Did you know that fractional CFO industry have become one of the fastest-growing trends in financial leadership? Many SME businesses struggle to justify the full-time CFO’s high fixed costs and rigid commitments, only to face gaps in strategic financial oversight.

These CFO outsourcing statistics reveal why more companies choose project-based CFO expertise to drive profitability, from skyrocketing demand and global market size projections to sector-specific adoption rates. Read on to discover how your business can benefit from a fractional CFO’s flexibility and strategic insight.

33% of US Small Businesses Outsource Operations

Over one-third of U.S. small businesses now outsource at least one core operation, most commonly finance and accounting functions, to external specialists. This trend reflects a strategic shift from the traditional full-time hire model, as smaller companies seek to control overhead while benefiting from high-caliber expertise.

By tapping into fractional CFO services, these businesses secure on-demand financial leadership for tasks like monthly close, cash-flow forecasting, and board-level reporting without the fixed salary commitments of a permanent CFO.

As a result, they enjoy greater budget flexibility, access to seasoned strategic advisors, and the ability to scale financial oversight up or down in line with business cycles.

Source: Clutch

Global BPO Market Expected to Reach $525B by 2030

The global business process outsourcing (BPO) industry is forecast to reach $525 billion by 2030, driven by digitally enabled remote service delivery and the rising complexity of back-office functions.

Finance and accounting outsourcers, including fractional CFO providers, are a key growth segment within this market. Companies are increasingly turning to these specialists to handle routine bookkeeping or payroll and fill gaps in financial leadership.

Source: Exploding Topics

83% of SMEs and SMBs Use Business Outsourcing

A staggering 83% of SMEs/SMBs now engage with external firms to manage non-core functions, from IT support and customer service to business financial management. Outsourced financial leadership has emerged within this cohort as a powerful lever for improving profitability and operational efficiency.

By outsourcing part-time CFO services, these organizations gain access to expertise in capital planning, risk management, and performance reporting that they might otherwise forgo due to cost or headcount constraints.

Source: SMB Guide

52% of Executives Outsource at Least One Finance Function

More than half of corporate leaders, 52%, report that they outsource at least one finance function, ranging from accounts payable to strategic cash‐flow analysis. This trend highlights the mainstreaming of financial leadership outsourcing.

By doing so, organizations boost forecasting accuracy, tighten controls around working capital, and free their in-house teams to focus on growth initiatives. The flexibility inherent in fractional engagements allows companies to scale CFO support up or down around peak periods.

Source: Deloitte

54% of Healthcare CFOs Expect Efficiency Gains After Outsourcing

Over half (54 percent) of healthcare CFOs believe outsourcing non-core financial functions will drive significant efficiency improvements. In an environment marked by shrinking reimbursements and rising regulatory complexity, fractional CFOs bring process‐optimization expertise and technology.

Client hospitals and physician groups engaging fractional CFOs often see faster billing cycles, reduced denial rates, and more real-time financial visibility, enabling them to reinvest savings into patient care and innovation.

Source: Becker’s Hospital Review

CFO Requests Increased by 51% Since 2020 for C-Suite Requests

Demand for interim and fractional CFO roles has surged, up a staggering 310 percent compared to 2020. Out of which, 51% of C-suite requests are for CFO roles.

CFOs provide deep, project-based expertise to guide critical financial decisions, whether negotiating debt facilities, setting up financial controls, or leading carve-outs, without the cost or lag associated with permanent executive searches.

