You need to know when it’s the right time to invest in CFO services. This can shape your growth track. In fact, many small businesses now outsource at least one core function.

These CFO services provide structured financial clarity, precise forecasting, and strategic planning. It’ll eventually help your business transition from operations into high-growth phases.

Understanding CFO Services and Their Role

When your business’s leadership extends beyond bookkeeping, you must understand the role of CFO services.

Overview of What CFO Services Include

Once you determine it’s the best time to invest in CFO services, it’s time to clarify what CFO services include and how they support.

They are:

- Financial Reporting: Expert preparation of accurate financial statements, KPI, and variance reports that boost decision‑making .

- Cash Flow Forecasting: This shows future cash needs and helps you to avoid shortages and plan for funding in advance.

- Budgeting and Planning: Alignment of budgets with long‑term goals, and creating plans that adjust with growth.

- Controls and Risk Management: This will ensure regulatory compliance and strengthen oversight.

- Investor Reporting: Preparation of a clear, credible financial record boosts confidence during fundraising.

Strategic vs. Operational CFO Functions

You need to understand CFO services and their role to differentiate how financial leadership supports daily operations and long-term vision.

Here’s how strategic vs. operational CFO functions compare:

| Function | Operational CFO | Strategic CFO |

| Focus & Timing | Manages day-to-day financial operations and cash flow | Directs long-term planning and financial strategy |

| Core Activities | Oversee AP/AR, internal controls, liquidity, and budgeting | Conduct scenario modeling and forecasting, mergers, acquisitions, and investor communications |

| Value Connection | Helps to control costs, avoid financial surprises, and maintain daily fiscal discipline | Helps to align financial resources, capital investment, and competitive positioning |

Learn More: What are CFO Services?

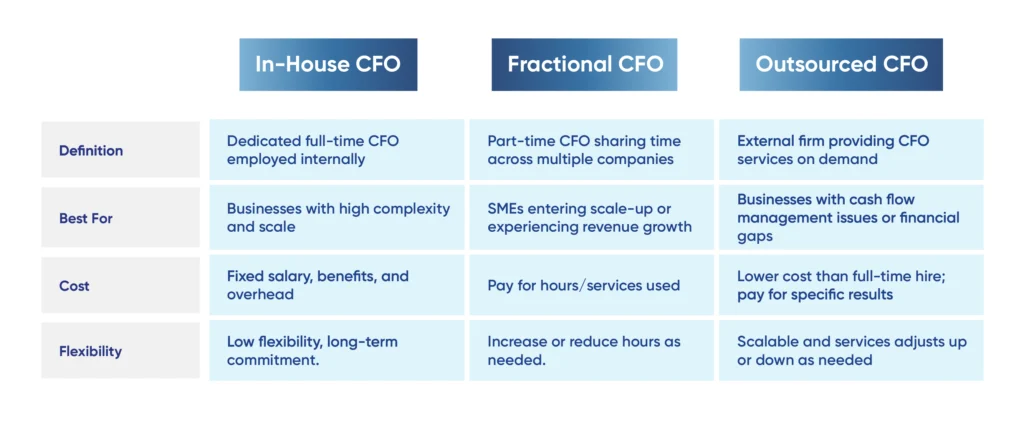

Difference Between In-House, Fractional, and Outsourced CFOs

If you want to make the most of CFO services, then it’s crucial to understand the different engagement models available.

How CFO Services Evolve With Business Stages

The scope and nature of CFO services adapt significantly as a business matures. Here’s how financial leadership evolves across different business stages:

1. Startup / Early Stage

Businesses in this phase require financial visibility. Fractional CFO services or virtual CFO services often serve startups effectively. You’ll get high-value financial oversight without the full-time cost.

2. Growth / Scaling Stage

As revenue rises, strategic direction becomes critical. So, your business must adopt CFO services that add budgeting, forecasting, and strategic financial planning. This will support your business growth, investor engagement, and capital raises.

3. Established/Pre‑Exit Stage

If your company is getting ready for an IPO, M&A, or major growth, then start using advanced fractional CFO services. These offer better financial planning, performance tracking, and risk management.

4. Maturity/Long‑Term Stability

Mature companies often transition to in‑house CFOs but still benefit from external input. Additionally, outsourced or fractional CFO services help with specific projects like internal controls, evaluating new ventures, or strategic financial leadership.

Common Misconceptions About CFO Services

Although we know the growing importance of CFOs, there are still many myths, especially among SMEs. Below are common misconceptions that often hold companies back:

- CFOs are no different than accountants.

- CFO services only make sense for large corporations.

- Fractional or outsourced CFOs lack commitment.

- CFO services are expensive for small businesses.

