Many businesses recognize the impact of CFO services, yet only a fraction uses them. Firms working with fractional CFOs report up to a 20% increase in profit. As companies aim for sustainability, CFO expertise becomes essential.

An outsourced CFO delivers actionable insights to businesses preparing for capital raises or pursuing M&A. CFO services enhance transparency, stronger investor relations, and a forward‑looking strategy.

Why Long-Term Growth Requires Financial Leadership

Seamless alignment from strategy to actionable planning drives long-term business success. Active financial leadership sets direction, maintains control, and builds investor trust.

The Role of CFO Services in Shaping Business Vision

To achieve long-term growth, consider how CFO expertise brings clarity and guidance:

- CFO services help align financial strategy with the overarching business vision.

- Reinforce robust internal controls and accurate financial statements.

- With effective bookkeeping and payroll, CFO services support structural alignment.

- Transparent and well-structured reporting enhances credibility for potential capital raises or M&A readiness.

Why Financial Statements Matter for Sustainable Decisions

Accurate financial statements are foundational for the better impact of CFO services, offering insights into profitability, liquidity, and operational trends. These reports enable business leaders to set informed budgets.

Moreover, consistent reporting reveals performance patterns for companies with CFOs who aim for long-term business growth. CFOs use this data to align financial strategy with business goals and prepare for audits, capital raises, or expansion.

Establishing Internal Controls for Long-Term Stability

Satisfactory control can protect assets, enhance financial statement accuracy, and create long-term business growth. CFOs ensure efficient operations through preventative checks and monitoring.

Auditors found 53 serious problems in how some big organizations handle their financial reporting. These issues show that when proper checks aren’t in place, mistakes or fraud can easily occur.

Aligning Financial Operations With Growth Objectives

Effective alignment of financial operations with your company’s expansion goals transforms financial strategy into a growth engine. CFOs embed this alignment by linking budgets, forecasts, and resource deployment with measurable business milestones.

Through a finance strategy, companies can transform operational data into strategic insights and inform investment decisions that align with their long-term vision. Businesses can achieve a lasting impact through tailored financial leadership by consistently monitoring performance.

Building Investor Trust Through Financial Transparency

CFOs play a critical role in enhancing transparency. Financial transparency is the foundation for building investor trust. Today, investors demand more than just balance sheets; they seek assurance that the company operates with integrity.

CFOs help businesses create reports highlighting performance trends, risk exposure, and strategic opportunities. These reports present a consistent narrative of financial health and alignment with vision.

Strategic Benefits of CFO Services for Long-Term Success

Transitioning from the strategic importance of financial leadership, exploring how CFO services turn vision into action is crucial.

Annual Operating Plans that Support Growth Strategies

Annual operating plans lay the actionable roadmap essential for sustainable business expansion:

- Set clear, measurable annual financial goals linked to your long-term vision.

- Align departmental budgets with strategic priorities to ensure efficient resource utilization.

- Provide quarterly performance checkpoints to adapt proactively.

- Integrate regulatory compliance into financial scheduling.

Leveraging Forecasting and Modeling for Market Adaptability

Financial forecasting and modeling are vital tools that enhance strategic planning and decision-making. These models serve as the backbone for businesses, enabling them to anticipate trends, evaluate scenarios, and adjust their strategies promptly.

CFOs drive long-term business growth through robust financial modeling. They also align projections with strategic goals and ensure that planning remains responsive and data-backed.

Moreover, CFOs model revenue, costs, and cash flows under multiple scenarios. Forecasting supports finance teams by enabling them to stress-test budgets and optimize capital deployment.

How CFO Services Improve Audit Preparation and Compliance

CFO services elevate and improve audit preference by embedding rigorous audit protocols. They design financial systems that streamline documentation, maintain regulatory alignment, and facilitate timely audits.

Moreover, financial statement audits have improved operational readiness. A financial report enhances transparency, accountability, and asset management, underscoring the importance of audit preparation.

Scaling Bookkeeping and Payroll Systems Effectively

As companies grow, manual financial processes become unsustainable. CFOs implement integrated systems that automate bookkeeping and payroll, reduce human error, and maintain compliance.

Moreover, these improvements ensure efficient workflows, timely reporting, and real-time visibility into costs and liabilities. With robust systems, businesses can reallocate resources, streamline audits, and manage compensation efficiently.

Positioning Companies for Mergers & Acquisitions

Worldwide, the number of M&A dropped by 9% in the first half of 2025 compared to the same period in 2024. However, the total value of those deals increased by 15%, showing that while there were fewer deals, they were larger and more valuable.

Connecting operational readiness with strategic expansion also prepares businesses to capitalize on merger and acquisition (M&A) opportunities. This strategy can:

- Show clean, scalable financial records to attract buyers.

- Align financial metrics with growth narratives to leverage negotiation.

- Stress-test forecasts to project post‑acquisition performance.

CFO Services and Their Role in Business Transformation

CFO services can shift financial management from reactive responses to a proactive, growth-focused strategy.

Transitioning From Reactive to Proactive Financial Management

CFO services deliver actual value by replacing reactive financial fixes with forward-thinking strategies that anticipate challenges and drive growth. CFOs also implement early-warning systems, forecast future scenarios, and guide resource allocation ahead of demand.

Through scenario planning and rolling forecasts, companies adapt swiftly to market shifts, regulatory changes, or evolving customer behaviors. CFOs embed financial strategy and CFO support into decision-making, ensuring operations align with future goals.

Supporting Capital Raise with Strategic Financial Planning

Most of the capital raised is allocated to larger investment funds, making it more challenging for individual businesses to secure funding in this highly competitive environment. What the CFO does in this situation is:

- Craft detailed financial models that align fundraising with expansion goals.

- Forecast transparent cash flow for investor confidence.

- Maintain compliance with fundraising regulations and disclosures.

- Coordinate due diligence documentation for a smooth capital process.

Driving Efficiency in Business Accounting Functions

Relating proactive financial transformation to operational precision ensures every dollar is tracked effectively and supports long‑term growth.

- Implement cloud-based systems to centralize records and reduce duplication.

- Automate reconciliations to cut manual errors and save time.

- Standardize the chart of accounts for consistency across departments.

- Embed automated alerts for anomalies, improving oversight.

Enhancing Reporting to Meet SEC Compliance Standards

CFOs strengthen reporting frameworks to meet SEC accuracy. They also boost benefits via compliance, reliability, and credibility.

Using advanced tagging systems like Inline XBRL, CFOs can enhance transparency. This transparency ensures timeliness in filings and reduces error exposure, which is critical for outsourced CFO services to achieve scalability and regulatory resilience.

Optimizing Resource Allocation for Future Expansion

Integrating insight with action, CFOs guide deploying smart resources that fuel long-term business growth. Moreover, allocating resources effectively sets the groundwork for sustainable expansion and operational resilience.

CFOs analyze investments, prioritize spending, and redirect funds toward high-yield areas. Strategic allocation supports company growth, ensuring resources are channeled toward initiatives that scale efficiently.

How NOW CFO Ensures Sustainable Business Growth

NOW CFO’s unique strength is the ability to deliver customized CFO services tailored to industry needs.

How NOW CFO Ensures Sustainable Business Growth

- Customized CFO Services Tailored to Industry Needs

- Expertise in Audit Preparation and Regulatory Compliance

- Supporting Capital Raises with Financial Readiness

- Providing Ongoing Modeling and Forecasting Support

- Partnering with Businesses for Mergers & Acquisitions Growth

Customized CFO Services Tailored to Industry Needs

Many businesses outsource roles such as CFOs to gain cost efficiency and flexibility, reflecting the demand for specialized expertise. Delivering targeted financial expertise differentiates NOW CFO by aligning strategy with sector-specific needs.

- Adapt financial frameworks to sector-specific risks and regulations.

- Align performance metrics with your industry’s growth triggers.

- Use specialized forecasting models unique to your market.

- Integrate tailored internal controls to meet the standards of your industry.

Expertise in Audit Preparation and Regulatory Compliance

NOW CFO designs audit documentation and compliance systems that align with industry standards and regulatory deadlines. This report reduces risk, enhances reporting accuracy, and enables long-term business growth.

CFOs apply financial strategy and support to map norm changes, update controls, and coordinate audit-ready workflows. Highlighting how they deliver trust and credibility essential for scalability and investor readiness.

Supporting Capital Raises with Financial Readiness

CFOs coordinate capital readiness through precise planning, compliance, and forecasting. Businesses seeking long-term growth rely on CFO-led modeling and documentation to engage investors strategically.

Through tailored presentations, accurate cap tables, and runway analyses, all align to strengthen funding negotiations. CFOs position the company as a credible, growth-ready partner, demonstrating how outsourced CFO services help companies grow.

Providing Ongoing Modeling and Forecasting Support

Continuous modeling and forecasting create adaptability through informed strategy.

- Update rolling forecasts regularly to respond to market shifts.

- Model scenarios for demand changes, budgets, and cash flow stress tests.

- Incorporate real-time internal and external data for agility.

- Track forecast accuracy and refine assumptions proactively.

Partnering with Businesses for Mergers & Acquisitions Growth

M&A brings companies together with financial readiness and strategic opportunity.

- Prepare detailed financial presentations to support valuation discussions and analysis.

- Ensure clean due diligence by organizing documentation proactively.

- Coordinate with legal and compliance teams to navigate antitrust guidelines.

Conclusion: Why Investing in CFO Services Pays Off Long Term

Understanding the impact of CFO services isn’t just about improving numbers, it’s about securing your business in financial clarity. The insights shared here illustrate how CFO services drive long‑term business growth with CFO services.

