Delayed or inaccurate financial reports can degrade credibility and derail strategic decisions. A study analyzed SMEs and found that firms that outsourced accounting tasks exhibited higher reporting quality than firms that kept these tasks in‑house.

Outsourced CFOs support financial reporting by embedding structure, precision, and foresight into the entire process. An outsourced CFO turns the burden of financial statements into a powerful tool for growth and confidence.

1. Dramatic Cost Savings Compared to Full-Time CFOs

Hiring a full-time CFO can be cost-prohibitive for many growing companies. Beyond a base salary often exceeding $400,000, the cost of bonuses, benefits, and stock options can escalate rapidly.

Outsourced CFOs support financial reporting and overall fiscal management at a fraction of that cost, offering the same level of expertise without full-time financial commitment. This cost-efficient model allows businesses and startups to reinvest capital into growth initiatives while benefiting from senior-level financial services.

Source: NOW CFO

2. Proactive Cash Flow Management Prevents Business Failures

Cash flow problems are the silent killer of small businesses. Without clear oversight and forecasting, companies can quickly find themselves strapped for liquidity. That’s where outsourced CFOs shine.

By offering real-time reporting strategies and establishing forward-looking cash flow statements, outsourced CFOs help companies avoid common pitfalls. The result? Better capital planning, fewer surprises, and more confident financial leadership.

Source: Forbes

3. Rapid Adoption of Outsourced CFO Services

The need for flexible, high-level financial leadership is soaring. A 103% increase in demand signals a broader market trend, businesses of all sizes are embracing outsourced CFOs to support financial reporting and executive decision-making.

This surge stems from growing pressure to be audit-ready, optimize capital structure, and prepare for investment rounds. By delivering a CFO reporting structure without the long-term hiring risk, outsourced solutions are becoming the go-to model for companies.

Source: Business Talent Group

4. Increasing Focus on Technology Investment and Implementation

Today’s CFOs are more than financial stewards; they’re technology champions. Modern outsourced CFOs oversee digital finance transformation from cloud ERPs to automation and AI tools.

This investment pays off. Tech-forward CFOs support accurate financial statements by reducing manual input errors, accelerating close cycles, and delivering real-time financial dashboards. Businesses benefit from more insightful reporting, compliance, and faster decision-making.

Source: PwC

5. Outsourcing Popularity Among SMEs

SMEs increasingly turn to outsourced financial leadership to scale efficiently. With cloud ERP systems and flexible subscription-based pricing models, outsourced CFOs support financial reporting in ways that are now more accessible than ever.

These services offer tailored financial reporting for investor readiness, budgeting, and forecasting. This model delivers enterprise-grade insight at a manageable cost for SMEs with growth ambitions and lean resources.

Source: Global Growth Insights

6. Most Outsourced Finance Tasks for Small Businesses

Financial reporting is one of the top outsourced functions among SMEs, alongside bookkeeping, payroll, and accounts payable. This trend highlights a shift toward fractional expertise, particularly in functions that require precision and compliance.

Outsourced CFOs step in to manage accurate financial statements, prepare for audits, and establish the CFO reporting structure needed for decision-making and fundraising. Their impact extends beyond cost savings; they add strategic value where it matters most.

Source: Clutch

7. Growing Executive Commitment to Outsourced Financial Expertise

Executives are doubling down on outsourced financial leadership to handle today’s fast-evolving regulatory and operational landscape. With growing pressure for audit-ready accuracy, reporting compliance, and timely insights, outsourced CFOs are becoming indispensable.

These experts help businesses scale while strengthening internal controls and preparing financial statements for investors, lenders, and board members. This trend shows no slowing as businesses seek scalable solutions that deliver transparency and financial clarity.

Source: Deloitte

Conclusion

Outsourced CFOs transform how businesses approach financial reporting. They deliver accurate reporting, GAAP-compliant, but also actionable and investor-ready. The result? Faster closings, fewer compliance headaches, and clearer visibility into performance.

If your business is facing delays or gaps in internal controls, an outsourced CFO is the solution. NOW CFO offers flexible engagement models designed to meet you where you are, whether that’s building your first reporting infrastructure or leveling up for a potential acquisition.

Long-term growth requires visionary financial leadership. Around 65% of companies report that outsourcing enables them to focus on core functions.

An outsourced CFOs support and brings high-level financial acumen and objectivity, empowering businesses to construct scalable financial foundations. Through rigorous forecasting, analysis, and capital planning, these financial stewards lay the groundwork for scalable expansion.

Outsourced CFOs Now Lead Broader Strategic Mandates

A recent survey revealed that 93% of CFOs feel their responsibilities today carry far greater significance than in the past. This underscores a paradigm shift; CFOs are no longer limited to financial reporting but are now instrumental in driving long-term business strategy.

This evolution brings clear advantages for companies leveraging outsourced CFOs. These professionals bring enterprise-grade strategic financial leadership to the table, allowing businesses to access high-level insight without full-time commitment.

Source: Accenture

CFOs Remain Optimistic About Long-Term Growth

According to the 2025 Global CFO Report, 72% of CFOs anticipate revenue growth exceeding 10%. This bold outlook demonstrates confidence in data-backed planning and agile execution.

Outsourced CFOs are uniquely positioned to drive this momentum for mid-market companies and startups. Through precise forecasting and business growth planning, they help translate strategic ambition into achievable financial outcomes.

Source: Forensic Technologies International

Rising Appetite for Long-Term Financial Risk

CFOs are willing to increase risk on their balance sheets, rising to 17%, after a 5% jump in quarter-over-quarter. This indicates a growing tolerance for long-term financial risk in pursuit of strategic growth.

This is for companies that want to embrace bold moves, whether investing in innovation or expansion. Building risk models and buffers ensures that calculated decisions align with long-term business strategy. It’s a smart way to innovate without risking the foundation.

Source: Deloitte

Digital Transformation: A Core CFO Priority

SAP CFO research reports that 73% of finance leaders have improved cost control and risk mitigation through digital transformation, demonstrating how technology is a lever for strategic impact.

Outsourced CFOs lead this evolution with a future-focused CFO services approach. From implementing scalable finance models to leveraging automation tools, they optimize operations while monitoring cost efficiency.

Source: SAP CFO

Tech-Driven CFOs Fuel Future Readiness

Nearly half of CFOs (44%) intend to increase technology investment over the next year to reduce costs. This reflects a broader shift in how CFOs leverage innovation to fund long-term growth and operational efficiency.

Outsourced CFOs are at the forefront of this transformation. With expertise in digital finance tools and scalable platforms, they help businesses streamline processes, reduce overhead, and strategically reinvest savings.

Source: PwC

CFO Confidence Hits a Ten-Quarter High

Deloitte’s latest survey reveals that the CFO Confidence Score reached 5.8 in Q4 2024, its highest level in ten quarters. This uptick signals renewed optimism in financial strategy, even amid evolving market pressures.

Outsourced CFOs provide the same strategic foresight for businesses without internal financial leadership, fueling this confidence. Through scenario planning, performance alignment, and capital efficiency, they equip organizations to make bold, data-informed decisions.

Source: Deloitte

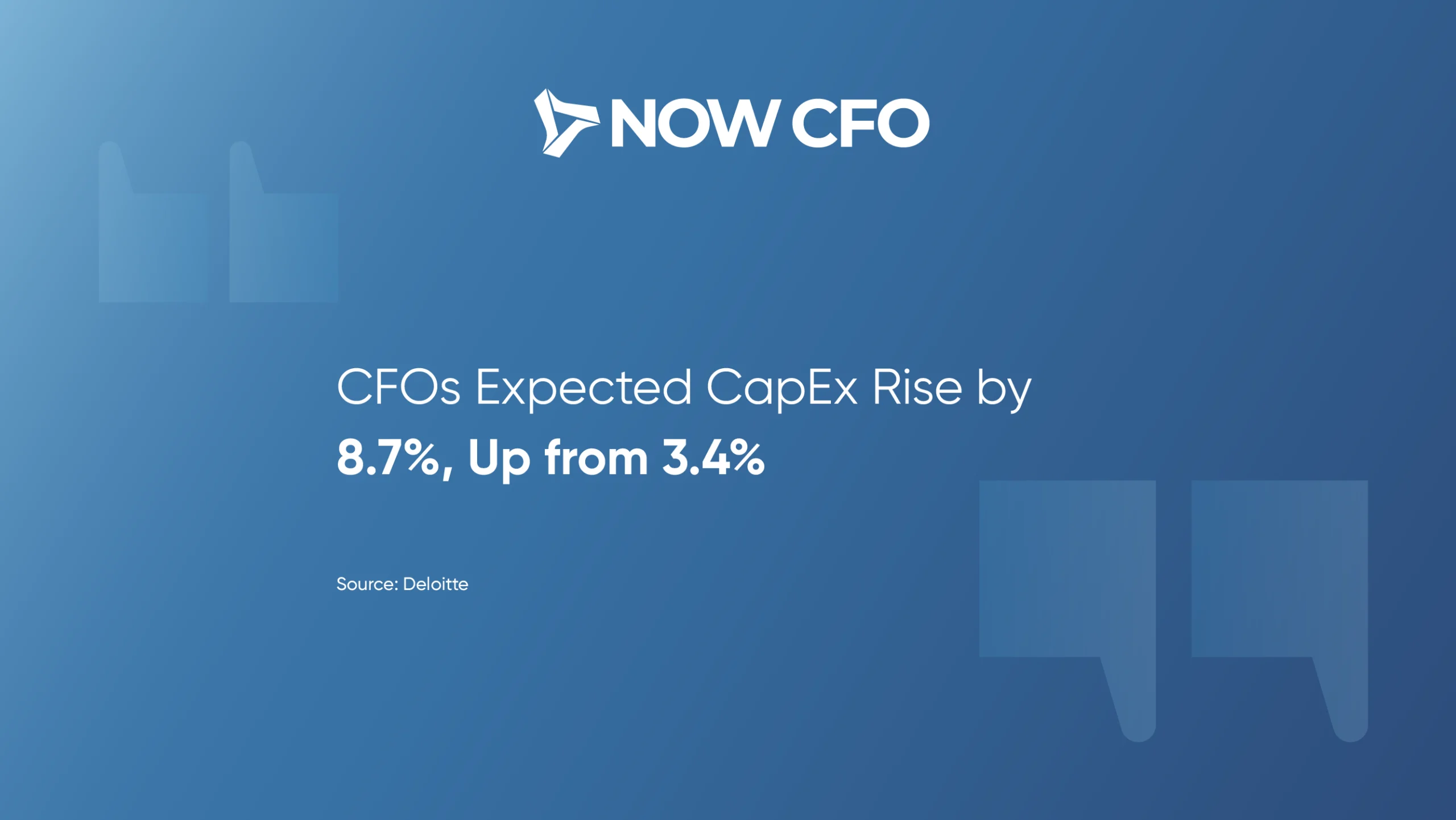

Capital Investments Accelerate in 2025

CFOs anticipate a significant rise in capital expenditure, up 8.7%, indicating a shift from defensive tactics to growth-oriented investments. This transition marks a renewed focus on long-term value creation.

