A clear and well-structured bookkeeping system is the financial backbone for any business, big or small. Yet, nearly 71% of SMOs rely on accounting apps and pen‑and‑paper or spreadsheets to manage finances, exposing themselves to human error and fragmentation.

Well‑maintained bookkeeping helps you stay on top of daily tasks and gives you a clear picture of your cash flow, taxes, and financial health. Organized financial records make better decisions and do better than those who just use outdated methods.

Understanding the Basics of Bookkeeping Systems

To build a smooth foundation for your bookkeeping system, explore essential definitions and why a structured digital or manual setup matters. These core insights pave the way for precise, accurate tracking and financial decision-making.

What Is a Bookkeeping System?

A bookkeeping system is the structured process by which businesses record financial transactions, organize financial data, and produce reliable records for decision-making. It serves as the backbone of financial clarity and transparency.

Businesses use bookkeeping systems to track income, expenses, assets, liabilities, and equity. These records enable timely financial reporting and support audit readiness. Whether conducted manually or digitally, bookkeeping creates accountability and financial discipline.

Why Every Business Needs an Organized Bookkeeping Process

An organized bookkeeping process ensures financial clarity, supports compliance, and drives business growth. Without structure, you risk misclassification, tax errors, or missed deductions.

Here’s what a streamlined process delivers:

- Accurate financial insights

- Tax preparation ease

- Informed decision-making

- Professional presentation

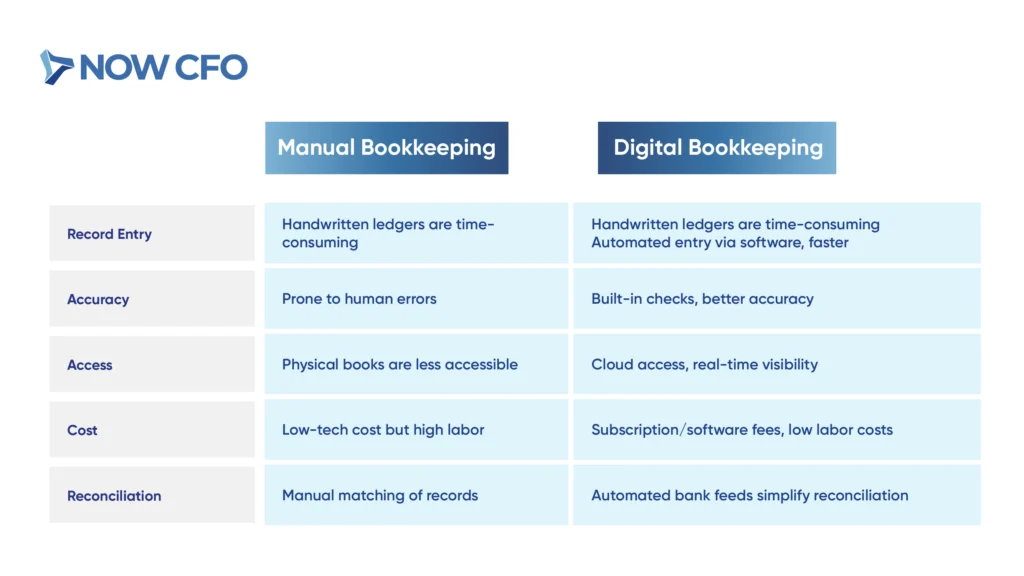

Difference Between Manual and Digital Bookkeeping Systems

Choosing between manual and digital bookkeeping shapes your workflow and efficiency.

The Role of Double‑Entry in Bookkeeping Accuracy

Double‑entry bookkeeping forms the core of accuracy in a bookkeeping system. Every transaction impacts two accounts: debits and credits, ensuring that the accounting equation (Assets = Liabilities + Equity) stays balanced.

This method reduces errors and improves error detection: if total debits do not match credits, it signals immediately that something is off. Many digital bookkeeping tools use double‑entry logic to ensure accuracy without manual adjustments.

Double-entry formats encourage disciplined tracking and clear audit trails, requiring each entry to balance. This system supports transparency and tax compliance and prevents oversight, even when handling complex transactions like payroll or loans.

Common Bookkeeping Tools and Methods

Effective bookkeeping blends methods and tools to increase accuracy and efficiency.

- Spreadsheets: Low-cost and flexible for basic tracking.

- Cloud-Accounting Software: Automates entries and generates reports.

- Receipt-Scanning Tools: Digitally capture expense documents for easy storage.

- Paper Ledgers or Binders: Useful for low-tech or backup processes.

- Manual Journals + Digital Templates: Hybrid method for transitional workflows.

Preparing to Set Up Your Bookkeeping System

Assessing your business’s specific financial needs and choosing the right tools and support is essential before building your bookkeeping system. This preparation phase lays the groundwork for accurate tracking and long-term success.

Identifying Your Business’s Financial Needs

To structure an effective bookkeeping system, evaluate your business’s specific financial demands. Service-based ventures, retail, or e-commerce operations have clear expense flows, sales volumes, and documentation needs.

Business owners should consider transaction frequency, cash flow complexity, payroll requirements, and regulatory obligations in a detailed assessment phase. Identifying these factors allows your bookkeeping system to align with real burdens.

To emphasize the importance of proper financial clarity, SEOS are nearly twice as likely to report volatile personal income month-to-month compared to non-owners; 41% versus 21%. Identifying your business’s financial needs now helps anchor your bookkeeping system in clarity and preparedness.

Choosing Between DIY and Professional Help

Deciding who to manage your bookkeeping system is a key step affecting accuracy, time investment, and long-term scalability.

| Factor | DIY Bookkeeping | Professional Bookkeeping |

| Cost | Lower upfront, software, and time costs | Higher fee, but saves time and reduces errors |

| Accuracy | Depends on the owner’s skill and discipline | Expert handling reduces misclassification |

| Control | Full control and flexibility | Delegation of tasks, less daily oversight |

| Scalability | Must upgrade tools as you grow | Services adapt to business complexity |

| Compliance Comfort | Risk without accounting knowledge | Professionals ensure regulatory compliance |

Setting Financial Goals for Your System

Setting clear financial goals gives your bookkeeping system purpose. Rather than just tracking numbers, decide what you want to achieve, such as monitoring profit margins or improving reconciliation speed.

Start by identifying measurable targets like increasing revenue, building cash reserves, or making your bookkeeping process more efficient. These goals help shape your chart of accounts, reporting frequency, and automation setup so your financial tracking supports real business outcomes.

Establishing Internal Controls

Implementing internal controls ensures your bookkeeping system remains secure and reliable. Controls protect against fraud, errors, and mismanagement.

Here are key internal control practices to implement:

- Define Clear Financial Roles: Separating responsibilities minimizes the risk of error or fraud by ensuring no one person controls the entire financial process.

- Implement Approval Workflows: Many digital bookkeeping tools allow for automated approval hierarchies and alert setups, boosting accountability and transaction transparency.

- Enforce Regular Reconciliations: Designate someone other than the data-entry person to review and reconcile bank accounts to detect differences or unauthorized activity.

- Schedule Periodic Reviews: Perform monthly or quarterly audits to verify documentation, ensure compliance, and assess the effectiveness of your bookkeeping system tools.

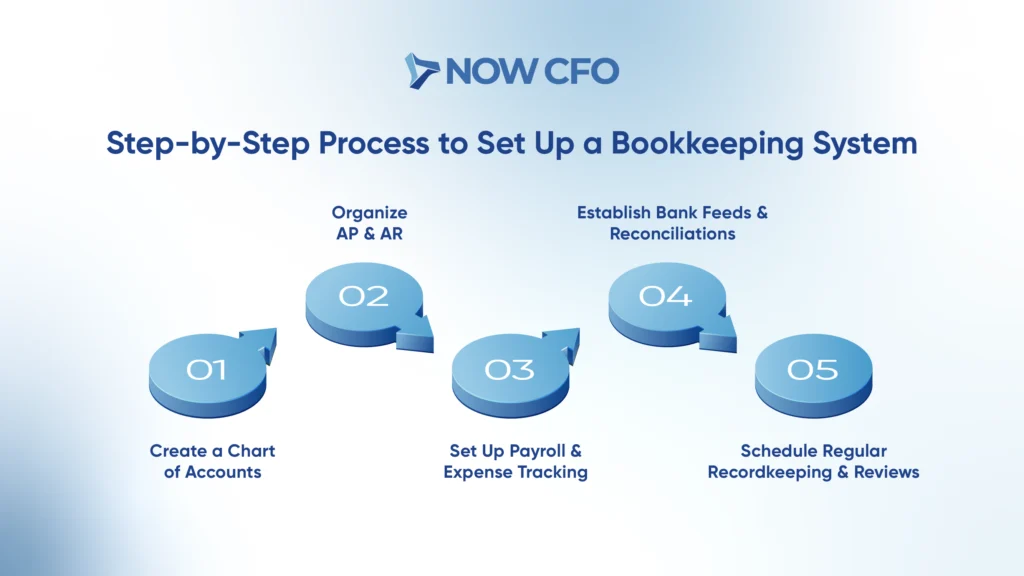

Step-by-Step Process to Set Up a Bookkeeping System

Setting up a structured bookkeeping system ensures every financial transaction is accurately recorded and easy to track.

Create a Chart of Accounts

You start your bookkeeping system by creating a chart of accounts, which classifies all accounts: assets, liabilities, equity, income, and expenses. This chart lays a structured foundation for tracking financial activity accurately.

Begin by listing the active accounts your business requires. Include bank accounts, receivables, payables, capital contributions, revenue streams, and expenses. Organize them logically; assets first, then liabilities, equity, income, and costs.

Organize Accounts Payable and Receivable

With the chart of accounts in place, the next step in your bookkeeping system is to organize accounts payable and receivable. Managing obligations and incoming payments clearly separates inflows and outflows for efficient cash management.

- Accounts Payable (AP): Establish a tracking method for vendor invoices, due dates, and payment status. Label each expense using your chart of accounts.

