Effective bookkeeping is a cornerstone of financial clarity and growth for small businesses. Yet, many SMOs face instability, over 20% points more likely than non-owners to experience income drops, income volatility, or unexpected financial stress.

Organized financial records reveal key trends in cash flow, pinpointing expense patterns and smoothing out seasonal fluctuations. From categorizing expenses to reconciling accounts, bookkeeping supports more precise forecasting, strengthens compliance, and boosts readiness for audits.

What is Bookkeeping and Why is it Important?

Accurate financial tracking establishes a transparent foundation for your business decisions. The definition of bookkeeping clarifies this essential function in the section that follows.

Definition of Bookkeeping

Bookkeeping systematically records financial activities, including sales, purchases, expenses, receipts, and payments, in ledgers or accounting systems. SME bookkeeping provides a clear view of transactions, enabling owners to track cash inflows and outflows.

Maintaining organized financial records helps owners gain clarity into their cash flow management. Breaking entries into AR/AP and the general ledger supports financial reporting and informed decision-making.

The Purpose of Bookkeeping in Business

A clear understanding of bookkeeping’s purpose in business builds on the foundational definition and reveals why organized financial records matter.

- Financial Statements: These reports support informed leadership and effective financial management.

- Track Income Sources and Expenses: Logging revenue and costs ensures cash flow and profitability clarity. Organized entries help identify redundant expenditures and optimize resource allocation.

- Support Tax Filing and Compliance: Precise records simplify the preparation of tax returns and substantiation of deductions.

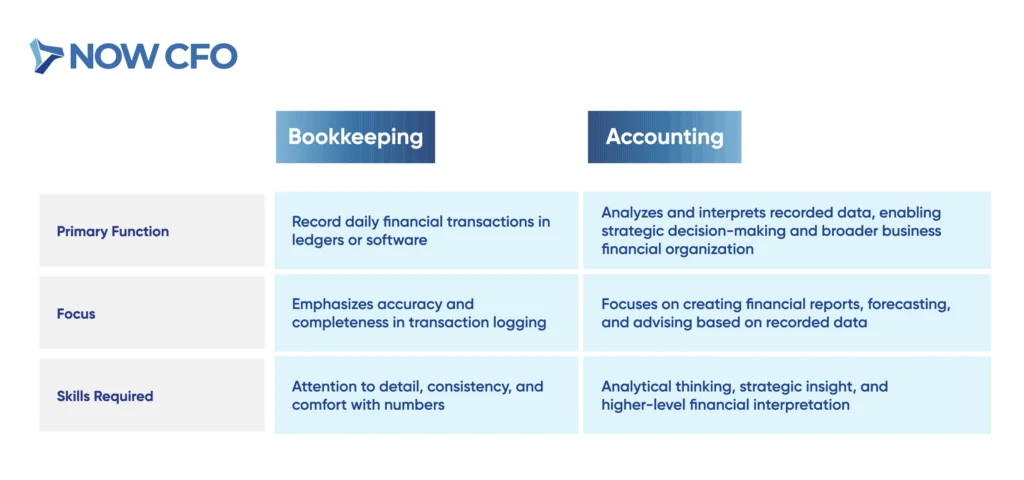

Difference Between Bookkeeping and Accounting

Understanding the distinct roles of bookkeeping and accounting helps businesses allocate responsibilities effectively and build a stronger financial infrastructure.

Why Accurate Records Drive Better Decisions

Maintaining precise financial records empowers business leaders to assess performance and confidently forecast future trends. Organized bookkeeping basics ensure reliable data, enabling real-time cash flow and profitability analysis.

Firms that maintain detailed financial records are likely to secure external funding, highlighting the critical role of accuracy. Moreover, SMEs document their finances and regularly review statements to improve decision-making.

Compliance and Tax Benefits of Proper Bookkeeping

Accurate and consistent bookkeeping helps businesses report taxable income and claim eligible deductions. It also keeps them audit-ready, supporting a stronger overall business financial organization. Proper bookkeeping basics preserve documentation required for tax filings, ensure compliance, and support an accurate financial strategy.

