Understanding what bookkeeping is critical for building financial clarity and making informed business decisions. Yet, 34% of SME owners still manage their company’s books themselves, which heightens the risk of expense misclassification.

When done correctly, bookkeeping does much more than log transactions. Bookkeeping is the backbone for monitoring cash flow, ensuring tax compliance, and producing accurate financial statements.

What is Bookkeeping?

Bookkeeping is the structured process of recording, organizing, and systematically maintaining all business financial transactions. Professional bookkeeping relies on consistency, accuracy, and compliance with financial standards to keep records transparent and reliable.

Definition of Bookkeeping

Bookkeeping is the systematic process of recording and organizing every financial transaction a business undertakes. By capturing purchases, sales, receipts, and payments, bookkeeping is the critical backbone of accounting.

Accurate records show financial health. In fact, 36% of Americans lack financial literacy. Underscoring why business owners need CFOs with strong bookkeeping practices to avoid costly errors and poor decisions.

The Role of a Bookkeeper

Bookkeepers are more than record keepers; they are the financial organizers who keep business operations running smoothly.

- Record daily financial transactions to ensure accuracy and consistency.

- Reconcile bank statements to detect errors and discrepancies early.

- Manage accounts payable and receivable to maintain healthy cash flow.

- Prepare financial reports that guide informed business decisions.

- Ensure compliance with tax regulations and reporting requirements.

