Outsourced accounting has surged in popularity over the past two decades. The global market for alternative finance was estimated at US$8.6 billion in 2024 and is projected to reach US$11.6 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030.

Outsourced accounting services provide scalable solutions that replace costly in-house hires and support solid financial control. SMEs leverage these arrangements for outsourced bookkeeping, remote accounting services, and virtual accounting teams, freeing internal teams to focus on business growth.

What are Outsourced Accounting Services?

When exploring outsourced accounting, it’s helpful to break down what it includes, who engages in it, and which industries gain the most strategic advantage.

Core Services Provided

Businesses contract third-party firms to handle essential accounting services such as:

- Bookkeeping: Recording transactions, reconciliations, and journal entries

- Accounts Payable/Receivable (AP/AR): Invoice processing, vendor payments, collections

- Payroll Management: Employee pay, benefits, tax filings

- Month-End Close/Reconciliations: Ensuring all accounts are accurate

- Financial Statement Preparation: Balance sheets, P&L reports

- Controller Oversight: Reviewing and validating financial processes

- Integration with CFO Services: Aligning numbers with strategic decisions

Who Typically Uses Outsourced Accounting?

Many SMEs and startups leverage outsourced accounting to fill gaps when internal capacity is limited or costly. Founders who need financial clarity without the expense of full-time hires turn to outsourced bookkeeping and remote accounting services.

Even larger firms in transitional phases, such as M&A or rapid expansion, use these external accounting services to supplement in-house teams during peak periods.

Virtual accounting teams offer scalable support in sectors with seasonal fluctuations or cyclical revenue without adding permanent headcount. Additionally, businesses encountering regulatory changes or hiring challenges benefit from expertise packed into CFO accounting support.

Industries That Benefit Most

Certain sectors find outsourcing particularly compelling:

- Professional & Business Services: 17.6% of output is outsourced, the highest among industries.

- Retail Trade: 16.2% of gross output comes from outsourcing.

- Healthcare & Education: Consistent use of external finance teams improves compliance.

- Manufacturing: Streamlines overhead, enabling focus on production

- Tech Startups: Get rapidly scalable accounting outsourcing solutions without hiring delays.

These industries benefit most because outsourced providers reliably handle transaction volume, help with compliance, and favorably support the in-house vs. outsourced accounting comparison by cutting costs and increasing flexibility.

