Choosing the right fractional CFO for your organization requires a careful and strategic approach. This guide’s sections are structured to ensure business owners have practical insights, proven methods, and actionable steps to make decisions.

For instance, SMEs comprise 99.9% of all U.S. businesses, underscoring organizations’ crucial need for flexible financial leadership.

Understanding the Role of a Fractional CFO

Understanding the role played by a fractional CFO is essential. As businesses increasingly look for innovative financial management models, knowing how to choose the right fractional CFO is imperative.

Defining the Scope and Value of Fractional CFO Services

To begin with, when you choose the right fractional CFO, you are not just hiring an external financial expert but investing in a service that offers flexibility, cost-effectiveness, and specialized expertise. Fractional CFO services can be tailored to address unique business needs and growth strategies.

How Fractional CFOs Differ from Full-Time CFOs

From now on, it is essential to note the clear distinctions between fractional CFOs and their full-time counterparts. While full-time CFOs are embedded within the corporate structure with a broad scope of responsibilities, fractional CFOs bring specialized expertise on a part-time or project basis.

Key differences include:

- Cost Efficiency: Fractional CFOs often come at a fraction of the cost.

- Flexibility: Their engagement is scalable and adjustable to specific needs.

- Diverse Experience: They frequently work across multiple industries, offering a broader perspective.

Key Functions and Strategic Benefits

Subsequently, one should consider the key functions that a fractional CFO performs and the strategic benefits they deliver. Transitioning into this discussion, it becomes evident that a fractional CFO’s role encompasses much more than basic bookkeeping. They are pivotal in strategic planning, risk management, and driving growth initiatives.

Core functions include:

- Financial forecasting and budgeting

- Strategic planning and risk management

- Cost control and profitability enhancement

In addition, adopting a flexible model such as CFO as a service empowers organizations to address seasonal financial challenges and capitalize on growth opportunities without the burden of fixed salaries.

Common Challenges Addressed by Fractional CFOs

Engaging a fractional CFO effectively mitigates the challenges that many companies face. A common issue is the misalignment of financial strategy with operational execution.

A fractional CFO can realign these aspects by providing expert guidance on cost management, revenue optimization, and cash flow improvements.

Challenges they tackle include:

- Cash flow issues and budgeting errors

- Inefficient financial reporting systems

- Lack of strategic foresight in uncertain markets

Therefore, knowing how to hire a fractional CFO means understanding these challenges and recognizing the benefits of having an expert who can navigate complex financial landscapes.

How NOW CFO Delivers Expert Fractional CFO Services

Next, let’s transition to how NOW CFO stands out by providing top-tier fractional CFO services. When you choose the right fractional CFO through NOW CFO, you can access an expert team that combines deep industry knowledge with practical financial strategies.

NOW CFO’s model is built on flexibility, scalability, and a client-centric approach that ensures every engagement is aligned with your business goals.

Service highlights include:

- Customized financial planning sessions

- Regular performance reviews and reporting

- Strategic advisory tailored to your business stage

In addition, NOW CFO’s proprietary framework incorporates robust evaluation techniques, such as evaluating fractional CFO candidates, to ensure that each client’s needs are met precisely.

The Impact of Flexible Financial Leadership on Business Growth

Finally, this section explores the broader impact of flexible financial leadership on business growth. Companies that embrace innovative economic models, such as fractional CFO selection, report enhanced agility and improved financial outcomes.

The strategic deployment of financial expertise flexibly fosters a culture of proactive decision-making and rapid response to market changes.