If you’re ready to elevate your company’s growth potential, NOW CFO offers a tailored free consultation to suit your stage and industry. Whether you’re preparing for funding, optimizing operations, or planning an acquisition, we stand ready to partner with you.

Frequently Asked Questions

What are the Key Benefits of Using CFO Services for Long-Term Business Growth?

CFO services offer strategic financial planning, enhance reporting accuracy, improve compliance, and help align operations with growth objectives. These strategies contribute to sustainable, scalable business success.

How do Outsourced CFO Services Differ From Hiring a Full-Time CFO?

Outsourced CFOs offer flexible, cost-effective expertise tailored to your needs, while full-time CFOs are permanent hires with broader internal responsibilities. Outsourced solutions are ideal for scaling businesses or those preparing for capital events.

How can CFO Services Support my Business During a Capital Raise or Acquisition?

CFOs ensure your financials are investor-ready and prepare detailed forecasts. CFOs also manage due diligence and align valuation with the strategic growth report.

What Industries Benefit most from strategic CFO services?

CFO services are valuable across sectors, but especially in industries facing rapid growth, stringent regulatory requirements, or complex forecasting needs, such as technology, healthcare, manufacturing, and professional services.

When is the Right Time to Bring in Outsourced CFO Services?

The right time is when your business is growing, preparing for funding, facing compliance challenges, or lacks internal financial leadership. Early engagement ensures better planning and reduced risk.

Cost-saving strategies CFO services can implement aren’t just about cutting back, they’re about spending smarter. A good CFO looks at where your money is going, finds the waste, and helps you keep more profits without hurting the business.

Many companies try to save money by making quick cuts, often leading to bigger problems. A smarter approach is to focus on what’s driving up your costs and fix those areas with a plan.

Review Contracts for Savings

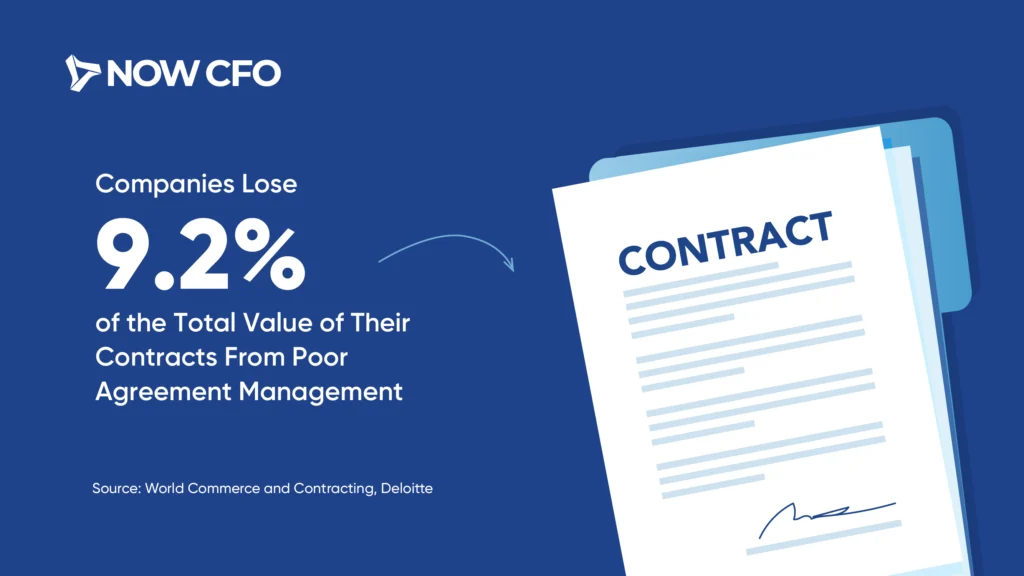

Companies lose about 9.2% of a contract’s value just from not managing agreements well. Missed details, unclear terms, or forgotten renewal dates can quietly drain money without anyone noticing.

CFOs review contracts regularly, catch hidden charges, and work to get better deals. With the proper financial oversight, your business can avoid waste, cut costs, and get more value from every agreement.

Source: World Commerce and Contracting, Deloitte

Optimizing Budget Allocation

67% of executives reinvest cost savings into other business areas, showing that reducing expenses isn’t just about cutting back but driving smarter growth. When budgets are aligned with strategic goals, companies can amplify returns without increasing total spending.

Additionally, financial efficiency strategies play a key role in this shift. By analyzing past spending and forecasting future needs, CFOs help businesses reallocate resources to the highest-impact areas.

Source: BCG

Reducing Overhead Costs

Strong companies aim to keep overhead costs below 35% of total revenue. Staying within this range helps protect profit margins and creates financial stability, especially during periods of growth or uncertainty.

Fractional CFO savings support this goal by reviewing non-operational expenses, such as administrative, office, and support costs. They also help identify areas where spending can be reduced without disrupting daily operations.

Source: Prialto

Using Technology & Automation

79% of CFOs plan to increase AI budgets, and 94% believe generative AI will significantly benefit at least one area of finance. This shift shows how automation is becoming essential to improving accuracy, cutting costs, and streamlining reporting.

Cost management practices can guide companies through this transition by selecting the right tools. CFOs also help customize automation strategies and ensure seamless integration with existing systems.

Source: Bain Capital Ventures

Monitor Cost Drivers to Sustain Savings

Only 11% of organizations sustain cost reductions beyond three years. This finding highlights a significant challenge: short-term cuts rarely last unless businesses actively monitor what’s driving their expenses.

CFO services regularly check where your money is going, spot areas where costs are creeping up, and make changes before minor problems become big. This constant attention keeps savings in place and helps your business stay financially healthy.

Source: Gartner

Conclusion

Cost-saving strategies CFO services can implement are all about making your business run better without wasting money. Instead of guessing where to cut back, a CFO helps you find real ways to save.

If you’re ready to see where your business can save money and improve how it runs, we’re here to help. You can book a free strategy session! Let’s work together to make your business leaner, stronger, and more profitable, without cutting corners.

Frequently Asked Questions

How can CFO services spot hidden financial inefficiencies?

CFOs use financial reporting, trend analysis, and benchmarking to uncover areas where money is wasted, such as outdated systems, duplicate subscriptions, or poorly negotiated contracts.

What’s the difference between cutting costs and improving cost efficiency?

Cutting costs often means reducing spending across the board. Improving cost efficiency focuses on getting more value from every dollar spent, such as streamlining processes, improving vendor terms, or reallocating budgets to high-performing areas.

Are outsourced CFOs effective for smaller businesses trying to save money?

Yes, outsourced CFOs offer high-level expertise without the full-time salary burden. They bring experience from various industries and can quickly identify savings opportunities tailored to a company’s size and stage.

How soon can a business expect results from CFO-led cost-saving strategies?

Some savings, like renegotiated contracts or automation, can be realized within weeks. Others, such as tax restructuring or strategic budget shifts, may take a quarter or more to fully reflect in the financials.

What tools do CFOs use to monitor and control business spending?

CFOs often rely on dashboards, ERP systems, and AI-powered analytics to track spending in real time, ensuring that cost controls stay in place and that trends are caught early.

Competitive businesses understand that financial clarity isn’t just about balancing the books, but also about enabling smart, scalable growth. The benefits of CFO services go far beyond traditional accounting by offering expert guidance on cash flow, risk, funding, and strategic forecasting.

With markets becoming increasingly unstable and decision-making cycles faster than ever, having the right financial partner is crucial. CFO services offer executive-level insight tailored to a company’s stage, industry, and goals.

CFOs Retire Above the Average Age

56 percent of CFOs who leave their roles either retire or move into board positions, the highest rate recorded in the past 7 years. This trend highlights how much companies value their CFOs’ experience and continue to rely on their strategic guidance.

A CFO provides this same depth of leadership daily. Unlike external advisors, a full-time CFO is deeply embedded in the company’s operations, aligning strategy, risk management, and financial planning with long-term goals.

Source: Russell Reynolds Associates

Strong Internal Succession Builds Financial Continuity

57% of global incoming CFOs were appointed internally. This trend shows that organizations with financial leaders are better positioned for smooth succession, ensuring continuity and stability at the executive level.

A CFO strengthens the leadership pipeline for tomorrow. By grooming internal talent, companies reduce disruption, preserve institutional knowledge, and maintain consistent financial oversight.

Source: Russell Reynolds Associates

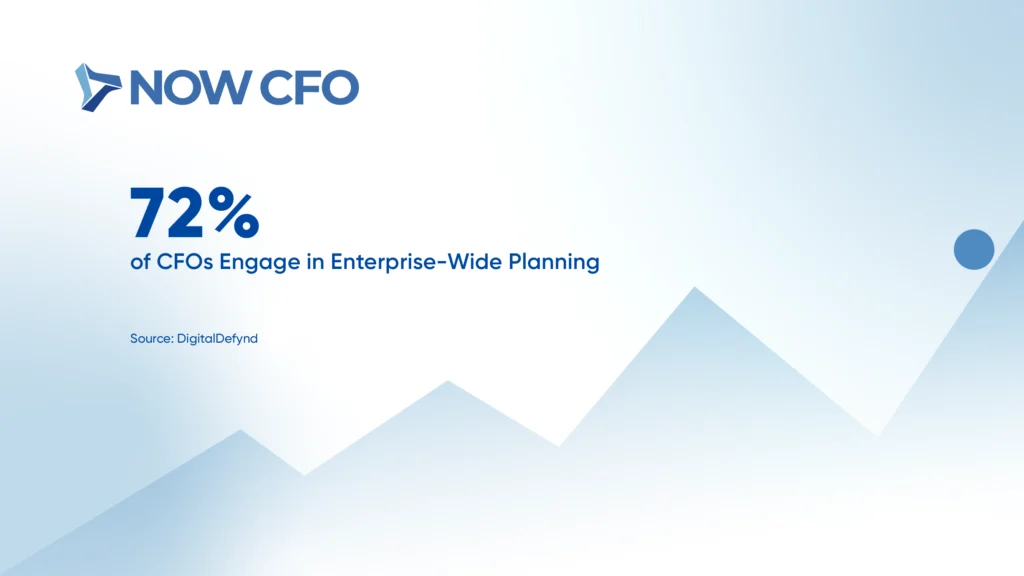

Beyond Finance: CFOs as Enterprise-Wide Strategists

CFOs today do much more than manage finances. In fact, 72% of them now lead strategic planning across the entire organization, not just within the finance department.

