Keeping your books in order is a strategic decision you should make. Yet many businesses struggle with hidden errors that quietly siphon away time, money, and peace of mind.

These errors often go unnoticed until they cause cash flow issues or compliance setbacks. Outsourcing brings expert oversight to catch problems early and keep your finances on track.

Misclassifying Expenses

When expenses are recorded under the wrong category, you end up with a distorted profit and loss statement. Over time, these small misclassifications can lead to under or over payment of taxes and misinformed budgeting decisions.

An outsourced accounting team establishes a standardized chart of accounts tailored to your business structure. Every transaction is checked against this framework, and dedicated month-end reviews reconcile receipts, vendor statements, and electronic payments.

Source: Codat

Missing Tax Deadlines

Tax calendars can be complex, with quarterly estimated payments, payroll filings, sales tax returns, and year-end documents all coming due at different times. Missing even one deadline can trigger penalties, interest charges, and unwanted scrutiny from authorities.

By partnering with an outsourced accounting provider, you gain access to a centralized compliance calendar that integrates with your company’s ERP or bookkeeping system. Automated reminders alert both you and your accounting team weeks before each due date, and preparatory work begins well in advance.

Source: HubSpot

Poor Cash Flow Management

Without a clear view of incoming receivables and outgoing payables, businesses can find themselves unable to cover payroll, pay suppliers, or invest in growth initiatives. A single unplanned expense can push you from a healthy cash position into a crisis.

Outsourced CFO services deliver rolling cash flow projections that update dynamically as invoices are issued, and bills are paid. These forecasts are paired with real-time dashboards, highlighting upcoming cash gaps and surpluses.

Source: Score

Inaccurate Financial Reporting

Errors in financial statements can inflate your tax liability and obscure true profitability. Inaccurate reports also undermine investor confidence and make strategic planning nearly impossible.

An outsourced accounting partner implements multi-tiered review processes that adhere strictly to GAAP. Using cloud-based accounting software, they reconcile revenue recognition, verify expense allocations, and run variance analyses to catch anomalies.

Source: Forbes

Lack of Reconciliation

When you skip monthly bank and credit-card reconciliations, discrepancies go unchecked. Small variances multiply over time, leading to major headaches at tax-time or during growth spurts.

Outsourced accounting teams enforce a disciplined reconciliation schedule. Every ledger entry is matched against bank statements and credit-card feeds, and any mismatches are investigated immediately.

Source: Accountancy Age

Mixing Personal and Business Finances

Blurring personal and business transactions complicates bookkeeping, raises audit flags, and can jeopardize your liability protection. When you can’t clearly separate which expenses belong to the business, reimbursements get messy, and tax deductions may be disallowed.

An outsourced accounting provider establishes clear policies and separate banking structures from day one. They map each transaction to the appropriate account, implement user roles for spend approvals, and run periodic reviews to ensure no personal charges slip through.

Source: Pymnts

Delayed Accounts Receivable

When invoices linger unpaid for 46 days or longer, you tie up working capital that could be used for payroll, inventory, or strategic investments. Slow collections not only strain cash flow but also increase the risk of bad debts.

Outsourced accounting teams implement automated invoicing systems and structured follow-up schedules. By integrating payment reminders, online payment portals, and escalation workflows, they shorten your DSO.

Source: Kaplan Group

Overestimating In-House Financial Literacy

High confidence doesn’t always translate into accurate bookkeeping or strategic financial management. Many business owners discover too late that gaps in expertise lead to costly mistakes.

By outsourcing, you gain access to seasoned professionals and best-practice frameworks. Expert teams guide you through complex accounting tasks, educate your leadership on key metrics.

Source: CPA Practice Advisor

Conclusion

Accounting errors in small businesses are roadblocks to growth, profitability, and compliance. By outsourcing your accounting functions, you gain standardized processes, proactive oversight, and expert insights that eliminate these costly missteps.

Ready to protect your business from errors and position yourself for strategic success? Talk to NOW CFO today and discover how tailored outsourced accounting solutions can safeguard your finances and fuel your next phase of growth.

Frequently Asked Questions

1. What are the Most Common Accounting Mistakes Small Businesses Make?

Small businesses often misclassify expenses, miss tax deadlines, mix personal and business finances, and delay accounts receivable. Each of these errors can distort your financial picture and invite regulatory scrutiny.

2. How Does Outsourcing Accounting Reduce Financial Risk?

Outsourced accounting teams bring standardized workflows, regular reconciliations, and real-time dashboards. This structured approach prevents errors before they happen and flags anomalies for quick resolution.

3. Can Outsourced Accounting Help Avoid Tax Penalties?

Professional accounting firms maintain detailed filing calendars, prepare returns in advance, and apply the latest tax codes, so you never face late-filing fines or interest charges.

4. Why do Businesses Fail Due to Cash Flow Issues?

Eighty-two percent of small business failures are tied to poor cash flow management. Without accurate forecasts or timely invoicing, companies can’t cover payroll, pay vendors, or invest in growth.

