Many businesses lack the resources for a full-time CFO and face complex decisions in funding, compliance, and operational efficiency. A surprising 60% of SME owners confess they lack confidence in accounting and finance.

Therefore, CFO services bridge this gap with expert insights on cash flow, profitability, and long-term planning without the in-house hiring. Besides, sustainable growth demands more than revenue, it requires disciplined financial leadership.

Introduction to CFO Services

Effective CFO services help businesses manage complex financial operations, forecasting, and strategic growth. Many businesses reduce audit costs by leveraging shared CFO support through local cooperatives.

Moreover, 60% of SME owners’ concerns is their cash flow management. By hiring CFOs, SMEs can enhance their cash flow visibility. These figures highlight how CFO services deliver measurable financial benefits.

What are CFO Services?

CFO services provide businesses with expert financial leadership. Through CFO services, companies access budgeting, forecasting, and financial reporting. They include cash flow modeling, risk assessment, and advice on capital structure and investment.

Besides, your clients can benefit from tailored financial dashboards, KPI tracking, and scenario planning. Professionals offering these services embed into a company’s operations, align financial strategy with growth goals, and help optimize working capital.

Learn More: What are CFO Services?

The Role of a CFO in Modern Businesses

As businesses adapt to rapid technological changes and strategies, CFO services empower leaders to make data-driven decisions.

These are the roles that modern CFOs perform:

- Offers forecasting, budgeting, and strategic financial modeling to drive decision-making.

- Using automation and AI to deliver real-time insights and elevate operational efficiency.

- Serves as a trusted bridge between leadership, investors, and boards through transparent communication.

Why Businesses are Turning to Professional CFO Services

Businesses increasingly engage professional CFO services for strategic financial leadership without a full-time hire. These CFO services offer flexible budgeting, accurate forecasting, and risk management.

Additionally, companies utilize them for capital-raising support and financial modeling, leveraging industry insights. Also, the global financial and accounting BPO market is projected to hit $110.74 billion by 2030.

Types of CFO Services Available

Many businesses recognize the strategic value of CFO-level support without the full-time cost. Let’s see how outsourced accounting fuels growth more strategically.

Fractional CFO Services

It’s essential to explore how fractional CFO services provide the same strategic leadership.

- A fractional CFO service delivers C-suite financial leadership without the cost of a full-time hire.

- These services boost strategic outsourced accounting by focusing on budgeting, forecasting, and cash flow improvement.

- Firms implementing this model often see sharper decision-making and accelerated business growth with accounting outsourcing.

- Companies scale financial leadership up or down as needed without long-term commitments to a full-time CFO.

- Fractional CFOs’ adaptable insights can help outsourced accountants with strategy.

Outsourced CFO Services

These services deliver expert financial leadership on demand, striking a balance between full-time commitment and flexible, high-level support.

- An outsourced CFO service delivers high-caliber CFO guidance on a flexible schedule for businesses.

- Companies engage outsourced CFOs for specific triggers like fundraising, expansion, or budgeting.

- Strategic outsourced accounting tells exactly when decision‑critical moments arise.

- An outsourced CFO brings experience across industries and maturation phases.

- They optimize unit economics or guide capital raises.

- Elevates businesses from reactive bookkeeping to proactive financial leadership.

Interim or Temporary CFO Services

During events like executive exits, M&A, or funding rounds, interim or temporary CFO services provide immediate, strategic support. They step in full‑time on a defined basis, bridging leadership gaps while optimizing financial clarity.

Demand for these roles has surged, with organizations reporting a 103% year‑over‑year increase in interim CFO requests.

Interim CFOs guide rapidly growing companies through transitions. They implement scalable systems, strengthening compliance, and prepare investor-ready financial structures.

Virtual CFO Services

Virtual CFO services offer entrepreneurs and SMEs strategic financial leadership remotely. This model helps demonstrate how outsourced accounting fuels growth by offering budget-friendly access to high-level insights.

Additionally, working with a virtual CFO can save businesses in costs. So, it’s a smart option for founders focused on business growth with accounting outsourcing.

Key Responsibilities of a CFO

To understand how strategic financial leadership empowers growth, here are three core elements.

Financial Planning and Strategy Development

Let’s break down how financial planning and strategy development by a CFO turns numbers into actionable growth roadmaps.