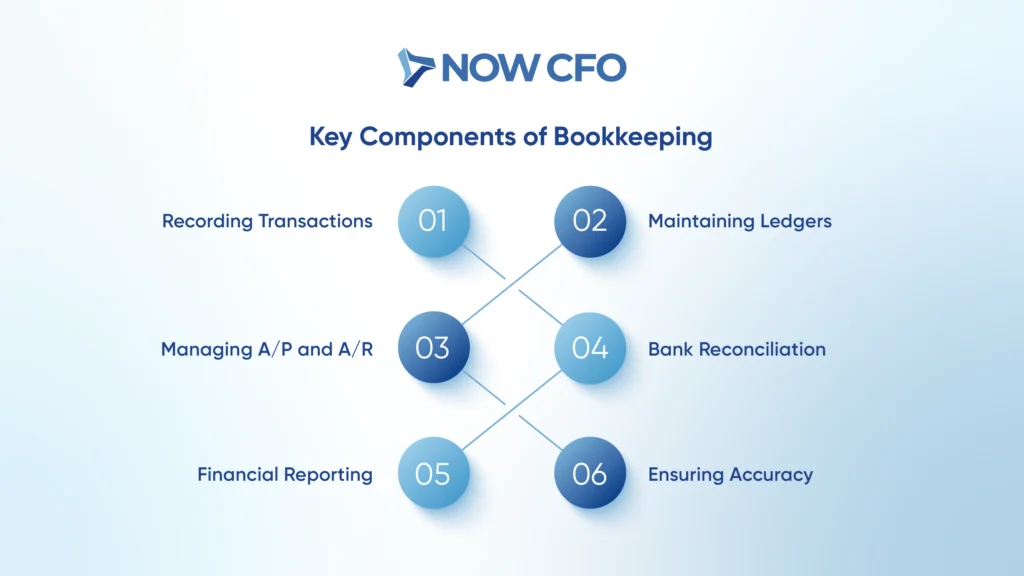

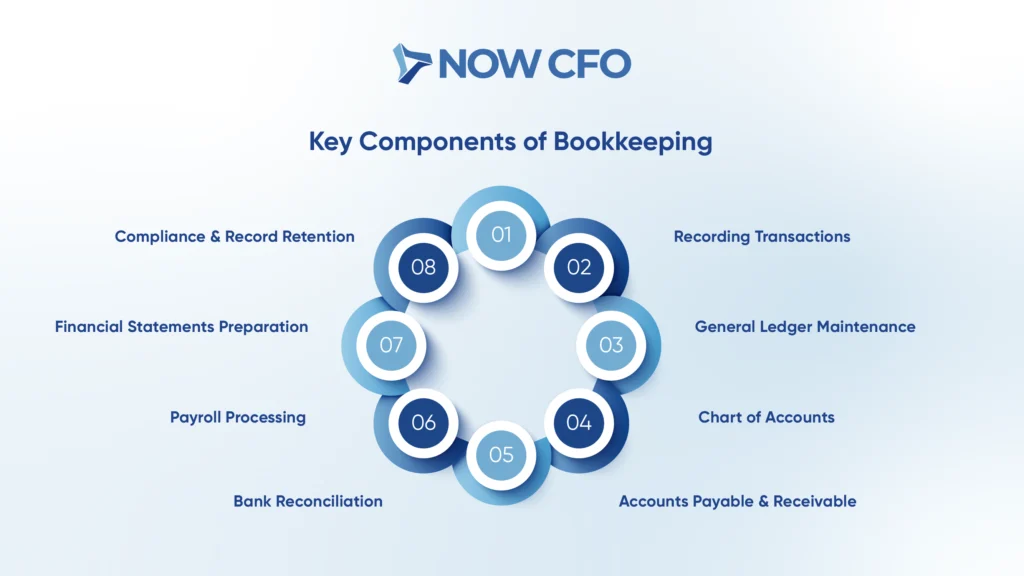

Key Components of Bookkeeping

To understand bookkeeping, you need to examine its building blocks. These components ensure every transaction is organized and translated into meaningful financial insights.

- Recording Transactions: Systematically log sales, purchases, receipts, and payments.

- Maintaining Ledgers: Organize these transactions into categories like assets, liabilities, equity, revenue, and expenses.

- Managing A/P and A/R: Track what the business owes (payables) and what is owed (receivables).

- Bank Reconciliation: Reconcile bank statements with internal records to spot discrepancies and ensure integrity.

- Financial Reporting: Prepare critical documents like balance sheets, income statements, and cash flow reports.

- Ensuring Accuracy: Compile debit and credit balances from your general ledger into a trial balance.

Bookkeeping in Modern Business

Businesses rely on digital solutions to maintain accurate financial record‑keeping. Besides, many SMEs use accounting software, such as QuickBooks, Xero, or Zoho Books, to streamline bookkeeping basics.

Additionally, cloud and electronic systems, endorsed by authorities like the IRS, ensure these digital records meet legal standards and are audit-ready. Such systems enhance tax compliance and reporting by integrating transaction tracking, reporting, and data backup.

Why Bookkeeping is the Backbone of Financial Management

Accurate bookkeeping basics form the foundation for businesses to monitor progress, prepare financial statements, and track deductible expenses effectively. Good records will help you monitor your business’s progress and prepare accurate financial statements.

Moreover, bookkeeping enhances organizing, planning, controlling, and leading, directly supporting management activities. Bookkeeping powers informed decisions, safeguards against financial missteps, and anchors long-term financial stability.

Why is Bookkeeping Important for Businesses?

Bookkeeping is far more than an administrative task; it’s the backbone of financial clarity and accountability. To truly understand what is bookkeeping, business owners must recognize that accurate record-keeping enables informed decision-making.

Proper bookkeeping ensures every transaction is documented, providing a clear view of cash flow, profitability, and liabilities. Without bookkeeping, businesses risk compliance issues, missed opportunities, and financial mismanagement.

Financial Clarity and Decision-Making

Accurate bookkeeping basics give business owners the clarity to assess current performance and chart future direction. With organized financial record‑keeping, owners craft budgets, forecast revenue, and make informed decisions.

Moreover, maintaining clear financial records reduces errors and enhances confidence in decision-making. In fact, nearly 50% of SMEs fail in the first five years, often due to poor financial planning and unclear visibility in cash management.

Tax Compliance and Reporting

Effective financial record-keeping ensures your business meets tax deadlines, accurately reports income, and claims rightful deductions. By maintaining organized records, business owners support tax compliance and reporting confidently.

Integrating bookkeeping into your routine ensures financial clarity, supports smooth audits, and safeguards against missed deductions and penalties. This strengthens your operation’s stability and fuels data-driven decisions.

