Understanding how financial reports impact your bank loan eligibility can be a game changer when seeking financing. These documents are not just formalities; they are a deep dive into your business’s or personal finances’ financial health, providing crucial information to lenders.

Overview of Financial Reports

- The Balance Sheet: This is a detailed snapshot of an entity’s financial condition at a specific point in time. It categorizes current and long-term assets. Liabilities are divided into current and long-term liabilities. Equity represents the owner’s share and includes retained earnings and shareholders’ equity. This statement is essential for assessing the entity’s solvency and capital structure, showing what it owns versus what it owes.

- The Income Statement: The income statement tracks revenue and expenses over a specific period—typically a quarter or a year. It starts with sales figures, then subtracts costs of goods sold to calculate gross profit, followed by the deduction of operating expenses, taxes, and interest to arrive at the net income. This statement is crucial for gauging the entity’s operational efficiency and profitability, indicating how effectively it can turn sales into profit. It also highlights trends in revenue and expenses that could impact financial performance over time.

- The Cash Flow Statement: Complementing the balance sheet and income statement, the cash flow statement details the actual cash flow into and out of the entity over the period. It is divided into cash flows from operating activities (which reflects the cash generated from the entity’s core business operations), investing activities (which cover cash used for and generated from investments like buying or selling assets), and financing activities (which tracks cash exchanges involving debt, equity, and dividends). This statement is indispensable for understanding the entity’s liquidity, showing how cash is generated and used, and whether the entity can maintain positive cash flow to sustain operations and growth.

Debt-to-Income Ratio

The debt-to-income ratio (DTI) is an important metric in your financial reports. Lenders use it extensively to assess your financial health and determine your eligibility for new loans. Understanding its calculation and implications can significantly affect your loan approval process. Here’s a detailed look at each component:

- Calculation of DTI: To calculate your DTI, lenders add up all your monthly debt payments—this includes payments on credit cards, student loans, car loans, mortgages, and any other fixed debts. They then divide this total by your gross monthly income. The result is expressed as a percentage. For example, if your total monthly debts are $1,000 and your gross monthly income is $4,000, your DTI would be 25%.

- Significance of a Lower DTI: A lower DTI percentage demonstrates to lenders that a smaller portion of your income is dedicated to debt, leaving more available for additional expenses, including the potential loan you are applying for. Generally, lenders prefer a DTI ratio of 35% or less, as it indicates good financial health and suggests that you’re less likely to face difficulties with additional loan repayments.

- Impact on Loan Eligibility: Lenders consider a low DTI indicative of a borrower’s ability to take on and responsibly manage new debt. A high DTI, on the other hand, can signal potential financial strain, making lenders hesitant to approve new credit. Keeping your DTI low enhances your appeal to lenders, increasing your chances of obtaining favorable loan terms. Additionally, some loan programs, particularly mortgages, have strict DTI requirements that must be met for loan approval.

Liquidity Ratios

Liquidity ratios are critical financial metrics derived from your financial reports that banks examine closely. These ratios assess your ability to settle short-term liabilities without requiring additional cash inflows. Two primary liquidity ratios are:

1. The Quick Ratio, or acid-test ratio, measures your ability to cover your immediate financial obligations using your most liquid assets. This ratio excludes inventory because inventory is not always readily convertible to cash.

- Calculation: The quick ratio is calculated by dividing liquid assets (cash and equivalents, marketable securities, and receivables) by current liabilities. A quick ratio of 1:1 or higher indicates good liquidity health, showing that the company can cover its immediate obligations without selling any long-term assets or obtaining additional financing.

Quick Ratio=Current Liabilities/“Quick Assets”

Quick Assets=Cash+CE+MS+NAR

CE=Cash equivalents

MS=Marketable securities

NAR=Net accounts receivable

- Significance: This ratio is a stringent liquidity test, reflecting the company’s ability to use its most liquid assets to pay short-term debts instantly. Lenders often view A higher quick ratio favorably, as it suggests financial robustness and a low risk of default.

2. The Current Ratio evaluates whether you have enough resources to pay off all your debts due within one year. It considers all current assets, including inventory, which may take longer to convert into cash than other assets.

- Calculation: The current ratio is determined by dividing all current assets by liabilities. A ratio above 1 is generally preferable, indicating that the assets exceed the liabilities on a short-term basis.

- Significance: This ratio gives a comprehensive overview of your financial health in the short term. It indicates your ability to generate enough cash to meet your obligations, with a buffer provided by more liquid assets. Banks often prefer a higher current ratio as it decreases the risk associated with the loan, providing a cushion against market fluctuations and unexpected downturns.

Maintaining strong liquidity ratios, as reflected in your financial reports, demonstrates to lenders that your financial health is robust enough to handle additional debt. This influences their decision to extend credit and impacts the terms of any potential loan.

Profitability Metrics

Profitability metrics, integral to your financial reports, reflect your business’s ability to generate earnings and manage expenses effectively. These metrics are crucial for lenders assessing your potential to service new debt. Key profitability metrics include:

1. Net Profit Margin: This ratio reveals what percentage of your revenues is converted into profits after all operating expenses, taxes, and interest payments are accounted for. A higher net profit margin demonstrates your business’s efficiency in controlling costs and converting sales into actual profits. It is calculated by dividing net profit by total revenue and multiplying by 100 to express it as a percentage. Lenders favor businesses with consistently high net profit margins, indicating lower financial risk and a greater likelihood of sustained profitability.

Net Profit Margin = ((R-COGS-E-I-T)/R)*100

R = Revenue

COGS = The Cost of Goods Sold

E = Operating and Other Expenses

I = Interest

T = Taxes

2. Return on Assets (ROA): ROA measures the effectiveness with which your company utilizes its assets to generate profit. This metric particularly tells how well management uses the company’s resources, whether equipment, intellectual property, or cash reserves. To calculate ROA, divide the net income by the total assets. A higher ROA indicates that the company is more efficient at using its assets to produce income, thus enhancing its attractiveness to lenders who see such efficiency as indicative of good management and stable returns.

Return on Assets = Net Income/Total Assets

By understanding and optimizing these profitability metrics in your financial reports, you improve your operational performance and strengthen your case for better loan conditions. As reflected in these metrics, efficient management of resources and expenses can significantly enhance your loan eligibility.

Understanding the detailed role of financial reports in shaping your bank loan outcomes is crucial. Maintaining robust financial records and understanding these key metrics can improve your chances of securing favorable loan terms. Remember, a healthy financial report opens doors to better financial opportunities and showcases your readiness to manage new debts responsibly.

Need help decoding your financial statements? Contact a NOW CFO specialist for more information.

Outsourcing Your Accounting For Success

In today’s competitive business environment, the strategic decision to engage in outsourced accounting can significantly influence a company’s trajectory toward success. By partnering with external accounting professionals, businesses can leverage specialized expertise, streamline operations, and focus more intently on their core competencies.

Introduction to Outsourcing Accounting

Outsourced accounting refers to hiring external service providers to manage a company’s accounting tasks instead of handling these responsibilities internally. This approach has evolved significantly over the past few decades, initially emerging as a cost-saving measure for companies looking to minimize overhead expenses. However, its value proposition has expanded, encompassing cost efficiency and access to specialized accounting expertise and technology. Today, the trend towards outsourced accounting continues to grow, driven by its potential to enhance operational efficiency and strategic flexibility.

The Importance of Accounting in Business

Accounting is the backbone of any successful business, offering a foundation for informed decision-making, financial health monitoring, regulatory compliance, and strategic planning:

- Foundation for Informed Decision-Making: Accounting provides the financial insights to make informed business decisions. By accurately tracking income, expenses, and profitability, businesses can determine the best strategies for growth and investment.