Moreover, CFO play a hands-on role in shaping business direction and driving execution. By embedding financial discipline into daily decisions, CFOs help companies stay focused and aligned with long-term objectives.

Source: DigitalDefynd

Using AI and Analytics for Smarter Decisions

CFOs are increasingly becoming technology leaders, not just financial stewards. 58% of CFOs invest in AI and advanced analytics to adjust planning in today’s volatile environment.

CFOs ensure that these technology investments align directly with the company’s strategy. Embedding AI-driven analytics into financial planning enables more agile responses to shifting market conditions, regulatory pressures, and evolving customer demands.

Source: PwC

Technology as a Cost-Reduction Priority

CFOs are placing technology at the core of their cost management strategies. In fact, 44% of CFOs identified expanding technology use to cut costs as a top funding priority for the next 12 months.

As financial leaders, CFOs guide these technology investments to ensure they align with the company’s broader financial goals. By balancing cost reduction with strategic reinvestment, CFOs drive long-term value and position the organization for sustainable growth.

Source: PwC

Capital Allocation Transparency

CFOs communicate clearly about capital allocation, enabling employees to understand how the company utilizes its resources. They share these plans to align strategic goals with daily operations, helping teams connect their work to the broader financial picture.

This open communication builds trust and increases engagement across the organization. When employees understand the reasons behind capital decisions, they can actively support key initiatives and contribute to stronger performance and long-term growth.

Source: EY

Conclusion

Ultimately, the benefits of CFO services are grounded not just in numbers but in strategic impact. A visionary CFO brings clarity, financial rigor, and disciplined innovation, all tailored to your business growth.

Ready to amplify your financial horsepower? Explore NOW CFO’s flexible engagement models and schedule a free strategy session for real-time guidance.

Frequently Asked Questions

What Does a CFO Actually Do for a Growing Business?

A CFO helps manage a business’s financial health by overseeing budgeting, forecasting, cash flow, and financial strategy. They also support major decisions, such as fundraising, investments, and cost management, to help the company grow sustainably.

When Should a Business Consider Hiring a CFO?

A business should consider hiring a CFO when it starts scaling, struggles with financial clarity, plans to raise capital, or needs better insight into performance metrics and financial risks.

Are CFO Services Only for Large Companies?

Not at all. Many small and mid-sized businesses use fractional or outsourced CFOs to access senior financial expertise without committing to a full-time salary.

What is the Difference Between a CFO and a Regular Accountant?

An accountant handles day-to-day financial tasks, such as bookkeeping and tax filing. A CFO, on the other hand, focuses on high-level strategy, financial planning, risk management, and long-term goals.

How Can CFO Services Help with Business Growth?

CFO services help identify growth opportunities, enhance decision-making through data-driven insights, manage capital efficiently, and ensure the business is financially prepared to scale.

Understanding what bookkeeping is critical for building financial clarity and making informed business decisions. Yet, 34% of SME owners still manage their company’s books themselves, which heightens the risk of expense misclassification.

When done correctly, bookkeeping does much more than log transactions. Bookkeeping is the backbone for monitoring cash flow, ensuring tax compliance, and producing accurate financial statements.

What is Bookkeeping?

Bookkeeping is the structured process of recording, organizing, and systematically maintaining all business financial transactions. Professional bookkeeping relies on consistency, accuracy, and compliance with financial standards to keep records transparent and reliable.

Definition of Bookkeeping

Bookkeeping is the systematic process of recording and organizing every financial transaction a business undertakes. By capturing purchases, sales, receipts, and payments, bookkeeping is the critical backbone of accounting.

Accurate records show financial health. In fact, 36% of Americans lack financial literacy. Underscoring why business owners need CFOs with strong bookkeeping practices to avoid costly errors and poor decisions.

Learn More: Basics Of Business Bookkeeping

The Role of a Bookkeeper

Bookkeepers are more than record keepers; they are the financial organizers who keep business operations running smoothly.

- Record daily financial transactions to ensure accuracy and consistency.

- Reconcile bank statements to detect errors and discrepancies early.

- Manage accounts payable and receivable to maintain healthy cash flow.

- Prepare financial reports that guide informed business decisions.

- Ensure compliance with tax regulations and reporting requirements.

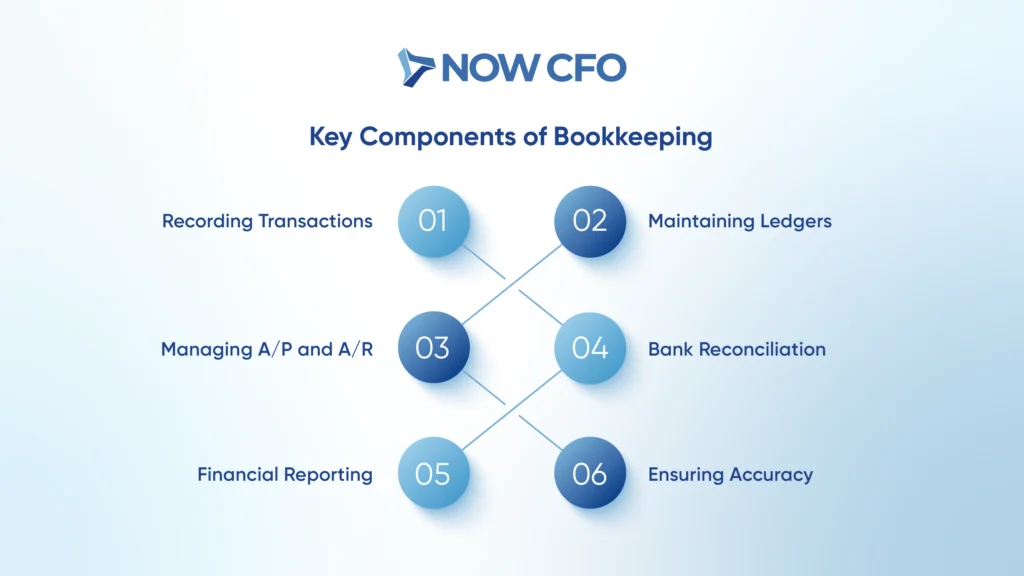

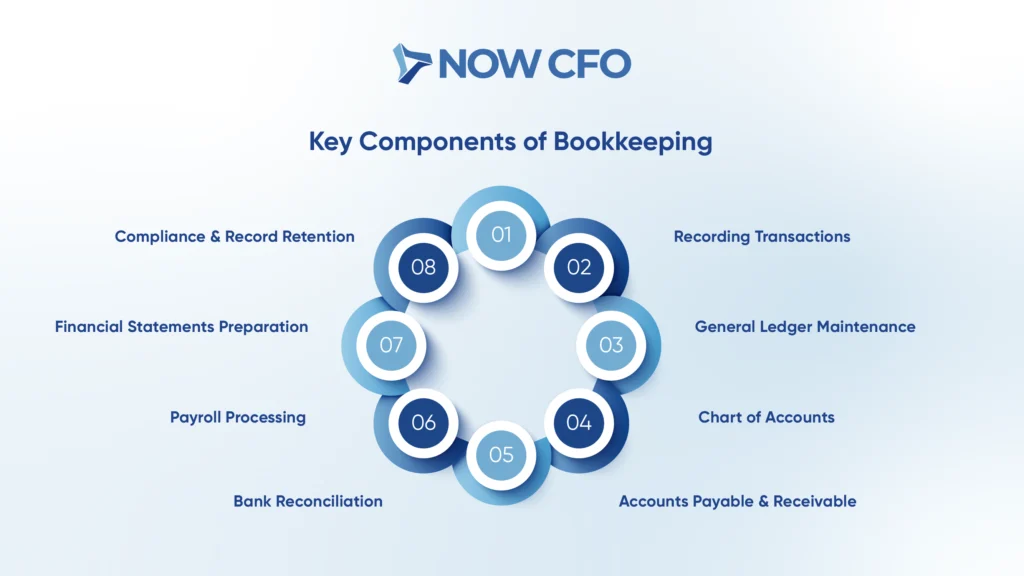

Key Components of Bookkeeping

To understand bookkeeping, you need to examine its building blocks. These components ensure every transaction is organized and translated into meaningful financial insights.

- Recording Transactions: Systematically log sales, purchases, receipts, and payments.

- Maintaining Ledgers: Organize these transactions into categories like assets, liabilities, equity, revenue, and expenses.

- Managing A/P and A/R: Track what the business owes (payables) and what is owed (receivables).

- Bank Reconciliation: Reconcile bank statements with internal records to spot discrepancies and ensure integrity.

- Financial Reporting: Prepare critical documents like balance sheets, income statements, and cash flow reports.

- Ensuring Accuracy: Compile debit and credit balances from your general ledger into a trial balance.

