Every business owner knows numbers matter, but many overlook how crucial accurate bookkeeping is for survival and growth. About 34.7% of U.S. private-sector businesses survive to operate a decade after they are founded, roughly one in three new companies.

Maintaining precision in financial records isn’t simply about compliance; it determines whether your business thrives or folds. Small misclassifications, delayed entries, or missing documentation can ruin trust with lenders, twist profit margins, and complicate tax obligations.

What Does Accurate Bookkeeping Really Mean?

Strong financial management begins with precise records that accurately reflect every transaction. When accurate bookkeeping is in place, businesses maintain accurate financial records, ensure compliance, and gain the clarity needed for business decisions.

Definition of Accurate Bookkeeping

Accurate bookkeeping systematically records all financial transactions with precision, consistency, and integrity. It ensures that income, expenses, assets, liabilities, and equity are appropriately documented in the ledger.

Bookkeeping goes beyond simple data entry. It demands that records be up‑to‑date, verifiable, and free of misclassifications or omissions. Ultimately, bookkeeping supports compliance and provides a reliable representation of the financial position.

Learn More: What Is Bookkeeping?

Core Elements of Accurate Recordkeeping

Proper bookkeeping depends on several fundamental components to ensure error‑free, usable records.

- Every financial transaction, income, expense, asset purchase, and liability incurred must be recorded with date, amount, and description.

- Entering transactions daily or weekly so records reflect current figures and cash flow status.

- Use a clear chart of accounts and categorize transactions correctly (assets, liabilities, equity, revenue, expenses).

- Maintain organized ledgers (by account) and journals (chronological entries) for tracking transactions.

- Generate income statements, balance sheets, and cash flow statements that mirror the underlying transactions accurately.

- Keep documentation/receipts and source documents so every entry can be traced back and verified.

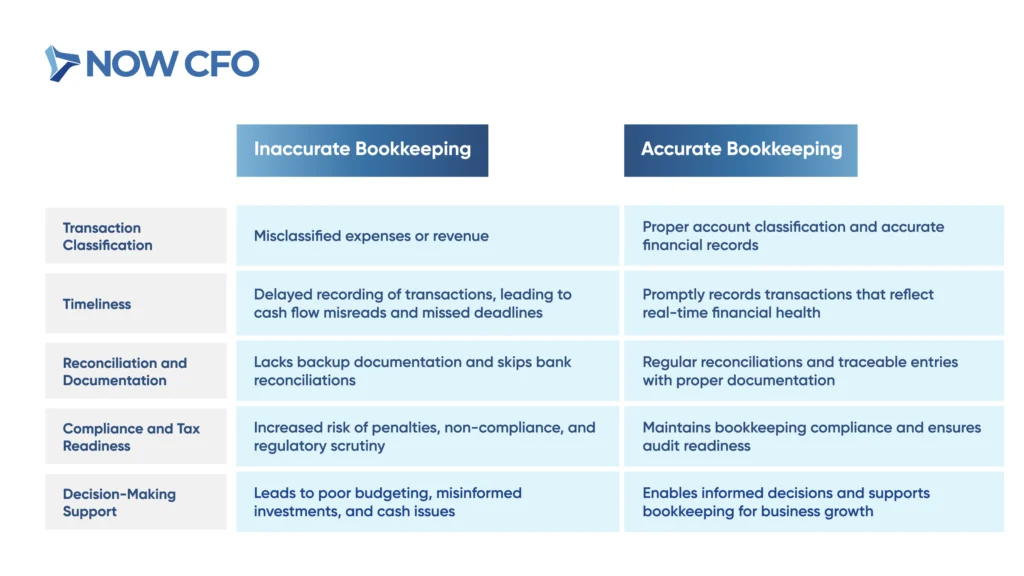

Difference Between Accurate and Inaccurate Bookkeeping

Human data entry errors rise when no verification process exists.

Tools and Practices That Ensure Accuracy

Accurate bookkeeping succeeds when reliable tools combine with disciplined practices that enforce precision in every entry, classification, and reconciliation. These tools and practices support bookkeeping by reducing human error.

- Accounting Software with Automation: Use tools such as QuickBooks and Xero.

- Regular Bank Reconciliation: Match internal ledgers with bank statements often to detect errors early.

- Clear Chart of Accounts: Define and stick to categories so similar transactions always use the same accounts.

- Trial Balances: Run trial balances each period to check debits = credits, and adjust for accruals or depreciation as needed.

- Use Double‑Entry Bookkeeping System: Every transaction must affect at least two accounts.

- Data Backup: Maintain backups so data stays safe and can be recovered under failure or loss circumstances.