Notable impacts include:

- Improved cash flow management and forecasting accuracy

- Enhanced risk mitigation and strategic planning

- Increased operational efficiency and competitive advantage

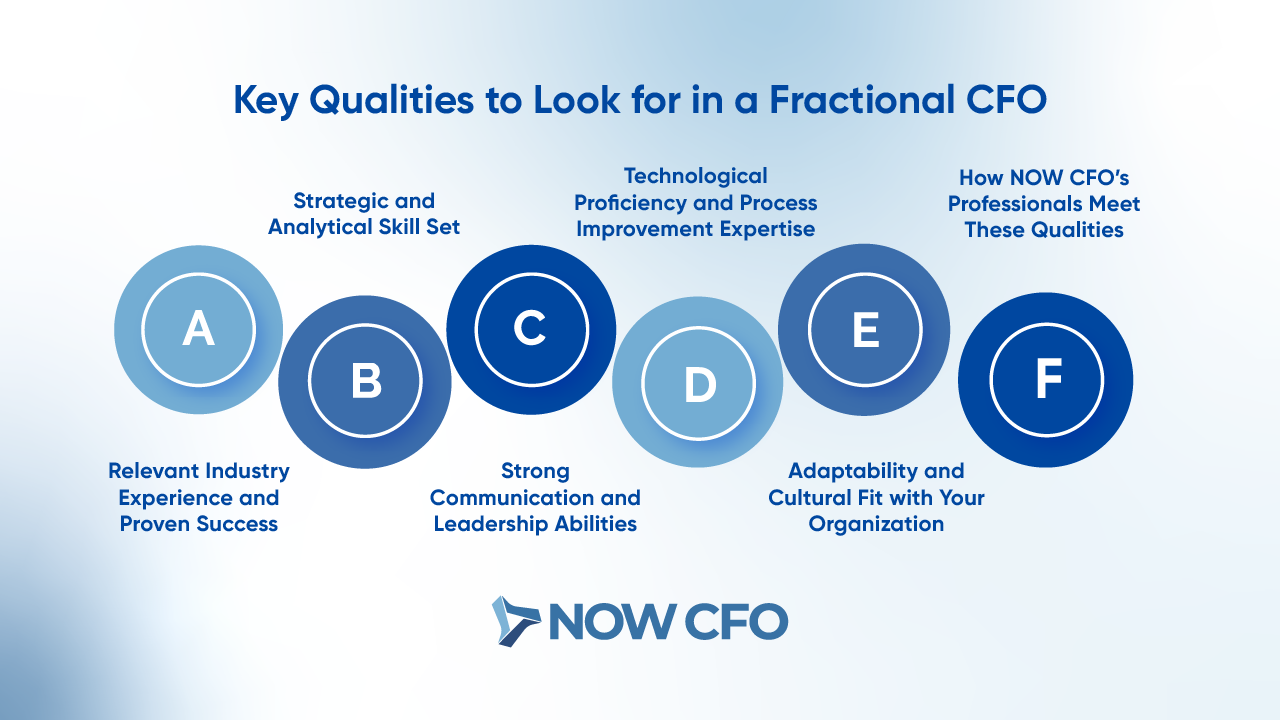

Key Qualities to Look for in a Fractional CFO

Transitioning from understanding the role, the next step is to examine the key qualities essential for selecting an effective fractional CFO. As you choose the right fractional CFO, evaluating the traits and experiences that translate into tangible business results is critical.

Relevant Industry Experience and Proven Success

When choosing the right fractional CFO, it is paramount to ensure that the candidate has relevant industry experience. A CFO with proven success in similar industries is more likely to understand your unique challenges.

Essential qualities include:

- Demonstrated industry-specific expertise

- A track record of measurable business improvements

- Experience with startups, growth companies, or mature organizations

Strategic and Analytical Skill Set

Subsequently, a fractional CFO must possess a robust strategic and analytical skill set. When choosing the right fractional CFO, ensure the candidate can analyze complex financial data and translate it into actionable strategies.

Key competencies include:

- Advanced data analytics and forecasting capabilities

- Strategic planning and scenario analysis

- Expertise in financial modeling and risk assessment

Strong Communication and Leadership Abilities

Furthermore, it is crucial to recognize that strong communication and leadership abilities are essential when you choose the right fractional CFO. An effective CFO must articulate complex financial concepts accessible to all stakeholders, including board members and internal teams.

Attributes include:

- Clear, concise, and proactive communication

- Ability to lead and inspire financial teams

- Skilled in cross-department collaboration and stakeholder engagement

Research from McKinsey indicates that organizations with leaders who communicate effectively see up to a 22% to 25% increase in team productivity. This data reinforces the necessity of seeking the best fractional CFO qualities that combine leadership with communication excellence.

