The popularity of fractional CFO services is soaring, with demand for these roles increasing rapidly. For many growth-stage companies, this surge reflects the desire to access high-level financial leadership without the hefty long-term commitment and overhead of hiring a full-time CFO.

Traditional CFO roles often come with six-figure salaries and full-time demands, which may not align with the needs of evolving enterprises. The fractional CFO model provides a compelling solution, offering seasoned financial leadership on a flexible, part-time basis.

Surge in Interim CFOs Demand Skyrockets

Requests for interim CFOs have surged by an astounding 310% since 2020, with CFO roles now representing over half of all interim C-suite placements. This dramatic increase highlights a broader shift toward agile, outsourced financial leadership, especially as companies seek to navigate uncertain markets with precision and control.

The rising popularity of fractional CFO services reflects a growing need for leadership that’s both strategic and scalable. Interim CFOs are no longer a temporary fix, they’re a preferred solution for companies needing financial clarity during transitions, M&A, restructuring, or periods of rapid growth.

Source: Business Talent Group

Fractional CFO Market Growth Production

The global finance and accounting outsourcing market is projected to reach $76.359 billion by 2033, growing at a CAGR of 5.75% from 2025. Starting at $46.168 billion in 2024, this steady rise reflects expanding demand for cost-efficient, scalable financial services.

This market boom is closely tied to the rise of part-time CFOs and outsourced financial leadership trends. As businesses seek to trim overhead without compromising on strategy, fractional CFOs offer the perfect blend of cost control and expert guidance.

Source: Business Research Insights

Demand for Fractional CFOs Has Doubled in Two Years

The demand for fractional CFOs in the U.S. has skyrocketed, with a staggering 103% year-over-year increase. These trends reflect a significant shift in how businesses, especially startups and growth-stage companies, approach financial leadership.

Instead of committing to the high fixed costs of full-time CFOs, companies are turning to fractional solutions that deliver flexibility without sacrificing strategic expertise.

This surge in demand proves that more businesses are recognizing the benefits of experienced, project-based financial leadership. With fractional CFOs, companies can access tailored financial strategies, budget oversight, and forecast support exactly when needed.

Source: Business Talent Group

Outsourced CFOs are Cost Effective

Hiring a full-time CFO can cost anywhere from $300K to $500K per year, making it a steep investment for many mid-market firms and startups. In contrast, fractional CFO engagements typically range from $3,000 to $15,000 per month, depending on complexity and scope.

These numbers demonstrate why the benefits of hiring a fractional CFO are so compelling. Businesses pay only for what they need, whether it’s strategic planning, financial modeling, or cash flow oversight. More importantly, the flexible model supports companies through changing financial priorities, without long-term commitments.

Source: Salary.com, NOW CFO

Engagements Are Long Enough to Drive Impact

Contrary to the misconception that fractional CFOs are short-term placeholders, data shows otherwise: 45.6% of engagements last between one and two years, while 42% run for several months. This proves that fractional CFOs are delivering real impact during critical growth phases or organizational transitions.

This model of interim financial leadership provides companies with strategic consistency and continuity. Businesses benefit from embedded, high-level finance leadership that’s present long enough to drive results, yet flexible enough to scale or step back as needed.

Source: HubSpot

CFO Turnover Drives Fractional CFO Adoption

CFO turnover reached a three-year high of 22% in 2024, causing disruption across industries. As a result, many organizations are turning to fractional CFO demand as a proactive solution to fill leadership gaps swiftly and efficiently.

Fractional CFOs offer rapid onboarding, strategic clarity, and operational stability at a time when many companies can’t afford long recruitment cycles. These professionals’ step in with immediate impact, offering insights on cash flow, compliance, and long-term planning.

Source: HealthLeaders Media

Conclusion

By offering top-tier planning, forecasting, and reporting at a fraction of the cost, fractional CFO empowers organizations to operate with agility and confidence. From startups navigating Series A rounds to private equity-backed firms seeking quick stabilization, the value of on-demand CFO model has never been popular.

Considering CFO expertise without full-time cost? NOW CFO is here to help. Book a free consultation session to explore a bespoke engagement designed for your business goals.

FAQs

Why are Fractional CFOs Becoming More Popular?

The popularity of fractional CFO services is rising as businesses seek agile, scalable financial leadership without committing to a full-time hire. This model allows companies to access CFO expertise on demand, particularly valuable in a remote-first world where top financial talent can be engaged regardless of location.

What are the Benefits of Using a Part-time CFO?

The rise of part-time CFOs offers numerous advantages. Businesses gain access to high-level financial strategy, cash flow forecasting, and investor relations support at a fraction of the cost.

How Much Can I Save by Hiring a Fractional CFO?

On average, companies save significantly when hiring a fractional CFO versus a full-time executive. These outsourced financial strategies are tailored, meaning businesses only pay for what they need.

Are Fractional CFOs Effective for Startups?

Absolutely, fractional CFO adoption among startups has grown significantly, particularly during early funding rounds. Startups benefit from investor-ready modeling, scalable finance strategy, and critical insights without the overhead of a full-time CFO.

What Services do Fractional CFOs Typically Offer?

Fractional CFOs go beyond traditional accounting. Their services include strategic financial support/planning, forecasting, budget creation, cash flow management, KPI tracking, and fundraising support.

The way businesses secure top-tier financial guidance is changing fast. On LinkedIn alone, profiles that mention fractional leadership roles have exploded from about 2,000 in 2022 to more than 110,000 in 2024, a 55-fold jump.

Why the surge? Traditional, full-time CFO posts often saddle growing companies with six-figure salaries, bonuses, and equity grants. At the same time, competitive pressure and real-time analytics mean CEOs need high-caliber insight now, not after a lengthy recruitment cycle.

Fractional CFOs offer an agile solution, providing experienced financial leadership on demand, without the long-term expense or operational delay of a full-time hire. This model enables businesses to scale their financial expertise in tandem with growth, leveraging strategic forecasting, cash flow management, and investor readiness as needed.

Below are seven research-backed reasons explaining exactly why and how this flexible model redefines strategic finance.

Reason 1: Cost Efficiency Without Compromising Expertise

To hire full-time CFOs, companies must spend $250K to $400K annually (plus benefits). This cost is not feasible for most startups and SMEs. In contrast, on average, fractional CFO costs around $12 K per month.

This enables businesses to reduce CFO-related expenses by 30% to 40% while maintaining high-caliber financial leadership. Fractional CFOs are often seasoned professionals who bring on-demand expertise tailored to your company’s most pressing needs.

Source: Forbes

Reason 2: Soaring Market Demand for Fractional CFOs

The demand for fractional CFOs in the U.S. has skyrocketed, with a staggering 103% year-over-year increase. These fractional CFO trends reflects a significant shift in how businesses, especially startups and growth-stage companies, approach financial leadership.

Instead of committing to the high fixed costs of full-time CFOs, companies are turning to fractional solutions that deliver flexibility without sacrificing strategic expertise.

This surge in demand demonstrates that an increasing number of businesses are recognizing the benefits of experienced, project-based financial leadership. With fractional CFOs, companies can access tailored financial strategies, budget oversight, and forecasting support exactly when needed.

Source: Business Talent Group

Reason 3: Rising CFO Turnover Driving Part-Time Financial Leadership

The executive talent market is evolving rapidly. Between 2019 and 2020 alone, CFO resignations spiked by 27%, creating significant leadership gaps for businesses of all sizes. This trend accelerated the need for part-time, interim, and fractional CFO solutions to fill the void left by departing finance leaders.

Fractional CFOs have become the ideal bridge, providing experienced financial oversight without the long hiring timelines or hefty compensation packages of permanent hires. They ensure stability, strategic continuity, and investor confidence while allowing businesses the flexibility to decide on their long-term leadership needs.

Source: The Wall Street Journal

Reason 4: Fractional Executive Workforce Has Doubled Since 2022

The fractional executive workforce in the U.S. has experienced unprecedented growth, doubling from 60,000 in 2022 to over 120,000 today. This rapid expansion reflects how companies embrace flexible leadership models to navigate economic uncertainty, growth challenges, and evolving market demands.