Bookkeeping in Modern Business

Businesses rely on digital solutions to maintain accurate financial record‑keeping. Besides, many SMEs use accounting software, such as QuickBooks, Xero, or Zoho Books, to streamline bookkeeping basics.

Additionally, cloud and electronic systems, endorsed by authorities like the IRS, ensure these digital records meet legal standards and are audit-ready. Such systems enhance tax compliance and reporting by integrating transaction tracking, reporting, and data backup.

Why Bookkeeping is the Backbone of Financial Management

Accurate bookkeeping basics form the foundation for businesses to monitor progress, prepare financial statements, and track deductible expenses effectively. Good records will help you monitor your business’s progress and prepare accurate financial statements.

Moreover, bookkeeping enhances organizing, planning, controlling, and leading, directly supporting management activities. Bookkeeping powers informed decisions, safeguards against financial missteps, and anchors long-term financial stability.

Why is Bookkeeping Important for Businesses?

Bookkeeping is far more than an administrative task; it’s the backbone of financial clarity and accountability. To truly understand what is bookkeeping, business owners must recognize that accurate record-keeping enables informed decision-making.

Proper bookkeeping ensures every transaction is documented, providing a clear view of cash flow, profitability, and liabilities. Without bookkeeping, businesses risk compliance issues, missed opportunities, and financial mismanagement.

Financial Clarity and Decision-Making

Accurate bookkeeping basics give business owners the clarity to assess current performance and chart future direction. With organized financial record‑keeping, owners craft budgets, forecast revenue, and make informed decisions.

Moreover, maintaining clear financial records reduces errors and enhances confidence in decision-making. In fact, nearly 50% of SMEs fail in the first five years, often due to poor financial planning and unclear visibility in cash management.

Tax Compliance and Reporting

Effective financial record-keeping ensures your business meets tax deadlines, accurately reports income, and claims rightful deductions. By maintaining organized records, business owners support tax compliance and reporting confidently.

Integrating bookkeeping into your routine ensures financial clarity, supports smooth audits, and safeguards against missed deductions and penalties. This strengthens your operation’s stability and fuels data-driven decisions.

Tracking Business Performance

One of the clearest ways to see the value of bookkeeping lies in its ability to track business performance. Beyond simply recording transactions, bookkeeping provides the data needed to evaluate profitability, understand spending patterns, and measure growth over time.

- Track monthly income to identify peak seasons, customer behavior, and sales fluctuations.

- Analyze fixed and variable costs to control spending and reduce unnecessary overhead.

- Calculate gross and net profits to assess financial health and long-term sustainability.

- Use historical data to forecast cash needs and build financial plans grounded in actual performance.

- Benchmark your progress with consistent metrics to detect opportunities or early warning signs.

Improving Cash Flow Management

Strong bookkeeping practices are the foundation of effective cash flow management. Accurate records ensure owners know when receivables are due, when payables must be met, and how much working capital is available at any given time.

This financial visibility prevents cash shortages, reduces reliance on costly credit, and allows for timely investments in growth. By tracking expenses and income consistently, businesses can forecast upcoming needs, identify patterns, and take steps to maintain liquidity.

Ensuring Financial Accountability

Companies have higher profitability associated with strong financial accountability practices. Accurate financial record‑keeping promotes transparency and trust, helping stakeholders rely on your information.

Consistent reporting holds management accountable and supports sound decision-making. Additionally, financial accountability fosters compliance with reporting standards and regulatory frameworks, which are essential for your business.

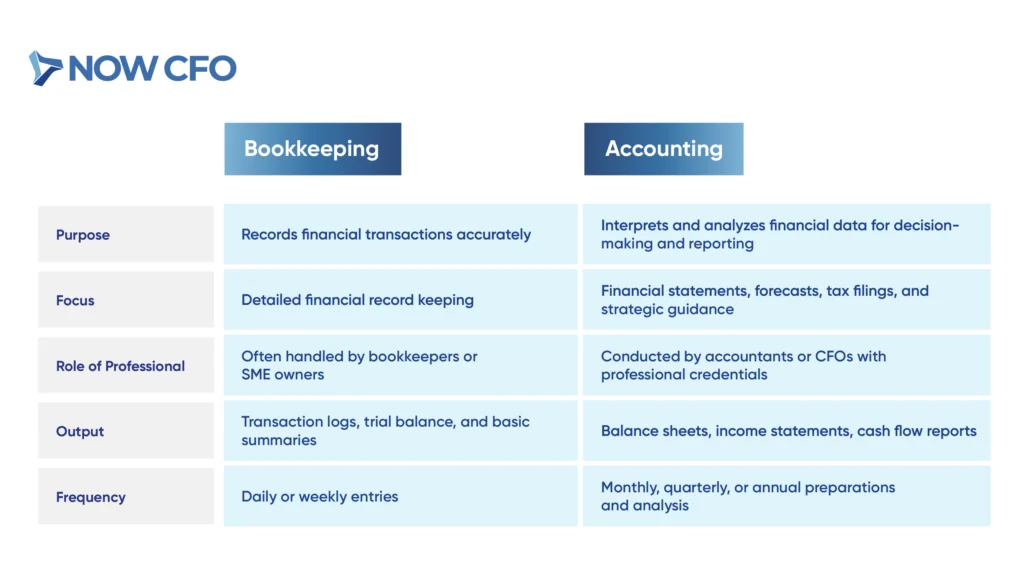

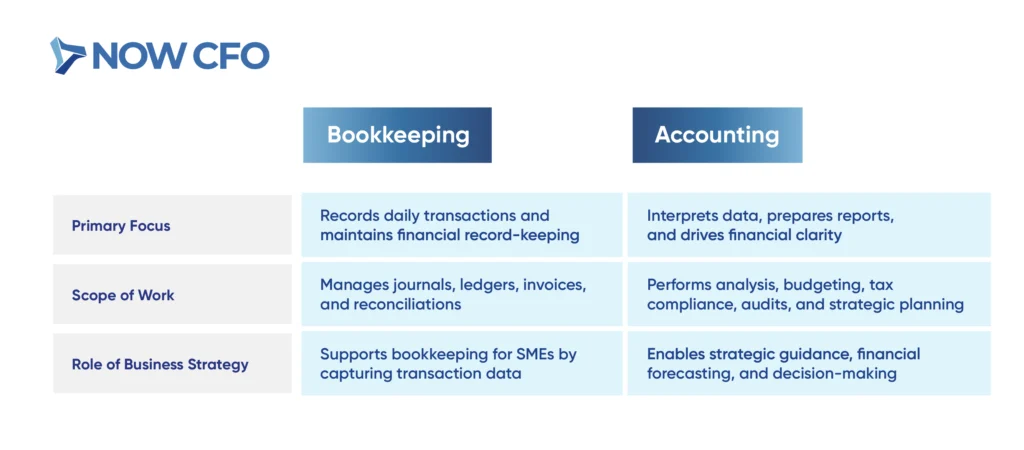

Bookkeeping vs Accounting: What’s the Difference?

While many use the terms interchangeably, bookkeeping and accounting serve distinct but complementary roles in business finance. To fully answer what bookkeeping is, it’s essential to see it as the foundation.

Key Differences Between Bookkeeping and Accounting

How Bookkeeping and Accounting Work Together

Bookkeeping records every financial transaction, capturing sales, receipts, expenses, and payments. Accountants then analyze that meticulously organized data to prepare financial statements, assess profitability, and guide strategic decisions.

Both bookkeeping and accounting ensure clarity in financial record‑keeping and transform raw data into meaningful insights for growth and compliance. Businesses build a foundation that accountants convert into smarter forecasting, reports, and long-term planning tools.

When to Use Bookkeeping vs Accounting Services

Use bookkeeping basics daily to record transactions and maintain financial record‑keeping when your business is small or in the startup phase. As complexity grows, you’ll require strategic tax planning or audit-ready statements. Engage an accountant or outsourced service to interpret data, ensure tax compliance and reporting, and guide scaling.

Which Does Your Business Need?

If your company handles simple, routine transactions, bookkeeping may be all you need to maintain accurate financial records and stay organized. However, tax planning, forecasting, and transitioning to accounting services become necessary as your business grows.

Bookkeeping ensures that your daily financial activities are properly logged, while accounting provides deeper analysis and strategic guidance. Choosing the right service depends on your business stage, ensuring you understand bookkeeping and when to incorporate.

Types of Bookkeeping Systems

Businesses rely on two primary systems to record, track, and organize their financial transactions effectively.

Single-Entry Bookkeeping

Single‑entry bookkeeping records each financial transaction only once, usually in a cash book, much like tracking personal checkbook activities. It captures only income and expenses, without detailing assets, liabilities, or equity.

This simplicity supports financial record‑keeping and avoids complexity, but it lacks the detail needed for robust financial insights, tax compliance, or performance tracking. Still, it provides a simple way for startups to support financial management.

Double-Entry Bookkeeping

Double-entry bookkeeping records each financial transaction in two accounts: a debit and a credit. Ensuring the fundamental equation (Assets = Liabilities + Equity) stays balanced.

This bookkeeping method actively prevents errors and fraud, offering clarity and accuracy in bookkeeping for SMEs and financial record‑keeping alike. Its dual-entry structure makes it the standard system accounting professionals use across industries.

Unlike the simpler system, double‑entry has complex needs such as tracking inventory, managing payables and receivables, and preparing audit-ready statements. It becomes vital when businesses plan to scale, attract investors, or ensure tax compliance.

Essential Bookkeeping Tasks

Keeping accurate financial records requires consistency, organization, and attention to detail. Essential bookkeeping tasks form the structure that ensures a business operates smoothly and remains financially transparent.