5. What Financial Reports Should Business Owners Review Monthly?

At minimum, review your profit & loss statement, balance sheet, cash flow report, and accounts receivable aging. These reports highlight trends, pinpoint issues, and guide strategic decisions.

6. How do I Choose the Right Outsourced Accounting Solution?

Look for a partner with industry experience, transparent pricing, cloud-based tools, and a track record of delivering on-time, GAAP-compliant reports. A good fit will offer scalable services that grow with your business.

Many businesses lack the resources for a full-time CFO and face complex decisions in funding, compliance, and operational efficiency. A surprising 60% of SME owners confess they lack confidence in accounting and finance.

Therefore, CFO services bridge this gap with expert insights on cash flow, profitability, and long-term planning without the in-house hiring. Besides, sustainable growth demands more than revenue, it requires disciplined financial leadership.

Introduction to CFO Services

Effective CFO services help businesses manage complex financial operations, forecasting, and strategic growth. Many businesses reduce audit costs by leveraging shared CFO support through local cooperatives.

Moreover, 60% of SME owners’ concerns is their cash flow management. By hiring CFOs, SMEs can enhance their cash flow visibility. These figures highlight how CFO services deliver measurable financial benefits.

What are CFO Services?

CFO services provide businesses with expert financial leadership. Through CFO services, companies access budgeting, forecasting, and financial reporting. They include cash flow modeling, risk assessment, and advice on capital structure and investment.

Besides, your clients can benefit from tailored financial dashboards, KPI tracking, and scenario planning. Professionals offering these services embed into a company’s operations, align financial strategy with growth goals, and help optimize working capital.

Learn More: What are CFO Services?

The Role of a CFO in Modern Businesses

As businesses adapt to rapid technological changes and strategies, CFO services empower leaders to make data-driven decisions.

These are the roles that modern CFOs perform:

- Offers forecasting, budgeting, and strategic financial modeling to drive decision-making.

- Using automation and AI to deliver real-time insights and elevate operational efficiency.

- Serves as a trusted bridge between leadership, investors, and boards through transparent communication.

Why Businesses are Turning to Professional CFO Services

Businesses increasingly engage professional CFO services for strategic financial leadership without a full-time hire. These CFO services offer flexible budgeting, accurate forecasting, and risk management.

Additionally, companies utilize them for capital-raising support and financial modeling, leveraging industry insights. Also, the global financial and accounting BPO market is projected to hit $110.74 billion by 2030.

Types of CFO Services Available

Many businesses recognize the strategic value of CFO-level support without the full-time cost. Let’s see how outsourced accounting fuels growth more strategically.

Fractional CFO Services

It’s essential to explore how fractional CFO services provide the same strategic leadership.

- A fractional CFO service delivers C-suite financial leadership without the cost of a full-time hire.

- These services boost strategic outsourced accounting by focusing on budgeting, forecasting, and cash flow improvement.

- Firms implementing this model often see sharper decision-making and accelerated business growth with accounting outsourcing.

- Companies scale financial leadership up or down as needed without long-term commitments to a full-time CFO.

- Fractional CFOs’ adaptable insights can help outsourced accountants with strategy.

Outsourced CFO Services

These services deliver expert financial leadership on demand, striking a balance between full-time commitment and flexible, high-level support.

- An outsourced CFO service delivers high-caliber CFO guidance on a flexible schedule for businesses.

- Companies engage outsourced CFOs for specific triggers like fundraising, expansion, or budgeting.

- Strategic outsourced accounting tells exactly when decision‑critical moments arise.

- An outsourced CFO brings experience across industries and maturation phases.

- They optimize unit economics or guide capital raises.

- Elevates businesses from reactive bookkeeping to proactive financial leadership.

Interim or Temporary CFO Services

During events like executive exits, M&A, or funding rounds, interim or temporary CFO services provide immediate, strategic support. They step in full‑time on a defined basis, bridging leadership gaps while optimizing financial clarity.

Demand for these roles has surged, with organizations reporting a 103% year‑over‑year increase in interim CFO requests.

Interim CFOs guide rapidly growing companies through transitions. They implement scalable systems, strengthening compliance, and prepare investor-ready financial structures.

Virtual CFO Services

Virtual CFO services offer entrepreneurs and SMEs strategic financial leadership remotely. This model helps demonstrate how outsourced accounting fuels growth by offering budget-friendly access to high-level insights.

Additionally, working with a virtual CFO can save businesses in costs. So, it’s a smart option for founders focused on business growth with accounting outsourcing.

Key Responsibilities of a CFO

To understand how strategic financial leadership empowers growth, here are three core elements.

Financial Planning and Strategy Development

Let’s break down how financial planning and strategy development by a CFO turns numbers into actionable growth roadmaps.

1. Aligning Long-Term Vision

A CFO builds financial plans rooted in business goals. They create roadmaps that connect monthly budgets to strategic milestones. This helps to drive how outsourced accounting fuels growth by ensuring every investment supports scale and efficiency.

2. Using Real-Time Data

CFOs rely on accurate, live financial insights to guide strategic pivots. Besides, 90% of business owners reported that their department performs accurate, real-time planning and data analysis.