- Accounts Receivable (AR): Set up a system to invoice clients promptly, assign unique invoice numbers, and record customer payments against those invoices. Link each receivable to its revenue account category.

Set Up Payroll and Expense Tracking

Setting up payroll and expense tracking is essential for maintaining accuracy and control within your bookkeeping system.

- Payroll Tracking: Implement a system to record wages, deductions, and employer tax contributions clearly. Retain records as required by law (e.g., employers must keep payroll records for at least three years).

- Expense Tracking: Log all business expenses using organized methods, tagging each with a category from your chart of accounts. Include dates, amounts, vendor names, and purpose.

Establish Bank Feeds and Reconciliations

Next, set up bank feeds and reconciliations to synchronize your financial records with account activity. Connecting your bookkeeping platform or spreadsheet to your bank feeds allows daily or weekly transaction import, reducing manual entry.

Once feeds are active, reconcile your accounts regularly, match imported transactions to entries in your bookkeeping system, and investigate discrepancies. Institutions must compare book and bank balances and analyze differences monthly.

Schedule Regular Recordkeeping and Reviews

Finally, schedule regular recordkeeping and reviews to keep your bookkeeping system accurate and responsive. Consistency builds trust in your financial data and supports proactive decision-making.

Create a routine by recording transactions daily, reconciling accounts weekly, reviewing cash flow, and closing books monthly. Using reminders in your calendar or system helps you stay consistent and build long-term discipline into your bookkeeping process.

During each review period, verify that all transactions are properly categorized according to your chart of accounts. Confirm that AP and AR lists are up to date, reconciliations are complete, and payroll and expense logs reflect actual activity.

Best Practices for Maintaining a Bookkeeping System

Once your bookkeeping system is in place, consistently maintaining it is crucial to ensuring accuracy and efficiency over time. These best practices help keep your financial records organized, compliant, and ready for strategic decision-making.

Keep Receipts and Documentation Organized

Begin by organizing receipts and documentation to help the bookkeeping system and ensure that every expenditure ties back to the record. Store receipts digitally using apps or scan them into a central folder immediately after purchase to reduce evidence loss.

When organizing, categorize documents by type, and ensure each map is assigned to the proper line in your chart of accounts or bookkeeping software. Structured filing supports seamless reconciliation and simplifies audit preparation.

Separate Personal and Business Finances

Maintaining a clear divide between personal and business funds strengthens your bookkeeping system and protects your financial clarity. Mixing personal and business transactions invites errors, complicates tax reporting, and ruins the separation of liabilities.

46% of SMEs use personal credit cards for business expenses, often blurring lines between personal and professional finances. Start by opening a dedicated business bank account and credit card.

Reconcile Bank Statements Monthly

Settling your accounts regularly preserves accuracy and fosters confidence in your bookkeeping system. Conduct monthly bank reconciliations by comparing the bank’s statement with your internal records.

Study every difference, unrecorded deposit, missing fee, or data entry error. Catching these differences quickly keeps cash flow visible and prevents misstatements. Automating reconciliation can further streamline this process and reduce manual error.

Use Automation to Save Time and Reduce Errors

Using automation enhances your bookkeeping system’s efficiency and accuracy. Tools that automate bank feeds, categorization, and receipt capture reduce manual workload and control potential mistakes. 36% of companies already use robotic process automation (RPA) or AI for accounting tasks, and up to 50% of back‑office tasks could be automated soon.

Schedule Periodic Financial Checkups

Scheduling structured financial reviews maintains your bookkeeping system’s relevance and performance. Plan quarterly or semi-annual checkups where you review expense trends, assess profitability, and adjust your chart of accounts or processes as needed.

During these reviews, analyze whether your current setup supports goals like tracking revenue streams, managing cash flow, or supporting credit needs. If your business model has evolved, update expense categories, automation rules, or internal controls accordingly.

Common Mistakes to Avoid in Bookkeeping Setup

To keep your bookkeeping system accurate and reliable, it’s crucial to recognize and avoid common setup missteps.

Misclassifying Transactions in the Chart of Accounts

Misclassifying transactions in your chart of accounts ruins the integrity of your bookkeeping system. For example, assigning a $2,000 equipment purchase to office supplies distorts your expense patterns and compromises tax deductions.

Minor misclassifications add to significant inaccuracies. To avoid this, maintain a clear, well-organized chart of accounts and train your team on proper assignment. Also, review your accounts regularly to catch mislabeling early.

Falling Behind on Daily or Weekly Entries

Consistent transaction recording prevents backlog and maintains financial clarity within your bookkeeping system.

- Daily Entries: This ensures accuracy and avoids lost records. It also provides real-time visibility on cash flow and prevents task accumulation.

- Weekly Review: A Weekly check helps catch misclassified expenses, missing receipts, or duplicate entries quickly.

Overlooking Cash Flow Tracking

Cash flow mismanagement is a top threat to business survival. Your bookkeeping system must closely monitor the timing and movement of cash. Missing this oversight risks shortfalls and impaired operations.

- Track Inflows and Outflows: Log all payments received and outgoing disbursements, aligning them with accounts receivable and payable. Without precise tracking, you lose visibility into liquidity.

- Forecast Cash Needs: Estimate future cash needs based on upcoming expenses and expected income. This foresight gives you time to arrange financing or adjust spending.

- Monitor Free Cash Flow Trends: Identify patterns to anticipate financial stress and avoid surprises.

Not Leveraging Bookkeeping Software Features

Neglecting the advanced features of your bookkeeping software undermines its efficiency and accuracy potential. Many tools offer a wealth of automation and oversight capabilities that go unused.

Automated bank feeds, transaction categorization rules, and recurring entries can save hours and reduce manual errors. Yet, businesses often default to manual entry, missing out on productivity gains.

Beyond automation, features like audit trails, customizable reports, and alerts for anomalies are powerful. Regularly exploring and applying these tools ensures your bookkeeping system operates smoothly, with faster reconciliations and clearer insights.

Skipping Professional Oversight

Managing your bookkeeping system alone without expert oversight raises your risk of misclassified entries, compliance mistakes, and missed financial improvements. Minor errors add up quickly when no bookkeeper reviews your records regularly.

Even limited check-ins from a financial professional, quarterly reviews, or tax preparation bring valuable insights to improve your overall process. Professionals detect issues, refine workflows, and confirm that reconciliations match your financial activity.

Should You Outsource Your Bookkeeping System Setup?

To decide whether to outsource your bookkeeping system setup, you must weigh the professional advantages, costs, timing, and hybrid models.

Benefits of Professional Bookkeeping Setup

Outsourcing your bookkeeping system setup brings specialized benefits that often outweigh DIY efforts:

- Cost Savings: Outsourcing can cut bookkeeping expenses by reducing full-time salaries, training, and benefit costs.

- Access to Expertise: You gain immediate access to skilled accountants who understand tax laws, compliance, and best practices, enhancing accuracy and peace of mind.

- Improved Efficiency & Accuracy: Professional services minimize misclassification, streamline reconciliation, and elevate your bookkeeping system’s reliability.

- Scalability & Flexibility: As your business evolves, outsourced bookkeeping scales up or down seamlessly without the overhead of hiring or training internally.

Costs of DIY vs. Outsourcing Setup

Compare the financial and operational implications of managing setup yourself versus outsourcing it:

| Aspect | DIY Setup | Outsourced Setup |

| Upfront Cost | Low software or manual tools cost; high time cost | Higher fee—but eliminates hiring and training costs |

| Time Investment | The owner spends hours on configuration and learning | Experts set up faster with optimized workflows |

| Accuracy & Compliance | Dependent on your accounting knowledge | Professional oversight improves reliability |

| Scalability & Adaptability | Requires manual updates as business grows | Outsourced services adjust as your needs evolve |

| Access to Expertise & Tech | Limited to own skills and software subscription | Includes advanced tools and experience |

When Outsourcing Makes the Most Sense

Outsourcing your bookkeeping system setup becomes especially prudent when you:

- Limited internal accounting expertise may elevate the risk of misclassification or compliance errors for businesses.

- You value your time and prefer to focus on growth, core operations, or client service rather than learning bookkeeping from scratch.

- Require immediate, reliable access to financial insights, dashboards, or reporting capabilities.

- Need a quick solution that scales as your business evolves.

Hybrid Solutions: DIY + Professional Support

A hybrid approach combines your hands-on involvement with specialist oversight, offering both control and support:

| Component | DIY Role | Professional Role |

| Chart of Accounts Setup | Draft initial structure based on business needs | Review and refine for optimal classification |

| Monthly Reconciliation | Conduct basic reconciliations | Audit results and provide insights |

| Software Configuration | Install and customize bookkeeping software | Optimize settings, automation, and reports |

| Reporting & Analysis | Generate routine reports (profit/loss, cash flow) | Provide advanced analytics, forecasting, and advice |

How NOW CFO Helps Businesses Build Reliable Bookkeeping Systems

At NOW CFO, we tailor bookkeeping solutions that anchor your business with accuracy, clarity, and strategic foresight. We begin by reviewing your current bookkeeping system structure and align it with your chart of accounts, transaction flows, and software environment.

We integrate automation tools and bank feeds to streamline data flows, reduce manual work, and improve real-time visibility into financial health. This approach strengthens efficiency and accuracy, supporting clean reconciliations and simplified monthly closes.

Our professionals also provide ongoing oversight, auditing monthly records, enhancing internal controls, and offering real-time insights. We streamline compliance, prepare you for tax readiness, and offer forecasting support so you make informed decisions with confidence.

Conclusion

Building and maintaining an effective bookkeeping system is much more than tracking numbers. Whether you implement the process yourself or engage experts, the key is consistency and alignment with your goals.

Every organized receipt, reconciled bank statement, and accurate chart of accounts entry reinforces the financial data you rely on to operate and grow. If you’re ready to elevate your bookkeeping with NOW CFO, let’s explore how your business can benefit from streamlined workflows, automated tools, and proactive guidance together.