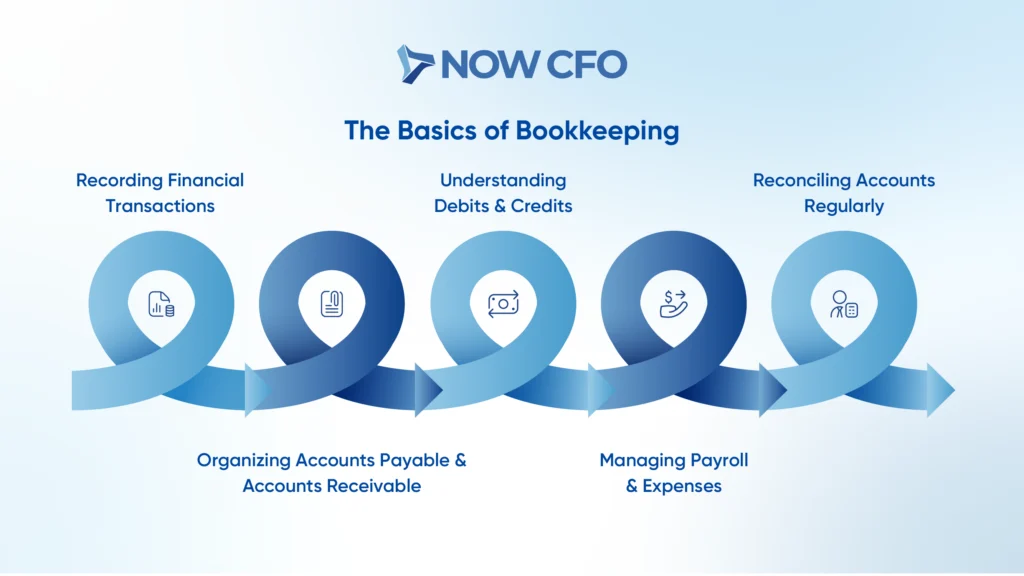

The Basics of Bookkeeping

Bookkeeping serves as the essential framework for tracking a business’s financial health. Every financial movement, from sales and purchases to expenses and payroll, must be accurately recorded and organized to maintain a clear financial picture.

Recording Financial Transactions

Each transaction clearly supports bookkeeping basics, business financial organization, and efficiency as operations scale.

- Logging each sale, expense, and payment into ledgers or digital tools ensures accurate bookkeeping.

- Assigning every entry to its correct account, such as accounts payable or general ledger, enhances clarity in small business bookkeeping.

- Structured documentation like invoices, receipts, and bank statements supports transaction validation and smooth audits.

Organizing Accounts Payable and Accounts Receivable

Organizing AR/AP ensures businesses maintain liquidity and strengthen vendor and client relationships. Precise tracking of incoming invoices and outgoing payments enhances SME bookkeeping and business financial organization.

Companies that manage these flows efficiently reduce late fees and prevent cash flow gaps. Clear labeling and timely entries support accurate bookkeeping and streamline financial operations.

Understanding Debits and Credits

Every financial transaction follows the double-entry principle, with at least one debit and one credit, ensuring books stay balanced and reliable. Debits increase asset and expense accounts, while credits boost liability, equity, and revenue accounts.

Accurately applying these movements keeps the general ledger accurate and supports organized bookkeeping basics. Double‑entry bookkeeping ensures total debits match total credits, maintaining accuracy and detecting potential fraud or misrecorded data.

Managing Payroll and Expenses

Managing payroll and expenses is vital for bookkeeping. It ensures financial outflows remain accurate and sustainable. Processing payroll involves wage payments and employer-paid taxes, benefits, and insurance.

SME bookkeeping benefits from precise expense categorization, distinguishing between payroll, benefits, and operating costs, which supports business financial organization. Employers experience total compensation costs that extend beyond salaries.

Reconciling Accounts Regularly

Reconciling accounts compares bank statements with bookkeeping records monthly to ensure consistency and catch differences. Regular reconciliation detects fraud, bank errors, or missing transactions and supports reliable bookkeeping.

Performing monthly reconciliations aligns with recommended internal controls and maintains organizational trust. Most businesses reconcile monthly, while higher‑risk or higher‑volume operations may reconcile more frequently.

Bookkeeping Systems and Methods

Bookkeeping systems and methods define how businesses document, process, and manage their financial data. Selecting the right structure strengthens the business’s overall financial organization and supports long-term financial clarity.

Single-Entry vs. Double-Entry Bookkeeping

Each system has distinct advantages based on the complexity and scale of operations. While single-entry may suffice for micro-businesses, double-entry offers greater control and accountability.

| Aspect | Single‑Entry Bookkeeping | Double‑Entry Bookkeeping |

| Entry Style | Records each transaction once, typically in a simple cash book | Records each transaction twice, once as a debit and once as a credit |

| Simplicity vs. Accuracy | Easy to apply with basic tracking of income and expenses | More complex but supports comprehensive ledgers, reconciliation, and precise financial tracking |

| Use Case Suitability | Works for one-person operations or sole proprietors | Suits growing businesses that require reliable bookkeeping basics and accurate business financial organization |

