Dealing with the complexities of SEC compliance has become more demanding for public companies and those gearing up for IPOs. The SEC reported a record $8.2 billion in financial remedies in fiscal year 2024, highlighting the intensified scrutiny on corporate financial practices.

An outsourced CFO for SEC compliance offers a strategic solution by delivering financial clarity, reducing risk, and ensuring companies meet evolving regulatory demands. They provide specialized expertise to ensure accurate financial reporting, adherence to regulatory standards, and effective risk management.

The Role of SEC Compliance in Business Operations

Managing the complexities of SEC compliance is essential for companies striving to maintain transparency and build investor trust. A solid grasp of its foundational principles lays the groundwork for accurate financial reporting and consistent regulatory alignment.

What is SEC Compliance and Why Does It Matter

SEC compliance refers to the adherence to regulations set forth by the U.S. Securities and Exchange Commission, which mandates that public companies disclose accurate financial information. This compliance ensures that companies provide timely and truthful information about their financial health, enabling investors to make informed decisions.

For instance, under the Securities Exchange Act of 1934, companies must file periodic reports detailing their financial performance and operations, including 10-K and 10-Q preparation. These filings are crucial for maintaining transparency and trust in the capital markets.

Moreover, the Sarbanes-Oxley Act of 2002 introduced stringent reforms to enhance corporate responsibility and financial disclosures, emphasizing the importance of Sarbanes-Oxley compliance in safeguarding investor interests.

Financial Reporting Obligations for Public Companies

Public companies must adhere to specific financial reporting requirements to ensure transparency and protect investors. These obligations include:

- Form 10-K: An annual comprehensive report detailing a company’s financial performance, including audited financial statements, management’s discussion and analysis, and disclosures about market risk.

- Form 10-Q: A quarterly report providing unaudited financial statements and continuing disclosures about the company’s financial condition and operations.

- Form 8-K: A report filed to announce major events that shareholders should know about, such as acquisitions, bankruptcy, or changes in executive leadership.

These filings are integral to maintaining SEC compliance support, ensuring investors can access timely and accurate information. Failure to meet these obligations can lead to severe consequences, including legal penalties and loss of investor confidence.

Consequences of Non-Compliance and Missed Filings

Failing to comply with SEC regulations or missing filing deadlines can significantly affect public companies. These consequences include:

- Legal Penalties: The SEC can impose fines and sanctions on companies that fail to meet reporting requirements.

- Loss of Investor Confidence: Non-compliance can erode investor trust, leading to a decline in stock prices and market capitalization.

- Delisting from Stock Exchanges: Persistent non-compliance may result in a company’s removal from major stock exchanges, limiting access to capital markets.

- Increased Scrutiny: Companies may face heightened scrutiny from regulators, auditors, and the public, which could impact their reputation and operations.

Key Regulatory Bodies and Requirements

Understanding the regulatory landscape is crucial for companies striving to maintain compliance. The primary regulatory bodies and their associated requirements include:

- Securities and Exchange Commission (SEC): The SEC enforces federal securities laws and oversees the disclosure of important market-related information.

- Financial Industry Regulatory Authority (FINRA): FINRA regulates broker-dealers and ensures that the securities industry operates fairly and honestly.

- Public Company Accounting Oversight Board (PCAOB): The PCAOB oversees the audits of public companies to protect investors and the public interest by promoting informative, accurate, and independent audit reports.

Together, these entities form the backbone of public company financial oversight, ensuring capital markets remain transparent and trustworthy.

Common Pitfalls in SEC Financial Reporting

Despite the best efforts, companies often encounter challenges meeting SEC financial reporting requirements. Utilizing outsourced SEC filing support minimizes errors in reporting and ensures timely submissions, especially during high-stakes periods.

Common pitfalls include:

- Inaccurate Financial Statements: Errors or misstatements in financial reports can lead to restatements and regulatory scrutiny.

- Inadequate Internal Controls: Weaknesses in internal control systems can result in non-compliance with the Sarbanes-Oxley Act.

- Delayed Filings: Missing filing deadlines can trigger penalties and damage a company’s reputation.

- Insufficient Disclosure: Failing to make comprehensive disclosures can mislead investors and violate SEC regulations.

Implementing robust financial controls for SEC reporting and leveraging outsourced SEC filing support can help companies avoid these pitfalls and maintain compliance.