- Monitoring Financial Health: Regular financial reporting, a core accounting component, allows businesses to monitor their financial health in real-time. This ongoing review helps identify trends, manage cash flow effectively, and anticipate future financial needs or challenges.

- Ensuring Regulatory Compliance: Compliance with local, national, and international tax laws and financial regulations is essential for any business. Accounting is pivotal in ensuring that all financial reporting is accurate and compliant, avoiding potential legal penalties.

- Facilitating Strategic Planning: Effective accounting informs strategic planning by clearly showing the business’s financial status and prospects. This insight is crucial for setting realistic goals, allocating resources efficiently, and planning for long-term success.

Benefits of Outsourcing Accounting

Below, we delve into the multifaceted benefits of outsourcing accounting and the critical considerations for forging a productive partnership:

- Cost Savings: One of the most compelling arguments for outsourced accounting is the potential for cost savings. Companies can reduce overhead by avoiding the expenses associated with hiring, training, and maintaining an in-house accounting team. Outsourcing provides access to top-tier accounting services at a fraction of the cost of an internal department.

- Access to Expertise and Specialized Skills: Outsourced accounting firms specialize in financial management and are equipped with the latest accounting technologies and practices. This gives businesses access to expertise and efficiency that might be hard to achieve internally, especially for small to medium-sized enterprises.

- Scalability and Flexibility: As businesses grow or experience fluctuations in demand, outsourced accounting services can easily adjust to changing needs without the logistical challenges of scaling an internal team. This scalability ensures that businesses can respond swiftly to market opportunities or challenges.

- Enhanced Focus on Core Business Activities: By delegating accounting tasks to external experts, business leaders can reallocate their focus and resources toward strategic activities that drive growth and competitive advantage.

- Improved Compliance and Risk Management: Outsourced accounting partners stay abreast of the latest regulatory changes and accounting standards, ensuring that businesses remain compliant and minimize their risk of financial inaccuracies or legal penalties.

Challenges and Considerations

While the benefits of outsourcing accounting are significant, navigating the process comes with challenges and considerations. Key among these are:

- Selecting the Right Outsourcing Partner: The compatibility and reliability of your outsourcing partner are fundamental to the success of this strategic move. Choosing a partner whose capabilities align with your business needs and who upholds the highest standards of professionalism and confidentiality is crucial.

- Maintaining Confidentiality and Data Security: Outsourcing accounting functions often involves sharing sensitive financial data. Ensuring this information remains secure and confidential is paramount, requiring stringent data protection measures from the chosen outsourcing firm.

- Overcoming Communication Barriers: Effective communication is essential to operate outsourced accounting services seamlessly. Challenges such as time zone differences, language barriers, and cultural differences can impact the efficiency of this collaboration, necessitating strategies to ensure clear and consistent communication, especially around key topics.

- Managing the Transition Effectively: Transitioning from an in-house to an outsourced accounting model can be complex. It involves not just logistical adjustments but also managing changes in team dynamics and ensuring continuity in financial management practices. Effective change management strategies are critical to minimize disruption and facilitate a smooth transition.

Types of Accounting Tasks to Outsource

Outsourcing accounting functions can cover a broad spectrum of tasks, each integral to a business’s financial health and operational efficiency. Expanding on these tasks:

- Bookkeeping: Bookkeeping is the foundational accounting task that involves recording all financial transactions, including sales, purchases, payments, and receipts. Outsourcing this function ensures that records are accurate, up-to-date, and prepared according to professional accounting standards, laying a solid foundation for informed decision-making and financial reporting.

- Tax Preparation and Planning: Navigating the complexities of tax law requires specialized knowledge and expertise. Outsourcing tax preparation and planning can help businesses comply with current laws and regulations and strategically plan their finances to minimize tax liabilities. This task includes preparing tax returns, calculating liabilities, and identifying potential tax savings.

- Payroll Processing: Managing payroll involves calculating wages, withholding taxes, and ensuring timely employee payments. Outsourcing this function can alleviate the administrative burden on businesses, ensuring compliance with employment and tax laws while handling complex calculations and reporting requirements.

- Financial Reporting and Analysis: Creating detailed financial reports and performing analyses are crucial for understanding a business’s financial health and guiding strategic decisions. Outsourced accounting professionals can provide comprehensive financial analysis and insights, including profit and loss statements, balance sheets, and cash flow analyses, allowing businesses to assess their financial position accurately and plan for the future.

- Accounts Payable/Receivable Management: Efficient accounts payable and receivable management is vital for maintaining healthy cash flow. Outsourcing these tasks can help businesses ensure timely payments to suppliers, manage incoming payments effectively and maintain optimal cash flow levels. This includes invoice processing, reconciling vendor statements, and managing customer accounts to minimize late payments and bad debts.

Outsourced accounting offers enhanced efficiency, cost savings, and strategic focus for businesses of all sizes. By carefully selecting the right outsourcing partner and aligning services with business needs, companies can leverage outsourced accounting as a strategic asset for success.

Need guidance on outsourcing your accounting? Contact a NOW CFO representative for more information.

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Is It Time to Outsource Your Accounting?

In our journey toward financial well-being, conducting a mid-year financial review is akin to pausing for a compass check during a hike. This process reveals where we currently stand and reorients us towards our ultimate financial destinations. The mid-year financial review is a comprehensive assessment of one’s financial situation, examining everything from budgeting and investments to debts and insurance. Its significance cannot be overstated for individuals and businesses, as it lays bare the financial health of the entity in question. The mid-year timing is particularly advantageous for several reasons: it offers a pivotal moment for goal reassessment, allows for adjustments in financial planning, and facilitates early tax planning, thus avoiding year-end surprises.

Benefits of Conducting a Mid-Year Financial Review

Conducting a mid-year financial review can be incredibly beneficial. Here are some key advantages:

- Spotting Opportunities and Risks: Mid-year is an excellent time to assess the performance of your investments. This scrutiny allows you to discover sectors or assets that have performed exceptionally well and might warrant additional investment. Conversely, it can reveal underperforming areas that could drain your financial resources, signaling a need for strategic divestment or reallocation.

- Adjusting Financial Goals: Financial objectives set at the beginning of the year may no longer be in sync with your current situation or the broader economic landscape by mid-year. A financial review offers the perfect opportunity to adjust these goals, ensuring they remain realistic and achievable. Whether it’s ramping up savings, reducing spending, or shifting investment focus, the mid-year review acts as a corrective lens for your financial roadmap.

- Tax Planning: Tax considerations are crucial in overall financial planning. A mid-year review allows for the identification of tax-saving opportunities that could be leveraged before the year ends. Early planning ensures you’re caught on top of tax season, whether through charitable donations, investment in tax-advantaged accounts, or optimizing deductions.

- Budget Realignment: Lastly, a mid-year review assesses whether your budget effectively supports your financial goals. This can mean adjusting your spending patterns to align with your income and financial objectives or reallocating funds to prioritize areas of higher return. It’s about ensuring every dollar is contributing towards achieving your financial aspirations.

How to Conduct a Mid-Year Financial Review

Conducting a mid-year financial review might seem daunting, but it can be broken down into manageable steps:

- Review Your Budget: Compare your planned budget with your actual spending and income. Look for any significant variances that need addressing—perhaps you’ve overspent on discretionary items or underutilized a planned saving strategy. Adjust your budget to better align with your financial goals for the remainder of the year, considering any changes in income or unexpected expenses.

- Evaluate Your Investments: Assess the performance of your investment portfolio against your financial goals and the current market conditions. Consider the balance of your investments across different asset classes (stocks, bonds, real estate, etc.) and whether it’s time to rebalance your portfolio to maintain your desired level of risk exposure. It’s also an opportunity to weed out underperforming investments and consider new opportunities.