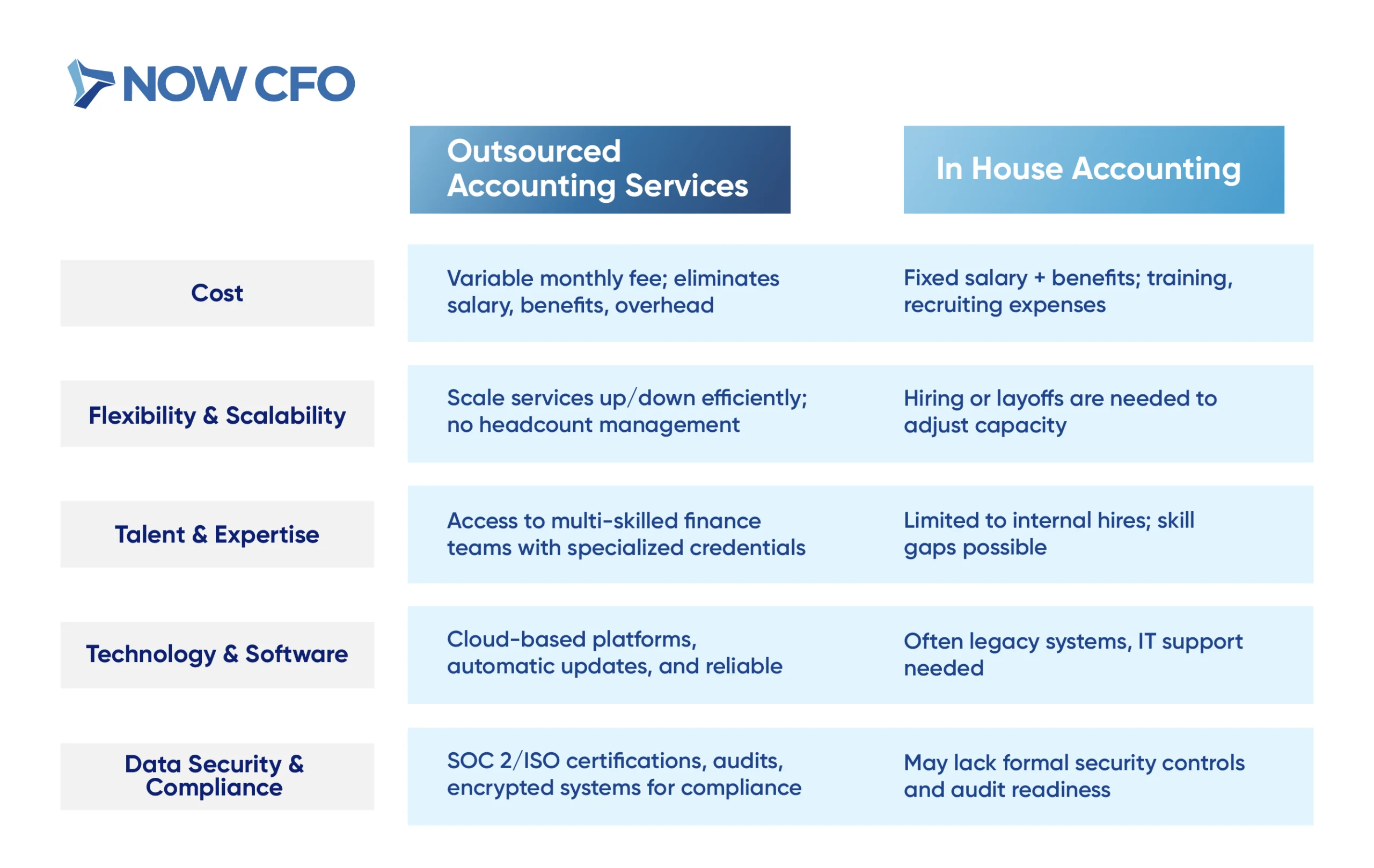

Outsourced Accounting vs. In-House Accounting

When weighing outsourced accounting against in-house teams, it’s crucial to compare cost, flexibility, talent access, technology, and security.

Cost Differences

Outsourcing eliminates fixed salaries, benefits, and overhead tied to in-house staff. Companies typically pay monthly fees or per-task rates. Compared to hiring a full-time controller, outsourced providers cost significantly less while delivering high-quality CFO accounting support and external accounting services.

Firms avoid recruitment and training expenses, and scale services up or down to match their needs. The cost of outsourced accounting is far below full-time equivalents.

Flexibility and Scalability

Outsourced providers adjust quickly to business volatility, scaling up during peak season or down when demand recedes. Companies avoid managing fluctuating headcount or staff burnout. You gain responsive support without overhead with outsourced bookkeeping and remote accounting services.

Also, finance teams can flex service levels monthly or annually based on growth, ensuring virtual accounting teams and accounting outsourcing solutions align with business cycles and goals.

Talent and Expertise Access

Outsourced partners assemble teams with specialized expertise covering the full finance spectrum. You benefit from collective knowledge, workflows, and continuous training. In contrast, in-house teams often lack depth, especially in regulatory compliance or advanced reporting.

Outsourced accounting provide access to accounting outsourcing solutions designed by experts accustomed to multiple clients and industries. This ensures your company receives up-to-date best practices without investing in certifications or systems internally.

