Benefits of Hiring a Fractional CFO Service

Companies increasingly turn to fractional CFO services to gain a competitive edge. Notably, 66% of small businesses face financial challenges, with 43% citing managing operation expenses. Consequently, expert financial guidance is no longer a luxury but a strategic necessity that supports sustainable growth and agile decision-making.

Many organizations are turning to fractional CFO services as a strategic advantage. Initially, businesses recognized the need for specialized financial oversight without the cost of a full-time executive. Moreover, leaders increasingly rely on fractional CFO services to gain critical insights and drive growth.

Understanding Fractional CFO Services

Before delving deeper, it is essential to clarify what fractional CFO services genuinely encompass. As we transition into this section, notice how each aspect builds on the previous point to offer a comprehensive view.

Definition of Fractional CFO Services

Firstly, fractional CFO services refer to part-time, outsourced financial leadership that provides high-level expertise without the expense of a full-time CFO. Companies hire experts as needed to manage budgeting, forecasting, and strategic planning.

Furthermore, approximately 20% of new businesses fail within the first year due to inadequate financial management. This statistic reinforces the importance of robust financial leadership provided by fractional CFO services.

How Fractional CFO Services Differ from Full-Time CFOs

Subsequently, the contrast between fractional CFO services and full-time CFO roles is significant. While full-time CFOs work exclusively within a single organization, fractional CFO services offer flexible engagement that suits evolving business needs.

- Cost Efficiency: Utilizing fractional CFO services minimizes overhead costs.

- Agility: They provide nimble solutions that adjust to business cycles.

- Diverse Expertise: Companies can leverage the specialized skills of a professional who has worked across multiple industries.

Moreover, this model addresses challenges that traditional roles may overlook, making fractional CFO services an attractive option for businesses seeking agility and financial acumen.

Overview of Outsourced CFO Models

Moving forward, many enterprises are now exploring outsourced CFO models. The emphasis shifts to how organizations engage external financial experts.

- Consultative Approach: fractional CFO services are often provided consultatively.

- Project-Based Engagements: Some companies opt for CFO as a service, which offers tailored solutions.

- Hybrid Models: Integrating virtual CFO Services with internal teams for comprehensive management.

In addition, this approach often complements other flexible financial strategies such as CFO on demand and cost-effective financial leadership.

Key Functions of a Fractional CFO

Additionally, understanding the core responsibilities of a fractional CFO is critical. They typically oversee financial forecasting, budgeting, and risk management while ensuring compliance with regulatory requirements.

- Strategic budgeting and forecasting

- Cash flow analysis and management

- Financial reporting and analysis

- Regulatory compliance oversight

These tasks ensure that fractional CFO services provide the expertise necessary for sound financial management.

Why Businesses Opt for a Virtual CFO Model

Simultaneously, many companies are drawn to the virtual CFO model due to its inherent flexibility and cost-effectiveness. By leveraging digital tools and remote working capabilities, fractional CFO services are more accessible than ever.

- Reduced overhead costs through virtual engagement.

- Enhanced communication and collaboration across remote teams.

- Quick adaptation to market trends.

Moreover, in response to the question, why consider hiring a virtual CFO for your business? Organizations find that this model integrates seamlessly with modern operational practices.

Benefits of Cost-Effective Financial Leadership

Finally, the core advantage lies in the benefits of fractional CFO provided by fractional CFO services. Businesses enjoy strategic oversight without the permanent expense of a full-time executive.

- Additional Insight: By engaging Flexible CFO Solutions, companies can respond promptly to market changes while maintaining robust financial control.

- Statistical Insight: Firms with rigorous financial planning grow up to 30% faster than those without. This further validates the impact of fractional CFO services on sustainable growth.

