A clear and well-structured bookkeeping system is the financial backbone for any business, big or small. Yet, nearly 71% of SMOs rely on accounting apps and pen‑and‑paper or spreadsheets to manage finances, exposing themselves to human error and fragmentation.

Well‑maintained bookkeeping helps you stay on top of daily tasks and gives you a clear picture of your cash flow, taxes, and financial health. Organized financial records make better decisions and do better than those who just use outdated methods.

Understanding the Basics of Bookkeeping Systems

To build a smooth foundation for your bookkeeping system, explore essential definitions and why a structured digital or manual setup matters. These core insights pave the way for precise, accurate tracking and financial decision-making.

What Is a Bookkeeping System?

A bookkeeping system is the structured process by which businesses record financial transactions, organize financial data, and produce reliable records for decision-making. It serves as the backbone of financial clarity and transparency.

Businesses use bookkeeping systems to track income, expenses, assets, liabilities, and equity. These records enable timely financial reporting and support audit readiness. Whether conducted manually or digitally, bookkeeping creates accountability and financial discipline.

Why Every Business Needs an Organized Bookkeeping Process

An organized bookkeeping process ensures financial clarity, supports compliance, and drives business growth. Without structure, you risk misclassification, tax errors, or missed deductions.

Here’s what a streamlined process delivers:

- Accurate financial insights

- Tax preparation ease

- Informed decision-making

- Professional presentation

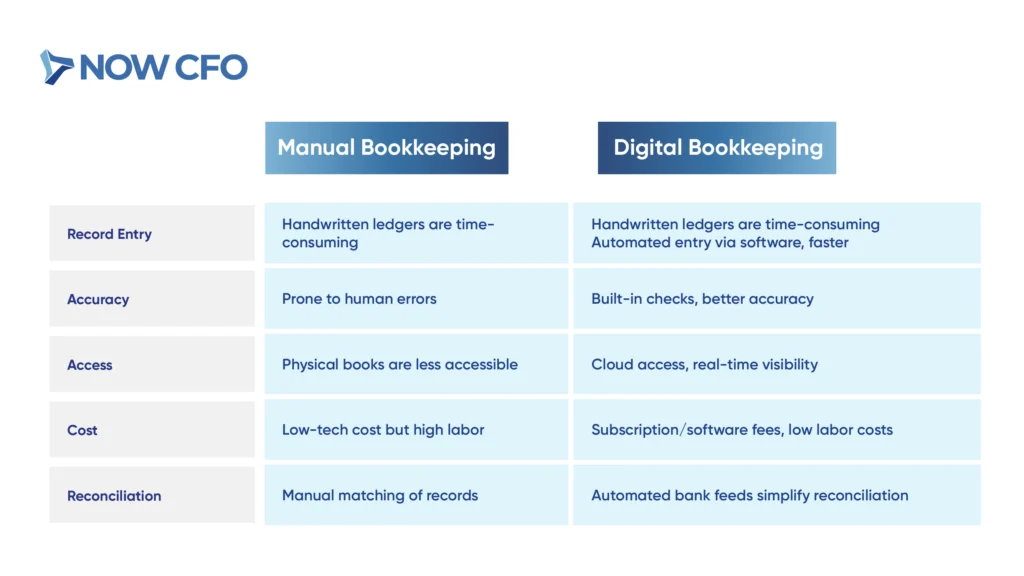

Difference Between Manual and Digital Bookkeeping Systems

Choosing between manual and digital bookkeeping shapes your workflow and efficiency.

The Role of Double‑Entry in Bookkeeping Accuracy

Double‑entry bookkeeping forms the core of accuracy in a bookkeeping system. Every transaction impacts two accounts: debits and credits, ensuring that the accounting equation (Assets = Liabilities + Equity) stays balanced.

This method reduces errors and improves error detection: if total debits do not match credits, it signals immediately that something is off. Many digital bookkeeping tools use double‑entry logic to ensure accuracy without manual adjustments.

Double-entry formats encourage disciplined tracking and clear audit trails, requiring each entry to balance. This system supports transparency and tax compliance and prevents oversight, even when handling complex transactions like payroll or loans.

Common Bookkeeping Tools and Methods

Effective bookkeeping blends methods and tools to increase accuracy and efficiency.

