SME owners hesitate to outsource accounting due to uncertainty or perceived complexity. They spend over six hours weekly on accounting, time better used for growth and strategy.

Before outsourced bookkeeping steps begin, the accounting outsourcing process starts with a structured assessment that sets clear expectations.

Understanding Your Current Financial Structure

In this phase, financial experts review your entire accounting environment. They map workflows, assess the chart of accounts, audit volumes, access controls, technology, data quality, and cash flow cycle, and document ERP and cloud system integrations to ensure compatibility and security.

Identifying Key Pain Points and Goals

With your baseline established, the next step is to identify critical challenges and define objectives. Hiring a new in-house accountant typically costs 1.25 to 1.4 times their salary, making outsourcing affordable.

- Cost Control: Pinpoint excessive spending on in-house resources.

- Scalability: Determine where manual processes hinder growth.

- Accuracy: Highlight areas prone to errors or compliance risk.

- Technology Gaps: Assess reporting tool limitations that impede efficiency.

Outlining a Customized Service Scope

After goals are clear, the provider formalizes a tailored engagement plan. This plan details deliverables, timelines for the steps involved in outsourced accounting, and communication protocols.

It defines responsibilities across bookkeeping, reporting cadences, and compliance checks. It also establishes SLAs and KPIs to measure success over time.

Data Gathering and System Integration

Once they define the service scope, the outsourcing team gathers data and integrates systems to build a solid technical foundation for efficient accounting operations.

Collecting Financial Records and Documentation

At this stage, providers compile essential financial artifacts from multiple sources:

- Export general ledger and trial balance reports

- Gather 12 months of bank and credit card statements

- Obtain accounts receivable and payable aging schedules

- Compile payroll journals, tax filings, and vendor agreements

- Digitize invoices, receipts, and expense logs

- Deliver fixed asset registers with depreciation details

- Provide variance analyses for prior fiscal periods

Setting Up Secure Software Access and Integrations

Next, the outsourced team configures your accounting platforms by establishing role-based permissions and implementing two-factor authentication. They integrate SSO for centralized access control and set up encrypted API connections for bank feeds, payment gateways, and payroll services.

Middleware tools automate data synchronization, while test transactions and validation scripts confirm integrity. Robust integration framework illustrates how outsourced accounting works, streamlining real-time data flow and reducing manual uploads.

Establishing Communication Workflows

Once the technical setup is complete, defining communication protocols prevents delays and misalignment:

- Assign primary contacts and escalation paths

- Schedule recurring check-ins (daily stand-ups, weekly reviews)

- Set response SLAs (e.g., 24-hour email turnaround)

- Use collaboration tools (Slack channels, Teams workspaces)

- Share calendars for deadline visibility

- Archive meeting notes in a central repository

- Employ ticketing systems for task tracking

Transitioning Accounting Responsibilities

Transitioning helps preserve workflow, access, and institutional knowledge so the team can deliver uninterrupted value.

Handing Off Bookkeeping and Reporting Tasks

The first transfer involves the full scope of recurring accounting duties. The outsourced team assumes responsibility for categorizing transactions, reconciling accounts, processing invoices and expenses, and preparing standard financial statements.

They efficiently use automation tools and remote access to mirror your internal accounting cycle. Using your chart of accounts and reporting timelines, they produce management reports such as balance sheets, profit and loss statements, and cash flow summaries.

Ensuring Continuity with Minimal Disruption

To maintain continuity, the outsourced accountant maps your existing accounting cycle to the new workflows established during onboarding. They follow SLAs to process tasks like invoicing, vendor payments, and payroll on time, and they document fallback procedures to handle errors or delays.

Outsourced teams guide you through process maps, close calendars, and GL reconciliation methods. They also create backup schedules, set rollback points, and log each transition step to ensure a smooth handover.

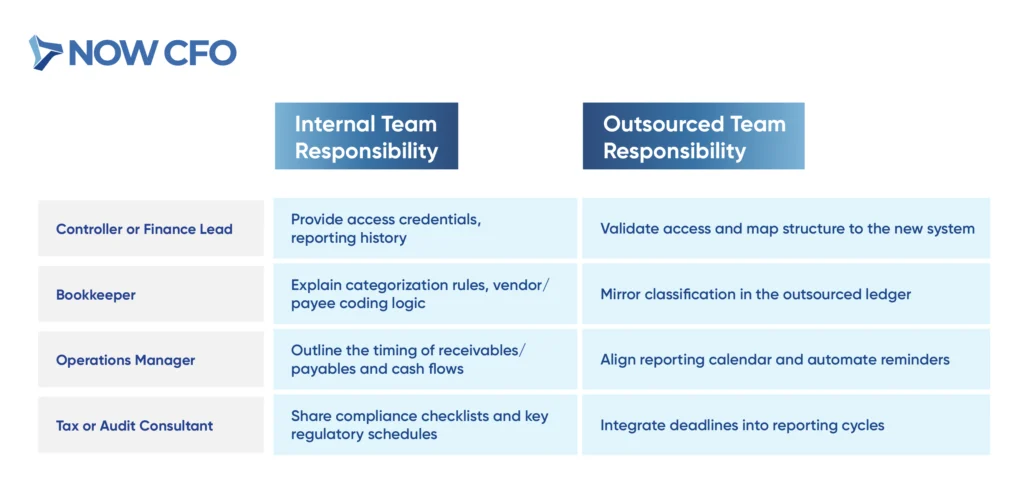

Internal Team Collaboration During Handover

Your internal team plays a pivotal role in the transition, using their institutional knowledge to bridge gaps between data and daily operations.