1. Aligning Long-Term Vision

A CFO builds financial plans rooted in business goals. They create roadmaps that connect monthly budgets to strategic milestones. This helps to drive how outsourced accounting fuels growth by ensuring every investment supports scale and efficiency.

2. Using Real-Time Data

CFOs rely on accurate, live financial insights to guide strategic pivots. Besides, 90% of business owners reported that their department performs accurate, real-time planning and data analysis.

3. Integrating Financial Strategy with Risk and Growth Scenarios

Beyond number-crunching, CFOs interpret multiple growth scenarios, assessing opportunities and risks alike. They transform data into direction, guiding leadership to capitalize on upside while mitigating exposure.

Budgeting and Forecasting

Any skilled CFO organizes budget creation and resource allocation by aligning spending plans with growth objectives. Moreover, the CFO anticipates risks and opportunities, allowing leadership to turn strategies swiftly. Through budgeting, monitoring, and modeling, they connect daily operations with long-term vision goals.

Risk Management and Compliance Oversight

CFOs collaborate with audit or risk committees to prioritize compliance, and many organizations note this helps to rank among the top‑three priorities for audit committees.

Here, we’ll see how risk management and compliance oversight safeguard business stability, strengthen governance, and ensure strategic decisions.

- A CFO embeds proactive risk frameworks that identify, assess, and mitigate threats.

- Aligns strategy with OMB’s requirement that management develop forward-looking risk profiles tied to strategic reviews.

- Ensures compliance with evolving regulations by maintaining internal controls structured around the COSO framework.

- Integrates risk insights into decision-making, interpreting non-financial threats and regulatory mandates.

Investor and Stakeholder Communication

Outsourced CFO leads in investor and stakeholder communication by translating financial data into clear narratives. This builds trust and connects leadership to the company’s financial health and future vision.

They deliver earnings presentations, manage regulatory disclosures, and guide messaging. Because transparent communication directly impacts valuation and market access. Their role extends to aligning investor expectations with financial strategy and shaping stakeholder confidence.

How CFO Services Benefit Your Business

CFO services lie in improving financial clarity and decision‑making. As well as a clear vision, it empowers leaders to act confidently and execute growth plans.

Improving Financial Clarity and Decision-Making

By delivering transparent, real-time insights, a CFO transforms complex numbers into clear direction.

- Provides real-time financial data that drives timely decisions across operations.

- Empowers leadership to act on objective insights rather than instincts alone.

- Supports cost-cutting and resource allocation through transparent metrics.

- Enhances strategic forecast accuracy amid market unpredictability

- Strengthens investor and stakeholder trust by showing financial discipline.

Driving Sustainable Business Growth

CFOs drive sustainable business growth by aligning financial planning with strategic objectives. They demonstrate how outsourced accounting fuels growth through disciplined forecasting, cost control, and capital optimization.

Also, they guide enterprises toward new revenue streams and enduring profitability by using data and market insights. Besides, 37% of organizations reported increased innovation and new business opportunities under CFO leadership.

Optimizing Cash Flow and Working Capital

CFO manages liquidity through better invoice timing, strategic payables, and accurate forecasting. Also, strategic outsourced accounting brings rigorous controls to working capital, smooth cycles between receivables, payables, and inventory.

Moreover, small businesses’ cash flow can stagnate or worsen. So, with proactive monitoring and prompt adjustments, CFOs can keep businesses agile in the face of surprises.

Enhancing Investor Confidence

CFO services can reinforce investor confidence by consistently delivering transparent financial insights and strategic clarity. They reveal how outsourced accounting fuels growth by translating complex data into credible investor narratives.

Strategic outsourced accounting ensures that every financial decision signals stability and potential growth. With clear investor communication, trustee discipline, and data-driven forecasting, CFOs shift perception to strategic partners.

When Should a Business Consider CFO Services?

It’s crucial to recognize the turning moments for engaging CFO services.

Early-Stage Companies Needing Financial Direction

Early‑stage companies often face steep failure rates. About 20% fail within their first year, due to weak financial planning and limited business knowledge.

But CFO services establish robust budgeting and forecasting, and elevate strategic outsourced accounting. Also, ensure real-time metrics guide growth. They also clarify capital needs, improve investor readiness, and reduce fatal missteps from assumptions.

