How to Decode Financial Statements

Small businesses form the economic backbone, employing 47% of U.S. workers and generating 38% of private-sector revenue, yet many struggle with financial clarity. Decoding Financial Statements matters because it empowers business leaders to transform raw data into insight.

By understanding and decoding financial statements, you can reveal who’s profitable, where cash flows, and what drives value. Whether you’re an entrepreneur, CFO, or stakeholder, grasping financial statement analysis boosts decision-making confidence, prepares you for growth-driven moves, and prevents surprises.

What are Financial Statements and Why do they Matter

When you begin decoding financial statements, it’s crucial to understand what they are and why they matter. Examining them closely sets the stage for interpreting key data and improving your financial statement analysis.

The Role of Financial Statements in Business Decision-Making

Financial statements show where money came from, where it went, and where it stands now, enabling evidence-based decisions.

- Informed Budgeting: You can build realistic budgets with insights from revenue trends and cost patterns.

- Performance Tracking: Government studies indicate that audited statements support accountability and reliable budgeting.

- Risk Management: Presenting accrual data helps you spot early warnings and avoid liquidity crises before cash runs dry.

Who Uses Financial Statements

Stepping into understanding financial statements, it helps to know who relies on them:

- Business owners manage cash, assets, and liabilities, optimizing operations and competitive edge.

- Investors assess financial health using metrics like profitability and solvency to guide capital deployment.

- Auditors ensure fairness and regulatory compliance; BLS notes auditors review statements to confirm accuracy and internal control.

Moreover, lenders and regulators evaluate your statements before approving loans or certifications. Therefore, income statement analysis and cash flow statement insights become indispensable communication tools.

How Financial Statements Impact Business Strategy

When decoding financial statements, your business strategy aligns with financial reality:

- By interpreting balance sheet strength, you identify investment readiness and capacity to access credit.

- Through income statement analysis, you uncover revenue drivers and expense leaks to optimize margins.

- With cash flow statement insights, you anticipate capital needs and time investments to match cycles.

- As a result, you shape strategy around growth, expansion, or cost control.

The Three Core Financial Statements Explained

Before diving into specifics, decoding financial statements requires a clear grasp of the three foundational reports every business must prepare. These statements reveal your firm’s financial story; understanding them is essential for accurate financial and income statement analyses.

Understanding the Balance Sheet: Assets, Liabilities, and Equity

Grasping the balance sheet sets the stage for a comprehensive understanding of financial statements. It snapshots what you own, owe, and the residual interest.

- Assets: These represent resources your business controls: cash, inventory, and equipment. For instance, businesses with over 50% of current assets often exhibit better liquidity.

- Liabilities: Reflects obligations like loans, payables, and debt. According to the Federal Reserve, the average small business debt-to-asset ratio is around 30%, indicating careful leverage.

- Equity: This reflects the owner’s claims and is calculated as Assets minus Liabilities. Positive equity indicates financial solvency and investor appeal.

Breaking Down the Income Statement: Revenue, Expenses, and Profits

Moving into the income statement analysis, this report details your performance over time, including how you earn and spend money.

- Revenue: The total earned from sales.

- Expenses: All costs; COGS, payroll, rent, marketing. Monitoring these allows you to control margins.

- Profits: The result after subtracting expenses, shown as gross profit, operating profit, and net profit.

Cash Flow Statement Essentials: Operating, Investing, and Financing Activities

Finally, cash flow statement insights reveal real money movement, crucial for liquidity clarity beyond accrual-based views.

- Operating activities: Cash from core operations. Positive cash flow from operations is vital for survival.

- Investing activities: Cash used or earned through asset purchases, sales, or investments. Helps monitor long-term asset management.

- Financing activities: Cash flow from loans, equity, and dividends. Reveals how you fund and grow the business.

Learn More: The 3 Key Financial Statements

Key Financial Metrics to Analyze in Financial Statements

You must go beyond the numbers and interpret key financial metrics to decode financial statements. Such financial statement analysis gives insight into profitability, stability, and efficiency, guiding strategic decisions precisely.

Profitability Ratios: Gross Margin, Net Profit Margin, Return on Equity

Delving into profitability ratios reveals how well your company turns sales into profit:

- Gross Margin: (Revenue – COGS) ÷ Revenue

- Net Profit: Net Profit ⁄ Total Revenue x 100

- Return on equity (ROE): Net Income ÷ Shareholder Equity

Strong ROE indicates efficient reinvestment and profitable operations.

These ratios indicate whether your business is financially strong or requires margin optimization.

Liquidity Ratios: Current Ratio, Quick Ratio, Working Capital

Shifting focus to liquidity ratios, you assess your ability to meet short-term obligations:

- Current Ratio: Current Assets ÷ Current Liabilities

- Quick Ratio (acid-test): (Current Assets – Inventory) ÷ Current Liabilities

- Working Capital: Current Assets – Current Liabilities

Liquidity improves operational resilience and reflects sound cash flow statement insights.

