Engaging a fractional CFO has become an increasingly popular strategy for businesses seeking high-level financial expertise without the commitment of a full-time executive.

Notably, 44% of early startup closures are attributed to a lack of cash flow management, highlighting the critical need for experienced financial leadership. However, organizations that counter challenges when hiring a fractional CFO ensure a successful partnership.

Introduction to Fractional CFO Hiring

Hiring a fractional CFO has become an increasingly popular choice for businesses seeking financial expertise without the commitment of a full-time executive. This approach provides access to seasoned financial leadership on a flexible basis, making it an ideal solution for companies of all sizes.

Before exploring the challenges when hiring a fractional CFO, it is essential to understand what these professionals do and the value they bring to an organization.

Overview of Fractional CFO Services and Their Value

An outsourced CFO is a financial expert who provides chief financial officer services part-time or contractually. This arrangement allows businesses, especially SMEs, to benefit from seasoned financial leadership without incurring the costs of a full-time CFO.

Fractional CFOs assist in strategic planning, economic forecasting, and risk management, ensuring the company’s financial strategies align with its business objectives.

The Growing Demand for Flexible Financial Leadership

The demand for flexible financial leadership has surged in recent years. Economic uncertainty, technological advancements, and the evolving nature of work have prompted businesses to seek adaptable financial strategies.

Part-time CFOs have grown by 103% year-over-year, reflecting a significant shift toward flexible financial expertise. This trend allows companies to access specialized skills tailored to their immediate needs without the long-term commitment of a full-time hire.

Key Benefits of Hiring a Fractional CFO

Engaging a fractional CFO offers several advantages:

- Cost Savings: Access to executive-level expertise without the expense of a full-time salary.

- Flexibility: Services can be scaled based on the company’s requirements.

- Specialized Expertise: Immediate access to niche financial skills and strategic insights.

These benefits enable businesses to enhance their financial operations effectively.

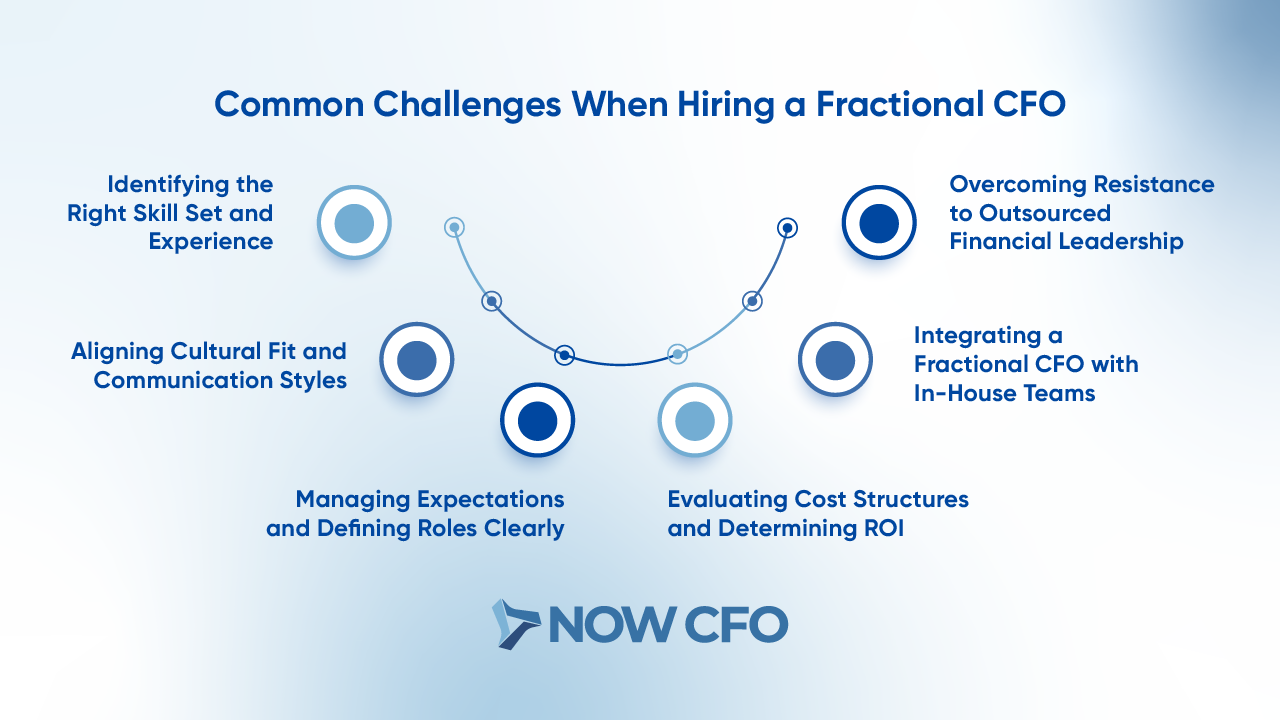

Common Challenges When Hiring a Fractional CFO

Despite the benefits, some challenges when hiring a fractional CFO are:

- Skill Alignment: Ensuring the CFO’s expertise matches the company’s needs.

