Ensuring operational efficiency and financial integrity is no longer optional for SMEs; it’s essential. At the heart of these efforts lies the role of internal controls, a system of policies, processes, and monitoring tools designed to safeguard assets, promote transparency, and prevent costly errors or fraud.

For business owners, CFOs, and entrepreneurs, understanding and implementing effective internal controls is key to building a resilient organization that can withstand evolving risks. 69% of board members rank internal controls among their top three priorities for organizational resilience.

What are Internal Controls and Why are They Important?

Strong governance begins with a clear grasp of the role of internal controls today. By defining what these controls entail and examining their tangible effects, organizations can appreciate how internal controls for business operations underpin financial integrity and risk mitigation.

Defining Internal Controls in Business

Internal controls are the policies, procedures, and mechanisms that an organization puts in place to ensure the accuracy of its financial reporting, safeguard assets, and promote operational efficiency. They establish standardized workflows that deter errors and detect discrepancies.

These controls form the backbone of a company’s internal control systems, guiding employees through predefined checks and balances. A robust control environment begins with management’s commitment: setting a “tone at the top” that emphasizes accountability and ethical behavior.

The Impact of Internal Controls on Business Operations

Internal controls extend beyond mere compliance; they reshape an organization’s daily operations. When controls align with strategic objectives, they enhance transparency and instill stakeholder confidence. Consider these key operational benefits:

Automated reconciliations and dual-approval processes reduce errors in ledgers and financial statements.

Enhanced Risk Management

- Proactive risk assessments identify potential vulnerabilities before they materialize.

- Embedding risk checkpoints into workflows helps organizations adapt controls as business needs evolve.

Streamlined Compliance

- Standardized control activities ensure adherence to regulations such as Sarbanes–Oxley and industry-specific mandates.

- Continuous monitoring simplifies audit processes, reducing compliance costs.

Operational Transparency and Accountability

- Clear documentation of control procedures promotes employee accountability and reduces conflicts of interest.

- Real-time dashboards give executives visibility into transaction flows, supporting data-driven decision-making.

Fraud Prevention and Detection

- Detective controls: such as periodic transaction reviews—catch irregularities quickly.

- Preventive measures, like mandatory vacations for finance staff, deter collusion.

Key Functions of Internal Controls in Business

Examining their core functions is vital to appreciate the role of internal controls. These functions, from ensuring financial accuracy with internal controls to fraud prevention, form a cohesive system that underpins every facet of operations.

Financial Accuracy and Integrity

Accurate financial reporting begins with well-designed controls that verify transaction data at each step. The role of internal controls mandates dual approvals, systematic reconciliations, and clear audit trails to catch errors before they affect the general ledger.

By enforcing standardized documentation, organizations can consistently produce reliable financial statements. Effective controls also facilitate timely adjustments, reducing the need for disruptive restatements.

Fraud Prevention and Detection

To counteract fraudulent schemes, organizations must integrate both preventive and detective measures. Internal controls prescribe proactive strategies to deter misconduct. Once deployed, detective controls such as transaction monitoring and exception reporting identify anomalies quickly, enabling swift investigation.

- Preventive Controls: Segregate authorization and record-keeping duties to eliminate single-point vulnerabilities. Enforce mandatory leave policies to reveal hidden collusion.

- Detective Controls: Implement real-time transaction reviews to spot irregular patterns. Use data analytics to flag outliers and reconcile discrepancies.

Risk Management and Mitigation

Robust risk management transforms potential threats into manageable scenarios. Internal controls integrate risk assessments into daily workflows, ensuring emerging risks receive timely attention.

- Risk Assessment: Regularly identify and rank risks by likelihood and impact, guiding control prioritization.

- Risk Response: Develop action plans; avoidance, transfer, or acceptance, aligned with organizational risk appetite.

- Ongoing Monitoring: Review control effectiveness and adapt to new risk landscapes.

Regulatory Compliance and Governance

Meeting regulatory mandates demands systematic control frameworks. Internal controls ensure policies reflect current laws and that every transaction meets established criteria. Continuous governance reviews keep the organization audit-ready.

