Delayed or inaccurate financial reports can degrade credibility and derail strategic decisions. A study analyzed SMEs and found that firms that outsourced accounting tasks exhibited higher reporting quality than firms that kept these tasks in‑house.

Outsourced CFOs support financial reporting by embedding structure, precision, and foresight into the entire process. An outsourced CFO turns the burden of financial statements into a powerful tool for growth and confidence.

1. Dramatic Cost Savings Compared to Full-Time CFOs

Hiring a full-time CFO can be cost-prohibitive for many growing companies. Beyond a base salary often exceeding $400,000, the cost of bonuses, benefits, and stock options can escalate rapidly.

Outsourced CFOs support financial reporting and overall fiscal management at a fraction of that cost, offering the same level of expertise without full-time financial commitment. This cost-efficient model allows businesses and startups to reinvest capital into growth initiatives while benefiting from senior-level financial services.

Source: NOW CFO

2. Proactive Cash Flow Management Prevents Business Failures

Cash flow problems are the silent killer of small businesses. Without clear oversight and forecasting, companies can quickly find themselves strapped for liquidity. That’s where outsourced CFOs shine.

By offering real-time reporting strategies and establishing forward-looking cash flow statements, outsourced CFOs help companies avoid common pitfalls. The result? Better capital planning, fewer surprises, and more confident financial leadership.

Source: Forbes

3. Rapid Adoption of Outsourced CFO Services

The need for flexible, high-level financial leadership is soaring. A 103% increase in demand signals a broader market trend, businesses of all sizes are embracing outsourced CFOs to support financial reporting and executive decision-making.

This surge stems from growing pressure to be audit-ready, optimize capital structure, and prepare for investment rounds. By delivering a CFO reporting structure without the long-term hiring risk, outsourced solutions are becoming the go-to model for companies.

Source: Business Talent Group

4. Increasing Focus on Technology Investment and Implementation

Today’s CFOs are more than financial stewards; they’re technology champions. Modern outsourced CFOs oversee digital finance transformation from cloud ERPs to automation and AI tools.

This investment pays off. Tech-forward CFOs support accurate financial statements by reducing manual input errors, accelerating close cycles, and delivering real-time financial dashboards. Businesses benefit from more insightful reporting, compliance, and faster decision-making.

Source: PwC

5. Outsourcing Popularity Among SMEs

SMEs increasingly turn to outsourced financial leadership to scale efficiently. With cloud ERP systems and flexible subscription-based pricing models, outsourced CFOs support financial reporting in ways that are now more accessible than ever.

These services offer tailored financial reporting for investor readiness, budgeting, and forecasting. This model delivers enterprise-grade insight at a manageable cost for SMEs with growth ambitions and lean resources.