- Virtual CFOs lack industry-specific knowledge.

- CFOs only focus on numbers, not strategy.

Key Indicators it’s Time to Invest in CFO Services

As your business grows, making more money without a clear financial plan, there are signs you need CFO services to guide you.

Revenue Growth Without Clear Financial Strategy

Revenue growth without a clear financial strategy leads to missed profit margins, operational blocks, and misaligned spending. In such a case, CFO services will provide clarity and help you create pricing strategies and profit analysis.

Simultaneously, strategic financial leadership makes sure your growth aligns with long‑term goals and scalability. Without this dual focus, growth can be useless, accelerating risks rather than delivering sustainable value.

Cash Flow Management Challenges

Over 74% of small businesses report having enough cash to cover only one month of operating expenses. This highlights the weakness of business liquidity.

- Regular delays in paying supplier or payroll obligations.

- Sales growth without a sufficient liquidity cushion.

- Frequent borrowing to meet operational expenses.

- Reliance on overdrafts or emergency financing.

- Inability to create accurate cash flow forecasts.

Preparing for Funding or Investor Engagement

When your company is preparing for fundraising or investor engagement, it’s the time to invest in CFO services. Because investors demand clean, credible financials and strategic alignment.

A CFO helps you create compelling financial predictions, including revenue, burn rate, and operational milestones. They showcase your strategic financial leadership through investor decks and forecast models. Without it, even strong revenue growth can collapse.

Entering New Markets or Product Lines

Are you considering entering new markets or product lines? Then it’s time to invest in CFO services immediately. Because as firms expand, financial complexity rises, which requires strategic financial leadership to avoid risks.

Moreover, a CFO helps evaluate local consumer behavior, regulatory environments, and profitability models. This helps to turn ambitious expansion into disciplined execution.

Here are the key financial considerations when expanding:

- Build financial models to balance pricing, cost, and margins.

- Evaluate upfront costs, cash flow, and working capital needs.

- Manage tariffs, taxes, and currency risks for compliance.

- Set up scalable finance systems and internal controls.

- Turn expansion plans into investor-ready financial narratives.

Struggling to Maintain Compliance and Manage Risk

When you find that your company is struggling to manage risk, it’s the critical time to invest in CFO services. Businesses often overflow with regulatory burdens that slow decision-making and consume resources.

Besides, small firms suffer significantly higher per-employee costs for compliance compared to larger enterprises. Small firms, with fewer than 20 employees, face a regulatory burden of $6,975 per employee yearly, 60% more than large firms.

Business Stages that Benefit Most from CFO Services

As your enterprise moves from start to expansion, knowing when to hire a CFO for your business becomes vital. Besides, this is important if you’re an early-stage startup entering growth mode.

Early-Stage Startups Entering Growth Mode

As early-stage startups shift into growth mode, the financial needs quickly evolve. This tells the need for targeted CFO services to maintain control and fuel expansion.

- Need strong financial systems like budgeting, cash‑flow tracking, and forecasting.

- Require strategic oversight amid scaling, optimizing burn rate, and runway.

- Benefit from investor-ready metrics and credible reporting frameworks.

- Must establish internal controls to support governance and compliance.

- Want lean, cost-effective expertise without full-time CFO overhead.

Established SMEs Scaling Operations

As SMEs progress, they benefit from outsourced CFO services to balance cost efficiency. Besides, when established SMEs pursue growth, they often struggle to manage financial systems.

This is where a CFO brings operational accuracy through financial modeling, internal controls, and KPI-driven decision-making. Therefore, this strategic financial leadership transforms growing operations into scalable, predictable operations.

Pre-IPO or Pre-Exit Companies

When a company positions itself for an IPO or strategic sale, the time to invest in CFO services is no longer optional.

| Aspect | Pre-IPO Companies | Pre-Exit Companies |

| Role of CFO | Guides IPO strategy and investor narrative | Aligns financials and operations with buyer expectations |

| Equity Incentives | Often compensated with 0.2%–1% equity to drive IPO success | Equity also ties CFOs to long-term exit outcomes |

Businesses in Financial Turnaround Situations

If your business enters a turnaround, it’s an urgent time to invest in CFO services.

- Growing debt obligations are making operations unsustainable.

- Recurring losses reduce cash reserves and stakeholder confidence.

- Suddenly tightened bank credit or higher interest rates.

- Reputation damage affecting revenue sources or partnerships.

- Inability to forecast or restore working capital.

Nonprofits Managing Multiple Funding Streams

As nonprofit organizations expand, the financial error requires more than basic bookkeeping. Outsourced CFO services or fractional CFO services both bring the expertise needed to maintain revenues.

