Acquisitions are the ultimate pathway for growth, expansion, and increased market share. Yet, while managing acquisitions presents significant opportunities, they also introduce complex financial, operational, and regulatory risks.

Research from the University of Virginia reveals that 65% to 85 % of M&A fail to create shareholder value, with nearly a quarter of deals actively destroying value. Without the right financial leadership, these risks can quickly derail even the most promising deal. That’s where an outsourced CFO becomes a game-changer.

Why an Outsourced CFO Is Essential for Managing Acquisitions

When navigating the complexities of mergers, businesses increasingly turn to an outsourced CFO to bridge resource gaps and accelerate deal success. By leveraging specialized financial acumen without the delay of hiring a full-time executive, companies gain critical momentum in planning and execution.

Expertise in Financial Planning and Analysis

An outsourced CFO brings deep proficiency in building robust financial models and stress-testing scenarios, capabilities that many growing companies lack internally. They design pro forma statements that factor in synergies, integration costs, and revenue ramp-ups, ensuring acquirers don’t overpay.

Every year, U.S. firms invest over $2 trillion in acquisitions, yet 70–90 percent of them fail due to flawed assumptions and planning.

Ability to Provide Objective, Unbiased Financial Insights

Engaging a fractional CFO ensures decisions are grounded in data, not internal politics or legacy biases.

- Independent Valuations: They assess targets without revenue cannibalization fears, delivering fair enterprise-value estimates.

- Clear Performance Metrics: By establishing KPIs, including EBITDA accretion, working-capital targets, and ROI thresholds, a fractional CFO highlights deal viability.

- Unvarnished Reporting: Their third-party stance surfaces hidden liabilities that internal teams might downplay.

Cost-Effective Solution Compared to In-House CFOs

For many SMEs, recruiting a full-time CFO can cost over $200,000 annually (salary plus benefits). Instead, outsourcing provides access to senior expertise at a fraction of that:

- Predictable Fees: Monthly retainer models cap costs, allowing firms to budget precisely.

- Avoided Overhead: No recruitment, training, or benefits expenses—your company pays only for hours used.

- Scalable Support: Engage additional project-based resources (tax, treasury, audit) without headcount approvals.

Learn More: Strategic role of a fractional CFO

Key Responsibilities of an Outsourced CFO in the Acquisition Process

As companies embark on mergers and acquisitions, they undergo rigorous evaluations, strategic planning, and regulatory scrutiny. An outsourced CFO acquisition management orchestrates each stage to guarantee effective integration and robust financial risk management.

1. Conducting Financial Due Diligence

An outsourced CFO leads comprehensive financial due diligence, examining historical financial statements, cash flows, and debt obligations. They reconcile revenue recognition discrepancies, validate working capital assumptions, and stress-test projections.

By engaging third-party auditors and leveraging digital data rooms, they uncover hidden liabilities, deferred tax exposures, and covenant breaches. They also assess inventory obsolescence and revenue backlog to ensure no material surprises.

2. Assessing Financial Health of Target Companies

An outsourced CFO evaluates the target’s balance sheet, income statements, and cash flow metrics to assess liquidity, leverage, and operational efficiency. They calculate key ratios to benchmark against industry standards.

They identify potential cash flow bottlenecks by examining aging receivables, inventory turnover, and working capital trends. Additionally, analysis of off-balance-sheet items, pension obligations, and contingent liabilities uncover hidden strains.

This assessment of financial health guides deals with pricing and informs post-acquisition integration strategies, ensuring that anticipated synergies are realistic and sustainable. Scrutiny of financial stability at the outset reduces surprises and bolsters confidence in acquisition outcomes.

3. Analyzing Valuations and Deal Structuring

After evaluating target viability, an outsourced CFO advances to analyzing valuations and deal structuring within the M&A framework, ensuring deal terms align with strategic objectives and value drivers.

- Enterprise Value Calculation: Employ comparable-company analysis, precedent transactions, and discounted cash flow models to triangulate fair value.

- Deal Structure Design: Advise on asset vs. stock purchase, earn-outs, contingent payments, tranche structures, and tax-efficient clauses to balance risk and reward.

- Synergy Assessment: Quantify cost and revenue synergies, mapping integration savings to support negotiation levers.

- Deal Economics Modeling: Develop pro forma income statements and balance sheets reflecting financing costs, tax effects, and integration expenses.

- Financing Scenario Planning: Evaluate debt-equity mix, interest rate sensitivity, and covenant impacts to optimize capital structure.

4. Forecasting Future Financial Performance

Building on structured deal terms, the outsourced CFO focuses on forecasting future financial performance, using scenario analysis to validate growth assumptions.