Frequently Asked Questions

What Information Should I Gather Before Starting a Bookkeeping System?

You’ll need details about your business structure, bank account information, a list of income sources, expense categories, and any existing financial records.

How do I Know Which Bookkeeping Software is Right for my Business?

Choose software based on your business size, transaction volume, integration needs, ease of use, and budget. Look for scalability and support.

Can I Manage Bookkeeping Independently, or Should I Always Hire Help?

You can start solo using simple tools, but as your business grows or your finances become more complex, professional help becomes more valuable.

How Often Should I Update and Review My Bookkeeping Records?

Daily entries and weekly reviews are ideal, with monthly reconciliations and quarterly checkups to keep everything accurate and up to date.

What Happens if I Make a Mistake Setting up My Bookkeeping System?

Mistakes can lead to misreported finances or tax issues. Regular reviews or expert consultations help you catch and fix them early.

Accurate financial tracking forms the backbone of business management, and double-entry bookkeeping delivers just that. Nearly all but the smallest firms rely on double-entry accounting to maintain financial accuracy and drive profit clarity.

Recording each transaction in two accounts, debits and credits, ensures balance and transparency across all records. This record enables business owners to catch errors quickly, precisely monitor cash flow, and make informed financial decisions.

What Is Double-Entry Bookkeeping?

Understanding the basics of double-entry bookkeeping is essential. In this system, every transaction affects the debit and credit accounts.

Definition of Double-Entry Bookkeeping

Double-entry bookkeeping involves every financial transaction impacting at least two accounts. Each entry has a corresponding opposite in this system: one side is debited, and another is credited, making it self-balancing and highly reliable.

Double-entry system accounting reduces errors and supports financial accuracy by immediately flagging imbalances. This structure allows businesses to trace transactions fully, uphold compliance, and produce trustworthy records.

The History and Origins of the Double-Entry System

Stepping from basic bookkeeping methods into the whole structure of the double‑entry system accounting takes us on a journey through time. This dual-entry approach wasn’t invented suddenly; it slowly spread over centuries.

In the late 13th century, between 1299 and 1300, Amatino Manucci, an Italian merchant, recorded his firm’s transactions with both debits and credits in Nîmes, France. That ledger is the earliest surviving example of accurate double‑entry bookkeeping.

While Manucci’s work is the oldest surviving record, the method flourished in Renaissance Italy, especially after the renowned mathematician Luca Pacioli published the first printed book to detail it in 1494, making it far more widely known and used.

How Debits and Credits Work Together

In double‑entry bookkeeping, every transaction affects debit and credit, so the accounting equation remains balanced. For instance, increasing an asset or expense account requires a debit, while raising a liability, equity, or revenue account demands a credit.

This dual-entry mechanism ensures strong internal control and enhances transparency. Also shows the reliability of financial statements within the double‑entry system accounting framework.

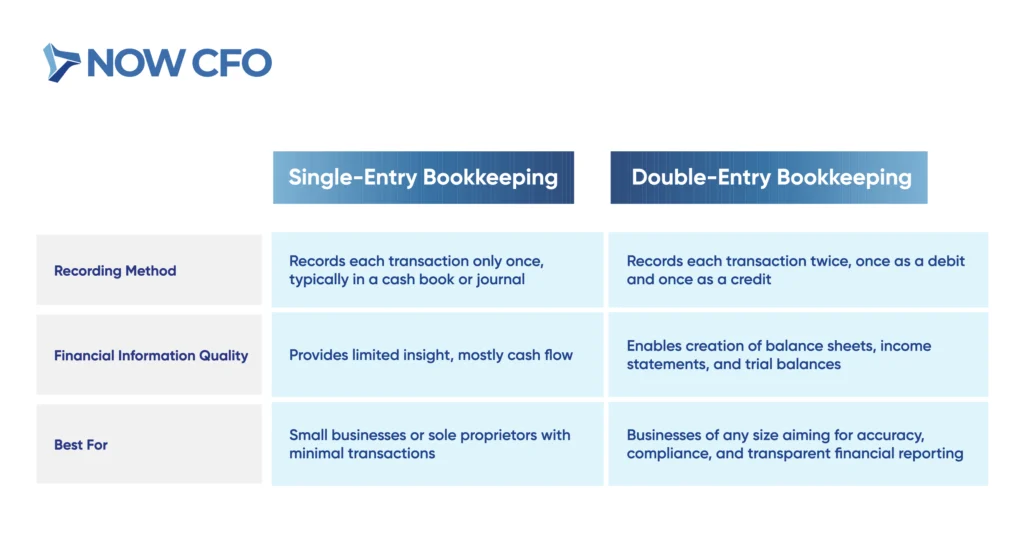

Difference Between Single-Entry and Double-Entry Bookkeeping

You need to know the main differences between single-entry and double-entry bookkeeping to see why most businesses rely on the double-entry accounting system.

Why Double-Entry Is the Standard in Modern Accounting

Double‑entry bookkeeping earned its status as the standard in modern accounting because it delivers unmatched financial accuracy. Regardless of size, all businesses adopt this method to ensure transparency and accountability.

Most U.S. public companies and many private firms must follow GAAP, which mandates double-entry bookkeeping as the default system. This system supports accrual-basis accounting, giving a full picture of the business.

How Double-Entry Bookkeeping Works

Recognizing how debits and credits work together sets the stage for exploring the mechanics of recording transactions in two accounts.

Recording Transactions in Two Accounts

In double‑entry bookkeeping, you reliably trace where money comes from and where it goes.

- First, each transaction gets recorded in a journal.

- Next, you post those entries to the general ledger.

Suppose you purchase inventory worth $1,500 on credit: debit Inventory (increasing assets) and credit AP (increasing liabilities). The dual posting ensures your accounting records remain precise and trustworthy.

Assets, Liabilities, and Equity Explained

Every transaction is reflected in core financial categories: assets, liabilities, and equity. Assets represent resources a business owns, liabilities denote what it owes, and equity equals what’s left for owners after liabilities.

For instance, when a business takes a loan, assets (cash) increase, and liabilities (loan payable) increase equally. This simultaneous change sustains financial accuracy in accounting, clearly showing where funds originate and how they affect overall ownership.

The Role of the General Ledger

The ledger is structured using the chart of accounts, an indexed setup that categorizes financial entries systematically, enabling clarity and scale.

- The general ledger is the primary repository for all financial transactions, consolidating journal entries and sub‑ledgers into organized accounts like assets, liabilities, equity, revenue, and expenses.

- It is the backbone of key outputs such as the trial balance, balance sheet, income statement, and cash flow reports.

- Each entry includes dates, descriptions, and amounts, making audits straightforward.

Example of a Double-Entry Transaction

Consider this practical scenario illustrating double‑entry bookkeeping in action:

A business pays a monthly rent of $780. The transaction affects two accounts:

- Debit: Rent Expense ($780)

- Credit: Cash ($780)

Each financial move impacts at least two accounts, keeping the books balanced. In ledger entries, the rent payment appears as a debit in the expense account and a corresponding credit in the cash account.

How Double-Entry Leads to Accurate Financial Statements

Every transaction generates equal debits and credits. This automatic balancing ensures that financial accuracy in accounting remains intact. Double‑entry accounting supports the creation of accurate balance sheets, income statements, and trial balances.

Detailed records, including account names, dates, descriptions, and amounts, allow auditors to trace each line item back to its origin. Consistency is maintained throughout periods with every transaction entered via matched debits and credits.

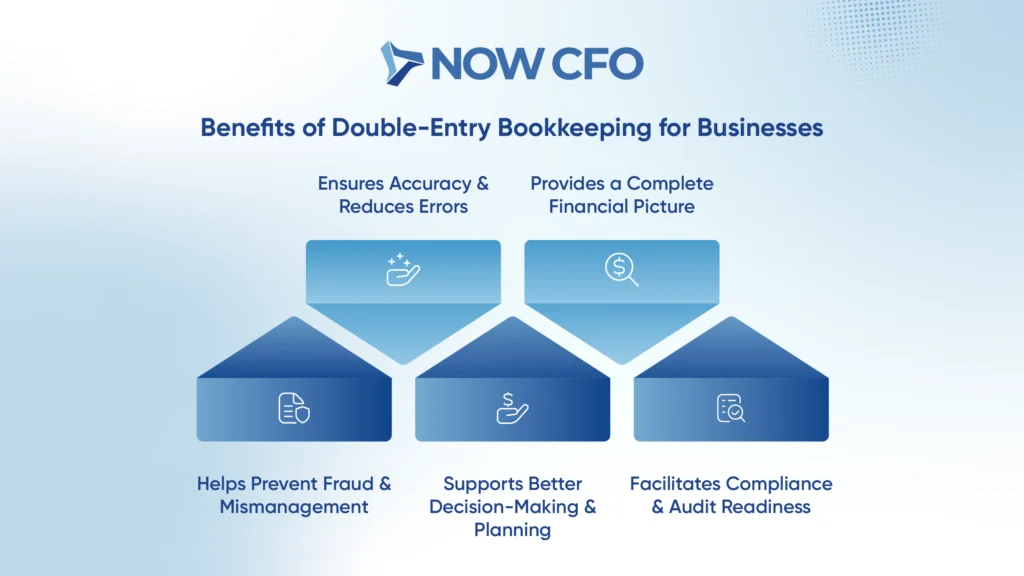

Benefits of Double-Entry Bookkeeping for Businesses

As you understand bookkeeping’s inner workings, it’s vital to recognize why those records matter. Double‑entry bookkeeping structures accuracy and transparency and delivers tangible business advantages.

Ensures Accuracy and Reduces Errors

Dual-entry data systems significantly reduce error rates. Also, double-entry systems generate fewer errors than visual checking methods.

Rather than narrowly tracking cash flow, the double‑entry system accounting method accounts for assets, liabilities, equity, inventory, and receivables. Mistakes such as data duplication or omission become detectable via unbalanced trial balances.

Provides a Complete Financial Picture

The significant advantage of double-entry bookkeeping is that it provides a complete financial picture.