Manual vs. Digital Bookkeeping Systems

While manual methods offer simplicity and low upfront costs, they can hinder growth and increase errors.

| Aspect | Manual Bookkeeping | Digital Bookkeeping |

| Process | Records transactions by hand in journals and ledgers | Captures entries instantly via software, eliminates posting delays, and maintains accurate financial records in real time |

| Data Accuracy & Errors | Prone to human error and delays | Automates calculations and reduces mistakes |

| Cost & Training | It has a low upfront cost and minimal training | Requires investment and onboarding, but yields long-term productivity gains and financial clarity |

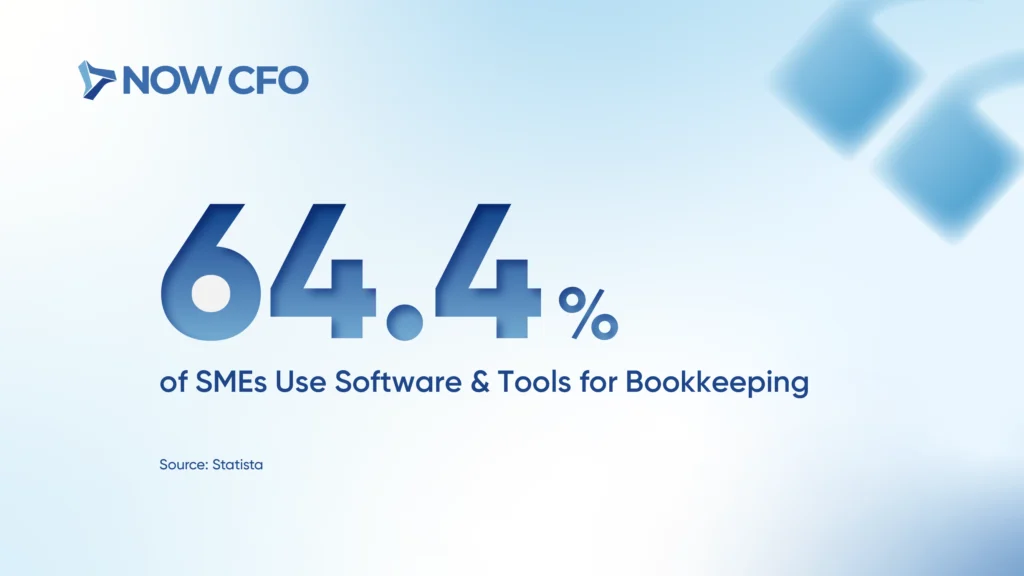

Popular Bookkeeping Tools and Software

Choosing the right tools elevates your bookkeeping from routine recordkeeping to powerful financial management. Around 64.4% of American SME use software to simplify their bookkeeping, indicating widespread adoption of digital solutions.

- QuickBooks Online

- Xero

- Zoho Books

- FreshBooks

- Wave Accounting

- Microsoft Dynamics 365 Business Central

- GnuCash

- Bench

Setting Up a Chart of Accounts

Setting up a chart of accounts establishes a structured framework for organizing transactions into categories like assets, liabilities, equity, income, and expenses. It supports bookkeeping by ensuring consistent classification, simplifying reporting, and strengthening business financial organization.

Keeping track of your finances with organized accounts is key to running your business smoothly and filing taxes correctly. Most small businesses need bookkeeping basics to stay on top of their money and avoid mistakes.

Choosing the Right System for Your Business

Selecting the correct bookkeeping method equips your business to grow with financial clarity and control. Simpler operations may adopt basic bookkeeping methods, while scaling businesses benefit from systems that support detailed financial records.

- Tools often deliver higher business financial organization, reducing errors and accelerating workflows.

- Digital platforms may require upfront investment and time commitment, but offer better long-term bookkeeping stability.

Best Practices for Staying Financially Organized

Maintaining financial clarity depends on implementing best practices that enhance daily and long-term management. SMOs benefit from structured processes that support bookkeeping accuracy, reduce tax-season stress, and enable timely strategic decisions.

Adopting foundational habits, such as tracking receipts and conducting monthly reconciliations, strengthens business financial organization and promotes operational efficiency.

Keeping Receipts and Supporting Documentation

Maintaining receipts, invoices, canceled checks, and supporting documents supports deduction claims, expense validation, and audit-readiness. Organizing documentation in physical or digital form strengthens financial records management.

Taxpayers meet their burden of proof by retaining documentation, such as receipts, to substantiate expenses, especially travel, entertainment, gifts, and auto costs. Careful recordkeeping supports bookkeeping, compliance, and clarity in financial tracking.

