SMEs rely on outsourced financial support to fuel growth. 71% of businesses outsource some or all of their accounting and finance functions. Understanding how outsourced accounting services support business growth enables founders and executives to leverage bookkeeping as a growth driver.

Definition and Scope of Outsourced Accounting

Outsourced accounting refers to hiring an external provider to manage financial tasks that are traditionally performed in-house. It transforms accounting from an internal cost center to a value-driving strategic service.

Companies contract out bookkeeping, payroll, tax filings, month-end close, and financial analysis. By engaging specialists, outsourced accounting services support business growth through enhanced accuracy and scalability.

Common Services Provided by Outsourced Teams

Outsourced accounting firms offer a comprehensive suite of services beyond basic bookkeeping. Standard outsourced accounting services include:

- AP/AR

- General ledger accounting

- Payroll processing

- Fixed asset tracking

- Budgeting, forecasting, and financial planning

- Cash flow management

- Regulatory compliance

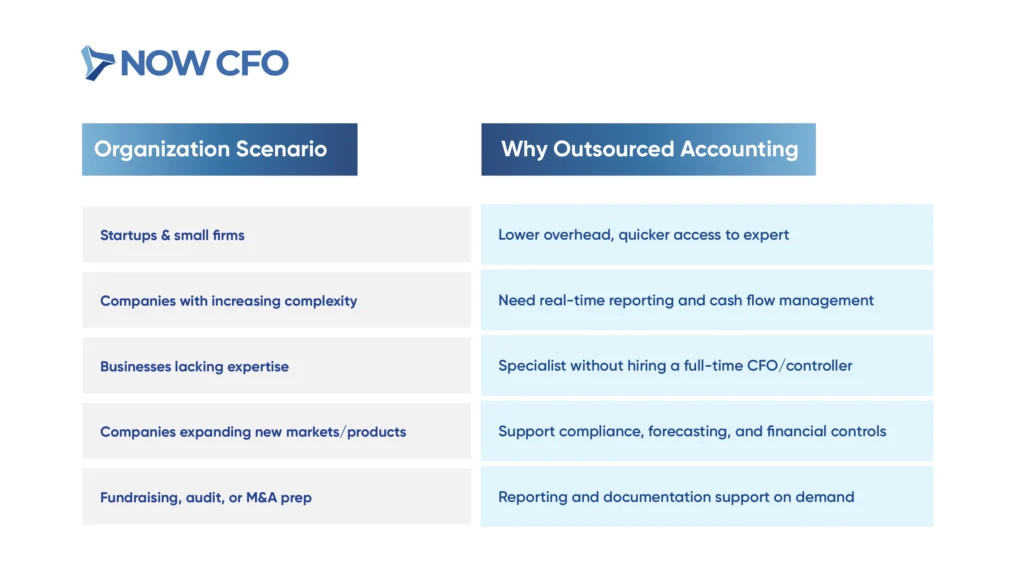

Who Uses Outsourced Accounting and Why?

Organizations across sectors rely on outsourced accounting to fuel strategic growth.

How Outsourced Accounting Accelerates Growth

After understanding the services involved, the next step is recognizing their impact. Here’s how they accelerate scalability, efficiency, and strategic focus across key business functions.

Reduces Overhead and Administrative Burden

Plugging overhead drains and slicing admin load, outsourced accounting cuts hiring, training, benefits, office space, and software costs. Companies report cost savings as the primary driver in the growth of outsourcing decisions.

Outsourcing routine bookkeeping, payroll, AR/AP, and compliance allows leadership to reduce internal headcount while preserving accuracy and control. Clear workflow improves financial efficiency and enables internal teams to focus on core growth.

Provides Accurate, Real-Time Financial Reporting

Efficient outsourced CFO use cloud dashboards to give real-time financial visibility, helping teams respond quickly to change

Key features include:

- Cloud dashboards displaying up-to-date revenue, expenses, and cash position

- Automated ledger closing that reduces manual errors

- Monthly or weekly standardized reports aligned with strategic metrics

- Compliance-check analytics, flagging anomalies or irregularities

Enables Informed Decision-Making Through Expert Insights

Building upon real-time reporting, outsourced teams contribute interpretation alongside raw financial data. They offer:

- Trend analysis identifying areas like cost overruns or revenue dips

- KPI monitoring: gross margin, burn rate, and liquidity metrics

- Scenario modeling for funding rounds, pricing changes, or new investments

- Advisory on budgeting strategies and risk mitigation

Frees Leadership to Focus on Core Business Activities

Outsourced accounting teams handle routine tasks, freeing leaders to focus on strategy while reducing internal distractions.