- Revenue Projections: Model base-case, best-case, and worst-case revenue scenarios incorporating market growth and customer retention metrics.

- Cost Forecasting: Forecast operating expenses, integration costs, and synergy realization timelines to predict margin impacts and guide post-acquisition integration budgeting.

- Sensitivity Analysis: Test variances in key drivers, pricing, volume, and input costs, to assess profit volatility.

- Cash Flow Modeling: Simulate free cash flow under different scenarios to inform financing decisions and valuation adjustments.

- Scenario Planning: Incorporate macroeconomic shocks, currency fluctuations, and competitive responses to stress-test forecasts.

5. Overseeing Financing and Capital Structure for the Acquisition

An outsourced CFO designs and manages the optimal capital structure for the acquisition, balancing debt and equity to minimize the cost of capital. They negotiate loan terms, interest rates, maturities, covenants, and explore alternative financing vehicles such as mezzanine debt or private equity tranches.

By modeling leverage ratios and debt-service coverage, they ensure the target can support post-close obligations. They also assess refinancing options and interest-rate hedges to mitigate volatility. They coordinate equity raises, pitch decks, and investor due diligence to secure timely funding and stakeholder alignment.

6. Managing Risk and Identifying Potential Red Flags

An outsourced CFO establishes robust financial risk management in acquisitions to spot deal-breaking issues early. They evaluate credit exposures, operational liabilities, and regulatory contingencies across the target’s business units.

By conducting scenario analysis, they stress-test exposure to market downturns, currency fluctuations, and supply-chain disruptions. Their red-flag checklist identifies anomalies in related-party transactions, off-balance-sheet commitments, and compliance gaps.

7. Ensuring Regulatory Compliance

As compliance demands intensify, an outsourced CFO will ensure regulatory compliance and coordinate all filings and approvals to avoid delays.

They prepare and file regulatory notifications, such as Hart-Scott-Rodino (HSR) submissions, ensuring accuracy and timeliness. Under the HSR Act, parties must wait 30 days (or 15 days for cash tender offers) before closing a transaction.

They interface with antitrust and industry regulators, respond to information requests, and secure necessary waivers. In sectors requiring industry-specific approval, such as healthcare or finance, they maintain thorough documentation and manage audit trails.

Learn More: What does an outsourced CFO do

How an Outsourced CFO Supports Acquisition Integration

When an acquisition closes, an outsourced CFO immediately pivots to unifying disparate financial platforms, which is critical for sustaining value and ensuring smooth integration. Standardizing processes and data flows eliminates reporting gaps and accelerates decision-making. Below, we examine four key integration tasks.

Aligning Financial Systems Post-Acquisition

An outsourced CFO consolidates ERPs, general-ledger platforms, and reporting tools into a single architecture. They map chart-of-accounts differences, reconcile transaction codes, and automate data feeds to prevent manual errors.

Enforcing standardized workflows and controls cuts cycle times and enhances visibility. Through expert financial advisory services, they configure dashboards that deliver real-time KPIs, ensuring leadership bases strategic moves on accurate, timely data.

Managing Cultural and Operational Integration

Successful post-acquisition integration demands more than systems work; it requires blending cultures and aligning operations under unified goals.

- Stakeholder Alignment: The outsourced CFO facilitates workshops to harmonize financial policies, KPIs, and performance incentives across legacy teams.

- Communication Protocols: They establish regular town halls and reporting cadences that bridge geography and hierarchy, reducing anxiety and turnover during transition.

- Operational Playbooks: By documenting best practices from both organizations, they create a hybrid operations manual that accelerates process adoption.

Streamlining Financial Reporting and Governance

With cultures aligned, the outsourced CFO tightens governance by embedding clear reporting standards and controls.

- Pro Forma Compliance: They ensure pro forma statements reflect acquisition effects, as required when acquisitions exceed 50% significance in aggregate under SEC S-X Article 11.

- Policy Consolidation: They merge accounting policies into a singular manual, reducing restatements.

- Governance Framework: They form a cross-functional steering committee that monthly reviews financial results, compliance risks, and audit findings.

Optimizing Cash Flow and Working Capital Post-Acquisition

Post-close, an outsourced CFO refine cash-management practices to free up liquidity for growth. They renegotiate payment terms, centralize treasury functions, and implement cash-forecast models that align with new business cycles.

They shrink DSO and reduce working-capital requirements by deploying automated collections systems and dynamic discounting. They also optimize inventory levels using just-in-time principles, lowering holding costs and risk.