- Policy Enforcement: Embed regulatory requirements into workflows and approval matrices.

- Documentation & Reporting: Maintain audit-quality records to satisfy regulators and external auditors.

- Governance Reviews: Conduct periodic board-level oversight to validate compliance posture.

Protecting Business Assets and Resources

Safeguarding organizational assets relies on layered control defenses. Internal controls mandate physical safeguards (e.g., access controls, CCTV) and digital protections (e.g., restricted permissions) to prevent asset loss.

Companies often deploy:

- Physical Controls: Secure storage, surveillance, and inventory counts.

- Digital Controls: Role-based access, encryption, and cybersecurity protocols.

- Periodic Reviews: Asset audits and surprise inspections to detect misappropriation.

How Internal Controls Strengthen Business Operations

Building on the core functions, the role of internal controls extends into tangible operational enhancements that drive efficiency and accuracy across the organization. Below, we explore how these internal controls for business operations translate into real-world improvements.

Streamlining Financial Reporting and Auditing

Well-designed controls expedite the close process and improve audit readiness. Organizations reduce manual effort and accelerate month-end close by automating reconciliations and embedding approval workflows.

These measures also ensure auditors have direct access to accurate, traceable records, reducing audit queries and facilitating smoother external reviews. When finance teams leverage standardized templates and digital checklists, they eliminate redundancies and focus on high-value analysis rather than data gathering.

Enhancing Decision-Making with Reliable Data

Accurate, timely data is the lifeblood of executive decision-making. Internal controls ensure that performance metrics and financial KPIs derive from validated sources. Controls like automated data feeds, access restrictions, and exception reporting guarantee that leadership reviews only high-integrity information.

With reliable dashboards updated in real-time, CEOs and CFOs can identify trends and respond swiftly to emerging challenges. The National Credit Union Administration provides quarterly Financial Performance Reports within 6–8 weeks of data submission, enabling board members to benchmark performance promptly.

By reinforcing governance and risk management, these controls transform raw numbers into strategic insights.

Ensuring Accountability and Transparency in Operations

The role of internal controls integrates clear ownership and oversight into every process to foster a culture of responsibility.

- Ownership Assignment: Designate responsible individuals for each control activity.

- Documented Workflows: Maintain version-controlled policies and log all approvals.

- Independent Oversight: Conduct periodic, unannounced reviews to verify adherence.

Safeguarding Against Fraud and Errors

Preventing and detecting misstatements requires multi-layered defenses. Internal controls prescribe both preventive measures and detective controls, such as exception reports and variance analyses.

Controls accelerate investigation and resolution by automatically flagging anomalies (e.g., duplicate payments or unusual invoice amounts). In addition, periodic data analytics reviews identify emerging fraud patterns, enabling proactive risk mitigation.

Together, these controls uphold financial accuracy with internal controls and protect organizational assets from intentional and accidental losses.

Reducing Operational Inefficiencies

The effective role of internal controls streamlines workflows by removing redundant tasks and standardizing procedures. Controls like automated invoice matching and electronic approvals replace manual bottlenecks, cutting process cycle times.

By mapping end-to-end processes and embedding controls at key junctures, businesses eliminate handoffs that cause delays. Continuous monitoring dashboards then highlight slow points, guiding targeted improvements.

