The basics of business bookkeeping aren’t just about balancing ledgers; they’re about gaining clarity, control, and confidence in finances. Yet many SME owners feel uncertain in this area, 60% feel not knowledgeable about accounting, and 21% admit they don’t know.

Strong bookkeeping practices provide more than compliance. They track daily transactions, reconcile accounts, and prepare reliable financial statements.

What is Bookkeeping?

Bookkeeping is the backbone of financial clarity; it represents the daily essence of the bookkeeping tasks.

Definition of Bookkeeping

At its core, bookkeeping is the systematic process of recording, organizing, and maintaining financial transactions. It ensures businesses accurately capture every sale, expense, payment, or receipt.

Unlike accounting, which analyzes and interprets information, bookkeeping is the foundational layer. Historically done by hand in journals or ledgers, it is now often executed using reliable bookkeeping software for accuracy and efficiency.

Bookkeeping gives startup and SME owners the insights they need to manage cash flow. This report allows owners to maintain financial record-keeping and prepare for tax preparation.

The Role of a Bookkeeper

A bookkeeper actively supports the financial record-keeping by managing the following key tasks:

- Recording daily transactions accurately.

- Organizing documents like invoices, receipts, and deposit slips.

- Reconciling accounts by comparing financial statements against bank records.

- Maintaining books using software to streamline bookkeeping for SMEs.

- Helping business owners meet tax timelines efficiently.

Key Components of Bookkeeping

An effective bookkeeping system centers on these critical components:

- An organized listing of assets, liabilities, equity, income, and expenses.

- Record transactions chronologically in journals, then post them into ledgers.

- Regularly compare your books against bank statements

- Prepare income statements, balance sheets, and cash flow statements.

Bookkeeping in Modern Business

Bookkeeping in modern business integrates digital tools to support financial record-keeping. It helps companies, particularly SMEs, to maintain financial record‑keeping accurately and efficiently.

Why Bookkeeping is Essential for Financial Management

Systematic financial record‑keeping enables business owners to track income, expenses, and trends. Bookkeeping also helps detect cash shortages early, avoiding cash flow problems.

Moreover, documenting transactions and retaining supporting receipts ensures businesses remain tax-ready and compliant. With real-time insights from organized bookkeeping, owners can easily budget, forecast, and set financial goals.

Why is Bookkeeping Important for Businesses?

Bookkeeping enables financial clarity and decision‑making, delivering the information needed to guide growth, optimize performance, and sustain success.

Financial Clarity and Decision-Making

Financial record-keeping empowers business owners to make complex choices with confidence and precision. By applying the bookkeeping best practice, entrepreneurs gain the visibility needed to evaluate performance, adjust strategies, and stay agile.

Through disciplined bookkeeping, small businesses unlock clear visibility into profit margins, cost centers, and revenue streams. Moreover, bookkeeping equips owners to compare actual performance against budgets, identify trends, and make timely decisions.

Tax Compliance and Reporting

It’s vital to ensure businesses meet legal obligations and avoid costly penalties. Through consistent record-keeping and organized documentation, owners align seamlessly with regulatory requirements.

Moreover, accurate bookkeeping simplifies tax filing by consolidating receipts, invoices, and transaction records. It reduces errors, helps business owners avoid risk, stay compliant, and focus on growth.

Tracking Business Performance

Bookkeeping enables owners to measure their progress, monitor trends, and assess the financial health of their business.

- Tracks income streams by product, service, or customer segment.

- Reveals fixed, variable, or recurring cost patterns.

- Owners can quickly identify gaps and adjust strategies.

- Helps determine gross and net profit over time.

- Uncovers fluctuations in cash inflow and outflow.

- Business owners use financial data to plan expansions, hire staff, or adjust pricing.

Improving Cash Flow Management

Effective bookkeeping directly enhances cash flow management. By monitoring daily income and expense patterns, businesses maintain adequate liquidity.

Accurate financial record‑keeping helps identify receivables delays or unexpected outflows. Through organized tracking, owners synchronize invoicing, bill payments, and collections.

Moreover, detailed cash flow data enables forecasting, helping owners plan for expansion or investment. Clear visibility into cash health strengthens credibility with suppliers or lenders, improving terms or securing funding when needed.

Ensuring Financial Accountability

Precise financial record‑keeping helps business owners demonstrate reliability.

- Every entry is backed by source documents, ensuring every receipt or expense is traceable.