Why Accuracy Matters More as Businesses Scale

Growing businesses face more complex financial operations, so bookkeeping becomes increasingly critical as complexity rises. As transaction volumes grow, stakeholder demands and regulatory obligations increase; accurate financial records are essential for business growth.

When operations expand, small mistakes can arise. Systems strained by scale reveal weaknesses in process, controls, and oversight. In scaling businesses, poor recordkeeping leads to cash flow mismanagement, tax risks, and weakens credibility with investors.

Learn More: Top bookkeeping practices every CFO Recommends

The Role of Accurate Bookkeeping in Business Success

Bookkeeping gives business owners confidence in managing their operations. Accurate daily records clarify cash flow, expenses, and revenue.

Supporting Day-to-Day Financial Management

Accurate bookkeeping assists daily operations, ensuring businesses run smoothly. It also allows managers to track which bills are due, monitor incoming payments, and see real‑time profit or loss.

With accurate financial records, business owners can spot cash shortages before crises occur. Regular entries decrease risks during tax season and help maintain bookkeeping compliance.

Enabling Informed Decision-Making

Bookkeeping provides actionable visibility into financial trends. Executives evaluate product lines, pricing, and investments with confidence. Financial records provide reliable financial clarity and decision‑making, leading businesses toward growth and stability.

Ensuring Compliance With Tax and Legal Requirements

Accurate bookkeeping forms the foundation for meeting tax and legal obligations without surprises or penalties. Businesses that maintain valid bookkeeping documents, timely filings, and correct classifications can avoid legal risks.

- Submit income, payroll, sales, or other required returns on schedule.

- Accurately categorize items under proper headings.

- Keep receipts, invoices, payroll records, contracts, and other proof.

- Deduct and remit payroll withholdings, federal/state taxes, social security, etc., in full and on time.

Building Investor and Lender Confidence

Accurate, clear records give stakeholders confidence in risk and returns. This credibility improves funding access and terms.

- Deliver regular, clear, and accurate reports, showing income, liabilities, and assets.

- Keep receipts, contracts, reconciliations, and books in order.

- Use accurate bookkeeping to show dependable cash flow and sound profit trends.

- Share realistic forecasts, budgets, and financial health indicators based on verifiable financial clarity.

Creating a Strong Foundation for Long-Term Growth

Bookkeeping does more than fix issues; it builds a platform for long-term growth. Owners keeping accurate books from the start gain benefits like:

- Reliable financial forecasting

- Effective cost management and scalability

- Strong capital raising potential

- Resilient risk mitigation and compliance readiness

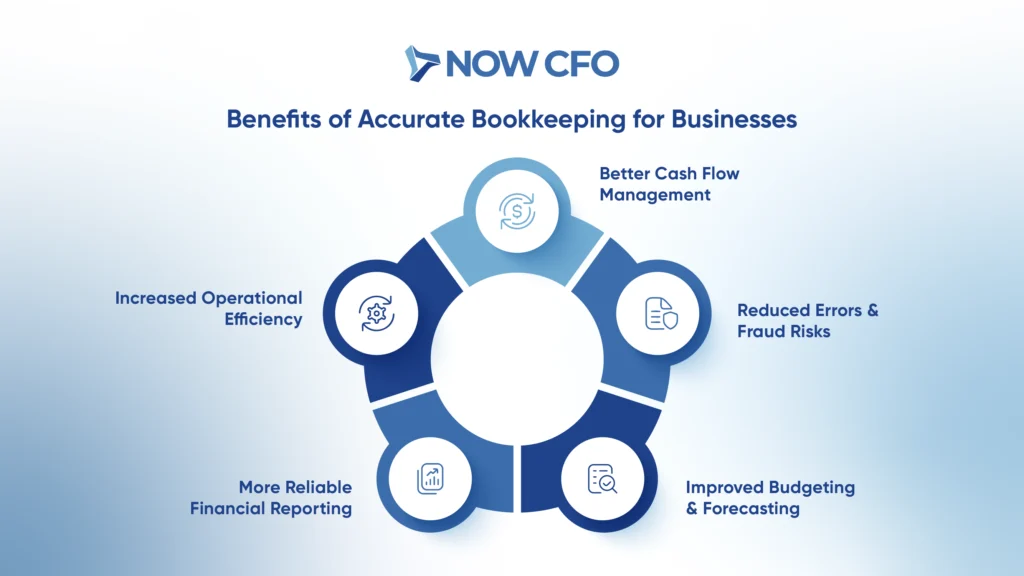

Benefits of Accurate Bookkeeping for Businesses

Maintaining accurate bookkeeping enables you to gain visibility into cash flow, reduce risks, and improve forecasting. These benefits enable businesses to make informed decisions and sustain their growth.

Better Cash Flow Management

Business owners use bookkeeping to detect cash shortages before they become crises and ensure that daily revenues and expenses are balanced. Accurate sales, receivables, payables, and inventory tracking deliver accurate financial records.

Moreover, cash flow projections built on precise data improve budgeting and guide growth decisions. Firms with better cash flow visibility show significantly higher financial performance metrics, such as return on assets and profit margins.

Reduced Errors and Fraud Risks

Proper bookkeeping strengthens internal checks and reduces costly mistakes and fraud.

- Assign different people to record, review, and approve transactions.

- Reconcile bank statements, invoices, payroll, and ledgers frequently.

- Classify every entry correctly, including expense vs asset and revenue vs other income.

- Keep invoices, receipts, contracts, and audit trails.

Improved Budgeting and Forecasting

Bookkeeping fuels more precise planning by ensuring your financial inputs reflect real performance. Proper bookkeeping allows you to build budgets rooted in actual data, reducing variance between forecasted and real outcomes.

Accurate budgeting and forecasting work best when:

- You use historical transaction data from your ledger to inform revenue and cost assumptions.

- Update forecasts regularly as new data arrives (monthly or quarterly) rather than yearly;

- Incorporate variances and sensitivity analyses to plan for risks.

- Align budget line‑items with real expense and income categories to avoid misclassification.

- Involve stakeholders across departments to surface hidden costs or revenue levers.

More Reliable Financial Reporting

Bookkeeping ensures reliable financial reporting by eliminating discrepancies, improving transparency, and reinforcing stakeholder trust. Businesses that uphold accurate bookkeeping produce financial records that reflect actual financial positions.

Government‑audited financial statements reveal the consequences when records lack accuracy. The GAO could not provide an opinion on the U.S. government’s consolidated financial statements for fiscal years 2023 and 2024 due to material weaknesses and insufficient supporting data.

Increased Operational Efficiency

Correct bookkeeping delivers repeatable, reliable workflows that let teams work smarter, not just harder.

Operational efficiency improves when businesses:

- Eliminate manual double entries and recurring corrections.

- Uses software tools to automate invoice processing, bank reconciliations, and record classification.

- Schedule regular reviews and audits to catch bottlenecks before they escalate.

- Align the chart of accounts and ledger workflows so financial data flows cleanly between departments.

- Standardize processes so that onboarding, expense approvals, and payroll entries follow uniform paths.

Learn More: The basics of business bookkeeping

Common Challenges in Maintaining Accurate Bookkeeping

Many SMEs struggle to keep their records accurate due to manual processes, untrained staff, or delays. These issues ruin bookkeeping, causing errors, misclassifications, and poor compliance.

Human Error in Manual Recordkeeping

Businesses still manage manual accounting report error rates of around 1%–3% per transaction for small‑volume operations.

- Manual entry often leads to typos or transposed numbers.

- Inexperienced or untrained staff may mislabel expenses, revenues, or assets.

- When entries lag behind actual transactions, inaccuracies accumulate.

- Manual calculations or copying figures from one sheet to another risk mistakes.

- Absence of reconciliation or secondary reviews enables human error to persist and multiply.

Misclassification of Transactions

Occasional misclassifications in bookkeeping twist how businesses view their financial health and compromise decision‑making.

Misclassification of transactions includes:

- Mislabeling expenses as assets inflates or deflates balance sheets and profit figures.

- Recording revenue in the wrong period, uneven income statements, and misleading decision‑makers.

- Grouping miscellaneous or other income/expense entries without detail, masking recurring costs or revenue streams.

- Mixing personal and business expenses in accounts.

Falling Behind on Daily or Weekly Entries

Accurate bookkeeping requires consistent, frequent updates so that financial records reflect what’s happening now, not what happened weeks or months ago. Missing daily or weekly entries ruins accurate bookkeeping for business growth.

Owners lose visibility into vendor bills, customer payments, or payroll obligations. Over time, backlog in recording leads to forgotten expenses, late payments, missed tax deadlines, and a lack of cash‑flow forecasting reliability.

Lack of Proper Oversight and Controls

Strong oversight and internal controls serve as guardrails for accurate bookkeeping, ensuring risk does not ruin accurate financial records. Mistakes, fraud, and poor decision‑making sneak into the system without them.

- Absence of regular control assessments

- No clear responsibility for controls

- Weak segregation ff duties

- Insufficient managerial or audit oversight

- Poor automation and monitoring tools

- Delayed or no corrective action

How Software and Outsourcing Can Help

Technology or external specialists boost bookkeeping accuracy, helping businesses keep solid records. Software tools and outsourcing solutions improve accuracy, efficiency, and scalability by:

- Software reduces manual input errors by logging transactions as they happen and reconciling bank statements automatically.