Outsourced CFOs play a key role in this pivot. They align capital planning with strategic business goals, ensuring every dollar deployed supports scalable outcomes. Whether guiding expansion, upgrading systems, or entering new markets, outsourced CFOs bring discipline and direction to capital strategies that matter most for long-term success.

Source: Deloitte

Conclusion

Outsourced CFOs are strategic architects who help embed sustainable growth into an organization’s DNA. By establishing scalable systems with performance-aligned metrics, they ensure a better tomorrow.

If you’re ready to elevate from managing challenges to designing tomorrow’s success, NOW CFO offers tailored, growth-focused financial leadership. Reach out for a no-pressure free strategy session.

Frequently Asked Questions

How do Outsourced CFOs Support Long-Term Business Planning?

Outsourced CFOs Support & provide strategic financial leadership that aligns a company’s financial operations with its long-term goals. They create a roadmap for sustainable growth through forecasting, budgeting, and scenario planning.

What Financial Strategies Help with Sustainable Growth?

Key strategies include scalable finance models, strategic capital planning, and aligning KPIs with long-term objectives. A fractional CFO strategy ensures these practices are tailored to your unique growth stage and industry, supporting strategic business growth planning from the inside out.

Can an Outsourced CFO Help Plan an Exit Strategy?

Yes, fractional CFOs specialize in preparing financials for M&A activity or business exits. By structuring the company’s financial health and creating valuation-boosting strategies, they ensure your business is exit-ready well in advance, maximizing outcomes when the time comes.

Why is Financial Forecasting Important for Long-Term Success?

Forecasting enables future-focused CFO services that anticipate cash flow needs, growth constraints, and market shifts. Businesses that engage in quarterly forecasting are more likely to meet their long-term goals and respond proactively rather than reactively.

What Role Does an Outsourced CFO Play in Capital Strategy?

An Outsourced CFO aligns debt, equity, and reinvestment decisions with the company’s vision. Strategic capital planning ensures you access the right capital at the right time, fueling expansion while maintaining financial health. This is a cornerstone of how CFOs support long-term vision alignment.

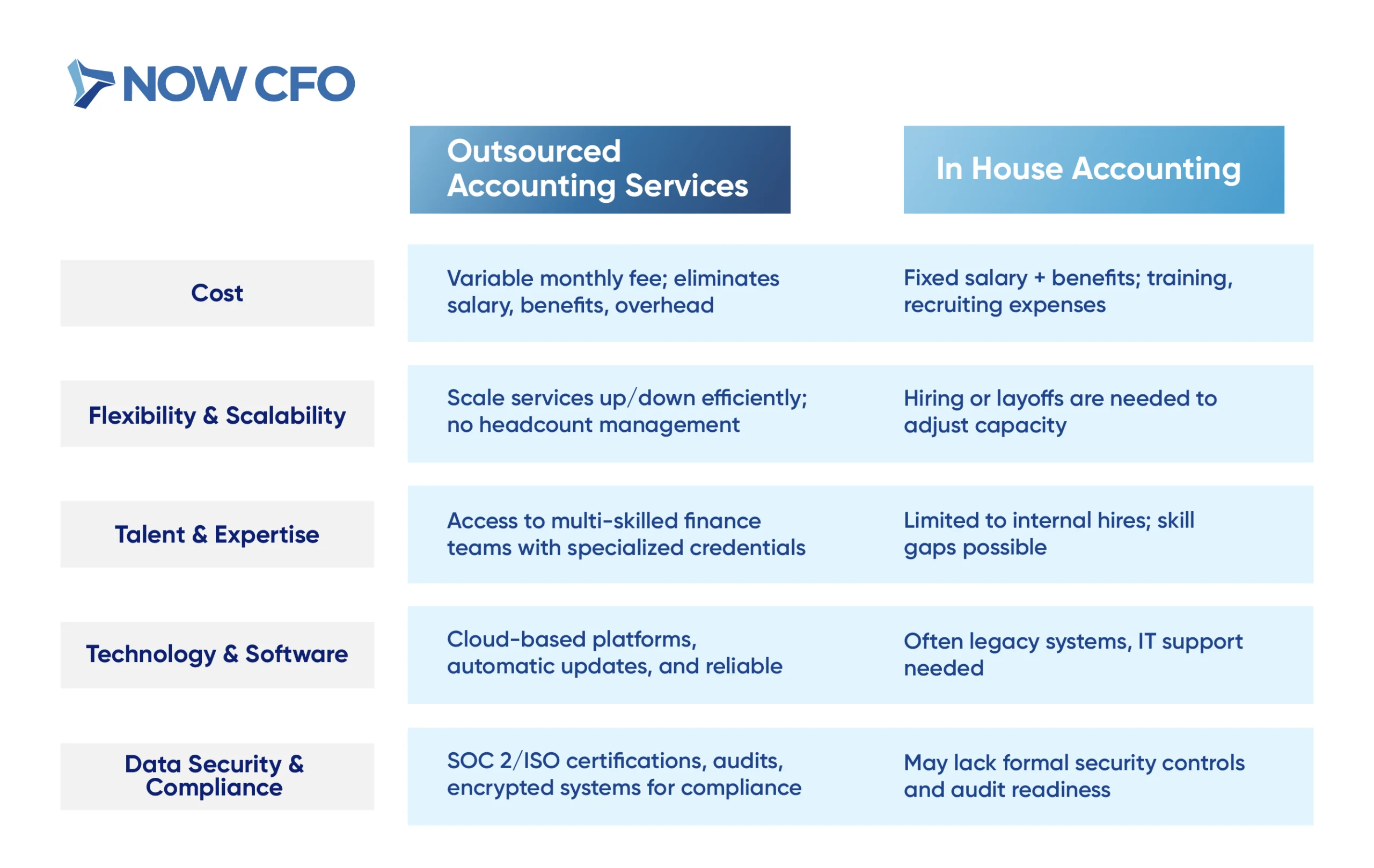

When weighing in-house accounting vs outsourced accounting services, leaders must consider cost, control, and expertise. A 2025 study found that 36.5% of businesses outsourced accounting, legal, or professional services.

Understanding the Basics: What is an In-House Accounting Team?

An in-house accounting team consists of dedicated employees who work solely for your company. These professionals manage day-to-day transactions, payroll, compliance, and reporting on-site or within internal systems.

With employees fully integrated into your operations, they gain a deep understanding of your business. However, this model incurs substantial in-house accountant costs, including full salaries, benefits, office space, training, and software licenses.

What is an Outsourced Accounting Service?

An outsourced accounting service involves contracting external professionals or firms to manage financial operations remotely. Services typically cover bookkeeping, payroll, tax preparation, economic analysis, and compliance.

Companies benefit from accessing specialized expertise (e.g., CFOs, analysts) without having to maintain a full-time staff. This outsourced accounting vs. internal accounting model often follows flexible pricing.

Why Businesses Choose One Over the Other

Businesses weigh strategic trade-offs when deciding between models:

| Decision Factor | In-House Accounting Team | Outsourced Accounting Service |

|---|---|---|

| Control vs Flexibility | Immediate, day-to-day management with direct oversight | Scalable support ideal for fluctuating or fast-growing needs |

| Cost Predictability | Predictable but high in-house accountant costs, including salaries, benefits, and overhead | Lower fixed costs with predictable monthly or usage-based pricing structures |

| Expertise Access | Limited in scope to the experience of internal staff | On-demand access to CPAs, CFOs, analysts, and tax specialists |

| Growth Stage Alignment | Suitable for mature or larger companies with industry-specific compliance needs | Ideal for startups or lean companies seeking agility and broad skill sets |

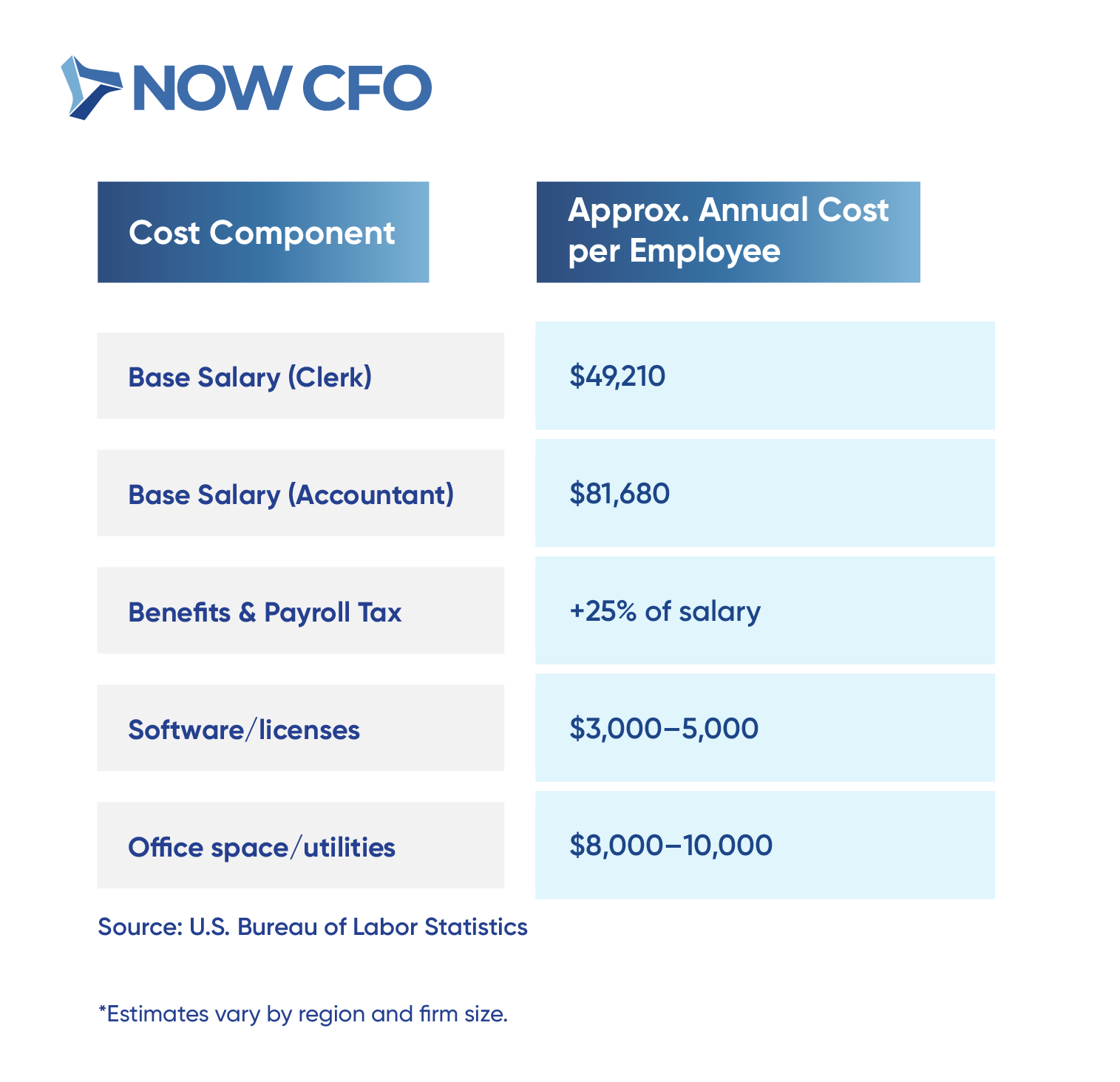

Cost Comparison

Salaries, Benefits, and Overhead of In-House Teams

Businesses must cover full salaries, benefits, training, software licenses, and workspace to maintain an in-house accounting team. BLS reports that the median annual wage for bookkeeping and auditing clerks is $49,210, whereas accountants and auditors earned a median of $81,680 annually.