- Spreadsheets: Low-cost and flexible for basic tracking.

- Cloud-Accounting Software: Automates entries and generates reports.

- Receipt-Scanning Tools: Digitally capture expense documents for easy storage.

- Paper Ledgers or Binders: Useful for low-tech or backup processes.

- Manual Journals + Digital Templates: Hybrid method for transitional workflows.

Preparing to Set Up Your Bookkeeping System

Assessing your business’s specific financial needs and choosing the right tools and support is essential before building your bookkeeping system. This preparation phase lays the groundwork for accurate tracking and long-term success.

Identifying Your Business’s Financial Needs

To structure an effective bookkeeping system, evaluate your business’s specific financial demands. Service-based ventures, retail, or e-commerce operations have clear expense flows, sales volumes, and documentation needs.

Business owners should consider transaction frequency, cash flow complexity, payroll requirements, and regulatory obligations in a detailed assessment phase. Identifying these factors allows your bookkeeping system to align with real burdens.

To emphasize the importance of proper financial clarity, SEOS are nearly twice as likely to report volatile personal income month-to-month compared to non-owners; 41% versus 21%. Identifying your business’s financial needs now helps anchor your bookkeeping system in clarity and preparedness.

Choosing Between DIY and Professional Help

Deciding who to manage your bookkeeping system is a key step affecting accuracy, time investment, and long-term scalability.

| Factor | DIY Bookkeeping | Professional Bookkeeping |

| Cost | Lower upfront, software, and time costs | Higher fee, but saves time and reduces errors |

| Accuracy | Depends on the owner’s skill and discipline | Expert handling reduces misclassification |

| Control | Full control and flexibility | Delegation of tasks, less daily oversight |

| Scalability | Must upgrade tools as you grow | Services adapt to business complexity |

| Compliance Comfort | Risk without accounting knowledge | Professionals ensure regulatory compliance |

Setting Financial Goals for Your System

Setting clear financial goals gives your bookkeeping system purpose. Rather than just tracking numbers, decide what you want to achieve, such as monitoring profit margins or improving reconciliation speed.

Start by identifying measurable targets like increasing revenue, building cash reserves, or making your bookkeeping process more efficient. These goals help shape your chart of accounts, reporting frequency, and automation setup so your financial tracking supports real business outcomes.

Establishing Internal Controls

Implementing internal controls ensures your bookkeeping system remains secure and reliable. Controls protect against fraud, errors, and mismanagement.

Here are key internal control practices to implement:

- Define Clear Financial Roles: Separating responsibilities minimizes the risk of error or fraud by ensuring no one person controls the entire financial process.

- Implement Approval Workflows: Many digital bookkeeping tools allow for automated approval hierarchies and alert setups, boosting accountability and transaction transparency.

- Enforce Regular Reconciliations: Designate someone other than the data-entry person to review and reconcile bank accounts to detect differences or unauthorized activity.

- Schedule Periodic Reviews: Perform monthly or quarterly audits to verify documentation, ensure compliance, and assess the effectiveness of your bookkeeping system tools.