- Tracks cash flow, assets, liabilities, equity, inventory, and accounts payable.

- Businesses consistently reflect changes across financial categories, making it possible to produce reliable balance sheets and income statements.

- Robust financial data helps management gain insights into profitability, operational efficiency, liquidity, and long-term value.

Helps Prevent Fraud and Mismanagement

Double‑entry bookkeeping reduces the opportunity for fraud. Because any unauthorized or mismatched entry triggers immediate imbalance, prompting investigation and correction. The dual recording ensures visibility across asset, liability, equity, and expense accounts.

Moreover, every entry includes descriptive dates, accounts, amounts, and narrative. This robust trail makes it far more challenging for fraudulent entries to go unnoticed.

Additionally, accounting software flags unusual patterns, like repeated rounding, unexpected account transfers, or sudden adjustments. These alerts come from double‑entry system accounting logic, which keeps financial statements consistent.

Supports Better Decision-Making and Planning

Organized financial data is essential fuel for smart decision‑making and forward‑looking planning. With a dual-entry transaction, the system delivers clarity on profitability, cash flow, and financial trends.

For example, when revenue entries consistently reflect in both income and equity accounts, management can confidently assess growth margins. Likewise, tracking payables and receivables systematically reveals short‑term liquidity dynamics.

Facilitates Compliance and Audit Readiness

Recording financial transactions as debit and credit requires robust internal controls. This method aligns with GAAP and other accounting standards, providing transparent and organized financial records.

Regulators and auditors expect businesses to present clear, accurate financial documentation. With dual-entry records, differences become instantly visible when trial balances do not align.

Furthermore, GAO’s Financial Audit Manual emphasizes that financial statement audits must comply with professional standards. A solid double‑entry system offers organized and reliable ledger data to underpin these audit phases.

Common Challenges in Double-Entry Bookkeeping

It’s important to acknowledge potential barriers businesses face when adopting double-entry bookkeeping.

Complexity Compared to Single-Entry

Compared to single-entry, double-entry bookkeeping introduces added layers of detail and structure.

- It requires an accurate understanding of debits and credits.

- Demands consistent reconciliations across ledgers.

- Relies on accounting knowledge or professional oversight.

- Greater software or tool dependency for efficiency.

- Higher chance of misclassification without training.

Mistakes in Recording Debits and Credits

Even with a structured framework, errors can easily creep in. Missteps in handling debits and credits are among the most common issues businesses face, often undermining the reliability of double-entry bookkeeping.

- Mixing up debit and credit sides

- Omitting one side of the transaction

- Inputting incorrect amounts

- Misclassifying accounts

- Lack of verification through trial balances

Maintaining an Accurate General Ledger

Maintaining an accurate general ledger is the core of double‑entry bookkeeping. This centralized record aggregates all transaction data, and inaccuracies are visible across financial statements. Without diligent maintenance, businesses risk misstatements, audit discrepancies, and flawed decision-making.

Maintaining ledger accuracy also involves timely posting of entries, consistent ledger maintenance, and regular internal reviews. Untimely or incomplete general ledger updates damage financial oversight and decision-making capability.

Challenges for Small Businesses Without Accounting Expertise

For many entrepreneurs, double-entry bookkeeping can feel overwhelming. These are common issues faced without accounting expertise:

- Difficulty understanding debit and credit rules

- Limited time to maintain accurate records

- Risk of misclassifying expenses and revenues

- Reliance on manual tracking methods

- Trouble reconciling bank and ledger balances

- Limited ability to detect fraud or mismanagement

How Software and Outsourcing Can Help

When bookkeeping feels overwhelming, software and outsourcing can reduce the gap. Modern accounting tools automate debits and credits, reconcile accounts, and generate financial statements with minimal manual intervention.

Real-World Applications of Double-Entry Bookkeeping

The advantage of double-entry bookkeeping is that businesses use it daily to maintain clarity, support compliance, and fuel smarter decisions.

Preparing Financial Statements

Financial statements are among the clearest demonstrations of double-entry bookkeeping in action. The system produces balanced, reliable reports that accurately reflect business performance by ensuring every transaction.

- Double‑entry bookkeeping ensures that both sides of each transaction are recorded.

- Well-prepared financial statements serve as the basis for forecasting trends and planning budgets.

- Banks, investors, and creditors rely on income statements and balance sheets to assess a company’s performance and stability.

- Accurate bookkeeping records are essential to prepare accurate financial statements supporting tax filings and regulatory compliance.

- Helps business owners monitor their company’s performance, identify sales trends, and make informed adjustments.

Supporting Budgeting and Forecasting

Double-entry bookkeeping supplies reliable, categorized financial data by capturing both sides of each transaction. Leaders gain insight into revenue cycles, expense trends, cash flow fluctuations, and performance drivers, enabling them to craft realistic financial projections.

Managing Cash Flow Effectively

Cash flow is often where businesses succeed or stumble, and double-entry bookkeeping provides the transparency needed to stay ahead. 43% of SMOs say cash flow is a problem for their business.

- Clear visibility into cash movements

- Better liquidity planning through forecasting

- Avoiding business failures from poor cash flow

- Enhanced decision-making with cash flow analysis

- Increased resilience and strategic agility

Providing Transparency for Investors and Lenders

Clear, traceable financial records are the cornerstone of transparency investors and lenders demand. Recording transactions with paired debits and credits ensures stakeholders see a balanced view of assets, liabilities, revenues, and equity.

Transparency aids access to capital for small businesses seeking loans. The CFPB rule emphasizes data reporting from lenders on small business credit applications.

Strengthening Long-Term Business Growth

Detailed ledgers enable better forecasting, risk assessment, and access to capital. Accurate record-keeping practices help monitor business progress, support tax filings, and ultimately increase the likelihood of business success.

Businesses maintain detailed, auditable financial histories through the double-entry accounting system. This robust record foundation helps organizations:

- Build credibility with investors and lenders, facilitating debt or equity financing.

- Make agile, evidence-based strategic decisions using performance trends.

- Sustain scalable practices as operations expand and complexity grows.

Should You Manage Double-Entry Bookkeeping In-House or Outsource It?

Every business faces a critical choice between in-house and outsourcing double-entry bookkeeping.

Benefits of Managing Bookkeeping In-House

Managing bookkeeping internally gives businesses a strong sense of ownership over their financial data. Here’s why many organizations keep double-entry bookkeeping in-house.

- Greater Control and Oversight: Business owners maintain direct visibility into every ledger entry, reconciliation, and report.

- Immediate Access to Financial Insights: Provides real-time access to financial data. When decisions surface unexpectedly, you can swiftly retrieve ledgers, analyses, or trial balances.

- Tailored Processes for Businesses: Allows you to customize procedures, the chart of accounts, and workflows to unique business needs.

- Enhanced Confidentiality: Sensitive financial data remains within your organization, reducing distribution risks.

- Team Integration and Accountability: An internal bookkeeper becomes familiar with your culture, operations, and strategic goals.

Limitations of DIY Bookkeeping for Business Owners

However, managing bookkeeping internally isn’t without its challenges. While in-house control offers benefits, the DIY approach can expose businesses to compliance risks, inefficiencies, and costly mistakes, such as:

- Knowledge and confidence gaps

- Time-intensive compliance tasks

- Regulatory and error risk

- High stakes from misentries

- Lack of internal segregation and control

- Scalability limitations

Advantages of Outsourced Bookkeeping Services

For most SMEs, outsourcing provides a balanced alternative. By leveraging professional bookkeeping firms, organizations gain access to expertise, advanced tools, and operational efficiencies that are difficult to replicate internally.

- Outsourcing leverages seasoned professionals, typically CPAs and dedicated bookkeeping teams, who bring deep industry experience in

- Outsourced bookkeeping often costs less than hiring and maintaining full-time staff, while offering flexible service levels tailored to business needs.

- Delegating accounting duties lets owners and managers redirect energy toward core functions, instead of balancing ledgers.

- Professional bookkeepers stay up to date with evolving regulations, tax laws, and audit requirements.

- Many outsourced providers use cloud-based platforms that offer real-time dashboards, automated reconciliations, and seamless integration.

- Outsourcing facilitates segregation between data entry, review, and reporting functions, helping to prevent fraud and mitigate errors.

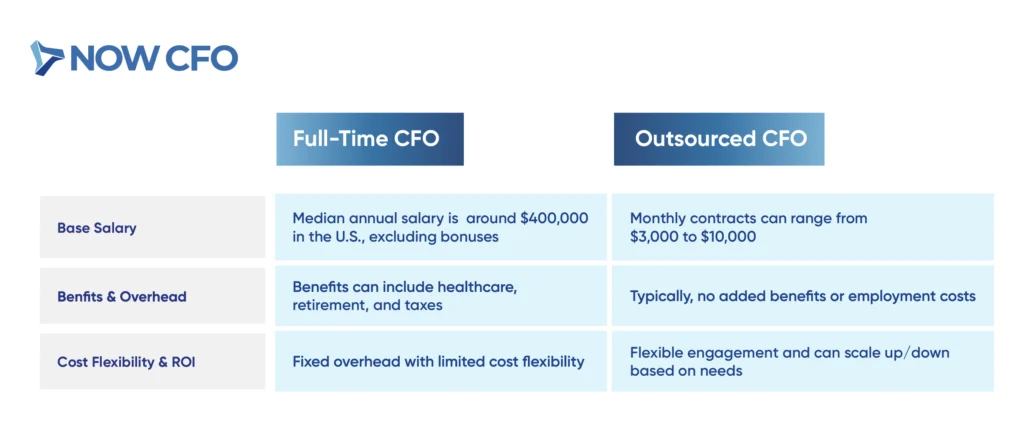

Cost Considerations for Outsourcing

Cost is one of the most critical factors in deciding whether to outsource double-entry bookkeeping. While outsourcing can bring expertise and scalability, weighing affordability and value against internal hiring is essential. Understanding typical pricing models helps businesses determine whether outsourcing aligns with their financial strategy.