3. Integrating Financial Strategy with Risk and Growth Scenarios

Beyond number-crunching, CFOs interpret multiple growth scenarios, assessing opportunities and risks alike. They transform data into direction, guiding leadership to capitalize on upside while mitigating exposure.

Budgeting and Forecasting

Any skilled CFO organizes budget creation and resource allocation by aligning spending plans with growth objectives. Moreover, the CFO anticipates risks and opportunities, allowing leadership to turn strategies swiftly. Through budgeting, monitoring, and modeling, they connect daily operations with long-term vision goals.

Risk Management and Compliance Oversight

CFOs collaborate with audit or risk committees to prioritize compliance, and many organizations note this helps to rank among the top‑three priorities for audit committees.

Here, we’ll see how risk management and compliance oversight safeguard business stability, strengthen governance, and ensure strategic decisions.

- A CFO embeds proactive risk frameworks that identify, assess, and mitigate threats.

- Aligns strategy with OMB’s requirement that management develop forward-looking risk profiles tied to strategic reviews.

- Ensures compliance with evolving regulations by maintaining internal controls structured around the COSO framework.

- Integrates risk insights into decision-making, interpreting non-financial threats and regulatory mandates.

Investor and Stakeholder Communication

Outsourced CFO leads in investor and stakeholder communication by translating financial data into clear narratives. This builds trust and connects leadership to the company’s financial health and future vision.

They deliver earnings presentations, manage regulatory disclosures, and guide messaging. Because transparent communication directly impacts valuation and market access. Their role extends to aligning investor expectations with financial strategy and shaping stakeholder confidence.

How CFO Services Benefit Your Business

CFO services lie in improving financial clarity and decision‑making. As well as a clear vision, it empowers leaders to act confidently and execute growth plans.

Improving Financial Clarity and Decision-Making

By delivering transparent, real-time insights, a CFO transforms complex numbers into clear direction.

- Provides real-time financial data that drives timely decisions across operations.

- Empowers leadership to act on objective insights rather than instincts alone.

- Supports cost-cutting and resource allocation through transparent metrics.

- Enhances strategic forecast accuracy amid market unpredictability

- Strengthens investor and stakeholder trust by showing financial discipline.

Driving Sustainable Business Growth

CFOs drive sustainable business growth by aligning financial planning with strategic objectives. They demonstrate how outsourced accounting fuels growth through disciplined forecasting, cost control, and capital optimization.