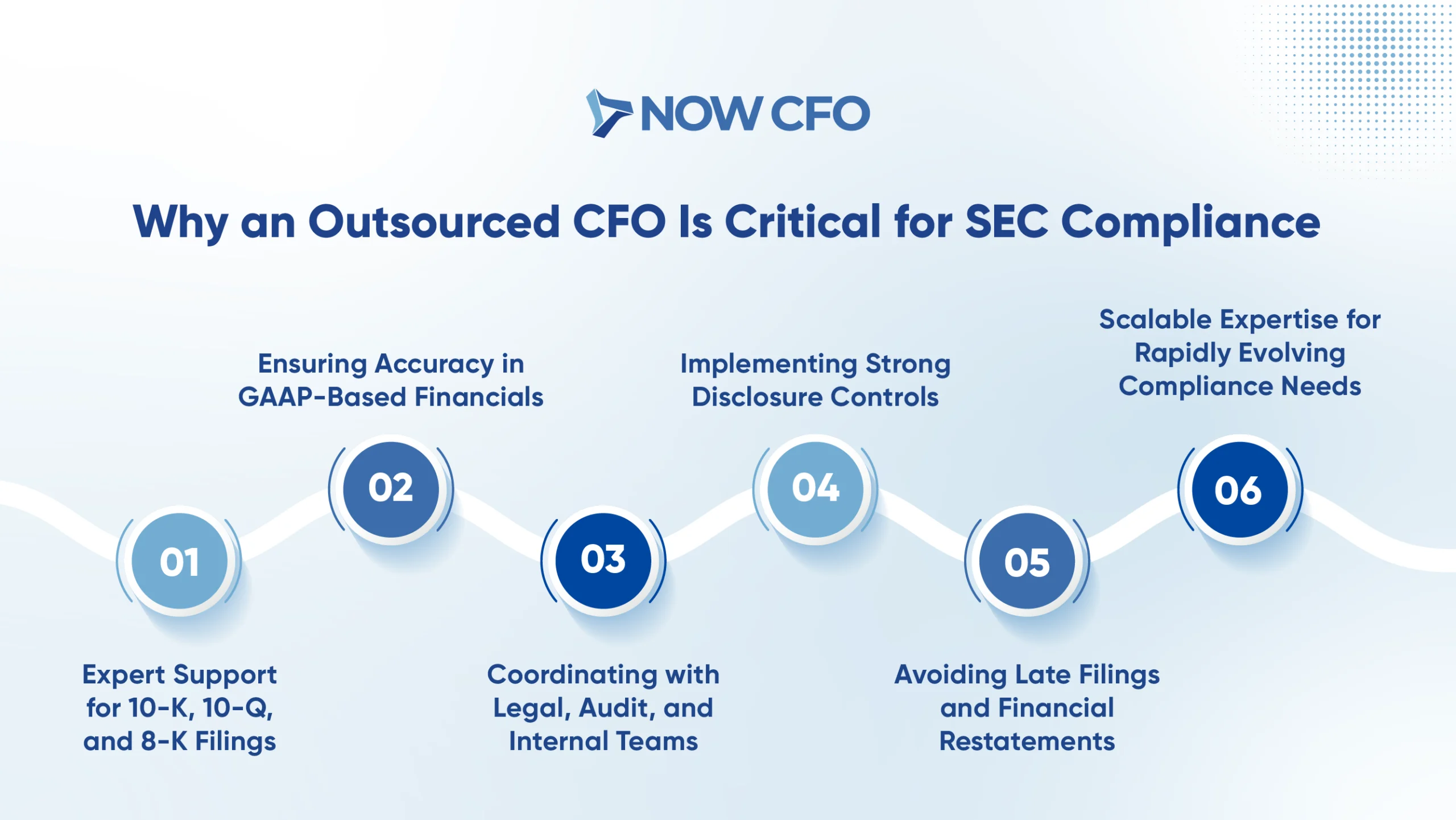

Why an Outsourced CFO Is Critical for SEC Compliance

Tackling SEC compliance complexities calls for deep expertise. Their familiarity with evolving SEC regulatory standards ensures companies fully align with federal expectations.

An outsourced CFO provides the proficiency and insight needed to maintain accurate financial reporting and meet regulatory deadlines.

Expert Support for 10-K, 10-Q, and 8-K Filings

An outsourced CFO for SEC compliance provides invaluable assistance in preparing and reviewing essential filings:

- Form 10-K Support: Annual comprehensive reports detailing financial performance.