When evaluating outsourced bookkeeping options, your main concerns typically include affordability, predictability, and value. A full-time bookkeeper’s salary is around $50,000 annually, plus benefits, whereas outsourced services can significantly reduce costs.

Conclusion

Double-entry bookkeeping gives your business the structure and transparency it needs for long-term sustainability. Ready to improve your bookkeeping with NOW CFO? Schedule a complimentary strategy session to explore the best solution for your business.

Frequently Asked Questions

What Types of Businesses Benefit Most From Double-Entry Bookkeeping?

Double-entry bookkeeping is helpful for businesses of all sizes. It benefits any company that requires detailed financial reporting or regulatory compliance.

How Does Double-Entry Bookkeeping Improve Financial Decision-Making?

Double-entry bookkeeping records transactions in two accounts, providing a complete picture of assets, liabilities, income, and expenses. This level of accuracy helps owners spot trends, manage cash flow effectively, and plan finance strategically.

Can Double-Entry Bookkeeping Help Detect Fraud?

Double-entry bookkeeping helps detect fraud because every transaction must balance with a debit and a credit, and differences stand out quickly. This creates a natural system of checks and balances to detect anomalies.

What Role Does Technology Play in Simplifying Double-Entry Bookkeeping?

Modern accounting software automates double-entry processes, reducing manual errors and saving time. These tools provide real-time dashboards, integrate with payroll and invoicing systems, and ensure compliance.

When Should a Business Consider Outsourcing Its Bookkeeping?

Outsourcing is practical when bookkeeping demands exceed your internal expertise. Businesses outsource to access professionals’ accuracy, advanced technology, and compliance support.

As your business scales, financial complexity increases, as does the risk of missteps. Knowing the right time to hire CFO services is critical when decisions impact long-term strategy, investor relations, and profitability.

Many SMEs fail due to inadequate financial management. Without CFO-level oversight, companies may miss growth opportunities or face setbacks.

1. You’ve Outgrown Basic Bookkeeping

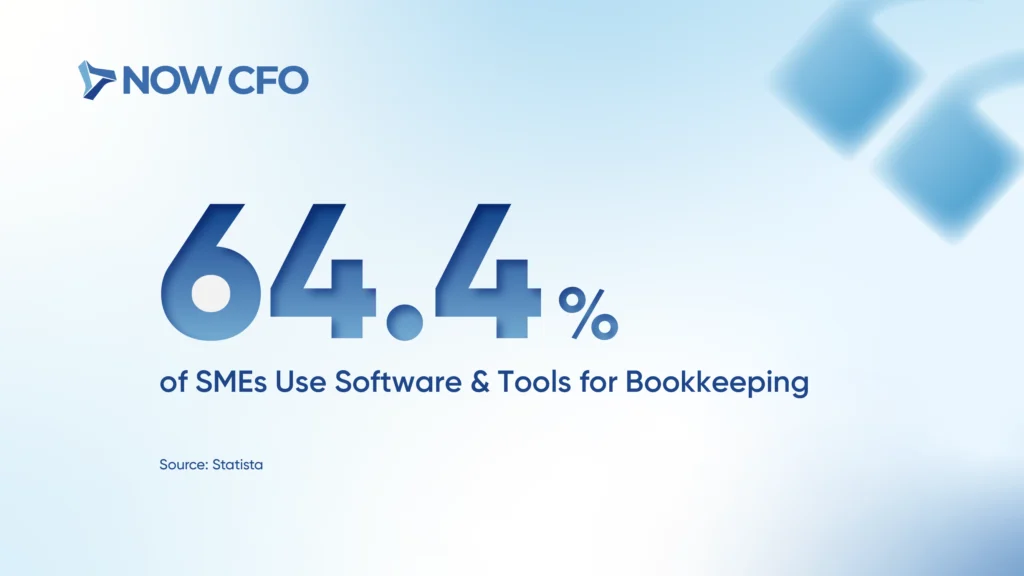

64% of SME owners handle their own bookkeeping rather than using professional accounting services, limiting their ability to gain strategic financial insights. While this approach may reduce short-term costs, it often results in missed opportunities for optimizing cash flow.

Outsourced CFOs provide clarity and strategy, which SEMs often lack. By implementing custom financial dashboards, managing compliance, and delivering actionable forecasts, they transform financial data into a roadmap for growth and expansion.

Source: Statista

2. Cash Flow Issues Keep Resurfacing

82% of small businesses fail due to poor cash flow management. Cash shortages can disrupt payroll, delay vendor payments, and hinder reinvestment, making even profitable companies vulnerable.

Meanwhile, CFOs address this risk by offering proactive cash flow strategies tailored to business cycles. They also implement real-time reporting tools to manage burn rates and liquidity.

Source: Score

3. Rising Complexity in Financial Reporting

About 51% of U.S. small businesses say regulatory compliance slows their growth. Complex rules, time pressures, and limited resources make accurate financial reporting difficult.

Fractional CFOs provide the expertise to manage compliance more effectively. They ensure reporting is accurate and timely and supports long-term business goals.

Source: U.S. Chamber of Commerce

4. Financial KPIs Are Missing or Misaligned

70% of businesses underutilize financial KPIs, missing valuable insights that could align operations with long-term strategy. Without measurable performance indicators, decision-makers often rely on incomplete or outdated data, leading to misaligned goals.

CFOS develops customized KPI frameworks tailored to business objectives to close this gap. Through ongoing monitoring and financial analysis, they help leaders track what matters most, improving clarity and accountability.

Source: Psico Smart

5. You’re Over-Leveraged or Considering New Debt

70% of small employer firms carry outstanding debt, often using credit to cover operational gaps or fund growth. Without structured repayment plans and financial oversight, this reliance on debt can strain cash flow and limit future financing.

Businesses manage debt strategically with the help of outsourced CFOs, balancing short-term needs with long-term financial health. From optimizing loan structures to forecasting repayment impacts, they provide clarity and control over liabilities.

Source: Small Business Administration

6. You Need a Long-Term Strategic Plan

Only 34.7% of businesses launched in 2013 are still operating. Economic fluctuations, poor financial planning, and a lack of strategic direction are common reasons many companies fail to sustain growth over time.

However, fractional CFOs offer the financial leadership needed to beat the odds. They build strong financial models, analyze market shifts, and guide investment decisions.

Source: U.S. Bureau of Labor Statistics

Conclusion

From unresolved cash flow issues to rising compliance demands, missing the right moment to level up financial leadership can limit your company’s growth potential. Recognizing the time to hire CFO services early empowers you to avoid financial missteps.

If your business approaches this turning point, explore what’s next with a free consultation at NOW CFO. Evaluate your strategic goals and operational needs. Whatever path you choose, NOW CFO supports your next growth phase.

Effective bookkeeping is a cornerstone of financial clarity and growth for small businesses. Yet, many SMOs face instability, over 20% points more likely than non-owners to experience income drops, income volatility, or unexpected financial stress.

Organized financial records reveal key trends in cash flow, pinpointing expense patterns and smoothing out seasonal fluctuations. From categorizing expenses to reconciling accounts, bookkeeping supports more precise forecasting, strengthens compliance, and boosts readiness for audits.

What is Bookkeeping and Why is it Important?

Accurate financial tracking establishes a transparent foundation for your business decisions. The definition of bookkeeping clarifies this essential function in the section that follows.

Definition of Bookkeeping

Bookkeeping systematically records financial activities, including sales, purchases, expenses, receipts, and payments, in ledgers or accounting systems. SME bookkeeping provides a clear view of transactions, enabling owners to track cash inflows and outflows.

Maintaining organized financial records helps owners gain clarity into their cash flow management. Breaking entries into AR/AP and the general ledger supports financial reporting and informed decision-making.

The Purpose of Bookkeeping in Business

A clear understanding of bookkeeping’s purpose in business builds on the foundational definition and reveals why organized financial records matter.

- Financial Statements: These reports support informed leadership and effective financial management.

- Track Income Sources and Expenses: Logging revenue and costs ensures cash flow and profitability clarity. Organized entries help identify redundant expenditures and optimize resource allocation.

- Support Tax Filing and Compliance: Precise records simplify the preparation of tax returns and substantiation of deductions.

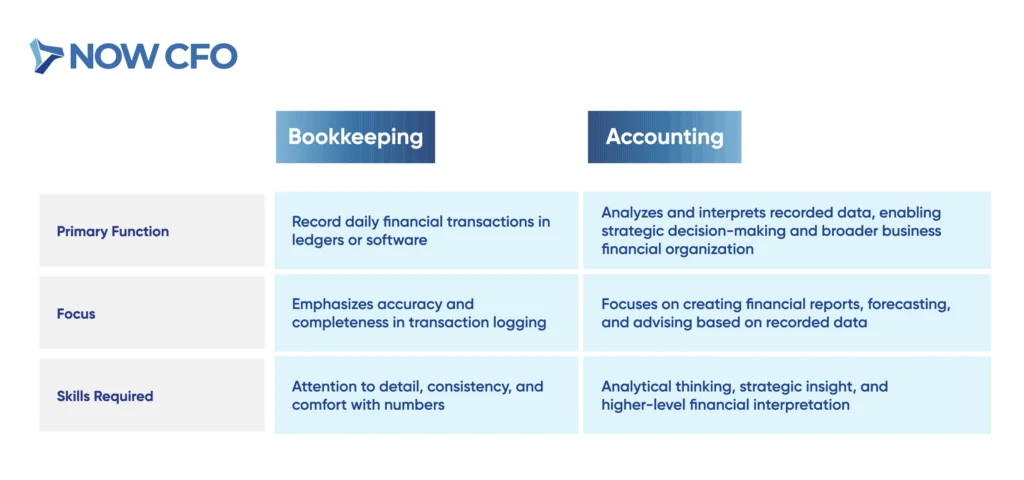

Difference Between Bookkeeping and Accounting

Understanding the distinct roles of bookkeeping and accounting helps businesses allocate responsibilities effectively and build a stronger financial infrastructure.