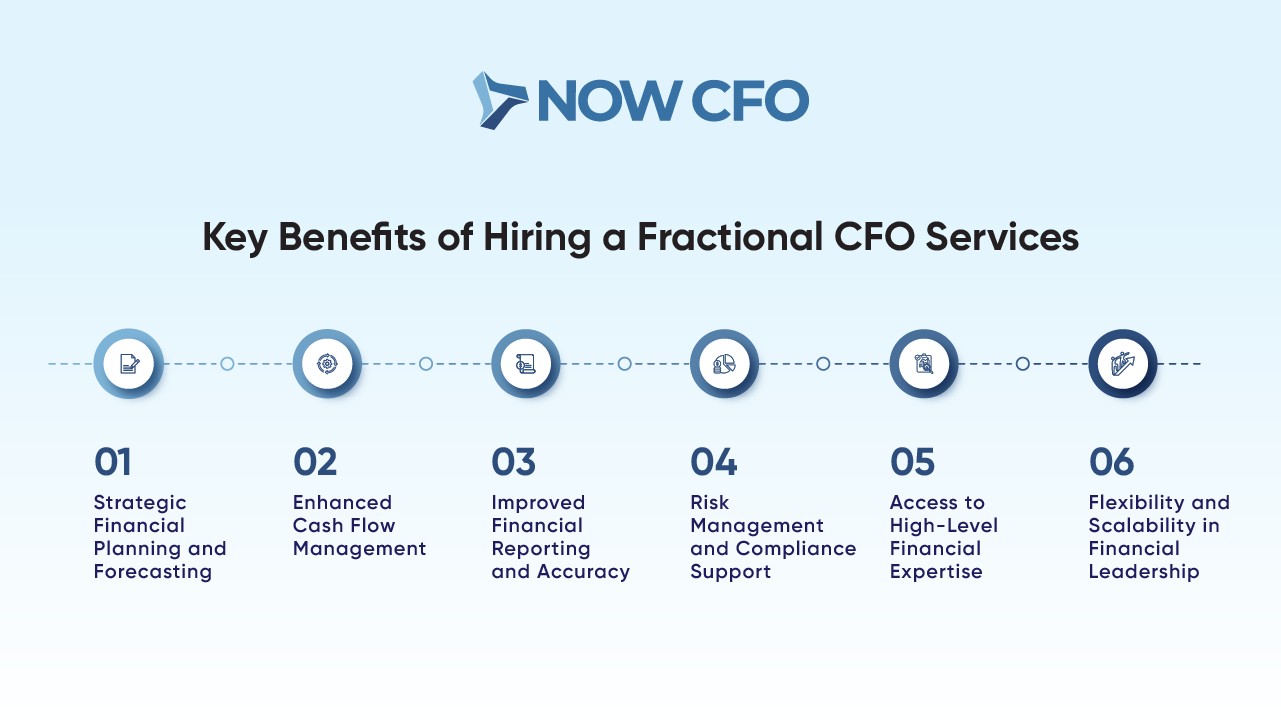

Key Benefits of Hiring a Fractional CFO Services

As we transition to exploring the advantages, it is essential to highlight that the key benefits extend beyond mere cost savings. fractional CFO services’ role is multifaceted, addressing strategic, operational, and compliance needs.

Strategic Financial Planning and Forecasting

Effective financial planning forms the backbone of business success. Fractional CFO services use robust methodologies to ensure forecast accuracy.

- Detailed budget creation aligned with business goals.

- Scenario analysis to prepare for market fluctuations.

- Investment planning and risk assessment.

Furthermore, adopting strategic financial planning with a part-time CFO helps organizations prepare for future challenges. This strategy ensures that fractional CFO services contribute to long-term growth plans.

Enhanced Cash Flow Management

Managing cash flow is crucial for operational stability. Fractional CFO services offer expert guidance in monitoring inflows and outflows to maintain liquidity.

Key Benefits:

- Improved liquidity through accurate cash flow forecasting.

- Timely identification of financial bottlenecks.

- Implementation of cost-saving measures.

Moreover, efficient cash management directly influences cost-effective financial leadership through a fractional CFO model. Companies can avoid cash crunches that might jeopardize their operations.

Improved Financial Reporting and Accuracy

Next, transparency in financial reporting is paramount. Fractional CFO services ensure that financial statements are precise and compliant with regulatory standards.

- Example: With clear reports and analytical insights, businesses can make data-driven decisions and secure investor confidence.

- Key Takeaway: Accurate financial reporting is a hallmark of effective fractional CFO services.

Likewise, this approach reassures stakeholders and aligns with modern compliance practices, reinforcing the benefits of fractional CFO.

Risk Management and Compliance Support

Equally important, risk management is a critical function at which fractional CFO services excel. By proactively identifying potential threats, these services help businesses avoid costly errors.

- Regular audits and internal controls.

- Implementation of risk mitigation strategies.

- Continuous monitoring of regulatory changes.

Moreover, this comprehensive support ensures that organizations stay ahead of compliance requirements. Notably, fractional CFO services provide insights into Outsourced CFO models supporting overall risk mitigation efforts.

Access to High-Level Financial Expertise

Furthermore, one of the most compelling advantages is access to top-tier financial expertise without the long-term commitment of a full-time hire. Fractional CFO services enable businesses to tap into a pool of professionals with diverse industry experience.

- Broad expertise across multiple sectors.

- Proven track record in navigating complex financial landscapes.

- Immediate impact on strategic decision-making.

Additionally, this model answers the query, what are the benefits of hiring a fractional CFO? by offering expert guidance that fuels business innovation and growth.

Flexibility and Scalability in Financial Leadership

Finally, fractional CFO services’ inherent flexibility makes them ideal for companies of varying sizes. As businesses evolve, their financial needs change, and these services provide scalable solutions.

- Adaptable engagement models such as CFO as a Service.

- Tailored financial solutions to meet growth demands.