Recording Daily Transactions

Recording daily transactions means logging all sales, purchases, payments, and receipts as they occur, providing real-time insight into your financial position. Moreover, expenses should be recorded when they occur, and it’s best to record transactions daily.

Daily updates to your books ensure accurate cash flow management, minimize missed entries, and support timely tax compliance and reporting. For growing businesses, daily transaction tracking reduces errors and supports swift decision-making.

Reconciling Bank Statements

Reconciling bank statements monthly verifies that your internal books align with the bank’s records. This report is essential for maintaining financial record‑keeping accuracy, detecting unauthorized transactions, and supporting tax compliance and reporting.

Managing Accounts Payable and Receivable

Managing AP/AR directly impacts cash flow and business stability.

- Monitor bills to ensure accurate payments are made on time.

- Maintain consistent payment cycles to avoid late fees.

- Issue and log invoices promptly to ensure revenue is captured correctly.

- Send reminders for overdue accounts to maintain steady inflows.

- Regularly compare payables and receivables to forecast cash needs and avoid shortages.

Tracking Expenses and Income

It’s essential to see how tracking expenses and income provides the foundation for profitability analysis and smarter financial planning.

- Keep detailed records of expenses and income, like supplies, sales, and services.

- Tracking forms the basis for the income statement, revealing net profit and helping you make strategic decisions.

- Organized expense monitoring helps identify inefficiencies, control costs, and improve budgeting and future planning.

Preparing Financial Statements

Preparing statements that turn raw transaction data into clear insights for decision-making and planning is vital in financial management.

- Compile assets, liabilities, and equity into a snapshot of financial standing.

- Translate tracked expenses and income into profit/loss over a period.

- Record the inflows and outflows, ensuring liquidity transparency and reinforcing bookkeeping basics.

Financial statements help to inform investors, lenders, and management, demonstrating the business value of accurate bookkeeping.

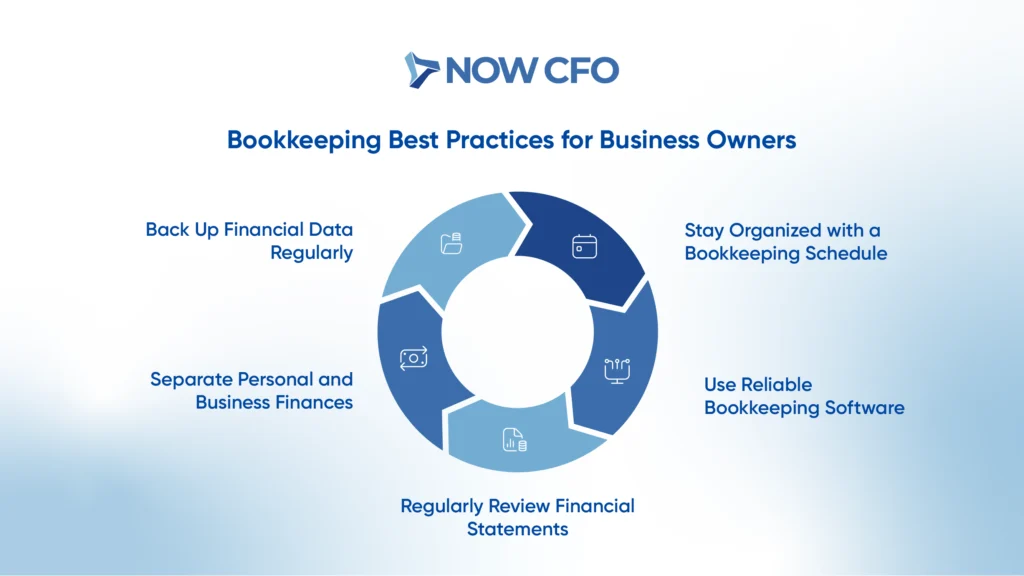

Bookkeeping Best Practices for Business Owners

Successful financial management depends on consistency, organization, and the adoption of reliable methods. Following bookkeeping best practices ensures that records remain accurate, processes stay efficient, and decision-making is based on trustworthy data.

Stay Organized with a Bookkeeping Schedule

Creating and following a consistent bookkeeping schedule ensures that every financial transaction receives timely attention, including sales, expenses, and invoice payments. A weekly or monthly bookkeeping routine helps you avoid backlogs and reduce entry errors.

You keep records accurate and current by setting a consistent schedule, like logging daily receipts each evening and reconciling bank statements weekly. This routine strengthens your ability to track performance and make informed financial decisions.

Use Reliable Bookkeeping Software

Adopting reliable bookkeeping software is essential for accurate financial record‑keeping. Unlike manual methods, digital platforms reduce errors, automate reconciliations, and ensure consistent bookkeeping.

In fact, 66% of SME owners use financial accounting software, which improves accuracy and simplifies processes. These systems support streamlined tax compliance and reporting by maintaining organized, audit-ready records.

Regularly Review Financial Statements

Establish a routine, preferably monthly, to review your income statement, balance sheet, and cash flow statement.

- Comparing income statements monthly helps you identify revenue fluctuations and control costs early.

- A consistent review of the balance sheet and cash flow shows whether you can meet liabilities and fund growth.

- Reviewing reports helps owners monitor progress and make timely adjustments, reducing risks of financial missteps.

Separate Personal and Business Finances

One of the most critical steps in maintaining clear and accurate financial records is drawing a firm line between personal and business money.

- Open dedicated business bank and credit accounts. Using separate accounts makes recordkeeping, tax compliance, and reporting easier.

- Keep personal and business spending distinct to ensure only legitimate business costs appear in your ledgers.

- Avoid mingling funds to uphold the limited liability of your business structure and preserve legal safeguards.

- Separate finances reduce confusion when preparing statements and backing up performance insights.

Back Up Financial Data Regularly

Backing up your financial data protects your business against unexpected losses from system crashes, theft, or cyberattacks. Storing copies in secure cloud platforms or external drives provides a safety net, allowing you to recover critical records quickly.

Regular backups safeguard historical data and help maintain compliance and business continuity. Creating a routine backup schedule reduces risks and gives your company a reliable foundation for future reporting and decision-making.

How to Choose the Right Bookkeeping Solution

Selecting the right bookkeeping solution depends on your business size, complexity, and long-term goals. SME may benefit from simple software that automates invoicing and expense tracking, while growing companies often need more robust platforms.

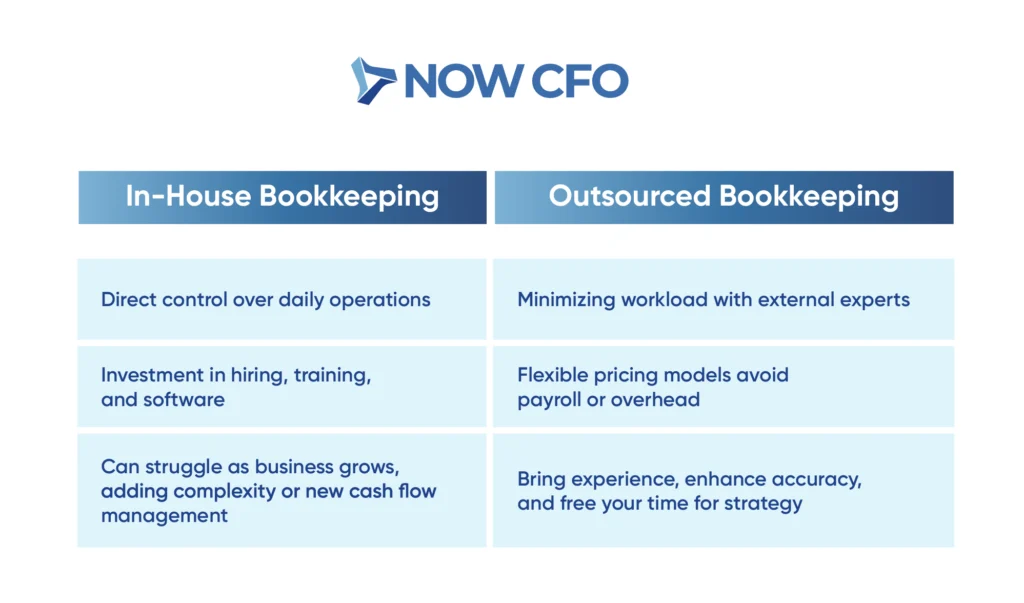

In-House vs Outsourced Bookkeeping

Deciding between in-house and outsourced bookkeeping involves balancing control, cost, and access to expertise.

| Features | In-House Bookkeeping | Outsourced Bookkeeping |

| Control & Oversight | Full control and direct oversight | Less direct control, but provides professional oversight |

| Cost & Resource Use | High overhead salaries, training, and software | More cost-effective, freeing resources for other strategic uses |

| Expertise & Skill Access | Lacks advanced knowledge in tax compliance | Access to a team of experts, helping maintain basic bookkeeping and regulatory knowledge |

| Flexibilities & Scalability | Less flexible, harder to scale with seasonal or growth-based needs | Easier to scale, ideal for fluctuating needs or growth-oriented businesses |

| Technology & automation | Requires internal investment in software upgrades and ongoing maintenance | Includes modern cloud tools and automated systems as part of the service |

Top Bookkeeping Software Options

Choosing the right bookkeeping software can make managing your finances more efficient and less time-consuming. The best platforms offer features like automated expense tracking, invoicing, and reporting, helping you stay on top of cash flow and compliance.

Below are some of the most popular bookkeeping software options businesses rely on today.

- QuickBooks Online

- Xero

- Sage Business Cloud Accounting

- Wave

- GnuCash

Factors to Consider When Choosing a Bookkeeping Service

When evaluating bookkeeping services, remember these key factors to find a provider that truly fits your business needs.