Why Accurate Records Drive Better Decisions

Maintaining precise financial records empowers business leaders to assess performance and confidently forecast future trends. Organized bookkeeping basics ensure reliable data, enabling real-time cash flow and profitability analysis.

Firms that maintain detailed financial records are likely to secure external funding, highlighting the critical role of accuracy. Moreover, SMEs document their finances and regularly review statements to improve decision-making.

Compliance and Tax Benefits of Proper Bookkeeping

Accurate and consistent bookkeeping helps businesses report taxable income and claim eligible deductions. It also keeps them audit-ready, supporting a stronger overall business financial organization. Proper bookkeeping basics preserve documentation required for tax filings, ensure compliance, and support an accurate financial strategy.

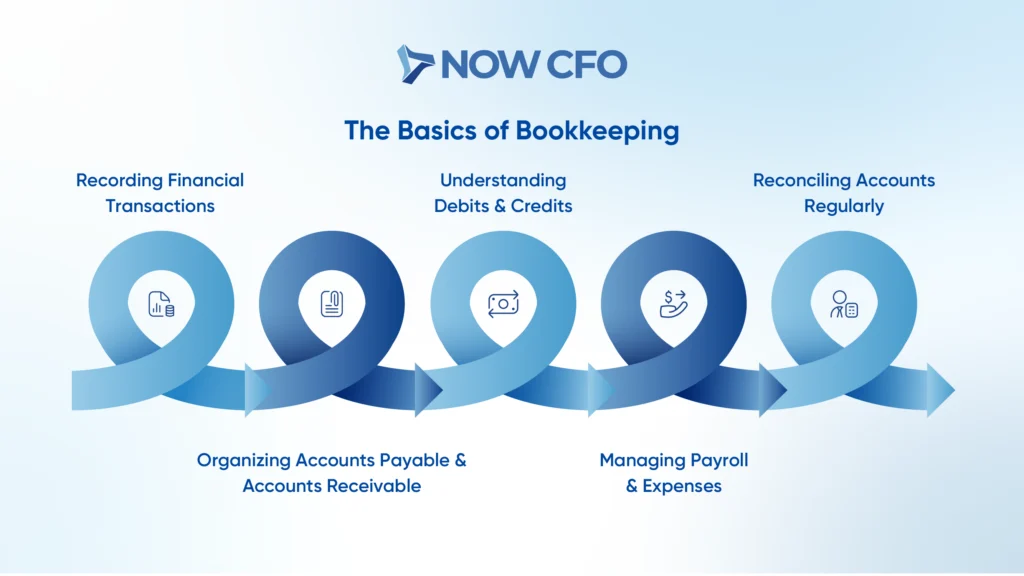

The Basics of Bookkeeping

Bookkeeping serves as the essential framework for tracking a business’s financial health. Every financial movement, from sales and purchases to expenses and payroll, must be accurately recorded and organized to maintain a clear financial picture.

Recording Financial Transactions

Each transaction clearly supports bookkeeping basics, business financial organization, and efficiency as operations scale.

- Logging each sale, expense, and payment into ledgers or digital tools ensures accurate bookkeeping.

- Assigning every entry to its correct account, such as accounts payable or general ledger, enhances clarity in small business bookkeeping.

- Structured documentation like invoices, receipts, and bank statements supports transaction validation and smooth audits.

Organizing Accounts Payable and Accounts Receivable

Organizing AR/AP ensures businesses maintain liquidity and strengthen vendor and client relationships. Precise tracking of incoming invoices and outgoing payments enhances SME bookkeeping and business financial organization.

Companies that manage these flows efficiently reduce late fees and prevent cash flow gaps. Clear labeling and timely entries support accurate bookkeeping and streamline financial operations.

Understanding Debits and Credits

Every financial transaction follows the double-entry principle, with at least one debit and one credit, ensuring books stay balanced and reliable. Debits increase asset and expense accounts, while credits boost liability, equity, and revenue accounts.

Accurately applying these movements keeps the general ledger accurate and supports organized bookkeeping basics. Double‑entry bookkeeping ensures total debits match total credits, maintaining accuracy and detecting potential fraud or misrecorded data.

Managing Payroll and Expenses

Managing payroll and expenses is vital for bookkeeping. It ensures financial outflows remain accurate and sustainable. Processing payroll involves wage payments and employer-paid taxes, benefits, and insurance.

SME bookkeeping benefits from precise expense categorization, distinguishing between payroll, benefits, and operating costs, which supports business financial organization. Employers experience total compensation costs that extend beyond salaries.

Reconciling Accounts Regularly

Reconciling accounts compares bank statements with bookkeeping records monthly to ensure consistency and catch differences. Regular reconciliation detects fraud, bank errors, or missing transactions and supports reliable bookkeeping.

Performing monthly reconciliations aligns with recommended internal controls and maintains organizational trust. Most businesses reconcile monthly, while higher‑risk or higher‑volume operations may reconcile more frequently.

Bookkeeping Systems and Methods

Bookkeeping systems and methods define how businesses document, process, and manage their financial data. Selecting the right structure strengthens the business’s overall financial organization and supports long-term financial clarity.

Single-Entry vs. Double-Entry Bookkeeping

Each system has distinct advantages based on the complexity and scale of operations. While single-entry may suffice for micro-businesses, double-entry offers greater control and accountability.

| Aspect | Single‑Entry Bookkeeping | Double‑Entry Bookkeeping |

| Entry Style | Records each transaction once, typically in a simple cash book | Records each transaction twice, once as a debit and once as a credit |

| Simplicity vs. Accuracy | Easy to apply with basic tracking of income and expenses | More complex but supports comprehensive ledgers, reconciliation, and precise financial tracking |

| Use Case Suitability | Works for one-person operations or sole proprietors | Suits growing businesses that require reliable bookkeeping basics and accurate business financial organization |

Manual vs. Digital Bookkeeping Systems

While manual methods offer simplicity and low upfront costs, they can hinder growth and increase errors.

| Aspect | Manual Bookkeeping | Digital Bookkeeping |

| Process | Records transactions by hand in journals and ledgers | Captures entries instantly via software, eliminates posting delays, and maintains accurate financial records in real time |

| Data Accuracy & Errors | Prone to human error and delays | Automates calculations and reduces mistakes |

| Cost & Training | It has a low upfront cost and minimal training | Requires investment and onboarding, but yields long-term productivity gains and financial clarity |

Popular Bookkeeping Tools and Software

Choosing the right tools elevates your bookkeeping from routine recordkeeping to powerful financial management. Around 64.4% of American SME use software to simplify their bookkeeping, indicating widespread adoption of digital solutions.

- QuickBooks Online

- Xero

- Zoho Books

- FreshBooks

- Wave Accounting

- Microsoft Dynamics 365 Business Central

- GnuCash

- Bench

Setting Up a Chart of Accounts

Setting up a chart of accounts establishes a structured framework for organizing transactions into categories like assets, liabilities, equity, income, and expenses. It supports bookkeeping by ensuring consistent classification, simplifying reporting, and strengthening business financial organization.

Keeping track of your finances with organized accounts is key to running your business smoothly and filing taxes correctly. Most small businesses need bookkeeping basics to stay on top of their money and avoid mistakes.

Choosing the Right System for Your Business

Selecting the correct bookkeeping method equips your business to grow with financial clarity and control. Simpler operations may adopt basic bookkeeping methods, while scaling businesses benefit from systems that support detailed financial records.

- Tools often deliver higher business financial organization, reducing errors and accelerating workflows.

- Digital platforms may require upfront investment and time commitment, but offer better long-term bookkeeping stability.

Best Practices for Staying Financially Organized

Maintaining financial clarity depends on implementing best practices that enhance daily and long-term management. SMOs benefit from structured processes that support bookkeeping accuracy, reduce tax-season stress, and enable timely strategic decisions.

Adopting foundational habits, such as tracking receipts and conducting monthly reconciliations, strengthens business financial organization and promotes operational efficiency.

Keeping Receipts and Supporting Documentation

Maintaining receipts, invoices, canceled checks, and supporting documents supports deduction claims, expense validation, and audit-readiness. Organizing documentation in physical or digital form strengthens financial records management.

Taxpayers meet their burden of proof by retaining documentation, such as receipts, to substantiate expenses, especially travel, entertainment, gifts, and auto costs. Careful recordkeeping supports bookkeeping, compliance, and clarity in financial tracking.

Reconciling Bank Statements Monthly

Reconciling business bank statements monthly tightens the link between your ledger and actual cash flow. Regular reconciliation helps promptly identify bank fees, missed deposits, and unauthorized charges, maintaining trust in your financial records.

Separating Business and Personal Finances

Maintaining separate accounts and records for personal and business expenses ensures that financial records remain clean and audit-ready. Opening a dedicated business checking account and obtaining a business credit profile to separate finances formally mitigates legal risk.

Scheduling Regular Bookkeeping Check-Ins

Establishing weekly or monthly bookkeeping check-ins for reviewing ledgers, invoices, and expense logs maintains financial record accuracy. Frequent check‑ins prevent backlog, eliminate errors, and reinforce business financial organization.

Routine financial reviews are part of ongoing management to ensure budgets stay on track and discrepancies are caught early. Reviewing transactions, balances, and pending entries strengthens bookkeeping and supports timely decision‑making.

Leveraging Technology for Efficiency

Modern bookkeeping solutions automate invoicing, categorize expenses, and sync directly with bank feeds. Electronic documentation reduces manual errors and ensures audit-ready financial records.

SMEs also use software to automate recordkeeping and financial tasks, demonstrating widespread reliance on digital systems.

Common Bookkeeping Mistakes to Avoid

Maintaining financial discipline provides stability and clarity for your bookkeeping. After organizing documentation and separating finances, recognizing mistakes prevents confusion, keeps financial records accurate, and supports business financial organization.

Mixing Personal and Business Transactions

Mixing personal and business transactions creates murky records that undermine bookkeeping basics and distort financial clarity for business decision-making. Using an individual card for business expenses or vice versa jeopardizes the integrity of your financial records.