- Seamless integration with existing teams.

In parallel, flexible CFO solutions enable organizations to scale their financial leadership in alignment with strategic objectives. This adaptability ensures that fractional CFO services remain relevant at every stage of business growth.

When to Hire Fractional CFO Services for Your Business

Transitioning into the next section, it is crucial to understand the optimal timing for engaging fractional CFO services. Evaluating internal needs and market conditions often provides a clear signal.

Signs Your Business Needs CFO-Level Guidance

Several red flags indicate that a company might benefit from CFO-level oversight. If you notice recurring budgeting errors, unclear financial reporting, or stagnating growth, these could be signals to consider fractional CFO services.

- Frequent cash flow issues.

- Uncertainty in strategic financial planning.

- Regulatory compliance challenges.

Additionally, these indicators serve as a call to action, prompting business leaders to reflect on the benefits of hiring a fractional CFO and the potential for enhanced oversight.

Stages of Business Growth That Benefit from Fractional CFO Services

Subsequently, the need for fractional CFO services often arises at critical growth junctures. Financial expertise is indispensable for startups and scaling companies alike.

- Early-stage: When foundational financial structures are established.

- Growth Phase: During periods of rapid expansion requiring strategic guidance.

- Maturity: When diversification and advanced forecasting become essential.

Moreover, many entrepreneurs ask, “How can outsourced CFO services drive business growth?” These services provide the necessary tools to navigate each growth stage effectively.

Budget Considerations and Cost Analysis

Furthermore, cost is always a significant consideration. Hiring full-time executives may not be feasible for all organizations, making fractional CFO services a cost-efficient alternative.

- Reduced salary and benefit expenses.

- Lower overhead costs associated with office space and resources.

- Pay-as-you-go models that align with business performance.

Additionally, this approach supports cost-effective financial leadership through a fractional CFO strategy, ensuring optimal resource allocation without compromising expertise.

Overcoming Financial Management Challenges

In addition, overcoming common financial hurdles is a major driver for adopting fractional CFO services. Many businesses struggle with disjointed financial systems and outdated processes.

- Integration of modern financial software.

- Streamlined reporting processes.

- Proactive risk management strategies.

Transitioning from In-House to Outsourced CFO Services

As businesses evolve, transitioning from an in-house model to Outsourced CFO solutions can be a strategic move. This shift offers scalability and introduces new perspectives into financial management.

Checklist:

- Evaluate current financial processes.

- Identify areas where external expertise is required.

- Develop a phased plan for transition.

Furthermore, embracing this transition fosters the implementation of fractional CFO services that align with evolving business dynamics.

Aligning Financial Goals with CFO Expertise

Finally, aligning your financial goals with the expertise provided by fractional CFO services is essential. It requires a clear understanding of your strategic objectives and a commitment to leveraging external insights.

- Set clear, measurable financial targets.

- Collaborate with professionals who understand your industry.

- Regularly review performance metrics and adjust strategies accordingly.

Additionally, this alignment ensures that the investment in fractional CFO services directly translates to business growth, effectively answering Strategic financial planning needs with a part-time CFO.

How to Choose the Right Fractional CFO Services for Your Organization

Choosing the ideal fractional CFO services becomes critical as we progress to the selection phase. It involves assessing multiple factors to ensure the right fit for your organization.

Evaluating Experience and Industry Expertise

The evaluation process should initially focus on the candidate’s experience and industry-specific expertise. Reviewing their track record in similar sectors ensures their approach aligns with your business model.

- Years of experience in financial leadership.

- Previous engagements in similar industries.

- Demonstrated ability to drive results.

Moreover, I will ask what the benefits of hiring a fractional CFO are. Naturally, this leads to examining the candidate’s past performance and ensuring that their expertise suits your needs well.

Assessing Compatibility with Your Business Culture

Subsequently, cultural compatibility is equally important. An effective fractional CFO services provider should integrate seamlessly into your organization.

- Alignment with core company values.

- Adaptability to your existing team structure.

- Strong communication and collaboration skills.

Furthermore, this evaluation ensures that fractional CFO services support a cohesive work environment, enhancing overall operational efficiency.

Key Questions to Ask for Prospective fractional CFO services

Next, preparing targeted questions can help gauge the fit of potential candidates. Consider asking:

- What strategies do you employ for financial forecasting and risk management?

- Can you provide examples of Virtual CFO Services you have successfully implemented?

- How do you ensure Cost-Effective Financial Leadership in varied business cycles?

Moreover, these questions will highlight whether the candidate offers CFO as a Service that aligns with your strategic vision.

Reviewing Client Testimonials and Track Record

Additionally, it is beneficial to examine client testimonials and case studies. This review can offer insights into how previous organizations have benefited from fractional CFO services.

Checklist:

- Success stories from similar industries.

- Quantifiable improvements in financial performance.