Tracking Business Performance

One of the clearest ways to see the value of bookkeeping lies in its ability to track business performance. Beyond simply recording transactions, bookkeeping provides the data needed to evaluate profitability, understand spending patterns, and measure growth over time.

- Track monthly income to identify peak seasons, customer behavior, and sales fluctuations.

- Analyze fixed and variable costs to control spending and reduce unnecessary overhead.

- Calculate gross and net profits to assess financial health and long-term sustainability.

- Use historical data to forecast cash needs and build financial plans grounded in actual performance.

- Benchmark your progress with consistent metrics to detect opportunities or early warning signs.

Improving Cash Flow Management

Strong bookkeeping practices are the foundation of effective cash flow management. Accurate records ensure owners know when receivables are due, when payables must be met, and how much working capital is available at any given time.

This financial visibility prevents cash shortages, reduces reliance on costly credit, and allows for timely investments in growth. By tracking expenses and income consistently, businesses can forecast upcoming needs, identify patterns, and take steps to maintain liquidity.

Ensuring Financial Accountability

Companies have higher profitability associated with strong financial accountability practices. Accurate financial record‑keeping promotes transparency and trust, helping stakeholders rely on your information.

Consistent reporting holds management accountable and supports sound decision-making. Additionally, financial accountability fosters compliance with reporting standards and regulatory frameworks, which are essential for your business.

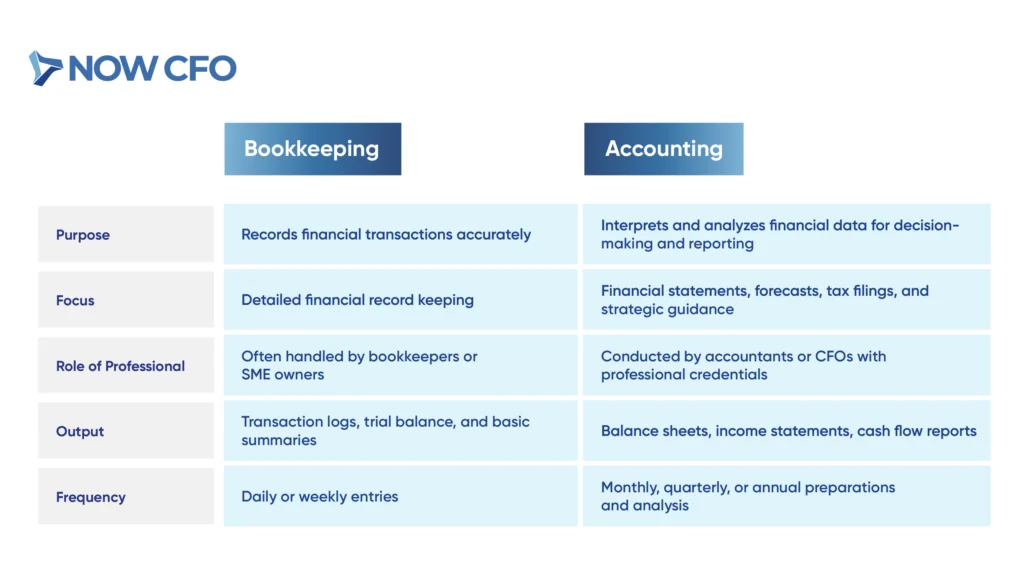

Bookkeeping vs Accounting: What’s the Difference?

While many use the terms interchangeably, bookkeeping and accounting serve distinct but complementary roles in business finance. To fully answer what bookkeeping is, it’s essential to see it as the foundation.

Key Differences Between Bookkeeping and Accounting

How Bookkeeping and Accounting Work Together

Bookkeeping records every financial transaction, capturing sales, receipts, expenses, and payments. Accountants then analyze that meticulously organized data to prepare financial statements, assess profitability, and guide strategic decisions.

Both bookkeeping and accounting ensure clarity in financial record‑keeping and transform raw data into meaningful insights for growth and compliance. Businesses build a foundation that accountants convert into smarter forecasting, reports, and long-term planning tools.