- Investors, lenders, and auditors rely on clean books to evaluate performance and gauge financial health.

- Well-organized records reduce delays or penalties during audits.

Bookkeeping vs Accounting: What’s the Difference?

Understanding bookkeeping and accounting is essential, as each plays a unique role in maintaining accurate records and guiding smarter financial decisions.

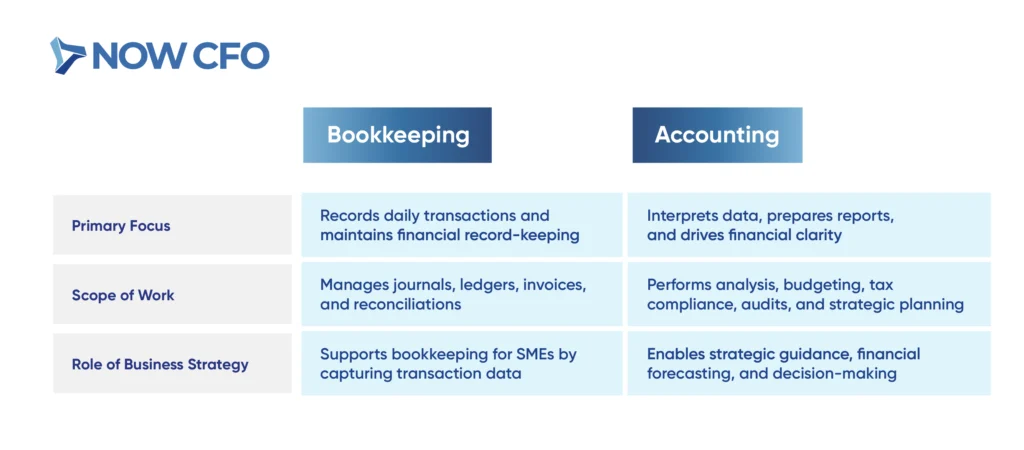

Key Differences Between Bookkeeping and Accounting

While both functions are closely connected, the key differences between bookkeeping and accounting lie in their focus, scope, and contribution to business strategy.

How Bookkeeping and Accounting Work Together

The basics of business bookkeeping and accounting interlock to form a robust financial framework. Bookkeeping lays the groundwork by systematically capturing daily transactions and maintaining financial record‑keeping.

Once accurate records exist, accountants interpret data, analyze it, and prepare strategic reports. Eventually, they turn raw numbers into actionable budgeting, forecasting, and performance tracking insights.

When to Use Bookkeeping vs Accounting Services

Deciding when to use bookkeeping and accounting depends on your business’s size, complexity, and financial goals.

| Scenario | Use Bookkeeping | Use Accounting |

| Transaction Volume & Revenue | Businesses process fewer transactions monthly | When business complexity grows |

| Growth Stage & Complexity | To handle recording, invoicing, and reconciling | To deliver analysis, compliance navigation, and advisory services |

Which Does Your Business Need?

A bookkeeper fits your needs if your business handles daily transactions, invoicing, reconciliations, and basic financial record‑keeping. They keep your books orderly and your data accurate at a manageable cost.

You’ll benefit from an accountant when your business reaches higher operational complexity, demanding forecasting, tax compliance, performance analysis, or planning. Accountant steps in to interpret data, align tax strategy, and guide growth decisions.

Types of Bookkeeping Systems

Not all bookkeeping is managed the same way; different systems offer varying levels of detail, control, and scalability. The right approach depends on your business size, complexity, and growth goals.

Single-Entry Bookkeeping

Under a single-entry bookkeeping system, you record only one side of each transaction, typically income or expense. This record is maintained in a daily cash receipt summary and monthly summaries of cash inflows and outflows.

A single-entry bookkeeping system is the simplest to maintain and can be practical for entrepreneurs launching a small venture. However, it lacks built‑in checks for errors and is less reliable when financial control and accuracy become vital.

Double-Entry Bookkeeping

Double‑entry bookkeeping ensures every financial transaction impacts at least two accounts, typically one debit and one credit. This record maintains both balance and accuracy.

Moreover, it provides a complete picture of your finances by capturing changes in assets, liabilities, equity, income, and expenses. Simultaneously, it reinforces strong financial record‑keeping and supports strategic cash flow management and tax preparation.