Rapidly Growing Businesses Facing Scaling Challenges

Rapid growth can overwhelm systems, hinder forecasting, and slow decisions. CFO services provide strong financial infrastructure, efficient budgeting, and agile cash flow management.

Companies Preparing for Funding or M&A

CFOs with higher influence improve M&A outcomes, completing deals quickly, identifying stronger targets, and delivering long-term performance.

- A CFO provides detailed analysis and modeling to ensure accurate valuation and stronger negotiations.

- CFOs identify financial, operational, and regulatory risks to structure deals smartly.

- They drive smooth post-deal integration by aligning systems and controls.

- Reassure investors and partners with clear forecasting and disciplined financial reporting.

Businesses Struggling with Cash Flow or Profitability

Businesses facing unpredictable cash flow or shrinking profit margins need structured leadership. And CFO services implement cash flow modeling, margin analysis, and restore investor confidence through transparent metrics.

Besides, 60% cite cash flow as a major challenge. So, by using CFO services, companies gain actionable dashboards, accurate forecasting, and capital structure planning.

Learn More: When is the Right Time to Invest in CFO Services?

Choosing the Right CFO Service Provider

Before evaluating provider credentials, choose the right time to bring in CFO support to maximize strategic impact.

Evaluating Experience and Industry Expertise

Selecting the right CFO service provider starts with verifying that they can address your challenges.

- Assess CFO service provider backgrounds, ensuring they understand industry-specific regulations and reporting nuances.

- Look for a CFO service provider with experience that aligns with the business lifecycle, from startups to scaling enterprises.

- Evaluate proven track record in strategic roadmap development, scenario modeling, and performance monitoring within your industry.

Understanding Pricing Models and Engagement Terms

Every business should review the CFO services pricing model options. It can be hourly rates, monthly retainers, project-based agreements, or value-driven plans.

It’s equally important to compare CFO services fee arrangements for cost efficiency, transparency, and flexibility. Whereas, for performance-based contracts with defined ROI and metrics, align the provider’s incentives directly with business goals.

Assessing Communication and Reporting Practices

You need to confirm that CFO services provide timely, transparent reports. Furthermore, effective CFO services adapt communication styles to match stakeholder needs. It can be visual aids and concise narratives to maximize clarity and build trust.

Additionally, board-level reporting combines financial data with forecasting insights to support informed decision-making. It ensures governance bodies stay aligned and equipped for long-term planning.

Checking References and Track Record

Reviewing a CFO service provider’s past performance helps ensure proven results and consistent value. Here’s how to do it.

- Speak with prior clients to validate the CFO service provider’s credibility.

- Verify the CFO service provider’s reliability through documented performance history.

- Examine benchmarking data, testimonials, and case studies to evaluate sustained ROI.

Cost Considerations for CFO Services

Understanding when to engage CFO services is just the beginning. Ensuring your budget matches the right pricing structure is equally critical.

Hourly vs Retainer Pricing Structures

Selecting between hourly and retainer pricing hinges on your budget, goals, and required engagement level.

| Pricing Model | Description | Benefits |

| Hourly Billing | Charge by the hour | Pay only for the time and expertise you need |

| Monthly Retainer | Fixed monthly fee | Consistent access to CFO services |

| Performance-Based | Depends on ROI or goal achievements | Value-driven financial leadership |

Factors That Influence the Cost of CFO Services

Larger businesses with high transaction volumes pay higher fees since complexity and volume directly scale cost requirements.

- Service fees are based on company size, transaction volume, and complexity.

- Pricing differences are influenced by industry-specific requirements and geographic location.

- Factor in technology integration costs, like financial systems or ERP setup.

- Industry needs and provider location impact cost.