With more qualified executives opting for fractional roles, businesses can access a deep, diverse talent pool without the high overhead. For financial leadership, fractional CFOs allow companies to harness strategic expertise, improve forecasting, and cost-effectively enhance profitability on demand.

Source: Column Content

Reason 5: Access to Highly Seasoned Financial Leaders

When it comes to financial leadership, experience is non-negotiable. Fortunately, businesses that opt for fractional CFOs don’t have to compromise. Approximately 80% of fractional executives bring more than 15 years of professional expertise, equipping them to handle complex financial challenges confidently.

This wealth of experience ensures that fractional CFOs can immediately step into your business, understand its unique financial landscape, and deliver results. Whether it’s navigating a fundraising round, improving cash flow, or supporting strategic growth, fractional CFOs provide the high-level insights typically expected from veteran executives, without the full-time price tag.

Source: Column Content

Reason 6: Scalable Support Across Multiple Companies

Fractional CFOs are designed for efficiency, offering their expertise to multiple businesses at once. Most fractional CFOs comfortably manage financial leadership across 2 to 3 companies simultaneously, providing tailored support exactly when each organization needs it.

This creates a scalable, on-demand solution for startups, SMEs, and private equity-backed firms to access top-tier financial guidance. It allows companies to gain strategic insights, improve financial processes, and drive growth without committing to the cost or structure of a full-time CFO.

Reason 7: C-Suite Caliber Leadership Without Full-Time Costs

Demand for interim and fractional C-suite leaders has surged as businesses strive to stay agile in uncertain markets. 56% of all interim executive requests are for C-suite positions, with fractional CFOs experiencing one of the fastest-growing demand curves.

This trend highlights the increasing reliance on experienced, part-time financial leaders to drive strategic initiatives, manage risk, and provide operational oversight. Fractional CFOs offer companies the ability to secure C-level expertise quickly and affordably, ensuring businesses stay competitive without incurring the fixed costs of a full-time hire.

Source: Fortune

Conclusion

Fractional CFOs have become a game-changer for businesses seeking financial expertise without the burden of a full-time hire. Their ability to deliver strategic guidance, experienced leadership, and flexible support makes them an ideal solution for companies navigating growth, change, or financial complexity.

From improving cost efficiency to providing seasoned financial insight, fractional CFOs empower organizations to make better decisions, enhance financial operations, and maintain stability during critical transitions. Their scalable approach allows businesses to access high-level financial leadership precisely when needed, without overextending resources.

Ready to see what fractional leadership could do for your balance sheet? Book a no-obligation strategy session to explore NOW CFO’s tailored fractional CFO services, your first step toward a brighter, more agile financial future.

Frequently Asked Questions

Why are Fractional CFOs Considered the Future of Financial Leadership?

They offer on-demand, flexible financial leadership that adapts to modern business needs. This allows companies to access high-level expertise without committing to full-time costs.

How Much Does a Fractional CFO Cost Compared to a Full-Time CFO?

Businesses typically save 30% to 40% by choosing fractional CFO services over hiring a full-time executive. You only pay for the strategic support and time your company needs.

What Types of Businesses Benefit Most From Fractional CFOs?

Growing startups, private equity-backed companies, and businesses facing financial complexity benefit most. Fractional CFOs provide scalable, expert financial guidance tailored to changing needs.

How do Fractional CFOs Use Technology?

They implement tools like cloud-based accounting, AI forecasting, and real-time dashboards to improve financial visibility. This helps businesses make faster, more informed decisions.

Is Hiring a Fractional CFO Better Than Outsourcing Bookkeeping?

They solve different problems; bookkeeping manages records, while fractional CFOs drive financial strategy and growth. Startups often need both to build a strong financial foundation.

Did you know that fractional CFO industry have become one of the fastest-growing trends in financial leadership? Many SME businesses struggle to justify the full-time CFO’s high fixed costs and rigid commitments, only to face gaps in strategic financial oversight.

These CFO outsourcing statistics reveal why more companies choose project-based CFO expertise to drive profitability, from skyrocketing demand and global market size projections to sector-specific adoption rates. Read on to discover how your business can benefit from a fractional CFO’s flexibility and strategic insight.

33% of US Small Businesses Outsource Operations

Over one-third of U.S. small businesses now outsource at least one core operation, most commonly finance and accounting functions, to external specialists. This trend reflects a strategic shift from the traditional full-time hire model, as smaller companies seek to control overhead while benefiting from high-caliber expertise.

By tapping into fractional CFO services, these businesses secure on-demand financial leadership for tasks like monthly close, cash-flow forecasting, and board-level reporting without the fixed salary commitments of a permanent CFO.

As a result, they enjoy greater budget flexibility, access to seasoned strategic advisors, and the ability to scale financial oversight up or down in line with business cycles.

Source: Clutch

Global BPO Market Expected to Reach $525B by 2030

The global business process outsourcing (BPO) industry is forecast to reach $525 billion by 2030, driven by digitally enabled remote service delivery and the rising complexity of back-office functions.

Finance and accounting outsourcers, including fractional CFO providers, are a key growth segment within this market. Companies are increasingly turning to these specialists to handle routine bookkeeping or payroll and fill gaps in financial leadership.

Source: Exploding Topics

83% of SMEs and SMBs Use Business Outsourcing

A staggering 83% of SMEs/SMBs now engage with external firms to manage non-core functions, from IT support and customer service to business financial management. Outsourced financial leadership has emerged within this cohort as a powerful lever for improving profitability and operational efficiency.

By outsourcing part-time CFO services, these organizations gain access to expertise in capital planning, risk management, and performance reporting that they might otherwise forgo due to cost or headcount constraints.

Source: SMB Guide

52% of Executives Outsource at Least One Finance Function

More than half of corporate leaders, 52%, report that they outsource at least one finance function, ranging from accounts payable to strategic cash‐flow analysis. This trend highlights the mainstreaming of financial leadership outsourcing.

By doing so, organizations boost forecasting accuracy, tighten controls around working capital, and free their in-house teams to focus on growth initiatives. The flexibility inherent in fractional engagements allows companies to scale CFO support up or down around peak periods.

Source: Deloitte

54% of Healthcare CFOs Expect Efficiency Gains After Outsourcing

Over half (54 percent) of healthcare CFOs believe outsourcing non-core financial functions will drive significant efficiency improvements. In an environment marked by shrinking reimbursements and rising regulatory complexity, fractional CFOs bring process‐optimization expertise and technology.

Client hospitals and physician groups engaging fractional CFOs often see faster billing cycles, reduced denial rates, and more real-time financial visibility, enabling them to reinvest savings into patient care and innovation.

Source: Becker’s Hospital Review

CFO Requests Increased by 51% Since 2020 for C-Suite Requests

Demand for interim and fractional CFO roles has surged, up a staggering 310 percent compared to 2020. Out of which, 51% of C-suite requests are for CFO roles.

CFOs provide deep, project-based expertise to guide critical financial decisions, whether negotiating debt facilities, setting up financial controls, or leading carve-outs, without the cost or lag associated with permanent executive searches.

Source: Business Talent Group

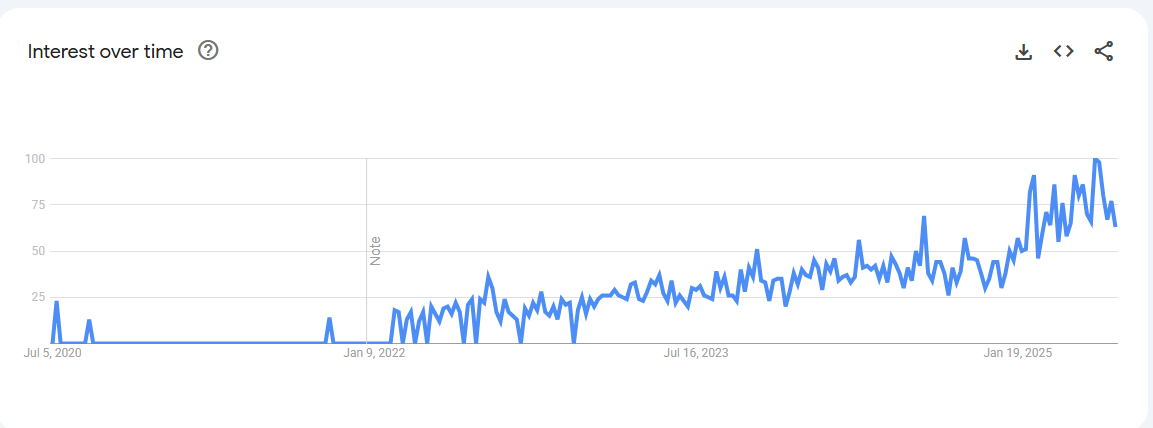

“Fractional CFO” Google Searches Soar Since 2022

Online search interest for fractional CFO in the U.S. has climbed dramatically since 2022, indicating rising market awareness and consideration among business leaders. As founders and finance teams explore cost-effective leadership models, a surge in search volume signals that fractional CFO services make it a mainstream option.

