What is a Reverse Merger?

A reverse merger, also referred to as a reverse IPO or reverse takeover, is a merger in which a private company becomes a public company by buying enough shares to control that publicly traded company. Then, the private company’s shareholder exchanges its shares in the private company for shares in the public company.

Reverse Mergers save a private company from the complicated process and expensive compliance of becoming a public company. Typically, the shareholders of the private company have large amounts of ownership in the public company and control the board of directors. Once this is all completed, the private and public company merge into one publicly traded company.

One of the biggest advantages of a Reverse Merger is that it can take a company public in as little as 30 days, whereas an IPO can take a year or more to complete. Because of this though, reverse mergers can come with liability lawsuits and poor record keeping. Reverse mergers succeed bets for companies that are not in a rush for the capital.

How to Spot a Reverse Merger?

Companies that are trying to raise at least $500,000 and are expected to do sales of at least $20 million during the first year as a public company is who is most likely to complete a reverse merger. Foreign companies that are looking to gain access and entry into the U.S. marketplace are also often utilizing reverse mergers.

KEY TAKEAWAY: If a company wants to become publicly traded, reverse takeovers/mergers can be a cheaper and quicker option than an IPO, but they tend to produce greater risks for investors.

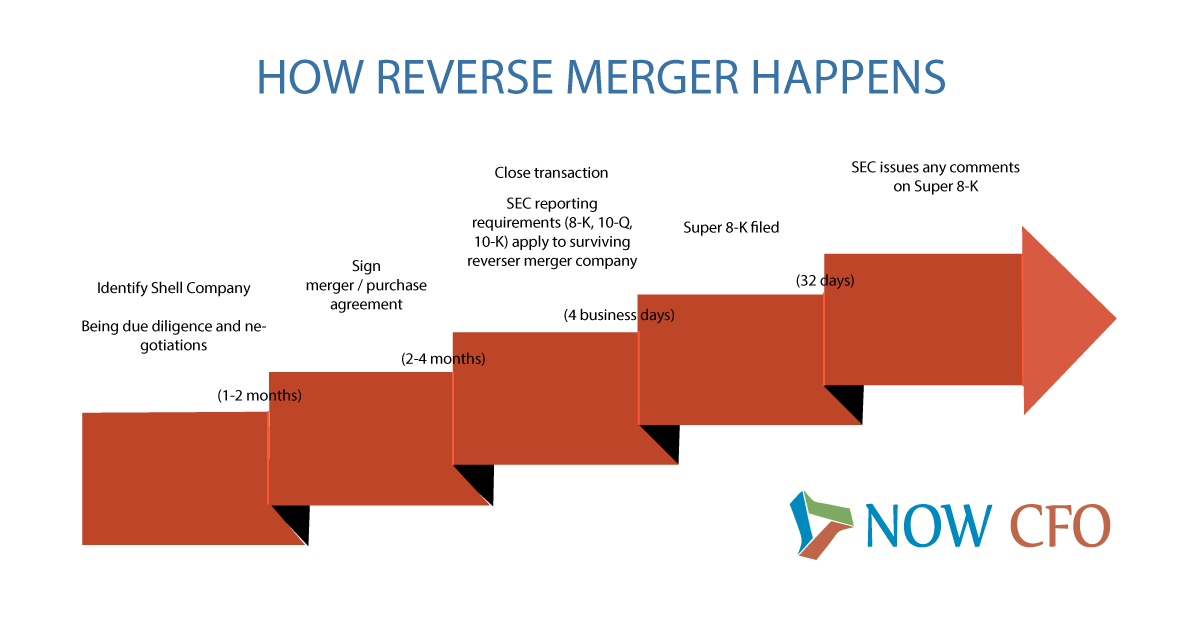

Reverse Merger Process

- Identify shell company.

- Begin due diligence & negotiations.

- Sign merger/purchase agreement

- Close transaction

- SEC Reporting Requirements (8-K, 10-Q, 10-K) apply to surviving reverse merger company.

- Super 8-K filed

- SEC issues any comments on Super 8-K

A company does not acquire any additional funds through a reverse merger, and it must have enough funds to complete the transaction on its own. Often, the company’s name changes in the process of a reverse merger or takeover. Prior to the reverse merger, usually the public company has had no recent activity or operations, working as a shell corporation. This allows the private company to move its operations into the shell of the public company while avoiding costs and regulatory requirements.

Advantages:

- Simplified process

- Risk minimization

- Less dependence on the market

- Less costly

- Gains the benefits of a public company.

Disadvantages:

- Information asymmetry

- Scope for fraud

- New burden of compliance

Why Doesn’t Every Company Go Through a Reverse Merger?

Even though reverse takeovers and mergers are cheaper and quicker, they bring up bigger risks to investors due to the short period of time and lacking due diligence. Studies have also shown that companies that go public through a reverse merger have lower survival rates and performance in the long term compared to companies that go through a traditional IPO. Many reverse mergers fail and reveal weakness in the private company’s management team and record keeping.

How We Can Help

Our consultants can help you through every step of the way throughout a reverse merger or takeover. We have the expertise to help with all the filings and documents needed, SEC reporting expertise, due diligence, and negotiations with investors. NOW CFO has years of expertise with reverse mergers to ease the stress and pressure of this process for you and your company, to in return make your company more successful for the future.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced, fractional, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.