- Confirm the bookkeeper holds relevant certifications and insurance.

- Seek experience in your sector to ensure the bookkeeping service understands your context and financial workflows.

- Ensure the service supports systems you already use, such as payroll and POS software, to streamline daily workflows.

- Choose a provider with strong reviews and dependable communication.

- Pick a service that adjusts capacity as your business grows

Cost of Bookkeeping Solutions

Bookkeeping costs vary significantly depending on approach and complexity. Outsourced solutions typically cost small businesses around $400 monthly. Outsourcing also offers specialized expertise, scalability, and lower fixed costs.

Hiring a part-time in-house bookkeeper averages $21–23 per hour, which can scale to $3,000–$6,000 monthly. When combined with benefits and workspace overhead, in-house sources can cost significantly more.

Scalability for Growing Businesses

As a business grows, financial tasks become more complex and time-consuming. Scalable bookkeeping solutions provide the flexibility to adapt to these changing needs.

Businesses can maintain accuracy and compliance with the right systems or professional support. They can also gain the insights to make confident decisions and sustain growth.

Common Bookkeeping Mistakes to Avoid

Even with the best systems and practices, businesses can encounter pitfalls.

Mixing Personal and Business Finances

Mixing personal and business finances blurs the line between personal and professional spending. This common bookkeeping mistake complicates financial record‑keeping and increases the risk of tax misclassification and scrutiny.

Poor separation of personal and business finances is central to undermining control and clarity. Combining funds can raise audit flags, so it’s recommended that separate accounts be maintained.

Neglecting to Reconcile Accounts

Failing to reconcile accounts regularly leaves financial records misaligned with reality and opens the door to errors, cash flow problems, and undetected fraud. Neglecting this step can lead to inaccurate financial reporting, tax issues, and disrupted operations.

Meanwhile, cash flow problems remain the top cause of SME failure. These risks highlight the need for consistent bookkeeping reconciliations to preserve accuracy in financial record‑keeping and avoid crippling disruptions.

Failing to Back Up Financial Data

Protecting financial data is just as important as tracking it. The following points highlight what can happen when backup practices fall short.

- Losing financial data can disrupt daily operations and create major setbacks.

- Without backups, essential records may be gone permanently.

- Not all backup attempts work as expected, leaving gaps in data protection.

- Failed recovery efforts can delay reporting and decision-making.

- Inconsistent backups can weaken financial accuracy and compliance.

- Over time, these gaps may harm business performance and stability.

Ignoring Small Transactions

To fully embrace what is bookkeeping, business owners must understand why ignoring small transactions is a costly mistake.

- Small expenses left unrecorded add up and distort the accurate financial picture.

- Untracked costs make it harder to control spending and stick to planned budgets.

- Missing transactions reduce visibility of net income and profitability.

- Skipping small amounts may lead to errors when filing deductions or reconciling accounts.

- Inaccurate data limits the ability to make sound, informed business choices.

Overlooking Tax Deadlines

Businesses face serious consequences when they miss important tax deadlines, whether for quarterly or annual filings. Late submissions can quickly create compliance issues, disrupt cash flow, and strain financial stability unnecessarily. Staying on top of reporting schedules is essential to avoid setbacks and keep operations running smoothly.

How Can Outsourced CFOs Help with Bookkeeping?

Building on best practices and systems, businesses ready to scale and sharpen their bookkeeping basics can use outsourced CFOs.

Expertise in Financial Record-Keeping

Outsourced CFOs bring expertise to financial record‑keeping, ensuring every ledger entry aligns with your financial statements and regulatory standards. Because they routinely manage complex financial systems.

CFOs help maintain bookkeeping basics with elevated accuracy and compliance. Additionally, outsourced CFOs use advanced tools and controls to reduce errors and streamline documentation, boosting clarity in your bookkeeping process.

Streamlining Bookkeeping Processes

Outsourced CFOs add value by streamlining processes, turning routine bookkeeping into a faster, more reliable system.

- Outsourced CFOs assess and reorganize your bookkeeping flow, consolidating duplicate steps and automating repetitive tasks.

- To reduce manual effort, CFOs introduce tech like cloud-based ledgers, auto-reconciliation, and dashboard reporting.

- By linking bookkeeping systems with payroll, invoicing, and POS platforms, CFO create a unified ecosystem that reduces errors.

- As transaction volumes grow, your streamlined bookkeeping adapts, ensuring accuracy and consistency with less manual oversight.

Implementing Advanced Bookkeeping Software

Advanced software has transformed how businesses manage their finances by offering real-time visibility, automation, and improved accuracy. Cloud-based platforms are now widely adopted, allowing companies to move away from manual processes.

These cloud-based platforms centralize ledger maintenance, reconciliation, and financial reporting into automated workflows. This integration strengthens bookkeeping basics and enhances long-term financial record-keeping.

Ensuring Compliance with Financial Regulations

Outsourced CFOs help embed compliance into your bookkeeping by aligning recording practices with evolving legal frameworks and reporting standards. Effective compliance reduces financial and legal risks as SMEs face significant regulatory burdens.

By overseeing accurate tax calculations, timely filings, and standards like GAAP, outsourced CFOs ensure your bookkeeping reflects legal standards. CFOs reinforce bookkeeping as a reliable and compliant financial foundation, not just a ledger.

Providing Strategic Insights from Bookkeeping Data

Beyond organizing numbers, outsourced CFOs transform financial data into insights that guide smarter strategies and support long-term business growth.=

- Analyzing revenue and expense trends reveals which products, services, or clients yield the highest margins.

- Using data patterns, outsourced CFOs help anticipate shortfalls or surpluses.

- CFOs compare current data against historical performance or industry standards to highlight strengths and improvement areas.

- Insights from bookkeeping data guide decisions on expansion, staffing, technology investments, or entering new markets.

Reducing Costs Through Efficient Bookkeeping Practices

Efficient bookkeeping practices help businesses cut unnecessary expenses by improving accuracy and reducing errors that often lead to costly corrections. By keeping financial records up to date, companies avoid late fees, missed payments, and duplicate charges.

Outsourced CFOs enhance this efficiency by standardizing workflows, introducing automation tools, and ensuring consistency across all financial activities. With streamlined bookkeeping, businesses can lower administrative costs and gain visibility into spending.

Scaling Bookkeeping Operations for Growing Businesses

Scaling bookkeeping operations means expanding systems, people, and processes as your business scales. This involves implementing workflows, automations, and tools capable of handling increased transaction volume, diverse revenue streams, and multiple entities.

Outsourced CFOs play a pivotal role by designing scalable bookkeeping frameworks, implementing advanced finance systems, and advising on delegation versus automation. They ensure consistent bookkeeping even as transaction load or audit requirements grow.

Conclusion

Mastering what is bookkeeping isn’t just about balancing ledgers; it’s about empowering your business with accuracy, clarity, and strategy. Integrating structured bookkeeping systems, using reliable software, avoiding mistakes, and engaging outsourced support protects your financial health and unlocks growth opportunities.

If you’re ready to elevate your financial management, why not book a free session with our experts at NOW CFO? We can assess your current processes and recommend strategies aligned with your business goals.

Frequently Asked Questions

How Does Bookkeeping Help Me Make Smarter Business Decisions?

Bookkeeping provides clear financial records that reveal where money is earned and spent, helping you plan budgets, control costs, and grow strategically.

Can I Handle Bookkeeping Alone, or Do I Need Professional Help?

Many small business owners start independently, but outsourcing or hiring support ensures accuracy and saves time as transactions grow more complex.

What Tools Make Bookkeeping Easier for Small Businesses?

Cloud-based bookkeeping software simplifies tasks like invoicing, reconciliation, and financial reporting, while reducing the risk of errors common in manual tracking.

How Often Should I Update My Financial Records?

Transactions should be recorded daily or weekly to avoid backlogs. Regular updates prevent errors and keep your financial picture up to date.

What Happens if Bookkeeping is Neglected?

Poor bookkeeping can lead to cash flow problems, tax penalties, and missed growth opportunities. Staying consistent safeguards compliance and supports financial stability.

The basics of business bookkeeping aren’t just about balancing ledgers; they’re about gaining clarity, control, and confidence in finances. Yet many SME owners feel uncertain in this area, 60% feel not knowledgeable about accounting, and 21% admit they don’t know.

Strong bookkeeping practices provide more than compliance. They track daily transactions, reconcile accounts, and prepare reliable financial statements.

What is Bookkeeping?

Bookkeeping is the backbone of financial clarity; it represents the daily essence of the bookkeeping tasks.

Definition of Bookkeeping

At its core, bookkeeping is the systematic process of recording, organizing, and maintaining financial transactions. It ensures businesses accurately capture every sale, expense, payment, or receipt.

Unlike accounting, which analyzes and interprets information, bookkeeping is the foundational layer. Historically done by hand in journals or ledgers, it is now often executed using reliable bookkeeping software for accuracy and efficiency.

Bookkeeping gives startup and SME owners the insights they need to manage cash flow. This report allows owners to maintain financial record-keeping and prepare for tax preparation.

The Role of a Bookkeeper

A bookkeeper actively supports the financial record-keeping by managing the following key tasks:

- Recording daily transactions accurately.

- Organizing documents like invoices, receipts, and deposit slips.

- Reconciling accounts by comparing financial statements against bank records.

- Maintaining books using software to streamline bookkeeping for SMEs.

- Helping business owners meet tax timelines efficiently.

Key Components of Bookkeeping

An effective bookkeeping system centers on these critical components:

- An organized listing of assets, liabilities, equity, income, and expenses.