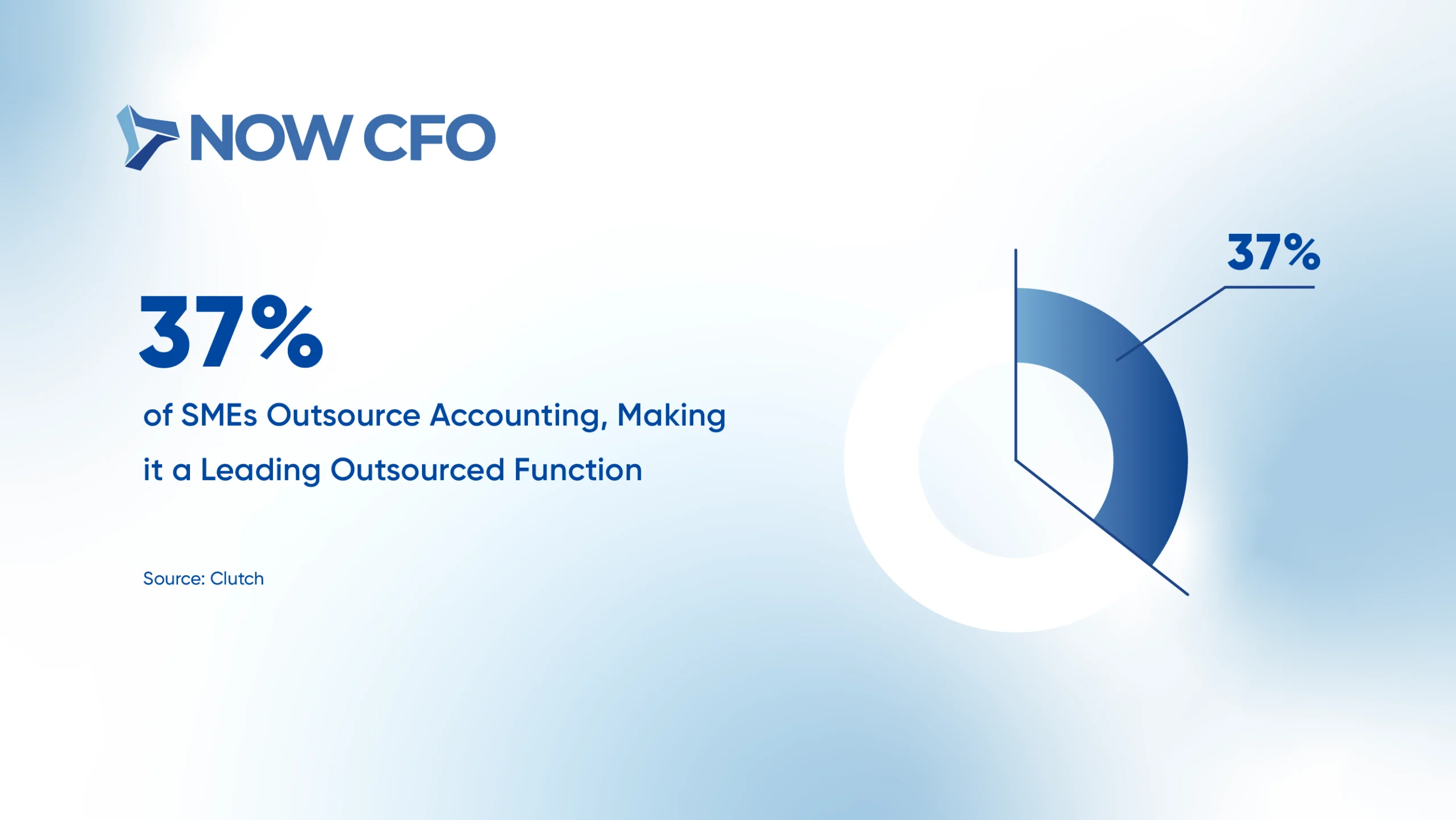

Also, they guide enterprises toward new revenue streams and enduring profitability by using data and market insights. Besides, 37% of organizations reported increased innovation and new business opportunities under CFO leadership.

Optimizing Cash Flow and Working Capital

CFO manages liquidity through better invoice timing, strategic payables, and accurate forecasting. Also, strategic outsourced accounting brings rigorous controls to working capital, smooth cycles between receivables, payables, and inventory.

Moreover, small businesses’ cash flow can stagnate or worsen. So, with proactive monitoring and prompt adjustments, CFOs can keep businesses agile in the face of surprises.

Enhancing Investor Confidence

CFO services can reinforce investor confidence by consistently delivering transparent financial insights and strategic clarity. They reveal how outsourced accounting fuels growth by translating complex data into credible investor narratives.

Strategic outsourced accounting ensures that every financial decision signals stability and potential growth. With clear investor communication, trustee discipline, and data-driven forecasting, CFOs shift perception to strategic partners.

When Should a Business Consider CFO Services?

It’s crucial to recognize the turning moments for engaging CFO services.

Early-Stage Companies Needing Financial Direction

Early‑stage companies often face steep failure rates. About 20% fail within their first year, due to weak financial planning and limited business knowledge.

But CFO services establish robust budgeting and forecasting, and elevate strategic outsourced accounting. Also, ensure real-time metrics guide growth. They also clarify capital needs, improve investor readiness, and reduce fatal missteps from assumptions.

Rapidly Growing Businesses Facing Scaling Challenges

Rapid growth can overwhelm systems, hinder forecasting, and slow decisions. CFO services provide strong financial infrastructure, efficient budgeting, and agile cash flow management.

Companies Preparing for Funding or M&A

CFOs with higher influence improve M&A outcomes, completing deals quickly, identifying stronger targets, and delivering long-term performance.

- A CFO provides detailed analysis and modeling to ensure accurate valuation and stronger negotiations.

- CFOs identify financial, operational, and regulatory risks to structure deals smartly.

- They drive smooth post-deal integration by aligning systems and controls.

- Reassure investors and partners with clear forecasting and disciplined financial reporting.

Businesses Struggling with Cash Flow or Profitability

Businesses facing unpredictable cash flow or shrinking profit margins need structured leadership. And CFO services implement cash flow modeling, margin analysis, and restore investor confidence through transparent metrics.

Besides, 60% cite cash flow as a major challenge. So, by using CFO services, companies gain actionable dashboards, accurate forecasting, and capital structure planning.

Learn More: When is the Right Time to Invest in CFO Services?

Choosing the Right CFO Service Provider

Before evaluating provider credentials, choose the right time to bring in CFO support to maximize strategic impact.

Evaluating Experience and Industry Expertise

Selecting the right CFO service provider starts with verifying that they can address your challenges.

- Assess CFO service provider backgrounds, ensuring they understand industry-specific regulations and reporting nuances.

- Look for a CFO service provider with experience that aligns with the business lifecycle, from startups to scaling enterprises.

- Evaluate proven track record in strategic roadmap development, scenario modeling, and performance monitoring within your industry.

Understanding Pricing Models and Engagement Terms

Every business should review the CFO services pricing model options. It can be hourly rates, monthly retainers, project-based agreements, or value-driven plans.

It’s equally important to compare CFO services fee arrangements for cost efficiency, transparency, and flexibility. Whereas, for performance-based contracts with defined ROI and metrics, align the provider’s incentives directly with business goals.

Assessing Communication and Reporting Practices

You need to confirm that CFO services provide timely, transparent reports. Furthermore, effective CFO services adapt communication styles to match stakeholder needs. It can be visual aids and concise narratives to maximize clarity and build trust.

Additionally, board-level reporting combines financial data with forecasting insights to support informed decision-making. It ensures governance bodies stay aligned and equipped for long-term planning.

Checking References and Track Record

Reviewing a CFO service provider’s past performance helps ensure proven results and consistent value. Here’s how to do it.