Source: Business Talent Group

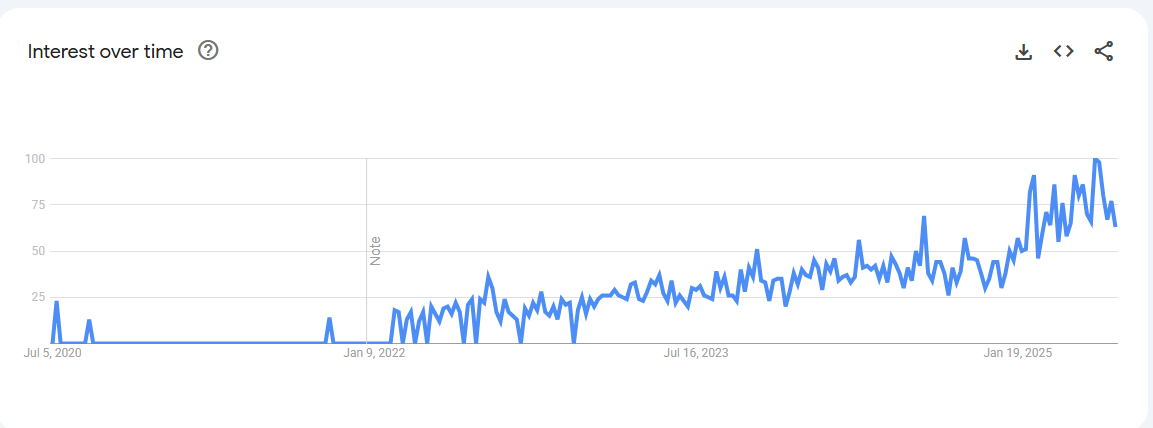

“Fractional CFO” Google Searches Soar Since 2022

Online search interest for fractional CFO in the U.S. has climbed dramatically since 2022, indicating rising market awareness and consideration among business leaders. As founders and finance teams explore cost-effective leadership models, a surge in search volume signals that fractional CFO services make it a mainstream option.

This digital footprint often represents the first step in the buyer’s journey, researching flexible CFO alternatives, which fractional CFO providers can capture through targeted content, thought leadership, and SEO-optimized resources.

Source: Google Trends

Soaring Market Demand for Fractional CFOs

The demand for fractional CFOs in the U.S. has skyrocketed, with a staggering 103% year-over-year increase. These trends reflect a significant shift in how businesses, especially startups and growth-stage companies, approach financial leadership.

Instead of committing to the high fixed costs of full-time CFOs, companies are turning to fractional solutions that deliver flexibility without sacrificing strategic expertise.

This surge in demand proves that more businesses are recognizing the benefits of experienced, project-based financial leadership. With fractional CFOs, companies can access tailored financial strategies, budget oversight, and forecasting support exactly when needed.

Source: Business Talent Group

Conclusion

The above statistics paint a clear picture: the fractional CFO industry fundamentally changes how businesses access high-level financial leadership, whether you’re a startup looking to stretch your runway, an established SMB aiming to optimize cash flow, or a healthcare organization seeking operational expertise.

Don’t let cost or headcount constraints hold back your financial strategy. Contact NOW CFO today to learn how our seasoned fractional CFOs can help you navigate growth, improve margins, and achieve your business goals.

FAQs

What is a Fractional CFO and How is it Different from a Full-time CFO?

A fractional CFO is a senior financial executive engaged on a part-time, project, or interim basis. Unlike a full-time CFO on your payroll 40 hours a week, a fractional CFO provides strategic guidance only when needed.

How Much Can Businesses Save by Hiring a Fractional CFO?

On average, businesses save up to 30% to 40% on CFO costs compared to a full-time hire. Savings come from reduced salary and benefits expenses, no long-term employment commitments, and the ability to scale hours based on project needs.

Which Industries Benefit the Most from Fractional CFO Services?

While fractional CFOs add value across many sectors, technology startups and healthcare organizations are among the largest adopters. Tech companies leverage their insights for fundraising, unit economics modeling, and rapid scaling, whereas healthcare CFOs use them to optimize revenue-cycle management and compliance.

How do Fractional CFOs Improve Cash Flow Management?

Fractional CFOs implement robust forecasting models and real-time financial dashboards, enabling proactive working-capital oversight. Within the first six months, clients often see double-digit improvements in cash-flow visibility and cycle times.

What is the Future Outlook for the Fractional CFO Industry?

Industry forecasts predict a continued upward trend: financial executives expect demand for fractional CFOs to increase over the next five years. Key drivers include growing acceptance of remote collaboration tools, tighter cost controls, and the need for specialized expertise during economic uncertainty.