When to Use Bookkeeping vs Accounting Services

Use bookkeeping basics daily to record transactions and maintain financial record‑keeping when your business is small or in the startup phase. As complexity grows, you’ll require strategic tax planning or audit-ready statements. Engage an accountant or outsourced service to interpret data, ensure tax compliance and reporting, and guide scaling.

Which Does Your Business Need?

If your company handles simple, routine transactions, bookkeeping may be all you need to maintain accurate financial records and stay organized. However, tax planning, forecasting, and transitioning to accounting services become necessary as your business grows.

Bookkeeping ensures that your daily financial activities are properly logged, while accounting provides deeper analysis and strategic guidance. Choosing the right service depends on your business stage, ensuring you understand bookkeeping and when to incorporate.

Types of Bookkeeping Systems

Businesses rely on two primary systems to record, track, and organize their financial transactions effectively.

Single-Entry Bookkeeping

Single‑entry bookkeeping records each financial transaction only once, usually in a cash book, much like tracking personal checkbook activities. It captures only income and expenses, without detailing assets, liabilities, or equity.

This simplicity supports financial record‑keeping and avoids complexity, but it lacks the detail needed for robust financial insights, tax compliance, or performance tracking. Still, it provides a simple way for startups to support financial management.

Double-Entry Bookkeeping

Double-entry bookkeeping records each financial transaction in two accounts: a debit and a credit. Ensuring the fundamental equation (Assets = Liabilities + Equity) stays balanced.

This bookkeeping method actively prevents errors and fraud, offering clarity and accuracy in bookkeeping for SMEs and financial record‑keeping alike. Its dual-entry structure makes it the standard system accounting professionals use across industries.

Unlike the simpler system, double‑entry has complex needs such as tracking inventory, managing payables and receivables, and preparing audit-ready statements. It becomes vital when businesses plan to scale, attract investors, or ensure tax compliance.

Essential Bookkeeping Tasks

Keeping accurate financial records requires consistency, organization, and attention to detail. Essential bookkeeping tasks form the structure that ensures a business operates smoothly and remains financially transparent.

Recording Daily Transactions

Recording daily transactions means logging all sales, purchases, payments, and receipts as they occur, providing real-time insight into your financial position. Moreover, expenses should be recorded when they occur, and it’s best to record transactions daily.

Daily updates to your books ensure accurate cash flow management, minimize missed entries, and support timely tax compliance and reporting. For growing businesses, daily transaction tracking reduces errors and supports swift decision-making.

Reconciling Bank Statements

Reconciling bank statements monthly verifies that your internal books align with the bank’s records. This report is essential for maintaining financial record‑keeping accuracy, detecting unauthorized transactions, and supporting tax compliance and reporting.

Managing Accounts Payable and Receivable

Managing AP/AR directly impacts cash flow and business stability.

- Monitor bills to ensure accurate payments are made on time.

- Maintain consistent payment cycles to avoid late fees.

- Issue and log invoices promptly to ensure revenue is captured correctly.

- Send reminders for overdue accounts to maintain steady inflows.

- Regularly compare payables and receivables to forecast cash needs and avoid shortages.

Tracking Expenses and Income

It’s essential to see how tracking expenses and income provides the foundation for profitability analysis and smarter financial planning.

- Keep detailed records of expenses and income, like supplies, sales, and services.

- Tracking forms the basis for the income statement, revealing net profit and helping you make strategic decisions.

- Organized expense monitoring helps identify inefficiencies, control costs, and improve budgeting and future planning.

Preparing Financial Statements

Preparing statements that turn raw transaction data into clear insights for decision-making and planning is vital in financial management.

- Compile assets, liabilities, and equity into a snapshot of financial standing.

- Translate tracked expenses and income into profit/loss over a period.

- Record the inflows and outflows, ensuring liquidity transparency and reinforcing bookkeeping basics.

Financial statements help to inform investors, lenders, and management, demonstrating the business value of accurate bookkeeping.