Key benefits include:

- Elimination of day-to-day accounting distractions

- Time savings on recruiting, onboarding, and supervising finance staff

- Consistent compliance handling and deadline management

- Ability to devote senior management time to core objectives

Learn More: Hire An Outsourced Accounting Service

Key Growth Benefits of Outsourcing Accounting

Beyond immediate operational improvements, outsourced accounting plays a strategic role in driving long-term success.

Scalability Without Hiring Internally

Businesses often face rapid demand spikes as they scale. Outsourced accounting enables companies to handle increased workloads without expanding internal headcount. Companies avoid the recruitment costs and delays tied to hiring qualified finance professionals.

By partnering with outsourced firms, organizations scale operations seamlessly without the overhead of salaries, benefits, and workspace. The flexible model also supports accounting services for growing businesses, enabling teams to level up or down according to revenue cycles or project load.

Access to a Team of Specialists On-Demand

Seamlessly building on scalability, outsourced partnerships offer immediate access to diverse financial expertise.

Key advantages include:

- Certified Expertise: Outsourced teams often include CPAs, controllers, tax specialists, and financial analysts with broad industry experience.

- Specialist Availability: Businesses that require guidance on complex matters gain access to relevant experts without hiring.

- Tailored Expert Support: Firms benefit from fractional controller-level insight or CFO-level consultation as needed.

Streamlined Systems and Processes

Outsourced accounting transforms fragmented internal processes into standardized, efficient workflows. Providers implement cloud-based accounting platforms, automated reconciliations, and real-time dashboards.

By systematizing tasks, businesses gain:

- Faster Close Cycles: Outsourced teams close books reliably and consistently every period.

- Automated Reconciliations and Alerts: Tools flag discrepancies early, improving accuracy.

- Centralized Document Workflows: Vendors manage AP, AR, and payroll through cloud portals, reducing administrative friction.

Strategic Tax Planning and Compliance

Building on streamlined operations, outsourced accounting also supports strategic tax planning and robust compliance.

Two key elements include:

- Proactive Tax Optimization: Outsourced teams analyze incentive structures, depreciation schedules, and entity structuring to minimize liabilities. Businesses earn credits and deductions as they grow or expand.

- Compliance with Evolving Regulations: Providers monitor and implement regulatory changes, reducing risk and enabling timely filings.

Data-Driven Forecasting and Cash Flow Management

Connecting financial systems and expert planning leads to sophisticated forecasting and cash flow oversight.

Two notable outputs:

| Function | Description | Business Impact |

|---|---|---|

| Scenario-Based Forecasting | Building models using variable assumptions like market shifts, pricing changes, or funding rounds | Helps leadership anticipate future cash needs and make informed investment decisions |

| Cash Flow Monitoring & Alerts | Real-time dashboards track upcoming payables and receivables to flag liquidity risks | Enables proactive working capital management and reduces the chance of shortfalls |

When Growing Businesses Should Consider Outsourced Accounting

To fully understand how outsourced accounting services support business growth, it’s crucial to identify the right moments to make the switch.

Revenue is Increasing, but Books are Delayed

As companies grow, transactional volume often outpaces internal accounting capacity. When revenue surges and the books lag, leadership loses financial visibility and risks missing cash flow issues or compliance deadlines.

In such situations, outsourcing your accounting can restore accuracy and timeliness. Providers update ledgers, reconcile accounts, and report regularly, ensuring financial data reflects real-time activity.

Your Internal Team Lacks Advanced Financial Expertise

When your in-house team handles day-to-day bookkeeping but lacks skills in forecasting, tax strategy, or complex compliance, gaps emerge. Many businesses find that key financial tasks exceed internal capabilities. Only 54% of small business owners report a solid understanding of financial management when they launched their business.

Outsourced accounting brings in-depth expertise, including CPA-level insight, budgeting and forecasting skills, and knowledge of evolving compliance requirements. With this accounting support, leadership clarifies financial strategy, reduces risk, and pushes growth forward.

You’re Entering New Markets or Launching New Products

Expansion into new territories or product lines brings complex financial requirements. Internal teams often lack the bandwidth or know-how to handle the complexity.

Outsourced accounting firms provide experience in cross-border regulations, multi-entity structuring, and scaling systems. They set up a compliant chart-of-accounts, forecast new revenue streams, and implement controls suited for expansion.

You’re Preparing for Funding, Audit, Or M&A

When organizations prepare for major milestones like funding rounds, audits, or mergers, precise financial reporting and clean records become essential. Leadership needs clarity, regulation-ready documentation, and seamless collaboration with investors or auditors at this stage.

Key support includes:

- Audit-ready financial statements and controls

- Investor-grade reporting and valuations

- Due diligence preparation for funding rounds or acquisitions

- Documentation for compliance with GAAP and IFRS

How Outsourced Accounting Aligns with Growth Stages

As financial needs shift with each growth stage, outsourced accounting adapts to match. Here’s how outsourced accounting services support business growth from startup through expansion.