Technology and Software Use

Outsourced providers typically operate on cloud-based platforms to deliver seamless, centralized reporting. The IRS emphasizes that cloud-computing contractors benefit from lower costs, automatic upgrades, and multi-region reliability.

This means clients avoid upfront IT investment, software licensing, and maintenance. Their data is backed up, version-controlled, and accessible anytime. Meanwhile, in-house setups often lag due to budget constraints or lack of IT support, making accounting outsourcing solutions more technologically advanced.

Plus, providers integrate add-ons, such as AP/AR automation, payroll modules, and real-time dashboards, offering a full-stack finance toolset that in-house teams rarely achieve without significant investment.

Data Security and Compliance

Security is critical. Reputable outsourced firms implement SOC 2 and ISO 27001 controls, encrypted data transfers, and role-based access. These safeguards often exceed in-house capabilities.

For example, IRS Publication 4812 mandates strict cloud data protection for all subcontractors. Compliance is built in; firms handle tax filings, payroll regulations, and audit-ready documentation. In contrast, internal teams may lack formal security policies or expert oversight, increasing the risk of breaches, fines, or inaccuracies.

Benefits of Outsourced Accounting Services

When evaluating the benefits of outsourced accounting, it becomes clear how they significantly reduce costs, improve accuracy, boost focus, and drive efficiency. Here’s how each advantage contributes to business success and strategic growth.

Reduced Overhead and Fixed Costs

By outsourced accounting, you transition from fixed payroll expenses to a predictable monthly fee. This eliminates salaries, benefits, workspace, and training overhead.

Typical full-time mid-size finance roles cost $80K—$120K/year + 20–30% benefits, totaling over $100K to $140K annually, plus indirect costs like equipment and software licensing. In contrast, outsourced accounting usually ranges from $3,000 to $7,500/month for small to mid-size businesses.

- Outsourcing cuts internal headcount by 1–2 full-time staff equivalents.

- It negates recruiting, onboarding, and ongoing training expenses.

- You avoid hardware, software, and office space costs tied to in-house teams.

Better Accuracy and Financial Reporting

Outsourced accounting use structured workflows, dual review systems, and cloud tools, raising accuracy and timeliness across financial reporting. Standardized processes reduce errors and inconsistencies, ensuring reliable data.

Providers often maintain checklists and automate reconciliations, minimizing manual mistakes. Clients gain access to timely, clean financials, facilitating better strategic decisions, smoother audits, and improved bank or investor confidence. This enhances accounting outsourcing solutions by delivering reliable metrics and promoting robust financial governance.

Increased Focus on Core Operations

By outsourcing routine finance tasks, leadership teams free up time for strategic priorities, like growth, customer acquisition, and innovation. Entrepreneurs and CEOs no longer manage day-to-day bookkeeping or payroll.

This shift improves business agility and responsiveness. When outsourced bookkeeping and remote accounting services handle the details, executives channel energy into expanding offerings, improving processes, and strengthening client relationships.

With financial operations offloaded, companies also enhance internal collaboration, team members focus on revenue-driving functions rather than transactional tasks. This sharper focus on core activities supports better long-term performance and customer satisfaction.

Faster Financial Close and Reporting Cycles

Outsourced accounting accelerates month-end close and reporting through dedicated teams operating in structured schedules. Instead of ad hoc internal timelines, cloud-based systems and automation streamline reconciliations and consolidations.

Faster closes deliver timely insights, improved forecasting, and compliance readiness. Real-time access improves decision-making, helping firms pivot swiftly amid market changes.

Real-Time Visibility and Dashboards

Outsourced providers often integrate live dashboards and financial portals, enabling real-time access to KPIs like cash flow, revenues, and expenses. This proactive reporting turns data into action, supporting fast responses to trends or anomalies.

By using accounting outsourcing solutions that sync with cloud platforms, executives receive automatic alerts and visual reports without waiting for monthly statements. Teams can monitor metrics daily, supporting agile decision-making and cash management.