Manual vs Digital Bookkeeping

Manual and digital bookkeeping show the difference between old-fashioned record-keeping by hand and modern software.

| Manual Bookkeeping | Digital Bookkeeping |

| Relies on handwritten ledgers | Uses software and cloud tools |

| Prone to human error, time-consuming reconciliations, and a limited audit trail | Automates calculations, reduces mistakes, and ensures cleaner financial record-keeping |

| Basic tracking and offers minimal insights or forecasting capacity for cash flow management | Generates real-time insights, supports forecasting, budgeting, and enhances strategic clarity |

Cloud-Based Bookkeeping Systems

Cloud‑based bookkeeping fully integrates the bookkeeping into a remote, data-driven environment. These systems enable secure, anytime access to financial record‑keeping, improving speed and accuracy across operations.

Cloud systems allow real-time collaboration, automatic updates, and streamlined tax preparation. These platforms often include automated invoicing, reconciliation, and reporting, supporting better cash flow management.

Essential Bookkeeping Tasks

Recording transactions each day can be seen as routine. But it’s the cornerstone of effective financial record‑keeping and maintains consistency across your books.

Recording Daily Transactions

Recording daily transactions captures the business’s day-to-day cash inflows and outflows. It’s best to record transactions daily, whether you’re recording expenses when they occur or identifying sources of income promptly.

By entering every sale, payment, receipt, and purchase as they happen, you prevent data gaps and maintain a reliable ledger. This practice supports tax preparation by ensuring that every deductible expense and every source of income is documented.

Reconciling Bank Statements

Reconciling bank statements ensures that your business records align with actual bank balances. Without this step, errors like unnoticed bank fees, deposits in transit, or uncleared checks can slip through and distort your financial records.

Regular reconciliation strengthens cash flow management by catching differences before they become bigger issues. It also streamlines tax preparation by creating a clear and reliable audit trail.

Managing Accounts Payable and Receivable

Efficiently managing AP/AR ensures that your financial cycle remains healthy and operational.

To manage AP/AR efficiently:

- Schedule vendor payments strategically to maintain strong supplier relationships and avoid late fees.

- Issue invoices promptly, follow up on overdue payments, and maintain clean financial record‑keeping.

- Monitor outstanding receivables and apply collection strategies.

- Adopt digital tools to streamline payables and receivables, reducing manual transactions and lag time.

- Track payables and receivables on time to inform cash flow forecasting, allowing you to plan purchases, investments, and growth.

Tracking Expenses and Income

Tracking expenses and income delivers actionable insights and ensures robust financial record-keeping. When you consistently record money spent and earned, you understand profitability, control costs, and support strategic decision-making.

Accurate tracking allows you to categorize expenses and monitor income from sales or services. Recording income and expenses promptly ensures cash flow management stays proactive.

Preparing Financial Statements

Financial statements transform bookkeeping into actionable business intelligence. It uses your financial record‑keeping to deliver clear snapshots of viability, performance, and opportunity.

- Creates Critical Reports: You produce the income, balance, and cash flow statements. Well‑organized records help small businesses to gain a deeper understanding of business progress and profitability.

- Loan and Investment: Lenders, investors, and potential partners depend on formal financial statements. A balance sheet helps track assets, liabilities, and equity.

- Enables Financial Analysis: With detailed statements, businesses compare performance period-to-period, flag trends, and spot anomalies.

- Strengthens Tax Preparation: Financial statements streamline tax preparation by summarizing income and deductible expenses, simplifying filings, and reducing audit exposure.

- Establishes Accountability and Strategy: You maintain accountability to stakeholders and sustain operational transparency.