- Debt Management: Review all your current debts, including mortgages, personal loans, and credit card balances. Evaluate interest rates and repayment terms to see if refinancing could be beneficial. Additionally, consider whether adjusting your repayment strategies helps you reduce debt faster or more efficiently by focusing on high-interest debt first (avalanche method) or targeting smaller debts for quick wins (snowball method).

- Emergency Fund Status: Ensure your emergency fund is sufficient to cover at least 3-6 months of living expenses. If it’s not, prioritize contributions to this fund. An adequate emergency fund is your financial safety net, protecting you against unexpected expenses without derailing your financial plans.

- Retirement Planning: Check in on your retirement savings progress. Are you on track to meet your retirement goals? Consider whether adjustments to your contributions are needed, especially if your financial situation or goals have changed. This could mean increasing your 401(k) contributions, exploring IRA options, or investing in other retirement savings vehicles.

- Insurance Coverage Review: Life changes, and so do your insurance needs. Review your policies (life, health, homeowners, auto, etc.) to ensure they provide adequate coverage. Family size, health, property, or even job status changes can all affect the type and amount of coverage you need. Update your policies as necessary to reflect your current situation.

Tools and Resources

A successful mid-year financial review requires intent and the right tools. Here are some resources that can facilitate this critical process:

- Financial Review Checklists: A financial review checklist acts as a roadmap, guiding you through each step of the review process. It can help ensure that every critical area is noticed, from budget adjustments to tax planning. Checklists are often found online or created based on personal financial goals and necessities.

- Software and Apps: Technology can be a powerful ally in managing finances. Budgeting apps like Mint or You Need a Budget (YNAB) offer user-friendly platforms for tracking expenditures and setting budgets. Investment apps and platforms provide analytics and insights to help you make informed decisions about your investment strategy. These tools can provide a clearer picture of your financial health and progress toward your goals.

- Professional Financial Advisors: While DIY tools and resources are abundant, some situations call for the expertise of a financial advisor. Whether navigating complex tax laws, planning for retirement, or managing a diverse investment portfolio, a professional can offer personalized advice and strategies tailored to your unique financial situation. They can also provide accountability and encouragement, keeping you focused on your long-term goals.

Common Pitfalls and How to Avoid Them

A mid-year financial review can significantly impact your financial health, but there are common pitfalls to avoid. Here are some you might encounter:

- Procrastination: The biggest obstacle to conducting a mid-year financial review is often getting started. Procrastination can result from feeling overwhelmed by the task or uncertain how to proceed. Combat this by setting a specific date for your review and breaking down the process into manageable steps. Consider using reminders or scheduling the review as an appointment in your calendar. Tackling the review in segments over a few days can make the task less daunting.

- Overlooking Small Expenses: It’s easy to dismiss minor expenses as inconsequential, but they can accumulate over time, diverting significant amounts from your savings or debt repayment efforts. To avoid this pitfall, track your spending meticulously for a month. You might be surprised at how small purchases add up. Budgeting apps can be particularly useful in tracking and categorizing these expenses, helping you identify areas where you can cut back.

- Ignoring Tax Changes: Tax laws and regulations can change yearly, impacting financial planning and strategies. Failing to stay informed about these changes can lead to unexpected tax liabilities or missed saving opportunities. Avoid this pitfall by subscribing to updates from a reliable financial news source or consulting with a tax professional. This will help ensure your financial planning considers current tax laws and regulations.

A mid-year financial review is an invaluable exercise that ensures you are on the right path towards achieving your financial goals. By taking stock of your current situation, you can make informed decisions that will steer you closer to financial success. Remember, the goal of the mid-year financial review is not just to assess but to adjust and advance. Whether adjusting your sails to catch the winds of prosperity or navigating through financial storms, a mid-year financial review is your compass, ensuring you remain steadfastly on course.

Need help conducting your mid-year financial review? Contact a NOW CFO specialist for more information.

Introduction

The current accountant shortage in the U.S. is a growing concern that affects not just the accounting profession but also businesses, investors, and the broader economy. This topic is crucial as the availability and quality of accounting professionals play a fundamental role in financial reporting, tax preparation, and overall economic health. Understanding the depth and breadth of this shortage helps stakeholders navigate its implications and consider possible solutions.

Background on the Accountant Shortage

The shortage of accountants is attributed to several interrelated factors:

- Aging Workforce: The aging workforce issue is particularly acute in accounting, where the expertise and judgment of experienced professionals are invaluable. As these individuals retire, the profession faces the challenge of transferring their knowledge and expertise to the next generation. This transition is complicated by the simultaneous reduction in new entrants, making it difficult to replace the depth of experience that is leaving the workforce.

- Decline in Accounting Graduates: The decline in students choosing accounting as their career path can be attributed to several factors. These include perceptions of the profession as less desirable or exciting than other fields, misconceptions about the nature of the work, and unawareness of the career opportunities available within accounting. While necessary for the profession’s integrity, rigorous education and certification requirements may deter potential entrants.

- Increasing Demand for Accounting Services: The demand for accounting services is not just growing; it’s also evolving. Businesses now require accountants who can navigate an increasingly complex and globalized regulatory landscape, provide strategic business insights, and work with new technologies. This expanded role requires a broader skill set, including data analysis, technological proficiency, and strategic thinking, increasing the pressure on the already limited supply of accounting professionals.

Impact on Earnings Reports

The accountant shortage has a direct impact on the preparation and accuracy of earnings reports through several key aspects:

- Delays in Report Preparation: In an environment where skilled accountants are scarce, businesses need help maintaining the pace of financial reporting required for timely decision-making. This impacts internal strategic planning and affects external stakeholders who rely on up-to-date financial information. Delays in report preparation can lead to missed opportunities, inefficient capital allocation, and a potential loss of investor confidence as the market reacts to perceived instability or lack of transparency in a company’s financial health.

- Errors in Financial Statements: The accuracy of financial statements is fundamental to the trust stakeholders place in a company. With fewer accountants to conduct thorough reviews and audits, the risk of errors—ranging from minor oversight to significant misstatements—increases. These inaccuracies can lead to many problems, including misinformed strategic decisions, loss of investor trust, and the potential for financial restatements. The latter involves considerable costs to correct and damages a company’s reputation and investor relations.

- Compliance and Accuracy Issues: Accountants are financial integrity and compliance gatekeepers. Their expertise ensures that earnings reports not only reflect the true financial position of a company but also adhere to the complex web of regulations governing financial reporting. With a shortage of these professionals, companies are at a higher risk of falling short of compliance requirements, leading to legal penalties, fines, and a loss of license to operate. Moreover, the integrity of the financial information being presented to investors and the public is at risk, potentially undermining the foundation of trust that supports financial markets.

Consequences for Businesses and the Economy

The accountant shortage leads to several significant consequences for businesses and the broader economy, including:

- Eroded Investor Trust: Investor trust is fundamental to functioning capital markets. When earnings reports are delayed or contain errors due to a shortage of accountants, it shakes the foundation of this trust. Investors rely on accurate and timely financial information to make informed decisions. With it, they may be willing to invest or withdraw their investments, reducing business capital flows. This erosion of trust can have long-term implications, making it more challenging for businesses to raise funds, invest in growth opportunities, or maintain their stock prices.

- Market Stability Concerns: Financial markets thrive on predictability and stability. When businesses consistently report inaccuracies or are forced to issue restatements due to insufficient accounting oversight, it introduces uncertainty into the market. This uncertainty can lead to volatility, with stock prices swinging wildly in response to the perceived risk. Such instability is detrimental to the companies directly involved and the market as a whole, potentially affecting investor sentiment and the economy at large.