Best Practices for Implementing Effective Internal Controls

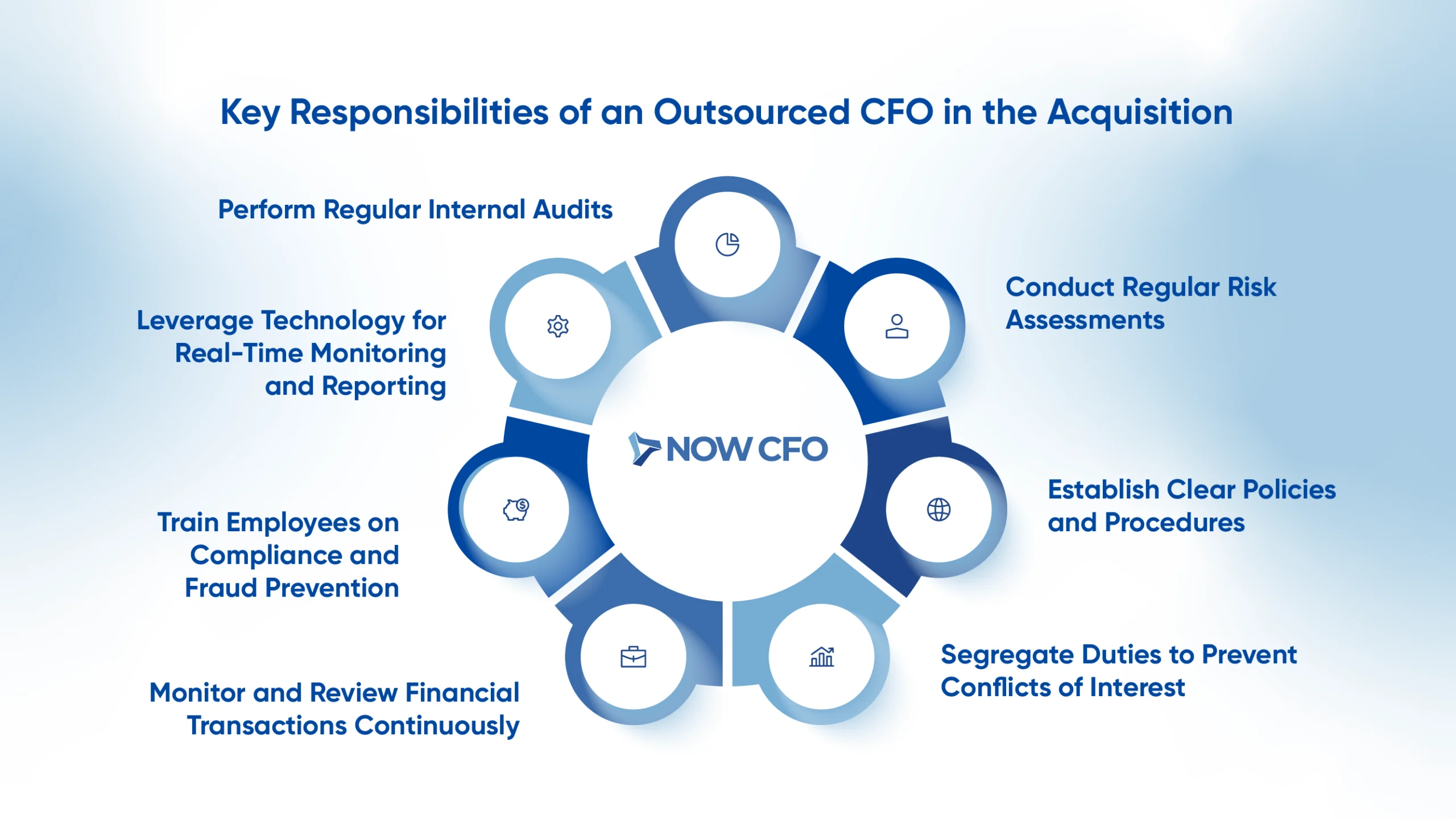

A mature control environment turns theory into action. The following seven best practices translate the role of internal controls into daily habits that fortify operations and inspire stakeholder confidence in your organization’s governance framework.

1. Conduct Regular Risk Assessments

Mapping threats is the first step toward mitigation. Schedule enterprise-wide risk assessments annually, scoring each risk by probability and impact. Engage cross-functional leaders to surface emerging issues and update the risk register immediately after material changes.

Pair qualitative interviews with quantitative data (e.g., variance analyses) to avoid blind spots. Consistent risk reviews align internal controls with strategy and support internal control systems for regulatory compliance by ensuring controls adapt as the business evolves.