Reconciling Bank Statements Monthly

Reconciling business bank statements monthly tightens the link between your ledger and actual cash flow. Regular reconciliation helps promptly identify bank fees, missed deposits, and unauthorized charges, maintaining trust in your financial records.

Separating Business and Personal Finances

Maintaining separate accounts and records for personal and business expenses ensures that financial records remain clean and audit-ready. Opening a dedicated business checking account and obtaining a business credit profile to separate finances formally mitigates legal risk.

Scheduling Regular Bookkeeping Check-Ins

Establishing weekly or monthly bookkeeping check-ins for reviewing ledgers, invoices, and expense logs maintains financial record accuracy. Frequent check‑ins prevent backlog, eliminate errors, and reinforce business financial organization.

Routine financial reviews are part of ongoing management to ensure budgets stay on track and discrepancies are caught early. Reviewing transactions, balances, and pending entries strengthens bookkeeping and supports timely decision‑making.

Leveraging Technology for Efficiency

Modern bookkeeping solutions automate invoicing, categorize expenses, and sync directly with bank feeds. Electronic documentation reduces manual errors and ensures audit-ready financial records.

SMEs also use software to automate recordkeeping and financial tasks, demonstrating widespread reliance on digital systems.

Common Bookkeeping Mistakes to Avoid

Maintaining financial discipline provides stability and clarity for your bookkeeping. After organizing documentation and separating finances, recognizing mistakes prevents confusion, keeps financial records accurate, and supports business financial organization.

Mixing Personal and Business Transactions

Mixing personal and business transactions creates murky records that undermine bookkeeping basics and distort financial clarity for business decision-making. Using an individual card for business expenses or vice versa jeopardizes the integrity of your financial records.

Commingling makes cash flow tracking unreliable and risks legal and tax complications. Blending personal and business finances may expose personal assets to liability by weakening entity separation for LLCs or corporations.

Falling Behind on Recordkeeping

Maintaining accurate financial practices ensures your bookkeeping remains reliable and supports long‑term success.

A QuickBooks survey reveals that approximately 42% of SME owners lack confidence in their accounting knowledge, increasing the likelihood of falling behind and making mistakes. Delays in tracking too frequently result in rushing through entries, leading to misclassifications, missed deductions, and inaccurate profit calculations.

Misclassifying Expenses or Income

Misclassifying expenses or income derails bookkeeping basics by distorting P&L statements, compromising financial records, and misleading decision-making. Assigning personal or capital costs as business expenses or mislabeling revenue inflates profitability or underreports taxable income.

Inaccurate classification often triggers audit risks and tax issues. The IRS warns that misclassification can result in penalties and heightened scrutiny, especially when expense categories don’t align with documented business activity. Proper categorization supports accurate deductions, prevents misstatements, and sustains business financial organization.

Ignoring Cash Flow Tracking

Neglecting cash flow monitoring erodes trust in financial operations and disrupts bookkeeping reliability. Reviewing the hazards reveals how vital oversight is to sustainable financial records and sound business financial organization.

- Creates operational blind spots

- Prevalent among small businesses

- Threatens stability and sustainability

- Complicates budgeting and profit analysis

Skipping Professional Help When Needed

Neglecting to seek professional assistance can expose your bookkeeping to avoidable errors, compliance issues, or strategic blind spots. Although hiring external support adds cost, the investment can dramatically improve the quality of your financial records and bolster your business’s financial organization.

Many small business owners rely on paid professionals for critical tasks like record keeping, tax planning, and return preparation, underscoring that professional help often substitutes for time-consuming internal work. Engaging a knowledgeable professional ensures accurate categorization, timely tax filing, and meaningful financial insights.