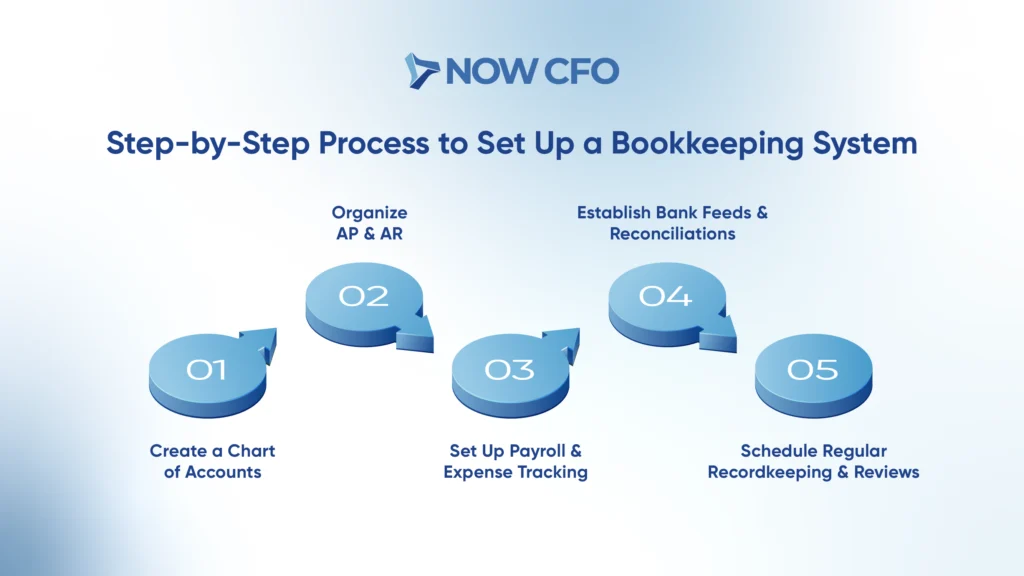

Step-by-Step Process to Set Up a Bookkeeping System

Setting up a structured bookkeeping system ensures every financial transaction is accurately recorded and easy to track.

Create a Chart of Accounts

You start your bookkeeping system by creating a chart of accounts, which classifies all accounts: assets, liabilities, equity, income, and expenses. This chart lays a structured foundation for tracking financial activity accurately.

Begin by listing the active accounts your business requires. Include bank accounts, receivables, payables, capital contributions, revenue streams, and expenses. Organize them logically; assets first, then liabilities, equity, income, and costs.

Organize Accounts Payable and Receivable

With the chart of accounts in place, the next step in your bookkeeping system is to organize accounts payable and receivable. Managing obligations and incoming payments clearly separates inflows and outflows for efficient cash management.

- Accounts Payable (AP): Establish a tracking method for vendor invoices, due dates, and payment status. Label each expense using your chart of accounts.

- Accounts Receivable (AR): Set up a system to invoice clients promptly, assign unique invoice numbers, and record customer payments against those invoices. Link each receivable to its revenue account category.

Set Up Payroll and Expense Tracking

Setting up payroll and expense tracking is essential for maintaining accuracy and control within your bookkeeping system.

- Payroll Tracking: Implement a system to record wages, deductions, and employer tax contributions clearly. Retain records as required by law (e.g., employers must keep payroll records for at least three years).

- Expense Tracking: Log all business expenses using organized methods, tagging each with a category from your chart of accounts. Include dates, amounts, vendor names, and purpose.

Establish Bank Feeds and Reconciliations

Next, set up bank feeds and reconciliations to synchronize your financial records with account activity. Connecting your bookkeeping platform or spreadsheet to your bank feeds allows daily or weekly transaction import, reducing manual entry.

Once feeds are active, reconcile your accounts regularly, match imported transactions to entries in your bookkeeping system, and investigate discrepancies. Institutions must compare book and bank balances and analyze differences monthly.

Schedule Regular Recordkeeping and Reviews

Finally, schedule regular recordkeeping and reviews to keep your bookkeeping system accurate and responsive. Consistency builds trust in your financial data and supports proactive decision-making.

Create a routine by recording transactions daily, reconciling accounts weekly, reviewing cash flow, and closing books monthly. Using reminders in your calendar or system helps you stay consistent and build long-term discipline into your bookkeeping process.

During each review period, verify that all transactions are properly categorized according to your chart of accounts. Confirm that AP and AR lists are up to date, reconciliations are complete, and payroll and expense logs reflect actual activity.

Best Practices for Maintaining a Bookkeeping System

Once your bookkeeping system is in place, consistently maintaining it is crucial to ensuring accuracy and efficiency over time. These best practices help keep your financial records organized, compliant, and ready for strategic decision-making.

Keep Receipts and Documentation Organized

Begin by organizing receipts and documentation to help the bookkeeping system and ensure that every expenditure ties back to the record. Store receipts digitally using apps or scan them into a central folder immediately after purchase to reduce evidence loss.

When organizing, categorize documents by type, and ensure each map is assigned to the proper line in your chart of accounts or bookkeeping software. Structured filing supports seamless reconciliation and simplifies audit preparation.

Separate Personal and Business Finances

Maintaining a clear divide between personal and business funds strengthens your bookkeeping system and protects your financial clarity. Mixing personal and business transactions invites errors, complicates tax reporting, and ruins the separation of liabilities.