Technological Proficiency and Process Improvement Expertise

Moving on, it is crucial to note that technological proficiency is increasingly a determining factor in how you choose the right fractional CFO. Furthermore, the candidate should have a strong command of modern financial software and be adept at implementing process improvements that drive efficiency.

Focus areas include:

- Familiarity with ERP systems and cloud-based financial management

- Experience in automating financial reporting and forecasting

- A proven track record in driving process enhancements

Adaptability and Cultural Fit with Your Organization

Furthermore, while technical skills are vital, adaptability and cultural fit play a critical role when you choose the right fractional CFO. A CFO’s ability to integrate into your organizational culture and adapt to evolving business needs.

Key considerations include:

- Alignment with your company’s core values and vision

- Flexibility to adjust strategies based on market shifts

- Demonstrated resilience in dynamic business environments

How NOW CFO’s Professionals Meet These Qualities

In addition, NOW CFO’s team is distinguished by its commitment to excellence and the embodiment of the abovementioned qualities. As you choose the right fractional CFO through NOW CFO, you are assured that every professional on their team has been rigorously vetted for industry expertise.

Service advantages include:

- A rigorous screening process aligned with fractional CFO selection

- In-depth reference checks and performance evaluations

- Continuous professional development and technology integration

Steps to Evaluate Fractional CFO Candidates

It is now essential to thoroughly outline the steps to evaluate fractional CFO candidates. When you choose the right fractional CFO, having a transparent, structured evaluation process is crucial.

Conducting Comprehensive Background and Reference Checks

To begin with, a critical step in the evaluation process is conducting comprehensive background and reference checks. As you choose the right fractional CFO, thoroughly verifying the candidate’s professional history and reputation is essential.

Steps include:

- Requesting detailed work history and client testimonials

- Verifying past roles and responsibilities through direct references

- Utilizing third-party verification tools for added credibility

Assessing Past Performance Through Measurable Outcomes

Furthermore, assessing the candidate’s past performance using measurable outcomes is essential. When you choose the right fractional CFO, reviewing key performance indicators from previous roles is invaluable.

Assessment methods include:

- Reviewing financial metrics and growth figures from past engagements

- Analyzing case studies that demonstrate process improvements

- Comparing historical performance with industry benchmarks

Interviewing for Strategic Alignment and Vision

Next, it is vital to interview candidates to assess their strategic alignment and vision. When you choose the right fractional CFO, the interview process must uncover technical skills and the candidate’s ability to align with your long-term business objectives.

Key focus areas include:

- Exploring the candidate’s vision for your company’s financial future

- Discussing past strategic initiatives and their outcomes

- Evaluating cultural fit and leadership style through scenario-based questions

Verifying Professional Credentials and Certifications

Moreover, verifying potential candidates’ professional credentials and certifications is imperative. Determining educational backgrounds and professional certifications is essential when choosing the right fractional CFO.

Verification steps include:

- Checking for CPA, CMA, or CFA designations

- Confirming continued professional education and relevant certifications

- Reviewing endorsements from reputable industry associations

Comparing Engagement Models and Cost Structures

Subsequently, comparing different engagement models and cost structures is a crucial step when you choose the right fractional CFO. Financial prudence requires that you examine the cost implications alongside the potential benefits of each candidate.

Considerations include:

- Evaluating fixed versus variable cost models

- Comparing short-term versus long-term engagement strategies

- Assessing overall return on investment based on historical data

Utilizing NOW CFO’s Evaluation Framework for Best Results

Finally, NOW CFO’s proprietary evaluation framework is designed to streamline selection and deliver optimal results. Transitioning into this discussion, it is evident that a structured approach that leverages industry best practices is vital when you choose the right fractional CFO.

Framework highlights include:

- A systematic scoring model for candidate comparison

- Integration of quantitative performance metrics and qualitative assessments

- Ongoing feedback loops and scenario testing for continuous improvement

Aligning Your Organizational Needs with CFO Expertise

As we transition to aligning organizational needs with CFO expertise, it is crucial to integrate your internal financial challenges. When you choose the right fractional CFO, the CFO’s expertise must align seamlessly with your company’s goals and challenges.