Ongoing Services Provided by an Outsourced Accounting Team

Once onboarding and handovers are complete, your business enters the most productive phase. Your outsourced partner manages transactions, analysis, and compliance at this stage.

Bookkeeping and Transaction Categorization

Bookkeeping is the daily operational core of any outsourced engagement. The provider records transactions in real time, adhering to a predefined chart of accounts and GAAP standards. Categorization includes tagging income and expenses, reconciling statements, and coding vendor payments.

They review each transaction for accuracy and consistency. Automation handles most tasks, but it also ensures compliance and manages exceptions. Clean books let them forecast, file taxes, and complete audits accurately.

Payroll Processing and Vendor Management

Bookkeeping, payroll, and vendor functions are typically the most time-sensitive areas after bookkeeping. Though transactional, these activities must be timely, compliant, and seamless for operations to run smoothly.

- Payroll Processing: Outsourced teams manage pay schedules, tax deductions, benefits allocations, and year-end reporting (e.g., W-2s, 1099s). They integrate platforms like Gusto or ADP to ensure accuracy and tax compliance.

- Vendor Management: AP teams schedule payments, track due dates, resolve discrepancies, and maintain updated vendor records. Many implement early-payment discount programs and monitor vendor performance metrics, reducing costs while enhancing procurement alignment.

Monthly Financial Reporting and Analysis

The outsourced team compiles standardized financial reports monthly, including P&L statements, balance sheets, and cash flow reports. These outputs follow a strict calendar, often within 5–7 days of the month’s end. Variance analysis highlights budget deviations, while trend comparisons reveal performance insights.

Reports are built to support stakeholders and can include dashboards customized for KPIs relevant to your industry. With data aggregated from real-time feeds, business leaders can use these reports to make informed decisions.

Budgeting, Forecasting, and Compliance Checks

Your outsourced team can take on strategic functions with reliable reporting, including forward-looking planning and regulatory assurance.

- Build rolling budgets and 12-month forecasts.

- Align forecasts to revenue models, hiring plans, and capital expenditure

- Scenario plan for best-case, worst-case, and mid-case growth

- Monitor compliance calendars (e.g., tax filing dates, GAAP checklists)

- Perform internal control reviews and transaction audits

- Prepare for board reporting or investor diligence cycles

How Communication Works with an Outsourced Partner

After they delegate tasks, they maintain alignment, accountability, and transparency through clear roles, consistent reporting, and real-time visibility, reducing uncertainty.

Regular Check-Ins and Reporting Cadence

An outsourced provider typically initiates recurring syncs to ensure timely updates and clarify deliverables. These include weekly check-ins for transaction status, bi-weekly financial reviews, and monthly reporting meetings aligned with your internal close cycle.

Leadership reviews are often quarterly to evaluate KPIs, cash forecasts, and budget variances. Each meeting has a defined agenda, and supporting documents are shared beforehand.

Who Handles What: Defining Roles Clearly

Defining responsibilities early is essential when outsourcing accounting. An RACI matrix helps clarify who handles documents, approvals, and reporting.

For example:

- Your internal team retains responsibility for invoice approvals and treasury decisions.

- The outsourced team handles categorization, reconciliations, reporting, and regulatory tracking.

- Controllers or CFOs (internal or fractional) validate accuracy and align reports to board requirements.

Tools Used for Collaboration and Transparency

Outsourced accounting teams leverage cloud-based systems and integrations that support transparency and real-time collaboration for smooth coordination. These tools are selected based on the client’s workflow complexity and volume:

- Slack, Microsoft Teams: Used for real-time communication and file sharing.

- Asana, Trello, or ClickUp: Task tracking with deadlines and responsibility tagging.

- Google Workspace or Microsoft 365: Collaborative document editing and shared calendars.

- Xero, QuickBooks Online, or NetSuite: Accounting platforms with shared dashboards.

- Secure file portals (e.g., ShareFile, Egnyte): For encrypted upload and storage of financial documents.

- Loom or Zoom: For recorded walkthroughs and review calls with screen sharing.

Milestones and Reporting You Can Expect

For businesses that outsource accounting, visibility doesn’t end at onboarding. A well-structured reporting schedule allows stakeholders to track deliverables across timeframes.