Learn More: Outsourced CFO services for budgeting and forecasting

The Role of an Outsourced CFO in Risk Management During Acquisitions

Proactive risk oversight ensures deal success and protects stakeholder value when navigating acquisitions. Outsourced CFO acquisition strategies embed rigorous controls and analytic frameworks to manage uncertainties and legal demands, leveraging financial risk management best practices.

Identifying and Mitigating Financial Risks

An outsourced CFO spearheads the early identification of deal-threatening financial exposures, then develops mitigation plans:

- Credit and Counterparty Risk: They analyze target receivables aging and supplier concentration to cap exposure.

- Market and Liquidity Risk: By stress-testing cash-flow scenarios, they ensure access to financing under adverse conditions.

- Hidden Balance-Sheet Liabilities: They scrutinize off-balance-sheet leases, pension shortfalls, and contingent litigation reserves.

- Integration Cost Overruns: Tracking actual vs. budgeted integration spend prevents budget leakage.

Managing Uncertainty with Scenario Analysis

To navigate volatile market conditions, an outsourced CFO constructs dynamic models that project outcomes under varied assumptions:

| Scenario Type | Approach | Purpose |

|---|---|---|

| Revenue Sensitivity | Model ±10 to 20% price and volume changes | Gauge EBITDA swings under market fluctuations |

| Cost Variability | Stress-test ±5% raw-material cost scenarios | Assess margin resilience to input cost inflation |

| Financing Stress | Simulate +200 basis point interest-rate hikes | Measure the impact on debt service coverage ratios |

| Synergy Realization | Chart best-, base-, and worst-case synergy capture timelines | Set realistic integration targets and track progress |

Ensuring Compliance with Legal and Regulatory Standards

An outsourced CFO navigates the complex legal landscape, coordinating all mandatory filings and approvals. They manage pre-merger notifications and monitor antitrust thresholds to prevent injunctions.

In regulated industries (e.g., healthcare, financial services), they secure sector-specific signoffs and maintain audit-ready documentation. By embedding compliance checkpoints into project plans, they avert fines and delays that can erode deal value.

Addressing Potential Tax Implications of the Acquisition

An outsourced CFO structures transactions to optimize tax outcomes and avoid post-close surprises. They evaluate asset vs. stock purchase elections, analyzing stepped-up basis impacts and potential depreciation benefits.

Key Benefits of Using an Outsourced CFO for Acquisitions

Businesses reap significant rewards when evaluating mergers and acquisitions strategy by leveraging an outsourced CFO’s specialized expertise. From cost savings to sharper decision-making, these benefits accelerate deal success and safeguard value.

Access to Expert Financial Knowledge Without Full-Time Costs

An outsourced CFO delivers veteran-level acquisition financial planning and analysis, eliminating the expense of a full-time hire. You gain immediate access to advanced modeling, capital-structure expertise, and treasury management best practices.

SMEs increasingly recognize this value: 37 percent of firms outsource at least one financial function to control costs and scale expertise as needed.

Objective Perspective on Financial and Strategic Decisions

An outsourced CFO brings an unbiased, third-party lens to your acquisition integration strategy. They challenge internal assumptions and highlight risks that insiders may overlook.

- Independent Valuations: Use market-based multiples and precedent transactions analyses to set fair purchase prices.

- KPI Alignment: To objectively track success, define clear targets; such as post-acquisition EBITDA growth or working-capital ratios.

- Risk Transparency: Surface contingent liabilities, aggressive revenue recognition practices, or off-balance-sheet exposures.

Improved Efficiency and Speed in the Acquisition Process

By streamlining core processes, an outsourced CFO reduces deal timelines and accelerates post-acquisition integration. They coordinate due diligence, negotiate financing, and secure regulatory approvals in parallel. Consider the Hart-Scott-Rodino (HSR) premerger notification:

| HSR Waiting Type | Standard | Cash Tender Offer / Bankruptcy |

|---|---|---|

| Initial Waiting Period | 30 days | 15 days |

| Second Waiting Period | 30 days | 10 days |

Reduced Risk Through Comprehensive Financial Due Diligence

An outsourced CFO fortifies your deal by executing deep financial due diligence across all business lines. They validate historical cash flows, reconcile balance-sheet discrepancies, and stress-test covenant compliance scenarios.

Their rigorous approach uncovers hidden liabilities and quantifies integration cost overruns.

Smooth Transition During Post-Acquisition Integration

A seamless acquisition hinges on coordinated execution across finance, operations, and culture. An Outsourced CFO orchestrates this transition by:

- Systems Unification: Merging ERPs and reporting platforms under a standardized chart-of-accounts.