2. Establish Clear Policies and Procedures

Policies transform intent into repeatable action. Draft concise, jargon-free process narratives that specify who performs each task, the documentation required, and approval thresholds. Publish these procedures in a centralized, version-controlled repository so employees always consult the latest guidance.

When rules conflict, they escalate to a designated policy steward for rapid clarification. Clarity reduces interpretation errors, which is one of the key best practices for implementing internal controls principle.

3. Segregate Duties to Prevent Conflicts of Interest

To block single-point manipulation, separate authorization, custody, and recording activities. Assign purchase approvals to budget owners, goods receipt to warehouse staff, and invoice entry to accounts payable. Follow up with periodic overlap checks:

- Access-Review Reports: Verify that no user retains incompatible roles.

- Rotation & Mandatory Leave: Force process hand-offs that expose concealed schemes.

- Exception Dashboards: Highlight transactions cleared outside typical paths.

4. Monitor and Review Financial Transactions Continuously

Real-time dashboards convert raw activity into actionable warnings. Configure rules that flag duplicate vendors, round-dollar journal entries, and payments above tolerance limits. Daily exception queues let controllers investigate anomalies long before month-end.

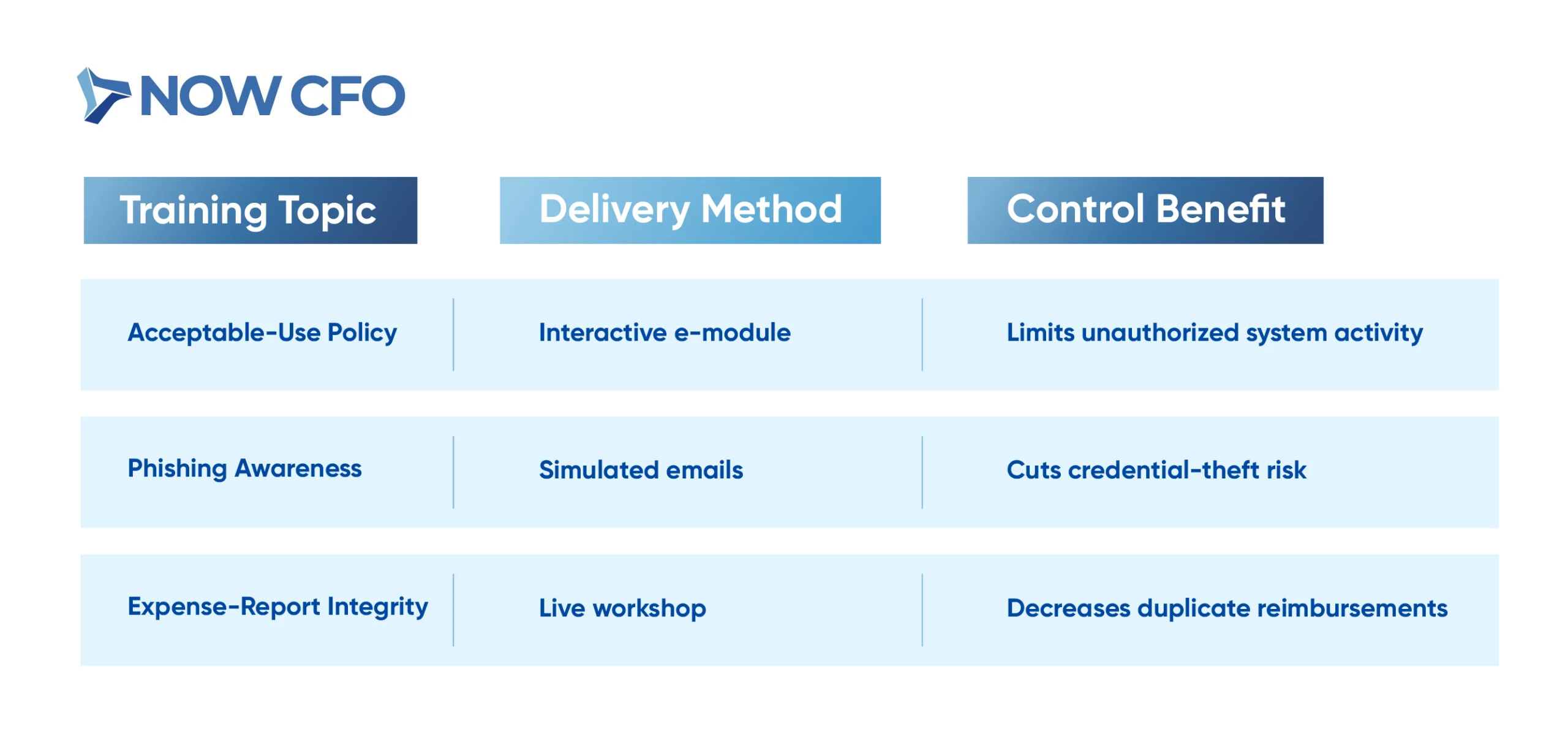

5. Train Employees on Compliance and Fraud Prevention

People are the last and often strongest line of defense. Use blended learning that couples micro-videos with scenario drills, then reinforce lessons through quarterly refreshers.

Institutionalizing learning embeds fraud prevention and internal controls into daily routines.

6. Leverage Technology for Real-Time Monitoring and Reporting

Automation magnifies oversight reach without ballooning headcount. Deploy cloud-based ERPs with built-in control libraries, robotic process automation for three-way-match invoices, and AI anomaly detection that scores transactions by deviation likelihood.

Configure push alerts so executives receive high-risk exceptions instantly. Technology accelerates remediation and supplies immutable logs that satisfy auditors and boosts internal control systems resilience.

7. Perform Regular Internal Audits

Internal audit provides an independent pulse-check on control fitness. Build a rolling audit plan tied to risk rankings, reserving extra hours for volatile processes like revenue recognition or IT change management. Each engagement should:

- Validate control design against objectives.

- Test operating effectiveness via sampling and walkthroughs.

