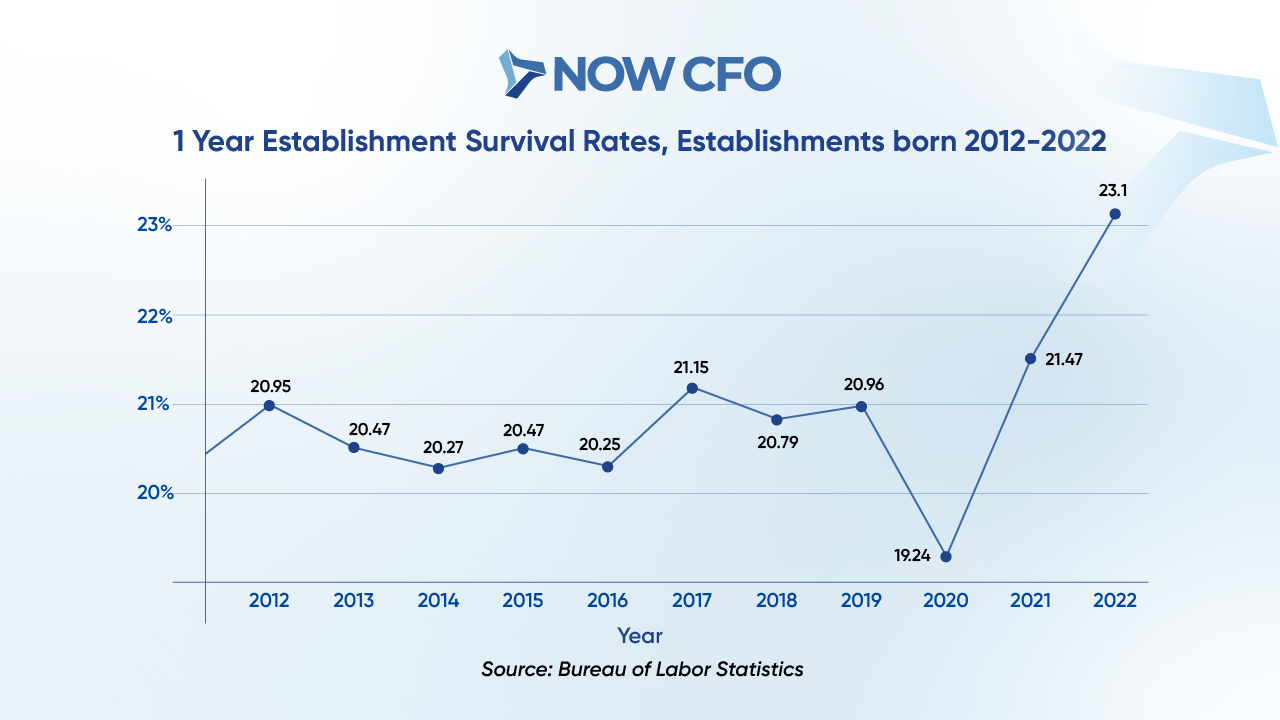

Financial mismanagement remains a leading cause of failure for SMEs. According to BLS, approximately 22% of SME fail within their first year, underscoring the importance of robust financial leadership.

An outsourced CFO can provide the strategic financial oversight necessary to navigate these challenges. An outsourced CFO helps businesses make informed decisions, manage cash flow effectively, and position themselves for sustainable growth by offering expertise in budgeting, forecasting, and financial planning. Let’s understand when you should hire an outsourced CFO for your business.

Understanding the Role of an Outsourced CFO

As businesses evolve, financial complexities often outpace internal capabilities. Understanding the role of an outsourced CFO becomes crucial.

What is an Outsourced CFO?

An outsourced CFO is a financial expert contracted externally, often hired as a strategic step when hiring an outsourced CFO becomes more cost-effective than maintaining a full-time executive. Particularly, an outsourced CFO for small businesses is a growing trend, helping founders access top-tier financial guidance without significant overhead costs.

Engaging an outsourced CFO allows businesses to access top-tier financial expertise flexibly. This cost-effective approach allows financial leadership to be scaled as the company grows.