Custom Solutions for Every Growth Stage

Outsourced accounting services adapt as your business evolves:

- Startup: Focus on core setup; basic bookkeeping, payroll, and cash flow tracking

- Growth Phase: Add AP/AR automation, month-end close structure, and financial dashboards

- Mature Phase: Introduce controller info, budget planning, tax readiness, integration with CFO accounting support

- Scale/Expansion: Optimize multi-entity consolidations, compliance modules, and ERP integrations

Learn More: Outsourcing Accounting Growth

Types of Services Offered in Outsourced Accounting

When detailing the services offered in outsourced accounting, it’s essential to understand each function’s role in supporting strategic financial management.

Bookkeeping

Outsourced providers handle daily ledger entries, categorize transactions, and reconcile bank accounts, ensuring reliable financial data. They use cloud-based platforms to track income and expenses promptly.

Accounts Payable/Receivable

Teams manage vendor invoices, payment approvals, and client billing, streamlining cash flow cycles. Automated reminders reduce late payments, while digital records maintain audit trails.

Payroll Management

Outsourced payroll services handle wage calculations, tax withholdings, deductions, and filings across jurisdictions. Providers ensure compliance with federal and state regulations, reducing employer liability.

Month-End Close and Reconciliations

Dedicated teams complete month-end close processes, reconcile all ledgers, and verify adjustments. This structured cycle typically closes books within five business days, improving the efficiency of accounting services.

Financial Statement Preparation

Outsourced providers generate GAAP-compliant balance sheets, income statements, and cash flow reports. They include narrative context and benchmarks to support strategic decision-making.

Controller Oversight

Providers assign experienced controller-level professionals to oversee accounting operations, ensuring data accuracy, internal controls, and best practices. These experts supervise processes, mentor staff, and provide escalation points.

Integration With CFO Services

Providers link accounting functions with high-level CFO advisory. The integration enables monthly financial reviews, budgeting, forecasting, and strategic insights. This seamless service layer ensures that outsourcing evolve into strategic finance partnerships.

Choosing the Right Outsourced Accounting Provider

When selecting outsourced accounting services, a structured evaluation ensures you choose a provider that delivers value, is professional, and aligns with your business goals.

Questions to Ask During Vetting

When interviewing prospective firms, ask detailed, outcome-driven questions:

- What is your team composition and experience?

- Which cloud platforms do you support?

- What are your standard workflows and reporting timelines?

- How do you handle compliance and audits?

- How do you report pricing and fee structure?

- How do you handle onboarding and transition?

What Qualifications and Tools to Look For

To ensure high standards, evaluate provider credentials and technology stack:

- Certifications: Ensure team members hold CPA credentials, and the firm is SOC 2 or ISO 27001 compliant. These standards underpin effective accounting services and the reliability of external accounting services.

- Technology Platforms: Look for proficiency in QuickBooks Online, Xero, Sage Intacct, and other advanced tools. Integrated cloud platforms support real-time data and scalability.

- Process Automation: Firms should utilize AP/AR automation, automated reconciliations, and workflow tools to reduce error rates and improve efficiency in accounting outsourcing solutions.

- Training and Continuing Education: Providers should invest in ongoing staff development, keeping teams current with accounting updates, tax law changes, and SaaS innovations.

- Security and Data Protection: Evaluate encryption standards, backup procedures, access controls, and compliance audits, aligning with IRS cloud security guidelines.

Challenges and How to Overcome Them

Addressing the challenges of outsourced accounting services starts with recognizing potential hurdles to ensure a smooth and efficient experience.

