Small businesses and growing companies often find themselves going through hard financial situations without the benefit of executive-level leadership. That’s where what are CFO services become a critical question.

Moreover, by 2032, the virtual CFO market will reach the value of USD 8.17 billion. This reflects how more organizations seek strategic financial guidance without hiring a full-time CFO. If financial complexity is increasing in your business, knowing CFO services is crucial.

Understanding CFO Services

To grasp the full scope of CFO Services for small businesses. Let’s begin by defining exactly what a CFO service entails and how it differs from other roles.

Definition of CFO Services

CFO services encompass strategic financial leadership, whether in-house or externally, that goes beyond basic accounting services. These services include financial strategy, budgeting, forecasting, cash-flow oversight, risk mitigation, and decision support.

Unlike traditional accounting roles, a CFO drives financial strategy rather than just recording transactions. Additionally, 52% of executives report outsourcing business functions to enhance forecasting and working‑capital control.

Key Roles and Responsibilities of a CFO

Also, it’s essential to recognize the key roles a CFO plays within an organization.

- Strategic Financial Planning & Forecasting: Guides long‑term financial strategy and creates detailed forecasts.

- Regulatory Compliance & Reporting: Ensures accurate financial reporting and compliance with GAAP, SOX, and industry regulations.

- Cash‑Flow Management & Liquidity Oversight: Continuously monitors and optimizes cash flow and liquidity to maintain operational stability.

- Budget Creation & Oversight: Leads budget development, tracks expenditure vs. targets, and enforces fiscal discipline.

- Financial Risk Management: Identifies financial risks and implements controls to protect the organization’s assets and performance.

- Investment, Capital & Funding Strategy: Advises on funding needs, capital structure, and assesses M&A or financing opportunities.

- Collaboration With Leadership & Boards: Partners with the CEO, board, and other executives to align finance with business strategy.

Types of CFO Services (In-house, Outsourced, Fractional, Virtual)

Below are the primary types of CFO Services, each described in one cohesive paragraph.

1. In‑House CFO

An in‑house CFO serves full-time within your organization and leads all financial strategy, budgeting, forecasting, and compliance efforts. This model gives you direct leadership and consistent oversight.

However, it includes full-time salary and benefits. So, it suits larger or mature companies that require continuous financial leadership.

2. Outsourced CFO Services

Outsourced CFO services deliver strategic financial leadership on a contract basis. So you can tap into top-tier financial expertise without the full-time cost.

Moreover, around 65% of companies report that outsourcing finance lets them focus on core operations while getting expert support. They suit small to mid-sized businesses seeking flexible, knowledgeable CFO support without burdening payroll.

3. Fractional CFO Services

Next is fractional CFO services, which provides part‑time CFO leadership, offering all core responsibilities on a shared basis. They offer seasonal or growth-phase support, delivering executive-level insight without full-time salaries.

4. Virtual CFO

Finally, the virtual CFO services deliver strategic financial guidance remotely, often via cloud tools and digital platforms. You’ll get real-time insights, process automation, and compliance expertise without onsite presence. Besides, pricing is typically lower than in-house models.

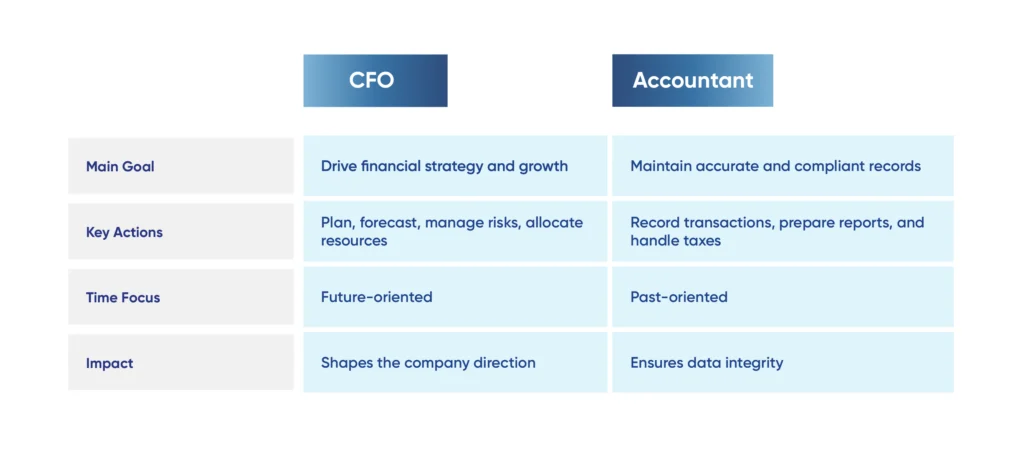

Difference Between a CFO and an Accountant

It’s important to clarify how a CFO’s role differs from that of an accountant, as the distinction impacts strategy, decision-making, and overall financial leadership.

Core Functions of CFO Services

To understand what are CFO services, you must look at one of their most critical functions.

Strategic Financial Planning and Forecasting

CFO guides leadership with forward-looking insights rather than lagging figures. They also inform resource allocation, funding decisions, and growth strategy.

Moreover, the CFO analyzes trends, seasonal patterns, and economic signals. So, you’ll get clarity on future cash flow, investments, and risk exposure, giving you executive-grade foresight.

Budget Creation and Oversight

Effective financial leadership goes beyond strategy; it requires precise budget creation and oversight.

- Budget Development: A CFO crafts comprehensive annual budgets to align financial planning with business objectives and growth forecasts.

- Monitoring Budget vs. Actual: The CFO compares projected budgets with actual outcomes.

- Adjusting Financial Plans: CFOs modify budget allocations throughout the year to optimize performance and ensure financial resilience.

Cash Flow Management and Optimization

Cash flow management and optimization are a core CFO responsibility. They actively monitor to ensure adequate liquidity and avoid operational shortfalls. Also forecasts future cash requirements, like funds for payroll, vendor payments, and debt obligations.

Financial Reporting and Compliance

To illustrate this key function, here’s a structured comparison highlighting core CFO responsibilities and how they uphold financial integrity.

| Responsibility | Role Description | Application |

| Financial Reporting | Timely, accurate financial statements | Preparing GAAP-compliant quarterly reports |

| Regulatory Compliance | Ensures adherence to SOX and GAAP | Coordinating with auditors |

Risk Management and Cost Control

Proactive risk management and cost control are key to protecting profitability and ensuring stability.

- Identify and Assess Risks: CFOs pinpoint internal and external threats, evaluate likelihood and impact, and prioritize accordingly.

- Risk Mitigation Strategies: Creates plans, like controls, insurance, or policies, to reduce or transfer financial threats.

- Monitor Costs and Variances: Track spending against budgets, detect deviations early, and enforce corrective actions to control costs.

How CFO Services Work in Practice

When exploring CFO Services, there are critical early step that reveals how this strategic support takes shape. Let’s have a look!

Initial Business Assessment and Onboarding

A successful partnership starts with a thorough initial business assessment and onboarding to establish a clear financial foundation.

- Review Current Financial Health: CFOs assess financial systems, reports, and tools to establish a clear baseline.

- Evaluate Processes and Tools: They audit workflows and technologies to identify inefficiencies and strategic gaps.

- Identify Key Risks and Opportunities: CFOs uncover financial weaknesses and growth levers for immediate action.

- Set Onboarding Milestones and Goals: They define plans centered on results, aligning with long‑term financial vision.

Creating Customized Financial Strategies

Creating customized financial strategies ensures every financial decision directly supports the company’s goals.

- CFOs align financial strategy with company goals and operational realities.

- They build flexible budgets that respond to business conditions and growth plans.

- CFOs balance funding, liquidity, and initiatives to preserve financial health.

- They define performance indicators to track strategy effectiveness and prompt adjustments.

Ongoing Monitoring and Reporting

Consistent ongoing monitoring and reporting are essential responsibilities that enable CFOs to uphold financial transparency. A key activity involves monitoring critical financial KPIs, like profitability, liquidity, and operational efficiency.

Additionally, CFOs ensure the accuracy and timeliness of financial reports, providing stakeholders with reliable data that supports informed decision-making and accountability across the organization.

Collaboration with Internal Teams and Stakeholders

Effective collaboration with teams and stakeholders ensures informed decision-making throughout the organization.CFOs add value by actively partnering with department heads, finance teams, and board members.

They foster cross-functional alignment by involving marketing, operations, and HR in financial planning. This collaborative approach breaks down silos and enhances strategic execution.

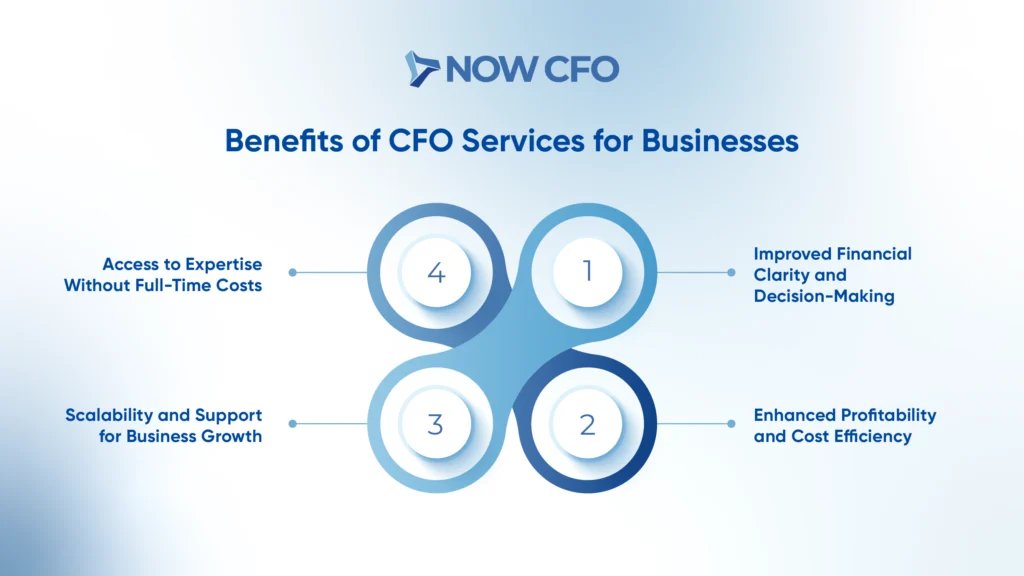

Benefits of CFO Services for Businesses

To fully understand what are CFO services in action, you also need to know the foundational advantage.

Improved Financial Clarity and Decision-Making

CFO services enhance financial clarity by transforming complex numbers into actionable insights. This clarity supports faster, more informed decision-making.

Furthermore, understanding what are CFO services mean involves recognizing their role as navigators of strategy. This will translate reports into pathways that inform smart resource allocation, risk mitigation, and profit optimization.

Enhanced Profitability and Cost Efficiency

Another benefit is that CFO services drive profitability by identifying inefficiencies and optimizing spending. So, you’ll have streamlined financial processes, eliminating waste, and revenue-enhancing opportunities.

Moreover, small businesses gain access to executive-level analysis without the cost of a full-time hire. This makes it easier for you to reinvest savings into innovation or expansion.

Scalability and Support for Business Growth

You must see how CFO services adapt alongside your business, so your financial infrastructure grows with you, not against you.

- CFOs create adaptable budgeting and forecasting systems that evolve with business expansion.

- They shift spending and investments as needs change to support growth without disruption.

- CFO services extend or contract engagement levels to match changing financial needs and stages.

Access to Expertise Without Full-Time Costs

Organizations receive high-impact, strategic financial guidance in areas like forecasting, budgeting, and risk management. All the while without paying for a full-time executive salary and benefits.

A fractional or outsourced CFO service equips teams with seasoned leadership and helps you save costs compared to a full-time hire. Also, companies gain clarity, responsiveness, and an elevated financial strategy without committing long-term.

Signs Your Business Needs CFO Services

Understanding what are CFO services becomes even more illuminating when businesses face the challenge.

Rapid Growth Without Financial Structure

When businesses scale quickly without proper financial frameworks, they expose themselves to risk, inefficiency, and missed opportunities. And most of the SMEs fail quickly, often due to financial mismanagement.

And that’s where CFO services step in to fill these gaps. They bring sound financial structures and provide clarity and infrastructure for sustainable expansion. So, your company avoids common pitfalls of overextension or cash-flow crises.

Declining Profit Margins

Below are key indicators that describe how declining profit margins can undermine business health.

- Profit margins fall below industry or historical benchmarks, reducing the buffer against cost fluctuations and squeezing profitability.

- Rising operational costs outpace revenue growth, eroding profitability even if sales remain steady.

- Revenue declines combine with pressured margins, signaling deeper financial stress and warning signs for CFO intervention.

Cash Flow Challenges

Below are the key indicators that reflect cash flow challenges.

- Cash inflows consistently lag behind outflows, shrinking reserves, and limiting the ability to pay expenses on time.

- Reliance on short-term financing to meet obligations, like using overdrafts or credit lines.

- Even when sales are steady, late invoicing or delayed receivables make operating cash unpredictable.

Preparing for Investment or Expansion

Businesses often seek capital, negotiate terms, and project returns. CFO services model funding requirements, prepare investor-ready reporting, and manage treasury strategies. And this ensures that growth aspirations translate into sustainable execution.

Choosing the Right CFO Service

It’s key to compare how CFO services align with your business objectives.

In-House vs Outsourced vs Fractional Models

Choosing between in-house, outsourced, or fractional CFO models depends on your business’s size, budget, and strategic needs.

| Model | Description | Cost & Flexibility |

| In-House CFO | Full-time executive, overseeing strategic finance, internal alignment, and daily operations | High fixed cost, lower flexibility |

| Outsourced CFO | External financial expert providing CFO-level guidance | Lower cost, adjustable engagement deadlines |

| Fractional CFO | Part-time CFO provides the same strategic oversight as in-house CFO | Cost-effective, highly scalable, and adaptable |

Factors to Consider (Industry, Size, Goals)

Here are the critical factors you should weigh when choosing between models.

1. Industry Relevance and Complexity

In businesses with heavy regulation, rapid innovation, or specialized funding, CFO services must offer industry‑specific insight. Also, a CFO who understands nuances adds strategic credibility and reduces ramp-up time.

2. Business Size and Stage

Early-stage and small businesses often need flexible, scalable CFO services without a full-time hire. Besides, many businesses don’t employ a CFO, making outsourced or fractional models especially relevant.

3. Growth Objectives and Financial Goals

Businesses with rapid expansion, fundraising plans, or operational scaling need CFO services that deliver proactive financial strategy and modeling. So, look for a CFO who understands your growth aspirations, from investor presentations to cash flow.

Questions to Ask Before Hiring

Here are vital questions to guide your CFO hiring process.

- Do you only offer CFO professional services or also accounting-level tasks?

- How have you supported companies in my industry or situation? You can ask for real-world examples.

- What deliverables should I expect from our engagement? Ask to clarify reporting formats, timelines, and outcomes.

- Can you provide references or case studies? This helps to validate credibility, reliability, and results.

Red Flags to Avoid

Here are key warning signs to watch for when evaluating CFO candidates or services.

- Mismatched skill set means it doesn’t align with your financial needs or strategic demands.

- If the candidate demonstrates vague expectations or unclear deliverables.

- Lack of industry-relevant experience.

- Absence of case studies or references.

Conclusion

Understanding what are CFO services equips you with a powerful edge as your business grows, scales, and faces new demands. Ready to turn ambition into structure? Schedule a strategy session, request a custom impact assessment, or book an exploratory call at NOW CFO.

These easy, low-commitment options help you access actionable insights and decide how CFO services might empower your direction. Regardless of your current trajectory, you deserve a partner who brings precision, foresight, and a tailored financial strategy.