- Speak with prior clients to validate the CFO service provider’s credibility.

- Verify the CFO service provider’s reliability through documented performance history.

- Examine benchmarking data, testimonials, and case studies to evaluate sustained ROI.

Cost Considerations for CFO Services

Understanding when to engage CFO services is just the beginning. Ensuring your budget matches the right pricing structure is equally critical.

Hourly vs Retainer Pricing Structures

Selecting between hourly and retainer pricing hinges on your budget, goals, and required engagement level.

| Pricing Model | Description | Benefits |

| Hourly Billing | Charge by the hour | Pay only for the time and expertise you need |

| Monthly Retainer | Fixed monthly fee | Consistent access to CFO services |

| Performance-Based | Depends on ROI or goal achievements | Value-driven financial leadership |

Factors That Influence the Cost of CFO Services

Larger businesses with high transaction volumes pay higher fees since complexity and volume directly scale cost requirements.

- Service fees are based on company size, transaction volume, and complexity.

- Pricing differences are influenced by industry-specific requirements and geographic location.

- Factor in technology integration costs, like financial systems or ERP setup.

- Industry needs and provider location impact cost.

Cost-Benefit Analysis Compared to In-House Hiring

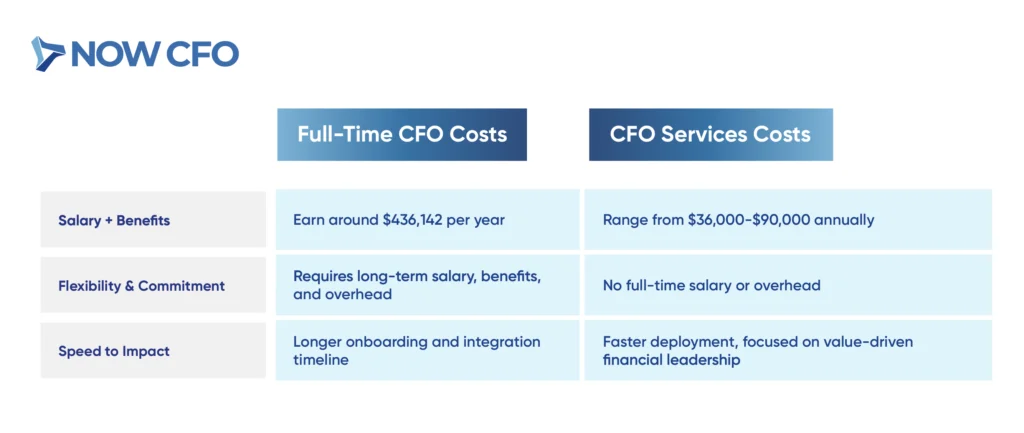

Choosing between a full-time CFO and CFO services comes down to cost, flexibility, and how quickly they deliver impact.

Common Misconceptions About CFO Services

Dispelling myths ensures businesses understand the true value of CFO services. Let’s see what those are.

Only Large Corporations Need CFOs

Misconception says CFOs suit only big firms, but CFO services deliver vital strategic financial management across all sizes.

Engaging CFO services helps to build robust financial systems early, establish transparent forecasting without the burdens of full-time cost. This demonstrates that CFO services act as accessible, high-impact leadership, transforming perception.

CFOs Only Handle Bookkeeping

Another myth is that startups often believe CFOs merely manage ledgers. But CFO services do much more; they analyze data, shape financial strategy, and guide future planning.

Additionally, a CFO interprets financial trends, builds forecasting models, and supports capital decisions with insights. They use deep financial expertise to analyze data and develop solid strategies

CFO Services are too Expensive for Small Businesses

Budget concerns stop some from exploring CFO services, yet the reality tells a different story. Compared to the six-figure salary and benefits required for a full-time CFO, using fractional or virtual CFO services provides strategic guidance.

These services make financial clarity and actionable insight accessible. This proves that the expense of a CFO service can deliver a strong return on investment, even for budget-conscious businesses.

How to Maximize the Value of Your CFO Services

Strategically using CFO services requires more than engagement. Because it demands clearly defined targets and mutual understanding.

Setting Clear Goals and Expectations

Clear goals and expectations enable CFO services to deliver focused, measurable, and strategic financial results.

Goal Definition

Begin by defining specific, measurable business objectives like cash flow improvement, margin targets, or strategic KPIs. Also, when goals are specific and challenging, performance improves.

By setting clear targets, you empower your CFO services partner to focus efforts on concrete outcomes, driving alignment between financial strategy and business growth.

Expectation Setting

Next is to outline the scope, key deliverables, reporting, and communication style expected from your CFO services arrangement. This clarity enhances accountability and ensures both parties understand responsibilities.

Performance Metrics

You need to agree on performance indicators that reflect operational health and strategic outcomes. Outcomes can be ROI, forecasting accuracy, or efficiency gains. Besides, modern CFOs leverage metrics beyond bookkeeping to measure impact and guide decisions.

Leveraging Technology and Financial Tools

Empowering CFO services with modern technology elevates them from financial operators to strategic accelerators. Also, real-time dashboards offer immediate visibility into performance metrics, enabling faster, data-driven decisions.