Solvency Ratios: Debt-to-equity, Interest Coverage

Analyzing solvency ratios helps determine long-term financial stability. First, the debt-to-equity ratio shows how much money you’re borrowed:

- Debt-to-equity: Total Liabilities ÷ Shareholder Equity

- Interest Coverage: Earnings Before Interest & Taxes (EBIT) ÷ Interest Expense

Efficiency ratios: Asset Turnover, Accounts Receivable Turnover

Efficiency metrics spotlight how effectively assets support revenue generation:

- Asset Turnover: Revenue ÷ Average Total Assets

- Accounts Receivable Turnover: Net Credit Sales ÷ Average Receivables

- Inventory Turnover: COGS / (Average Inventory)

Common Mistakes in Interpreting Financial Statements

Before exploring pitfalls, grasping the decoding of financial statements demands awareness of common missteps. When overlooked, they distort financial statement analysis and misguide strategic direction.

Misunderstanding Revenue vs. Profit

Often, readers confuse these critical metrics. Here’s a clear comparison to avoid that mistake:

| Metric | What It Represents | Why It Matters |

|---|---|---|

| Revenue | Total income from sales before costs | Indicates sales strength |

| Gross Profit | Revenue minus COGS | Shows cost efficiency |

| Net Profit | Bottom-line after all expenses and taxes | Reveals actual profitability |

Ignoring Cash Flow and Liquidity Concerns

Next, overlooking cash flow statement insights can be costly. A profitable firm may still face cash shortages. For instance:

- Delayed receivables can hamper payroll.

- Inventory buildup without corresponding sales locks up capital.

Overlooking Non-Recurring Expenses and Adjustments

Moreover, omitting one-off costs distorts trends. Common errors include:

- Legal settlements, asset write-downs, or severe one-time repairs.

- Without adjustment, these create misleading dips in earnings.

Relying Solely on Historical Data Without Forecasting

Finally, using only past numbers limits future planning. Historical trends offer insights, but they don’t predict:

- Shifts in consumer demand

- Cost inflation or supply chain changes

- Expansion or contraction seasons

How to Use Financial Statements for Strategic Decision-Making

Making informed strategic decisions requires more than raw numbers; it demands purposeful decoding of financial statements to drive growth. Through financial statement analysis, you can uncover key opportunities and manage risks.

Identifying Financial Strengths and Weaknesses

First, use financial statements to pinpoint where your business excels and where it risks lagging:

- Analyze profitability ratios like gross and net margin to spot areas of revenue or expense pressure.

- Review liquidity metrics such as current and quick ratios for short-term financial stability.

- Track solvency ratios (debt-to-equity, interest coverage) to assess long-term leverage and credit readiness.

Moreover, cross-sectional analysis, comparing these metrics over time, reveals trends. For instance, if your return on equity consistently outpaces the industry average, you’re capitalizing on equity efficiently. Conversely, declining liquidity warns of slowed collections or stressed cash flow.

Using Financial Statements for Business Forecasting

Next, build robust projections based on historical data and realistic scenarios. Begin with:

- Revenue trends: Map past revenues and apply growth rates rooted in market research.

- Expense forecasting: Budget COGS and operating costs using historical ratios.

- Cash flow projection: Incorporate operating, investing, and financing activities for liquidity scenarios.

Additionally, scenario planning helps. For example:

- Best case: 10% sales growth with stable margins

- Base case: 5% growth, current expense profile

- Downside: Contracted revenue, rising interest rates

Making Informed Investment and Expansion Decisions

Finally, apply financial insights to guide capital allocation:

When considering opening a new location or acquiring assets, evaluate:

- ROI on proposed projects versus current return on equity.

- Cash flow impact: Will projected cash flows cover new loan payments or capital expenditures?

- Balance sheet readiness: Can current assets and equity support expansion without overleveraging?

The Role of an Outsourced CFO in Financial Statement Analysis

Engaging an outsourced CFO elevates decoding financial statements from routine reporting to strategic insight. By combining expertise with accountability, an outsourced CFO enhances financial statement analysis and empowers better decisions.

Providing Expert Financial Insights

An outsourced CFO brings clarity and expertise through:

- Interpreting complex financial trends and emerging ratios

- Benchmarking performance against industry standards

- Detecting margin pressure, unusual cash flows, or underutilized assets

- Advising on cost structure optimization and pricing strategies

- Explaining results to stakeholders in clear, actionable terms

Ensuring Accuracy and Compliance

Meticulous financial integrity matters. An outsourced CFO ensures this by leveraging:

- GAAP and Regulatory Knowledge: They follow accepted accounting principles to maintain consistency and comparability.

- Internal Control Establishment: They implement processes that minimize errors and fraud, safeguarding reporting quality.

- Audit Preparation and Documentation: They assemble materials and present statements clearly for auditors, boosting credibility and reducing review time.

- Quarterly Reconciliations: Regular balance sheet reviews catch mistakes early, preserving trust.

- Regulatory Compliance Tracking: By monitoring tax, SEC, or other standards, regulatory compliance tracking ensures your business stays in good standing. According to the SBA, proper compliance supports funding eligibility and avoids costly penalties.