Here’s a breakdown of core cost elements:

Pricing Models of Outsourced Accounting Firms

Outsourced providers typically charge based on usage or service tier: hourly rates, fixed monthly retainers, or bundled pricing. Models vary:

| Pricing Model | Typical Cost Range | Best Use Case |

|---|---|---|

| Hourly | $75–$150/hr | Startups/occasional needs |

| Retainer | $1K–$5K/month | Growing businesses with steady needs |

| Bundled tiers | Varies by provider | Scaling ops needing CFO-level support |

Scalability and Flexibility of Outsourced Services

An outsourced accounting service offers unmatched scaling flexibility. You can ramp up support for tax season, audits, or fundraising and then scale back.

External firms offer wide-ranging financial expertise, including remote CFOs, tax specialists, and financial analysts, available exactly when needed. This flexibility enables startups and growing businesses to adjust financial support based on shifting operational demands and evolving priorities.

Learn More: Outsourcing Accounting Growth

Efficiency and Expertise

Skill Depth in Outsourced Accounting vs In-House Accounting

Outsourced firms assemble a collective of professionals specializing in different financial verticals. They invest in ongoing training to maintain certification standards.

In contrast, in-house accounting teams often rely on a few generalists with limited bandwidth to master all functions.

74% of accounting firms struggle to fill specialized roles, impacting skill depth. Meanwhile, outsourced providers offer access to niche expertise on demand, eliminating the need to recruit and train.

Access to Specialists (CFOs, CPAs, Analysts)

Connecting with deep expertise often tips the scales. Outsourced firms grant immediate access to senior specialists:

- Fractional CFOs: They offer high-level financial leadership, guiding strategic decisions such as budgeting, forecasting, fundraising, and long-term planning. They help companies set financial goals, interpret complex data, and prepare for investor presentations.

- Certified Public Accountants (CPAs): CPAs ensure accurate tax preparation, compliance with local and federal regulations, and support during audits. Their expertise helps businesses reduce risk and avoid costly penalties, particularly during critical reporting periods.

- Financial Analysts: Analysts dive into performance metrics, track KPIs, and generate financial models that aid decision-making. Their insights help companies monitor profitability, identify cost-saving opportunities, and forecast financial outcomes with precision.

Turnaround Time and Software Automation

Outsourced accounting services often streamline workflows through advanced cloud-based systems and automation tools. Routine tasks are handled swiftly via software that syncs with banking and ERP systems.

In contrast, in-house teams may lag due to fragmented tools, manual data entry, or software maintenance issues. As automation displaces repetitive tasks, internal teams must invest more time in system training and updates, further eroding productivity.

Support During Tax Season, Audits, or Fundraising

Businesses require additional expertise and headcount during high-stakes events—tax season, audits, and fundraising.

- Tax Season: Outsourced firms ramp up services with senior tax CPAs, ensuring accurate preparation and compliance during peak filings.

- Audit Support: Professional audit teams manage documentation, liaise with external auditors, and resolve inquiries efficiently.

- Fundraising: Analysts and CFO consultants prepare valuation models, investor decks, and due diligence reports.

Control, Access, and Communication

Day-To-Day Visibility of In-House Staff

An in-house accounting team offers constant, on-site visibility. Employees work with other departments, allowing real-time access to financial data, immediate responses to inquiries, and daily collaboration. This ensures tight integration with company culture, processes, and internal stakeholders.

In contrast, external teams lack this immersion, which may hamper responsiveness. Relying on emails or scheduled updates, outsourced providers risk delays in catching issues like unusual expenses or reconciliation errors.

Managing Communication with Outsourced Teams

- Scheduled Meetings: Regular video check-ins (weekly or biweekly) maintain alignment.

- Defined SLAs: Clear service-level agreements set expectations on response times and deliverables.

- Dedicated Liaisons: Assigning internal points of contact streamlines coordination.

- Progress Dashboards: Shared dashboards monitor tasks, invoices, and KPIs in real time.

Tools That Enable Transparency with Outsourcing

Modern tools ensure visibility even when teams operate remotely:

- Cloud Accounting Platforms: Tools like QuickBooks Online or Xero provide real-time access to financials.

- Collaboration Suites: Slack, Teams, or Asana enable seamless discussions, file-sharing, and task assignments.

- Dashboard Software: BI tools such as Tableau or Power BI present live KPIs and cash-flow metrics.

- Audit Trails: Cloud system access logs record every change, enhancing accountability and trust.

Learn More: Benefits of Hiring an Outsourced Accounting Service

When to Choose an Outsourced Accounting Service

Ideal for Startups and Fast-Growing Businesses

Startups and rapidly scaling companies often operate under tight budgets and unpredictable growth. An outsourced accounting service enables founders to allocate capital toward core activities while accessing professional financial management.

Cost-Conscious or Lean Teams

When budgets strain lean teams, outsourced accounting vs internal accounting becomes critical.

- Variable spending: Only pay for services as needed, no fixed salary or benefits.

- Reduced overhead: Save on software, training, and workspace costs.

- Lean operations: Tap into one-person virtual accounting teams for basic bookkeeping up to CFO-level insights.

Companies Scaling Across Multiple Locations

As businesses expand into new cities or countries, consistency in accounting practices becomes vital.

- Standardized processes: Outsourced firms implement unified systems across locations, reducing errors.

- Centralized reporting: Consolidated dashboards clarify cash flow, payroll, and compliance across sites.

- Local expertise: Providers often maintain regional specialists aware of varying tax and labor laws.

Need for Flexibility and Wide-Ranging Financial Expertise

Rapid change and complex financial tasks demand flexible, expert support.

- Modular services: Outsourced firms adjust service levels during seasonal peaks, audits, or fundraising.

- Specialist access: Engage CPAs, fractional CFOs, and analysts on-demand.

- Advanced tools: Benefit from cloud accounting, automation, and real-time insights without capital investment.

Learn More: Hire an Outsourced Accounting Service

Making the Right Decision for Your Business

To make the right choice, business leaders must weigh both cost and strategic alignment. Applying practical decision-making frameworks helps determine which accounting model best supports long-term business goals.

Key Questions to Ask Before Choosing

Ask targeted questions to weigh your options:

- What is our current monthly transaction volume, and how might it change in 12 months?

- Can we afford full-time salaries, benefits, and training, or do we need variable costs?

- Do we require industry-specific compliance or frequent on-site financial presence?

- How critical is day-to-day financial visibility vs periodic strategic insight?

- Are we scaling to new locations and need local tax/regulatory support?

Creating a Cost-Benefit Analysis

How NOW CFO Supports Both Models

NOW CFO offers hybrid solutions tailored to business needs:

- Embedded In-House Teams: We staff qualified controllers, bookkeepers, or CFOs who operate on-site or within your systems, delivering day-to-day financial oversight and compliance expertise.

- Fully Outsourced Services: We provide scalable bookkeeping, fractional CFOs, tax support, and audit prep for companies.

- Modular Model: Transition seamlessly between in-house and outsourced support as your business grows or your needs change. You gain continuity with minimal disruptions.

- Tools and security: We implement cloud platforms, dashboards, and robust data protocols to ensure transparency and data security.

Conclusion

If you’re ready to explore, NOW CFO can support you every step of the way. Let’s tailor an accounting strategy that aligns with your operational needs and financial targets. Reach out to schedule a complimentary strategic session.

Behind every transformative financial decision lies a foundation built on data. 85% of CFOs now view data analytics as indispensable for strategic decision-making. For business leaders, simply tracking revenues and expenses provides only a surface-level view; real insight comes from deeper, actionable metrics.

We’ll explore metrics outsourced CFOs use to drive financial decisions, metrics that go beyond the balance sheet to reveal operational efficiency, customer profitability, and forecast reliability.

By mastering these key performance indicators, you’ll be equipped to make data-backed choices on pricing, investment, and growth strategies, ensuring your organization doesn’t just survive but thrives.

Lets look at the 8 metrics outsourced CFOs use to drive financial decisions for your business.

Gross Profit Margin

Gross profit margin measures how efficiently a company turns revenue into profit by subtracting the COGS from total revenue and dividing the result by revenue. A high gross profit margin indicates strong pricing power and effective cost control, reflecting the core profitability of products or services.

Monitoring gross profit margin enables outsourced CFOs to refine pricing strategies, optimize supply-chain costs, and pinpoint underperforming product lines. By drilling into this metric, they can negotiate better supplier agreements, reallocate resources toward higher-margin offerings, and set more accurate sales targets.

Source: The CFO

Operating Cash Flow (OCF)

OCF reveals how much cash a business generates from its core operations, excluding financing and investing activities. It’s one of the most critical CFO dashboard metrics, offering a clear view of liquidity and short-term financial health.

Outsourced CFOs use OCF to make informed decisions about reinvestment, debt repayment, and cost optimization. By tracking this weekly metric, they identify patterns in inflows and outflows, ensuring that cash is available to meet obligations and capitalize on growth opportunities.

Source: GTreasury

EBITDA

EBITDA is a vital performance metric CFOs monitor to assess a company’s profitability. It strips away the effects of financial and accounting decisions, offering a cleaner picture of core earnings power.

Outsourced CFOs use EBITDA to benchmark company performance, evaluate acquisition targets, and support debt and equity financing strategies. With nearly half of CFOs at large firms prioritizing the Debt/EBITDA ratio, this metric plays a critical role in managing leverage and maintaining financial stability.