Bookkeeping Best Practices for Business Owners

Successful financial management depends on consistency, organization, and the adoption of reliable methods. Following bookkeeping best practices ensures that records remain accurate, processes stay efficient, and decision-making is based on trustworthy data.

Stay Organized with a Bookkeeping Schedule

Creating and following a consistent bookkeeping schedule ensures that every financial transaction receives timely attention, including sales, expenses, and invoice payments. A weekly or monthly bookkeeping routine helps you avoid backlogs and reduce entry errors.

You keep records accurate and current by setting a consistent schedule, like logging daily receipts each evening and reconciling bank statements weekly. This routine strengthens your ability to track performance and make informed financial decisions.

Use Reliable Bookkeeping Software

Adopting reliable bookkeeping software is essential for accurate financial record‑keeping. Unlike manual methods, digital platforms reduce errors, automate reconciliations, and ensure consistent bookkeeping.

In fact, 66% of SME owners use financial accounting software, which improves accuracy and simplifies processes. These systems support streamlined tax compliance and reporting by maintaining organized, audit-ready records.

Regularly Review Financial Statements

Establish a routine, preferably monthly, to review your income statement, balance sheet, and cash flow statement.

- Comparing income statements monthly helps you identify revenue fluctuations and control costs early.

- A consistent review of the balance sheet and cash flow shows whether you can meet liabilities and fund growth.

- Reviewing reports helps owners monitor progress and make timely adjustments, reducing risks of financial missteps.

Separate Personal and Business Finances

One of the most critical steps in maintaining clear and accurate financial records is drawing a firm line between personal and business money.

- Open dedicated business bank and credit accounts. Using separate accounts makes recordkeeping, tax compliance, and reporting easier.

- Keep personal and business spending distinct to ensure only legitimate business costs appear in your ledgers.

- Avoid mingling funds to uphold the limited liability of your business structure and preserve legal safeguards.

- Separate finances reduce confusion when preparing statements and backing up performance insights.

Back Up Financial Data Regularly

Backing up your financial data protects your business against unexpected losses from system crashes, theft, or cyberattacks. Storing copies in secure cloud platforms or external drives provides a safety net, allowing you to recover critical records quickly.

Regular backups safeguard historical data and help maintain compliance and business continuity. Creating a routine backup schedule reduces risks and gives your company a reliable foundation for future reporting and decision-making.

How to Choose the Right Bookkeeping Solution

Selecting the right bookkeeping solution depends on your business size, complexity, and long-term goals. SME may benefit from simple software that automates invoicing and expense tracking, while growing companies often need more robust platforms.

In-House vs Outsourced Bookkeeping

Deciding between in-house and outsourced bookkeeping involves balancing control, cost, and access to expertise.

| Features | In-House Bookkeeping | Outsourced Bookkeeping |

| Control & Oversight | Full control and direct oversight | Less direct control, but provides professional oversight |

| Cost & Resource Use | High overhead salaries, training, and software | More cost-effective, freeing resources for other strategic uses |

| Expertise & Skill Access | Lacks advanced knowledge in tax compliance | Access to a team of experts, helping maintain basic bookkeeping and regulatory knowledge |

| Flexibilities & Scalability | Less flexible, harder to scale with seasonal or growth-based needs | Easier to scale, ideal for fluctuating needs or growth-oriented businesses |

| Technology & automation | Requires internal investment in software upgrades and ongoing maintenance | Includes modern cloud tools and automated systems as part of the service |

Top Bookkeeping Software Options

Choosing the right bookkeeping software can make managing your finances more efficient and less time-consuming. The best platforms offer features like automated expense tracking, invoicing, and reporting, helping you stay on top of cash flow and compliance.

Below are some of the most popular bookkeeping software options businesses rely on today.

- QuickBooks Online

- Xero

- Sage Business Cloud Accounting

- Wave

- GnuCash

Factors to Consider When Choosing a Bookkeeping Service

When evaluating bookkeeping services, remember these key factors to find a provider that truly fits your business needs.

- Confirm the bookkeeper holds relevant certifications and insurance.

- Seek experience in your sector to ensure the bookkeeping service understands your context and financial workflows.

- Ensure the service supports systems you already use, such as payroll and POS software, to streamline daily workflows.

- Choose a provider with strong reviews and dependable communication.

- Pick a service that adjusts capacity as your business grows

Cost of Bookkeeping Solutions

Bookkeeping costs vary significantly depending on approach and complexity. Outsourced solutions typically cost small businesses around $400 monthly. Outsourcing also offers specialized expertise, scalability, and lower fixed costs.

Hiring a part-time in-house bookkeeper averages $21–23 per hour, which can scale to $3,000–$6,000 monthly. When combined with benefits and workspace overhead, in-house sources can cost significantly more.

Scalability for Growing Businesses

As a business grows, financial tasks become more complex and time-consuming. Scalable bookkeeping solutions provide the flexibility to adapt to these changing needs.

Businesses can maintain accuracy and compliance with the right systems or professional support. They can also gain the insights to make confident decisions and sustain growth.

Common Bookkeeping Mistakes to Avoid

Even with the best systems and practices, businesses can encounter pitfalls.

Mixing Personal and Business Finances

Mixing personal and business finances blurs the line between personal and professional spending. This common bookkeeping mistake complicates financial record‑keeping and increases the risk of tax misclassification and scrutiny.

Poor separation of personal and business finances is central to undermining control and clarity. Combining funds can raise audit flags, so it’s recommended that separate accounts be maintained.

Neglecting to Reconcile Accounts

Failing to reconcile accounts regularly leaves financial records misaligned with reality and opens the door to errors, cash flow problems, and undetected fraud. Neglecting this step can lead to inaccurate financial reporting, tax issues, and disrupted operations.

Meanwhile, cash flow problems remain the top cause of SME failure. These risks highlight the need for consistent bookkeeping reconciliations to preserve accuracy in financial record‑keeping and avoid crippling disruptions.

Failing to Back Up Financial Data

Protecting financial data is just as important as tracking it. The following points highlight what can happen when backup practices fall short.

- Losing financial data can disrupt daily operations and create major setbacks.

- Without backups, essential records may be gone permanently.

- Not all backup attempts work as expected, leaving gaps in data protection.

- Failed recovery efforts can delay reporting and decision-making.

- Inconsistent backups can weaken financial accuracy and compliance.

- Over time, these gaps may harm business performance and stability.

Ignoring Small Transactions

To fully embrace what is bookkeeping, business owners must understand why ignoring small transactions is a costly mistake.

- Small expenses left unrecorded add up and distort the accurate financial picture.

- Untracked costs make it harder to control spending and stick to planned budgets.

- Missing transactions reduce visibility of net income and profitability.

- Skipping small amounts may lead to errors when filing deductions or reconciling accounts.

- Inaccurate data limits the ability to make sound, informed business choices.

Overlooking Tax Deadlines

Businesses face serious consequences when they miss important tax deadlines, whether for quarterly or annual filings. Late submissions can quickly create compliance issues, disrupt cash flow, and strain financial stability unnecessarily. Staying on top of reporting schedules is essential to avoid setbacks and keep operations running smoothly.

How Can Outsourced CFOs Help with Bookkeeping?

Building on best practices and systems, businesses ready to scale and sharpen their bookkeeping basics can use outsourced CFOs.

Expertise in Financial Record-Keeping

Outsourced CFOs bring expertise to financial record‑keeping, ensuring every ledger entry aligns with your financial statements and regulatory standards. Because they routinely manage complex financial systems.

CFOs help maintain bookkeeping basics with elevated accuracy and compliance. Additionally, outsourced CFOs use advanced tools and controls to reduce errors and streamline documentation, boosting clarity in your bookkeeping process.

Streamlining Bookkeeping Processes

Outsourced CFOs add value by streamlining processes, turning routine bookkeeping into a faster, more reliable system.

- Outsourced CFOs assess and reorganize your bookkeeping flow, consolidating duplicate steps and automating repetitive tasks.

- To reduce manual effort, CFOs introduce tech like cloud-based ledgers, auto-reconciliation, and dashboard reporting.