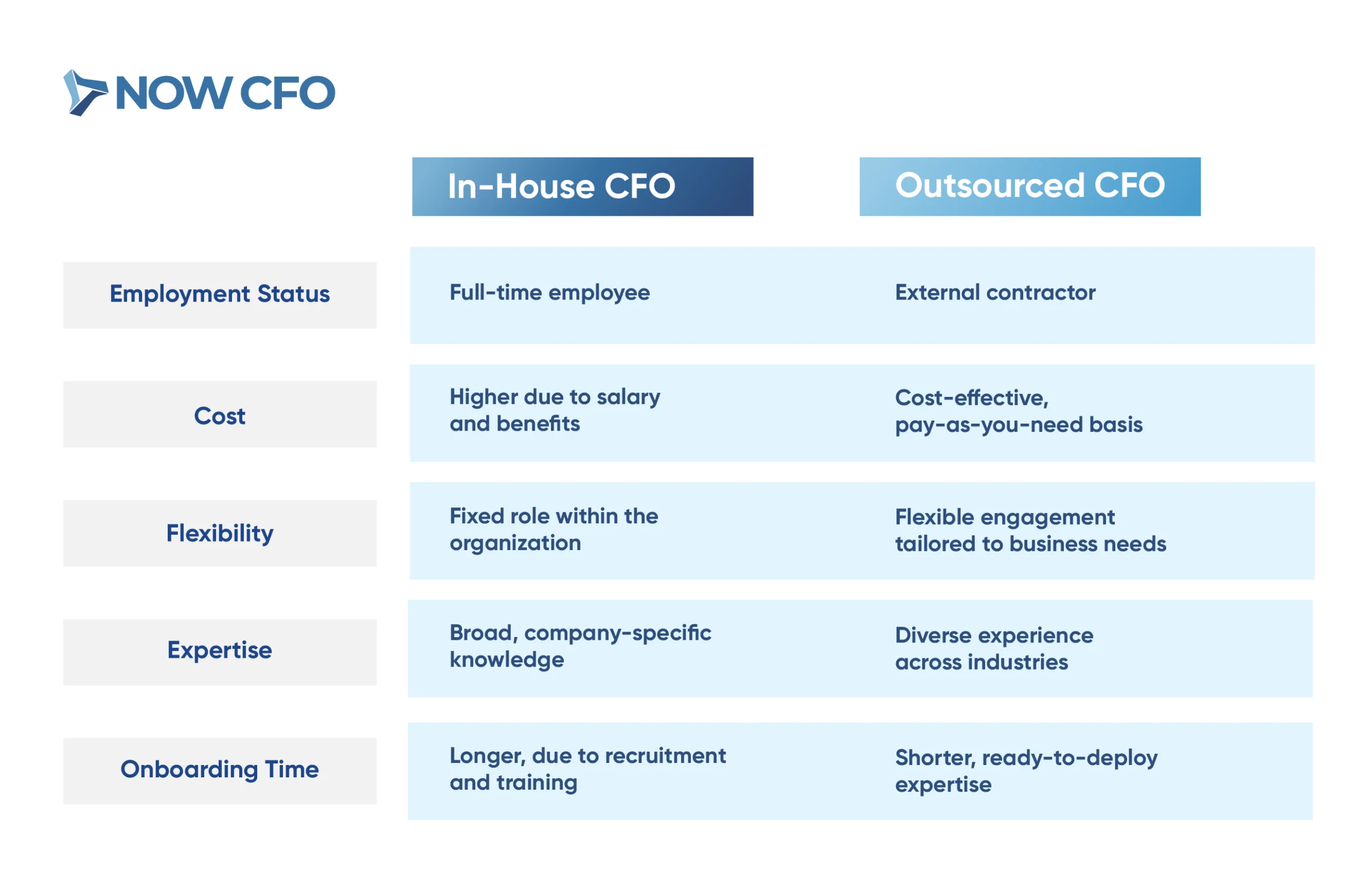

How an Outsourced CFO Differs from an In-House CFO

While both roles aim to steer the company’s financial strategy, key differences exist:

Key Responsibilities of an Outsourced CFO

An outsourced CFO undertakes several critical functions:

- Strategic Financial Planning: Developing long-term financial strategies aligned with business objectives.

- Budgeting and Forecasting: Creating detailed budgets and financial forecasts to guide decision-making.