Source: Journal of Finance via Wiley Online Library

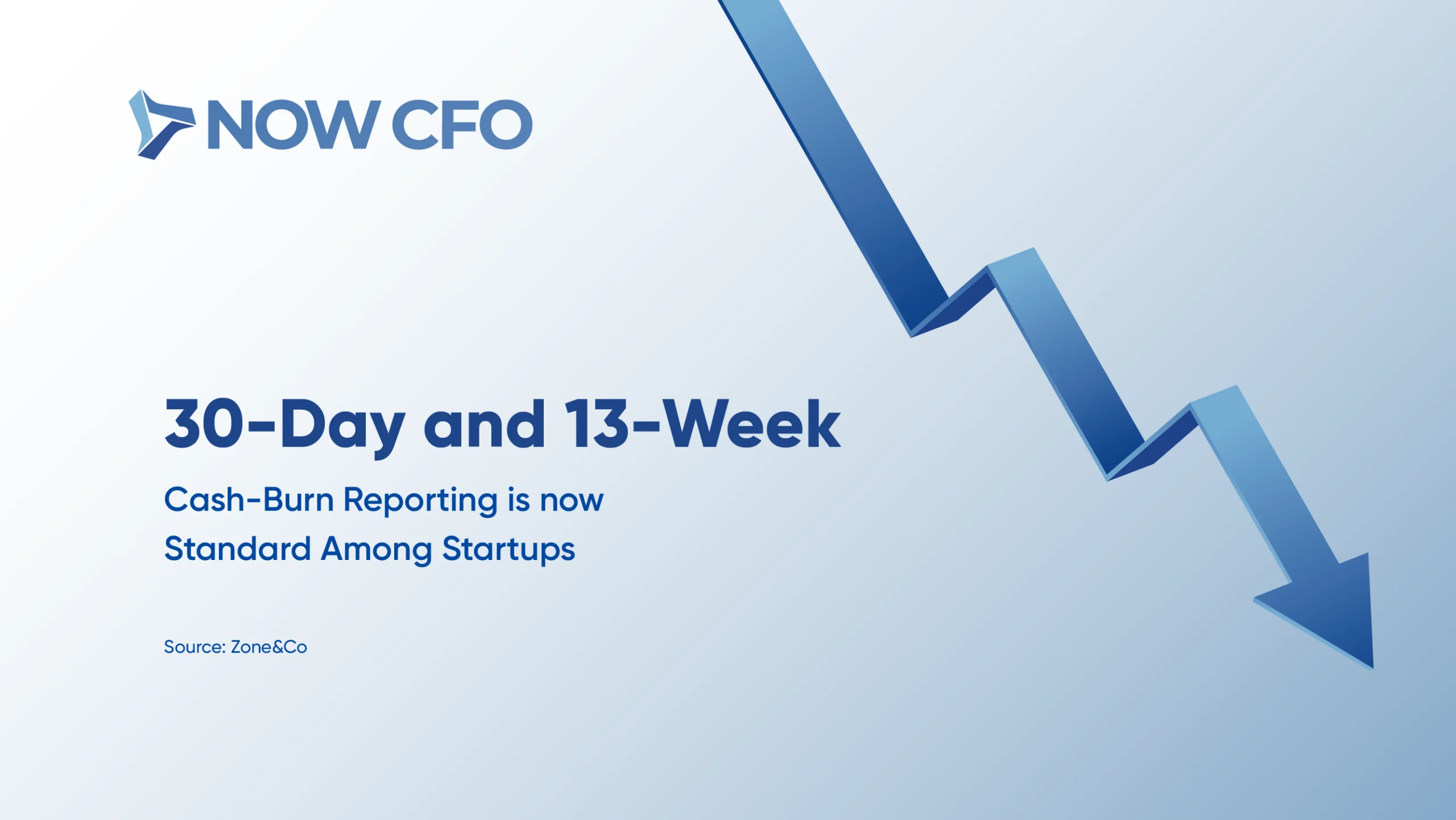

Burn Rate (for Startups)

Burn rate tracks how quickly a company spends its cash reserves, making it a crucial metric for startups navigating uncertain growth phases. The shift toward standard 30-day and 13-week cash-burn reporting reflects the heightened need for precision in managing runway and funding cycles.

Outsourced CFOs rely on this metric to monitor financial health and swiftly adjust hiring, marketing, or operational spending. Keeping a close eye on burn rate, they help startups stretch capital further, improve investor confidence, and avoid liquidity crises.

Source: Zone&Co

Customer Acquisition Cost (CAC)

CAC calculates the average expense a business incurs to acquire a new customer. It’s a core KPI used by outsourced CFOs to assess the efficiency of marketing and sales strategies. In sectors like SaaS and B2B, where CACs can run high, $702 and $536, respectively, tracking this metric is essential for optimizing ROI.

Outsourced CFOs use CAC to evaluate spending effectiveness and determine whether customer acquisition efforts are sustainable. When combined with Customer Lifetime Value (LTV), CAC insights can guide pricing, retention, and channel strategies. A well-managed CAC ensures that marketing investments fuel profitable, scalable growth.

Source: Userpilot

Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) estimates the total revenue a customer will generate over their entire relationship with a company. Measuring against CAC reveals how efficiently a business turns marketing spend into long-term value. In healthy SaaS businesses, LTV/CAC ratios typically range from 3:1 in Business Services to 7:1 in Adtech, with most industries averaging between 4:1 and 6:1.

Outsourced CFOs monitor this metric closely to guide pricing models, improve retention strategies, and determine customer acquisition budgets. A strong LTV enhances profitability and signals product-market fit and customer satisfaction, making it a vital metric for sustained growth and strategic decision-making.

Source: Eqvista

Forecast Accuracy

Forecast accuracy measures how closely actual results align with projected financials. It’s a vital decision-making metric that reflects the reliability of a company’s planning and budgeting processes. High forecast accuracy allows leadership to anticipate future conditions and adjust proactively and confidently.

Outsourced CFOs use this metric to refine scenario modeling, improve budget variance tracking, and strengthen strategic alignment. According to Deloitte, 42% of CFOs are now prioritizing enterprise risk management and digital transformation initiatives that rely heavily on accurate forecasting.

Source: Deloitte CFO

Accounts Receivable Turnover

AR turnover measures how efficiently a company collects payments from customers. A higher turnover ratio indicates that receivables are collected quickly, directly strengthening cash flow and working capital.

Outsourced CFOs implement centralized AR strategies to streamline billing, accelerate collections, and resolve disputes faster. According to McKinsey, this approach can free up to 30% more working capital, which can be reinvested into operations, R&D, or growth initiatives.

Improving AR turnover is one of the most actionable performance metrics CFOs monitor to boost liquidity and reduce reliance on external financing.

Source: McKinsey & Company

Conclusion

These metrics form the cornerstone of data-driven decision-making. Outsourced CFOs bring technical know-how to calculate these KPIs and the strategic perspective to interpret trends, identify opportunities, and mitigate risks.

Ready to turn your financial data into confident business actions? Book a one-on-one consultation with NOW CFO and design a metrics framework that aligns with your goals. Discover how partnering with an outsourced CFO can transform raw numbers into strategic insights.

Frequently Asked Questions

What are the Top Metrics CFOs Track?

Outsourced CFOs use a blend of key financial KPIs like gross profit margin, operating cash flow, and EBITDA to get a holistic view of business health. These decision-making metrics go beyond surface numbers to reveal cost efficiency, profitability trends, and liquidity status, ensuring strategic financial oversight.

How do Outsourced CFOs use Metrics to Make Decisions?

Fractional CFO analytics hinge on real-time CFO dashboard metrics. By monitoring metrics such as burn rate, CAC, and LTV, outsourced CFOs can adjust investments, pricing strategies, and expense controls to drive optimized growth and mitigate risk.

What KPIs Improve Financial Performance?

Performance metrics CFOs monitor, like accounts receivable and inventory turnover, directly impact working capital efficiency. By shortening receivables cycles and aligning inventory with demand, CFOs free up cash for reinvestment, boost profitability, and strengthen balance-sheet resilience.

Why is EBITDA Important for Decision-Making?

As a core valuation metric, EBITDA strips out interest, taxes, depreciation, and amortization to highlight underlying profitability. Outsourced CFOs leverage EBITDA to benchmark against industry peers, support M&A activities, and inform capital-raising strategies with precise, comparable performance data.

How Can Cash Flow Metrics Help with Strategic Planning?

Metrics like OCF and cash conversion cycle give CFOs clarity on liquidity and capital efficiency. Tracking OCF weekly or monthly enables data-driven scenario modeling, which guides debt management, reinvestment timing, and budgeting decisions to ensure sustainable growth.

What Financial Metrics do CFOs Track for Forecasting Accuracy?

Forecast accuracy is a critical decision-making metric that compares projected vs. actual results. Outsourced CFOs aim for over 90% forecast accuracy, using variance analysis and rolling forecasts to refine budgeting, plan for contingencies, and support long-term strategic planning.

Amid growing complexity in financial operations, many businesses are overwhelmed by in-house accounting demands. As of 2024, 30% of companies outsource their accounting to access agility and expertise.

What is an Outsourced Accounting Service?

Outsourced accounting services are utilized when businesses delegate finance and bookkeeping tasks to external firms or professionals rather than handling them in-house. These providers manage business accounting, payroll, tax prep, bank reconciliations, and financial reporting, acting as an on-demand accounting department.

How Outsourced Accounting Differs from Traditional In-House Teams

Companies hire full-time accountants in a traditional in-house model, building internal infrastructure and handling recruitment, training, and benefits. With outsourced accounting, business owners can access high-level expertise on a scalable basis, paying only for the needed services.

Firms benefit from automated processes, real-time dashboards, and enhanced compliance intelligence without overhead burdens. This difference highlights why hiring an outsourced accounting service rather than investing in a budget-draining internal team is wise.