- Recommend pragmatic fixes with clear owners and timelines.

Track findings in a central repository and report quarterly closure rates to the audit committee.

The Role of CFOs in Strengthening Internal Controls

Building on structured best practices, the role of CFOs in strengthening internal controls centers on leadership, strategy alignment, and cross-functional collaboration.

Leading the Design and Implementation of Internal Controls

As chief governance architect, the CFO defines control frameworks, assigns ownership, and oversees rollout across finance and operations. They draft control matrices mapping risks to activities, ensuring every material process has corresponding checks and balances.

CFOs also champion pilot programs to validate workflows before enterprise-wide deployment. Training sessions and regular town halls reinforce the role of internal controls as a strategic priority.

Ensuring Internal Controls Align with Business Strategy

CFOs translate corporate goals into control requirements, embedding financial and operational KPIs within control objectives. They review strategic plans to identify new risk areas, then modify control scopes accordingly. This alignment makes controls enablers rather than roadblocks, supporting agile decision-making.

Using Internal Controls to Support Financial Planning

In financial planning cycles, CFOs leverage controls to validate forecast inputs and scenario analyses. They integrate control checkpoints into budgeting tools, automatically flagging variances beyond tolerance thresholds. This ensures data integrity, instilling confidence in rolling forecasts and long-range models.

During planning workshops, CFOs review control logs from prior periods to refine assumptions, demonstrating governance and risk management in action. By embedding controls into every budgeting stage, they elevate planning from a back-office task to a strategic dialogue.

Collaborating With Other Departments to Maintain Control Integrity

CFOs cultivate partnerships with IT, operations, and HR teams to keep controls robust as business processes evolve. They establish cross-departmental control forums to review system changes, policy updates, and emerging risks.

For example, collaborating with IT ensures that user-access controls mirror procedural policies, while working with HR aligns payroll controls with headcount workflows. Regular joint audits and shared dashboards foster transparency, anchoring risk management through internal controls across functions.

Common Challenges in Internal Control Implementation and How to Overcome Them

Internal controls often stall when practical obstacles arise. Below, we explore four common hurdles and offer targeted strategies to overcome them.