- Cash Flow Management: Ensuring optimal liquidity by monitoring and managing cash inflows and outflows.

- Financial Reporting: Providing accurate and timely financial reports to stakeholders.

How an Outsourced CFO Helps Businesses Scale

Scaling a business requires a robust financial infrastructure. An outsourced CFO contributes by:

- Identifying Growth Opportunities: Analyzing market trends to pinpoint expansion possibilities.

- Optimizing Capital Structure: Advising on the best debt and equity financing mix.

- Implementing Financial Controls: Establishing systems to manage increased financial complexity.

- Risk Management: Assessing and mitigating financial risks associated with growth.

Common Misconceptions About Outsourced CFOs

Several myths surround outsourced CFO services:

- Limited Commitment: Some believe outsourced CFOs are less invested. They often bring high dedication and fresh perspectives.

- Lack of Industry Knowledge: Contrary to this belief, many outsourced CFOs have diverse experience across multiple sectors.

- Only for Troubled Companies: While they can aid in crisis, outsourced CFOs are also instrumental in guiding healthy businesses through growth and strategic transitions.

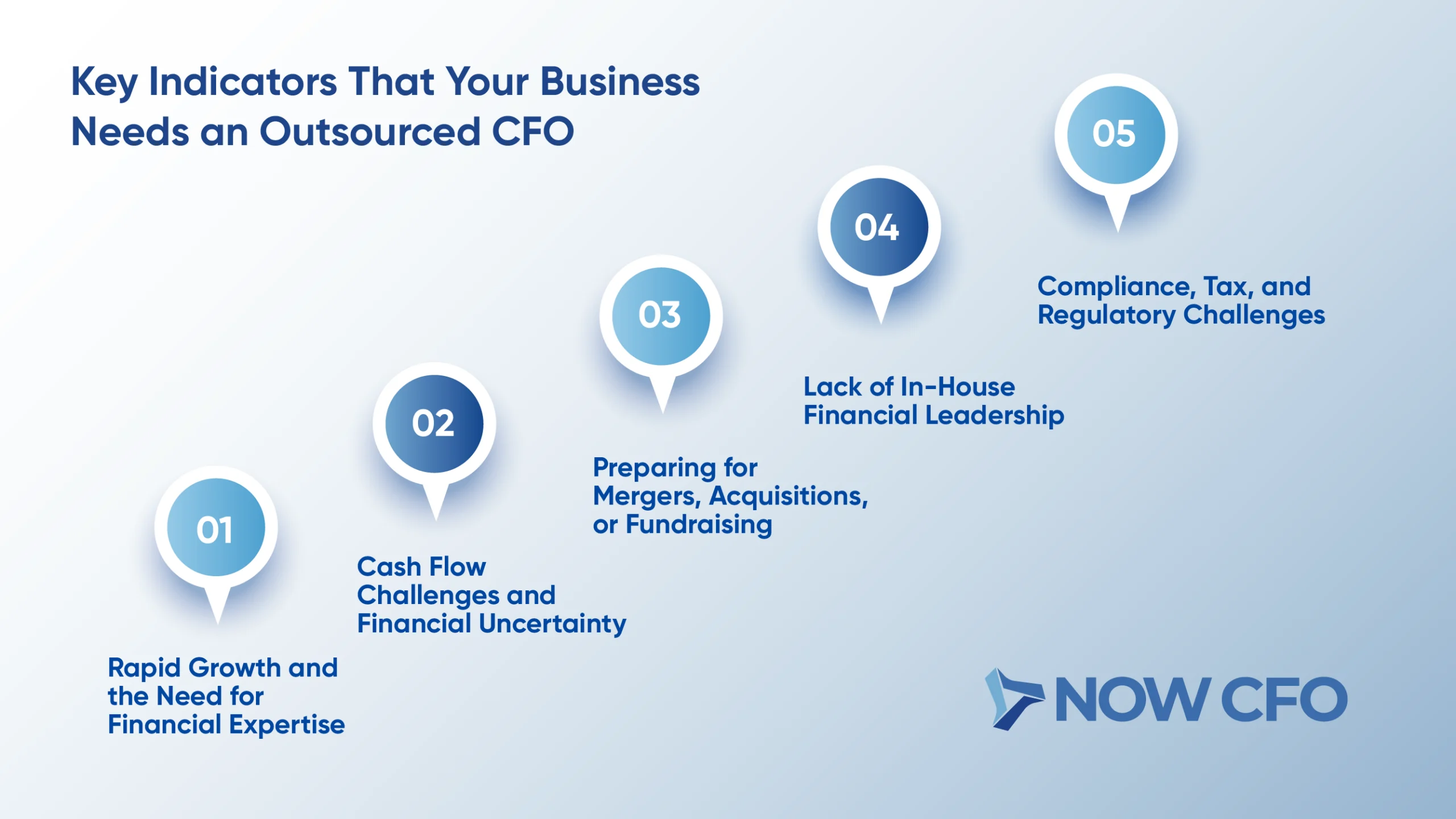

Key Indicators That Your Business Needs an Outsourced CFO

If you’re wondering whether it’s time, here are some signs you need an outsourced CFO; these are also key indicators that your company needs an outsourced CFO to manage increasing financial demands.

Rapid Growth and the Need for Financial Expertise

Experiencing swift expansion can strain existing financial systems. An outsourced CFO provides the necessary expertise to manage increased complexity, ensuring sustainable and sound financial growth. They help scale operations, optimize resource allocation, and maintain financial discipline during rapid change.

Cash Flow Challenges and Financial Uncertainty

Cash flow issues are a common pain point for businesses. An outsourced CFO can address these challenges through:

- Cash Flow Analysis: Identifying patterns and forecasting future cash needs.

- Expense Management: Implementing cost-control measures to improve liquidity.

- Revenue Optimization: Developing strategies to enhance income streams.

- Working Capital Management: Ensuring efficient use of current assets and liabilities.

- Financial Reporting: Providing insights into financial performance to inform decision-making.

Preparing for Mergers, Acquisitions, or Fundraising

Major financial events require meticulous planning. An outsourced CFO assists by:

- Due Diligence: Conducting thorough financial assessments to inform negotiations.

- Valuation Analysis: Determining accurate business valuations to attract investors or buyers.

- Financial Modeling: Creating projections to demonstrate potential returns and risks.

Lack of In-House Financial Leadership

Small businesses often lack a dedicated financial leader. An outsourced CFO fills this gap, providing strategic oversight and guiding the company’s financial direction. They bring expertise that might be inaccessible, helping establish strong financial foundations and informed decision-making processes.

Compliance, Tax, and Regulatory Challenges

Navigating the complex landscape of financial regulations is daunting. An outsourced CFO ensures compliance by:

- Regulatory Adherence: Keeping the business aligned with current laws and standards.

- Tax Planning: Developing strategies to optimize tax obligations and avoid penalties.

- Audit Preparation: Ensuring financial records are accurate and ready for scrutiny.

When is the Right Time to Transition to an Outsourced CFO?

Determining the optimal moment to engage an outsourced CFO is pivotal for businesses that enhance financial strategy and operational efficiency.

Early-Stage vs. Growth-Stage Companies

Additionally, understanding what industries benefit the most from an outsourced CFO, such as healthcare, SaaS, and manufacturing, can guide when and how to bring in external financial leadership. Understanding these differences is crucial in deciding when to hire an outsourced CFO.

| Aspect | Early-Stage Company | Growth-Stage Company |

|---|---|---|

| Financial Complexity | Basic budgeting and cash flow management | Advanced forecasting and financial modeling |

| Resource Availability | Limited financial resources | Increased revenue with complex allocation needs |

| Strategic Planning | Short-term survival focus | Long-term growth and scalability strategies |

| Regulatory Compliance | Minimal compliance requirements | Enhanced regulatory and reporting obligations |

| Need for CFO Expertise | Part-time or project-based financial guidance | Full-spectrum financial leadership and oversight |

Managing Financial Complexity as Your Business Expands

As businesses scale, financial operations become increasingly intricate. An outsourced CFO brings the expertise necessary to navigate this complexity.

Expanding businesses often face challenges in integrating new revenue streams, managing diverse expense categories, and ensuring accurate financial reporting. An outsourced CFO can implement robust financial systems and controls to handle these complexities effectively.