- Record transactions chronologically in journals, then post them into ledgers.

- Regularly compare your books against bank statements

- Prepare income statements, balance sheets, and cash flow statements.

Bookkeeping in Modern Business

Bookkeeping in modern business integrates digital tools to support financial record-keeping. It helps companies, particularly SMEs, to maintain financial record‑keeping accurately and efficiently.

Why Bookkeeping is Essential for Financial Management

Systematic financial record‑keeping enables business owners to track income, expenses, and trends. Bookkeeping also helps detect cash shortages early, avoiding cash flow problems.

Moreover, documenting transactions and retaining supporting receipts ensures businesses remain tax-ready and compliant. With real-time insights from organized bookkeeping, owners can easily budget, forecast, and set financial goals.

Why is Bookkeeping Important for Businesses?

Bookkeeping enables financial clarity and decision‑making, delivering the information needed to guide growth, optimize performance, and sustain success.

Financial Clarity and Decision-Making

Financial record-keeping empowers business owners to make complex choices with confidence and precision. By applying the bookkeeping best practice, entrepreneurs gain the visibility needed to evaluate performance, adjust strategies, and stay agile.

Through disciplined bookkeeping, small businesses unlock clear visibility into profit margins, cost centers, and revenue streams. Moreover, bookkeeping equips owners to compare actual performance against budgets, identify trends, and make timely decisions.

Tax Compliance and Reporting

It’s vital to ensure businesses meet legal obligations and avoid costly penalties. Through consistent record-keeping and organized documentation, owners align seamlessly with regulatory requirements.

Moreover, accurate bookkeeping simplifies tax filing by consolidating receipts, invoices, and transaction records. It reduces errors, helps business owners avoid risk, stay compliant, and focus on growth.

Tracking Business Performance

Bookkeeping enables owners to measure their progress, monitor trends, and assess the financial health of their business.

- Tracks income streams by product, service, or customer segment.

- Reveals fixed, variable, or recurring cost patterns.

- Owners can quickly identify gaps and adjust strategies.

- Helps determine gross and net profit over time.

- Uncovers fluctuations in cash inflow and outflow.

- Business owners use financial data to plan expansions, hire staff, or adjust pricing.

Improving Cash Flow Management

Effective bookkeeping directly enhances cash flow management. By monitoring daily income and expense patterns, businesses maintain adequate liquidity.

Accurate financial record‑keeping helps identify receivables delays or unexpected outflows. Through organized tracking, owners synchronize invoicing, bill payments, and collections.

Moreover, detailed cash flow data enables forecasting, helping owners plan for expansion or investment. Clear visibility into cash health strengthens credibility with suppliers or lenders, improving terms or securing funding when needed

Learn More: Cashflow management with an outsourced CFO

Ensuring Financial Accountability

Precise financial record‑keeping helps business owners demonstrate reliability.

- Every entry is backed by source documents, ensuring every receipt or expense is traceable.

- Investors, lenders, and auditors rely on clean books to evaluate performance and gauge financial health.

- Well-organized records reduce delays or penalties during audits.

Bookkeeping vs Accounting: What’s the Difference?

Understanding bookkeeping and accounting is essential, as each plays a unique role in maintaining accurate records and guiding smarter financial decisions.

Key Differences Between Bookkeeping and Accounting

While both functions are closely connected, the key differences between bookkeeping and accounting lie in their focus, scope, and contribution to business strategy.

How Bookkeeping and Accounting Work Together

The basics of business bookkeeping and accounting interlock to form a robust financial framework. Bookkeeping lays the groundwork by systematically capturing daily transactions and maintaining financial record‑keeping.

Once accurate records exist, accountants interpret data, analyze it, and prepare strategic reports. Eventually, they turn raw numbers into actionable budgeting, forecasting, and performance tracking insights.

When to Use Bookkeeping vs Accounting Services

Deciding when to use bookkeeping and accounting depends on your business’s size, complexity, and financial goals.

| Scenario | Use Bookkeeping | Use Accounting |

| Transaction Volume & Revenue | Businesses process fewer transactions monthly | When business complexity grows |

| Growth Stage & Complexity | To handle recording, invoicing, and reconciling | To deliver analysis, compliance navigation, and advisory services |

Which Does Your Business Need?

A bookkeeper fits your needs if your business handles daily transactions, invoicing, reconciliations, and basic financial record‑keeping. They keep your books orderly and your data accurate at a manageable cost.

You’ll benefit from an accountant when your business reaches higher operational complexity, demanding forecasting, tax compliance, performance analysis, or planning. Accountant steps in to interpret data, align tax strategy, and guide growth decisions.

Types of Bookkeeping Systems

Not all bookkeeping is managed the same way; different systems offer varying levels of detail, control, and scalability. The right approach depends on your business size, complexity, and growth goals.

Single-Entry Bookkeeping

Under a single-entry bookkeeping system, you record only one side of each transaction, typically income or expense. This record is maintained in a daily cash receipt summary and monthly summaries of cash inflows and outflows.

A single-entry bookkeeping system is the simplest to maintain and can be practical for entrepreneurs launching a small venture. However, it lacks built‑in checks for errors and is less reliable when financial control and accuracy become vital.

Double-Entry Bookkeeping

Double‑entry bookkeeping ensures every financial transaction impacts at least two accounts, typically one debit and one credit. This record maintains both balance and accuracy.

Moreover, it provides a complete picture of your finances by capturing changes in assets, liabilities, equity, income, and expenses. Simultaneously, it reinforces strong financial record‑keeping and supports strategic cash flow management and tax preparation.

Manual vs Digital Bookkeeping

Manual and digital bookkeeping show the difference between old-fashioned record-keeping by hand and modern software.

| Manual Bookkeeping | Digital Bookkeeping |

| Relies on handwritten ledgers | Uses software and cloud tools |

| Prone to human error, time-consuming reconciliations, and a limited audit trail | Automates calculations, reduces mistakes, and ensures cleaner financial record-keeping |

| Basic tracking and offers minimal insights or forecasting capacity for cash flow management | Generates real-time insights, supports forecasting, budgeting, and enhances strategic clarity |

Cloud-Based Bookkeeping Systems

Cloud‑based bookkeeping fully integrates the bookkeeping into a remote, data-driven environment. These systems enable secure, anytime access to financial record‑keeping, improving speed and accuracy across operations.

Cloud systems allow real-time collaboration, automatic updates, and streamlined tax preparation. These platforms often include automated invoicing, reconciliation, and reporting, supporting better cash flow management.

Essential Bookkeeping Tasks

Recording transactions each day can be seen as routine. But it’s the cornerstone of effective financial record‑keeping and maintains consistency across your books.

Recording Daily Transactions

Recording daily transactions captures the business’s day-to-day cash inflows and outflows. It’s best to record transactions daily, whether you’re recording expenses when they occur or identifying sources of income promptly.

By entering every sale, payment, receipt, and purchase as they happen, you prevent data gaps and maintain a reliable ledger. This practice supports tax preparation by ensuring that every deductible expense and every source of income is documented.

Reconciling Bank Statements

Reconciling bank statements ensures that your business records align with actual bank balances. Without this step, errors like unnoticed bank fees, deposits in transit, or uncleared checks can slip through and distort your financial records.

Regular reconciliation strengthens cash flow management by catching differences before they become bigger issues. It also streamlines tax preparation by creating a clear and reliable audit trail.

Managing Accounts Payable and Receivable

Efficiently managing AP/AR ensures that your financial cycle remains healthy and operational.

To manage AP/AR efficiently:

- Schedule vendor payments strategically to maintain strong supplier relationships and avoid late fees.

- Issue invoices promptly, follow up on overdue payments, and maintain clean financial record‑keeping.

- Monitor outstanding receivables and apply collection strategies.

- Adopt digital tools to streamline payables and receivables, reducing manual transactions and lag time.

- Track payables and receivables on time to inform cash flow forecasting, allowing you to plan purchases, investments, and growth.

Tracking Expenses and Income

Tracking expenses and income delivers actionable insights and ensures robust financial record-keeping. When you consistently record money spent and earned, you understand profitability, control costs, and support strategic decision-making.

Accurate tracking allows you to categorize expenses and monitor income from sales or services. Recording income and expenses promptly ensures cash flow management stays proactive.

Preparing Financial Statements

Financial statements transform bookkeeping into actionable business intelligence. It uses your financial record‑keeping to deliver clear snapshots of viability, performance, and opportunity.

- Creates Critical Reports: You produce the income, balance, and cash flow statements. Well‑organized records help small businesses to gain a deeper understanding of business progress and profitability.

- Loan and Investment: Lenders, investors, and potential partners depend on formal financial statements. A balance sheet helps track assets, liabilities, and equity.

- Enables Financial Analysis: With detailed statements, businesses compare performance period-to-period, flag trends, and spot anomalies.

- Strengthens Tax Preparation: Financial statements streamline tax preparation by summarizing income and deductible expenses, simplifying filings, and reducing audit exposure.

- Establishes Accountability and Strategy: You maintain accountability to stakeholders and sustain operational transparency.

Bookkeeping Best Practices for Business Owners

You create systems that keep your books accurate and reliable by staying organized and protecting your records.

Stay Organized with a Bookkeeping Schedule

Staying organized with a bookkeeping schedule ensures that financial record‑keeping stays accurate, timely, and meaningful. Consistent bookkeeping prevents backlog, reduces errors, and upholds best practices.

Daily or weekly bookkeeping routines strengthen cash flow management and improve tax readiness by avoiding overlooked entries or missing receipts. A daily accounting checklist simplifies responsibilities like updating transactions and reconciling accounts, and keeps financial records meticulously maintained.

