Effective budgeting and forecasting are critical foundations for business success. Compellingly, small businesses have created over 70% of net new jobs since 2019, underscoring their economic influence.

Companies can access elite financial forecasting strategies, cash flow planning, and budget management services by partnering with an outsourced CFO.

What Is Budgeting and Forecasting?

Connecting the broad concept of budgeting and forecasting to actionable business planning sets the stage for more profound insight.

Understanding the Difference Between Budgeting and Forecasting

Budgeting is a detailed financial road map for expected income and expenses. It is grounded in historical data and conservative estimates. It outlines what your business plans to achieve and where resources will go.

In contrast, forecasting and financial modeling involve projecting future trends based on real-time data, market shifts, and predictive analytics. Forecasts are updated regularly, ensuring your numbers stay relevant as conditions change.

Why Accurate Budgeting and Forecasting Are Crucial for Business Success

Accurate budgeting and forecasting are essential for businesses to operate confidently and strategically. Here are the key reasons:

- Cash Flow Planning & Liquidity: Reliable forecasts help ensure you always have enough cash to cover payroll, supplier bills, and unexpected costs.

- Informed Decision-Making: With precise forecasts, entrepreneurs can identify when to expand, hire, or tighten belts, supporting strategic financial planning that aligns with long-term goals.

- Risk Reduction & Contingency: Businesses with accurate forecasts spot potential downturns early, allowing proactive budget adjustments or cost-saving moves.

- Investor & Lender Confidence: Firms that routinely deliver on budgets build credibility.

- Resource Optimization: Knowing likely outcomes prevents over- or under-investment in inventory, marketing, or staffing.

How Outsourced CFO Services Enhance Budgeting and Forecasting

Outsourced CFOs bring specialist skills that elevate both planning and predictive financial performance.

Providing Expertise in Financial Modeling and Forecasting Techniques

Outsourced CFOs apply advanced financial forecasting strategies and forecasting and financial modeling methods to improve your planning accuracy. They build robust models to project various business scenarios and assess potential risks.

These professionals continuously refine models by integrating real-time market data, enabling you to see outcomes under different conditions (e.g., price changes, demand shifts). Their modeling incorporates historical performance and predictive analytics to simulate results, improving strategic decision-making with greater confidence.

Developing Accurate and Realistic Budgets for Business Growth

Outsourced CFOs craft budgets that align closely with growth objectives. Their process includes:

- Deep Analysis of Past Data: Using historical trends to set realistic projections.

- Targeted Forecasting: Incorporating seasonality, market expansion, and cost inflation.

- Stakeholder Collaboration: Ensuring budgets reflect operational realities and growth goals.

- Sensitivity Tests: Assessing how variations like a 10% sales dip or wage hikes affect cash flows.

- Periodic Reviews: Adjusting quarterly to stay informed and adaptive.

Improving Financial Decision-Making with Data-Driven Forecasts

Outsourced CFOs embed financial forecasting strategies into operations to shift decision-making from intuition to evidence. They deliver clear dashboards tracking key metrics such as revenue per product line, margins, and expense ratios. That visibility helps leadership quickly identify trends.

They also run scenario analyses, evaluating the outcomes of price changes, hiring plans, or investment decisions. Your team can make clear decisions by quantifying impacts on cash flow and profitability. In addition, comparing forecasts vs. actual results highlights forecasting accuracy over time, enabling continuous refinement.

Streamlining Cash Flow Management Through Better Planning

In addition to improved forecasts, outsourced CFOs enhance cash flow planning by:

- Analyzing cash conversion cycles and liquidity patterns.

- Designing cash flow forecasts that predict monthly/quarterly inflows and outflows.

- Advising on Net 30/60 terms to speed up receivables and optimize payables.

- Identify seasonal dips and implement lines of credit or savings buffers in advance.

- Automating cash tracking and metrics reporting for real-time insights.

Aligning Financial Plans with Long-Term Business Goals

Outsourced CFOs bridge day-to-day finance with strategic milestones:

- Interpret your vision: expansion, acquisitions, or innovation, and translate it into financial terms.

- Develop multi-year forecasts that map budget allocations, investment needs, and funding strategies.

- Conduct break-even and ROI analyses to prioritize initiatives that offer the best returns.

- Establish financial KPIs tied to growth in drivers (e.g., revenue per client, capital ROI).

- Track progress monthly, adapting forecasts to reflect new market trends, regulatory changes, or performance feedback.