Advanced tools like data analytics platforms improve forecasting accuracy and strengthen risk scenario planning. They also enable bold financial strategies that boost agility and support long-term business strength.

Maintaining Regular Communication and Performance Reviews

Ensuring strong alignment between your business and its finance leadership is crucial. Here’s what you can do!

- Hold monthly check-ins for CFO services to share updates, set priorities, and align strategy with business goals.

- Deliver concise reviews using dashboards and benchmarks to track financial progress.

- Create feedback loops for accountability, adjustments, and long-term alignment.

Final Thoughts and Next Steps

Effective financial leadership doesn’t require a full-time hire. But it demands precision, strategy, and flexibility. And CFO services deliver expert forecasting, cash flow oversight, and compliance alignment at a fraction of the in-house cost.

To explore how tailored financial guidance can transform your business, consider scheduling a strategy session with NOW CFO. Let us help you unlock clarity, accountability, and scalable financial leadership.

Outsourced accounting offers expert financial support, scalable technology, and streamlined operations without the burden of full-time hiring. A complete cost comparison of outsourced vs. internal accounting services, including the cost-effectiveness of outsourced accounting, often highlights how outsourcing provides greater efficiency and long-term value.

Comparing Direct Vs Indirect Costs

Finance teams associate direct costs with specific tasks, such as payroll, bookkeeping, or client projects, while indirect costs support overall operations and infrastructure.

| Cost Type | In-House Accounting Examples | Outsourced Accounting Impact |

|---|---|---|

| Direct Costs | Accountant salary, transaction staffing | Staff included in flat fee |

| Indirect Costs | Office space, benefits administration, systems upkeep | Shared overhead across multiple clients |

What Small Businesses Typically Overlook

SMEs often underestimate the cost of outsourced accounting by overlooking hidden indirect expenses. They focus on salaries for in-house staff, but forget the ongoing burden of:

- Inefficiencies in training new hires

- Time managers spend overseeing the finance staff

- Software upgrades, licenses, and patches

- Benefits administration and HR overhead

The Impact of Inefficiencies on Growth

Inefficiencies of in-house accounting can slow strategic growth and consume valuable time. Common impacts include:

- Billing delays due to manual processes

- Misclassification of expenses and compliance errors

- Cash-flow forecasting inaccuracies that stall decision-making

- Resource drain as senior staff manage routine accounting tasks

Breakdown of In-House Accounting Costs

To better understand cost comparison, you need to know what internal accounting truly costs.

Salary and Benefits for Full-Time Staff

Companies hire accountants at median salaries. According to the BLS, the median annual wage for accountants and auditors was $81,680 in May 2024. On top of that, employers pay benefits that can add around 30–40% to total compensation costs.

For private industry workers, wages and salaries accounted for 70.3%, benefits 29.7%, and an average of $45.38 per hour in March 2025. Employers typically incur a total cost equal to 1.25–1.4x salary when adding benefits and employer taxes.

Hiring, Onboarding, and Training Expenses

Hiring new accounting staff carries real costs that businesses often undervalue. Beyond salary and benefits, expenses include recruitment, orientation, training materials, and productivity ramp-up.

Three key cost pillars:

- Recruiting Fees: For a CFO role with a base salary of $400K, the recruitment fee, at 30%, comes to $120K.

- Training Spend: In 2024, U.S. companies invested $98 billion in training, with per-employee training costs ranging from $398 to $1,047, with small businesses at the upper end ($1,047).

- Onboarding Inefficiency: Poor onboarding experiences cost U.S. and U.K. organizations $37 billion annually, with only 12% of hires feeling onboarding was effective.

Software, Hardware, and Office Space

Purchasing and maintaining technology, workspace, and software licenses create significant overhead. Organizations must invest in systems, secure networks, and software subscriptions with periodic updates and backups. Additional costs include physical office space, furniture, utilities, and IT support.

Outsourced providers include technology, infrastructure, and IT support in their service packages. This bundled access to enterprise-grade tools reduces overhead and often makes outsourcing more cost-effective for SMEs.

Time Spent Managing Accounting Internally

Operating in-house accounting demands managerial oversight: reviewing reports, troubleshooting errors, scheduling audits, and coordinating with HR, IT, and external consultants. Managers often don’t track their time, which remains a crucial part of internal costs.

In contrast, outsourcing financial services saves time by shifting day-to-day oversight to experienced professionals. Business leaders shift from routine financial supervision to focusing on strategic initiatives, growth planning, and revenue-driving decisions.

What You Get with Outsourced Accounting

Outsourcing lets you access specialized expertise and resources. In this section, we’ll examine the services included in outsourced packages and the value they bring to growing businesses.

Services Typically Included in Outsourced Packages

Outsourced accounting packages commonly include bookkeeping, payroll processing, tax preparation, financial reporting, and month-end close activities. Many firms also offer budgeting, forecasting, compliance support, and cash-flow analysis as part of standard plans. Small and medium businesses increasingly rely on these bundled services to reduce internal overhead.