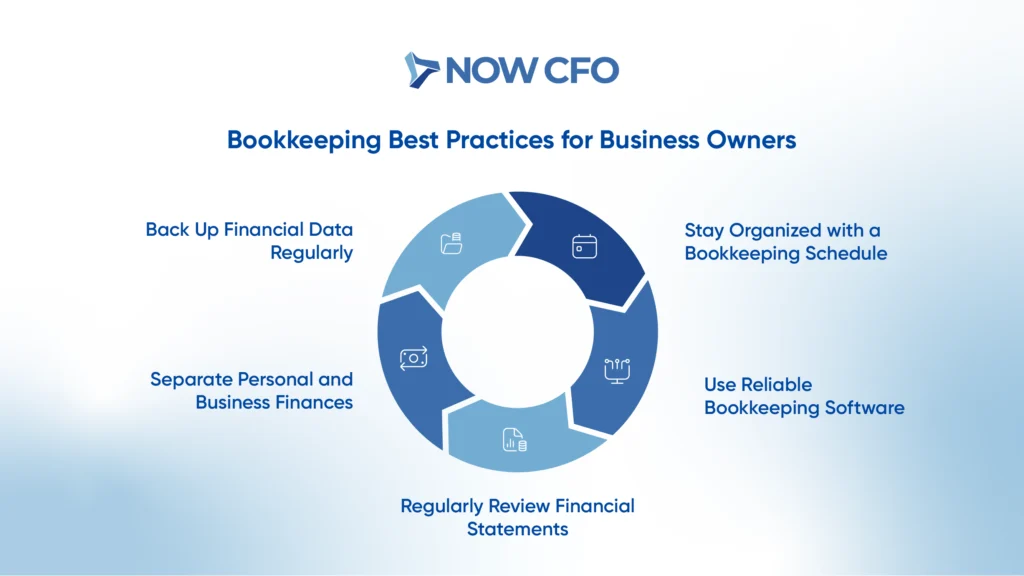

Bookkeeping Best Practices for Business Owners

You create systems that keep your books accurate and reliable by staying organized and protecting your records.

Stay Organized with a Bookkeeping Schedule

Staying organized with a bookkeeping schedule ensures that financial record‑keeping stays accurate, timely, and meaningful. Consistent bookkeeping prevents backlog, reduces errors, and upholds best practices.

Daily or weekly bookkeeping routines strengthen cash flow management and improve tax readiness by avoiding overlooked entries or missing receipts. A daily accounting checklist simplifies responsibilities like updating transactions and reconciling accounts, and keeps financial records meticulously maintained.

Use Reliable Bookkeeping Software

Integrating reliable software automates financial record‑keeping, minimizing errors, and reinforcing bookkeeping best practices.

- Software handles data entry, categorization, and reconciliation.

- Automating calculations and report generation ensures cleaner records, strengthens defenses during tax preparation, and supports clear audit trails.

- You’ll better understand cash flow management with dashboards and reports that update instantly.

- Cloud-enabled tools allow access from anywhere.

Regularly Review Financial Statements

Accurate bookkeeping requires ongoing review and analysis. Regularly examining financial statements gives you a clearer picture of strength and potential issues.

- Analyze income statements, balance sheets, and cash flow reports to assess performance.

- Review statements monthly or quarterly to detect revenue dips, rising expenses, or tightening liquidity early.

- Consistent statement reviews build credibility with investors, lenders, or partners.

Separate Personal and Business Finances

Maintaining a clear separation between personal and business finances protects personal assets and ensures clean financial record‑keeping. Mixing expenses or income blurs the line between personal and business transactions, leading to errors, confusion, and compliance risks.

Back Up Financial Data Regularly

Backing up your financial data consistently safeguards accurate financial record‑keeping and protects against data loss from hardware failure, human error, or cyber threats.

Secure, routine backups create a reliable recovery point for business-critical files such as ledgers, receipts, payroll records, and transaction logs. When disaster strikes, thorough backups save you from manually reconstructing records, preserving accuracy and compliance continuity.

How to Choose the Right Bookkeeping Solution

Choosing the right bookkeeping solution is not a one-size-fits-all decision. The best approach depends on your business size, growth stage, industry needs, and long-term goals.