Startup Phase: Bookkeeping, Payroll, Compliance

Foundational tasks like bookkeeping, payroll, and compliance are critical yet resource-intensive in the startup phase. Outsourced accounting services support business growth by efficiently managing these core functions from day one.

Firms receive professional bookkeeping, timely payroll processing, and help implementing compliance systems without hiring staff. Outsourced providers often offer standard compliance support.

By handling these areas, they let leadership focus on product development, market entry, and customer acquisition while ensuring accounting services for growing businesses are in place from the beginning.

Growth Phase: Cash Flow, Forecasting, Budgeting

As businesses enter the growth phase, they focus on managing cash flow, creating forecasts, and budgeting for expansion. Outsourced accounting offers expert support, delivering models, dashboards, and planning frameworks tailored to evolving needs.

Outsourced CFOs use tools that link historical data to upcoming projections. They help build budgets tied to KPIs and adjust forecasts dynamically based on performance.

Expansion Phase: Audit Prep, Investor Reporting, Controller Services

At the expansion phase, businesses prepare for external scrutiny by investors, auditors, or boards. They require audit-ready processes, investor-quality reporting, and controller-level service.

Providers deliver:

- Audit-ready financial statements, reconciliations, and controls

- Investor dashboards, KPI tracking, and valuations

- Virtual controller or fractional CFO services, aligning data with strategic planning

Comparing In-House vs. Outsourced Accounting for Growth

This comparison outlines how the outsourced model differs with in-house models across cost, skills, and risk dimensions.

| Category | In-House Accounting | Outsourced Accounting |

|---|---|---|

| Costs & Resources | $70K to $120K+ annually (salaries, benefits, tools) | 10K–25k/year depending on scope |

| Skillset & Tech | Limited expertise; manual systems, spreadsheets | Access to CPAs, controllers, and cloud-based reporting tools |

| Flexibility & Risk | Vulnerable to turnover, absences, and scaling issues | Team continuity, scalable service levels, and reduced fraud risk |

Cost And Resource Differences

Managing an in-house accounting team demands significant recurring costs: salaries, benefits, training, and software. For instance, an in-house accounting department costs over $100,000 annually, plus onboarding and tools.

In contrast, outsourced accounting typically costs between $10,00 and $25,000 per year, depending on complexity. Outsourcing eliminates fixed overhead: businesses pay for service tiers, not full-time staff.

Skillset And Technology Access

In-house teams have limited financial expertise and outdated tools, while outsourced accounting firms provide specialist knowledge and cutting-edge technologies. Outsourced providers typically include CPAs, controllers, tax experts, and analysts with ongoing training and multi-client exposure.

Moreover, outsourced accounting firms invest in advanced cloud-based platforms, automated workflows, and real-time dashboard technology, often beyond the reach of small internal teams. Businesses thus access high-level tools without additional internal tech investment.

Flexibility and Risk Management

In-house accounting models offer control but can falter when faced with turnover, absences, or fluctuating workloads. Outsourced accounting mitigates these risks through team-based operations, rigorous internal controls, and consistent coverage.

Outsourced teams employ checks and balances to reduce fraud and error risk. Small businesses are particularly vulnerable when a single in-house person controls financial functions. Outsourced firms likewise ensure continuity and reliability, lowering risk exposure.

Learn More: Benefits Of Hiring An Outsourced Accounting Service

Choosing the Right Outsourced Accounting Partner

Selecting the right provider is crucial to maximizing impact. Businesses should evaluate partners based on experience, scalability, and operational transparency to ensure they are well-evaluated.

Look For Industry-Specific Experience

Selecting a partner with experience in your sector amplifies value immediately. Outsourced teams that understand SaaS metrics, e-commerce margins, or compliance requirements bring tailored guidance.

Prioritize Scalable and Flexible Service Models

Growth often brings shifting financial demands, with some months focused on detailed reporting and others on routine tasks. The right CFO adapts to these changes. Choose outsourcing firms with tiered or modular service models that scale from basic bookkeeping to controller-level or CFO support without requiring new hires.

Review Data Security, Reporting Tools, and Communication Processes

With access to your sensitive financial data, the partner’s security protocols are paramount.

Ensure these elements:

- Data Protection Standards: The vendor applies encryption, access controls, and regular audits per industry guidelines published by entities like the FTC.

- Secure Reporting Tools: Cloud dashboards with multi-factor authentication and permissions management prevent unauthorized access.

- Clear Communication Workflows: Regular check-ins, SLAs, turnaround expectations, and centralized task tracking ensure transparency and accountability.

Conclusion

As your business grows, managing finances becomes more complex. Outsourced accounting gives you access to expert support and scalable solutions without expanding your internal team. NOW CFO helps you stay focused on growth while we handle the financial details. Schedule a free consultation to see how we can support your next stage.