- Regulatory and Legal Repercussions: Compliance with financial reporting standards and regulations is non-negotiable. When companies fall short due to errors, omissions, or delays in financial reporting, they face significant legal and regulatory consequences. These can range from fines and penalties to more severe measures like sanctions or criminal charges against company officers. Beyond the immediate financial impact, these repercussions can damage a company’s reputation, affecting its ability to attract customers, partners, and future investments. Furthermore, consistent regulatory failures can lead to stricter regulations for the industry, imposing additional burdens on all players.

Solutions and Responses

To address the accountant shortage, a variety of solutions and responses are being explored, each targeting different aspects of the problem:

- Educational Initiatives and Incentives: By highlighting the diverse and dynamic nature of accounting careers and offering scholarships, mentorship programs, and clearer career progression paths, educational institutions and professional organizations can attract a new generation of accountants. These efforts aim to dispel myths about the profession, showcasing it as a rewarding and intellectually stimulating career choice.

- Technological Solutions: Automation and AI can handle routine accounting tasks, such as data entry and basic compliance checks, freeing human accountants to focus on more complex and strategic activities. This not only helps alleviate the immediate burden caused by the shortage but also enhances the efficiency and effectiveness of the accounting function. Embracing technology can also make the profession more appealing to tech-savvy individuals who might not have previously considered a career in accounting.

- Policy Changes and Industry Standards: Regulatory bodies and professional associations can address the accountant shortage by reevaluating educational and licensing requirements, offering more flexible pathways into the profession, and encouraging continuous professional development. Adjusting industry standards to reflect the evolving role of accountants and the technological landscape can also help retain talent and ensure a sustainable supply of qualified professionals.

- As we continue to navigate the challenges of the accountant shortage, it’s clear that collaborative efforts from educational institutions, businesses, and regulatory bodies are essential. By addressing this issue, we can ensure the integrity of earnings reports and, by extension, the health of our businesses and economy.

Internal Controls in Your Business

The importance of robust internal controls for SMEs cannot be overstated. These mechanisms are essential for ensuring financial accuracy, preventing fraud, and maintaining compliance with regulatory standards.

In fiscal year 2024, the SEC filed 583 enforcement actions and secured a record $8.2 billion in financial remedies, the highest in its history, surpassing the nearly $5 billion obtained in the previous year. This highlights the crucial need for businesses to implement robust internal controls to mitigate risks and maintain financial integrity.

Understanding why you need internal controls is pivotal for long-term success. These systems safeguard assets, enhance operational efficiency, and foster stakeholder confidence.

What are Internal Controls?

Internal controls are rules and procedures that help businesses run safely and accurately. They protect assets, ensure correct financial data, and support compliance with laws. These controls include approving transactions, separating duties, and checking records.

Key functions of internal controls include

- Risk Mitigation: Identifying and managing risks that could impede the achievement of organizational goals.

- Operational Efficiency: Ensuring that business processes are carried out effectively and resources are optimally used.

- Financial Reporting Accuracy: Maintaining accurate and reliable financial records to support decision-making.

- Compliance: Adhering to laws, regulations, and internal policies to avoid legal penalties and reputational damage.

Different Types of Internal Controls in Businesses

Internal controls can be categorized into several types, each serving a unique purpose within an organization’s control environment.

1. Preventive Controls: These controls are designed to deter errors or irregularities from occurring. Examples include:

- Segregation of Duties: Dividing responsibilities among individuals to reduce the risk of error or inappropriate actions.

- Authorization Controls: Requiring approval from authorized personnel before transactions are executed.

2. Detective Controls: These controls aim to identify and detect errors or irregularities that have occurred. Examples include:

- Reconciliations: Regularly comparing data from different sources to identify discrepancies.

- Audits: Conduct periodic financial statements and operations reviews to ensure accuracy and compliance.

3. Corrective Controls: These controls focus on rectifying identified issues to prevent recurrence. Examples include:

- Backup Procedures: Implementing data recovery processes to restore lost or corrupted information.

- Disciplinary Actions: Enforcing consequences for violations of policies to deter future infractions.

How Internal Controls Impact Financial Stability

Internal controls are vital in enhancing an organization’s financial stability. By ensuring accurate financial reporting, safeguarding assets, and promoting operational efficiency, these controls contribute to a business’s overall financial health.

Key impacts include

- Enhanced Reliability of Financial Reporting: Accurate financial statements are crucial for stakeholders to make informed decisions. Internal controls ensure that financial data is recorded and reported correctly, reducing the risk of misstatements.

- Fraud Prevention Strategie: Robust internal controls deter fraudulent activities by establishing clear procedures and accountability. According to the Association of Certified Fraud Examiners, organizations with strong internal controls experience significantly lower fraud losses.

- Compliance with Regulations: Adhering to laws and regulations, such as the Sarbanes-Oxley Act, is essential for avoiding legal penalties and maintaining investor confidence. Internal controls facilitate compliance by ensuring that financial practices align with regulatory requirements.

- Operational Efficiency: Streamlined processes and clear procedures reduce redundancies and errors, leading to cost savings and improved resource utilization.

Preventing Fraud and Financial Misstatements with Internal Controls

Preventing fraud and financial misstatements is a critical objective for any business aiming to maintain integrity and trust. Implementing robust internal controls is a fundamental strategy for achieving this goal.

How Internal Controls Deter Fraud in Financial Operations

Internal controls are essential in creating an environment that discourages fraudulent behavior. By systematically addressing the elements of the fraud triangle: motive, opportunity, and rationalization, internal controls minimize the chances of fraud occurring.

One of the primary ways internal controls deter fraud is by eliminating opportunities for misconduct. This is achieved through:

- Authorization Procedures: Ensuring that all transactions are approved by designated personnel before execution.

- Access Controls: Restricting access to financial systems and sensitive information to authorized individuals only.

- Audit Trails: Maintaining comprehensive records of all financial transactions to facilitate monitoring and review is one of the internal audit best practices.

Segregation of Duties to Reduce Fraudulent Activities

Building upon the foundation of internal controls, segregation of duties (SoD) is a specific strategy that plays a pivotal role in financial risk management. By dividing responsibilities among different individuals, SoD ensures that no single person has control over all aspects of any critical financial transaction.

Key aspects of SoD include:

- Transaction Authorization: One individual is responsible for approving transactions.

- Record Keeping: Another person maintains the records related to the transaction.

- Asset Custody: A separate individual handles the physical assets involved.

This division of responsibilities creates a system of checks and balances, making it more difficult for fraudulent activities to go undetected. For instance, if one employee attempts to manipulate records, another employee responsible for a different aspect of the transaction will likely notice the discrepancy.

Identifying Red Flags in Financial Transactions

In addition to establishing preventive measures, organizations must remain vigilant in detecting potential signs of fraud. Recognizing red flags in financial transactions is crucial for early intervention and mitigating fraudulent activities.

Common red flags include:

- Unusual Transaction Patterns: Transactions that occur at odd times, involve round numbers, or deviate significantly from standard patterns.

- Discrepancies in Documentation: Missing, altered, or inconsistent records that raise questions about the legitimacy of transactions.

- Employee Behavior Changes: Employees exhibiting reluctance to take vacations, living beyond their means, or displaying secretive behavior.

Internal Controls and Compliance: Meeting Regulatory Standards

Compliance with financial reporting standards is a fundamental responsibility for businesses, particularly in today’s stringent regulatory environment. Robust internal controls facilitate accurate financial reporting and help organizations avoid costly penalties.

The Role of Internal Controls in Financial Reporting Compliance

Internal controls are essential mechanisms that ensure the accuracy and reliability of financial reporting. They encompass policies and procedures to prevent errors, detect irregularities, and safeguard assets.