Key Benefits of Outsourcing CFO Services for Budgeting and Forecasting

Building on the foundation of better budgeting and forecasting, outsourcing CFO services delivers tangible advantages.

Access to Specialized Expertise and Financial Insights

Outsourced CFOs bring a wealth of specialized expertise and actionable financial insights that internal teams often lack. They stay current on emerging financial forecasting strategies and regulatory updates.

Detailed Benefits:

- Niche Skill Sets: Outsourced CFOs are versed in advanced analytical tools—Monte Carlo simulations, scenario planning, and variance analysis, ensuring that your budgeting and forecasting reflect real-world dynamics.

- Cross-Industry Perspective: Having worked across sectors, they introduce best practices and benchmarks, giving you a competitive edge.

- Real-Time Advisory: Their insights help refine forecasts, optimize cost structures, and identify revenue opportunities before issues escalate.

- Technical Credibility: They bring credibility for stakeholder engagements—from investors to lenders, backed by rigorous, data-driven reports.

Cost-Effective Solution Compared to In-House CFOs

Outsourced CFOs provide financial leadership at a fraction of a full-time executive’s cost.

| Comparison | In-House CFO | Outsourced CFO |

|---|---|---|

| Base Salary + Benefits | $400K/year + perks | Pay-as-you-go model |

| Recruitment Costs | $30–$50K upfront | Included in service fees |

| Training & Software | Own training and licenses | Included or subsidized |

| Flexibility | Fixed cost regardless of workload | Adjust to business needs |

| ROI | Costly during slow growth | Scales revenue-to-cost ratio |

Flexibility to Scale Services as Business Grows

Outsourced CFOs adapt to your evolving needs. Whether launching new products, expanding markets, or navigating rapid growth, they adjust their focus and resources accordingly.

- Modular Engagements: Scale services up or down, say, during fundraisers or seasonal peaks, without overhead.

- Custom Expertise: Tap into specialists for debt structuring, M&A, or SaaS metrics as required.

- On-Demand Support: Get extra capacity during audits, budgeting cycles, or strategic initiatives, then scale back during quieter periods.

- Geographic Reach: Access financial talent with global or local nuances, ideal for international expansion.

Improved Forecasting Accuracy Through Advanced Analytics

Outsourced CFOs leverage advanced analytics to significantly enhance forecast precision, driving more accurate budgeting and forecasting.

Key Enhancements:

- Predictive Modeling: They incorporate statistical tools like ARIMA and LSTM, which reduce forecasting errors by up to 84–87% compared to traditional methods.

- Real-Time Data Integration: Forecasts continuously pull from ERP, CRM, and market APIs, enabling rolling forecasts that adapt swiftly.

- Dashboards & KPIs: Custom dashboards visualize key indicators (e.g., CAC, LTV, AR turnover), making trends visible at a glance.

- Anomaly Detection: Automated systems flag deviations early, preventing budget overruns and cash crunches.

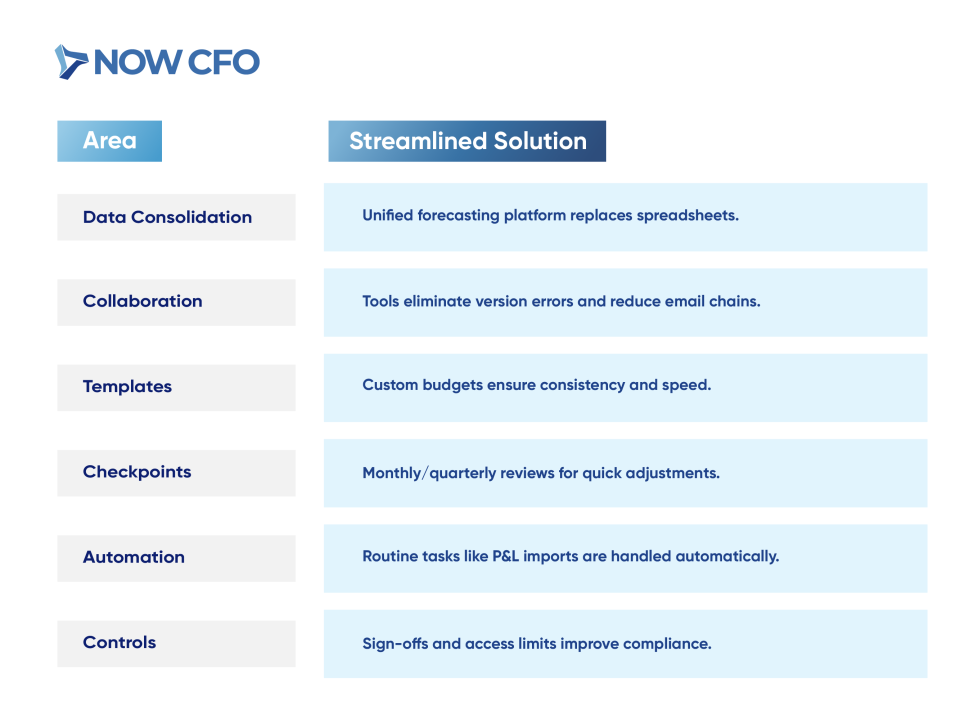

More Efficient Budget Management with Streamlined Processes

Outsourced CFOs transform budgeting into a streamlined, efficient process:

Learn More: Benefits of hiring an outsourced CFO.

How Outsourced CFOs Help Optimize Cash Flow Through Better Budgeting

Outsourced CFOs sharpen cash flow management by embedding detailed projections, controls, and contingency plans into your financial strategy.

Monitoring and Adjusting Cash Flow Projections

Outsourced CFOs continuously monitor cash flow planning by comparing actual inflows and outflows against forecasts. They conduct weekly or monthly variance analysis, tracking discrepancies in receivables, payables, and operating costs.

They also refine cash flow models based on trends, such as shifting customer payment behavior or supplier pricing changes. Updating the budgeting and forecasting with live data prevents liquidity shortfalls.

Identifying Cost-Saving Opportunities and Reducing Expenses

A proactive outsourced CFO doesn’t just watch cash; they uncover savings and cut waste.

Key tactics:

- Vendor Negotiation: Renegotiate payment terms, volume discounts, or bundled services; even a 5% reduction can save tens of thousands annually.

- Expense Audits: Review recurring services (e.g., software, subscriptions), cancelling dormant accounts, and ensure utilization aligns with value.

- Process Automation: Implement low-cost automation (e.g., accounts payable workflows) to reduce manual errors and associated late fees.

- Headcount Efficiency: Use forecasting to identify underutilized labor costs and realign staffing to peak periods.

- Energy & Overhead: Evaluate utility usage, lease agreements, and facility costs—minor optimizations often yield measurable savings.

Improving Cash Flow Forecasting for Greater Liquidity

Outsourced CFOs enhance financial forecasting strategies to ensure your business maintains sufficient liquidity. They integrate more dynamic data sources into cash flow models to predict tight periods in advance.

They also apply stress-testing scenarios: What happens if sales drop 20% or a major receivable is delayed? This forecast identifies minimum liquidity thresholds and required financing.

Implementing Financial Controls to Manage Cash Flow More Effectively

Outsourced CFOs establish controls that safeguard cash. They set approval thresholds, mandate dual signoffs for large disbursements, and tighten bill payment timetables. They also segregate duties, ensuring that no single employee handles invoice creation, approval, and payment, reducing fraud risk.

Automated reminders for receivables reduce aging balances, while scheduled reviews flag anomalies immediately. Regular reconciliation of bank and cash accounts becomes routine, ensuring accuracy and preventing leaks.

Creating Financial Contingency Plans for Unexpected Costs

Outsourced CFOs prepare you for the unexpected by building contingency budgets tied to worst-case scenarios. They allocate a percentage of monthly revenue to reserves or credit line capacity. They also map out triggers for deploying those reserves: major equipment failures, supplier disruptions, or economic shocks.

They prepare action plans, such as renegotiating supplier terms, delaying non-essential capital expenditures, or drawing on reserves. These strategies become part of your strategic financial planning toolkit, ensuring you can maintain operations and payroll even under stress.

Steps to Improve Budgeting and Forecasting with an Outsourced CFO

Outsourced CFOs guide businesses through a step-by-step process to enhance budgeting and forecasting accuracy and agility.

Conducting a Comprehensive Financial Assessment

Outsourced CFOs begin with a thorough financial assessment to establish a solid baseline. They identify trends in revenue, expense patterns, and working capital cycles, revealing areas for efficiency gains or structural improvement.

- Ratio & Trend Analysis: Calculate gross margin, operating margin, current ratio, and debt-to-equity to benchmark financial health.