Lack of Employee Buy-In for Internal Controls

Engaging staff is critical for effective internal control systems. When employees view controls as burdensome, compliance drops and errors rise.

- Communicate Purpose: Hold workshops explaining how controls protect the company and individual careers.

- Solicit Feedback: Involve frontline teams in control design to foster ownership and ensure procedures fit real workflows.

- Recognize Compliance: Tie control adherence to performance evaluations and reward contributions to risk mitigation.

Overly Complex Control Systems Leading to Operational Inefficiencies

When controls proliferate unchecked, they can bog down processes and frustrate users.

- Simplify Processes: Map end-to-end workflows, then consolidate redundant approvals and automate routine checks (e.g., three-way invoice matching).

- Tier Controls by Risk: Apply stringent checks only where risk warrants—low-risk transactions receive lighter oversight.

- Regular Rationalization: Quarterly reviews eliminate obsolete controls and streamline decision paths.

Inadequate Monitoring of Control Effectiveness

Even well-designed controls fail without ongoing oversight. Organizations must build continuous monitoring into daily operations. Effective monitoring blends automated analytics with periodic manual reviews to validate system performance.

Failure to Adapt Controls to Changing Business Needs

Static controls become obsolete as strategies, technologies, and regulations evolve. To stay current:

- CFOs should reintegrate risk assessments into strategic planning cycles.

- Deploy change-management forums where IT, finance, and operations stakeholders review control impacts before system upgrades.

How Internal Controls Contribute to Risk Management

A key aspect of internal control is its ability to manage business risks proactively. By embedding structured controls into operations, organizations can detect threats early, prevent fraud, and ensure compliance while enhancing accountability.

Identifying and Addressing Potential Risks Early

Early risk detection is essential for effective governance and risk management. Organizations that integrate risk assessments into daily processes can respond before threats escalate.

| Risk Category | Potential Threat | Control Measure |

|---|---|---|

| Financial | Revenue misstatements | Reconciliations, segregation of duties |

| Operational | Supply chain disruptions | Vendor audits, contingency planning |

| Cybersecurity | Data breaches | Access controls, regular system updates |

| Compliance | Regulatory violations | Policy reviews, automated compliance checks |

Establishing Controls to Prevent and Detect Fraud

Fraud undermines financial integrity, erodes trust, and exposes organizations to reputational damage. Robust internal controls for business operations serve as both deterrents and detection mechanisms.

Preventive controls limit opportunities for fraudulent behavior. Meanwhile, detective controls, including exception reporting and transaction monitoring, expose irregularities in real-time.