Key aspects include:

- Accuracy of Financial Statements: Internal controls ensure that financial data is recorded correctly and reflects the company’s true financial position.

- Prevention of Fraud: Controls such as segregation of duties and authorization requirements deter fraudulent activities.

- Compliance with Regulations: Following standards like the SOX necessitates robust internal controls to meet compliance obligations.

According to the GAO, the SEC collected $4.1 billion in penalties for securities law violations in FY2024, highlighting the importance of compliance.

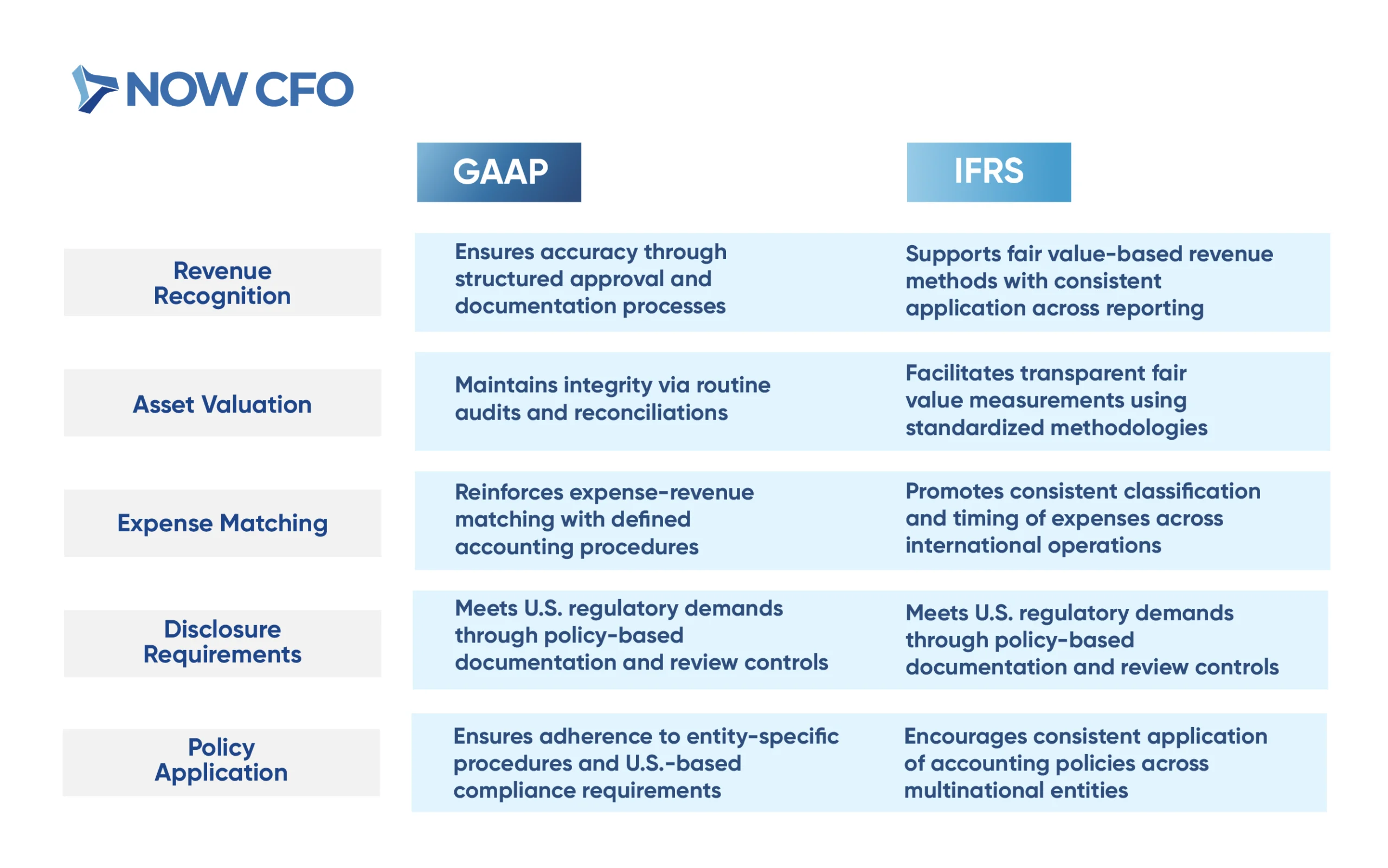

Aligning with GAAP and IFRS Requirements

Alignment with GAAP and IFRS is crucial for global financial reporting consistency. Internal controls play a pivotal role in ensuring adherence to these standards.

The following table outlines how internal controls align with key GAAP and IFRS requirements:

Avoiding Penalties and Legal Risks Through Internal Controls

Implementing robust internal controls is instrumental in mitigating legal risks and avoiding penalties associated with financial misreporting. These controls are proactive measures to detect and prevent violations that could lead to regulatory sanctions.

Key strategies include:

- Regular Audits: Conducting periodic internal and external audits to identify and rectify discrepancies.

- Compliance Monitoring: Establishing dedicated teams to oversee financial regulations and standards adherence.

- Employee Training: Educating staff on compliance requirements and ethical financial practices.

Strengthening Operational Efficiency Through Internal Controls

Businesses can significantly improve their operations by integrating automation and learning from real-world case studies.

How Internal Controls Improve Workflow and Accountability

Effective internal controls are the backbone of streamlined workflows and heightened organizational accountability. By establishing clear procedures and responsibilities, these controls minimize errors and ensure that tasks are executed efficiently.

Key benefits include:

- Standardized Procedures: Documented processes reduce ambiguity, enabling employees to perform tasks consistently and efficiently.

- Enhanced Oversight: Regular monitoring and audits ensure that operations align with organizational goals and regulatory requirements.

- Risk Mitigation: Proactively identifying and managing potential issues prevents disruptions and financial losses.

Automating Internal Controls for Better Efficiency

Transitioning from manual to automated internal controls can significantly enhance operational efficiency. Automation reduces the likelihood of human error, accelerates processes, and allows for real-time monitoring.

Advantages of automation include:

- Real-Time Monitoring: Automated systems provide instant insights into operations, facilitating prompt decision-making.

- Cost Savings: Reducing manual interventions lowers labor costs and minimizes errors that could lead to financial losses.

- Scalability: Automated controls can easily adapt to organizational growth without compromising efficiency.

Case Examples of Businesses Benefiting from Strong Internal Controls

Real-world examples underscore the tangible benefits of implementing robust internal controls:

- Bel Fuse Inc.: By enhancing its internal control systems, the company achieved greater efficiency in resource allocation and improved compliance with regulatory standards.

- Butuuro SACCO: A study revealed a significant positive relationship between a strong control environment and organizational operational efficiency.

- Commercial Banks in Ghana: Research indicated that effective internal control systems positively impact operational efficiency, reducing malfeasance and misuse of funds.

These cases illustrate how strategic implementation of internal controls can lead to enhanced operational performance and compliance.

Common Internal Control Weaknesses and How to Fix Them

Identifying and addressing internal control weaknesses is crucial for maintaining financial integrity and operational efficiency. Organizations can fortify their internal control systems by recognizing gaps in financial oversight, enhancing documentation processes, and implementing comprehensive employee training programs.

Recognizing Gaps in Financial Oversight

Financial oversight gaps often stem from insufficient segregation of duties, inadequate monitoring, and lack of timely reconciliations. These weaknesses can lead to errors, fraud, and non-compliance with regulatory standards.

Common indicators of oversight gaps include:

- Inadequate Segregation of Duties: When a single employee controls multiple financial processes, such as authorization and record-keeping, it increases the risk of undetected errors or fraud.