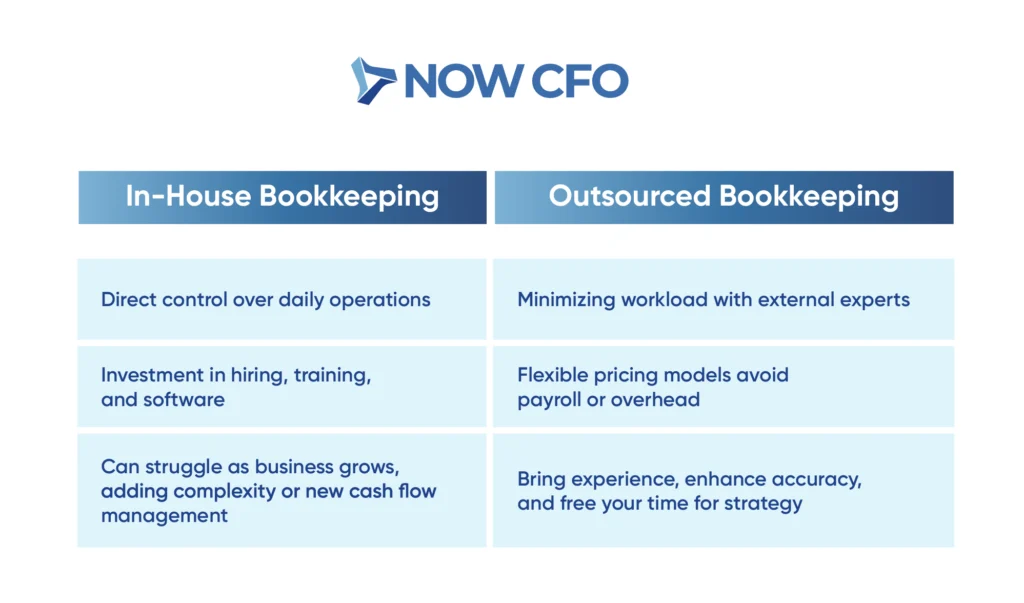

In-House vs Outsourced Bookkeeping

Choosing between in-house and outsourced bookkeeping involves balancing control, cost, and scalability.

Top Bookkeeping Software Options

You want software that streamlines financial record‑keeping and enhances bookkeeping best practices. Here are proven, widely-recommended options favored by small business owners:

- QuickBooks Online

- Xero

- Zoho Books

- FreshBooks

- Sage Business Cloud Accounting

- Wave Accounting

Factors to Consider When Choosing a Bookkeeping Service

When selecting a bookkeeping service, weighing several key factors is essential.

- Choose a service provider with proven experience in your sector.

- Evaluate whether the provider covers daily transaction processing, reconciliation, financial reporting, and other services.

- Look for a service that uses bookkeeping software that is compatible with your existing systems.

- Avoid service providers with hidden fees and confirm whether billing is monthly, per transaction, or per service bundle.

- Your provider should offer timely responses, regular updates, and accessible support.

Cost of Bookkeeping Solutions

Knowing the cost of bookkeeping solutions will help you plan budgets and achieve long-term financial clarity. Here’s a breakdown of typical cost structures:

- Monthly Packages: Many SMEs pay a flat monthly fee for comprehensive services.

- Percentage of Revenue: Certain providers charge based on revenue; typically 1% to 3%, aligning their compensation with your business success.

- Part-Time or Hourly Rates: Freelance or part-time bookkeepers often charge $21–23 per hour.

- In‑House Bookkeeper Cost: Hiring a full-time bookkeeper involves salary and benefits. The average annual salary of a bookkeeper is approximately $50,000.

Scalability for Growing Businesses

Enforcing accurate bookkeeping requires systems that scale seamlessly while preserving financial record‑keeping accuracy and efficiency as your business expands. Flexible solutions allow you to sustain growth without revising your entire bookkeeping process.

Scalable bookkeeping tools offer unmatched growth support. In the US, over 75% of SMEs have adopted cloud accounting. These platforms handle increasing transactions, multi-user access, and complex workflows.

Common Bookkeeping Mistakes to Avoid

Minor missteps in bookkeeping can have lasting consequences. By recognizing the common mistakes, you can take preventive steps to strengthen your bookkeeping practices.

Mixing Personal and Business Finances

One of the most pervasive and harmful mistakes in bookkeeping is commingling personal and business finances. Doing so compromises financial record‑keeping, inflates tax liabilities, and jeopardizes legal protections.

Besides, many SME owners mix personal and business expenses on their business cards. This seemingly minor action complicates bookkeeping, blurs expense tracking, and hinders accurate tax preparation.

Neglecting to Reconcile Accounts

Neglecting to reconcile accounts poses a serious risk because it weakens your financial record-keeping and can create hidden cash flow problems. When you skip regular reconciliation, you miss discrepancies like unrecorded bank fees, deposits in transit, or unauthorized withdrawals.

By reconciling monthly or weekly, you promote disciplined bookkeeping, prepare accurate statements for tax preparation, and ensure your financial foundation stays trustworthy.