- Outsourced services deliver timely reports and key financial metrics so decision‑makers can act proactively.

- Outsourcing gives access to trained accountants skilled in classification, tax rules, and audit preparation.

- Companies use outsourced partners or adjustable software tools to avoid hiring full‑time teams for periodic peaks like tax season.

How Outsourced Bookkeeping Ensures Accuracy

Businesses that outsource bookkeeping gain access to specialized expertise and systems that reinforce accurate bookkeeping across every transaction. Outsourced bookkeeping delivers oversight, checks, audit support, and best practices from professionals who maintain accurate financial records.

Professional Oversight and Expertise

Providers of outsourced bookkeeping bring expert accountants who apply professional standards to every record, classification, and reconciliation. They ensure accurate bookkeeping by implementing internal controls, reviewing entries, and flagging discrepancies.

Use of Advanced Bookkeeping Tools

Advanced tools and software strengthen accurate bookkeeping by automating repetitive tasks and enforcing data consistency.

- Tools sync bank feeds, invoices, and receipts, automatically matching transactions and reconciling accounts, reducing human error.

- System permissions ensure only authorized users can access sensitive data or make changes.

- Live dashboards that pull from updated entries show key metrics, such as cash flow, liabilities, and receivables, at a glance.

- Payroll, expenses, and CRM system integrations reduce duplicate entry and misclassification.

Scalable Solutions for Growing Companies

Outsourced bookkeeping adapts as your business expands, supporting sustained growth and preventing scale from overwhelming internal finance functions.

Growing companies benefit from scalable bookkeeping solutions in these ways:

- Outsourced providers often offer flexible packages, so bookkeeping capacity increases or decreases with transaction volume and business size.

- Software tools that support more users, higher transaction loads, and more complex reporting as the business grows.

- As financial operations become more complicated, outsourcing delivers expertise without recruiting full‑time specialists immediately.

- Outsourcing partners bring tested workflows that handle more data, reconciling many accounts in bulk and processing mass invoices..

Audit-Ready Documentation and Compliance Support

Professional bookkeeping services and software help businesses maintain audit‑ready documentation. Outsourced bookkeeping service providers establish standardized filing, preserve invoices and receipts, and maintain internal logs of every transaction. Entities that follow these practices reduce risk during tax or external audits and avoid penalties.

How NOW CFO Delivers Accurate Bookkeeping Services

NOW CFO delivers proper bookkeeping by combining expert people, tested processes, and modern systems. Professional oversight ensures each transaction is reviewed for correctness; double‑entry bookkeeping and frequent bank reconciliations reduce errors.

Our team applies classification best practices tailored to your industry, aligning your books with GAAP standards. They also prepare month‑end closes and financial statements on schedule, equipped with documentation supporting each entry.

Conclusion

Ensuring accurate bookkeeping transforms your business from reactive to proactive. When your books are precise, you reduce risks, strengthen compliance, and gain the financial clarity necessary for confident decision‑making and sustainable expansion.

Your company deserves a bookkeeping system that supports your goals. Let NOW CFO be the partner that ensures your records are audit‑ready, transparent, and built on best practices. Reach out for a free consultation to explore how our bookkeeping services, accounting, or outsourced CFO offerings can tailor to your needs.

Learn More: The Difference Between Bookkeeping and Accounting

Frequently Asked Questions

1. What are the Signs that My Business Needs Professional Bookkeeping Help?

If your books are consistently behind, tax filing becomes stressful, or you’re unsure of your cash position, it’s time to consider help. Frequent errors, missing receipts, and unclear financial reports also signal a need for professional bookkeeping support.

2. How Does Bookkeeping Impact My Ability to Get a Loan or Funding?

Lenders and investors review financial statements to assess your business’s financial health. Inaccurate or inconsistent records can raise red flags, delay funding, or lead to denial.

3. Can Bookkeeping Tools Fully Replace Human Bookkeepers?

While automation improves efficiency and reduces manual errors, tools still require oversight. Human professionals interpret data, categorize complex transactions, and ensure compliance, functions that software alone can’t handle reliably.

4. How Often Should My Bookkeeping be Updated?

Daily or weekly updates are ideal for accurate reporting and cash flow management. Falling behind can result in misinformed decisions and make reconciliation harder at the end of the month or during tax season.

5. What’s the Difference Between Bookkeeping and Accounting?

Bookkeeping focuses on recording financial transactions and keeping your records up-to-date. Accounting interprets those records to produce reports, analyze trends, and guide strategy.