- Lack of Regular Reconciliations: Failing to perform timely reconciliations between accounts can result in unnoticed discrepancies and financial misstatements.

- Insufficient Monitoring: Without ongoing monitoring of financial activities, organizations may overlook irregularities that could indicate deeper issues.

Strategies to address these gaps:

- Implement Segregation of Duties: Assign different individuals to authorize transactions, record them, and handle related assets.

- Establish Regular Reconciliation Processes: Schedule periodic reconciliations to ensure that all financial records are accurate and up to date.

- Enhance Monitoring Mechanisms: Utilize internal audits and real-time monitoring tools to detect and address anomalies promptly.

Enhancing Documentation and Reporting Processes

Robust documentation and reporting are fundamental to effective internal controls. They provide a clear audit trail, facilitate compliance, and support informed decision-making.

Key components of effective documentation:

- Comprehensive Policies and Procedures: Clearly defined policies ensure consistency and guide employees.

- Accurate Record-Keeping: Maintaining detailed records of all transactions supports transparency and accountability.

- Regular Updates: Keeping documentation current reflects process changes and regulatory requirements.

Best practices for enhancing documentation:

- Standardize Documentation Formats: Use uniform templates for policies, procedures, and records to ensure consistency.

- Implement Document Management Systems: Utilize digital tools to store, organize, and retrieve documents efficiently.

- Conduct Regular Reviews: Periodically assess and update documentation to align with current practices and regulations.

Employee Training and Awareness Programs for Internal Controls

Transitioning from process improvements to personnel development, employee training, and awareness is pivotal in reinforcing internal controls. Educated employees are better equipped to adhere to policies, recognize potential issues, and contribute to a culture of accountability.

Benefits of comprehensive training programs:

- Enhanced Understanding of Controls: Employees gain clarity on internal control procedures and their roles.

- Improved Compliance: Training ensures that staff know regulatory requirements and organizational policies.

- Increased Risk Awareness: Educated employees are more likely to identify and report irregularities, reducing the risk of fraud.

Strategies for implementing effective training:

- Develop Tailored Training Programs: Customize training content to address specific organizational roles and responsibilities.

- Utilize Interactive Training Methods: Incorporate workshops, simulations, and e-learning to engage employees and reinforce learning.

- Assess Training Effectiveness: Regularly evaluate training programs through assessments and feedback to ensure they meet organizational needs.

How an Outsourced CFO Can Help Strengthen Internal Controls

SMEs increasingly turn to outsourced CFOs to bolster their internal control systems. These professionals bring a wealth of experience and strategic insight, enabling organizations to enhance financial oversight, implement robust risk management strategies, and ensure scalability while maintaining compliance with evolving regulations.

Assessing and Improving Existing Internal Control Frameworks

An outsourced CFO begins by comprehensively assessing a company’s current internal control environment. This evaluation identifies weaknesses, inefficiencies, and areas susceptible to risk.

Key steps in this process include:

- Process Mapping: Documenting existing financial processes to identify gaps and redundancies.

- Control Testing: Evaluating the effectiveness of current controls through testing and analysis.

- Recommendations: Providing actionable insights to enhance control activities and monitoring mechanisms.

Implementing Risk Management Strategies

By identifying potential financial, operational, and compliance risks, an outsourced CFO establishes protocols to mitigate these threats effectively.

Key components of risk management include:

- Risk Identification: Analyzing internal and external factors that could impact financial stability.

- Risk Assessment: Evaluating the likelihood and potential impact of identified risks.

- Risk Mitigation: Developing policies and procedures to minimize or eliminate risks.

- Monitoring and Review: Continuously tracking risk factors and adjusting strategies as needed.

Ensuring Scalability and Compliance with Financial Regulations

Outsourced CFOs provide the expertise to ensure that internal controls scale appropriately and adhere to applicable laws and standards.

Strategies to achieve scalability and compliance:

- Regulatory Alignment: Ensuring financial practices comply with relevant laws and industry standards.

- Technology Integration: Implementing scalable financial systems that support compliance and efficiency.

- Policy Development: Establishing clear policies and procedures to guide financial operations.

- Training and Education: Providing ongoing education to staff on compliance requirements and best practices.

Partnering with NOW CFO for Enhanced Internal Controls

NOW CFO offers specialized outsourced CFO services to strengthen internal controls and drive business success. With a team of experienced professionals, we provide tailored solutions that address each organization’s unique challenges.

Benefits of partnering with NOW CFO:

- Expertise: Access to seasoned financial professionals with diverse industry experience.

- Customization: Solutions tailored to your business’s specific needs and goals.

- Efficiency: Streamlined processes that enhance financial reporting and operational performance.

- Compliance: Assurance that financial practices meet regulatory standards and requirements.

Conclusion: Securing Your Business with Strong Internal Controls

Recognizing the importance why you need internal controls is the first step toward fortifying your business against potential risks. Companies can achieve greater transparency, accountability, and resilience by investing in comprehensive internal control systems.

To embark on this journey toward enhanced financial governance, consider partnering with NOW CFO’s experts specializing in internal control frameworks. Schedule a free consultation to strengthen your internal controls and secure your business’s future.

The Importance of Business Credit Score

Credit scores are pivotal in navigating the business landscape, serving as a critical indicator of financial health and credibility. Understanding and mastering your business’s credit score can significantly enhance your chances of success, enabling you to secure financing on favorable terms, negotiate better deals with suppliers, and ultimately expand your operations.

Understanding Credit Scores

Credit scores are a crucial metric of financial trustworthiness for businesses, encapsulating the risk a lender may take when offering credit. A range of factors shapes these scores, each contributing to the overall evaluation of creditworthiness:

- Payment History: The cornerstone of your credit score and payment history reflects your punctuality in clearing bills and debt obligations. This factor is critical because it directly signifies your reliability in repaying borrowed funds. A pattern of late or missed payments can severely damage your credit score, while consistently meeting payment deadlines can enhance it.

- Credit Utilization: This metric evaluates how much credit you actively use out of your total. High utilization rates suggest potential overleveraging to lenders, indicating that a business is at a higher risk of defaulting. A lower utilization rate—ideally under 30%—demonstrates prudent credit management and financial stability.

- Length of Credit History: A longer credit history provides a more extensive track record of your financial behavior, offering creditors a clearer view of your long-term financial habits. This history includes the age of your oldest and newest accounts and the average age across all accounts. These rewarding businesses have maintained credit accounts over longer periods.

- New Credit: Opening several new credit accounts in a short timeframe can be perceived as risky by lenders, as it might suggest financial distress or an overreliance on credit. This is also reflected in the number of hard inquiries on your credit report, where excessive inquiries can negatively impact your score.

- Types of Credit in Use: The ability to responsibly manage a mix of credit types—installment loans, credit cards, and retail accounts—can positively influence your score. This diversity indicates to lenders that you can handle various credit products, suggesting a lower risk profile.

The Importance of Credit Scores in Business Financing

Credit scores are:

- A fundamental component in the financial landscape for businesses

- Influencing access to financing

- The cost of borrowing

- The terms of credit agreements

Their importance cannot be overstated, as they directly impact a business’s ability to grow, invest, and manage cash flow effectively:

- Loan Application Evaluations: When a business applies for a loan, its credit score is the first aspect lenders examine to gauge creditworthiness. A strong credit score suggests financial responsibility and a low default risk, making the application more likely to be approved. Conversely, a lower score can lead to rejection or the need for additional guarantees, such as collateral.

- Interest Rates and Loan Terms: The interest rate on a loan is directly influenced by the borrower’s credit score. Higher scores often secure lower interest rates, lowering total borrowing costs. Furthermore, favorable loan terms—such as longer repayment periods or more flexible repayment schedules—are more readily offered to businesses with strong credit profiles. In essence, the better your credit score, the more negotiating power you have regarding your financing terms.