46% of SMEs use personal credit cards for business expenses, often blurring lines between personal and professional finances. Start by opening a dedicated business bank account and credit card.

Reconcile Bank Statements Monthly

Settling your accounts regularly preserves accuracy and fosters confidence in your bookkeeping system. Conduct monthly bank reconciliations by comparing the bank’s statement with your internal records.

Study every difference, unrecorded deposit, missing fee, or data entry error. Catching these differences quickly keeps cash flow visible and prevents misstatements. Automating reconciliation can further streamline this process and reduce manual error.

Use Automation to Save Time and Reduce Errors

Using automation enhances your bookkeeping system’s efficiency and accuracy. Tools that automate bank feeds, categorization, and receipt capture reduce manual workload and control potential mistakes. 36% of companies already use robotic process automation (RPA) or AI for accounting tasks, and up to 50% of back‑office tasks could be automated soon.

Schedule Periodic Financial Checkups

Scheduling structured financial reviews maintains your bookkeeping system’s relevance and performance. Plan quarterly or semi-annual checkups where you review expense trends, assess profitability, and adjust your chart of accounts or processes as needed.

During these reviews, analyze whether your current setup supports goals like tracking revenue streams, managing cash flow, or supporting credit needs. If your business model has evolved, update expense categories, automation rules, or internal controls accordingly.

Common Mistakes to Avoid in Bookkeeping Setup

To keep your bookkeeping system accurate and reliable, it’s crucial to recognize and avoid common setup missteps.

Misclassifying Transactions in the Chart of Accounts

Misclassifying transactions in your chart of accounts ruins the integrity of your bookkeeping system. For example, assigning a $2,000 equipment purchase to office supplies distorts your expense patterns and compromises tax deductions.

Minor misclassifications add to significant inaccuracies. To avoid this, maintain a clear, well-organized chart of accounts and train your team on proper assignment. Also, review your accounts regularly to catch mislabeling early.

Falling Behind on Daily or Weekly Entries

Consistent transaction recording prevents backlog and maintains financial clarity within your bookkeeping system.

- Daily Entries: This ensures accuracy and avoids lost records. It also provides real-time visibility on cash flow and prevents task accumulation.

- Weekly Review: A Weekly check helps catch misclassified expenses, missing receipts, or duplicate entries quickly.

Overlooking Cash Flow Tracking

Cash flow mismanagement is a top threat to business survival. Your bookkeeping system must closely monitor the timing and movement of cash. Missing this oversight risks shortfalls and impaired operations.

- Track Inflows and Outflows: Log all payments received and outgoing disbursements, aligning them with accounts receivable and payable. Without precise tracking, you lose visibility into liquidity.

- Forecast Cash Needs: Estimate future cash needs based on upcoming expenses and expected income. This foresight gives you time to arrange financing or adjust spending.

- Monitor Free Cash Flow Trends: Identify patterns to anticipate financial stress and avoid surprises.

Not Leveraging Bookkeeping Software Features

Neglecting the advanced features of your bookkeeping software undermines its efficiency and accuracy potential. Many tools offer a wealth of automation and oversight capabilities that go unused.

Automated bank feeds, transaction categorization rules, and recurring entries can save hours and reduce manual errors. Yet, businesses often default to manual entry, missing out on productivity gains.

Beyond automation, features like audit trails, customizable reports, and alerts for anomalies are powerful. Regularly exploring and applying these tools ensures your bookkeeping system operates smoothly, with faster reconciliations and clearer insights.

Skipping Professional Oversight

Managing your bookkeeping system alone without expert oversight raises your risk of misclassified entries, compliance mistakes, and missed financial improvements. Minor errors add up quickly when no bookkeeper reviews your records regularly.

Even limited check-ins from a financial professional, quarterly reviews, or tax preparation bring valuable insights to improve your overall process. Professionals detect issues, refine workflows, and confirm that reconciliations match your financial activity.

Should You Outsource Your Bookkeeping System Setup?

To decide whether to outsource your bookkeeping system setup, you must weigh the professional advantages, costs, timing, and hybrid models.

Benefits of Professional Bookkeeping Setup

Outsourcing your bookkeeping system setup brings specialized benefits that often outweigh DIY efforts:

- Cost Savings: Outsourcing can cut bookkeeping expenses by reducing full-time salaries, training, and benefit costs.