- Form 10-Q Support: Quarterly reports providing unaudited financial statements.

- Form 8-K: Current reports announcing major events shareholders should know about.

To understand how an outsourced CFO supports SEC filings, consider the complexity of Form 10-K, 10-Q, and 8-K preparation.

Ensuring Accuracy in GAAP-Based Financials

The SEC’s enforcement actions in fiscal year 2024 resulted in over $600 million in civil penalties against over 70 firms for recordkeeping violations, underscoring the importance of accurate financial reporting.

Ensuring the accuracy of financial statements by GAAP is vital. An outsourced CFO for SEC compliance brings experience applying GAAP standards, ensuring that financial reports are accurate and compliant.

Through outsourced financial reporting, businesses benefit from consistent, audit-ready statements that align with evolving standards. This rigorous attention to detail aids in Material Misstatement Prevention, strengthening both investor trust and financial transparency

Coordinating with Legal, Audit, and Internal Teams

In fiscal year 2024, the SEC received 45,130 tips, complaints, and referrals, the most ever in a single year. This highlights the need for robust internal coordination to address potential issues proactively.

Effective coordination among legal, audit, and internal teams is crucial for seamless SEC compliance. An outsourced CFO for SEC compliance is a central liaison, facilitating communication and collaboration across departments.

Implementing Strong Disclosure Controls

Implementing robust disclosure controls and procedures is essential for accurate and timely financial reporting. An outsourced CFO for SEC compliance can assist in:

- Developing Comprehensive Policies: Establishing clear guidelines for financial disclosures.

- Conducting Regular Training: Ensure all relevant personnel know compliance requirements.

- Monitoring Compliance: Regularly reviewing processes to identify and address potential issues.

- Facilitating Audits: Preparing for and supporting internal and external audits to verify compliance.

Avoiding Late Filings and Financial Restatements

Timely and accurate filings, including quarterly reporting accuracy, are critical to maintaining investor confidence and avoiding regulatory penalties. An outsourced CFO for SEC compliance ensures that all reporting deadlines are met and that financial statements are accurate, reducing the likelihood of restatements.

Doing so significantly reduces financial restatement risk, a common concern for companies under SEC scrutiny.

Scalable Expertise for Rapidly Evolving Compliance Needs

To keep pace with shifting financial regulations, outsourced CFOs need agile expertise. An outsourced CFO for SEC compliance offers scalable solutions to meet evolving compliance requirements:

- Flexible Staffing: Adjusting resources to match the company’s changing needs.

- Continuous Training: Staying updated on the latest regulatory changes and best practices.

- Technology Integration: Implementing advanced tools to enhance compliance processes.

- Risk Management: Proactively identifying and mitigating potential compliance risks.

Learn More: Cash Flow Management with an Outsourced CFO

How Outsourced CFOs Improve SOX Readiness

SOX compliance CFO services are crucial for implementing structured internal controls and ensuring accurate disclosures that satisfy the Sarbanes-Oxley Act. An outsourced CFO with SEC compliance expertise helps companies manage these complexities, ensuring regulatory standards are met and financial integrity is strengthened.

Assessing Internal Control Frameworks

A foundational step in SOX readiness involves thoroughly evaluating a company’s internal control frameworks. An outsourced CFO for SEC compliance conducts comprehensive assessments to identify control deficiencies and areas susceptible to risk.

By leveraging their experience, outsourced CFOs can benchmark existing controls against industry best practices, providing actionable insights to strengthen the company’s internal control systems. This not only aids in achieving SOX compliance but also enhances operational efficiency and financial accuracy.

Supporting Risk Assessment and Testing Activities

Risk assessment is a critical component of SOX compliance, requiring companies to identify and evaluate potential threats to financial reporting accuracy. An outsourced CFO for SEC compliance plays a pivotal role in facilitating these assessments by:

- Identifying key risk areas within financial processes.

- Developing and implementing risk mitigation strategies.

- Coordinating with internal audit teams to test the effectiveness of controls.

Through these activities, outsourced CFOs ensure the company maintains a proactive stance in managing risks and strengthens internal audit coordination.

Implementing Controls Over Financial Reporting

Establishing adequate Internal Controls over Financial Reporting (ICFR) is essential for SOX compliance. An outsourced CFO for SEC compliance contributes significantly by:

- Designing and implementing control activities tailored to the company’s financial reporting processes.

- Ensuring that controls are documented, tested, and operating effectively.