- Endorsements highlighting the benefits of fractional CFO.

Furthermore, reputable testimonials underscore the value of fractional CFO services and build confidence in the provider’s capabilities.

Understanding the Scope of Services Offered

Furthermore, a clear understanding of the service scope is essential. Providers should outline the breadth of their services, ensuring a comprehensive approach.

- Detailed service breakdown.

- Customization options for specific business needs.

- Regular performance reviews and updates.

Moreover, evaluating these details will ensure that your chosen fractional CFO services deliver tangible value.

Comparing Cost Structures and Value Propositions

Finally, a critical part of the selection process involves comparing cost structures. Not all fractional CFO services are priced alike, so assessing the value proposition alongside the cost is vital.

- Request detailed proposals.

- Analyze pricing models and engagement terms.

- Compare benefits against overall costs.

In addition, this evaluation should highlight the advantages of Flexible CFO Solutions that cater to your budget constraints while providing high-level expertise.

Why Choose NOW CFO for Fractional CFO services

Transitioning to a more specific perspective, NOW CFO distinguishes itself in the competitive arena of fractional CFO services. The reasons for choosing NOW CFO are embedded in its proven track record and client-centric approach.

Proven Expertise and Track Record

We have established a reputation for excellence in delivering fractional CFO services. With years of experience and a portfolio of successful engagements, the firm exemplifies the Benefits of fractional CFO by consistently driving measurable financial improvements.

- Extensive industry experience.

- Recognized for effective strategic financial planning.

- A history of robust client outcomes.

Moreover, these achievements underscore why businesses consider NOW CFO when questioning, why consider hiring a virtual CFO for your business?

Customized and Scalable Financial Solutions

Subsequently, NOW CFO offers customized solutions that align with each client’s unique needs. By providing CFO as a service tailored to organizational requirements, they deliver scalable options that evolve alongside your business.

- Personalized financial strategies.

- Adaptability to both small and large enterprises.

- Scalable services that grow with your business.

Furthermore, this approach ensures that NOW CFO’s fractional CFO services remain highly effective across different stages of business development.

Access to Experienced Financial Professionals

Next, NOW CFO boasts a team of seasoned financial professionals who bring a wealth of knowledge. Their expertise, from part-time CFO roles to interim CFO engagements, provides comprehensive services designed to enhance your financial operations.

- Deep industry insights and proven methodologies.

- Regular updates on evolving market trends.

- A commitment to fostering cost-effective financial leadership.

Moreover, this expertise confirms the superiority of NOW CFO’s fractional CFO services.

Cost-Effective and Flexible Engagement Models

Furthermore, NOW CFO stands out for its cost-effective pricing models and flexible engagement structures. These models offer businesses the freedom to choose from various service levels, ensuring that fractional CFO services are accessible without compromising quality.

Example:

- Options range from short-term projects to long-term strategic partnerships.

- Payment structures that align with performance outcomes.

Additionally, this flexibility is a core element of Flexible CFO Solutions that NOW CFO proudly delivers.

Seamless Integration with Your Business Operations

In addition, we are committed to integrating seamlessly with your existing operations. Their approach ensures a smooth transition to fractional CFO services, minimizing disruption and fostering collaboration with internal teams.

Checklist:

- Onboarding processes designed for minimal downtime.

- Regular communication and progress updates.

- Integration with current financial systems and software.

Moreover, this seamless integration reinforces the value of NOW CFO’s fractional CFO services as a natural extension of your business operations.

Comprehensive Support Across Financial Functions

Simultaneously, NOW CFO provides comprehensive support for all critical financial functions. From strategic planning and risk management to day-to-day financial oversight, their expertise ensures that every aspect of your financial health is addressed.

- End-to-end financial strategy development.

- Proactive risk and compliance management.

- Detailed financial reporting and analysis.

Furthermore, this extensive support mechanism exemplifies the holistic nature of our fractional CFO services.

Outstanding Client Satisfaction and Industry Recognition

Lastly, NOW CFO’s commitment to excellence is reflected in its outstanding client satisfaction rates and industry recognition. With numerous accolades and positive testimonials, the firm stands as a benchmark for fractional CFO services.

Fact:

- Clients have reported cash flow management and strategic decision-making improvements after engaging NOW CFO’s services.

- Their reputation for excellence continues to attract top-tier businesses seeking Cost-Effective Financial Leadership.

Conclusion: Maximizing Business Growth with Fractional CFO Services

Throughout this discussion, we have integrated key insights such as: What are the benefits of hiring a fractional CFO? How can outsourced CFO services drive business growth?

Meanwhile, as organizations strive to optimize their financial strategy, leveraging fractional CFO services can transform businesses’ operations. In addition, if you’re ready to explore tailored financial solutions, consider scheduling a consultation to gain deeper insights into innovative financial management.