- Cultural Fit: Integrating an external leader into the existing company culture.

- Clear Expectations: Defining roles and responsibilities to prevent misunderstandings.

Addressing these obstacles is essential for a successful engagement.

How NOW CFO Streamlines Fractional CFO Recruitment

NOW CFO simplifies the recruitment of fractional CFOs by:

- Comprehensive Evaluation: Assessing candidates to ensure they meet specific business requirements.

- Customized Matching: Aligning CFOs with companies based on industry experience and cultural compatibility.

- Ongoing Support: Providing continuous assistance facilitates seamless integration and sustained success.

Learn More: How to Choose the Right Fractional CFO for Your Organization

Common Challenges When Hiring a Fractional CFO

An interim CFO can provide businesses with high-level financial expertise without the commitment of a full-time executive. However, there are several fractional CFO hiring challenges.

Identifying the Right Skill Set and Experience

Assessing a fractional CFO’s expertise to match specific business needs can be challenging. Companies often struggle to evaluate whether candidates’ experience aligns with their industry requirements and organizational goals.

For instance, a business in the manufacturing sector may need a CFO with experience in supply chain management and cost control. At the same time, a tech startup might prioritize expertise in scaling operations and securing venture capital.

Aligning Cultural Fit and Communication Styles

Ensuring that a fractional CFO aligns with the company’s culture and communication style is vital for effective collaboration. A mismatch can lead to misunderstandings, reduced morale, and inefficiencies.

For example, a company with a casual, open-door policy may face friction if the CFO prefers formal communication channels. Research indicates that 20% to 30% of employee turnover is due to poor cultural fit and environment. This statistic highlights the importance of cultural alignment in retaining top talent and ensuring smooth operations.

Managing Expectations and Defining Roles Clearly

Clearly defining the roles and responsibilities of a fractional CFO is essential to prevent overlaps and gaps in duties. Ambiguity can lead to unmet expectations and frustration among team members.

A clear role definition is crucial for effective management and operational success. Therefore, establishing a detailed scope of work and setting measurable objectives can align the fractional CFO’s efforts with the company’s strategic goals.

Evaluating Cost Structures and Determining ROI

A common concern is balancing the cost evaluation of fractional CFO services with the anticipated ROI. Companies must assess whether the financial leadership provided justifies the expense.

A U.S. Department of Energy study revealed that process improvements and strategic financial management can lead to significant cost savings. Some organizations achieve annual net savings per full-time equivalent of approximately $22,000.

This finding emphasizes the potential economic benefits of effective financial leadership, making it essential to evaluate the cost-benefit ratio when hiring a fractional CFO.

Integrating a Fractional CFO with In-House Teams

Integrating a fractional CFO into existing teams can pose challenges concerning workflow adjustments and team dynamics. Effective collaboration requires clear communication and defined processes.

A Joint Financial Management Improvement Program report highlights that streamlined processes and clear communication are vital for successful integration. Therefore, fostering an inclusive environment and providing orientation sessions can facilitate the fractional CFO’s smoother integration into the company’s operations.

Overcoming Resistance to Outsourced Financial Leadership

Internal resistance to outsourced financial leadership, such as hiring a fractional CFO, can stem from job security and trust concerns. Employees may fear external leaders who lack commitment or understanding of the company’s culture.

The White House Office of Science and Technology Policy notes that reducing barriers and increasing buy-in from senior leadership is essential for successfully integrating external expertise. Addressing these concerns through transparent communication and involving employees in onboarding can mitigate this.

Learn More: Fractional CFO vs Full-Time CFO

How NOW CFO Overcomes Challenges When Hiring a Fractional CFO

Various virtual CFO selection challenges exist, from selecting the right candidate to ensuring seamless integration within existing teams. NOW CFO addresses these obstacles comprehensively to meet diverse business needs.

Utilizing a Proven Evaluation Framework for Candidate Selection

To ensure the best fit, NOW CFO employs a structured evaluation process:

- Initial Screening: An internal recruiter conducts a 15-minute call to verify basic details.

- Technical Assessment: A 30-minute Zoom interview that evaluates technical competencies.

- Cultural Fit Evaluation: A face-to-face interview assesses alignment with the company’s culture and values.

This multi-stage process ensures that candidates possess the necessary skills and are well-suited to the client’s environment.

Providing Access to Experienced and Qualified Fractional CFOs

NOW CFO maintains a rigorous vetting process to ensure access to highly qualified CFOs:

- Comprehensive Interviews: Candidates undergo multiple interview stages to assess their expertise and experience.