Moreover, they provide strategic insights into capital structure optimization, investment analysis, and risk management, which are essential for sustainable growth. By leveraging their experience across various industries, an outsourced CFO can introduce best practices and innovative solutions tailored to the company’s unique challenges.

Scaling Operations While Keeping Costs Low

Balancing growth with cost-efficiency is a common challenge for expanding businesses. An outsourced CFO offers a solution by providing high-level financial expertise without the overhead of a full-time executive.

For instance, they can identify areas where automation and process improvements can reduce operational costs. Additionally, they assist in negotiating favorable terms with suppliers and service providers, directly impacting the bottom line.

Furthermore, an outsourced CFO can develop scalable financial models that align with the company’s growth trajectory, ensuring that resources are allocated efficiently. This strategic approach enables businesses to expand their operations while maintaining financial stability.

Data from BSL indicates that labor costs account for approximately 70.5% of total business expenses. Companies can access essential financial leadership by opting for an outsourced CFO while managing these significant costs effectively.

Navigating Economic Uncertainty and Market Shifts

Businesses must swiftly adapt to changing market conditions during economic volatility. An outsourced CFO provides the agility and expertise necessary to navigate these challenges.

Key contributions include:

- Risk Assessment: Evaluating financial risks and developing mitigation strategies to protect the company’s assets.

- Cash Flow Management: Ensuring liquidity through carefully monitoring and forecasting cash inflows and outflows.

- Strategic Pivoting: Advising on business model adjustments to align with new market realities.

- Stakeholder Communication: Providing transparent and timely financial information to investors and creditors.

How to Prepare Your Business for an Outsourced CFO

Transitioning to an outsourced CFO model requires careful preparation to maximize the benefits of this engagement. Begin by clearly defining the scope of responsibilities and setting measurable objectives for the outsourced CFO.

Ensure that internal financial data is organized and accessible, facilitating a smooth onboarding process. Knowing how to transition from an in-house CFO to an outsourced CFO for companies shifting internal roles can smooth the change while maintaining continuity in financial decision-making.

Establish communication protocols and reporting structures to integrate the outsourced CFO effectively into the company’s decision-making processes. Additionally, involve key stakeholders in the transition to foster collaboration and alignment with the company’s strategic goals.

How NOW CFO Provides Tailored Outsourced CFO Solutions

At NOW CFO, we deliver customized financial leadership solutions that align with your business’s unique needs and growth objectives.

Comprehensive Financial Planning and Strategy

We offer end-to-end financial planning services, including budgeting, forecasting, and long-term strategic development. Our approach ensures that your financial strategies are data-driven and aligned with your business goals.

Our outsourced CFOs specialize in strategic financial decision-making, guiding clients through long-term planning and tactical execution. As part of our CFO advisory services, we deliver insights that help shape sustainable financial frameworks.

We also conduct thorough financial analyses to identify growth opportunities and improvement areas, enabling informed decision-making. Our team collaborates closely with your internal stakeholders to implement these strategies effectively.

Industry-Specific CFO Expertise

Our team brings specialized knowledge across various industries, ensuring that our financial solutions are tailored to your sector’s unique challenges and opportunities.

Key areas of expertise include:

- Technology and SaaS: Navigating rapid growth and recurring revenue models.

- Healthcare: Managing regulatory compliance and complex billing systems.

- Manufacturing: Optimizing supply chain financing and cost accounting.

- Nonprofits: Ensuring fund accounting and donor reporting accuracy.

- Retail and E-commerce: Handling inventory management and seasonal cash flow fluctuations.

Customizable CFO Services Based on Business Needs

We understand that each business has distinct financial requirements. Therefore, we offer customizable outsourced CFO services tailored to your needs, whether project-based support, interim leadership, or ongoing strategic guidance.

Our flexible service model ensures you receive the right level of support at the right time, adapting to your business’s evolving demands.

Flexible Engagement Models for Cost Efficiency

Our engagement models are designed to provide cost-effective solutions without compromising on quality. By offering part-time, interim, or project-based outsourced CFO services, we enable businesses to access top-tier financial expertise while managing expenses efficiently.

This flexibility allows you to scale services up or down based on your current needs, ensuring optimal resource utilization.

How to Choose the Right Outsourced CFO for Your Business

Selecting the ideal outsourced CFO is a pivotal decision that can significantly influence your company’s financial trajectory. This section delves into the critical factors to consider, ensuring you make an informed choice that aligns with your business objectives.