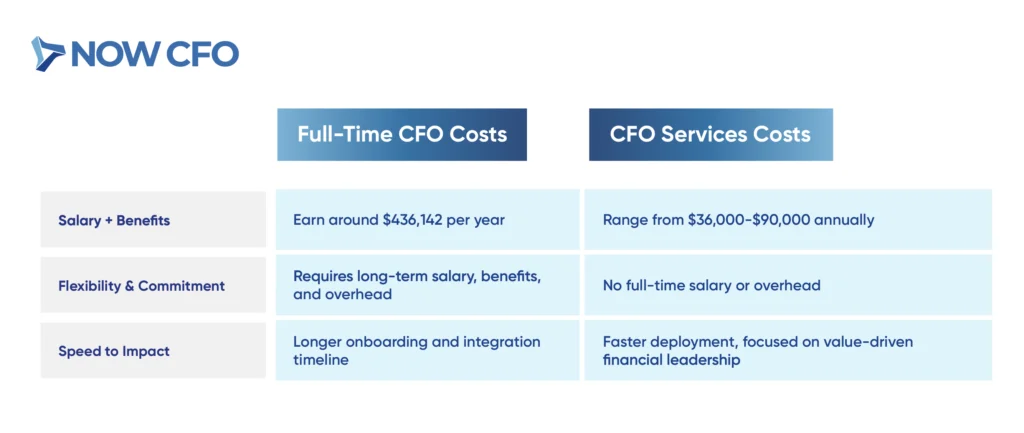

Cost-Benefit Analysis Compared to In-House Hiring

Choosing between a full-time CFO and CFO services comes down to cost, flexibility, and how quickly they deliver impact.

Common Misconceptions About CFO Services

Dispelling myths ensures businesses understand the true value of CFO services. Let’s see what those are.

Only Large Corporations Need CFOs

Misconception says CFOs suit only big firms, but CFO services deliver vital strategic financial management across all sizes.

Engaging CFO services helps to build robust financial systems early, establish transparent forecasting without the burdens of full-time cost. This demonstrates that CFO services act as accessible, high-impact leadership, transforming perception.

CFOs Only Handle Bookkeeping

Another myth is that startups often believe CFOs merely manage ledgers. But CFO services do much more; they analyze data, shape financial strategy, and guide future planning.

Additionally, a CFO interprets financial trends, builds forecasting models, and supports capital decisions with insights. They use deep financial expertise to analyze data and develop solid strategies

CFO Services are too Expensive for Small Businesses

Budget concerns stop some from exploring CFO services, yet the reality tells a different story. Compared to the six-figure salary and benefits required for a full-time CFO, using fractional or virtual CFO services provides strategic guidance.

These services make financial clarity and actionable insight accessible. This proves that the expense of a CFO service can deliver a strong return on investment, even for budget-conscious businesses.

How to Maximize the Value of Your CFO Services

Strategically using CFO services requires more than engagement. Because it demands clearly defined targets and mutual understanding.

Setting Clear Goals and Expectations

Clear goals and expectations enable CFO services to deliver focused, measurable, and strategic financial results.

Goal Definition

Begin by defining specific, measurable business objectives like cash flow improvement, margin targets, or strategic KPIs. Also, when goals are specific and challenging, performance improves.

By setting clear targets, you empower your CFO services partner to focus efforts on concrete outcomes, driving alignment between financial strategy and business growth.

Expectation Setting

Next is to outline the scope, key deliverables, reporting, and communication style expected from your CFO services arrangement. This clarity enhances accountability and ensures both parties understand responsibilities.

Performance Metrics

You need to agree on performance indicators that reflect operational health and strategic outcomes. Outcomes can be ROI, forecasting accuracy, or efficiency gains. Besides, modern CFOs leverage metrics beyond bookkeeping to measure impact and guide decisions.

Leveraging Technology and Financial Tools

Empowering CFO services with modern technology elevates them from financial operators to strategic accelerators. Also, real-time dashboards offer immediate visibility into performance metrics, enabling faster, data-driven decisions.

Advanced tools like data analytics platforms improve forecasting accuracy and strengthen risk scenario planning. They also enable bold financial strategies that boost agility and support long-term business strength.

Maintaining Regular Communication and Performance Reviews

Ensuring strong alignment between your business and its finance leadership is crucial. Here’s what you can do!

- Hold monthly check-ins for CFO services to share updates, set priorities, and align strategy with business goals.

- Deliver concise reviews using dashboards and benchmarks to track financial progress.

- Create feedback loops for accountability, adjustments, and long-term alignment.

Final Thoughts and Next Steps

Effective financial leadership doesn’t require a full-time hire. But it demands precision, strategy, and flexibility. And CFO services deliver expert forecasting, cash flow oversight, and compliance alignment at a fraction of the in-house cost.

To explore how tailored financial guidance can transform your business, consider scheduling a strategy session with NOW CFO. Let us help you unlock clarity, accountability, and scalable financial leadership.