Key benefits include:

- All primary functions under a single fee

- Elimination of piecemeal billing for accounting tasks

- Predictable budgeting aligned with the cost of outsourced accounting goals

Access To Expert CPAs, Controllers, and Technology

Outsourced accounting gives clients access to certified CPAs, experienced controllers, and advanced financial systems; firms staff teams with professionals specializing in tax, compliance, and financial strategy.

Flexibility To Scale Services Up or Down

Outsourcing accounting offers scalable service levels: you can increase support during busy seasons (e.g., tax season, audit periods), then scale back during quieter months. Providers adjust staffing and deliverable frequency without hiring or layoffs. This elasticity helps companies manage costs more precisely.

This flexibility is critical for growing organizations. It aligns finance support with seasonal cycles or shifting business needs and minimizes idle costs.

Side-by-Side Cost Comparison

With both in-house and outsourced costs defined, it’s time to compare them directly.

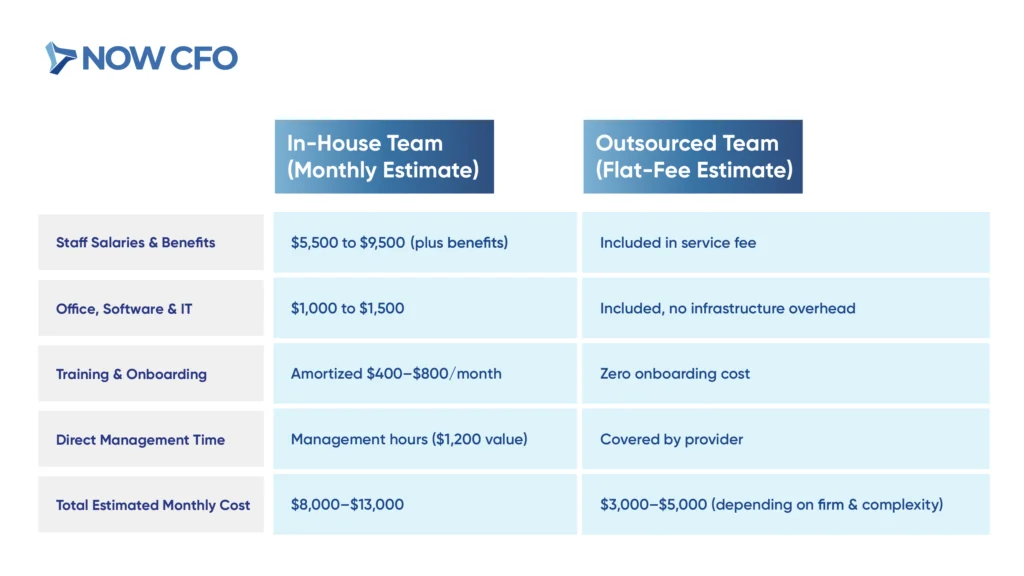

Monthly Cost of In-House Team Vs Outsourced Team

To understand whether outsourced accounting is cheaper, compare typical monthly expenses:

Short-Term Vs Long-Term Cost Advantages

Comparing short-term and long-term benefits highlights how in-house vs outsourced accounting costs evolve:

| Timeframe | In-House Team Advantages | Outsourced Team Advantages |

|---|---|---|

| Short-Term | Complete control, immediate internal accessibility | Quick deployment, fixed monthly cost, lower startup expense |

| Long-Term | Building internal competency and alignment with company culture | Consistent cost predictability, scalability, reduced turnover & training costs |

Hidden Savings with Outsourced Accounting

Cost savings often go beyond what you see on paper. Here, we’ll explore the often-overlooked financial benefits of outsourcing.

Reduced Error Rates and Penalties

Outsourced accounting reduces costly mistakes, often caused by in-house teams handling heavy workloads or lacking specialization. Nearly 59% of accountants report several monthly errors, tied to capacity constraints and regulatory complexity.

Furthermore, small businesses face stiff fines: failing to file required information returns like 1099 or W-2 can result in penalties ranging from $50 to $270 per return, depending on the delay. Outsourced teams maintain structured review processes and automation to improve accuracy, avoid submission errors, and minimize exposure to IRS audits or late-filing fines.

Better Cash Flow Management and Forecasting

Connected to error reduction, outsourcing enhances financial planning capabilities that small businesses often miss when managing accounting internally. Improved cash flow management and forecasting help leaders make timely decisions and avoid surprises.

Two key benefits:

- Proactive Forecasting Tools: Outsourced accounting delivers real-time dashboards and forecasting models. Organizations gain visibility into liquidity cycles, plan working capital needs, and prevent cash crunches.

- Strategic Timing of Payments and Receipts: Providers analyze payment terms and invoice cycles to optimize timing, stretching payables carefully and accelerating receivables. It sharpens financial clarity, which is pivotal when asking how much outsourced accounting costs in comparison to the intangible benefits gained.

Opportunity Cost: Time Back to Grow Your Business

By outsourcing routine accounting functions, businesses reclaim critical leadership time. Executives and founders often spend hours resolving bookkeeping errors, preparing reports, and coordinating compliance.