Use Reliable Bookkeeping Software

Integrating reliable software automates financial record‑keeping, minimizing errors, and reinforcing bookkeeping best practices.

- Software handles data entry, categorization, and reconciliation.

- Automating calculations and report generation ensures cleaner records, strengthens defenses during tax preparation, and supports clear audit trails.

- You’ll better understand cash flow management with dashboards and reports that update instantly.

- Cloud-enabled tools allow access from anywhere.

Regularly Review Financial Statements

Accurate bookkeeping requires ongoing review and analysis. Regularly examining financial statements gives you a clearer picture of strength and potential issues.

- Analyze income statements, balance sheets, and cash flow reports to assess performance.

- Review statements monthly or quarterly to detect revenue dips, rising expenses, or tightening liquidity early.

- Consistent statement reviews build credibility with investors, lenders, or partners.

Separate Personal and Business Finances

Maintaining a clear separation between personal and business finances protects personal assets and ensures clean financial record‑keeping. Mixing expenses or income blurs the line between personal and business transactions, leading to errors, confusion, and compliance risks.

Back Up Financial Data Regularly

Backing up your financial data consistently safeguards accurate financial record‑keeping and protects against data loss from hardware failure, human error, or cyber threats.

Secure, routine backups create a reliable recovery point for business-critical files such as ledgers, receipts, payroll records, and transaction logs. When disaster strikes, thorough backups save you from manually reconstructing records, preserving accuracy and compliance continuity.

How to Choose the Right Bookkeeping Solution

Choosing the right bookkeeping solution is not a one-size-fits-all decision. The best approach depends on your business size, growth stage, industry needs, and long-term goals.

In-House vs Outsourced Bookkeeping

Choosing between in-house and outsourced bookkeeping involves balancing control, cost, and scalability.

Top Bookkeeping Software Options

You want software that streamlines financial record‑keeping and enhances bookkeeping best practices. Here are proven, widely-recommended options favored by small business owners:

- QuickBooks Online

- Xero

- Zoho Books

- FreshBooks

- Sage Business Cloud Accounting

- Wave Accounting

Factors to Consider When Choosing a Bookkeeping Service

When selecting a bookkeeping service, weighing several key factors is essential.

- Choose a service provider with proven experience in your sector.

- Evaluate whether the provider covers daily transaction processing, reconciliation, financial reporting, and other services.

- Look for a service that uses bookkeeping software that is compatible with your existing systems.

- Avoid service providers with hidden fees and confirm whether billing is monthly, per transaction, or per service bundle.

- Your provider should offer timely responses, regular updates, and accessible support.

Cost of Bookkeeping Solutions

Knowing the cost of bookkeeping solutions will help you plan budgets and achieve long-term financial clarity. Here’s a breakdown of typical cost structures:

- Monthly Packages: Many SMEs pay a flat monthly fee for comprehensive services.

- Percentage of Revenue: Certain providers charge based on revenue; typically 1% to 3%, aligning their compensation with your business success.

- Part-Time or Hourly Rates: Freelance or part-time bookkeepers often charge $21–23 per hour.

- In‑House Bookkeeper Cost: Hiring a full-time bookkeeper involves salary and benefits. The average annual salary of a bookkeeper is approximately $50,000.

Scalability for Growing Businesses

Enforcing accurate bookkeeping requires systems that scale seamlessly while preserving financial record‑keeping accuracy and efficiency as your business expands. Flexible solutions allow you to sustain growth without revising your entire bookkeeping process.

Scalable bookkeeping tools offer unmatched growth support. In the US, over 75% of SMEs have adopted cloud accounting. These platforms handle increasing transactions, multi-user access, and complex workflows.

Common Bookkeeping Mistakes to Avoid

Minor missteps in bookkeeping can have lasting consequences. By recognizing the common mistakes, you can take preventive steps to strengthen your bookkeeping practices.

Mixing Personal and Business Finances

One of the most pervasive and harmful mistakes in bookkeeping is commingling personal and business finances. Doing so compromises financial record‑keeping, inflates tax liabilities, and jeopardizes legal protections.

Besides, many SME owners mix personal and business expenses on their business cards. This seemingly minor action complicates bookkeeping, blurs expense tracking, and hinders accurate tax preparation.

Neglecting to Reconcile Accounts

Neglecting to reconcile accounts poses a serious risk because it weakens your financial record-keeping and can create hidden cash flow problems. When you skip regular reconciliation, you miss discrepancies like unrecorded bank fees, deposits in transit, or unauthorized withdrawals.

By reconciling monthly or weekly, you promote disciplined bookkeeping, prepare accurate statements for tax preparation, and ensure your financial foundation stays trustworthy.

Failing to Back Up Financial Data

Neglecting to back up your financial information puts your business at serious risk. Without reliable backups, even a single disruption can lead to irretrievable data loss, costly downtime, and regulatory headaches.

Nearly 35% of businesses face data losses and can’t recover their data because they lack proper backups. Even minor failures can disrupt your bookkeeping, making data loss highly probable.

Ignoring Small Transactions

Overlooking small transactions can quietly derail your bookkeeping. While they may seem insignificant, these entries impact your financial record‑keeping accuracy and obscure cash flow visibility.

Ignoring small transactions disrupts the completeness of your records, diminishes data integrity, and undermines bookkeeping best practices. Without tracking minor costs, businesses can miss cumulative expense leaks that negatively affect profitability.

Overlooking Tax Deadlines

Failing to meet tax deadlines threatens the bookkeeping and exposes your business to financial record‑keeping risks.

Here’s why staying on top of deadlines matters:

- Monthly Penalties: Missing a tax filing deadline triggers a 0.5 % penalty on the unpaid tax per month (up to a maximum of 25%).

- Liability Across Tax Types: Quarterly estimated tax payments and employment or sales tax filings also carry penalties and interest if missed.

- Increased Audit Risk & Administrative Burden: Repeated missed deadlines can attract IRS attention, draw scrutiny, and increase compliance burdens.

Conclusion

The basics of business bookkeeping are the backbone for sustainable financial health. When done right, bookkeeping keeps your records accurate, your cash flow steady, and your business prepared for tax obligations. More importantly, it transforms your financial data into a tool for intelligent decisions.

NOW CFO specializes in helping businesses like yours establish strong bookkeeping practices. Take the next step: Reach out for a no-pressure, free consultation and connect with one of our experts. By partnering with experienced professionals, you ensure that your bookkeeping is not just a requirement but a strategy for long-term success.

Frequently Asked Questions

What is the Easiest Way for a Beginner to Start Bookkeeping?

A beginner can start by setting up a simple system to record income and expenses daily, either using spreadsheets or user-friendly bookkeeping software.

How Often Should Small Businesses Update Their Books?

Most small businesses benefit from updating their books weekly, while larger businesses with higher transaction volumes should update them daily.

Do I Need Bookkeeping if I Already Use Accounting Software?

Accounting software helps, but proper bookkeeping is still needed to enter accurate data, reconcile accounts, and generate meaningful reports.

What Happens if I Don’t Keep Accurate Bookkeeping Records?

Inaccurate records can lead to poor financial decisions, missed tax deductions, compliance issues, and potential cash flow problems.

When Should a Business Consider Outsourcing Bookkeeping?

Businesses often outsource when transactions increase, when owners want to focus on growth rather than admin tasks, or when professional accuracy becomes essential.

Startups face an unforgiving market, with over 70% failing within five years, often due to mismanaged finances and a lack of strategic oversight. Given this reality, financial clarity becomes mission-critical.

A recognized trend underlines that startups should consider CFO services early on. CFO services bring structured financial discipline to startups, enabling precise forecasting, scalable accounting, and seamless investor engagement.

Why Financial Leadership Matters for Startups

Strong financial leadership lays the foundation for startup resilience, helping founders manage resources wisely and gain investor confidence.

Common Financial Challenges in the Startup Phase

CFO-led cash-flow forecasting protects companies from liquidity crises and extends their runway. Here are the most urgent obstacles founders encounter:

- Poor cash‑flow forecasting leads to sudden capital shortages.

- Burn‑rate miscalculations erode runway unexpectedly.

- Lack of structured budgets or financial projections.

- Weak internal oversight increases financial risk.

- Overly optimistic revenue assumptions derail growth plans.

Importance of Reliable Financial Statements for Investors

Reliable financial statements prove startup viability and guide investor decisions. Startups should consider CFO services from day one.

Key investor requirements:

- Audited or reviewed statements enhance credibility with potential backers.

- Financial disclosures reduce perceived investment risk.

- Clear revenue and expense reporting supports valuation accuracy.

How Early Financial Planning Prevents Future Setbacks

Detailed early-stage financial planning supports founders in growing with foresight and resilience. Effective early-stage financial planning, guided by seasoned CFOs, transforms reactive operations into a proactive strategy.

Establishing solid budgets and forecasts ahead of milestones helps avoid cash crunches, staffing missteps, or missed revenue targets. CFO involvement in annual operating plans further structures financial trajectories, which will promote informed investments.

Building Credibility with Stakeholders and Lenders

Credible financial leadership builds lasting trust with key stakeholders. Active, structured financial management signals maturity and transparency. CFO services for startups enable disciplined reporting and governance that earn lender confidence.

Precise financial forecasts, backed by startup financial management systems, reduce uncertainty, making lenders more receptive. Strong documentation and clean reporting also ease underwriting.

Why Startups Often Underestimate Financial Oversight

Early-stage entrepreneurs may overlook critical oversight due to inexperience, resource constraints, or overly optimistic forecasts. Careful oversight requires structured accounting, clear authorization protocols, and audit readiness.