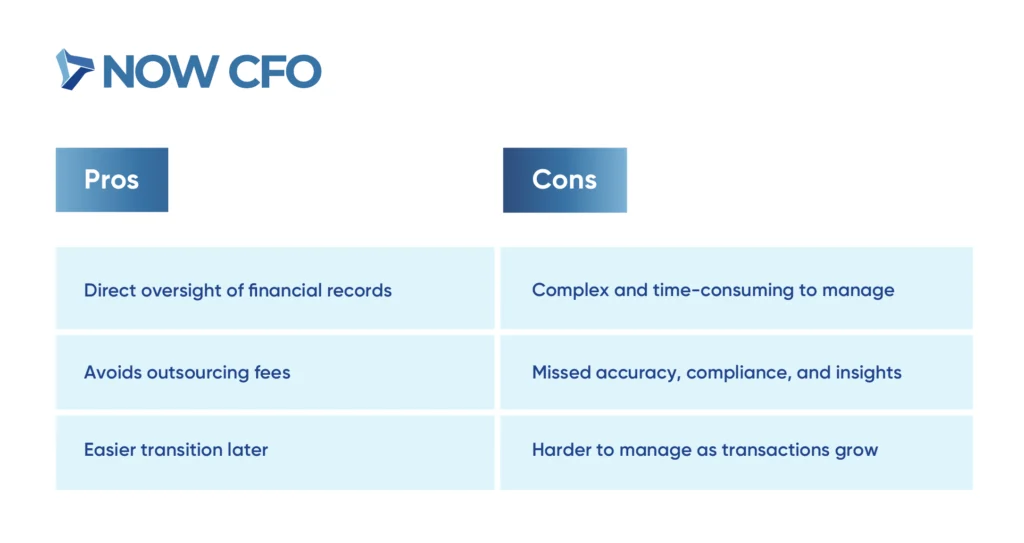

Should You Handle Bookkeeping Yourself or Outsource It?

Choosing between DIY bookkeeping and outsourcing affects your business’s financial clarity and operational efficiency.

Pros and Cons of DIY Bookkeeping

DIY bookkeeping offers control but often at a cost.

When to Hire a Professional Bookkeeper

Evaluating whether to handle bookkeeping in-house or outsource it guides how effectively your business manages it accurately and efficiently.

- Overwhelmed by Administrative Work: When financial tasks consume more time than core activities, outsourcing preserves focus and supports better business financial organization.

- Consistent Backlog or Late Reporting: Professional support ensures financial records stay updated and audit-ready if records remain behind schedule or reconciliation lags.

- Starting to Feel Compliance Strain: Hiring a bookkeeper becomes essential when compliance and tax deadlines approach.

- Scaling Business and Volume Growth: As transaction volume grows, managing bookkeeping manually can strain operations; professionals offer scalable accuracy.

- Avoiding Costly Year-End Cleanups: Regular bookkeeping by a professional prevents year-end rushes and expensive cleanup.

Benefits of Outsourced Bookkeeping Services

Determining whether to manage bookkeeping internally or outsource it significantly impacts your bookkeeping quality and operational efficiency.

- Cost savings on staffing and overhead

- Access to specialized expertise and accuracy

- Flexibility and scalability

- Improved time efficiency

- Enhanced fraud prevention and compliance

Cost Considerations for Small Businesses

Cost structures vary significantly between in-house and outsourced models. Hiring a full-time bookkeeper, including salary, benefits, and overhead, costs around $50,000 annually.

Outsourced services present a more affordable alternative, depending on service depth and complexity (pay-as-you-go model). Flexible pricing models also exist, offering clarity for volume-based businesses.

How NOW CFO Supports Bookkeeping for Growth

NOW CFO delivers professional bookkeeping services tailored for businesses poised to grow. We offer accurate, reliable, and scalable solutions that elevate bookkeeping basics. Our approach includes double-entry bookkeeping, consistent bank reconciliations, and thorough financial statement preparation, ensuring clarity and compliance.

We offer scalable models that adapt as operations expand, aligning with shifting needs and transaction volumes. Strategic cleanup offerings restore accuracy to financial records, especially when irregularities or outdated data hinder decision-making.

Conclusion

Strong bookkeeping serves as a record-keeping exercise and a growth enabler. By implementing the practices described, business owners gain clarity, retain compliance, and support expansion. Whether you manage bookkeeping internally or engage experts, maintaining organized financial records keeps your business agile and transparent.

Ready to level up your financial infrastructure with NOW CFO? Our team can tailor a plan that aligns with your growth stage and simplifies decision-making. Let your financial data become your growth roadmap.

Frequently Asked Questions

What’s the Difference Between Bookkeeping and Accounting in Small Businesses?

Bookkeeping focuses on recording financial transactions, while accounting interprets that data to produce reports, make forecasts, and support strategic decisions.

How Often Should a Business Reconcile Its Accounts or Bank Statements?

Monthly reconciliation is ideal. It ensures your bookkeeping records match actual bank activity and helps detect errors or fraud early.

Do Small Businesses Need to Use Double-Entry Bookkeeping?

It depends on business complexity. Single-entry may work for sole proprietors, but double-entry offers better financial organization and error tracking.

Are there Affordable Digital Tools for managing SME Finances?

Yes, many tools, such as Wave, Zoho Books, and QuickBooks Online, offer scalable features and low-cost plans for basic bookkeeping needs.

Why is Separating Business and Personal Finances Important?

Blending accounts can create tax issues and financial confusion. Separation supports cleaner bookkeeping and improves audit readiness.