- Governance Alignment: Establishing joint steering committees to monitor performance metrics and compliance.

- Cash-Flow Optimization: Centralizing treasury functions and optimizing working-capital cycles for the combined entity.

Steps to Take When Working with an Outsourced CFO on an Acquisition

Clear collaboration steps ensure you harness their expertise effectively. By aligning objectives, due diligence protocols, and integration roadmaps, you set the stage for a successful acquisition.

Establish Clear Acquisition Goals and Objectives

Before diving into numbers, define what success looks like. An outsourced CFO collaborates to:

- Articulate Strategic Rationale: Align the acquisition with growth targets (market share, new capabilities) and document desired outcomes.

- Set Financial Metrics: Agree on KPIs; EBITDA accretion, ROIC thresholds, and payback periods, to measure deal success.

- Define Integration Scope: Specify which functions, geographies, and systems must converge post-close.

Collaborate on Financial Due Diligence and Valuation

With objectives clear, your outsourced CFO leads a structured due diligence process. Together you:

- Standardize Data Requests: Use a secure virtual data room with templates for financial statements, contracts, and forecasts.

- Map Valuation Assumptions: Review comparable-company multiples, precedent transactions, and DCF inputs to ensure alignment on value drivers.

- Coordinate Expert Inputs: Schedule sessions with tax, legal, and operational advisors to validate liabilities, synergies, and integration costs.

