfront ensures your remote accounting services provide value and remain flexible as your goals evolve.

Onboarding And Transition Process

Ensure the vendor has a clear onboarding roadmap, timelines, data migration, internal role mapping, and communication protocols. Clarify kickoff deliverables and establish regular check-ins to keep the process on track and aligned with your decision to hire an outsourced accounting service.

Measuring ROI And Performance

Define KPIs: cost reduction, cycle time, error rates, reporting accuracy, and advisory impact. Track them monthly or quarterly. Regular performance reviews ensure the partnership stays aligned with your outsourced accounting goals and supports company growth.

Common Mistakes to Avoid When Hiring an Outsourced Team

Ensuring you sidestep these frequent errors is essential to secure value from your outsourced accounting partnership.

Choosing Based Only on Price

Opting for the lowest-cost provider often means sacrificing quality, expertise, or technology. When you hire an outsourced accounting service, balance cost considerations with proven performance, software capabilities, and service offerings to avoid costly oversights.

Lack of Clear KPIs

Before engagement, define metrics: close-cycle time, error reduction, reporting accuracy, or cost savings. Without these, evaluating success becomes difficult. For instance:

- Reporting accuracy > 98%

- Close-cycle ≤ 5 business days

- Monthly financial reviews conducted

Poor Communication Expectations

Misaligned communication protocols cause delays and frustration. Clarify:

- Meeting cadence (weekly, monthly)

- Responsible contacts and escalation paths

- Reporting formats and dashboards

- Response time targets (< 24 hours)

Not Verifying Security and Compliance Protocols

Failing to confirm data security, encryption standards, and compliance certifications (e.g., SOC 2) exposes you to cyber risk and regulatory penalties. Ensure robust controls before you hire an outsourced accounting service to protect data and maintain compliance.

Conclusion

When you hire an outsourced accounting service, you’re unlocking expert financial support tailored to your business. Outsourcing enables more than just operational efficiency; it provides a strategic partnership to drive decision-making, ensure compliance, and scale confidently.

At NOW CFO, our experienced team delivers outsourced bookkeeping, payroll, reporting, and CFO-level advisory. Book a complimentary discovery session with NOW CFO to evaluate how we can support your financial operations.