- By linking bookkeeping systems with payroll, invoicing, and POS platforms, CFO create a unified ecosystem that reduces errors.

- As transaction volumes grow, your streamlined bookkeeping adapts, ensuring accuracy and consistency with less manual oversight.

Implementing Advanced Bookkeeping Software

Advanced software has transformed how businesses manage their finances by offering real-time visibility, automation, and improved accuracy. Cloud-based platforms are now widely adopted, allowing companies to move away from manual processes.

These cloud-based platforms centralize ledger maintenance, reconciliation, and financial reporting into automated workflows. This integration strengthens bookkeeping basics and enhances long-term financial record-keeping.

Ensuring Compliance with Financial Regulations

Outsourced CFOs help embed compliance into your bookkeeping by aligning recording practices with evolving legal frameworks and reporting standards. Effective compliance reduces financial and legal risks as SMEs face significant regulatory burdens.

By overseeing accurate tax calculations, timely filings, and standards like GAAP, outsourced CFOs ensure your bookkeeping reflects legal standards. CFOs reinforce bookkeeping as a reliable and compliant financial foundation, not just a ledger.

Providing Strategic Insights from Bookkeeping Data

Beyond organizing numbers, outsourced CFOs transform financial data into insights that guide smarter strategies and support long-term business growth.=

- Analyzing revenue and expense trends reveals which products, services, or clients yield the highest margins.

- Using data patterns, outsourced CFOs help anticipate shortfalls or surpluses.

- CFOs compare current data against historical performance or industry standards to highlight strengths and improvement areas.

- Insights from bookkeeping data guide decisions on expansion, staffing, technology investments, or entering new markets.

Reducing Costs Through Efficient Bookkeeping Practices

Efficient bookkeeping practices help businesses cut unnecessary expenses by improving accuracy and reducing errors that often lead to costly corrections. By keeping financial records up to date, companies avoid late fees, missed payments, and duplicate charges.

Outsourced CFOs enhance this efficiency by standardizing workflows, introducing automation tools, and ensuring consistency across all financial activities. With streamlined bookkeeping, businesses can lower administrative costs and gain visibility into spending.

Scaling Bookkeeping Operations for Growing Businesses

Scaling bookkeeping operations means expanding systems, people, and processes as your business scales. This involves implementing workflows, automations, and tools capable of handling increased transaction volume, diverse revenue streams, and multiple entities.

Outsourced CFOs play a pivotal role by designing scalable bookkeeping frameworks, implementing advanced finance systems, and advising on delegation versus automation. They ensure consistent bookkeeping even as transaction load or audit requirements grow.

Conclusion

Mastering what is bookkeeping isn’t just about balancing ledgers; it’s about empowering your business with accuracy, clarity, and strategy. Integrating structured bookkeeping systems, using reliable software, avoiding mistakes, and engaging outsourced support protects your financial health and unlocks growth opportunities.

If you’re ready to elevate your financial management, why not book a free session with our experts at NOW CFO? We can assess your current processes and recommend strategies aligned with your business goals.

Frequently Asked Questions

How Does Bookkeeping Help Me Make Smarter Business Decisions?

Bookkeeping provides clear financial records that reveal where money is earned and spent, helping you plan budgets, control costs, and grow strategically.

Can I Handle Bookkeeping Alone, or Do I Need Professional Help?

Many small business owners start independently, but outsourcing or hiring support ensures accuracy and saves time as transactions grow more complex.

What Tools Make Bookkeeping Easier for Small Businesses?

Cloud-based bookkeeping software simplifies tasks like invoicing, reconciliation, and financial reporting, while reducing the risk of errors common in manual tracking.

How Often Should I Update My Financial Records?

Transactions should be recorded daily or weekly to avoid backlogs. Regular updates prevent errors and keep your financial picture up to date.

What Happens if Bookkeeping is Neglected?

Poor bookkeeping can lead to cash flow problems, tax penalties, and missed growth opportunities. Staying consistent safeguards compliance and supports financial stability.