- Technical Screening: Each candidate is evaluated for technical proficiency to ensure they meet the specific requirements of the role.

- Cultural Assessment: Candidates are screened for cultural fit to ensure seamless integration with the client’s team.

This thorough process ensures that clients are matched with professionals who meet their needs.

Customizing Engagement Models to Fit Business Needs

Recognizing that each business has unique requirements, NOW CFO offers a flexible hiring structure that counters outsourced CFO integration issues:

- Tailored Solutions: Engagement models are customized to meet clients’ financial needs and objectives.

- Scalability: Services can be adjusted based on the business’s evolving needs, ensuring continuous alignment with goals.

This adaptability ensures that clients receive services precisely tailored to their circumstances.

Ensuring Seamless Integration with Your Financial Team

To facilitate smooth onboarding and collaboration, NOW CFO:

- Collaborative Approach: Works closely with existing teams to understand workflows and integrate effectively.

- Clear Communication: Establishes open lines of communication to ensure alignment and address any concerns promptly.

This approach minimizes disruptions and promotes a cohesive working environment.

Offering Ongoing Support and Performance Monitoring

NOW CFO provides continuous assistance to maintain financial leadership effectiveness:

- Regular Check-ins: Schedule consistent meetings to monitor progress and address any issues.

- Performance Reviews: Conduct evaluations to ensure the CFO’s contributions align with the client’s goals.

This ongoing support ensures sustained success and adaptability to changing business needs.

Demonstrating a Track Record of Client Success

NOW CFO showcases its effectiveness through documented success stories:

- Case Studies: Provides detailed accounts of how their services have led to significant improvements for clients across various industries.

- Client Testimonials: Features feedback from satisfied clients highlighting the positive impact of their services.

By addressing common challenges when hiring a fractional CFO, NOW CFO ensures that businesses receive tailored, effective, and seamless financial leadership solutions.

Learn More: Fractional CFO Services vs Traditional CFO Hiring

Tips for Successfully Hiring a Fractional CFO

A fractional CFO can significantly enhance a company’s financial strategy and operations. To ensure a successful partnership, consider the following best practices.

Best Practices for Interviewing and Assessing Candidates

Selecting the right fractional CFO requires a thorough evaluation process:

- Assess Industry Experience: Ensure the candidate has relevant experience in your sector, as this familiarity can lead to more tailored financial strategies.

- Evaluate Technical Proficiency: Review their financial planning, analysis, and report expertise to confirm they can meet your company’s specific needs.

- Consider Cultural Fit: A CFO whose working style aligns with your company’s culture can facilitate smoother collaboration and integration.

Implementing these practices can lead to a more effective selection process.

Key Questions to Ask During the Hiring Process

To effectively counter hiring obstacles for fractional CFOs, consider asking:

- What industries do you specialize in?

This helps determine their familiarity with your sector’s challenges. - Can you provide examples of how you’ve helped other businesses grow?

This reveals their track record in facilitating business development. - How do you approach financial planning and strategy?

Understanding their methodology ensures alignment with your company’s goals.

These questions can provide deeper insights into a candidate’s suitability for your organization.

Setting Clear Objectives and Performance Metrics

Defining success for a fractional CFO involves:

- Establishing Specific Goals: Clearly outline expectations, such as improving cash flow management or preparing for fundraising.

- Developing KPIs: Implement measurable metrics to monitor progress, like reducing operational costs by a certain percentage.

- Regular Review Meetings: Schedule consistent evaluations to discuss achievements and adjust objectives as necessary.

This structured approach ensures the CFO’s efforts are aligned with your company’s strategic objectives.

Leveraging NOW CFO’s Expertise for Informed Decision-Making

Consulting with NOW CFO offers several advantages:

- Access to Experienced Professionals: Benefit from a pool of vetted CFOs with diverse industry expertise.

- Customized Solutions: Receive tailored financial strategies that align with your business goals.

Engaging their services can enhance your company’s financial decision-making processes.

Establishing Continuous Feedback and Adjustment Mechanisms

To ensure ongoing alignment and success with your fractional CFO:

- Implement Regular Feedback Loops: Encourage open communication to address concerns promptly.

- Adapt Strategies as Needed: Be prepared to adjust financial plans in response to evolving business dynamics.

This proactive approach fosters a collaborative environment conducive to achieving financial objectives.

Conclusion

Countering the challenges when hiring a fractional CFO requires a strategic approach to overcome common challenges and fully leverage the benefits of flexible financial leadership. NOW CFO offers outsourced CFO as a service in affordable rates.

Businesses can effectively integrate a fractional CFO into their operations by implementing best practices in candidate selection, setting clear objectives, and fostering open communication. Schedule a free consultation with our experts today to explore how this approach can drive your company’s financial success.