Financial clarity and agility are more crucial than ever. Startups and growing businesses often face resource constraints that limit their ability to manage complex financial functions in-house.

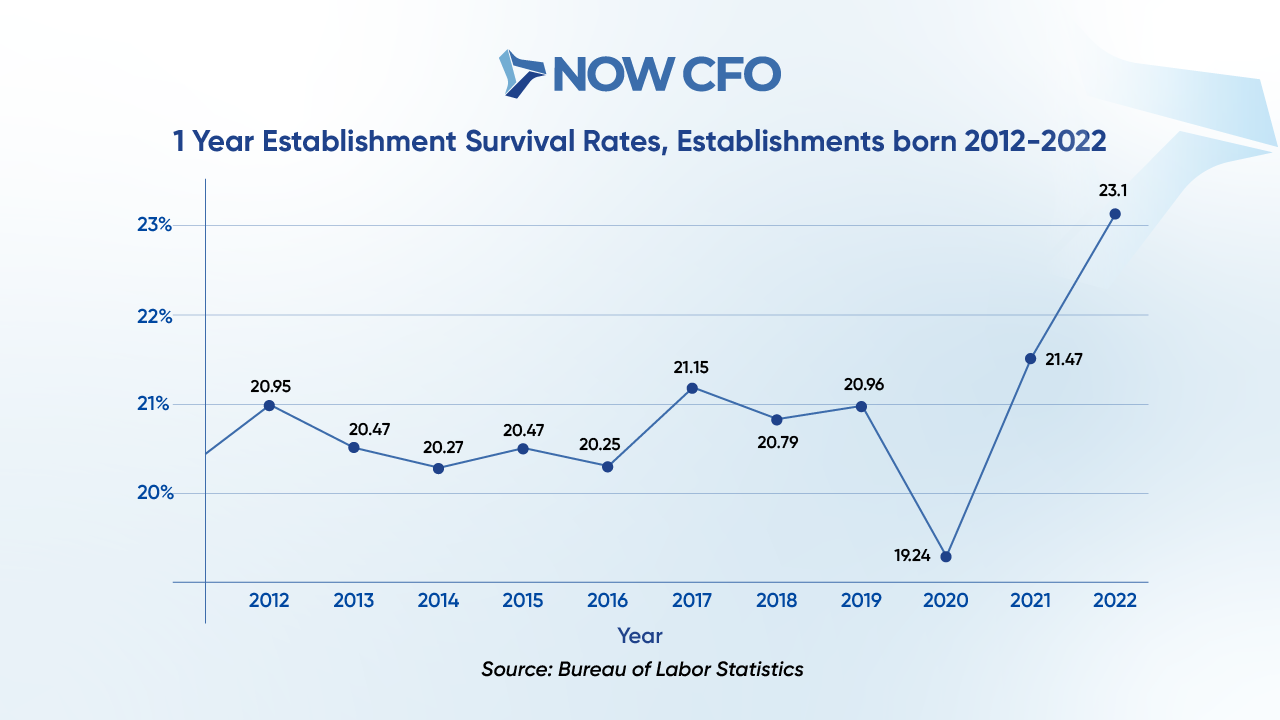

Around 22% of new businesses in the U.S. fail within their first year, with poor financial management ranking as one of the top causes. This statistic alone highlights why many companies use external experts to bridge the financial strategy gap.

Below is the chart showing the US businesses’ year-by-year survival rates from 2012 to 2022.

An outsourced CFO for startups and SMES improves financial planning by bringing seasoned financial leadership and decision-making without the cost of a full-time hire. These professionals help implement systems for cash flow forecasting, budgeting, financial reporting, and strategic decision-making.

The Role of an Outsourced CFO in Strategic Financial Planning

Financial strategy isn’t just about crunching numbers but seeing the whole picture. Once a company understands the value of accurate financial oversight, the next step is to explore how an outsourced CFO improves financial planning by aligning strategy with long-term goals.

Let’s dive into their critical role in building a foundation for intelligent, data-driven decision-making.

How Financial Strategy Outsourcing Helps You

Financial strategies require more than just number crunching; they demand a visionary approach. An outsourced CFO improves financial planning by bringing a wealth of experience and an objective perspective.

They assess your company’s financial health, identify areas of improvement, and craft tailored strategies that align with your business goals.

Key Benefits of Outsourced CFO

- Objective financial assessment

- Customized strategic planning

- Enhanced decision-making capabilities

Creating Accurate Financial Forecasts with Expert Guidance

Transitioning from reactive to proactive financial management is essential for business success. An outsourced CFO improves financial planning by developing precise financial forecasts that inform strategic decisions.

These forecasts consider various factors, including market trends, operational costs, and revenue projections, providing a comprehensive financial outlook. With accurate forecasting, businesses can allocate resources efficiently, plan for growth, and mitigate risks.