Commingling makes cash flow tracking unreliable and risks legal and tax complications. Blending personal and business finances may expose personal assets to liability by weakening entity separation for LLCs or corporations.

Falling Behind on Recordkeeping

Maintaining accurate financial practices ensures your bookkeeping remains reliable and supports long‑term success.

A QuickBooks survey reveals that approximately 42% of SME owners lack confidence in their accounting knowledge, increasing the likelihood of falling behind and making mistakes. Delays in tracking too frequently result in rushing through entries, leading to misclassifications, missed deductions, and inaccurate profit calculations.

Misclassifying Expenses or Income

Misclassifying expenses or income derails bookkeeping basics by distorting P&L statements, compromising financial records, and misleading decision-making. Assigning personal or capital costs as business expenses or mislabeling revenue inflates profitability or underreports taxable income.

Inaccurate classification often triggers audit risks and tax issues. The IRS warns that misclassification can result in penalties and heightened scrutiny, especially when expense categories don’t align with documented business activity. Proper categorization supports accurate deductions, prevents misstatements, and sustains business financial organization.

Ignoring Cash Flow Tracking

Neglecting cash flow monitoring erodes trust in financial operations and disrupts bookkeeping reliability. Reviewing the hazards reveals how vital oversight is to sustainable financial records and sound business financial organization.

- Creates operational blind spots

- Prevalent among small businesses

- Threatens stability and sustainability

- Complicates budgeting and profit analysis

Skipping Professional Help When Needed

Neglecting to seek professional assistance can expose your bookkeeping to avoidable errors, compliance issues, or strategic blind spots. Although hiring external support adds cost, the investment can dramatically improve the quality of your financial records and bolster your business’s financial organization.

Many small business owners rely on paid professionals for critical tasks like record keeping, tax planning, and return preparation, underscoring that professional help often substitutes for time-consuming internal work. Engaging a knowledgeable professional ensures accurate categorization, timely tax filing, and meaningful financial insights.

Should You Handle Bookkeeping Yourself or Outsource It?

Choosing between DIY bookkeeping and outsourcing affects your business’s financial clarity and operational efficiency.

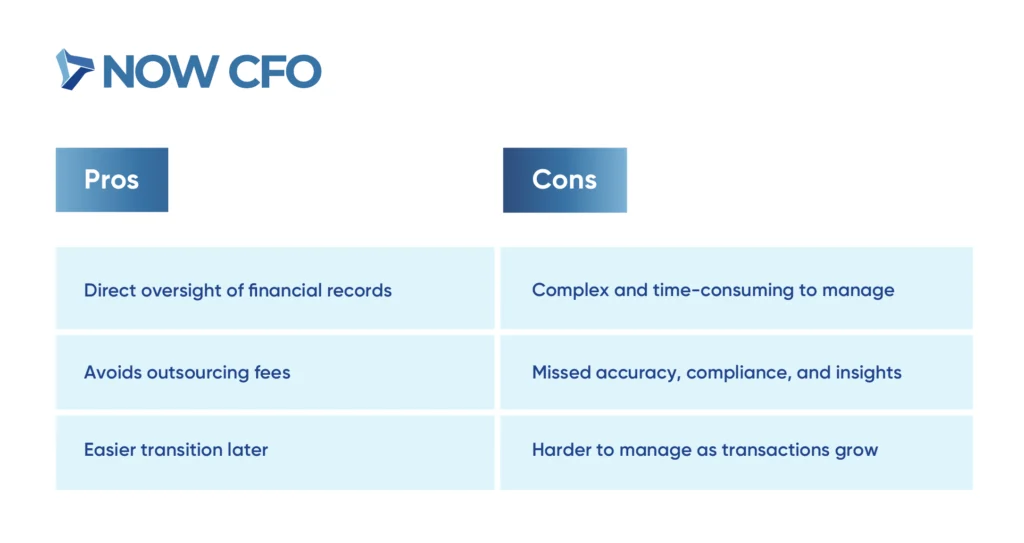

Pros and Cons of DIY Bookkeeping

DIY bookkeeping offers control but often at a cost.

When to Hire a Professional Bookkeeper

Evaluating whether to handle bookkeeping in-house or outsource it guides how effectively your business manages it accurately and efficiently.

- Overwhelmed by Administrative Work: When financial tasks consume more time than core activities, outsourcing preserves focus and supports better business financial organization.

- Consistent Backlog or Late Reporting: Professional support ensures financial records stay updated and audit-ready if records remain behind schedule or reconciliation lags.

- Starting to Feel Compliance Strain: Hiring a bookkeeper becomes essential when compliance and tax deadlines approach.

- Scaling Business and Volume Growth: As transaction volume grows, managing bookkeeping manually can strain operations; professionals offer scalable accuracy.

- Avoiding Costly Year-End Cleanups: Regular bookkeeping by a professional prevents year-end rushes and expensive cleanup.

Benefits of Outsourced Bookkeeping Services

Determining whether to manage bookkeeping internally or outsource it significantly impacts your bookkeeping quality and operational efficiency.

- Cost savings on staffing and overhead

- Access to specialized expertise and accuracy

- Flexibility and scalability

- Improved time efficiency

- Enhanced fraud prevention and compliance

Cost Considerations for Small Businesses

Cost structures vary significantly between in-house and outsourced models. Hiring a full-time bookkeeper, including salary, benefits, and overhead, costs around $50,000 annually.

Outsourced services present a more affordable alternative, depending on service depth and complexity (pay-as-you-go model). Flexible pricing models also exist, offering clarity for volume-based businesses.

How NOW CFO Supports Bookkeeping for Growth

NOW CFO delivers professional bookkeeping services tailored for businesses poised to grow. We offer accurate, reliable, and scalable solutions that elevate bookkeeping basics. Our approach includes double-entry bookkeeping, consistent bank reconciliations, and thorough financial statement preparation, ensuring clarity and compliance.

We offer scalable models that adapt as operations expand, aligning with shifting needs and transaction volumes. Strategic cleanup offerings restore accuracy to financial records, especially when irregularities or outdated data hinder decision-making.

Conclusion

Strong bookkeeping serves as a record-keeping exercise and a growth enabler. By implementing the practices described, business owners gain clarity, retain compliance, and support expansion. Whether you manage bookkeeping internally or engage experts, maintaining organized financial records keeps your business agile and transparent.

Ready to level up your financial infrastructure with NOW CFO? Our team can tailor a plan that aligns with your growth stage and simplifies decision-making. Let your financial data become your growth roadmap.

Frequently Asked Questions

What’s the Difference Between Bookkeeping and Accounting in Small Businesses?

Bookkeeping focuses on recording financial transactions, while accounting interprets that data to produce reports, make forecasts, and support strategic decisions.

How Often Should a Business Reconcile Its Accounts or Bank Statements?

Monthly reconciliation is ideal. It ensures your bookkeeping records match actual bank activity and helps detect errors or fraud early.

Do Small Businesses Need to Use Double-Entry Bookkeeping?

It depends on business complexity. Single-entry may work for sole proprietors, but double-entry offers better financial organization and error tracking.

Are there Affordable Digital Tools for managing SME Finances?

Yes, many tools, such as Wave, Zoho Books, and QuickBooks Online, offer scalable features and low-cost plans for basic bookkeeping needs.

Why is Separating Business and Personal Finances Important?

Blending accounts can create tax issues and financial confusion. Separation supports cleaner bookkeeping and improves audit readiness.

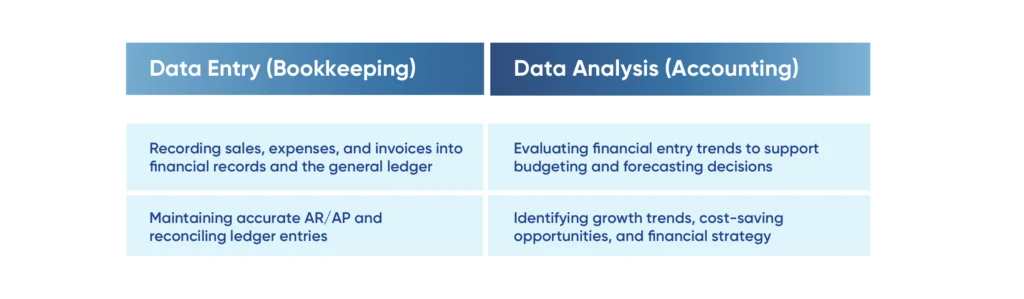

Understanding the difference between bookkeeping and accounting is vital for financial clarity and business growth. Bookkeeping ensures the disciplined capture of every transaction, while accounting transforms that data into strategic insight.

Many SME owners find themselves overwhelmed by financial terminology, with 60% reporting low confidence in their accounting knowledge. Through precise record-keeping, SMEs gain reliable financial records, clean ledgers, and accurate financial statements.

What Is Bookkeeping?

Bookkeeping is the structured process of recording a business’s financial transactions, including sales, purchases, receipts, and payments. It organizes this data in a general ledger for easy tracking and reporting, forming the foundation for accurate accounting.

Definition of Bookkeeping

Bookkeeping records every financial transaction, profit, expense, invoice, and receipt in journals or digital ledgers. This consistent tracking of financial records ensures clarity in the general ledger.

Many U.S. businesses are SME, emphasizing how nearly every enterprise relies on precise bookkeeping for basic operation and tax compliance. Additionally, about 38% of SMEs use specialized software to automate recordkeeping, enhancing accuracy and efficiency.

Core Bookkeeping Tasks (Recording Transactions, Managing Ledgers)

By accurately recording transactions into journals or software. Consistent transaction entry supports reliable financial statements, strengthening overall accounting integrity. Many SMEs use some form of digital bookkeeping, highlighting that most rely on technology rather than manual methods.

The Role of Debits, Credits, and Double-Entry

Accurate bookkeeping depends on structured processes:

- Debits: Increase asset or expense accounts, decrease liability or equity accounts. That precise categorization supports organized financial records and enhances general ledger reliability.