Identifying Core Financial Challenges and Growth Objectives

Identifying your organization’s core financial challenges and growth objectives is the first step toward a successful alignment. You should also comprehensively review your financial processes, pain points, and strategic ambitions.

Key considerations include:

- Pinpointing cash flow management issues and budgeting constraints

- Determining areas where financial forecasting falls short

- Establishing growth objectives and performance metrics

Defining the Scope and Duration of CFO Engagement

Next, defining the scope and duration of the CFO’s involvement is essential when you choose the right fractional CFO. This involves setting clear parameters regarding the extent of responsibilities, timelines, and expected deliverables.

Engagement components include:

- Specifying the duration of the contract

- Outlining key deliverables and performance milestones

- Defining integration levels with internal finance teams

Budgeting and Cost Considerations for CFO Services

Moreover, transitioning into financial planning, budgeting and cost considerations play a pivotal role when you choose the right fractional CFO. Companies that adopted fractional financial services reported improved financial decision-making within six months and a 15% reduction in COGS.

Budgeting tips include:

- Evaluating cost structures relative to service benefits

- Considering variable versus fixed engagement models

- Calculating the potential ROI from improved financial management

Determining the Level of Integration with Your Existing Team

Furthermore, transitioning into team dynamics and determining the level of integration between the outsourced CFO and your existing team are critical factors. When you choose the right fractional CFO, you must ensure that the candidate can collaborate seamlessly with your internal financial and operational teams.

Evaluating fractional CFO candidates should not only rely on technical skills but also on their ability to work cohesively within your existing structure. These integration practices are vital for organizations looking to choose the right fractional CFO.

Balancing Short-Term Needs with Long-Term Strategic Goals

Additionally, balancing short-term needs with long-term strategic goals is essential when you choose the right fractional CFO. Considering how immediate financial challenges can be addressed without losing sight of your organization’s growth plans is critical.

How NOW CFO Customizes Solutions to Fit Unique Business Requirements

NOW CFO distinguishes itself by tailoring solutions that meet the unique needs of every organization. When you choose the right fractional CFO through NOW CFO, you are assured that each financial strategy is designed specifically for your business context.

Customization features include:

- Personalized financial roadmaps based on in-depth business analysis

- Scalable engagement models that evolve with your company’s needs

- Dedicated support teams that facilitate smooth integration and continuous improvement

Why Choose NOW CFO for Fractional CFO Services

Transitioning into a discussion of vendor selection, it is essential to understand why NOW CFO stands out when you choose the right fractional CFO. In this section, we highlight the unique value propositions and strategic advantages that NOW CFO brings.

Proven Expertise and a Strong Track Record

To begin with, our team boasts proven expertise and a strong track record in delivering superior financial leadership. Transitioning into this discussion, it is critical to evaluate past performance and success metrics before you make a choice.

Key points include:

- A history of successfully supporting diverse industries

- Documented case studies and client testimonials

- High success rates in turnaround strategies and growth initiatives

Tailored, Scalable Financial Solutions

Furthermore, our commitment to tailored and scalable financial solutions sets us apart.

Scalable solution components include:

- Modular engagement plans that adapt to growth stages

- Customizable service packages to meet budget constraints

- Ongoing support and periodic strategy reviews to ensure alignment

Access to a Team of Experienced Financial Professionals

Next, NOW CFO offers clients access to a broad team of seasoned financial professionals. When you choose the right fractional CFO through NOW CFO, you are not limited to a single expert but benefit from the collective expertise.

Team benefits include:

- Diverse industry knowledge and cross-functional expertise

- Collaborative problem-solving and innovative financial strategies

- Rapid scalability to meet increased financial demands

Cost-Effective, Flexible Engagement Models

Moreover, our cost-effective and flexible engagement models provide significant value. Also, you will benefit from our model, which has been adapted to your financial constraints while delivering high-impact services.