- Access to Expertise: You gain immediate access to skilled accountants who understand tax laws, compliance, and best practices, enhancing accuracy and peace of mind.

- Improved Efficiency & Accuracy: Professional services minimize misclassification, streamline reconciliation, and elevate your bookkeeping system’s reliability.

- Scalability & Flexibility: As your business evolves, outsourced bookkeeping scales up or down seamlessly without the overhead of hiring or training internally.

Costs of DIY vs. Outsourcing Setup

Compare the financial and operational implications of managing setup yourself versus outsourcing it:

| Aspect | DIY Setup | Outsourced Setup |

| Upfront Cost | Low software or manual tools cost; high time cost | Higher fee—but eliminates hiring and training costs |

| Time Investment | The owner spends hours on configuration and learning | Experts set up faster with optimized workflows |

| Accuracy & Compliance | Dependent on your accounting knowledge | Professional oversight improves reliability |

| Scalability & Adaptability | Requires manual updates as business grows | Outsourced services adjust as your needs evolve |

| Access to Expertise & Tech | Limited to own skills and software subscription | Includes advanced tools and experience |

When Outsourcing Makes the Most Sense

Outsourcing your bookkeeping system setup becomes especially prudent when you:

- Limited internal accounting expertise may elevate the risk of misclassification or compliance errors for businesses.

- You value your time and prefer to focus on growth, core operations, or client service rather than learning bookkeeping from scratch.

- Require immediate, reliable access to financial insights, dashboards, or reporting capabilities.

- Need a quick solution that scales as your business evolves.

Hybrid Solutions: DIY + Professional Support

A hybrid approach combines your hands-on involvement with specialist oversight, offering both control and support:

| Component | DIY Role | Professional Role |

| Chart of Accounts Setup | Draft initial structure based on business needs | Review and refine for optimal classification |

| Monthly Reconciliation | Conduct basic reconciliations | Audit results and provide insights |

| Software Configuration | Install and customize bookkeeping software | Optimize settings, automation, and reports |

| Reporting & Analysis | Generate routine reports (profit/loss, cash flow) | Provide advanced analytics, forecasting, and advice |

How NOW CFO Helps Businesses Build Reliable Bookkeeping Systems

At NOW CFO, we tailor bookkeeping solutions that anchor your business with accuracy, clarity, and strategic foresight. We begin by reviewing your current bookkeeping system structure and align it with your chart of accounts, transaction flows, and software environment.

We integrate automation tools and bank feeds to streamline data flows, reduce manual work, and improve real-time visibility into financial health. This approach strengthens efficiency and accuracy, supporting clean reconciliations and simplified monthly closes.

Our professionals also provide ongoing oversight, auditing monthly records, enhancing internal controls, and offering real-time insights. We streamline compliance, prepare you for tax readiness, and offer forecasting support so you make informed decisions with confidence.

Conclusion

Building and maintaining an effective bookkeeping system is much more than tracking numbers. Whether you implement the process yourself or engage experts, the key is consistency and alignment with your goals.

Every organized receipt, reconciled bank statement, and accurate chart of accounts entry reinforces the financial data you rely on to operate and grow. If you’re ready to elevate your bookkeeping with NOW CFO, let’s explore how your business can benefit from streamlined workflows, automated tools, and proactive guidance together.

Frequently Asked Questions

What Information Should I Gather Before Starting a Bookkeeping System?

You’ll need details about your business structure, bank account information, a list of income sources, expense categories, and any existing financial records.

How do I Know Which Bookkeeping Software is Right for my Business?

Choose software based on your business size, transaction volume, integration needs, ease of use, and budget. Look for scalability and support.

Can I Manage Bookkeeping Independently, or Should I Always Hire Help?

You can start solo using simple tools, but as your business grows or your finances become more complex, professional help becomes more valuable.

How Often Should I Update and Review My Bookkeeping Records?

Daily entries and weekly reviews are ideal, with monthly reconciliations and quarterly checkups to keep everything accurate and up to date.

What Happens if I Make a Mistake Setting up My Bookkeeping System?

Mistakes can lead to misreported finances or tax issues. Regular reviews or expert consultations help you catch and fix them early.