Develop a Detailed Post-Acquisition Integration Plan

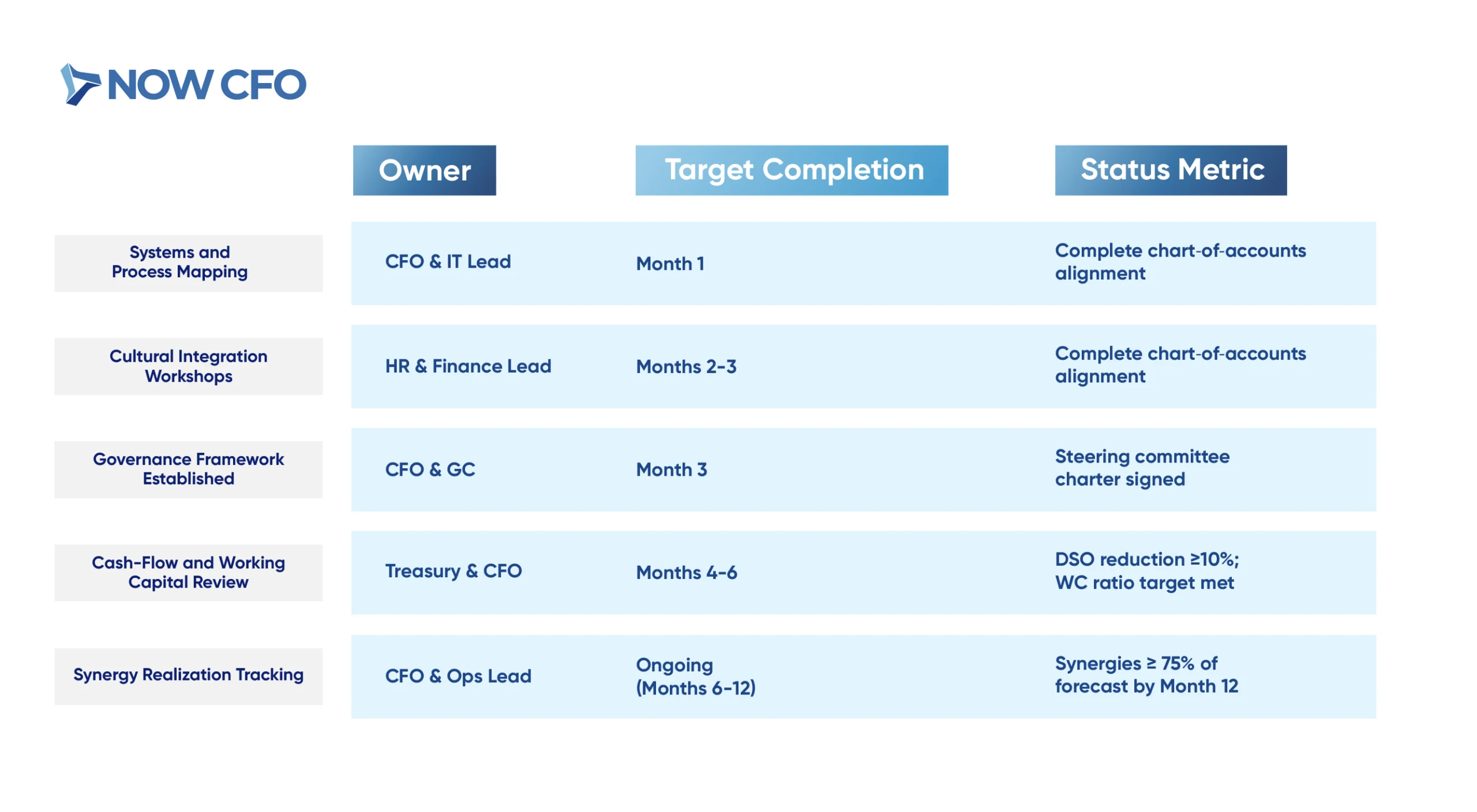

Effective post-acquisition integration hinges on a phased roadmap. Your outsourced CFO helps draft a plan featuring timelines, owners, and deliverables:

Monitor Financial Performance Post-Acquisition

After close, your outsourced CFO sets up a dashboard to track actual vs. projected performance:

- Regular Reporting Cadence: Weekly cash-flow snapshots and monthly P&L reviews keep stakeholders informed.

- KPI Variance Analysis: Highlight deviations in revenue, margins, and working capital to trigger corrective actions.

- Integration Spend Controls: Compare integration expenses against budgets to prevent cost overruns.

Adjust Acquisition Strategy as Needed Based on Insights

Finally, leverage real-time insights to refine your approach:

- Scenario Re-Forecasting: Revisit base-case, best-case, and worst-case models if market conditions shift.

- Reprioritize Integration Actions: Accelerate high-ROI synergies and delay non-critical tasks to optimize resource allocation.

- Governance Checkpoints: Hold quarterly steering committee meetings to reassess targets and approve strategy pivots.

How to Choose the Right Outsourced CFO for Managing Acquisitions

Selecting the right outsourced CFO can determine the success or failure of your acquisition. Here’s how to choose for seamless acquisition integration and risk mitigation.

Look for Experience in Managing Mergers and Acquisitions

A qualified outsourced CFO should bring extensive hands-on experience leading M&A across industries and deal sizes. They need familiarity with every stage: due diligence, valuation, deal structuring, and integration.

Look for evidence of successful transactions, particularly where the CFO delivered tangible financial outcomes such as EBITDA improvement, working capital optimization, or successful synergy realization.

Assess Their Ability to Conduct Thorough Financial Due Diligence

Once you’ve confirmed acquisition experience, evaluate their due diligence capabilities. An effective outsourced CFO will:

- Audit Financial Statements: Review P&L, balance sheets, and cash flow to validate historical performance.

- Identify Liabilities: Uncover off-balance-sheet risks, tax exposures, and contingent obligations.

- Test Assumptions: Validate revenue, margin, and synergy assumptions against realistic benchmarks.

Verify Their Track Record in Post-Acquisition Integration

A successful acquisition doesn’t end at closing; it depends on seamless post-acquisition integration. When selecting, review their history of:

- Financial Systems Alignment: Unifying ERPs and reporting platforms to ensure data consistency.

- Governance Implementation: Establishing reporting standards, controls, and steering committees.

- Synergy Delivery: Tracking integration KPIs and ensuring cost and revenue synergies materialize.

Ensure Strong Communication and Analytical Skills

Beyond technical expertise, your outsourced CFO must be an effective communicator capable of translating complex financial data into actionable insights. Look for someone who can:

- Facilitate Cross-Functional Alignment: Collaborate with legal, tax, HR, and operations teams.

- Present to Leadership: Articulate the deal risks, value drivers, and strategic trade-offs to the board.

- Deliver Clear Reports: Provide concise, KPI-driven updates that support fast, informed decisions.

Confirm Their Alignment with Your Business’s Acquisition Goals

Finally, ensure your outsourced CFO understands and supports your broader strategic vision. Whether your goals involve market expansion, vertical integration, or financial consolidation, they must align financial models, risk assessments, and integration plans accordingly.

They should ask the right questions and adapt their approach to your industry, size, and resources. A CFO misaligned with your objectives can inadvertently undermine the deal’s value, even with technical competence.

Conclusion: Achieving Successful Acquisitions with an Outsourced CFO

Acquisitions are among the most impactful and complex strategic moves a business can make. While they can drive growth and unlock new market opportunities, they require careful financial planning, rigorous due diligence, and seamless post-acquisition integration.

If your company is considering an M&A, NOW CFO offers the fractional financial leadership you need to execute with precision. Schedule a free consultation today and connect with our team for a robust financial strategy.