This digital footprint often represents the first step in the buyer’s journey, researching flexible CFO alternatives, which fractional CFO providers can capture through targeted content, thought leadership, and SEO-optimized resources.

Source: Google Trends

Soaring Market Demand for Fractional CFOs

The demand for fractional CFOs in the U.S. has skyrocketed, with a staggering 103% year-over-year increase. These trends reflect a significant shift in how businesses, especially startups and growth-stage companies, approach financial leadership.

Instead of committing to the high fixed costs of full-time CFOs, companies are turning to fractional solutions that deliver flexibility without sacrificing strategic expertise.

This surge in demand proves that more businesses are recognizing the benefits of experienced, project-based financial leadership. With fractional CFOs, companies can access tailored financial strategies, budget oversight, and forecasting support exactly when needed.

Source: Business Talent Group

Conclusion

The above statistics paint a clear picture: the fractional CFO industry fundamentally changes how businesses access high-level financial leadership, whether you’re a startup looking to stretch your runway, an established SMB aiming to optimize cash flow, or a healthcare organization seeking operational expertise.

Don’t let cost or headcount constraints hold back your financial strategy. Contact NOW CFO today to learn how our seasoned fractional CFOs can help you navigate growth, improve margins, and achieve your business goals.

FAQs

What is a Fractional CFO and How is it Different from a Full-time CFO?

A fractional CFO is a senior financial executive engaged on a part-time, project, or interim basis. Unlike a full-time CFO on your payroll 40 hours a week, a fractional CFO provides strategic guidance only when needed.

How Much Can Businesses Save by Hiring a Fractional CFO?

On average, businesses save up to 30% to 40% on CFO costs compared to a full-time hire. Savings come from reduced salary and benefits expenses, no long-term employment commitments, and the ability to scale hours based on project needs.

Which Industries Benefit the Most from Fractional CFO Services?

While fractional CFOs add value across many sectors, technology startups and healthcare organizations are among the largest adopters. Tech companies leverage their insights for fundraising, unit economics modeling, and rapid scaling, whereas healthcare CFOs use them to optimize revenue-cycle management and compliance.

How do Fractional CFOs Improve Cash Flow Management?

Fractional CFOs implement robust forecasting models and real-time financial dashboards, enabling proactive working-capital oversight. Within the first six months, clients often see double-digit improvements in cash-flow visibility and cycle times.

What is the Future Outlook for the Fractional CFO Industry?

Industry forecasts predict a continued upward trend: financial executives expect demand for fractional CFOs to increase over the next five years. Key drivers include growing acceptance of remote collaboration tools, tighter cost controls, and the need for specialized expertise during economic uncertainty.

Navigating the financial complexities of a growing business often necessitates specialized expertise. However, many SMEs face challenges in accessing such resources. Notably, 66% of SMEs encounter financial obstacles, with 43% struggling to manage operational expenses.

Business owners must decide whether they need a high-level strategist to guide long-term financial planning or a controller to manage the integrity of day-to-day accounting operations. Each role offers unique value, and understanding their differences can be the key to sustainable growth and operational stability.

Understanding the Roles: Fractional CFO vs Fractional Controller

Fractional financial professionals are invaluable assets for organizations seeking expertise without the commitment of full-time hires. Two pivotal roles, fractional CFO and the fractional controller. Understanding their distinct functions is crucial for businesses aiming to optimize financial management.

What is a Fractional CFO?

A fractional CFO is a seasoned financial executive who offers strategic financial leadership on a part-time or project basis. This arrangement allows companies to access high-level financial guidance without the expense of a full-time CFO.

Fractional CFOs typically hold advanced certifications such as CPA or CMA and possess extensive experience in financial strategy and management.

What is a Fractional Controller?

Conversely, a fractional controller focuses on the meticulous oversight of accounting operations, ensuring accuracy and compliance in financial reporting. They manage daily accounting tasks, maintain internal controls, and ensure adherence to regulatory standards.

This role is essential for the integrity of financial data and supports informed decision-making.

Key Responsibilities: Fractional CFO vs Fractional Controller

Now, lets look into the key responsibilities of a fractional CFO and a fractional controller.

Key Responsibilities of a Fractional CFO

- Strategic Financial Planning: Developing long-term financial strategies aligned with the company’s goals.

- Financial Forecasting and Modeling: Creating financial models to guide decision-making and anticipate future financial scenarios.

- Cash Flow Management: Ensuring sufficient liquidity for operations and growth initiatives.

- Growth Strategy: Advising on mergers, acquisitions, and market expansion opportunities.

- Risk Management: Identifying and mitigating financial risks to safeguard the company’s assets.

Key Responsibilities of a Fractional Controller

- Financial Reporting: Preparing accurate financial statements and reports.

- Compliance: Ensuring adherence to accounting standards and regulatory requirements.

- Budget Management: Overseeing budgeting processes and monitoring expenditures.

- Internal Controls: Implementing procedures to maintain financial data integrity.

- Audit Coordination: Facilitating internal and external audits to ensure compliance and accuracy.

Overlapping Functions Between CFOs and Controllers

While distinct, the roles of CFOs and controllers often intersect, particularly in financial reporting and compliance. Both are integral to maintaining financial health, with Controllers focusing on accuracy and CFOs on strategic application. Collaboration between the two ensures comprehensive financial oversight.

Key Differences Between a Fractional CFO and a Fractional Controller

Understanding the distinct roles and responsibilities of fractional vs fractional controller is essential for businesses aiming to optimize their financial strategies. While both positions contribute significantly to an organization’s financial health, their focuses and functions differ.

Strategic vs. Tactical Focus in Financial Management

A primary distinction in fractional CFO vs fractional controller lies in their strategic versus tactical orientations. A fractional CFO primarily engages in high-level strategic planning like analyzing market trends, evaluating investment opportunities, and formulating strategies.

In contrast, a fractional controller concentrates on tactical aspects, managing daily accounting operations, ensuring accurate financial records, and implementing internal controls to maintain compliance and efficiency.

Role in Financial Reporting and Compliance

Both roles are integral to financial reporting and compliance, yet their contributions differ. A fractional controller is responsible for preparing accurate financial statements, overseeing ledger maintenance, and ensuring adherence to accounting standards and regulatory requirements.

On the other hand, a fractional CFO utilizes these reports to provide strategic insights, assess financial risks, and communicate the company’s financial health to stakeholders, thus influencing decision-making at the highest levels.

Decision-Making and Long-Term Planning Capabilities

Decision-making scopes vary significantly between the two roles. A fractional CFO engages in long-term planning and making decisions on investments, capital structure, and strategic initiatives that shape the company’s future. They assess financial risks and opportunities, guiding the organization toward its long-term objectives.

In contrast, a fractional controller focuses on short-term decision-making, such as managing cash flow, budgeting, and ensuring that financial operations run smoothly daily.

Budgeting, Forecasting, and Cash Flow Management

In the areas of budgeting, forecasting, and cash flow management, both roles play pivotal yet distinct parts. A fractional CFO develops comprehensive financial forecasts and budgets that align with the company’s strategic goals, analyzing market conditions and business trends to predict future financial performance.

Conversely, a fractional controller implements these budgets, monitors actual performance against forecasts, and manages daily cash flow to ensure operational liquidity.

Interaction with Stakeholders and Leadership Teams

The extent of interaction with stakeholders and leadership teams also differentiates these roles. A fractional CFO frequently collaborates with the CEO, board members, and external investors, providing strategic financial insights and participating in high-level decision-making.