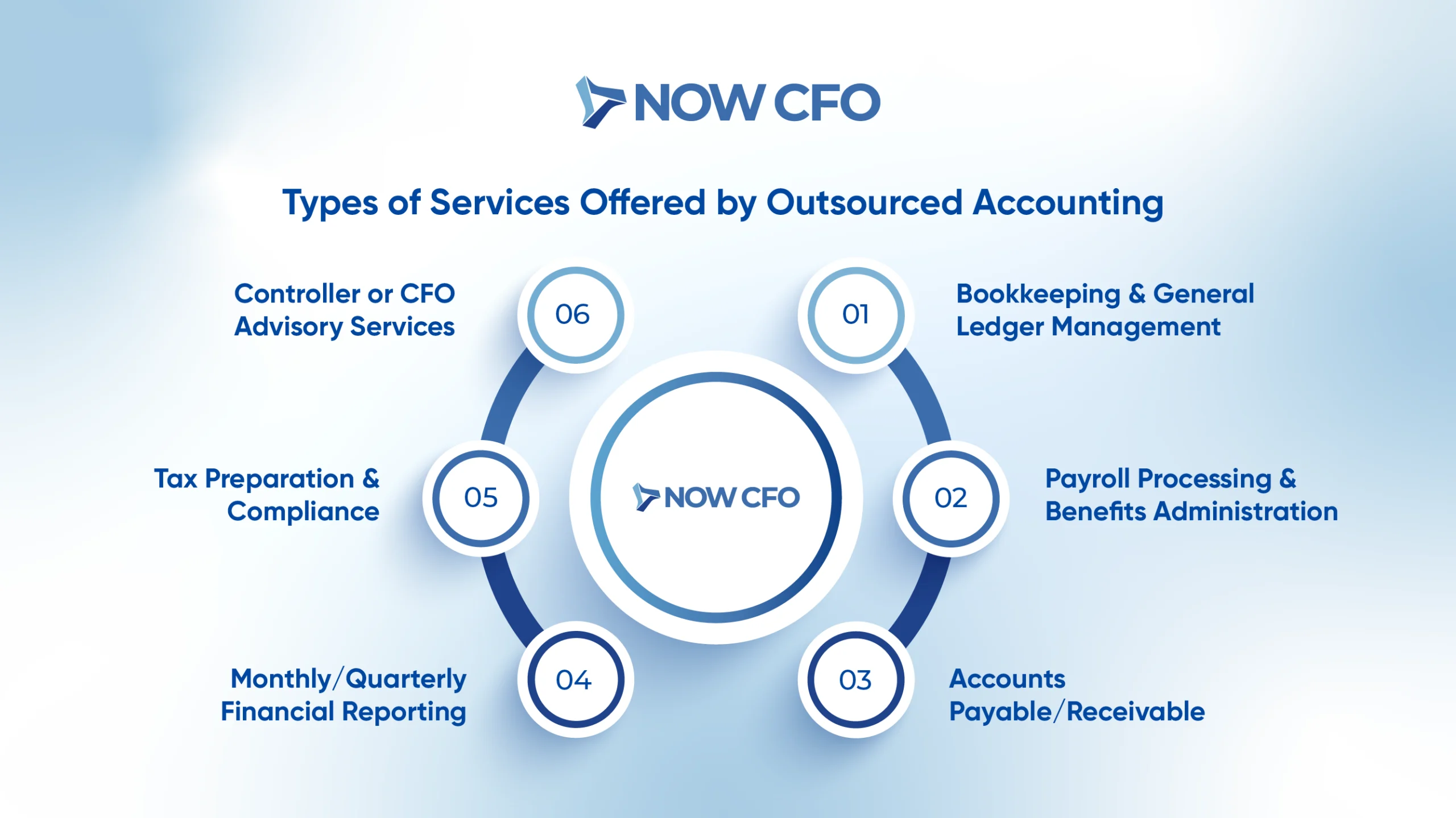

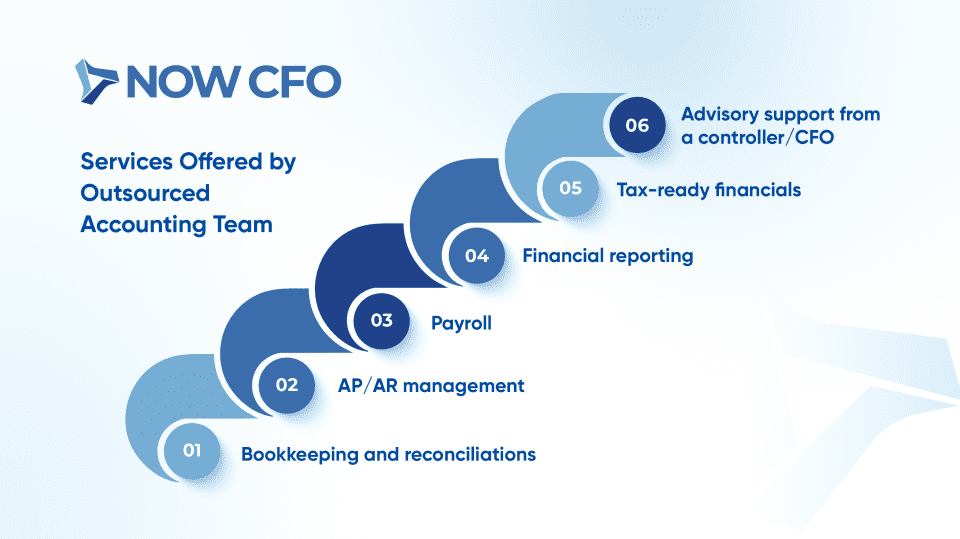

Types of Services Offered by Outsourced Accounting

Most outsourced providers bundle key accounting services tailored to each client’s needs. Shared services typically include:

Financial Benefits of Hiring an Outsourced Accounting Service

Lower Overhead and Payroll Costs

Outsourced accounting eliminates the need for full-time hires, reducing costs for salaries, benefits, training, and office space. Companies can scale finance support on demand, substituting fixed overhead with variables, aligned to business activity.

Predictable and Scalable Pricing

Outsourced providers offer pricing models that make budgeting predictable. Businesses avoid unexpected costs associated with overtime, turnover, or training needs.

As companies grow or scale back, they can seamlessly upgrade or downgrade services without salary adjustments, ensuring they only pay for what they need. This drives cost-effective financial services for businesses and supports small business accounting scalability.

Avoiding Costly Accounting Errors

Common safeguards include:

- Multiple-level review processes

- Month-end reconciliations

- Software-backed error detection

- Regular audit-prep procedures

Improved Cash Flow Visibility

An outsourced partner enhances cash flow management through timely reporting and forecasting tools. Access to cloud-based dashboards allows decision-makers to react proactively.

With better visibility, businesses optimize payables, receivables, and working capital levels, empowering real-time insights, fostering strategic benefits, and more informed executive decision-making.

Key improvements include:

- Weekly cash flow snapshots

- Rolling 13-week cash forecasts

- Alerts on liquidity risks

- Scalable financial insights

Learn More: Hire an outsourced accounting service for your business

Operational Benefits of Outsourced Accounting

Outsourced accounting benefits extend beyond finance, boosting efficiency, talent access, and leadership bandwidth while integrating tech-smart tools.

Faster Month-End Close and Reporting

Outsourced providers streamline accounts reconciliation and financial close processes using standardized workflows and automation. This reduces cycle time dramatically, letting companies finalize monthly books within days instead of weeks.

Access to Top Accounting Professionals

Outsourcing gives you immediate access to experienced professional CFOs, controllers, and accountants. Benefits include:

- Specialized expertise across industries.

- Senior-level advisory on strategy, taxes, and compliance.

- Cross-company best practices from diverse clients.

- Continuity and depth, avoiding disruption if staff leave.

Integration of Cloud-Based Tools and Systems

Outsourced accounting partners use advanced cloud-based tools to connect accounting platforms, CRMs, and banks. They implement scalable accounting systems with real-time data, secure remote access, and automated workflows.

This integration empowers business leaders with synchronized financial data, enabling strategic benefits through a virtual accounting service model.

Reduced Time Burden for Leadership

Delegating accounting to experts frees executives to focus on growth, operations, and strategy. With regular, accurate financial reports, leadership spends less time reviewing internal statements and more time driving value. Indeed, outsourcing enhances efficiency while boosting leadership focus.

Strategic Benefits of Outsourced Accounting

Building on efficiency and expertise, outsourced accounting services extend into strategic growth avenues, empowering businesses with timely insights, expert support, and scalable frameworks tailored to evolving needs.

Real-Time Insights for Better Decision-Making

When you outsource, you access live financial dashboards and actionable analytics. These capabilities transform financial data into strategic tools, fueling predictive decision-making and operational agility.

- Instant revenue vs. budget comparisons

- Variance alerts for fast response

- KPI trend tracking across cash flow, margins, and growth

Support During Fundraising, Audits, or Tax Season

Outsourced accounting teams bolster critical financial milestones with deeper resources and experience:

Outsourced Accounting Team in Key Financial Events

Fundraising Preparation

- Compiles investor-ready financial reports

- Model projections for valuation discussions

- Ensure GAAP/IFRS compliance for due diligence

Audit Readiness

- Maintain reconciliation documentation

- Provide organized trial balances

- Liaise with external auditors

Tax Season Efficiency

- Prepare accurate tax schedules

- Integrate real-time data to meet deadlines

- Leverage tax credits and opportunities

Scalable Solutions That Grow with Your Business

Outsourced accounting adapts alongside your business, expanding services as transaction volumes rise or scaling back in slower periods. There’s no need for hiring sprees; your virtual accounting service flexes with demand.

Proactive Financial Strategy Support from Experts

Beyond bookkeeping, outsourced teams often include advisors who help shape financial strategy. They suggest budgeting frameworks, growth capital planning, margin optimization tactics, and risk mitigation.

Learn More: Outsourcing accounting growth

Benefits for Startups and Small Businesses

Outsourced accounting services are especially valuable for startups and small companies. They offer flexibility, talent access, and compliance safeguards without excessive costs.

Avoid Hiring Too Early

Startups often rush to hire in-house accountants before generating consistent revenue. Outsourcing accounting provides an outsourced accounting solution that scales with your activity, so you only pay for services you need.

This approach supports cost-effective financial services for businesses in their earliest stages, enabling resources to focus on core product development and market testing—without sacrificing accounting accuracy.

Access Enterprise-Level Talent Without the Cost

Using an outsourced firm, startups gain access to senior financial talent: CFOs, controllers, or tax experts. These professionals bring strategic experience and compliance knowledge that aligns with growing business needs.

In short, you benefit from virtual accounting service expertise comparable to enterprise firms.

Flexible, Tailored Services

Outsourcing allows small businesses to customize accounting packages according to their stage and complexity:

- Modular Offerings: Bookkeeping, payroll, CFO support, tax prep; choose only what you need.

- Seasonal Scaling: Expand services during peaks or fundraising rounds, then scale down during lean periods.

- Industry-Specific Customization: Providers adapt to your sector: SaaS, retail, professional services.

Peace of Mind with Compliance and Accuracy

Ensuring compliance and precise accounting is vital for startups. Outsourced teams implement:

- Updated regulatory compliance (e.g., GAAP, IRS)

- Regular internal audits and reconciliations

- Secure financial controls preventing errors and fraud

Common Misconceptions About Outsourced Accounting

Let’s tackle the top myths surrounding outsourced accounting and why they don’t withstand scrutiny.

It’s Only for Big Companies

Many believe outsourced accounting suits large firms, but small business accounting equally benefits. Outsourced services scale with you; there is no need for full departments.

Startups, SMBs, and solopreneurs leverage virtual finance teams for part-time CFO support. 70% of businesses outsource at least one business function, demonstrating that cost-effective financial services for businesses of all sizes include outsourced accounting.

You Lose Control of Your Finances

A common worry is losing visibility, but virtual accounting service models emphasize transparency. Real-time dashboards, frequent status calls, and shared logins maintain control. You determine permissions and review cycles while benefiting from expert processes, keeping you in charge of financial direction.

They’re Not as Reliable as In-House Teams

Skeptics argue outsourcing sacrifices reliability, but providers use multi-layer quality checks and standardized protocols. Firms employ certified accountants, enforce internal audits, and follow compliance frameworks, often outperforming small in-house setups.

It’s Expensive in the Long Run

Concerns about hidden long-term fees are valid, but the benefits of outsourced accounting services outweigh the costs. Providers offer tiered, transparent pricing, and you avoid salaries, benefits, recruitment, and software expenses.

How to Maximize the Benefits of Your Outsourced Accounting Partner

To leverage the benefits, businesses must proactively manage the relationship, aligning objectives, tracking progress, and optimizing engagement.

Set Clear Goals and Expectations

Begin by jointly defining objectives, scope, and KPIs. This clarity positions both parties for success.

- Outline deliverables (monthly closings, cash flow forecasts, tax filings).

- Agree on timelines (e.g., books closed by the 5th business day).

- Define responsibilities (who handles bank reconciliations vs. who approves).

- Establish performance indicators (error rates, timeliness, communication response time).

Regularly Review Performance Metrics

Track key metrics like close cycle time, error frequency, and budget accuracy. Quarterly reviews uncover improvement areas and shape adjustments. By analyzing these metrics, you also validate ROI and reinforce the business advantages of an outsourced remote finance team.

Leverage Their Full Range of Services

Engage providers across their full capabilities to maximize value.

- CFO Advisory: Scenario planning, cash flow modeling, growth strategy.

- Tax Optimization: Exploring credits, staying compliant with evolving regulations.

- Audit Support: Year-end preparation and documentation.

- Project-Based Services: Integration, system migrations, or financial implementations.

Maintain Open Communication

Foster a partnership through scheduled updates, shared dashboards, and transparency. When priorities shift, communicate with them early so the outsourced team can adapt. This ongoing dialogue sustains trust and ensures outsourced accounting remains aligned with evolving business objectives.

Conclusion

The benefits of hiring an outsourced accounting service increase as your business grows. By outsourcing, companies avoid premature hires, eliminate administrative burdens, and gain access to enterprise-level talent.

Ready to capitalize on these advantages with NOW CFO? Request a free outsourced accounting consultation to identify cost savings and process improvements.

When business leaders fixate on skyrocketing revenue, they often overlook the real measure of success: return on investment. An outsourced CFO can shift that focus and deliver tangible results.

Yet, many organizations underutilize outsourced CFOs or treat them merely as number crunchers. This blog aims to change that perception by showcasing five high-impact, result-oriented strategies that fractional CFOs employ to transform businesses. Let’s look at 5 proven strategies Outsourced CFOs Use to enhance ROI for your business.

Strategic Cash Flow Forecasting

Cash flow forecasting evaluates the timing and amount of inflows and outflows to help businesses maintain adequate liquidity and avoid cash crunches. Accurate forecasting ensures that companies can meet obligations, plan investments, and reinvest wisely for growth.

Outsourced CFOs enhance financial strategy execution by deploying tools and models that improve forecast accuracy and adaptability. Their proactive planning helps clients manage seasonality, prepare for downturns, and optimize capital usage, essential components in improving ROI with outsourced CFOs.

Source: EY Parthenon

Cost Structure Optimization

Cost structure analysis breaks down a company’s fixed and variable expenses to uncover inefficiencies and reduce unnecessary spend. A leaner cost structure directly improves margins and creates headroom for strategic reinvestment.

Fractional CFOs use financial performance optimization techniques to evaluate vendor contracts, eliminate waste, and centralize expenses for better visibility. These CFO ROI strategies contribute to scalable, long-term cost savings while maintaining operational strength.

Source: Deloitte

Revenue Stream Diversification & Pricing Strategy

Revenue diversification spreads risk across multiple income sources, while smart pricing strategy ensures maximum profitability from each transaction. When managed effectively, both drive stronger, more sustainable returns.

Outsourced CFOs use data-driven financial strategy to explore new revenue models and refine pricing tactics. These business growth financial tactics help companies attract higher-value customers and reduce dependence on any single channel.

Source: Bain & Company

Financial KPI Alignment with Business Goals

Financial KPIs like EBITDA, ROI, and working capital turnover must map directly to strategic business outcomes. When KPIs are siloed from vision, leadership can’t measure progress or pivot effectively.

CFOs apply ROI-driven financial leadership to align every department’s financial metrics with growth priorities. This alignment improves decision-making and ensures that each initiative contributes to overall return on investment.

Source: PicoSmart

Scenario Planning & Risk Management

Scenario planning tests a business’s response to best-case, worst-case, and status quo financial outcomes. It helps organizations proactively mitigate risk and strengthen resilience.

By leveraging forecasting models and advanced analytics, outsourced CFOs reduce volatility and ensure the business is prepared for disruption. This reduces financial shocks, supports strategic cost management, and ultimately boosts ROI.

Source: Verecol

Conclusion

Outsourced CFOs drive strategic financial initiatives that improve capital efficiency, reduce costs, and align performance with long-term goals. They empower businesses to not just grow, but grow profitably and with purpose.

Ready to see the difference strategic financial leadership can make? Let’s discuss how a fractional CFO tightens your profit margins or uncover new revenue opportunities. A detailed ROI report, or a peer case study that mirrors your situation, NOW CFO is here to support your journey toward smarter, ROI-driven growth.

FAQs

How Can a CFO Improve Business ROI?

A CFO enhances ROI by implementing ROI-driven financial leadership, aligning strategy with key metrics, and optimizing capital allocation. Outsourced CFOs bring proven strategies that focus on cost efficiency and smarter growth planning.

What ROI Strategies do Fractional CFOs Use?

Fractional CFOs use CFO ROI strategies like cash flow forecasting, cost structure optimization, and KPI alignment with business goals. These financial performance optimization tactics drive measurable gains in profitability and efficiency.

Can Outsourced CFOs Help with Cost Management?

Yes, outsourced CFOs apply strategic cost management techniques to identify inefficiencies and streamline operations. By reviewing expenses and improving spending allocation, they play a key role in improving ROI with outsourced CFOs.

What KPIs are Best for Tracking ROI?

Effective ROI tracking includes KPIs such as net profit margin, customer acquisition cost, return on assets, and cash conversion cycle. CFOs ensure these financial strategy execution metrics directly support long-term business growth financial tactics.

How Does Financial Planning Increase Return on Investment?

Comprehensive financial planning boosts ROI by guiding smarter investments, improving liquidity, and preparing for market volatility. Using financial strategy to drive ROI ensures sustainable and scalable outcomes for businesses.

When business owners consider hiring an outsourced accounting service, understanding the strategic payoff is essential. In 2021, 62% of SMEs relied on in-house accountants, a number that has been steadily declining since then.

When you hire an outsourced accounting service, you gain expert oversight without the full-time salary burden. Outsourced teams handle everything from outsourced bookkeeping and AP/AR to payroll and tax-ready financials, delivering accuracy and timeliness.

What Is an Outsourced Accounting Service?

Outsourced accounting involves partnering with an external provider to manage your financial operations. This model provides expert bookkeeping, reporting, and advisory services without the overhead of full-time in-house staff.

Core Functions Provided

Outsourced accounting teams handle tasks like:

- Bookkeeping & reconciliations

- Accounts payable/receivable

- Payroll processing

- Monthly/quarterly financial reporting

- Tax-ready statement preparation

- CFO-level advisory on cash flow, forecasting, and strategy

Differences From In-House Accountants

Outsourced firms and in-house accountants each serve crucial roles, but vary significantly:

What Types of Businesses Benefit

Many company types thrive from outsourcing accounting.

- Early-stage startups with limited budgets and no internal finance hires

- Growing SMBs scaling operations and needing better financial visibility

- Seasonal businesses with fluctuating workloads

- M&A or fundraising candidates requiring clean, audit-ready books

- Companies lacking internal expertise, avoiding errors and penalties

- Firms aiming to reduce headcount costs while improving control

Signs It’s Time to Hire an Outsourced Accounting Service

Recognizing these warning signs helps business owners transition from reactive accounting to proactive strategy.

Your Books Are Always Behind or Inaccurate

If your financial records lag or contain errors, cash flow forecasts suffer, and so do decision-making. Falling behind on reconciling accounts triggers inaccurate performance snapshots, risking poor planning or missed revenue.

You’re Spending Too Much Time on Accounting Tasks

Spending excessive hours on bank reconciliations, payroll, or invoicing pulls you away from strategic roles. That’s where a remote accounting service comes in. By handling repetitive accounting chores, you are freed to focus on scaling operations or improving small business accounting solutions.

You’re Scaling Quickly and Need Financial Clarity

Rapid revenue or headcount growth without solid financial tracking causes blind spots. When your team expands quarter-over-quarter, forecasting and budgeting suffer.

Hiring an outsourced accounting provider ensures accurate scaling metrics, improved cash burn analysis, and financial insights that support operational decisions. This shift gives you both clarity and confidence during high-growth phases.

You’re Preparing for Fundraising or M&A

Due diligence demands spotless, credible accounts. Investors and acquirers require clean financials going back at least 2–3 years. Companies often discover errors during due diligence, potential deal killers.

By bringing on an outsourced accounting service, you get audit-ready books, polished financial statements, and proactive advice on documentation and compliance. Whether you’re exploring when to outsource accounting or planning funding rounds, expert accounting support clears the path to capital and negotiation leverage.

You Lack Internal Accounting Expertise

Cash flow modeling, tax planning, and inventory automation require qualified experts. However, hiring a full-time accountant or CFO with those capabilities may exceed budget constraints.

In 2023, the BLS noted 1.6 million accounting and auditing jobs, with incomes averaging over $81,000/year, a steep price for startups. Instead, an outsourced vs in-house accounting decision leans toward outsourced: you access top-tier expertise.

You’ve Had Errors in Taxes or Compliance

Mistakes in tax returns or compliance filings can lead to fines, penalties, or audits. On average, businesses spend hundreds of hours each year and incur significant expenses just to meet regulatory compliance requirements.

Outsourced accounting firms specialize in up-to-date tax laws and internal controls. They build audit-ready processes and proactively correct discrepancies, mitigating risk and protecting your business.

Benefits of Hiring an Outsourced Accounting Service

Partnering with an outsourced accounting provider can bring measurable gains without overloading your budget.

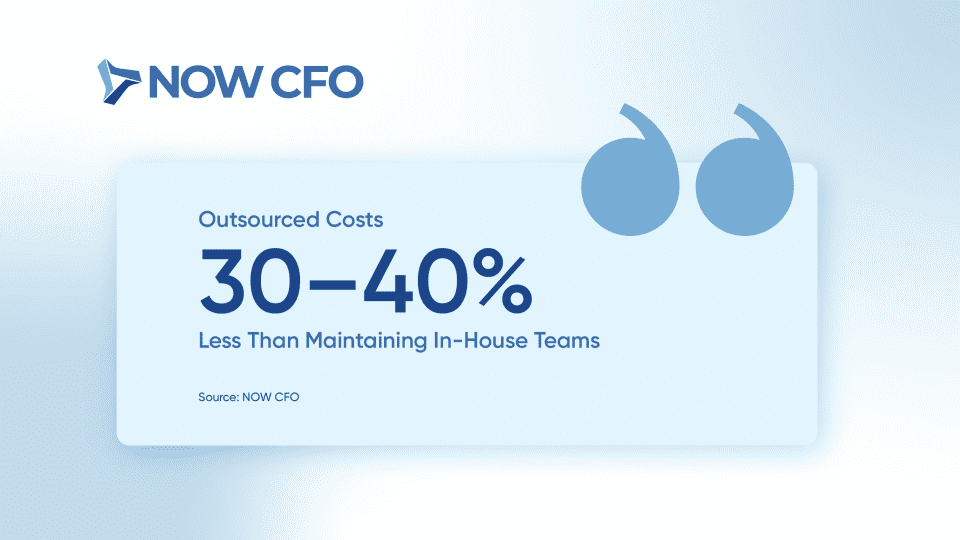

Lower Operational Costs

Outsourced models often cost 30–40% less than maintaining an in-house team. You avoid salaries, benefits, office space, and software expenses. You pay only for the services you need.

Source: NOW CFO

- Eliminate healthcare, payroll taxes, and recruitment fees

- No overhead for software licenses or office equipment

- Adjust services monthly as your needs change

Access to Experienced Professionals

Outsourced providers assemble cross-functional teams that include CPAs, controllers, and finance specialists. Unlike a single in-house hire, these experts bring diverse niches, from tax compliance to cash flow management.

Faster Reporting and Close Cycles

Outsourced accounting firms streamline month-end and quarterly closings using efficient processes and seasoned staff. This speed clarifies performance tracking and financial forecasting, essential during growth phases or pre-investment, and accelerates visibility and action when hiring an outsourced accounting service.

Flexibility to Scale Services

Outsourced teams adjust support based on seasonal demands or market conditions. Whether you need quarterly tax prep or project-based advisory, your scope adapts monthly, and no hiring or layoffs are required.

Technology and Automation Integration

Outsourced firms invest in cloud-based ERP, AI-driven reconciliation, and automation tools, and include software costs in their fees. They implement bots and OCR tech to reduce manual data entry errors significantly.

- Automate bank feeds, invoices, and reconciliation

- Provide real-time dashboards with key metrics

- Ensure cybersecurity and compliance via vendor-grade protocols

When is the Right Time Based on Business Stage?

Tailoring the decision to hire an outsourced accounting service by stage ensures you’re not paying for capabilities you don’t yet need. Below, we match business stage with optimal accounting support.

Early-Stage Startups

In the earliest phase, startups focus on product-market fit yet must manage cash flow. With limited resources and no full-time financial team, outsourcing delivers financial discipline and accuracy.

Over 66% of SMEs outsource, including bookkeeping, to stay lean. By bringing a virtual accounting team onboard early, founders can access timely financial reports, streamlined expense tracking, and better investor transparency without full-time overhead.

Growth-Stage Companies

As sales and headcount ramp up, complexity stretches in-house capabilities. You may need remote accounting services and small business accounting solutions to interpret P&L variances, model cash requirements, or prepare for new funding.

A study shows that 37% of businesses outsource accounting during growth, delivering expertise and lightening internal load. With outsourced partners, you gain monthly forecasts, budgeting support, and strategic analysis, allowing leadership to spend less time on reconciliation and more on growth.

Mid-Market Businesses

Manual reporting strains agility once you reach mid-market, with revenue of $10M+. This trend reflects demand for standardized, scalable financial operations without hiring full-time controllers or CFOs.

Outsourced accounting provides structure: clean financial closes, compliance oversight, KPI dashboards, and advisory support. The flexibility to tier up or down aligns perfectly with questions like when to outsource accounting.

Companies Undergoing Audits or Acquisitions

You need clean and compliant records when preparing for audits, acquisitions, or fundraising rounds.

- Implement audit-ready processes and controls

- Deliver due diligence-quality documentation

- Provide CFO/advisory support during deal structuring

- Ensure regulatory and GAAP compliance

What Services Should You Expect from an Outsourced Team?

Outsourced accounting teams cover end-to-end finance functions, freeing you from detailed work while delivering strategic insights. Below are the core services included.

Services Offered by Outsourced Accounting Team

Bookkeeping and Reconciliations

Outsourced teams manage day-to-day entries, bank reconciliation, and expense categorization, ensuring books are always accurate and up to date. These services underpin small business accounting solutions and form the foundation for reliable financial statements.

AP/AR Management

Outsourced teams track payables and receivables, send invoices, reconcile vendor statements, and manage collections. By automating accounts payable and accounts receivable, they improve cash flow visibility, which is part of both outsourced and virtual accounting team offerings.

Payroll

Outsourced payroll ensures timely, compliant wage processing and tax filings. The IRS notes that many businesses outsource payroll to third-party providers to “meet filing deadlines and deposit requirements. This service frees you from manual payroll tracking and error risk.

Financial Reporting

Teams produce monthly, quarterly, and annual financial reports; P&L, balance sheet, and cash flow statements, aligned with GAAP. They provide actionable monthly dashboards, enabling strategic decisions and aligning with when to outsource accounting for clarity and accountability.

Tax-Ready Financials

Outsourced providers prepare clean, audit-ready records and handle tax-related adjustments. This ensures accurate filings and support during tax season, reducing errors and risk. It’s a key benefit of outsourced vs in-house accounting.

Advisory Support from a Controller/CFO

Providers often include strategic advisory services, such as forecasting, budgeting, and cash-flow modeling. This CFO-level counsel helps with growth planning, fundraising, and decision-making. It complements outsourced bookkeeping by elevating financial strategy through sound analysis.

How to Choose the Right Outsourced Accounting Partner

Selecting a provider requires careful alignment of expertise, process, and outcomes. Use the criteria below to guide your decision-making.

Questions To Ask Before Hiring

Before signing on, ask targeted questions:

- What is your experience with companies at our stage?

- Can you share references or case studies?

- Which software and automation tools do you use?

- What is your turnaround time for monthly close and reporting?

Matching Services with Your Goals

Map your needs: bookkeeping, tax compliance, advisory, and provider services. Confirm they deliver both outsourced bookkeeping and CFO-level insight if needed. Ask how they handle scale and complexity. Aligning expectations upfront ensures your remote accounting services provide value and remain flexible as your goals evolve.

Onboarding And Transition Process

Ensure the vendor has a clear onboarding roadmap, timelines, data migration, internal role mapping, and communication protocols. Clarify kickoff deliverables and establish regular check-ins to keep the process on track and aligned with your decision to hire an outsourced accounting service.

Measuring ROI And Performance

Define KPIs: cost reduction, cycle time, error rates, reporting accuracy, and advisory impact. Track them monthly or quarterly. Regular performance reviews ensure the partnership stays aligned with your outsourced accounting goals and supports company growth.

Common Mistakes to Avoid When Hiring an Outsourced Team

Ensuring you sidestep these frequent errors is essential to secure value from your outsourced accounting partnership.

Choosing Based Only on Price

Opting for the lowest-cost provider often means sacrificing quality, expertise, or technology. When you hire an outsourced accounting service, balance cost considerations with proven performance, software capabilities, and service offerings to avoid costly oversights.

Lack of Clear KPIs

Before engagement, define metrics: close-cycle time, error reduction, reporting accuracy, or cost savings. Without these, evaluating success becomes difficult. For instance:

- Reporting accuracy > 98%

- Close-cycle ≤ 5 business days

- Monthly financial reviews conducted

Poor Communication Expectations

Misaligned communication protocols cause delays and frustration. Clarify:

- Meeting cadence (weekly, monthly)

- Responsible contacts and escalation paths

- Reporting formats and dashboards

- Response time targets (< 24 hours)

Not Verifying Security and Compliance Protocols

Failing to confirm data security, encryption standards, and compliance certifications (e.g., SOC 2) exposes you to cyber risk and regulatory penalties. Ensure robust controls before you hire an outsourced accounting service to protect data and maintain compliance.

Conclusion

When you hire an outsourced accounting service, you’re unlocking expert financial support tailored to your business. Outsourcing enables more than just operational efficiency; it provides a strategic partnership to drive decision-making, ensure compliance, and scale confidently.

At NOW CFO, our experienced team delivers outsourced bookkeeping, payroll, reporting, and CFO-level advisory. Book a complimentary discovery session with NOW CFO to evaluate how we can support your financial operations.

The popularity of fractional CFO services is soaring, with demand for these roles increasing rapidly. For many growth-stage companies, this surge reflects the desire to access high-level financial leadership without the hefty long-term commitment and overhead of hiring a full-time CFO.

Traditional CFO roles often come with six-figure salaries and full-time demands, which may not align with the needs of evolving enterprises. The fractional CFO model provides a compelling solution, offering seasoned financial leadership on a flexible, part-time basis.

Surge in Interim CFOs Demand Skyrockets

Requests for interim CFOs have surged by an astounding 310% since 2020, with CFO roles now representing over half of all interim C-suite placements. This dramatic increase highlights a broader shift toward agile, outsourced financial leadership, especially as companies seek to navigate uncertain markets with precision and control.

The rising popularity of fractional CFO services reflects a growing need for leadership that’s both strategic and scalable. Interim CFOs are no longer a temporary fix, they’re a preferred solution for companies needing financial clarity during transitions, M&A, restructuring, or periods of rapid growth.

Source: Business Talent Group

Fractional CFO Market Growth Production

The global finance and accounting outsourcing market is projected to reach $76.359 billion by 2033, growing at a CAGR of 5.75% from 2025. Starting at $46.168 billion in 2024, this steady rise reflects expanding demand for cost-efficient, scalable financial services.

This market boom is closely tied to the rise of part-time CFOs and outsourced financial leadership trends. As businesses seek to trim overhead without compromising on strategy, fractional CFOs offer the perfect blend of cost control and expert guidance.

Source: Business Research Insights

Demand for Fractional CFOs Has Doubled in Two Years

The demand for fractional CFOs in the U.S. has skyrocketed, with a staggering 103% year-over-year increase. These trends reflect a significant shift in how businesses, especially startups and growth-stage companies, approach financial leadership.

Instead of committing to the high fixed costs of full-time CFOs, companies are turning to fractional solutions that deliver flexibility without sacrificing strategic expertise.

This surge in demand proves that more businesses are recognizing the benefits of experienced, project-based financial leadership. With fractional CFOs, companies can access tailored financial strategies, budget oversight, and forecast support exactly when needed.

Source: Business Talent Group

Outsourced CFOs are Cost Effective

Hiring a full-time CFO can cost anywhere from $300K to $500K per year, making it a steep investment for many mid-market firms and startups. In contrast, fractional CFO engagements typically range from $3,000 to $15,000 per month, depending on complexity and scope.

These numbers demonstrate why the benefits of hiring a fractional CFO are so compelling. Businesses pay only for what they need, whether it’s strategic planning, financial modeling, or cash flow oversight. More importantly, the flexible model supports companies through changing financial priorities, without long-term commitments.

Source: Salary.com, NOW CFO

Engagements Are Long Enough to Drive Impact

Contrary to the misconception that fractional CFOs are short-term placeholders, data shows otherwise: 45.6% of engagements last between one and two years, while 42% run for several months. This proves that fractional CFOs are delivering real impact during critical growth phases or organizational transitions.