Helping Businesses Navigate Financial Challenges

In the face of financial adversity, an outsourced CFO improves financial planning by offering strategic solutions tailored to the company’s unique challenges. They analyze financial data to identify issues such as cash flow shortages or budget overruns and implement corrective measures promptly.

By addressing these challenges head-on, outsourced CFOs help businesses maintain financial stability and avoid potential pitfalls. Their expertise ensures that companies can adapt to changing market conditions and continue to thrive.

Identifying Growth Opportunities Through Data-Driven Insights

Leveraging data analytics, an outsourced CFO improves financial planning by uncovering growth opportunities that may not be immediately apparent. They analyze key performance indicators, market trends, and financial statements to identify areas where the business can expand or improve.

This data-driven approach enables companies to make informed decisions, invest wisely, and capitalize on emerging market opportunities.

Aligning Financial Goals with Business Objectives

Ensuring that financial goals support overarching business objectives is crucial. An outsourced CFO improves financial planning by aligning budgeting, forecasting, and financial strategies with the company’s mission and vision. This alignment fosters department coherence, enhances operational efficiency, and drives sustainable growth.

Alignment Techniques

- Integrated financial planning

- Cross-departmental collaboration

- Performance monitoring

The Impact of Outsourced CFOs on Cash Flow Management and Profitability

Companies often face financial pressures after establishing a strategic framework, especially with cash flow and cost control.

Streamlining Cash Flow Management With an Outsourced CFO for Business Stability

Maintaining steady cash flow is essential for business stability. An outsourced CFO improves financial planning by implementing effective cash flow management strategies.

They analyze cash inflows and outflows, identify patterns, and forecast future cash needs. This proactive approach ensures businesses can meet their financial obligations and avoid liquidity crises.

By leveraging their expertise, outsourced CFOs help businesses:

- Develop accurate cash flow forecasts

- Implement efficient billing and collection processes

- Manage expenses to align with revenue cycles

Reducing Overhead Costs with Outsourced Financial Leadership

High overhead costs can erode profitability. An outsourced CFO improves financial planning by identifying and eliminating unnecessary expenses. They conduct thorough reviews of operational costs, negotiate better terms with vendors, and implement cost-saving measures.

For private firms, overhead costs can account for approximately 14% of total revenues or 38% of gross profits.

Key strategies include:

- Analyzing fixed and variable costs to identify savings

- Implementing technology solutions to automate processes

- Restructuring staffing models for efficiency

Businesses can allocate resources more effectively by reducing overhead, improving margins, and enhancing competitiveness.

Maximizing Profitability by Optimizing Operational Efficiency

Operational efficiency is a key driver of profitability. An outsourced CFO improves financial planning by streamlining processes and eliminating inefficiencies. They assess workflows, identify bottlenecks, and implement best practices to enhance productivity.

Approaches include:

- Standardizing procedures to reduce errors

- Leveraging data analytics for informed decision-making

- Aligning operations with strategic goals

These efforts lead to cost reductions, faster turnaround times, and improved customer satisfaction, contributing to increased profitability.

Predictive Analysis and Forecasting for Better Cash Flow Decisions

Predictive analysis enables businesses to anticipate financial trends and make proactive decisions. An outsourced CFO improves financial planning by utilizing forecasting tools to model various scenarios. They analyze historical data, market conditions, and business cycles to predict cash flow patterns.

Benefits include:

- Identifying potential cash shortfalls in advance

- Planning for seasonal fluctuations

- Making informed investment decisions

Aligning Business Expenses with Financial Goals for Growth

Aligning expenses with strategic objectives is crucial for sustainable growth. An outsourced CFO improves financial planning by ensuring that spending supports long-term goals. They evaluate budgets, monitor expenditures, and adjust allocations to prioritize high-impact areas.

Key actions include:

- Setting clear financial targets

- Regularly reviewing and adjusting budgets

- Eliminating non-essential spending

How an Outsourced CFO Supports Strategic Decision-Making

With core financial operations in place, making confident, informed decisions becomes essential. That’s where financial leadership steps in. An outsourced CFO improves financial planning not only through execution but by equipping business leaders with the insights needed to make agile, forward-looking decisions.

Here’s how they influence strategic direction through real-time financial guidance.

Leveraging Financial Insights to Drive Business Decisions

To make informed strategic decisions, businesses need accurate and timely financial insights. An outsourced CFO improves financial planning by providing comprehensive analyses that guide decision-making processes. They interpret complex financial data, identify trends, and offer actionable recommendations that align with the company’s objectives.

By leveraging these insights, companies can:

- Allocate resources efficiently

- Identify profitable opportunities

- Mitigate financial risks

How Outsourced CFOs Provide Objective Financial Guidance

An outsourced CFO improves financial planning by offering unbiased financial guidance. Unlike internal staff, outsourced CFOs are not influenced by company politics or internal biases, allowing them to provide objective assessments of financial health and performance.