Engagement model highlights include:

- Flexible pricing options tailored to business size and needs

- Engagement durations that can be scaled up or down as required

- Performance-based fee structures that ensure a high ROI

Seamless Integration with Your Business Operations

Another compelling advantage is the seamless integration of NOW CFO’s services with your business operations. When you choose the right fractional CFO, our integration process is designed to be smooth and non-disruptive.

Comprehensive Support and Ongoing Strategic Guidance

Additionally, NOW CFO provides comprehensive support and ongoing strategic guidance beyond the initial engagement. Our continuous support is critical for maintaining momentum and adapting to changing market dynamics.

Support services include:

- Regular financial performance reviews and strategy sessions

- Continuous advisory services and market trend analysis

- Access to a dedicated support team for real-time problem-solving

High Client Satisfaction and Industry Recognition

Finally, a high level of client satisfaction and industry recognition are significant indicators of NOW CFO’s effectiveness. When you choose the right fractional CFO, you benefit from our consistently delivered exceptional results, as evidenced by numerous client testimonials and awards.

Learn More: Fractional CFO vs Full-Time CFO

Tips for Successful Fractional CFO Integration

Integrating a fractional CFO into your organization requires careful planning and effective communication. Our outsourced CFO hiring tips ensure a smooth transition and maximize your organization’s benefit. In this section, we outline practical tips that focus on operational excellence and continuous improvement.

Establishing Clear Communication Protocols

To start with, establishing clear communication protocols is fundamental for successful integration. Also, the chosen CFO must be equipped to maintain regular, transparent communication with all stakeholders.

Key protocols include:

- Setting up weekly check-ins and status reports

- Utilizing collaborative platforms for real-time updates

- Defining a transparent chain of command for financial decisions

Defining Roles, Responsibilities, and Expectations

Furthermore, transitioning to role clarity and defining roles, responsibilities, and expectations from the outset is crucial. Setting clear parameters helps avoid misunderstandings and maximizes the CFO’s contributions.

Essential steps include:

- Developing a detailed job description and scope of work

- Outlining performance metrics and accountability measures

- Clarifying integration points with internal teams and external advisors

Setting Up Performance Metrics and Regular Reporting

Moreover, setting up performance metrics and ensuring regular reporting is essential for ongoing success. When you choose the right fractional CFO, having measurable indicators allows you to track progress and make data-driven decisions.

Performance measures include:

- Establishing KPIs aligned with business goals

- Creating dashboards for real-time financial tracking

- Scheduling periodic review meetings to assess progress

Creating a Structured Onboarding Process

Next, a structured onboarding process is critical to ensure the virtual CFO can quickly adapt to your organization’s environment. A well-defined onboarding strategy accelerates integration and fosters early success.

Onboarding strategies include:

- A comprehensive orientation program covering company processes and systems

- Introduction meetings with key stakeholders and department heads

- Detailed briefings on current financial challenges and strategic priorities

Leveraging Technology for Seamless Collaboration

Additionally, leveraging technology for seamless collaboration is another key factor. When you choose the right fractional CFO, integrating collaborative tools ensures that the interim CFO remains connected with your team, regardless of location.

Technology benefits include:

- Cloud-based financial management and communication platforms

- Real-time data sharing and project management tools

- Enhanced remote collaboration features to support virtual engagements

Maintaining Open Feedback Channels for Continuous Improvement

Finally, maintaining open feedback channels for continuous improvement is essential for long-term success. When you choose the right fractional CFO, regular feedback loops ensure that the CFO’s contributions are aligned with evolving business needs.

Feedback practices include:

- Regular performance reviews and constructive feedback sessions

- Surveys and informal check-ins with team members

- Adapting strategies based on feedback to drive continuous improvement

Learn More: Fractional CFO Services vs Traditional CFO Hiring

Conclusion

Follow these details to choose the right fractional CFO for your organization. The careful alignment of qualities, evaluation steps, and integration techniques ensures that every decision is data-driven.

Ready to find the perfect part-time CFO for your organization? At NOW CFO, we provide expert financial leadership tailored to your business needs. Let our experienced professionals help you drive growth, improve financial strategy, and ensure long-term success.

Contact NOW CFO today to get started!