Evaluating Experience and Industry Knowledge

When considering an outsourced CFO, assessing their experience and familiarity with your industry is essential. An outsourced CFO with a background in your specific sector will understand the unique challenges and opportunities it presents, enabling them to provide tailored financial strategies.

When selecting an outsourced CFO, consider industry experience and how their past clients reflect your growth phase. Whether hiring an outsourced CFO for the first time or replacing an existing one, alignment with your business strategy is key.

For instance, a CFO experienced in the healthcare industry will be adept at navigating complex regulatory environments. At the same time, one with a tech background will understand the nuances of SaaS revenue models.

Moreover, evaluating their track record with businesses at similar growth stages can provide insights into their capability to guide your company through its financial journey. A seasoned outsourced CFO will have a portfolio demonstrating successful financial planning, risk management, and strategic growth initiatives.

Assessing the Scope of Services Offered

Understanding the range of services an outsourced CFO provides is crucial to ensure they meet your business needs. A comprehensive service offering indicates their ability to handle various financial aspects, contributing to your company’s financial health.

Key services to consider include:

- Strategic Financial Planning: Developing long-term financial strategies aligned with your business goals.

- Budgeting and Forecasting: Creating detailed budgets and financial forecasts to guide decision-making.

- Cash Flow Management: Monitoring and optimizing cash inflows and outflows to maintain liquidity.

- Financial Reporting: Providing accurate and timely financial reports for stakeholders.

- Risk Management: Identifying financial risks and implementing mitigation strategies.

- Compliance and Tax Planning: Ensuring adherence to regulatory requirements and optimizing tax obligations.

When comparing providers, it is helpful to review how the best outsourced CFO firms structure their offerings to meet specific industry needs.

Understanding Pricing and Engagement Models

Before engaging an outsourced CFO, it’s vital to comprehend their pricing structures and engagement models to ensure alignment with your budget and expectations. Standard pricing models include hourly rates, monthly retainers, and project-based fees.

For instance, hourly rates typically range between $185 and $350, while monthly fees can vary from $3,000 to $10,000, depending on the scope of services and company size. Understanding these models helps in budgeting and aligning expectations.

Additionally, clarify the terms of engagement, including the duration, deliverables, and additional costs. Transparent communication about pricing and engagement models ensures a mutually beneficial relationship.

Ensuring Effective Communication and Collaboration

Effective communication is the cornerstone of a successful partnership with an outsourced CFO. Clear communication channels and collaboration protocols ensure that financial strategies are implemented seamlessly.

Key considerations include:

- Regular Meetings: Schedule consistent check-ins to discuss financial performance and strategic initiatives.

- Reporting Cadence: Agree on the frequency and format of financial reports to keep stakeholders informed.

- Accessibility: Ensure the outsourced CFO is readily available to address urgent financial matters.

- Integration with Teams: Facilitate collaboration between the outsourced CFO and internal departments for cohesive financial management.

Checking References and Client Testimonials

Before finalizing your decision, you must check references and review client testimonials to gauge the outsourced CFO’s performance and reliability. Speaking with past clients provides insights into their experience, work ethic, and the tangible results delivered.

Inquire about the outsourced CFO’s ability to meet deadlines, communicate effectively, and contribute to strategic financial planning. Review case studies highlighting their problem-solving skills and adaptability to various business scenarios.

According to the NOW CFO, reviewing testimonials and case studies helps gauge past performance and client satisfaction, ensuring an informed choice. Knowing how to evaluate outsourced CFO services can be the difference between a good match and a missed opportunity.

Conclusion: Making the Right CFO Decision for Your Business

Recognizing the right time to engage an outsourced CFO is crucial for success. For additional insights, check out our article on Fractional CFO vs. Outsourced CFO to better understand which model best suits your business needs.

At NOW CFO, we deliver customized outsourced CFO services that align with your unique business needs. Our team of experienced professionals offers comprehensive financial planning, industry-specific expertise, and flexible engagement models to ensure cost efficiency and strategic alignment.

Visit our website to learn more about our services or schedule a consultation to discuss how we can support your financial goals. Partner with NOW CFO and take the first step toward achieving financial clarity and growth.