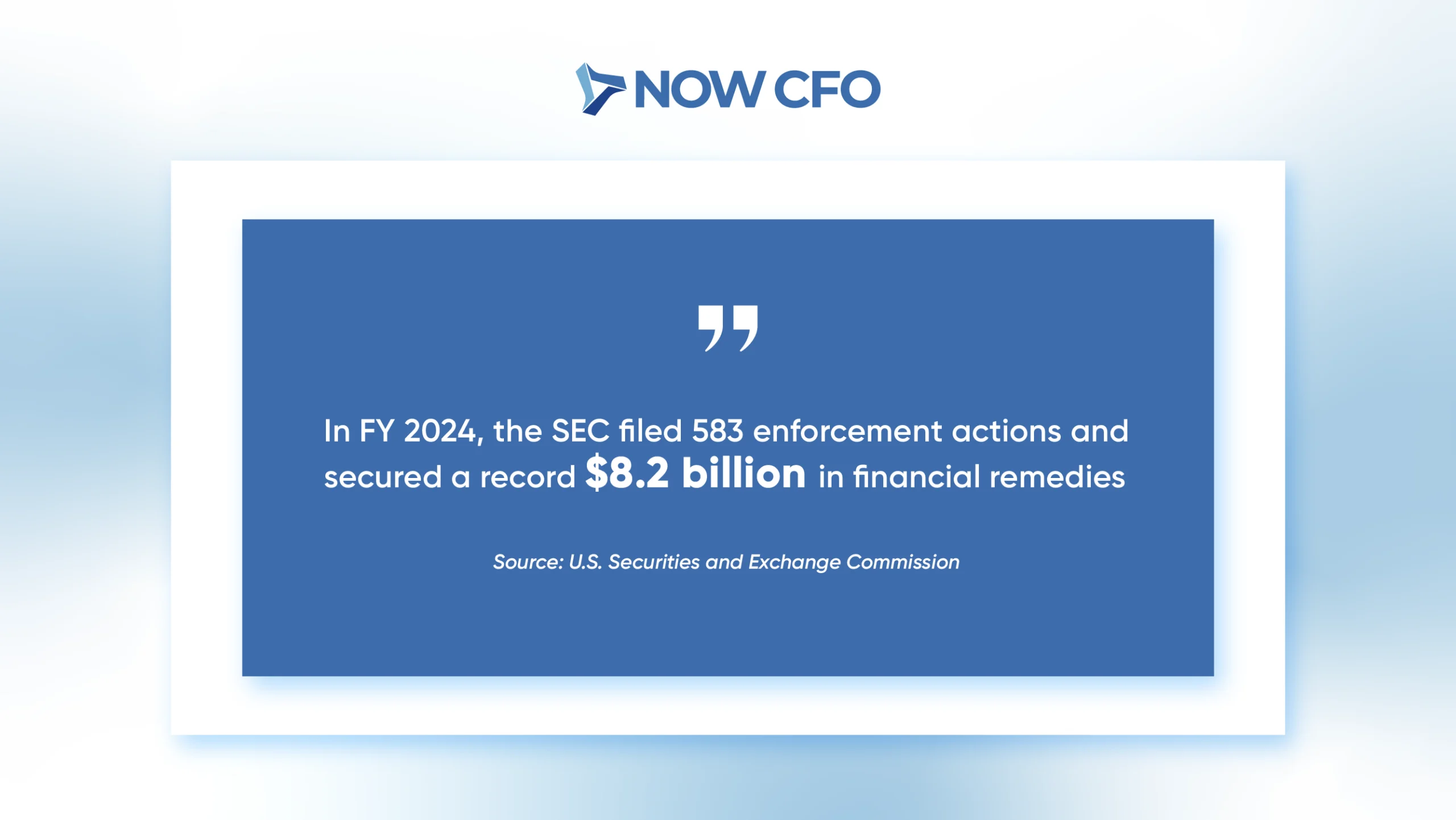

Ensuring Compliance with Regulatory Requirements

Effective internal control systems for regulatory compliance are vital to avoid penalties and maintain operational licenses. Controls must translate complex regulatory frameworks into daily tasks. Automated systems flag non-compliant activities, while periodic reviews ensure processes reflect current regulations.

In fiscal year 2024, the U.S. Securities and Exchange Commission filed 583 enforcement actions and obtained a record $8.2 billion in financial remedies. This comprised $6.1 billion in disgorgement and prejudgment interest and $2.1 billion in civil penalties, marking the highest recovery in SEC history.

Source: U.S. Securities and Exchange Commission

Enhancing Accountability Across Business Functions

Accountability is the foundation of effective risk management. Through internal controls, businesses ensure that responsibility for risks and controls is distributed across all departments, not just finance.

Key accountability strategies include:

- Role Clarity: Clearly defining control of ownership within each department.

- Integrated Dashboards: Providing executives with cross-functional control status updates.

- Cross-Department Reviews: Conducting joint audits to validate control performance across functions.

Conclusion: Strengthening Business Operations with Effective Internal Controls

Building a strong control environment is one of the most reliable ways to drive operational efficiency and protect your organization. For CFOs, executives, and business owners, investing in robust internal controls means safeguarding your reputation, minimizing fraud risks, and building stakeholder trust.

If your business is ready to take the next step toward operational excellence and financial integrity, NOW CFO is here to help. Schedule a complimentary consultation with our financial experts and request a personalized internal controls assessment. Let’s work together to build your internal control systems for success and resilience.