Data Privacy and Secure Access

Outsourcing raises concerns around sensitive information. Many firms now consider data privacy/security practices critical when selecting partners. Ensure providers encrypt data, limit access, and conduct regular audits per IRS and GDPR standards. Points to ensure security:

- Implement role-based access control and two-factor authentication

- Enforce data encryption at rest and in transit

- Require SOC 2 or ISO 27001 compliance certifications

- Schedule regular vulnerability scans and third-party audits

Communication And Time Zone Issues

When teams operate across regions, synchronizing communication becomes complex. Research shows that a 1-hour time zone gap reduces real-time interactions. This impacts timely decision-making and creates delays. To address this:

- Set core overlapping hours for synchronous calls

- Use collaborative tools (Slack, Asana) to manage async updates

- Record meetings so remote staff can catch up asynchronously

Integration With Internal Teams

Seamless onboarding with internal staff is vital. Lack of coordination can cause delays or duplicate tasks. Virtual teams face barriers in informal communication, leading to misunderstandings.

Best practices include:

- Define roles and handoff procedures clearly

- Use shared project management tools for transparency

- Schedule regular check-ins to align tasks and deadlines

Resistance to Change

Internal teams may resist new processes or fear job displacement when introducing outsourced services. To overcome this:

- Involve employees early, communicate benefits clearly

- Provide training on new workflows and cloud tools

- Highlight efficiency gains, reduced error rates, and strategic focus

Transition and Onboarding Process

A smooth transition is critical. Effective onboarding includes:

- Detailed process mapping of current accounting workflows

- Secure data migration to cloud-based systems

- Joint kickoff meetings with key stakeholders

- Defined milestones with accountability checkpoints

- Regular status updates during the first 60 days

Learn More: When to Outsource Your Accounting?

How NOW CFO Can Help with Outsourced Accounting Services

When partnering with NOW CFO for outsourced accounting services, you gain structured support, seasoned talent, and scalable finance solutions that align with your growth objectives.

Custom Engagement Models

NOW CFO provides tailored hourly, project-based, or retainer arrangements that fit your needs and budget. We adapt service levels as your business evolves. You can scale down during slow periods or ramp up ahead of growth initiatives.

- Flexible pricing tied to outcomes, not headcount

- Service bundles aligned with your growth stage

- On-demand CFO accounting support for strategic financial needs

National Team of Accounting Experts

NOW CFO’s outsourced services are powered by a national network of certified professional CPAs, controllers, payroll specialists, and automation experts. Your organization gains advanced skills beyond in-house limits by tapping into this collective expertise.

Each expert brings deep experience in technology, healthcare, and retail sectors. That sector-specific knowledge enhances compliance, speeds financial close, and boosts reporting quality. Clients benefit from best practices refined across the country.

Scalable Solutions for Fast Growth

NOW CFO aligns your accounting with business speed. We proactively scale staffing and systems during expansion phases.

- Fast deployment of additional resources before peak periods

- Modular add-ons like financial dashboards, AP/AR automation, and forecasting

- Flexible adjustment of service tiers based on monthly volume

Transparent Reporting and Communication

NOW CFO emphasizes clear, proactive communication. You receive:

- Consolidated monthly reports, KPIs, and commentary

- Real-time dashboards are accessible anytime via cloud platforms

- Regular video or phone check-ins to review results and recommendations

Partnership With Your Leadership Team

NOW CFO embeds itself within your executive team to become a strategic finance partner. They:

- Attend leadership meetings to represent finance

- Align KPIs with your company’s growth and strategic plan

- Offer scenario modelling, budgeting, and long-term forecasting support

- Serve as an extension of your leadership, providing guidance on investment, cash flow, and compliance

Conclusion

The case for outsourced accounting services is clear: they reduce costs, improve accuracy, accelerate reporting, and allow your team to concentrate on strategic initiatives. From startups to mid-sized companies, outsourcing offers tailored, flexible financial solutions, transforming accounting from a burden into a growth enabler.

If you’re ready for more than just standard bookkeeping, NOW CFO is prepared to build a finance partnership that scales with your ambition. Let’s explore how NOW CFO can support your success by scheduling a complimentary strategy session. Your next growth chapter begins with confident, reliable accounting at your side.