- Credits: Increase liability or equity accounts, decrease asset or expense accounts. That balance ensures each transaction reflects both sides of an exchange.

- Double-Entry: Every transaction records both debit and credit entries to maintain equilibrium. The IRS system follows this method rigidly, assigning unique journal numbers for cross-referencing and error reversal (irs.gov).

Tools and Software Commonly Used by Bookkeepers

Reliable tools support daily bookkeeping operations, supporting data integrity before accountants begin their strategic evaluations.

- QuickBooks and Peachtree

- Electronic Accounting Software

- Cloud-Based Platforms

- Spreadsheet Programs (Excel, Google Sheets)

- Bank Integration Tools

Why Bookkeeping Is Essential for Small Businesses

SMEs rely on precise bookkeeping to maintain financial clarity and reliable reporting. Recording transactions accurately drives financial records.

Moreover, accurate ledgers improve tax preparation accuracy, reduce audit risks, and support better budgeting and forecasting. Solid bookkeeping also directly impacts small business survival.

What is Accounting?

Accounting summarizes, analyzes, and interprets financial data to support business decision-making and ensure regulatory compliance. It transforms raw financial records into meaningful insights through financial statements, budgeting, and forecasting.

Definition of Accounting

Accountants create financial statements, such as balance sheets, P&L, and cash flows, to inform decision-makers, regulators, and potential investors. Strong bookkeeping supports the accounting process by feeding accurate data into strategic analysis.

Additionally, accounting supports business operations by enabling adequate budgeting, forecasting, and timely tax preparation. By transforming data into actionable insights, accounting helps bookkeeping ensure organized inputs and maximizes strategic value.

Core Accounting Functions (Analysis, Reporting, Compliance)

Clarity from bookkeeping evolves into a meaningful strategy through accounting.

- Analysis: Evaluates financial data to support budgeting and forecasting, assess performance, and inform decisions.

- Reporting: Compiles data into financial statements, balance sheets, P&L, and cash flow, ensuring transparency for stakeholders and regulators.

- Compliance: Follows tax laws and financial regulations. Accurate tax preparation relies on structured reporting and audit-ready documentation to avoid penalties.

The Role of Accountants in Financial Strategy

Precise bookkeeping provides essential inputs, and accounting shapes those inputs into a strategic direction.

- Accountants guide business growth by crafting budgets, forecasts, and long-term financial plans that steer decisions.

- Analysts use historical data to model future outcomes, enabling smarter allocation of resources and better budgeting.

- Accountants often lead the planning of yearly budgets, explain how the business is doing financially to company leaders, and help guide financial decisions.

Accounting Deliverables: Balance Sheets, P&L, Cash Flow Statements

Accurate bookkeeping lays the groundwork for meaningful strategy.

- Balance Sheets: Offer a snapshot of assets, liabilities, and equity at a specific moment. Small businesses use them to assess financial health and make strategic comparisons.

- Profit & Loss (P&L) Statements: These reports detail revenue, expenses, and net income over a period. They support budgeting and forecasting by pinpointing profit trends and operational efficiency.

- Cash Flow Statements: Track cash inflows and outflows from operations, investments, and financing. This is critical for managing liquidity and making informed financial decisions.

Why Accounting Goes Beyond Record-Keeping

Accounting ensures financial statements reflect actual business performance. Relying on precise bookkeeping as input, accountants derive insights from organized data to guide decision-making.

SMEs often engage professionals for strategy and tax compliance; record-keeping time burdens account for significant portions of the workload. This makes having an accounting expert a necessity and a time-saving solution.

Key Differences Between Bookkeeping and Accounting

Precision in bookkeeping supplies the accurate data that accountants transform into strategic value.

Key Differences Between Bookkeeping & Accounting

- Day-to-Day Tasks vs. Strategic Oversight

- Data Entry vs. Data Analysis

- Historical Records vs. Forward-Looking Planning

- Compliance Support vs. Strategic Guidance

- Skill Sets and Qualifications Compared

Day-to-Day Tasks vs. Strategic Oversight

Understanding how daily financial activities differ from long-term planning helps clarify the roles of bookkeeping and accounting in business operations.

| Daily Transaction Tasks | Strategic Financial Oversight |

| Recording every sale, payment, and expense into the ledger | Analyzing ledger data to guide budgeting and forecasting, business planning, and performance evaluation |

| Handling AR/AP, invoicing, and reconciliation | Communicating financial health via reports to stakeholders, aligning with long-term growth strategies |

Data Entry vs. Data Analysis

Reliable and accurate bookkeeping enables accountants to apply strategy and insight.

Historical Records vs. Forward-Looking Planning

Differentiating between tracking past transactions and planning shows the distinct focus areas of bookkeeping and accounting functions.

| Historical Records (Bookkeeping) | Forward‑Looking Planning (Accounting) |

| Maintains precise records of past transactions, assets, liabilities, revenue, expenses, and invoice history | Uses recorded data to create budgets, budgeting, and forecasting |

| Ensures the accuracy of financial statements and audit readiness | Applies trend analysis and projections to inform growth strategy and resource allocation |

Compliance Support vs. Strategic Guidance

Accounting goes far beyond record-keeping. It ensures compliance support, meets legal and tax requirements, and safeguards business integrity. Active compliance reduces the risk of penalties and instills confidence with regulators.

At the same time, accounting delivers strategic guidance, plans budgets, forecasts cash flow, and advises on growth decisions. It uses accurate bookkeeping data to shape financial strategy and enable informed action.

Skill Sets and Qualifications Compared

Accounting goes far beyond record-keeping. It ensures compliance support, meets legal and tax requirements, and safeguards business integrity. Active compliance reduces the risk of penalties and instills confidence with regulators.

At the same time, accounting delivers strategic guidance, plans budgets, forecasts cash flow, and advises on growth decisions. It uses accurate bookkeeping data to shape financial strategy and enable informed action.

How Bookkeeping and Accounting Work Together

Bookkeeping and accounting are interconnected functions. Accurate data entry forms the foundation for an insightful financial strategy. The difference between bookkeeping and accounting lies in their roles.

Bookkeeping as the Foundation for Accounting

Accurate bookkeeping establishes organized ledgers and up-to-date financial records.

Clear record maintenance supports:

- Timely and accurate reporting

- Responsible tax preparation and compliance

- Effective budgeting and forecasting

Moreover, SME owners spend substantial time organizing and entering tax-related receipts, highlighting how foundational bookkeeping drives subsequent accounting efficiency.

Ensuring Accurate Financial Reporting

Accurate financial reporting depends on careful bookkeeping practices that feed reliable data into the accounting process.

- Consistent Ledger Reconciliation: Verifies all expenses, revenues, and liabilities to produce trustworthy financial statements.

- Audit‑Ready Record Maintenance: Applies organized records to support compliance and reduce the risk of audit penalties.

- Error Identification and Correction: Bookkeeping identifies differences like duplicate or misposted entries.

- Timely Report Preparation: Organized entries allow for prompt delivery of financial statements.

Supporting Tax Preparation and Compliance

Precise bookkeeping lays the groundwork for strategic accounting, defining the difference between bookkeeping and accounting through dependable data.

- Records of receipts, invoices, and expenses support tax filing and audit readiness.

- Organized bookkeeping simplifies tax planning and compliance efforts.

- Audit-ready financial records reduce risk and support accurate reporting.

Improving Budgeting and Forecasting Accuracy

Effective budgeting and forecasting rely on accurate, up-to-date financial data, something only precise bookkeeping can provide. Bookkeeping ensures accountants have a reliable foundation for modeling future cash flow, revenue projections, and expense planning.

Moreover, bookkeeping focuses on capturing real-time data, while accounting uses that information to build financial forecasts and strategic budgets. When both functions align, businesses can plan confidently and respond proactively to financial trends.

Helping Businesses Make Informed Financial Decisions

Well-maintained bookkeeping ensures accurate inputs for accounting to translate into strategy and insight.

- Accountants analyze ledger data to recommend where to invest or cut costs for optimal returns.

- Historical expense data supports informed pricing models that improve profit margins and responsiveness to market fluctuations.

- Analysis of financial records enables businesses to adapt decisions based on broader economic shifts and forecasted risks.

Benefits of Outsourcing Bookkeeping and Accounting for Small Businesses

Outsourcing bookkeeping and accounting allows SMEs to access professional expertise without the cost of full-time staff. It strengthens the difference between bookkeeping and accounting by ensuring both functions are handled with precision.

Saving Time and Reducing Errors

Outsourcing simplifies financial operations by removing manual workload, allowing SMEs to operate more efficiently and reduce risk through professional accuracy.

- Outsourced services reduce time and cost.

- Delegating routine tasks such as accounts payable, receivable, and reconciliations frees up business focus and improves accuracy.

- Outsourced financial reporting improves accuracy, supporting clearer insights and better business decisions.

Gaining Access to Professional Expertise

Outsourcing brings specialized financial knowledge and analytical strength, which might be unaffordable in-house. Cost savings also drive outsourcing. Accessing skilled professionals enhances the accuracy of financial records and supports budgeting and forecasting.

Lower Costs Compared to Hiring Full-Time Staff

When outsourcing replaces full-time staffing, precise financial records become more affordable. Bookkeeping remains accurate and efficient, while outsourced accounting adds strategic value without inflating costs.

- Outsourcing financial services can save businesses on direct accounting costs, reducing payroll and software overhead.

- Companies typically avoid investing in full-time salaries, benefits, training, and licensing, achieving scalability while controlling expenses.

Leveraging Technology and Cloud-Based Tools

Cloud accounting solutions provide on-demand access, secure storage, and real-time financial visibility. Many SMEs are investing in automation and digital tools, with cloud accounting identified as a vital asset for efficiency and real‑time data access.

Cloud-based tools eliminate local software dependencies, offering automatic updates, remote access, and collaborative functionality. Instantly updated, reliable financial records feed directly into strategic accounting functions.

Scalability for Growing Businesses