This model of interim financial leadership provides companies with strategic consistency and continuity. Businesses benefit from embedded, high-level finance leadership that’s present long enough to drive results, yet flexible enough to scale or step back as needed.

Source: HubSpot

CFO Turnover Drives Fractional CFO Adoption

CFO turnover reached a three-year high of 22% in 2024, causing disruption across industries. As a result, many organizations are turning to fractional CFO demand as a proactive solution to fill leadership gaps swiftly and efficiently.

Fractional CFOs offer rapid onboarding, strategic clarity, and operational stability at a time when many companies can’t afford long recruitment cycles. These professionals’ step in with immediate impact, offering insights on cash flow, compliance, and long-term planning.

Source: HealthLeaders Media

Conclusion

By offering top-tier planning, forecasting, and reporting at a fraction of the cost, fractional CFO empowers organizations to operate with agility and confidence. From startups navigating Series A rounds to private equity-backed firms seeking quick stabilization, the value of on-demand CFO model has never been popular.

Considering CFO expertise without full-time cost? NOW CFO is here to help. Book a free consultation session to explore a bespoke engagement designed for your business goals.

FAQs

Why are Fractional CFOs Becoming More Popular?

The popularity of fractional CFO services is rising as businesses seek agile, scalable financial leadership without committing to a full-time hire. This model allows companies to access CFO expertise on demand, particularly valuable in a remote-first world where top financial talent can be engaged regardless of location.

What are the Benefits of Using a Part-time CFO?

The rise of part-time CFOs offers numerous advantages. Businesses gain access to high-level financial strategy, cash flow forecasting, and investor relations support at a fraction of the cost.

How Much Can I Save by Hiring a Fractional CFO?

On average, companies save significantly when hiring a fractional CFO versus a full-time executive. These outsourced financial strategies are tailored, meaning businesses only pay for what they need.

Are Fractional CFOs Effective for Startups?

Absolutely, fractional CFO adoption among startups has grown significantly, particularly during early funding rounds. Startups benefit from investor-ready modeling, scalable finance strategy, and critical insights without the overhead of a full-time CFO.

What Services do Fractional CFOs Typically Offer?

Fractional CFOs go beyond traditional accounting. Their services include strategic financial support/planning, forecasting, budget creation, cash flow management, KPI tracking, and fundraising support.

Outsourced accounting has surged in popularity over the past two decades. The global market for alternative finance was estimated at US$8.6 billion in 2024 and is projected to reach US$11.6 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030.

Outsourced accounting services provide scalable solutions that replace costly in-house hires and support solid financial control. SMEs leverage these arrangements for outsourced bookkeeping, remote accounting services, and virtual accounting teams, freeing internal teams to focus on business growth.

What are Outsourced Accounting Services?

When exploring outsourced accounting, it’s helpful to break down what it includes, who engages in it, and which industries gain the most strategic advantage.

Core Services Provided

Businesses contract third-party firms to handle essential accounting services such as:

- Bookkeeping: Recording transactions, reconciliations, and journal entries

- Accounts Payable/Receivable (AP/AR): Invoice processing, vendor payments, collections

- Payroll Management: Employee pay, benefits, tax filings

- Month-End Close/Reconciliations: Ensuring all accounts are accurate

- Financial Statement Preparation: Balance sheets, P&L reports

- Controller Oversight: Reviewing and validating financial processes

- Integration with CFO Services: Aligning numbers with strategic decisions

Who Typically Uses Outsourced Accounting?

Many SMEs and startups leverage outsourced accounting to fill gaps when internal capacity is limited or costly. Founders who need financial clarity without the expense of full-time hires turn to outsourced bookkeeping and remote accounting services.

Even larger firms in transitional phases, such as M&A or rapid expansion, use these external accounting services to supplement in-house teams during peak periods.

Virtual accounting teams offer scalable support in sectors with seasonal fluctuations or cyclical revenue without adding permanent headcount. Additionally, businesses encountering regulatory changes or hiring challenges benefit from expertise packed into CFO accounting support.

Industries That Benefit Most

Certain sectors find outsourcing particularly compelling:

- Professional & Business Services: 17.6% of output is outsourced, the highest among industries.

- Retail Trade: 16.2% of gross output comes from outsourcing.

- Healthcare & Education: Consistent use of external finance teams improves compliance.

- Manufacturing: Streamlines overhead, enabling focus on production

- Tech Startups: Get rapidly scalable accounting outsourcing solutions without hiring delays.

These industries benefit most because outsourced providers reliably handle transaction volume, help with compliance, and favorably support the in-house vs. outsourced accounting comparison by cutting costs and increasing flexibility.

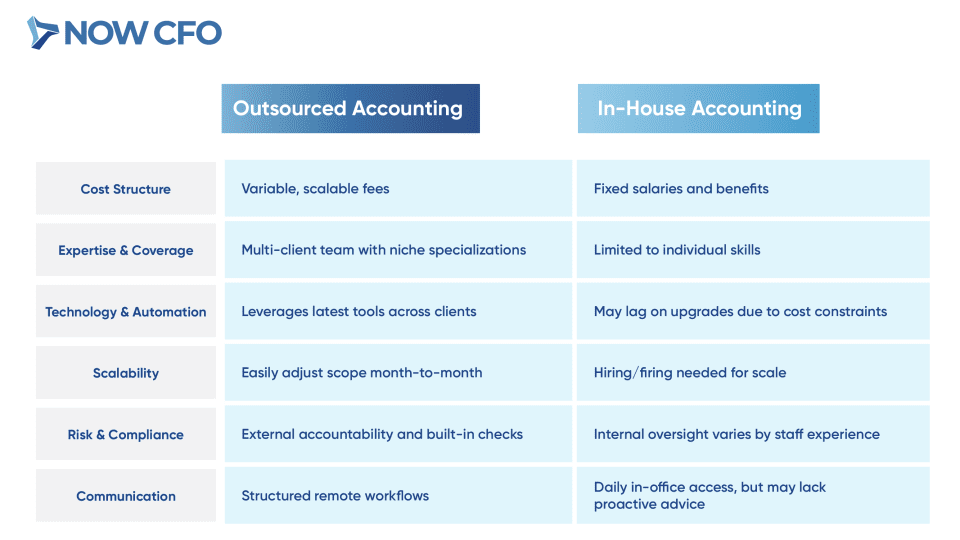

Outsourced Accounting vs. In-House Accounting

When weighing outsourced accounting against in-house teams, it’s crucial to compare cost, flexibility, talent access, technology, and security.

Cost Differences

Outsourcing eliminates fixed salaries, benefits, and overhead tied to in-house staff. Companies typically pay monthly fees or per-task rates. Compared to hiring a full-time controller, outsourced providers cost significantly less while delivering high-quality CFO accounting support and external accounting services.

Firms avoid recruitment and training expenses, and scale services up or down to match their needs. The cost of outsourced accounting is far below full-time equivalents.

Flexibility and Scalability

Outsourced providers adjust quickly to business volatility, scaling up during peak season or down when demand recedes. Companies avoid managing fluctuating headcount or staff burnout. You gain responsive support without overhead with outsourced bookkeeping and remote accounting services.

Also, finance teams can flex service levels monthly or annually based on growth, ensuring virtual accounting teams and accounting outsourcing solutions align with business cycles and goals.

Talent and Expertise Access

Outsourced partners assemble teams with specialized expertise covering the full finance spectrum. You benefit from collective knowledge, workflows, and continuous training. In contrast, in-house teams often lack depth, especially in regulatory compliance or advanced reporting.

Outsourced accounting provide access to accounting outsourcing solutions designed by experts accustomed to multiple clients and industries. This ensures your company receives up-to-date best practices without investing in certifications or systems internally.

Technology and Software Use

Outsourced providers typically operate on cloud-based platforms to deliver seamless, centralized reporting. The IRS emphasizes that cloud-computing contractors benefit from lower costs, automatic upgrades, and multi-region reliability.

This means clients avoid upfront IT investment, software licensing, and maintenance. Their data is backed up, version-controlled, and accessible anytime. Meanwhile, in-house setups often lag due to budget constraints or lack of IT support, making accounting outsourcing solutions more technologically advanced.

Plus, providers integrate add-ons, such as AP/AR automation, payroll modules, and real-time dashboards, offering a full-stack finance toolset that in-house teams rarely achieve without significant investment.

Data Security and Compliance

Security is critical. Reputable outsourced firms implement SOC 2 and ISO 27001 controls, encrypted data transfers, and role-based access. These safeguards often exceed in-house capabilities.

For example, IRS Publication 4812 mandates strict cloud data protection for all subcontractors. Compliance is built in; firms handle tax filings, payroll regulations, and audit-ready documentation. In contrast, internal teams may lack formal security policies or expert oversight, increasing the risk of breaches, fines, or inaccuracies.

Benefits of Outsourced Accounting Services

When evaluating the benefits of outsourced accounting, it becomes clear how they significantly reduce costs, improve accuracy, boost focus, and drive efficiency. Here’s how each advantage contributes to business success and strategic growth.

Reduced Overhead and Fixed Costs

By outsourced accounting, you transition from fixed payroll expenses to a predictable monthly fee. This eliminates salaries, benefits, workspace, and training overhead.

Typical full-time mid-size finance roles cost $80K—$120K/year + 20–30% benefits, totaling over $100K to $140K annually, plus indirect costs like equipment and software licensing. In contrast, outsourced accounting usually ranges from $3,000 to $7,500/month for small to mid-size businesses.

- Outsourcing cuts internal headcount by 1–2 full-time staff equivalents.

- It negates recruiting, onboarding, and ongoing training expenses.

- You avoid hardware, software, and office space costs tied to in-house teams.

Better Accuracy and Financial Reporting

Outsourced accounting use structured workflows, dual review systems, and cloud tools, raising accuracy and timeliness across financial reporting. Standardized processes reduce errors and inconsistencies, ensuring reliable data.

Providers often maintain checklists and automate reconciliations, minimizing manual mistakes. Clients gain access to timely, clean financials, facilitating better strategic decisions, smoother audits, and improved bank or investor confidence. This enhances accounting outsourcing solutions by delivering reliable metrics and promoting robust financial governance.

Increased Focus on Core Operations

By outsourcing routine finance tasks, leadership teams free up time for strategic priorities, like growth, customer acquisition, and innovation. Entrepreneurs and CEOs no longer manage day-to-day bookkeeping or payroll.

This shift improves business agility and responsiveness. When outsourced bookkeeping and remote accounting services handle the details, executives channel energy into expanding offerings, improving processes, and strengthening client relationships.

With financial operations offloaded, companies also enhance internal collaboration, team members focus on revenue-driving functions rather than transactional tasks. This sharper focus on core activities supports better long-term performance and customer satisfaction.

Faster Financial Close and Reporting Cycles