- Cash Flow Evaluation: Examine receivables, payables, and inventory turnover to pinpoint liquidity bottlenecks.

- Forecast vs. Actual Review: Compare past projections with outcomes, measuring forecast accuracy through metrics like MAPE (Mean Absolute Percentage Error).

- Stakeholder Interviews: Engage management to understand drivers, pain points, and strategic priorities.

- System Audit: Assess current tools (ERPs, forecasting platforms) for data integrity and integration readiness.

Setting Realistic Budgeting Goals Based On Historical Data

Outsourced CFOs leverage past performance to define achievable goals. They analyze seasonal patterns, revenue volatility, and expense fluctuations over multiple cycles. Adjusting for outliers and one-time events, they craft budget targets rooted in business behavior.

Implementing Advanced Forecasting Tools and Technologies (≈330 words)

To elevate accuracy, outsourced CFOs introduce robust forecasting tools and tech solutions. They implement software integrating accounting platforms, CRM, sales, and market data.

Key Elements:

- Integrated data pipelines

- Scenario modeling features

- Dashboard visualization

- Collaboration tools

- AI-enhanced forecasting

Monitoring Key Financial Metrics and Performance Indicators

Once systems are in place, outsourced CFOs continuously monitor essential metrics. They build dashboards tracking:

Critical Metrics:

- Cash burn rate & Cash runway

- Gross and operating margin

- Days Sales Outstanding (DSO) & Days Payable Outstanding (DPO)

- Forecast accuracy metrics

- Working capital ratio

Adjusting Budgets and Forecasts as Market Conditions Change

When markets shift, outsourced CFOs steer timely budget revisions and forecast updates.

| Trigger Condition | Adjustment Action |

|---|---|

| Sudden revenue drop (>10%) | Reforecast cash flow, pause discretionary spending |

| Cost inflation (+5–8%) | Update expense budgets, adjust pricing assumptions |

| New product or expansion | Integrate new revenue/cost lines and capital needs |

| Regulatory change | Model compliance cost impacts on margins |

| Seasonal deviation (±15%) | Refresh forecasts and budgets to match current trends |

Benefits of Accurate Budgeting and Forecasting for Business Growth

Enhancing business growth begins with robust budgeting and forecasting, establishing stability, and fueling strategic expansion.

Improved Financial Stability and Profitability

Accurate budgeting and forecasting help secure a stable financial foundation by realistically aligning spending with revenue.

1. Predictable Cash Flow Buffer: Businesses avoid sudden shortfalls by projecting inflows and matching them to expenses.

2. Margin Improvement through Expense Management: Forecast-driven budgets highlight cost inefficiencies, allowing targeted cuts.

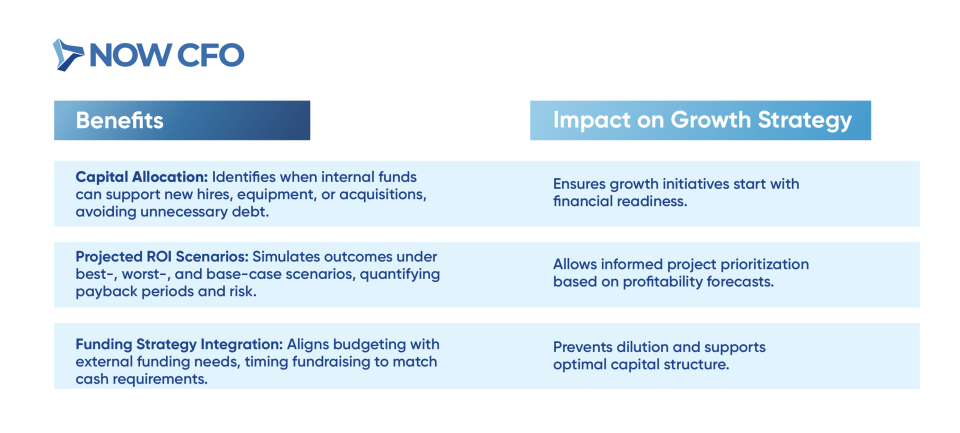

Enhanced Ability to Plan for Future Investments and Growth

Accurate forecasts empower strategic investment decisions by aligning forecasts and capital planning.

Reduced Financial Risk Through Proactive Planning

Forecast-driven budgets help companies anticipate and manage risk before it escalates. Businesses can establish contingency actions by simulating external pressures, like tightening variable costs or drawing down credit lines.