Besides, diversifying revenue offers strength but only if you manage it strategically. About 30% of nonprofits analyzed have a second revenue stream making up at least 10% of their total income.

Benefits of Investing in CFO Services at the Right Time

Strong financial leadership at the right moment unlocks major advantages. This helps to make the most improved decision‑making through accurate data.

Improved Decision-Making Through Accurate Data

When financial insight matters most, it’s the time to invest in CFO services. Businesses rely on credible financial data to drive strategy. Besides, financial accounting delivers consistent, transparent reporting that supports decisions.

Moreover, advanced analytics improve financial decision-making through real‑time insight and predictive modeling. This helps organizations to predict risks.

Optimized Cash Flow and Capital Allocation

Always know it’s time to invest in CFO services when your business needs careful management of liquidity.

- They help to improve visibility into spending and cash flow controls.

- Enable identification of supplier savings and payment term optimization.

- Focus spending on projects that bring the most return.

- Balance cost structure while supporting investment decisions.

Enhanced Strategic Planning and Forecasting

When a company invests in CFO services, it gains a structured long-term vision. Also, CFOs create multiyear financial plans that align budgets with growth strategies.

- Establish multiyear financial plans tied to growth and capital needs.

- Utilize predictive forecasting to anticipate market shifts and uncertainty.

- Embed strategic initiatives into budgets, balancing risk and opportunity.

- Align operations with long‑term goals using balanced scorecards.

Increased Investor and Stakeholder Confidence

Whether through outsourced CFO services, fractional CFO services, or full-time appointments, they offer financial clarity. Moreover, reliable financial help is needed during transitions like fundraising, scaling, or exits.

Besides, 65% of CFOs expressed confidence in meeting their company’s growth prediction. Because accurate financial insights promote stakeholder alignment. Whereas, transparency in reporting supports confidence and eases audit processes.

Better Long-Term Financial Stability

To invest in CFO services at the right time enhances long‑term financial stability. Because financial control directly correlates with business longevity. Poor management, not just weak financial skills, is still one of the main reasons businesses fail.

Moreover, many CFOs believe that their organizations will remain financially stable over the next five years. This shows how CFO guidance supports long-term thinking.

How to Choose the Right CFO Services Provider

To bridge your financial strategy with impactful results, it’s essential to match services to your unique needs. Especially when deciding the time to invest in a CFO for business growth.

Matching Services to Your Business Needs

Matching services to need ensures you’re paying for impactful support when it matters most. Because clarifying objectives avoids unnecessary cost inefficiencies.

- Begin by clarifying whether you need basic bookkeeping and reporting, budgeting and forecasting, or deeper strategic financial advisory.

- Evaluate if you need fractional CFO services, interim CFO services, or something more full-time.

- Look for CFOs with experience in your industry or scale stage.

- Review case studies or testimonials to know if they align with your stage.

- Ensure the provider offers more than a solo advisor.

Checking Industry Experience and Track Record

Companies led by experienced executives in their sector are more likely to achieve sustained profitability.

- They understand industry-specific financial challenges and regulations.

- Also, has led companies through your current business stage.

- Can show measurable financial improvements in past roles.

- Offers client references with similar growth profiles.

- Demonstrates familiarity with regulatory and compliance demands.

Balancing Cost With Expected ROI

Balancing the CFO cost and ROI is critical when deciding to invest in CFO services. Moreover, a fractional CFO offers companies a cost-effective path to expert financial strategy without the full-time salary.

Also, the right CFO services don’t just manage budget, they improve operational efficiency and tax strategy. Hence, your business will gain productivity and long-term clarity.

Reviewing Contracts and Engagement Terms

When you recognize it’s time to invest in CFO services, reviewing engagement contracts becomes essential. Because, thoughtful survey ensures the agreement aligns with your business needs.

- Start by confirming scope clarity.

- Examine term length and termination clauses.

- Review the fee structure and additional costs closely.

- Ensure the contract includes performance metrics or results tied to milestones.

- Consider liability and compensation clauses.

Ensuring Cultural and Operational Fit

So, you’re thinking it’s time to invest in CFO services. But you need to make sure they help your leaders work better and gain support from the team.

- They must share core values, vision, and communication style with your team.

- Also, understands and respects organizational decision‑making.

- Shows adaptability to your company’s culture and working norms.

- Values transparency and ethics in line with your expectations.

Conclusion

Deciding when it’s the right time to invest in CFO services can be the turning point for sustainable growth. Also, a timely CFO boosts your business with powerful decision-making, optimized cash flow, and long-term stability.

If you’re ready to upgrade your financial leadership, consider scheduling a complimentary consultation at NOW CFO. Whether you want case studies, contract templates, or personalized financial modeling, take that next confident step.