Strategies for Improving Your Business Credit Score

Improving your business credit score is a strategic process that can open up new financing opportunities, enhance your terms with suppliers, and position your business for growth. By focusing on key areas, businesses can effectively elevate their creditworthiness:

- Establishing Credit History: For new businesses or those without a well-established credit history, it’s crucial to begin building one. This can be done by opening business credit accounts with suppliers that report to credit bureaus, using business credit cards responsibly, and ensuring any loans or lines of credit are in the business’s name. Establishing credit early helps create a financial track record that reflects the business’s ability to navigate debt.

- Improving Payment History: Timely payment of all financial obligations is the most effective way to improve a credit score. Setting up payment reminders or automating payments can help ensure that bills, loans, and other credit obligations are paid on or before their due dates. Over time, a consistent record of timely payments will significantly boost your credit score.

- Managing Credit Utilization: Keeping credit utilization low demonstrates to creditors that you need to be more active on credit for operational expenses. Maintaining a utilization ratio below 30% is recommended. This can be achieved by paying down existing balances and judiciously using credit facilities.

- Diversifying Credit Types: A mix of credit types, including trade credit, credit cards, installment loans, and lines of credit, can positively impact your credit score. It shows lenders that you can handle various forms of credit responsibly. However, it’s important only to take on new credit when necessary and when you’re confident in your ability to manage it.

- Handling Disputes and Inaccuracies: Regularly reviewing your credit report for inaccuracies and promptly disputing errors is crucial. Inaccuracies can unfairly lower your score and impact your ability to obtain credit. Engage with credit bureaus and creditors to correct errors, providing documentation to support your disputes.

Leveraging Your Credit Score for Business Growth

A robust credit score is not just a metric of your business’s financial health; it’s a pivotal asset that can be strategically used to fuel expansion, improve operational efficiencies, and secure competitive advantages. Here’s how you can leverage a good credit score for your business’s growth:

- Securing Better Financing Options: A high credit score opens the door to a wider range of financing options with more favorable terms. Businesses can use lower interest rates, higher borrowing limits, and more flexible repayment schedules. This means you can access the capital needed for expansion or operational needs at a lower cost, directly impacting your bottom line and growth potential.

- Negotiating Better Terms with Suppliers: Beyond financing, a strong credit score can be leveraged in negotiations with suppliers to secure better payment terms. This could include longer payment periods or discounts for early payment, which can improve cash flow management. Better terms with suppliers enhance your operational efficiency and strengthen relationships with key partners in your supply chain.

- Expanding Through Credit and Financing: With a good credit score, businesses are better positioned to pursue growth opportunities, such as launching new products, entering new markets, or acquiring complementary businesses. Financing from a solid credit score can support these initiatives, providing the necessary resources to invest in research and development, marketing, or capital expenditures without straining operational finances. A good credit score can be instrumental when exploring strategic partnerships or investment opportunities. It signals to potential partners and investors that your business is financially stable and a reliable entity to engage with, thereby enhancing your attractiveness as a business partner or investment prospect.

- Utilizing Credit for Emergency Preparedness: A strong credit score also means quickly accessing funds in unforeseen circumstances, allowing your business to remain agile and responsive in volatile market conditions. This preparedness can be a significant advantage, enabling your business to navigate challenges more effectively than competitors.

Credit scores are more than just numbers; they are reflections of your business’s financial integrity and potential. By mastering the art of managing credit scores, you can unlock new avenues for growth and success in the competitive business world.

Do you need help strategizing how to improve your business’s credit score? Contact a NOW CFO specialist for more information.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Internal Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Financial Current State Analysis

What Is Relationship Between Financial Forecasting And Budgeting?

In the quest for financial mastery, the art and science of forecasting and budgeting stand as critical pillars. Mastering these tools is essential for anyone looking to navigate the tumultuous waters of personal finance or steer a business toward prosperity. This blog post will delve into each component’s intricacies, showcasing how they coexist and complement each other to create a robust financial plan. By understanding and effectively using forecasting and budgeting, individuals and organizations can unlock their full financial potential, making informed decisions that pave the way for financial success.

Introduction to Financial Mastery

Financial mastery is essential for anyone looking to navigate their financial journey confidently and successfully. It hinges on two pivotal tools: forecasting and budgeting, which form the foundation of strategic financial planning and management. Let’s briefly outline their roles in attaining financial mastery:

- Informed Decision-Making: Utilizing forecasting and budgeting enhances decision-making by relying on data-driven insights rather than guesswork, allowing individuals and organizations to make smarter financial choices.

- Strategic Financial Planning: These tools enable setting realistic goals and developing actionable plans to achieve them, ensuring plans are both forward-looking and grounded in current realities.

- Risk Management and Opportunity Maximization: Forecasting helps identify potential risks and opportunities, while budgeting ensures resources are allocated efficiently to mitigate risks and seize opportunities.

- Resource Allocation and Control: Budgeting provides a structured approach to managing finances, ensuring spending aligns with priorities and goals, thus maximizing financial well-being.

- Adaptability to Change: Financial mastery requires flexibility. The iterative forecasting and budgeting processes allow for continuous updates to financial plans, ensuring they remain relevant in an ever-changing financial landscape.

Understanding Forecasting

Financial forecasting is essential in predicting future financial conditions, enabling informed strategic planning and decision-making. Here’s a streamlined overview of its main components:

- Historical Data Analysis: This foundational step involves examining past financial performance to identify trends and patterns. It provides a basis for making educated predictions about future outcomes, leveraging historical financial data to forecast future scenarios.

- Types of Forecasting Models: Various models are employed based on the forecasting needs, including:

- Linear regression models, which predict outcomes based on independent variables.

- Time series analysis is used for detecting trends, seasonality, and patterns over time.

- Qualitative forecasting relies on expert opinions without sufficient historical data.

Each model is selected according to the specific aspect of business or market trends being forecasted.

- Scope and Purpose: The scope of forecasting ranges from analyzing broad market trends to specific financial metrics of a company. It aims to aid in strategic planning, risk assessment, and decision-making by anticipating market changes and potential financial risks and opportunities.

- Informed Decision-Making: Financial forecasting facilitates informed decision-making by offering insights into future scenarios. This enables businesses and individuals to strategically plan for expansion, adjust strategies, or allocate resources to maximize profitability.

- Predicting Financial Conditions and Trends: Successful forecasting combines historical data analysis with understanding current market conditions to predict future financial performance. It requires balancing quantitative data with qualitative insights to make accurate and relevant predictions.

Exploring Budgeting

Budgeting is an essential financial management tool, enabling individuals and organizations to effectively plan, allocate, and oversee their financial resources. It encompasses several key steps, each contributing to the overall goal of achieving financial stability and growth.

- Setting Financial Goals: The foundation of any budget is the establishment of clear, attainable financial objectives. These goals guide the budgeting process, from savings targets to debt reduction, shaping the allocation of resources in alignment with one’s financial aspirations.

- Categorizing Expenses: Effective budgeting requires a thorough understanding of expenses, typically categorized into fixed (unchanging monthly costs like rent) and variable (fluctuating costs like dining out) expenses. This categorization aids in identifying where funds are going and where potential savings lie.

- Allocating Resources: With goals set and expenses categorized, the next step is strategically allocating funds. This involves prioritizing spending and savings to meet essential expenses while advancing toward financial goals.

- Monitoring Financial Performance: A budget is a living document requiring regular review. Monitoring how actual spending compares to the budgeted amounts allows for timely adjustments, ensuring financial plans remain on track and goals are achievable.