A fractional controller works closely with internal departments, such as accounting and operations, ensuring that financial processes are efficient and compliant, thus supporting the information needs of the leadership team.

Pros and Cons of Hiring a Fractional CFO

Engaging a fractional CFO can offer businesses strategic and flexible financial leadership without the commitment of a full-time executive. However, it’s essential to weigh the advantages and potential drawbacks to determine if this approach aligns with your organization’s needs.

Benefits of a Fractional CFO for Business Growth

CFO as a service brings a wealth of experience and strategic insight, which can be pivotal for business expansion. Key advantages include:

- Enhanced Decision-Making: With accurate financial data and analysis, businesses can make informed decisions, reducing the risk of costly mistakes.

- Improved Cash Flow Management: By closely monitoring cash flow, a fractional CFO can identify potential shortages or surpluses and develop strategies to address them, ensuring operational stability.

- Strategic Planning: They assist in formulating long-term financial strategies, aligning financial goals with business objectives to drive growth.

- Investor Confidence: Their expertise can enhance credibility with investors, facilitating funding opportunities and fostering business growth.

Learn More: How a Fractional CFO Can Be Benefit to Your Business

Cost Considerations and Budget Implications

Virtual CFO services offers a cost-effective alternative to a full-time executive. Financial implications include:

- Reduced Overhead: Businesses access top-tier financial expertise without incurring full-time salary and benefits, optimizing resource allocation.

- Flexible Engagements: Companies can adjust the level of CFO involvement based on current needs, ensuring financial leadership aligns with budget constraints.

Learn More: Fractional CFO Services vs Traditional CFO Hiring Cost

Optimal Situations for Hiring a Fractional CFO

Certain scenarios make the engagement of a fractional CFO particularly beneficial:

- Financial Challenges: When facing complex financial issues beyond the existing team’s expertise, a fractional CFO can provide the necessary guidance.

- Growth Phases: During periods of rapid expansion, their strategic oversight ensures sustainable development and financial stability.

- Resource Limitations: Small to medium-sized businesses that require high-level financial advice but lack the budget for a full-time CFO find this model advantageous.

Learn More: Benefits of hiring a fractional CFO

Challenges in Working with a Fractional CFO

Despite the benefits, there are potential fractional controller limitations to consider:

- Limited Integration: Due to part-time involvement, a fractional CFO may not fully immerse themselves in the company’s culture and operations, potentially leading to misaligned strategies.

- Communication Gaps: Effective communication is crucial; without it, misunderstandings can arise, hindering financial initiatives.

- Availability Constraints: Balancing multiple clients might limit their responsiveness to urgent matters within your organization.

Evaluating the Impact of a Fractional CFO on Strategic Financial Leadership

Assessing the effectiveness of a fractional CFO involves examining their contributions to:

- Financial Planning: Their ability to develop and implement strategies that align with business goals.

- Risk Management: How they identify and mitigate financial risks impacting the company’s stability.

- Performance Metrics: The improvement in key financial indicators, such as profitability and cash flow, under their guidance.

Pros and Cons of Hiring a Fractional Controller

Engaging a fractional controller can significantly impact a company’s financial operations. Understanding the advantages and potential drawbacks is essential for making an informed decision.

How a Fractional Controller Enhances Day-to-Day Accounting

A fractional controller plays a pivotal role in refining daily accounting functions. They ensure accurate financial reporting, maintain compliance with regulations, and implement efficient processes.

By leveraging technology and automation, they expedite routine tasks, providing faster access to essential financial data. This enhancement allows businesses to focus on strategic initiatives, knowing that their financial foundation is solid.

Efficiency Benefits and Cost Savings

Hiring a fractional controller offers notable efficiency gains and cost reductions. Companies can access high-level expertise without the financial commitment of a full-time position, leading to significant savings.

This approach is especially beneficial for smaller businesses or those experiencing rapid growth, as it provides flexibility and scalability. Additionally, fractional controllers often bring diverse industry experience, introducing best practices that streamline operations and reduce inefficiencies.

When to hire a Fractional Controller?

Determining the appropriate time to engage a fractional controller depends on several factors:

- Rapid Growth: Businesses experiencing swift expansion may need enhanced financial oversight to manage increased complexity.

- Budget Constraints: Organizations that require financial expertise but cannot justify a full-time hire find fractional controllers to be a cost-effective solution.

- Process Improvement Needs: Companies aiming to optimize financial processes and implement robust internal controls can benefit from the specialized skills of a fractional controller.

Limitations of a Fractional Controller

Despite the advantages, there are inherent limitations to consider:

- Limited Availability: Fractional controllers often juggle multiple clients, which may affect their responsiveness to urgent matters.

- Integration Challenges: As external consultants, they might lack deep familiarity with company-specific nuances, potentially leading to less tailored solutions.

- Remote Collaboration: Many fractional controllers operate remotely, necessitating adjustments in communication and collaboration practices within the organization.

Evaluating the Operational Impact of a Fractional Controller

The influence of a fractional controller on operations can be substantial. They identify areas where processes can be streamlined, implement automation to reduce manual errors, and establish key performance indicators to monitor financial health.

By providing detailed financial analysis, they enable informed decision-making, contributing to the organization’s overall efficiency and profitability.

How to Decide Between a Fractional CFO and a Fractional Controller

Choosing between fractional CFO vs fractional controller is crucial for aligning financial leadership with your business’s specific needs. This decision hinges on several factors, including your company’s financial requirements, industry nuances, budget constraints, and strategic objectives.

Assessing Your Business’s Financial Needs

Evaluating your organization’s financial landscape is the first step in this decision-making process. If your business requires high-level strategic planning, such as fundraising, mergers, or market expansion, an outsourced CFO is likely more suitable. They provide forward-thinking strategies and identify growth opportunities.

Conversely, if the focus is on maintaining accurate financial records, ensuring compliance, and managing daily accounting operations, a fractional controller would be the appropriate choice. They excel in overseeing day-to-day financial management and ensuring data accuracy.

Industry-Specific Considerations: Outsourced CFO vs Controller

The nature of your industry significantly influences this choice. Industries with complex regulatory environments, such as healthcare or finance, may benefit more from a fractional controller to ensure meticulous compliance and accurate reporting.

In contrast, sectors experiencing rapid growth or technological disruption might require an interim CFO to navigate strategic challenges and capitalize on emerging opportunities. For instance, a tech startup seeking venture capital would find a fractional CFO advantages invaluable for investor relations and financial forecasting.

CFO vs Controller Key Differences: Cost Structures and ROI

Financial considerations play a pivotal role in this decision. Engaging a full-time CFO can be costly, with salaries ranging from $250,000 to $500,000 per year. In contrast, a fractional CFO responsibilities offers flexibility and cost-effectiveness, with services typically costing between $3,000 to $10,000 per month, depending on the scope of work and company size.

This approach provides access to high-level expertise without the financial burden of a full-time executive. Similarly, a fractional controller role provides essential financial oversight at a fraction of the cost.

When to Hire Both for Maximum Efficiency

In certain scenarios, both fractional CFO and fractional controller can maximize efficiency. This combination ensures comprehensive financial management, with the Controller focusing on accurate financial reporting and the CFO providing strategic direction.

Businesses undergoing significant transformations, such as mergers or rapid scaling, can benefit from this dual approach to maintaining financial stability while pursuing growth.

Choosing the Right Fractional Finance Professional for Your Business

Selecting the appropriate financial professional requires a clear understanding of your business’s current stage, challenges, and goals. A thorough assessment of your financial operations, growth plans, and industry demands will guide this choice.

Engaging in consultations with potential candidates can provide insights into how their expertise aligns with your needs, ensuring a strategic fit that supports your company’s objectives.

Conclusion: Which One is Right for Your Business?

Choosing between a fractional CFO vs fractional controller shouldn’t feel like a gamble, it should be a strategic move grounded in your business’s goals. Whether you require sharp forecasting and investor-ready insights, or tighter financial controls and accurate reporting, fractional financial leadership offers the flexibility to scale smartly without overspending.

If you’re unsure where your business fits on the financial leadership spectrum, NOW CFO can help. Our team has supported thousands of companies in defining their financial infrastructure and unlocking measurable growth.

Schedule a no-cost financial consultation. Explore our success stories to see how we’ve helped businesses just like yours.