Source: Global Growth Insights

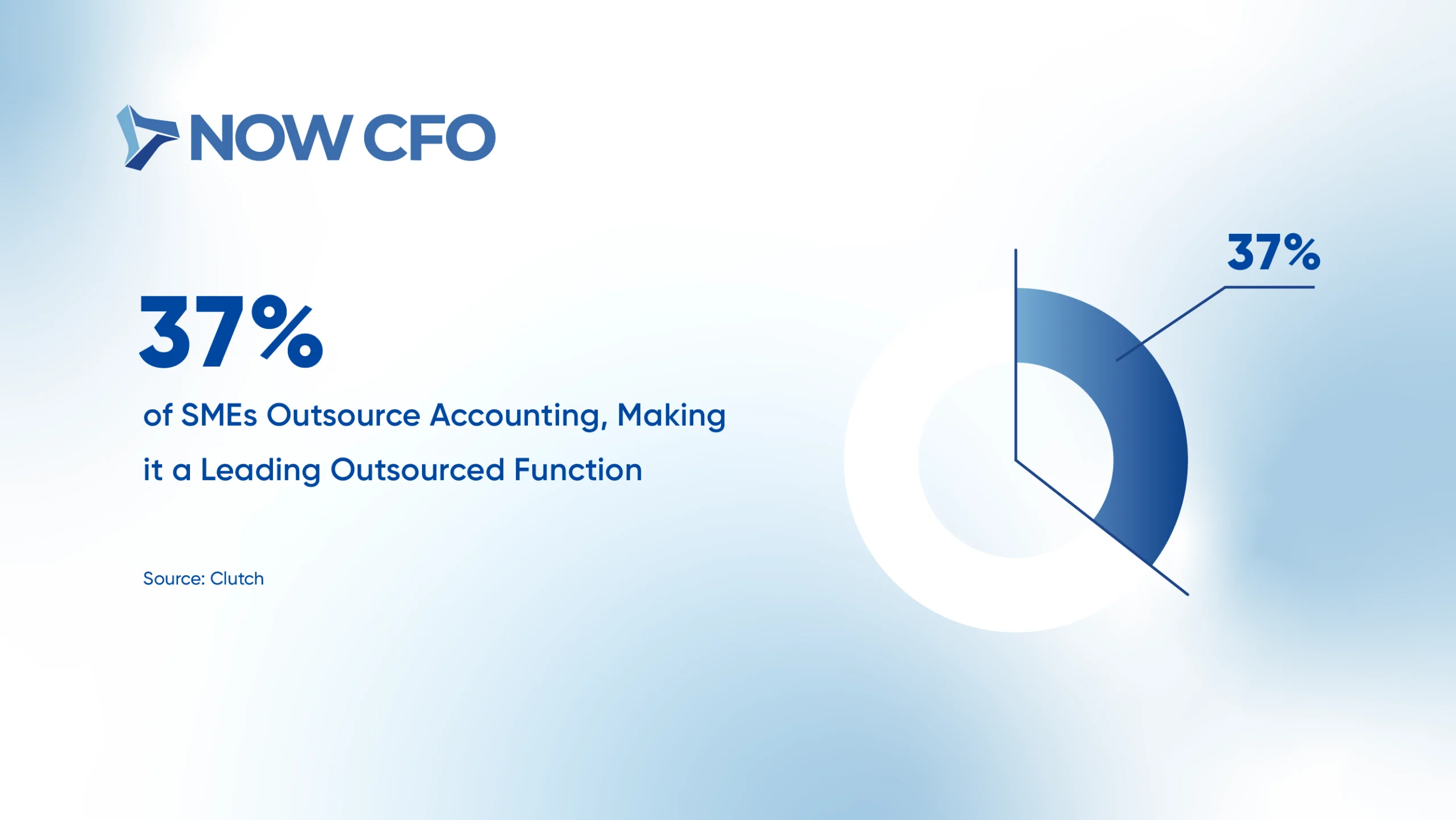

6. Most Outsourced Finance Tasks for Small Businesses

Financial reporting is one of the top outsourced functions among SMEs, alongside bookkeeping, payroll, and accounts payable. This trend highlights a shift toward fractional expertise, particularly in functions that require precision and compliance.

Outsourced CFOs step in to manage accurate financial statements, prepare for audits, and establish the CFO reporting structure needed for decision-making and fundraising. Their impact extends beyond cost savings; they add strategic value where it matters most.

Source: Clutch

7. Growing Executive Commitment to Outsourced Financial Expertise

Executives are doubling down on outsourced financial leadership to handle today’s fast-evolving regulatory and operational landscape. With growing pressure for audit-ready accuracy, reporting compliance, and timely insights, outsourced CFOs are becoming indispensable.

These experts help businesses scale while strengthening internal controls and preparing financial statements for investors, lenders, and board members. This trend shows no slowing as businesses seek scalable solutions that deliver transparency and financial clarity.

Source: Deloitte

Conclusion

Outsourced CFOs transform how businesses approach financial reporting. They deliver accurate reporting, GAAP-compliant, but also actionable and investor-ready. The result? Faster closings, fewer compliance headaches, and clearer visibility into performance.

If your business is facing delays or gaps in internal controls, an outsourced CFO is the solution. NOW CFO offers flexible engagement models designed to meet you where you are, whether that’s building your first reporting infrastructure or leveling up for a potential acquisition.