This budgeting and forecasting approach reduces risk by enabling early detection of red flags. When revenue underperforms, contingency budgets can delay non-essential spending, preventing crises.

Better Decision-Making with Reliable Financial Projections

Reliable forecasts turn budgeting into a strategic tool, not just a reporting exercise.

- Informed Operational Choices: Based on forecasted ROI, CFOs can determine optimal hiring timelines, marketing investment levels, or production scale-up.

- Scenario-Based Planning: When contemplating new market entry or pricing changes, projections help quantify the impact on revenues and margins.

- Comparative Results: Forecast vs. actual reporting highlights model accuracy and informs improvements in forecasting and financial modeling frameworks.

Stronger Investor Confidence Through Transparent Financial Reporting

Investors and lenders value clarity and consistency. Presenting detailed, transparent budgets and forecasts backed by credible assumptions strengthens credibility. When investors see robust budgeting and forecasting tied to KPIs and scenario paths, confidence in management grows.

Outsourced CFOs elevate this process by translating complex models into accessible narratives and dashboards, ensuring stakeholders understand assumptions, risks, and strategies. This reinforces governance and positions your company as investment-ready.

How to Choose the Right Outsourced CFO for Budgeting and Forecasting

Selecting the ideal outsourced CFO ensures your budgeting and forecasting efforts translate into real strategic value and growth.

Look For Expertise in Financial Planning and Analysis

Begin by evaluating a candidate’s depth in financial planning and analysis. They should master preparing detailed budgets, conducting variance analysis, and modeling cash flow scenarios.

Ask for examples of summary dashboards or monthly reports they’ve produced. FP&A expertise ensures your budgeting and forecasting are grounded in analytical rigor, improving resource allocation and aligning spending with strategy.

Assess Their Ability to Develop Custom Financial Models

An outsourced CFO must excel at building forecasting and financial modeling tailored to your business. Inquire about model complexity; do they create multi-scenario projections, break-even analyses, or funding-growth ROI dashboards?

Ask to review samples or walk through a model. Models should be dynamic (e.g., allowing pricing or volume tweaks) and transparent, enabling you to adjust assumptions independently.

Verify Their Track Record in Improving Forecasting Accuracy (≈240 words)

Ask for metrics on forecast precision. A top-performing CFO should provide historical comparisons. Third-party certifications (e.g., CFA, FP&A) or case studies add credibility.

Firms with structured forecasting (like rolling forecasts) reduce variance. This reflects mastery in budgeting and forecasting, boosting confidence that their interventions produce measurable gains.

Ensure They Have Experience in Managing Cash Flow and Budgets

Thorough cash flow planning and budget control experience matters. Verify they’ve handled working capital cycles, receivables/payables optimization, and contingency budgets.

- Cash Cycle Management: Ask how they improved DSO/DPO ratios in previous roles.

- Budget Control Systems: Explore their use of approval workflows, zero-based budgeting, or rolling forecasts to maintain discipline.

- Real-Time Monitoring: They should know how to set up dashboards with key metrics (e.g., burn rate, runway, variance alerts).

- Crisis Response: Ask for examples where they protected liquidity during downturns or surprise expenses.

Confirm Their Alignment with Your Business’s Financial Goals

Your outsourced CFO must share your vision and understand industry specifics.

- Strategic Fit: Gauge whether they prioritize your growth areas, such as geographic expansion, product development, or margin improvement.

- Customization Flexibility: Can they adapt models and reporting to reflect your market seasonality, customer dynamics, or regulatory environment?

- Communication Style: Ensure they can translate complex budgeting and forecasting models into clear visual tools and actionable summaries for stakeholders.

- Cultural Alignment: Evaluate whether their process matches your company’s pace and decision-making preferences.

- Long-Term Vision: They should propose multi-year plans and funding strategies linked to your business objectives, not just short-term budgets.

Learn More: Outsourced CFO vs Full-Time CFO

Conclusion: Achieving Financial Success with Outsourced CFO Services for Budgeting and Forecasting

Investing in accurate budgeting and forecasting through an outsourced CFO offers transformative results. Businesses gain a strategic edge and operational discipline by integrating cutting-edge analytics, customized financial modelling, and adaptive budget frameworks.

If you’re ready to elevate your financial planning and propel your business forward, connect with NOW CFO. You can schedule a complimentary consultation to explore tailored CFO solutions.