Today, businesses face increasing financial complexities and uncertainties. Approximately 20% of small businesses fail within the first year due to financial mismanagement. Leveraging a fractional CFO can help companies counter these challenges by enhancing financial efficiency and risk management.

Fractional CFOs provide targeted expertise, advanced financial insights, and strategic support, ensuring businesses maintain economic stability, optimize operations, and proactively and cost-effectively mitigate risks.

The Evolving Role of Financial Leadership in Today’s Market

Today’s businesses require more agile and strategic approaches than ever before. How can a fractional CFO enhance financial efficiency and manage risk? By responding to evolving market dynamics, NOW CFO provides adaptable tailored solutions.

Shifts in Business Demands and Financial Complexity

Initially, organizations focused on straightforward financial management, balancing budgets, overseeing payroll, and maintaining tax compliance. However, modern business environments demand more intricate management.

As businesses grow and diversify, their financial complexity rises dramatically. Operational financial excellence has become a necessity, not merely a goal. Companies face pressures such as:

- Complex regulatory compliance

- Increased globalization

- Sophisticated investor expectations

Consequently, businesses need expert financial insights to remain competitive and secure in rapidly evolving markets.

The Rise of Outsourced and Fractional CFO Models

Moreover, the traditional in-house CFO role is evolving. Historically, CFO positions were costly and typically reserved for large corporations. However, even small businesses and startups are shifting toward cost-effective financial leadership through outsourced models.

Also, fractional CFOs offer companies a scalable solution. They adapt financial management to their precise operational needs, enhancing financial efficiency and risk mitigation.

Impact of Technology on Financial Operations

Additionally, technology has drastically shaped flexible financial leadership. Businesses adopting advanced technology platforms benefit from real-time data analytics, AI-driven forecasting, and cloud-based reporting tools.

Technology notably amplifies fractional CFO benefits. These finance professionals, equipped with advanced financial technologies, help companies achieve digital transformation seamlessly, ensuring effective implementation and maximized returns.

The Strategic Need for Enhanced Efficiency and Risk Control

Furthermore, the global economy’s volatility highlights the need for robust risk management strategies. Businesses encounter risks ranging from cyber threats to unpredictable economic shifts, requiring proactive financial planning and rigorous controls.

A fractional CFO is uniquely positioned to address these risks with comprehensive frameworks designed to effectively anticipate and mitigate potential threats. These experts significantly reduce vulnerability and enhance overall business resilience by adopting a proactive approach.

How NOW CFO Leads the Charge in Enhanced Financial Efficiency and Risk Management

NOW CFO stands apart in this evolving market, offering tailored fractional CFO services directly targeting current financial leadership demands. With an emphasis on customized solutions, our professionals effectively blend strategic expertise and technological capabilities, achieving a balance between immediate, cost-effective financial leadership.

Ultimately, NOW CFO leads the industry by pairing data-driven insights with tailored strategies, ensuring businesses meet today’s financial complexities and thrive amidst uncertainty.

Learn More: Fractional CFO Vs Full-Time CFO

Key Strategies to Enhance Financial Efficiency

Optimizing financial operations is vital for business growth. To enhance financial efficiency and risk management, fractional CFOs utilize targeted strategies that streamline operations, optimize resources, and leverage technological advancements.

Streamlining Financial Reporting and Data Analysis

First, fractional CFOs target financial reporting inefficiencies. Clear and accurate reporting is fundamental for decision-making. By refining these processes, fractional CFOs eliminate redundant tasks, reducing manual workloads while boosting accuracy.

Businesses adopting streamlined reporting experience quicker decision-making improved financial clarity, and better resource allocation.

Furthermore, fractional CFOs ensure robust financial efficiency improvement by leveraging powerful data analysis. Advanced analytics simplify complex financial data, uncover inefficiencies, and empower leadership with actionable insights to drive profitability.

Optimizing Cash Flow Management and Budget Forecasting

Moreover, enhancing cash flow management is another critical area on which fractional CFOs focus. Efficient cash flow and accurate budget forecasting significantly reduce financial uncertainties. Fractional CFO benefits include designing precise forecasting models, ensuring timely financial insights, and enabling proactive decision-making.

Businesses regularly face cash flow bottlenecks, often due to poor forecasting practices. By contrast, fractional CFOs integrate comprehensive tools to accurately predict cash inflows and outflows. For example, implementing 13-week rolling cash forecasts provides clarity and control, allowing rapid response to market changes or financial disruptions.

Implementing effective forecasting also aligns budgets strategically with company objectives, reducing overspending and improving resource allocation for critical growth initiatives.

Implementing Cost Reduction and Process Improvement Measures

Fractional CFOs systematically implement cost-reduction strategies to enhance financial efficiency and risk management. By performing meticulous expense audits, they identify and eliminate unnecessary expenditures, streamline processes, and optimize financial resource allocation.

Cost-effective financial leadership provided by fractional CFOs reduces operational costs and identifies hidden efficiencies through improved vendor negotiations, process automation, and resource realignment. These targeted approaches lead to measurable improvements in bottom-line profitability.

Learn More: Fractional CFO Services vs Traditional CFO Hiring Cost

Leveraging Advanced Financial Technologies and Automation

Another essential method fractional CFOs employ is leveraging advanced financial technology solutions. Automated accounting platforms, AI-driven financial analytics, and machine learning-based forecasting tools provide real-time, accurate insights.

Fractional CFOs are often implemented:

- Cloud-based strategic financial management platforms

- AI-driven forecasting tools

- Automated invoicing and expense-tracking software

Through technological integration, fractional CFOs drastically reduce manual errors and improve data accuracy, enhancing operational financial excellence significantly.

Businesses adopting financial automation typically experience a 40% decrease in administrative workload, improving overall efficiency and freeing resources for strategic growth.

How NOW CFO’s Fractional CFOs Deliver Operational Excellence

Finally, NOW CFO specializes in precisely these financial improvements. We deliver operational excellence by implementing tailored financial strategies and customized technological solutions aligned with each client’s needs.

Our fractional CFOs streamline financial reporting, improve budgeting accuracy, and automate core financial processes, substantially boosting efficiency and profitability. By integrating these strategies, NOW CFO empowers businesses to proactively manage financial resources, maintain regulatory compliance, and enhance efficiency.

Leveraging NOW CFO’s fractional CFO services ensures companies achieve significant operational improvements and long-term financial sustainability.

Learn More: Hire A Fractional CFO

Robust Risk Management Techniques

Enhancing financial efficiency and risk management is paramount for organizational stability and growth. This involves implementing robust risk management techniques, safeguarding assets, and ensuring compliance and operational excellence.

Identifying and Assessing Financial Risks Proactively

Proactive identification and assessment of financial risks form the cornerstone of effective risk management. Organizations must systematically evaluate threats like market volatility, credit defaults, and operational disruptions. Regular risk assessments allow businesses to anticipate challenges and develop strategies to mitigate them effectively.

According to the U.S. Government Accountability Office, estimated annual financial losses from fraud range between $233 billion and $521 billion, underscoring the critical need for proactive risk identification.

Developing and Implementing Outsourced CFO Risk Mitigation Frameworks

Furthermore, establishing comprehensive risk mitigation frameworks is essential. These frameworks should encompass policies and procedures designed to address identified risks. Key components include:

- Risk Appetite Definition: Clearly articulate the level of risk the organization is willing to accept.

- Control Activities: Implementing checks and balances to prevent or detect errors and irregularities.

- Risk Response Plans: Develop action plans for various risk scenarios to ensure swift responses.

A study reveals that only 33% of organizations have complete enterprise risk management (ERM) processes.

Ensuring Compliance and Strengthening Internal Controls

Additionally, ensuring compliance with applicable laws and regulations is vital. Organizations should establish robust internal controls to monitor adherence and prevent violations. This includes regular audits, employee training, and a culture of ethical behavior.

The Bureau of Labor Statistics reports that employment of compliance officers is projected to grow 5% from 2023 to 2033.

Integrating Scenario Planning and Stress Testing

Moreover, integrating scenario planning and stress testing into risk management practices enables organizations to evaluate their resilience under adverse conditions. By simulating various scenarios, businesses can identify vulnerabilities and enhance their preparedness.