- Facilitating the remediation of identified control deficiencies.

Strong financial controls for SEC reporting are essential to maintaining SOX compliance and investor confidence.

Managing External Audit Relationships

Effective collaboration with external auditors is vital for a successful audit process. An outsourced CFO for SEC compliance enhances this relationship by:

- Serving as the primary liaison between the company and external auditors.

- Coordinating the preparation and provision of necessary documentation and information.

- Addressing auditor inquiries and facilitating timely responses.

- Implementing recommendations provided by auditors to improve financial reporting processes.

Maintaining Audit Trails and Documentation

Maintaining comprehensive audit trails and documentation is crucial for demonstrating compliance and facilitating audits. An outsourced CFO for SEC compliance ensures this by:

- Implementing systems to track and record financial transactions accurately as part of thorough compliance documentation.

- Ensuring documentation is organized, accessible, and aligned with regulatory requirements.

- Regularly reviewing and updating records to reflect changes in processes or controls.

- Providing training to staff on proper documentation practices.

Providing Leadership During Financial Reviews

Strong leadership is essential during financial reviews to navigate complex regulatory landscapes and ensure compliance. An outsourced CFO for SEC compliance provides this leadership by:

- Guiding the financial review process with strategic oversight.

- Identifying areas for improvement and implementing necessary changes.

- Communicating effectively with stakeholders to align on objectives and expectations.

- Ensuring that reviews are conducted efficiently and by regulatory standards.

Learn More: How to Choose the Right Outsourced CFO for Your Business

Choosing the Right Outsourced CFO for SEC Compliance

When evaluating outsourced CFO services for public company reporting, it’s essential to assess experience with SEC filings, SOX standards, and internal control management

The right partner ensures adherence to regulatory standards and enhances the organization’s financial integrity and operational efficiency.

Experience with SEC Filings and SOX Standards

An effective outsourced CFO for SEC compliance should possess:

- Proven Track Record: Demonstrated experience preparing and filing Forms 10-K, 10-Q, and 8-K, ensuring timely and accurate submissions.

- SOX Compliance Expertise: In-depth knowledge of SOX requirements, particularly Sections 302 and 404, to establish and maintain robust internal controls over financial reporting.

- Audit Coordination Skills: Ability to liaise effectively with external auditors, facilitating smooth audit processes and addressing any identified issues promptly.

- Regulatory Insight: Staying abreast of evolving SEC regulations and ensuring the organization’s compliance strategies are updated accordingly.

Working Knowledge of PCAOB Guidelines

An outsourced CFO must comprehensively understand the PCAOB guidelines for SEC compliance. This includes familiarity with auditing standards and inspection processes that impact financial reporting.

In 2024, the PCAOB reported a decrease in the aggregate Part I. A deficiency rate of 39%, down from 46% in 2023, indicates improvements in audit quality. This knowledge supports PCAOB readiness by ensuring internal controls and audit responses meet the board’s quality benchmarks.

Integration with Legal and Audit Counsel

Effective collaboration with legal and audit teams is a hallmark of a proficient outsourced CFO for SEC compliance. This integration ensures financial disclosures are accurate, complete, and aligned with regulatory expectations.

The CFO can navigate complex compliance issues and mitigate potential risks by working closely with legal counsel. Similarly, coordination with audit professionals facilitates efficient audit processes and timely resolution of identified concerns.

Real-Time Reporting Capabilities

In today’s fast-paced regulatory environment, providing real-time financial reporting is invaluable. An outsourced CFO for SEC compliance should implement advanced financial systems that offer up-to-date insights into the organization’s economic health.

Ability to Scale with Growth and Regulation Shifts

As organizations evolve, their compliance needs become more complex. An adaptable outsourced CFO for SEC compliance can scale services to match the organization’s growth. Such scalability ensures sustained compliance and supports the organization’s long-term strategic objectives.

Outsourcing is often the preferred choice for growing firms when comparing outsourced CFO vs. in-house for SEC compliance, scalability, flexibility, and cost-efficiency.

Conclusion: Stay Ahead with SEC Compliance Support

As regulations evolve and scrutiny increases, so does the risk of costly missteps. Partnering with an outsourced CFO for SEC compliance offers a safeguard: expert guidance, real-time reporting capability, and integrated financial leadership.

We’re here to support you if you’re ready to build a more resilient compliance structure. Explore best practices for SEC reporting with an outsourced CFO via a free consultation with our compliance team today.