Supporting Strategic Growth with Financial Data

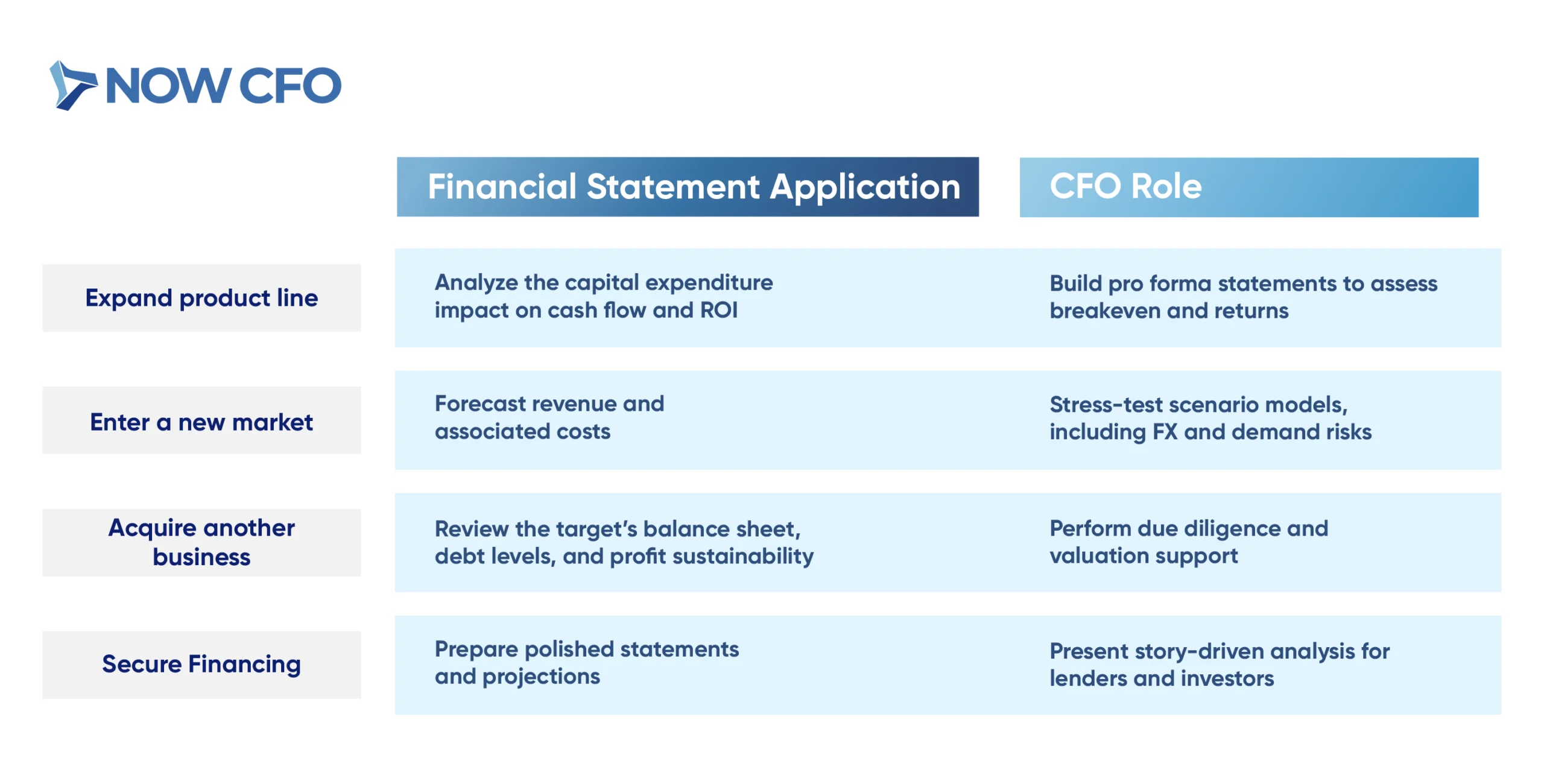

When guiding growth, outsourced CFOs map financial data to strategy, shown here:

How NOW CFO Can Help You

When you partner with NOW CFO, our outsourced CFO service provides:

- Deep-dive statement reviews tailored to your business

- Monthly dashboarding of key metrics and trends

- Custom budgeting, forecasting, and scenario planning

- Expert presentation support for lenders, investors, or boards

Conclusion: Mastering Financial Statements for Business Success

A clear understanding of financial statements equips you with more than just knowledge; it builds the financial confidence necessary for strategic, data-driven decisions. Whether managing cash flow, analyzing profitability, or preparing for growth, a firm grasp of your financial reports helps you lead clearly.

Businesses that actively apply financial statement analysis are better positioned to adapt to change, reduce risk, and uncover hidden opportunities. But you don’t have to walk through this process alone.

Our experienced outsourced CFOs at NOW CFO provide guidance and precision to turn your financial data into a strategic asset. If you’re ready to gain deeper insight into your company’s financial health and align your numbers with your goals, schedule a free consultation with our team today.