How NOW CFO’s Expertise Reduces Financial Exposure

NOW CFO delivers tailored fractional CFO services that significantly enhance financial efficiency and risk management. Our experts assist organizations in:

- Customized Risk Assessments: Identifying unique financial risks pertinent to the organization.

- Strategic Framework Development: Implementing effective risk mitigation strategies aligned with business objectives.

- Compliance Enhancement: Ensuring adherence to regulatory requirements and strengthening internal controls.

- Advanced Scenario Analysis: Conducting comprehensive scenario planning and stress testing to bolster organizational resilience.

By leveraging NOW CFO’s expertise, businesses can reduce financial exposure and achieve operational excellence.

The Strategic Impact of a Fractional CFO on Business Performance

Businesses require agile strategies to achieve their goals efficiently. A fractional CFO is pivotal in enhancing financial efficiency and risk management, aligning financial strategy with business performance, and driving sustained competitive advantages.

Aligning Financial Strategy with Business Objectives

First and foremost, aligning financial strategy directly with business objectives is essential. Fractional CFOs collaborate closely with leadership teams to clearly define strategic priorities, allocate resources effectively, and more to meet organizational goals.

To achieve alignment, part-time CFOs typically:

- Establish clear, quantifiable financial goals tied to broader business milestones.

- Prioritize investments that directly enhance strategic business outcomes.

- Monitor financial performance consistently to ensure alignment with established targets.

A well-integrated financial strategy enables businesses to achieve clarity in decision-making, optimized resource allocation, and targeted growth.

Enhancing Decision-Making Through Data-Driven Insights

Next, fractional CFOs significantly boost organizational decision-making through advanced, data-driven insights. Businesses often lack timely, actionable financial data, which negatively impacts agility.

Fractional CFOs bridge this gap, transforming complex data into actionable insights by:

- Implementing predictive analytics to forecast future financial scenarios

- Leveraging real-time data dashboards for immediate insights and agile responses

- Conducting in-depth analyses of key financial metrics to identify growth opportunities proactively

Driving Sustainable Growth and Competitive Advantage

Moreover, sustainable growth and competitive advantage are paramount for business success in today’s environment. Fractional CFOs enhance financial efficiency and risk management by strategically managing resources to foster sustainable growth.

This includes:

- Identifying profitable revenue streams

- Minimizing financial wastage

- Strategically reinvesting profits to fuel continuous growth

Balancing Short-Term Efficiency with Long-Term Risk Management

Additionally, virtual CFOs balance short-term efficiency gains with long-term risk management strategies. Short-term profitability must not overshadow long-term viability; fractional CFOs integrate balanced approaches.

These professionals typically:

- Create flexible financial frameworks adaptable to changing market conditions

- Regularly reassess risk exposure and manage potential vulnerabilities proactively

- Maintain operational and financial excellence to ensure ongoing business health

A balanced approach enhances immediate efficiency and sustained risk resilience, protecting organizational stability even in volatile markets.

Realizing Measurable ROI with Fractional CFO Services

Finally, fractional CFO as a service delivers clear and measurable ROI. Businesses often struggle to quantify returns on executive roles, but fractional CFOs provide transparent, measurable results, establishing their value.

NOW CFO, for instance, demonstrates measurable ROI through:

- Direct cost savings from optimized financial processes

- Improved profitability via targeted financial strategies

- Enhanced compliance, reducing financial penalties and risk exposure

NOW CFO’s structured approach to fractional CFO services ensures companies consistently achieve measurable efficiency and profitability improvements. Also, validating investment in their expertise to enhance financial efficiency and risk management effectively.

Learn More: Strategic role of a fractional CFO

Why Choose NOW CFO for Fractional CFO Services

Enhancing financial efficiency and risk management is crucial for sustained growth today. NOW CFO is a premier provider of fractional CFO services, offering tailored solutions that drive success.

Proven Expertise and Industry Recognition

NOW CFO’s commitment to excellence is evident through its consistent industry recognition. We secured a spot on the 2024 Inc. 5000 list, ranking No. 4786, with an impressive three-year revenue growth of 81%. This accolade underscores our dedication to delivering exceptional financial services.

Customized and Scalable Financial Solutions

Understanding that each business has unique financial needs, NOW CFO offers customized and scalable solutions. Our services range from accounting support to strategic financial planning, ensuring alignment with specific business objectives.

This adaptability allows companies to effectively enhance financial efficiency and risk management.

Access to a Network of Experienced Financial Professionals

Partnering with NOW CFO provides access to a vast network of seasoned financial professionals. This collective expertise ensures businesses receive insights tailored to their industry and operational challenges. Such access is invaluable for informed decision-making and strategic planning.

Cost-Effective Engagement Models with Tangible Results

NOW CFO offers flexible engagement models that are both cost-effective and results-driven. By providing fractional CFO services, businesses can access top-tier financial expertise without the overhead of a full-time executive. This approach optimizes costs and delivers measurable improvements in financial performance.

Seamless Integration and Ongoing Strategic Support

The professionals at NOW CFO integrate seamlessly into existing teams, ensuring minimal disruption. They provide ongoing strategic support, adapting to evolving business needs and market conditions. This continuous collaboration fosters a proactive approach to financial management.

High Client Satisfaction and Success Metrics

Client satisfaction is a cornerstone of NOW CFO’s operations. According to reviews on Indeed, employees express high levels of satisfaction, with one stating, “I truly enjoy working for NOW CFO. I have learned a lot and have been offered growth opportunities.”

Our proven expertise, tailored solutions, extensive professional network, cost-effective models, seamless integration, and commitment to client satisfaction. This makes a compelling choice for businesses seeking to enhance financial efficiency and risk management through fractional CFO services.

Learn More: How to choose the right fractional CFO

Conclusion

By partnering with NOW CFO, businesses can access tailored solutions that align financial strategies with organizational goals, drive efficiency, and mitigate risks. Our proven expertise and customized services have empowered numerous clients to achieve measurable improvements in their financial performance.

Schedule a complimentary consultation with our team to explore how NOW CFO can enhance financial efficiency and risk management.

Businesses are adapting by seeking fractional CFO services to enhance financial strategy without the commitment of a full-time executive. Companies of all sizes, especially startups and mid-market firms, leverage outsourced financial expertise to drive profitability and mitigate risks.

As businesses face economic uncertainty, fractional CFO services provide a solution that aligns with shifting market demands while ensuring strategic financial management. Embracing the future of fractional CFO services is critical for companies aiming to stay competitive.

Introduction to Fractional CFO Services and Future Trends

Fractional CFO services offer businesses access to seasoned financial professionals on a part-time or project basis, providing critical insights into financial planning, risk management, and operational efficiency.

Engaging a fractional CFO can benefit companies by providing high-level expertise tailored to their needs, ensuring agile and informed decision-making.

Overview of Fractional CFO Services in the Modern Economy

The role of a fractional CFO encompasses a wide range of strategic financial management trends, including budgeting, forecasting, cash flow management, and strategic financial planning. Unlike traditional full-time CFOs, fractional CFOs offer flexibility, allowing businesses to scale services according to their current requirements.

This model is particularly advantageous for SMEs that may not have the resources to support a full-time CFO but still require sophisticated financial oversight. By embracing the future of fractional CFO services, companies remain both agile and competitive in an ever-changing economic landscape.

Evolution of CFO Roles and the Rise of Outsourced Financial Leadership

The traditional role of the CFO has evolved significantly, transitioning from essential financial oversight to a more strategic partnership in business growth. This evolution has given rise to outsourced financial leadership, where companies engage external experts to fulfill CFO duties.

The drive for specialized skills, cost efficiency, and the agility to overcome financial obstacles underscores the importance of understanding the future of fractional CFO services. This modern approach allows companies to tap into high-caliber expertise without incurring the expense of a full-time role.

Importance of Future Trends in Shaping Financial Strategy

Staying abreast of emerging trends is crucial for businesses aiming to maintain a competitive edge. Technological advancements, regulatory changes, and market dynamics continually influence the financial landscape. Understanding these trends enables companies to anticipate challenges and adapt their strategies accordingly.

For instance, integrating AI and automation into financial processes not only streamlines operations but also reinforces the future of fractional CFO services. This forward-thinking mindset enables firms to be proactive rather than reactive.