The Interplay Between Forecasting and Budgeting

Forecasting and budgeting are crucial for effective financial planning, acting as the backbone of strategic decision-making. Let’s explore the key aspects of their interaction:

- Strategic Planning Foundation: Forecasting sets the stage for strategic planning by projecting future financial conditions and guiding the creation of realistic and goal-aligned budgets. For example, anticipated market demand increases may influence budget adjustments toward production or marketing.

- Continuous Improvement Cycle: The synergy between forecasting and budgeting forms a feedback loop, enabling continuous refinement. Comparing actual outcomes with forecasts and budgets highlights discrepancies, prompting adjustments to improve future accuracy and resource allocation.

- Risk Management: Forecasting identifies potential risks and opportunities, while budgeting allocates resources to address or exploit them. This coordinated approach enhances an organization’s ability to navigate uncertainties effectively.

- Effective Resource Allocation: Integrating forecasts with budgeting ensures resources are allocated wisely, aligning with anticipated future needs. This strategic allocation supports timely investments and operational requirements.

- Adaptability to Change: The dynamic nature of forecasting and budgeting allows for adaptability, enabling organizations to adjust their financial strategies in response to new information or unexpected events.

- Enhanced Communication and Alignment: This process fosters organizational communication and alignment, ensuring that all departments work towards unified financial goals.

Practical Strategies for Harmonizing Forecasting and Budgeting

Effective integration of forecasting and budgeting into financial planning necessitates strategic approaches. Here are streamlined strategies for achieving harmony between these two critical processes:

- Utilize Financial Planning Software: Adopt financial planning software to enhance accuracy and efficiency. These tools automate data analysis and provide real-time insights, enabling more informed decisions.

- Regular Financial Reviews: Review financial performance against forecasts and budgets to identify variances, understand their causes, and adjust plans accordingly. This ensures responsiveness to financial realities.

- Embrace Flexibility: Design forecasting and budgeting flexibly, allowing quick adjustments to unexpected changes. This might involve creating adaptable budget lines or updating forecasts with new data.

- Integrate Forecasting and Budget Revisions: Use forecasting insights to inform and regularly update budgets. This iterative approach keeps budgets aligned with the latest financial projections and market trends.

- Promote Financial Awareness: Cultivate a culture of financial literacy and engagement, emphasizing the importance of active participation in forecasting and budgeting processes. This enhances collective understanding and accountability.

- Apply Scenario Planning: Employ scenario planning to prepare for future possibilities. Analyzing different outcomes helps develop flexible strategies to adjust to evolving financial landscapes.

The synergy between forecasting and budgeting is indispensable for achieving financial mastery. These tools provide the foundation for sound financial planning, enabling informed decision-making that leads to financial stability and growth. Individuals and organizations can confidently navigate the financial world’s complexities by understanding and effectively integrating forecasting and budgeting into their financial practices. The dynamic duel between forecasting and budgeting is not about choosing one over the other but recognizing their interdependence and utilizing them to unlock financial success.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Financial Modeling vs Forecasting

In the complex world of business operations, one term can often bring a mix of anxiety and necessity to the forefront: audit. Navigating the audit maze requires more than just a reactive stance; it demands proactive preparedness and a deep understanding of what audits entail, their types, purposes, and the strategic approaches businesses can adopt to survive and thrive through them. This post aims to clarify audits for the uninitiated, providing smart strategies for business preparedness that ensure compliance, financial accuracy, and operational integrity.

Understanding Audits

At its core, an audit thoroughly examines a company’s financial records, compliance with regulations, and adherence to internal controls. Audits can be classified into several types, each serving a distinct purpose and requiring specific preparations.

- Financial Audits: Financial audits involve verifying a company’s financial statements and records to ensure they are accurate and per accounting standards. External auditors often conduct these, objectively assessing a business’s financial health and reporting practices.

- Compliance Audits: Compliance audits assess a company’s adherence to regulatory requirements and laws. These are crucial for highly regulated businesses, ensuring they meet external standards and avoid legal penalties.

- Internal Audits: Unlike external audits, internal audits are conducted by the company’s audit department. They are a self-check mechanism to identify internal weaknesses and improve efficiency, controls, and compliance processes.

- External Audits: External audits are done by external entities, providing an unbiased evaluation of a company’s financial status, compliance, and control environments. These audits offer valuable insights and validation for stakeholders outside the company.

Understanding these audits is the first step in preparing for them. Each type of audit enhances transparency, accountability, and compliance, making them indispensable tools for business integrity and success.

Pre-Audit Preparation

Preparation is key to navigating the audit process smoothly. Here are strategies to ensure your business is ready when audit time comes around.

- Maintain Organized and Accurate Financial Records: Efficient audit preparation starts with impeccable financial record-keeping. Businesses should ensure every transaction is accurately recorded and easily accessible, leveraging accounting software and regular staff training to uphold these standards. This foundation simplifies the audit process, allowing for swift retrieval of transaction evidence.

- Understand Relevant Laws and Regulations: A thorough grasp of applicable laws and regulations is crucial. Businesses should integrate legal compliance into their operational frameworks, possibly with the help of legal experts. Regular compliance training for employees reinforces a culture of adherence to these laws, ensuring the company remains on the right side of regulations.

- Develop Internal Controls and Processes: Effective internal controls and processes are essential for preventing and detecting errors or fraud. The following controls also demonstrate to auditors that the company is committed to maintaining a robust compliance and financial reporting environment:

- Risk Assessment: Regularly assess internal and external risks that could impact financial accuracy and compliance, adjusting controls as necessary.

- Control Activities: Implement specific actions such as approvals, authorizations, verifications, and reconciliations to mitigate identified risks.

- Information and Communication: Ensure that information related to policies, procedures, and compliance is communicated effectively throughout the organization. This can involve regular training sessions, memos, and access to a centralized repository of information.

- Monitoring Activities: Establish ongoing or periodic reviews of the internal control system to ensure it is operating effectively and make adjustments as needed.

Documentation Best Practices

Documentation plays a pivotal role in substantiating transactions and demonstrating compliance with regulations. Here are some best practices to consider:

- Keep Comprehensive Records: It’s vital to document all financial transactions, including sales, purchases, and payroll, along with contracts and regulatory communications. A checklist for document types can ensure nothing is overlooked. This thorough record-keeping supports both audit preparedness and strategic financial planning.

- Organize Documents Effectively: Adopting an electronic document management system (EDMS) can streamline document storage, indexing, and retrieval. Implement a standardized filing system that categorizes documents by type or financial year for easy access. This organization aids quick retrieval during audits and enhances overall efficiency.

- Retention Policies: Different documents have varying legal retention periods. Establish a clear retention policy that outlines how long each document type should be kept based on legal requirements. Regularly review and securely dispose of documents no longer needed, ensuring electronic records are backed up and accessible for their required retention period.

Implementing Internal Controls

Internal controls ensure the reliability of financial reporting, compliance with laws and regulations, and effective and efficient operations. Here are examples of effective controls:

- Segregation of Duties: Divide responsibilities among different individuals to mitigate the risk of errors and fraud. This means separating the processes of transaction handling, reconciliation, and approvals across multiple employees to ensure checks and balances.

- Access Controls: Limit access to financial systems and data through strong password policies, multi-factor authentication, and regular audits of access privileges. Ensure employees only have access to the resources necessary for their roles, adjusting these permissions as roles change.

- Regular Reviews: Conduct periodic financial and operational procedures audits to verify compliance and efficiency. These reviews should encompass financial transactions, policy compliance, and operational efficiency and effectiveness checks.

Dealing with Auditors

Interacting with auditors is a critical component of the audit process. Here are tips to facilitate a smooth audit: