Many businesses say financial difficulty demands more than just basic bookkeeping. Knowing why your business needs CFO services is clear when considering that the demand for CFO will grow 18.7% by 2026.

Moreover, a skilled CFO can secure forecasting, interpret real-time data, manage risks, and adjust course. Whether facing cash flow gaps, funding challenges, or shrinking margins, a CFO delivers the structure and foresight for lasting success.

The Changing Role of CFOs in Modern Business

For a business owner, it’s essential to understand how today’s CFOs have evolved.

From Bookkeeping to Strategic Leadership

The modern CFO no longer just handles ledgers and compliance; they provide financial strategy support. In many firms, CFOs lead digital transformation and risk modeling that guide long‑term planning.

More CFOs are moving into CEO positions, showing the expanding strategic influence of the role. This shift highlights the growing value of outsourced CFO benefits for small and mid-size companies.

Adapting to Fast-Moving Market Trends

It’s a must for CFOs to stay ahead of shifting dynamics by quickly aligning strategies with emerging technologies.

1. CFOs Embrace AI and Generative Technologies

While many CFOs were cautious about AI in the early days, that’s not the case now. Reflecting the rapid acceptance of AI as a strategic tool. The majority of CFOs have aggressively adopted AI to increase cost savings and revenues.

2. Digital Leadership Responsibility Skyrockets

CFOs are increasingly taking charge of their organization’s digital initiatives, while also expanding their role in managing investor relations. This reflects a broader shift toward technology-driven and strategically integrated leadership.

3. Role Expansion Amidst Complexity

CFO roles are evolving to blend traditional finance duties with emerging priorities like sustainability reporting, generative AI integration, and stakeholder value management. This expansion reflects the growing complexity and strategic importance of the position.

Leveraging Technology and Data Analytics

To fully harness the benefits of CFO services, businesses must embrace technology-driven strategies.

- Automate repetitive financial processes to improve efficiency and accuracy across departments.

- Use cloud-based forecasting tools to enable agile and collaborative budget planning.

- Centralize financial data in real-time dashboards to monitor trends and KPIs.

- Improve visibility by integrating ERP, CRM, and accounting platforms.

- Measure marketing ROI and customer lifetime value through cross-departmental data use.

- Guide capital allocation using trend-based financial forecasting and simulations.

Supporting Remote and Hybrid Work Models

As businesses increasingly operate beyond traditional office boundaries, CFOs play a pivotal role in ensuring financial operations remain seamless.

| Remote Model | Hybrid Model |

| Use cloud-based financial tools | Integrate both in-office and remote workflows |

| Set up automated alerts to monitor KPIs | Dashboards to display site-specific and remote performance insights |

| Ensure remote expense reporting aligns with compliance standards | Standard budgeting procedures across both on-site and virtual teams |

| Strengthen cybersecurity for remote financial data access | Train cross-functional teams on collaboration tools |

Learn More: What are CFO Services?

Guiding Businesses Through Uncertain Economies

When the economy is uncertain, CFOs help run businesses by focusing on stability, smart planning, and quick adjustments.

- CFOs Lead Scenario Planning: They run stress tests and forecasts to prepare for downturns and market fluctuations.

- Strengthen Financial Resilience: CFOs build buffers through liquidity planning, cost controls, and capital flexibility.

- Inform Investor and Board Strategy: They translate economic volatility into clear guidance and decisive planning.

- Adjust Operations Proactively: CFOs align budgets and spending with emerging economic risks and costs.

- Monitor Macroeconomic Indicators: They track inflation, interest rate trends, and geopolitical shifts to guide decisions.

- Enable Agile Response: By integrating real-time data and analytics, CFOs adapt strategies swiftly.

Key Benefits of CFO Services for Your Business

CFO services add value by delivering clear, data-driven financial planning to guide short- and long-term growth.

Expert Financial Planning and Forecasting

CFOs craft dynamic budgets, model various scenarios, and forecast cash flow. This will give leadership clear direction even during fluctuation. This kind of financial strategy support ensures capital aligns with priorities.

Improved Cash Flow and Profitability Management

CFOs optimize working capital, streamlining collections, and managing expenses. They also implement cash forecasting tools and apply tight margin controls. This supports strategic planning with CFO services.

Many SME owners face challenges like delaying their paychecks or struggling to cover basic expenses. Poor cash flow is also a common cause of business failures. This is why having CFO services in place is a must.

Enhanced Decision-Making with Real-Time Data

With real-time information, CFOs can make quicker, smarter decisions that help their business stay ahead of the competition.

- CFOs use real‑time dashboards to monitor and act on financial trends instantly.

- They access live economic indicators, like inflation and unemployment rates, from trusted government sources.

- Immediate visibility into cash flow, inventory, and performance metrics supports data‑driven decision making.

- Better‑structured, real‑time data transforms CFOs into strategic leaders.

Risk Assessment and Mitigation Strategies

CFOs play a key role in spotting potential risks early and creating strategies to protect your business.

- They design enterprise risk frameworks that integrate with business planning.

- They lead identification threats like operational, financial, and cybersecurity.

- CFOs lead business continuity and disaster recovery planning.

- They implement insurance, contracts, and compliance measures to limit potential losses effectively.

Optimizing Costs Without Sacrificing Growth

Your business needs CFO services because it can eliminate inefficiencies and reinvest savings into growth initiatives. They also conduct spend reviews, streamline operations, and refine supplier contracts.

Moreover, organizations achieved only 48% of their cost-saving targets. It’s a gap that often ruins growth unless CFOs lead execution with precision. This data says why business needs CFO services to align cost discipline with long-term growth.

How CFO Services Support Business Growth in Today’s Market

In 2025, 58% of CFOs focused on global expansion, which drove a 25% increase in international revenue.

Strategic Budget Allocation for Expansion

CFOs ensure that every dollar in the budget is directed toward initiatives that drive sustainable growth.

- CFOs prioritize expansion budgeting to align resources with high‑impact growth opportunities.

- They analyze ROI across initiatives, ensuring capital flows toward scalable projects.

- CFOs balance short‑term liquidity goals with long‑term investment priorities.

- They secure growth funding, working with lenders or investors.

Access to Capital and Investor Relations

CFOs also secure SBA, SBIC, and private-equity financing to boost expansion. They structure funding sources, align debt and equity, and tap federal incentives.

At the same time, CFOs foster investor relations, building transparency through clear financial reporting. They also guide investor discussions and nurture trusts, showing the value of strategic planning with CFO services.

Scaling Operations Efficiently

CFOs focus on building systems and processes that allow a business to grow smoothly without losing efficiency or profitability.

- They lead process standardization and shared services.

- Deploy ERP, automation, and analytics to boost productivity as operations grow.

- Align cross-functional teams under scalable financial systems for control and visibility.

- Monitor unit economics to prevent margin erosion during scaling.

- Integrate scalable platforms to support efficient volume expansion.

Identifying and Capitalizing on Market Opportunities

With CFOs, you can systematically monitor growing markets, customer behavior shifts, and technological trends. This will help you to spot strategic opportunities, deliver financial strategy support, and demonstrate why business needs CFO services.

Moreover, CFOs lead market analysis to prioritize usable segments, assess scaling potential, and model ROI. They also collaborate closely with sales, product, and marketing teams to align financial usage with market timing.

Strengthening Competitive Advantage

By focusing on strategies that enhance market position and foster innovation, CFOs help businesses maintain a lasting edge over competitors.

- CFOs align financial planning with long-term strategic goals, ensuring resources drive sustainable value.

- They apply forward-looking capital allocation strategies to fuel innovation and business growth.

- Crafts reporting and communication that emphasize competitive strengths and future opportunities.

- Also, coordinates cross-functional efforts to build and protect intangible assets.

Signs Your Business Needs CFO Services Now

If your profits keep changing or going down, it’s a strong sign you may need expert financial help to find the problem and fix it.

Inconsistent or Declining Profit Margins

Profit margins can fluctuate or decline; this is where CFOs step in to restore stability and clarity. They implement detailed margin analytics, finding underperforming business lines, production, or customer segments.

CFOs also develop margin forecasting and monitoring systems that support strategic planning with CFO services. If margins slip over time, it’s a clear signal that the business needs CFO services to realign the cost structure.

Cash Flow Problems Despite Steady Sales

Over 70% of SMEs continued to experience cash flow pressure, despite maintaining operations.

- Businesses may report healthy sales, yet delayed receivables or stretched payables create liquidity gaps..

- CFOs implement cash flow forecasting and tight collections strategies.

- They secure short-term credit lines or optimize payment terms to avoid disruptions.

- Enhance cash conversion cycles and working capital tracking..

- Ongoing cash shortages, even when sales are steady, hurt your ability to compete.

Lack of Financial Reporting Accuracy

When financial statements contain errors or inconsistencies, businesses risk costly missteps and lost stakeholder trust. This is where CFOs step in to standardize reporting processes, implement internal controls, and automate reconciliations.

Moreover, accurate reporting builds the foundation for strategic planning with CFO services. They also conduct periodic audits and variance analysis to catch irregularities before they escalate.

Difficulty Securing Funding or Credit

When businesses struggle to obtain loans or capital, it’s a clear signal that the business needs CFO services. Besides, CFOs assess credit fitness, enhance financial reporting for lenders, and identify alternative funding sources.

Additionally, they strengthen lender relationships and fine-tune business credit profiles. Without this expertise, businesses risk growth inactivity. This problem shows why careful planning with CFO services is so valuable.

Rapid Growth Outpacing Financial Infrastructure

When growth happens faster than your systems can handle, CFO services become essential. Businesses may experience a rise in sales or job creation without scaling internal systems.

- CFOs implement updated accounting platforms, tighter controls, and structured workflows.

- They align staffing, tools, and processes with the growth pace to avoid blocks.

- CFOs integrate ERP and forecasting systems to support increasing transaction volumes and complexity.

Learn More: When Is The Right Time To Invest In CFO Services?

Choosing the Right CFO Services Provider

Once you have figured out the clear signs of your business’s unique needs, the next step is to evaluate potential CFO service providers. This ensures you’re hiring a financial expert and a strategic partner who can align with your priorities.

Understanding Your Business’s Unique Needs

Before engaging a CFO service, it’s essential to map your strategic ambitions, available resources, and key growth drivers. This helps define the exact financial requirements and clarify why your business needs CFO services tailored to its specific context and priorities.

When assessing your needs, consider:

- Map your strategic ambitions, resources, and growth drivers to define specific financial oversight requirements.

- Identify unique pain points, whether in margins, scale, or investor access.

- If your business requires specialized industry experience, tech integration knowledge, or compliance capabilities.

- Clarify your operational rhythm and reporting expectations to ensure seamless partnership and data fit.

- This deep alignment ensures that business needs for CFO services are met with precision.

Evaluating Industry Experience and Track Record

Before engaging a CFO service, one of the most critical steps in choosing the right CFO services provider is evaluating their industry experience and track record.

When evaluating a potential provider, consider the following:

- Relevance: Look for a deep understanding of sector-specific financial drivers and proven success with similar businesses.

- Regulatory Expertise: Ensure they are familiar with sector-specific compliance standards to support accurate financial reporting and governance.

- Financial Strategy Development: Choose a provider experienced in adapting to industry changes and economic cycles.

- Innovation and Technology: Assess their exposure to modern financial tools and systems.

- Risk and Crisis Management: Look for insight into industry-specific threats and the ability to proactively mitigate risks.

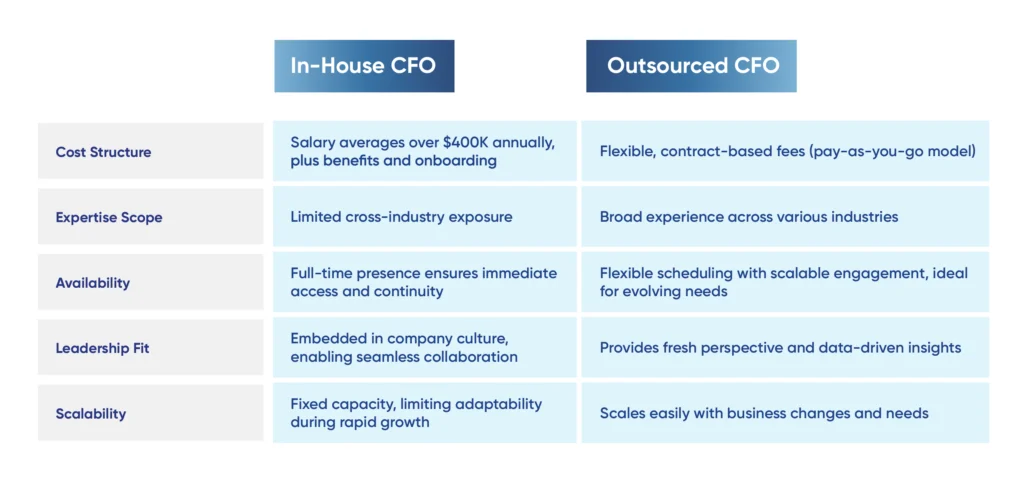

Comparing In-House vs Outsourced CFO Models

Now, let’s compare the in-house CFO vs the outsourced model.

Ensuring Transparent Pricing and Deliverables

CFO providers must offer clear, itemized proposals detailing fees, services, and deliverables. Transparent pricing prevents surprises and ensures your investment aligns with growth objectives. These proposals often specify scope, deliverable timelines, and contingency terms.

This clarity underpins strategic planning with CFO services, ensuring businesses pay only for necessary expertise while avoiding hidden fees. Firms that commit to transparent agreements reflect strong alignment with clients’ long-term goals.

Aligning with Long-Term Business Goals

CFOs align financial planning and resources with your company’s vision, ensuring every initiative supports sustainable scale and future-proofing strategy. This long-term alignment shows why business needs CFO services that deeply understand the present and future needs.

By adopting scenario planning, CFOs deliver strategic planning with CFO services that anticipate market shifts and growth phases. They synchronize financial roadmaps with operational milestones, underlining financial strategy support that evolves with business goals.

Conclusion

Choosing the right financial leadership is an investment in long-term security and growth. When a business needs CFO services, a dependable provider can serve as a strategic partner, enhancing clarity, profitability, and preparedness for future challenges.

If you’re ready to begin that partnership, consider scheduling a free strategy session with NOW CFO. Our CFO team stands ready to tailor its approach to your operational rhythm, strategic ambitions, and budget framework.