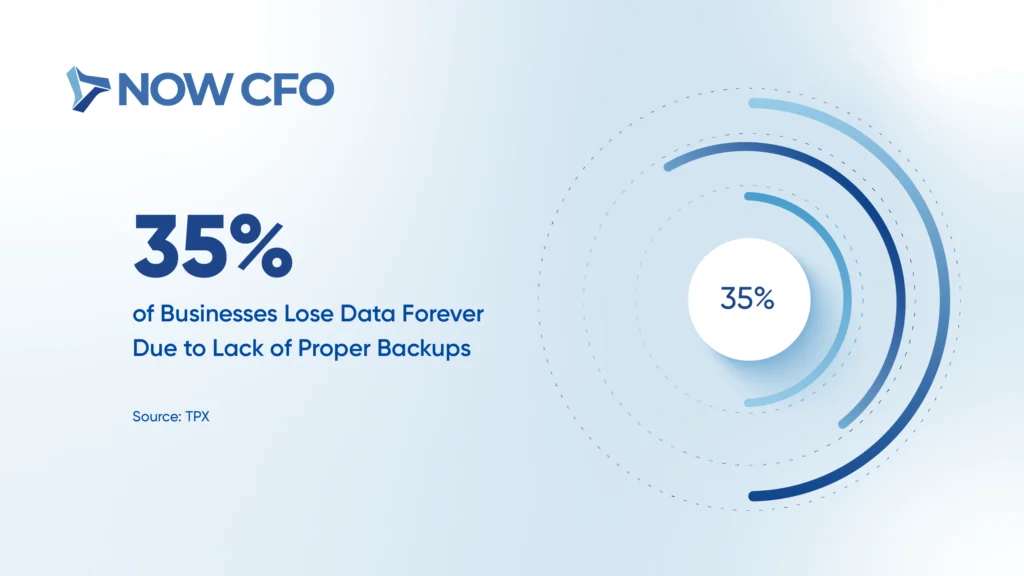

Failing to Back Up Financial Data

Neglecting to back up your financial information puts your business at serious risk. Without reliable backups, even a single disruption can lead to irretrievable data loss, costly downtime, and regulatory headaches.

Nearly 35% of businesses face data losses and can’t recover their data because they lack proper backups. Even minor failures can disrupt your bookkeeping, making data loss highly probable.

Ignoring Small Transactions

Overlooking small transactions can quietly derail your bookkeeping. While they may seem insignificant, these entries impact your financial record‑keeping accuracy and obscure cash flow visibility.

Ignoring small transactions disrupts the completeness of your records, diminishes data integrity, and undermines bookkeeping best practices. Without tracking minor costs, businesses can miss cumulative expense leaks that negatively affect profitability.

Overlooking Tax Deadlines

Failing to meet tax deadlines threatens the bookkeeping and exposes your business to financial record‑keeping risks.

Here’s why staying on top of deadlines matters:

- Monthly Penalties: Missing a tax filing deadline triggers a 0.5 % penalty on the unpaid tax per month (up to a maximum of 25%).

- Liability Across Tax Types: Quarterly estimated tax payments and employment or sales tax filings also carry penalties and interest if missed.

- Increased Audit Risk & Administrative Burden: Repeated missed deadlines can attract IRS attention, draw scrutiny, and increase compliance burdens.

Conclusion

The basics of business bookkeeping are the backbone for sustainable financial health. When done right, bookkeeping keeps your records accurate, your cash flow steady, and your business prepared for tax obligations. More importantly, it transforms your financial data into a tool for intelligent decisions.

NOW CFO specializes in helping businesses like yours establish strong bookkeeping practices. Take the next step: Reach out for a no-pressure, free consultation and connect with one of our experts. By partnering with experienced professionals, you ensure that your bookkeeping is not just a requirement but a strategy for long-term success.

Frequently Asked Questions

What is the Easiest Way for a Beginner to Start Bookkeeping?

A beginner can start by setting up a simple system to record income and expenses daily, either using spreadsheets or user-friendly bookkeeping software.

How Often Should Small Businesses Update Their Books?

Most small businesses benefit from updating their books weekly, while larger businesses with higher transaction volumes should update them daily.

Do I Need Bookkeeping if I Already Use Accounting Software?

Accounting software helps, but proper bookkeeping is still needed to enter accurate data, reconcile accounts, and generate meaningful reports.

What Happens if I Don’t Keep Accurate Bookkeeping Records?

Inaccurate records can lead to poor financial decisions, missed tax deductions, compliance issues, and potential cash flow problems.

When Should a Business Consider Outsourcing Bookkeeping?

Businesses often outsource when transactions increase, when owners want to focus on growth rather than admin tasks, or when professional accuracy becomes essential.