How NOW CFO is Pioneering Innovation in Fractional CFO Solutions

NOW CFO stands at the forefront of delivering innovative fractional CFO solutions, adapting to the evolving needs of modern businesses. By integrating cutting-edge technologies and methodologies, we provide clients with tailored financial strategies that drive growth and efficiency.

By integrating cutting-edge technologies and advanced methodologies, NOW CFO provides clients with tailored financial strategies that drive growth and efficiency. This approach exemplifies the future of fractional CFO services, combining strategic foresight with continuous innovation.

Learn More: Strategic role of a Fractional CFO

Objectives for Exploring Emerging Trends

Exploring emerging trends in fractional CFO services serves multiple objectives:

- Enhancing Strategic Planning: By understanding future developments, businesses can refine financial strategies to align with anticipated market shifts and the future of fractional CFO services.

- Optimizing Resource Allocation: Gaining insights into upcoming trends allows companies to allocate resources more effectively, ensuring investments are directed where they will yield the highest returns as part of the outsourced CFO future predictions.

- Mitigating Risks: Proactive awareness of industry changes enables businesses to identify and address potential risks before they impact operations.

- Driving Innovation: Staying informed about technological advancements empowers companies to adopt new tools and processes that enhance financial performance.

Emerging Technologies Impacting Fractional CFO Services

Emerging technologies are transforming how fractional CFO services are delivered. These advancements are reshaping financial operations and offering strategic insights that underpin the future of fractional CFO services.

The Role of AI and Automation in Financial Management

AI and automation revolutionize financial management by streamlining operations and reducing manual workloads. AI-driven tools can analyze vast datasets to identify patterns, predict economic trends, and automate routine tasks such as bookkeeping and compliance reporting.

This transformation increases accuracy and enables CFOs to focus on strategic decision-making, one of the hallmarks of the future of fractional CFO services. Notably, a study by the National University indicates that AI could increase labor productivity growth by 1.5 percentage points over the next decade.

Leveraging Big Data and Analytics for Strategic Insights

Integrating big data analytics enables fractional CFOs to derive actionable insights from complex financial information. By leveraging advanced analytics, CFOs can assess market trends, evaluate financial risks, and make informed strategic decisions.

This data-driven approach facilitates proactive financial planning and enhances the organization’s ability to adapt to changing economic conditions.

Cloud-Based Solutions and Remote CFO Capabilities

Cloud computing has revolutionized the accessibility and scalability of financial services. By adopting cloud-based platforms, fractional CFOs can securely access financial data from anywhere, facilitating remote work and real-time collaboration.

Research from MIT has linked this transition to improved productivity and revenue growth.

Integration of Fintech Innovations into CFO Services

The rise of financial technology (fintech) innovations is reshaping the role of CFOs by introducing tools that enhance financial operations. These include automated invoicing systems, blockchain for transparent transactions, and AI-powered financial forecasting models. Integrating these fintech tools is essential for realizing the future of fractional CFO services.

How NOW CFO Utilizes Advanced Technology for Enhanced Efficiency

NOW CFO leverages cutting-edge technologies to provide superior fractional CFO services. We enhance data accuracy and operational efficiency by integrating AI and cloud-based solutions. This real-time financial analysis and strategic planning ensure that clients remain ahead of the curve, fully aligned with the future of fractional CFO services.

Future Tech Trends That Will Transform CFO Operations

Looking ahead, several technological trends are poised to transform CFO operations further:

- AI and ML: These technologies will continue to advance, offering deeper predictive analytics and automating complex financial tasks.

- Blockchain Technology: This is Expected to provide enhanced security and transparency in financial transactions.

- Robotic Process Automation (RPA): This will automate repetitive tasks, allowing CFOs to focus on strategic initiatives.

Collectively, these trends will accelerate and define the future of fractional CFO services, ensuring that financial leadership is both innovative and responsive.

Learn More: Benefits of Hiring A Fractional CFO

Shifts in Business Demands and Global Market Trends

Several factors are reshaping financial leadership. The increasing demand for flexible and cost-effective financial leadership innovations, particularly among SMEs, underscores the growing importance of the future of CFO services.

Additionally, evolving regulatory landscapes and globalization are pushing companies to adopt scalable financial models that reflect the adaptive nature of the future of fractional CFO services.

Increasing Demand for Flexible and Cost-Effective CFO Solutions

Businesses are increasingly seeking flexible and cost-effective CFO solutions to navigate financial complexities without the commitment of a full-time executive. This trend is particularly evident among small to mid-sized enterprises aiming to access high-level financial expertise while managing costs.

Notably, there has been a 103% surge in the hiring of interim CFOs over the past year, highlighting the growing recognition of adaptable financial leadership.

Changing Regulatory Landscapes and Their Impact on Financial Leadership

The evolving regulatory environment significantly influences CFO responsibilities. Regulatory changes are becoming more frequent, and the cost of non-compliance escalates, making adherence to new laws a critical aspect of a CFO’s role.

This dynamic landscape necessitates that CFOs stay abreast of regulatory developments to ensure compliance and mitigate associated risks.

Globalization and the Need for Scalable CFO Models

As businesses expand globally, the complexity of financial operations increases, necessitating scalable CFO models. Fractional CFOs offer the flexibility to manage multinational financial strategies, adapting to diverse market demands without the overhead of a full-time position.

Trends in Outsourcing and Virtual Financial Services

The rise in outsourcing and virtual services has transformed financial management. Companies increasingly adopt virtual CFO solutions, leveraging technology to access financial expertise remotely. This model provides cost savings and access to a broader talent pool, aligning with the modern trend toward remote work and digital collaboration.

How NOW CFO Adapts to Evolving Business Needs

NOW CFO addresses these evolving demands by offering tailored fractional CFO services that provide flexible and scalable financial leadership. We ensure clients receive adaptive and compliant financial strategies by staying informed about regulatory changes and embracing virtual service models.

Market Dynamics Driving the Evolution of CFO Services

Several key forces are shaping the future of CFO roles:

- Technological Advancements: Integrating AI and automation streamlines financial processes, enhancing efficiency.

- Economic Uncertainty: Fluctuating markets prompt businesses to seek flexible financial leadership to navigate challenges.

- Focus on Strategic Planning: CFOs are increasingly shaping long-term business strategies beyond traditional financial oversight.

Future Predictions and Strategic Implications for CFO Services

Fractional CFO services are poised for significant growth, driven by market dynamics and strategic shifts in business practices.

Anticipated Growth and Market Trends for Fractional CFO Services

The demand for fractional CFO services will rise as businesses seek flexible and cost-effective financial leadership. This trend is particularly prominent among SMEs that aim to access high-level financial expertise without the commitment of a full-time executive.

Strategic Shifts in Financial Leadership Models

Companies are redefining financial management by embracing fractional CFOs who offer strategic insights on a part-time basis. This model benefits businesses from seasoned financial expertise tailored to their needs, ensuring agile and informed decision-making.

The Role of Continuous Innovation and Professional Development

Continuous innovation and professional development are crucial for CFOs to navigate the complexities of modern finance. Embracing technological advancements such as artificial intelligence and data analytics enables CFOs to enhance operational efficiency and strategic planning.

Ongoing education and skill development ensure that financial leaders remain adept at leveraging new tools and methodologies to drive business success.

Preparing for Future Economic Uncertainties and Financial Risks

Businesses must proactively prepare for economic uncertainties and financial risks by implementing robust risk management strategies. Engaging fractional CFO services provides access to expertise in forecasting, cash flow management, and financial planning, which are essential for navigating market volatility.

Recommendations for Businesses to Stay Ahead of the Curve

To remain competitive, businesses should consider the following strategies:

- Adopt Flexible Financial Leadership: Engage fractional CFOs to harness the benefits of the virtual CFO evolution.

- Invest in Technology: Incorporate advanced financial technologies to streamline operations and enhance decision-making capabilities.

- Prioritize Professional Development: Encourage continuous learning for financial teams to stay abreast of industry trends and innovations.

- Implement Robust Risk Management: Develop comprehensive plans to mitigate risks, forming a foundation for the future of fractional CFO services.

