Cost-saving strategies CFO services can implement aren’t just about cutting back, they’re about spending smarter. A good CFO looks at where your money is going, finds the waste, and helps you keep more profits without hurting the business.

Many companies try to save money by making quick cuts, often leading to bigger problems. A smarter approach is to focus on what’s driving up your costs and fix those areas with a plan.

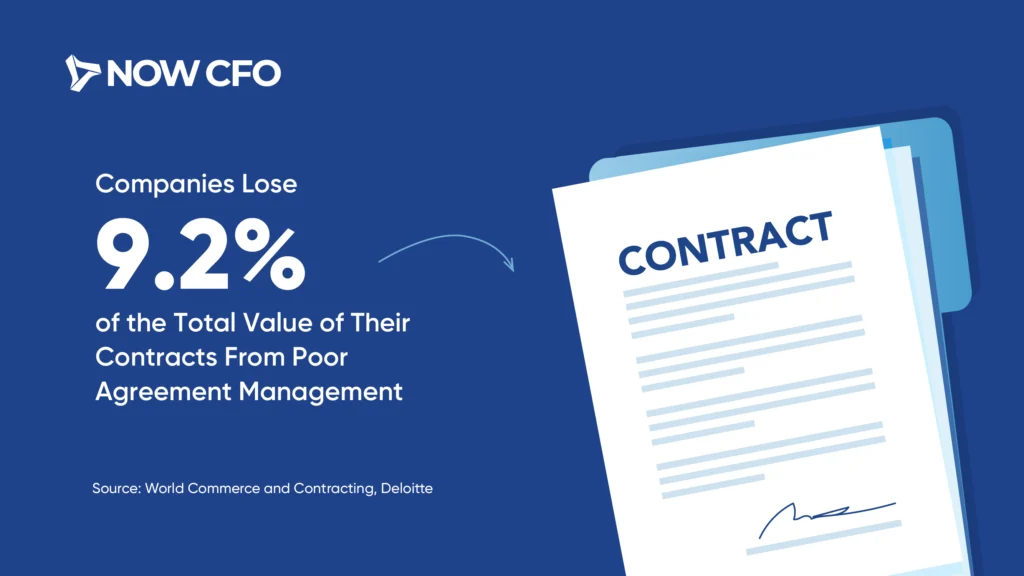

Review Contracts for Savings

Companies lose about 9.2% of a contract’s value just from not managing agreements well. Missed details, unclear terms, or forgotten renewal dates can quietly drain money without anyone noticing.

CFOs review contracts regularly, catch hidden charges, and work to get better deals. With the proper financial oversight, your business can avoid waste, cut costs, and get more value from every agreement.

Source: World Commerce and Contracting, Deloitte

Optimizing Budget Allocation

67% of executives reinvest cost savings into other business areas, showing that reducing expenses isn’t just about cutting back but driving smarter growth. When budgets are aligned with strategic goals, companies can amplify returns without increasing total spending.

Additionally, financial efficiency strategies play a key role in this shift. By analyzing past spending and forecasting future needs, CFOs help businesses reallocate resources to the highest-impact areas.

Source: BCG

Reducing Overhead Costs

Strong companies aim to keep overhead costs below 35% of total revenue. Staying within this range helps protect profit margins and creates financial stability, especially during periods of growth or uncertainty.

Fractional CFO savings support this goal by reviewing non-operational expenses, such as administrative, office, and support costs. They also help identify areas where spending can be reduced without disrupting daily operations.

Source: Prialto

Using Technology & Automation

79% of CFOs plan to increase AI budgets, and 94% believe generative AI will significantly benefit at least one area of finance. This shift shows how automation is becoming essential to improving accuracy, cutting costs, and streamlining reporting.

Cost management practices can guide companies through this transition by selecting the right tools. CFOs also help customize automation strategies and ensure seamless integration with existing systems.

Source: Bain Capital Ventures

Monitor Cost Drivers to Sustain Savings

Only 11% of organizations sustain cost reductions beyond three years. This finding highlights a significant challenge: short-term cuts rarely last unless businesses actively monitor what’s driving their expenses.

CFO services regularly check where your money is going, spot areas where costs are creeping up, and make changes before minor problems become big. This constant attention keeps savings in place and helps your business stay financially healthy.

Source: Gartner

Conclusion

Cost-saving strategies CFO services can implement are all about making your business run better without wasting money. Instead of guessing where to cut back, a CFO helps you find real ways to save.

If you’re ready to see where your business can save money and improve how it runs, we’re here to help. You can book a free strategy session! Let’s work together to make your business leaner, stronger, and more profitable, without cutting corners.

Frequently Asked Questions

How can CFO services spot hidden financial inefficiencies?

CFOs use financial reporting, trend analysis, and benchmarking to uncover areas where money is wasted, such as outdated systems, duplicate subscriptions, or poorly negotiated contracts.

What’s the difference between cutting costs and improving cost efficiency?

Cutting costs often means reducing spending across the board. Improving cost efficiency focuses on getting more value from every dollar spent, such as streamlining processes, improving vendor terms, or reallocating budgets to high-performing areas.

Are outsourced CFOs effective for smaller businesses trying to save money?

Yes, outsourced CFOs offer high-level expertise without the full-time salary burden. They bring experience from various industries and can quickly identify savings opportunities tailored to a company’s size and stage.

How soon can a business expect results from CFO-led cost-saving strategies?

Some savings, like renegotiated contracts or automation, can be realized within weeks. Others, such as tax restructuring or strategic budget shifts, may take a quarter or more to fully reflect in the financials.

What tools do CFOs use to monitor and control business spending?

CFOs often rely on dashboards, ERP systems, and AI-powered analytics to track spending in real time, ensuring that cost controls stay in place and that trends are caught early.