Their impartial perspective helps businesses:

- Identify areas of inefficiency

- Implement cost-saving measures

- Develop realistic financial goals

Enhancing Budgeting and Forecasting Accuracy for Smarter Decisions

Financial forecasting and outsourced CFO services go hand in hand and are essential for effective financial planning. An outsourced CFO improves financial planning using advanced tools and methodologies to create precise budgets and forecasts. They analyze historical data, market trends, and operational metrics to predict future financial performance.

Benefits include:

- Improved cash flow management

- Informed investment decisions

- Enhanced stakeholder confidence

This precision allows businesses to allocate resources effectively and confidently plan for growth.

Using Financial Reports to Guide Long-Term Business Strategy

Financial reports are vital tools for strategic planning. An outsourced CFO improves financial planning by interpreting these reports to inform long-term business strategies. They analyze income, balance sheets, and cash flow statements to assess financial health and identify trends.

Key uses include:

- Evaluating investment opportunities

- Assessing operational efficiency

- Monitoring progress toward financial goals

Reducing Financial Risks and Improving Business Agility

Managing financial risk is crucial for business agility. An outsourced CFO improves financial planning by identifying potential risks and developing mitigation strategies. They assess market conditions, regulatory changes, and internal processes to anticipate challenges.

By proactively managing risks, businesses can:

- Adapt quickly to market changes

- Maintain financial stability

- Seize new opportunities

Key Metrics to Track When Measuring Growth with an Outsourced CFO

Monitoring specific metrics is crucial to assess the impact of an outsourced CFO. Key performance indicators include:

- Revenue Growth Rate: Measures the increase in sales over a specific period.

- Gross Profit Margin: Indicates financial health by showing the percentage of revenue exceeding the cost of goods sold.

- Operating Cash Flow: Reflects the cash generated from regular business operations.

- Customer Acquisition Cost (CAC): Calculates the cost of acquiring a new customer.

- Customer Lifetime Value (CLV): Estimates the total revenue expected from customers throughout their relationship with the company.

How NOW CFO Supports Businesses in Achieving Financial Growth

NOW CFO offers tailored outsourced CFO services for startups and SMEs to help them achieve financial growth. Their approach includes:

- Strategic Financial Planning: Developing customized financial strategies aligned with business goals.

- Cash Flow Management: Ensuring optimal liquidity to support operations and growth.

- Budgeting and Forecasting: Providing accurate budget management with an outsourced CFO.

- Risk Management: Identifying and mitigating financial risks to safeguard assets.

Overcoming Common Financial Planning Challenges with an Outsourced CFO

While the benefits of an outsourced CFO are clear, many companies are still struggling with core financial obstacles. From cash flow issues to reporting delays, these challenges can slow growth or derail success altogether.

Here’s how an outsourced CFO improves financial planning by solving businesses’ most common pain points.

Addressing Cash Flow Issues with Expert CFO Guidance

Cash flow challenges are a leading cause of business failures. An outsourced CFO improves financial planning by implementing strategies such as:

- Developing cash flow forecasts

- Optimizing accounts receivable and payable

- Identifying cost-saving opportunities

By addressing these areas, businesses can maintain liquidity and avoid financial distress.

Solving Budgeting and Forecasting Gaps with Strategic Financial Planning

Accurate budgeting and forecasting are essential for informed decision-making. An outsourced CFO improves financial planning by:

- Analyzing historical financial data

- Incorporating market trends

- Utilizing advanced forecasting tools

This approach enables businesses to set realistic financial goals and allocate resources effectively.

Managing Scaling Challenges with Expert Financial Oversight

Scaling a business introduces complexities that require expert financial oversight. An outsourced CFO improves financial planning by:

- Assessing financial readiness for expansion

- Identifying funding opportunities

- Implementing scalable financial systems

This guidance ensures that growth initiatives are financially sustainable and aligned with long-term objectives.

Enhancing Financial Reporting Accuracy and Timeliness

Timely and accurate financial reporting is crucial for transparency and compliance. A fractional CFO improves financial planning by:

- Implementing standardized reporting processes

- Ensuring compliance with accounting standards

- Providing real-time financial insights

These practices enhance stakeholder confidence and support strategic decision-making.

Providing Scalable Solutions for Growing Businesses

As businesses grow, their financial needs evolve. A virtual CFO improves financial planning by offering scalable solutions such as:

- Customizing financial strategies to match growth stages

- Integrating flexible financial systems

- Adapting to changing market conditions

Conclusion: Business Growth With Outsourced CFO

Financial clarity is the foundation of business success; exemplary outsourced finance teams are game changers. By aligning operations with economic goals, improving visibility across departments, and forecasting growth opportunities, an outsourced CFO improves financial planning in tangible, measurable ways.

If you’re facing budgeting hurdles, unsure about your scalability, or want more insight into how to drive profitability, NOW CFO has the tools and expertise to help. We’ve helped hundreds of businesses across industries gain strategic clarity and operational control through our tailored outsourced CFO services.