How NOW CFO’s Vision Aligns with the Future of Fractional CFO Services

NOW CFO is at the forefront of providing innovative fractional CFO services that align with emerging industry trends. By integrating cutting-edge technology and emphasizing continuous professional development, our approach underscores the emerging fractional CFO trends.

Conclusion: Future of Fractional CFO Services

As the need for fractional CFO services continues to grow, companies that embrace flexible financial leadership will gain a competitive edge. Staying ahead of industry shifts, adopting cutting-edge technology, and leveraging expert financial guidance can position your business for long-term success.

Let’s discuss how your company can benefit from customized CFO solutions and prepare for the future of fractional CFO services. Book a free consultation today for a personalized financial assessment. Your business deserves strategic expertise; let’s build a stronger economic future together.

Financial mismanagement remains a leading cause of failure among small enterprises. Notably, 82% of small businesses fail due to cash flow problems.

To mitigate such risks, many organizations are turning to fractional CFOs, seasoned financial professionals who provide strategic guidance on a part-time or contractual basis. This approach allows businesses to access high-level financial expertise without the commitment of a full-time executive.

Introduction to Fractional CFOs

Organizations increasingly seek flexible financial leadership to navigate complex financial landscapes. One solution to gain prominence is the fractional CFO. Understanding this role and its benefits can be pivotal for businesses aiming to optimize financial strategies without the commitment of a full-time executive.

Definition and Overview of a Fractional CFO

A fractional CFO, a part-time CFO, or an outsourced CFO is a financial expert engaged on a part-time or contractual basis to provide high-level financial guidance.

Unlike traditional full-time CFOs, fractional CFOs offer their expertise to multiple organizations, allowing businesses to access seasoned financial leadership without incurring the costs of a full-time executive position.

The Emergence of Outsourced Financial Leadership

Over recent years, the concept of outsourced financial leadership has gained traction. This trend allows businesses to focus on core competencies while leveraging external expertise for specialized functions.

Notably, more than half of firms allocate over 5% of their budgets to outsourced services, with over 10% dedicating more than 25%, highlighting the growing reliance on external partners for critical operations.

Key Differences Between Fractional and Full-Time CFOs

While both fractional and full-time CFOs aim to steer a company’s financial strategy, their engagement models differ:

- Engagement Scope: Full-time CFOs are deeply integrated into the company’s daily operations, whereas fractional CFOs focus on specific projects or strategic initiatives.

- Cost Implications: Employing a full-time CFO entails a significant salary and benefits package. In contrast, fractional CFOs provide expertise at a fraction of the cost, offering financial flexibility.

- Flexibility: Fractional CFOs offer scalable services, adjusting their involvement based on the company’s evolving needs, unlike full-time CFOs with fixed commitments.

Benefits of Flexible Financial Leadership for Modern Businesses

Embracing flexible financial leadership through fractional CFOs offers several advantages:

- Cost Efficiency: Companies can access top-tier financial expertise without the overhead of a full-time salary, optimizing resource allocation.

- Diverse Expertise: Fractional CFOs often bring experience from various industries, providing fresh perspectives and innovative solutions.

- Scalability: Businesses can adjust the level of financial oversight based on current needs, ensuring agility in decision-making processes.

How NOW CFO Pioneers Tailored Fractional CFO Services

NOW CFO stands at the forefront of providing customized fractional CFO services. By understanding each client’s unique challenges, we deliver strategic financial guidance that aligns with specific business goals.

Incorporating a fractional CFO can be a strategic move for businesses aiming to enhance financial management without the commitment of a full-time executive. This model offers flexibility, cost savings, and access to specialized knowledge, making it an attractive option.

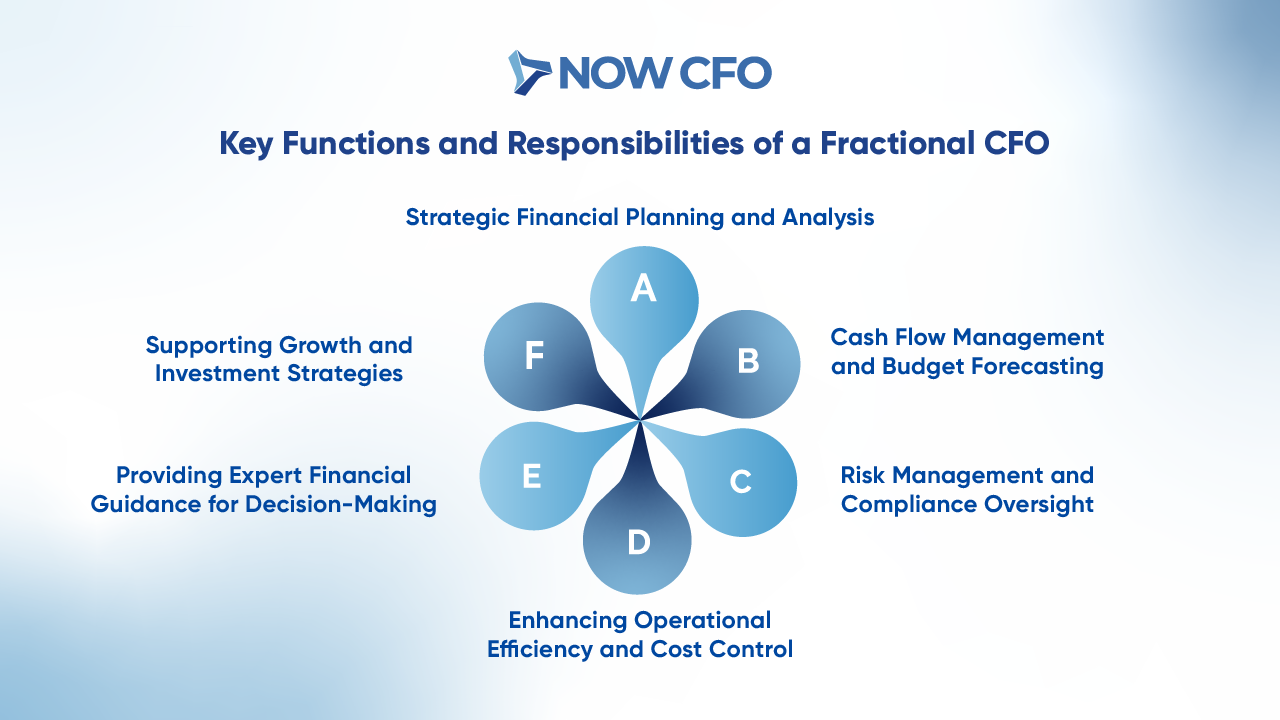

Key Functions and Responsibilities of a Fractional CFO

Understanding their key functions and responsibilities is essential for businesses aiming to optimize financial performance.

Strategic Financial Planning and Analysis

A primary responsibility of a fractional CFO is to develop and implement comprehensive financial strategies. They analyze financial data to identify trends, opportunities, and potential challenges, ensuring that the company’s financial goals align with its overall business objectives.

By leveraging their expertise, fractional CFOs assist in crafting long-term plans that drive sustainable growth and profitability.

Cash Flow Management and Budget Forecasting

Effective cash flow management is crucial for maintaining a company’s financial health. Fractional CFOs monitor cash inflows and outflows, ensuring that the organization can meet its obligations and invest in growth opportunities.

They also develop accurate budget forecasts, providing a financial roadmap that guides decision-making and resource allocation.

Risk Management and Compliance Oversight

Navigating financial risks and ensuring compliance with regulatory standards are critical aspects of a fractional CFO’s role. They identify potential financial risks, such as market fluctuations or credit risks, and develop strategies to mitigate these threats.

Additionally, they ensure that the company’s financial practices adhere to legal standards and regulatory requirements, maintaining the organization’s integrity and reputation.

Enhancing Operational Efficiency and Cost Control

Fractional CFOs play a vital role in improving operational efficiency and controlling costs. They analyze existing processes to identify inefficiencies and implement strategies to streamline operations. By optimizing resource allocation and reducing unnecessary expenses, they enhance the company’s profitability and competitiveness.

Providing Expert Financial Guidance for Decision-Making

Informed decision-making is facilitated by the expert financial guidance provided by fractional CFOs. They offer insights into various financial matters, from investment opportunities to cost management, enabling leadership to make decisions that align with the company’s financial objectives.