Weekly, Monthly, and Quarterly Deliverables

Most providers outline a structured timeline for deliverables post-handover. These outputs are built into the accounting calendar and tailored to each client’s size, industry, and regulatory needs. Below is a breakdown of typical deliverables by reporting cycle:

Year-End Support and Audit Readiness

As year-end approaches, they compile trial balances, reconcile accounts, post closing journal entries, and assemble GAAP-compliant financial statements. They also generate or organize tax documents for the CPA to review.

They often maintain a permanent audit folder containing each quarter’s invoices, contracts, and reconciliations to streamline review. If your company undergoes an audit, the team facilitates data pulls, auditor requests, and management representation letters.

Continuous Insights for Decision-Making

Beyond static reports, account outsourcing services include dashboards and real-time analytics that empower leadership with timely insights. These forward-facing outputs are significant when scaling or pivoting a strategy. To help maximize the impact, they use a data-driven approach that supports strategic decisions.

Key insight outputs include:

- Revenue trends by product, service, or client segment

- Cash runway forecasts and burn rate tracking

- Scenario modeling based on growth or cost shifts

- A/R collection cycle timeframes

- Expense-to-revenue ratio trends over rolling periods

- Monthly breakeven point analysis

Addressing Common Concerns About Outsourcing

Even when the benefits are clear, many business leaders hesitate to outsource their accounting. Addressing these upfront helps clarify what happens when you outsource accounting.

Is My Financial Data Secure?

Security is among the most frequently asked questions when businesses consider outsourcing. Reputable firms adhere to industry-grade cybersecurity protocols to safeguard sensitive financial data from unauthorized access and breaches.

They encrypt data both in transit and at rest. They also manage access through role-based permissions, multi-factor authentication, and IP-restricted login portals. Client records stay secure on SOC 2 and ISO 27001 compliant servers like AWS and Azure.

For added assurance, many firms sign BAAs/NDAs to govern how data is accessed and handled.

Will I Lose Control Over My Finances?

Concerns over control often surface during outsourcing accounting. However, outsourcing is structured around transparency and shared authority, not whole delegation without oversight.

Here’s how you maintain control:

- You approve all outgoing payments and payroll

- You have 24/7 access to real-time dashboards and general ledger data

- You receive scheduled reports and variance alerts

- You define workflows for reviews, escalations, and reconciliations

- You hold monthly check-ins to assess performance and adjust scope

What if I Outgrow the Service?

Another common concern is whether the model can evolve alongside your company. When appropriately designed, outsourced accounting arrangements are built to scale, not to constrain.

Here’s how outsourced financial operations flex to meet complexity:

- Modular Service Tiers: Upgrade from bookkeeping-only to complete controller oversight or CFO support.

- Specialized Add-Ons: Integrate cash flow forecasting, fundraising decks, or board reporting as needs change.

- Industry Expertise: Many firms assign specialists by sector (e.g., SaaS, construction, eCommerce) as you expand.

When Outsourcing Makes the Most Sense

Outsourcing is a strategic move made at critical growth junctures. Recognizing when to outsource can help prevent bottlenecks, avoid costly hiring missteps, and increase long-term operational efficiency.

You’re Scaling Rapidly and Need Expert Support

As companies scale, financial complexity increases. Growth introduces new revenue streams, evolving tax obligations, and stakeholder reporting demands that exceed the capacity of generalist bookkeepers.

Outsourcing provides immediate access to experts in fundraising, GAAP, and compliance. It eliminates the need to pause growth for recruiting and onboarding internal staff. With flexible engagement models, businesses can start with foundational support and expand to strategic advisory.

Your Internal Team Is Overworked or Underqualified

Suppose your current staff struggles to keep up with month-end closes, vendor communications, or accurate reconciliations. In that case, it’s a strong sign that it’s time to consider outsourced accounting. When finance teams are overextended, errors increase, reporting delays pile up, and morale suffers.

Outsourcing eases pressure by supplementing your team with skilled professionals who bring process maturity and tool-based efficiencies. Businesses retain control while eliminating backlogs, improving compliance accuracy, and standardizing financial processes.

You Want Real-Time Reporting Without Full-Time Costs

For startups and SMBs, hiring a full-time controller or CFO can cost upward of six figures annually. Yet the need for timely, accurate financial reporting persists. Outsourced accounting bridges the gap between resource constraints and data expectations.

With outsourced solutions, you gain access to real-time dashboards, KPI monitoring, and scenario modeling at a fraction of the cost of building an in-house team. These tools integrate during onboarding and are updated continuously, giving leadership visibility into burn rates, revenue shifts, and performance trends.

Conclusion

When outsourcing, you’re building a more intelligent financial engine. Outsourcing brings structure to chaos, improves compliance, and empowers strategic growth with expert insights and transparent reporting.

Ready to outsource your accounting to capable hands? Start by scheduling a free session with NOW CFO’s senior consultants. Find the best-fit model for your team, no pressure, no pushy sales, just clarity.