When outsourced partners manage such functions, internal teams focus on strategy and value-driven projects. This shift reduces mismanagement risks and operational friction. As a result, these time savings support broader goals like fundraising, scaling operations, or entering new markets.

When Outsourced Accounting Is NOT Cheaper

While outsourcing works well for many, it’s not always the better choice. In specific scenarios, in-house accounting can be budget-friendly and efficient.

Large Enterprises with Complex, Daily Transactions

Large enterprises with high transaction volumes, multiple subsidiaries, or complex daily financial flows often find outsourced accounting less cost-effective. These businesses typically require extensive internal control, frequent internal audits, and timely intercompany reconciliations.

According to GrowthForce, maintaining a mid-market in-house finance team can cost nearly 1 million dollars annually in salary alone. Added infrastructure, benefits, and training inflate that figure further. Outsourcing such complexity may mean multiple providers, bespoke arrangements, and higher fees.

Businesses Needing Constant On-Site Financial Presence

Outsourced accounting may not be practical when companies require a consistent, on-site financial presence. Firms in regulated industries or those with complex inventory operations often need staff physically present to handle sensitive processes on-site.

Reliance on external teams can lead to communication delays, reduced real-time responsiveness, or gaps in compliance oversight. Outsourcing presents risks, including loss of control and communication barriers.

Long-Term Cost Efficiency Vs Short-Term Priorities

Connecting from on-site needs, we now explore how cost dynamics vary over time, especially when short-term needs eclipse long-term savings.

Key considerations:

- Short-Term Priority: If your business faces urgent financial challenges, it incurs higher costs in outsourcing setup fees or ramp-up periods. Internal staffing allows complete control during transitions.

- Long-Term Efficiency: Outsourced accounting helps SMEs scale services, cut onboarding and turnover costs, and ease infrastructure demands, leading to more predictable and lower overall expenses.

ROI Beyond Cost: The Strategic Benefits

When used strategically, accounting is a key driver of growth. Now, we’ll examine the added benefits of outsourcing accounting during key business events, such as audits or fundraising.

Real-Time Data and Financial Clarity

Outsourced accounting partners often provide real-time dashboards and analytics that give leaders immediate financial visibility. Companies operating in “real-time-ness” achieved 62% higher revenue growth and 97% higher profit margins than slower counterparts.

In-house accounting teams typically deliver monthly or quarterly snapshots, which miss critical trends and may delay decision-making. In contrast, outsourced providers enable real-time access to trusted data, improving financial clarity, faster course corrections, and empowering executive action.

Built-In Compliance and Tax Readiness

Connected from real-time clarity, outsourcing also embeds compliance and tax readiness into standard workflows.

Two core advantages:

- Regular Tax Filings and Updates: Outsourced teams stay current on tax codes, ensuring timely 1099s, W-2s, payroll tax filings, and information returns to reduce the risk of IRS fines ranging from $50 to $270 per late form.

- Proactive Audit Preparedness: Providers maintain audit trails, internal controls, and organized documentation. Businesses can respond quickly with accurate records when audits or regulatory reviews arise.

Support During Audits, Funding, And Scaling

Connecting from compliance benefits, outsourced accounting extends support for business milestones like audits, funding rounds, and scaling operations:

- Audit Preparedness and Support: Providers maintain clean records, prepare audit packages, and liaise with auditors.

- Investor and Lender Reporting: Outsourced teams produce professional financial statements, forecasts, and KPI dashboards that appeal to investors or lenders during funding rounds.

- Scalable Financial Oversight: As businesses grow or launch new initiatives, outsourced providers can quickly add controller-level oversight, integrated forecasting, and strategic insights.

Conclusion

Evaluating outsourced accounting costs requires more than comparing paychecks. Outsourced accounting offers predictable pricing, lower overhead, and bundled services while freeing your team to focus on strategic priorities and growth.

Choosing the right outsourced accounting partner is a crucial decision for owners. As more SMEs recognize the advantages of delegating finance functions, outsourcing has become vital for efficiency and growth.

Outsourcing with a strategic partner lets you focus on core business goals. It delivers scalable accounting services, clear financial visibility, and timely insights.

1. Proven Industry Experience

30% of U.S. businesses outsource part of their financial operations, signaling a shift from in-house teams to external providers. Outsourcing reflects a growing demand for cost savings and access to specialized expertise.

An outsourced accounting partner navigates unique regulations, reporting standards, and operational challenges. Additionally, consultants provide tailored solutions for businesses, thereby reducing operational burdens.

Source: Statista

2. Transparent Pricing

A transparent pricing structure helps businesses manage costs with confidence. Outsourced accounting costs range from 0.5% to 1.5% of annual revenue, significantly lower than full-time staff.

With transparent pricing, business owners fully see where their money goes. By eliminating hidden fees, companies can focus on maximizing the value of strategic financial guidance.

Source: Fidelity

3. Alignment With Strategic Goals

70% of businesses cite cost savings as the primary reason for outsourcing accounting services. Outsourcing reduces overhead and ensures resources are invested in growth-driving activities.

Strategic budgeting, forecasting, and KPI tracking in outsourced accounting help clients optimize savings. These practices ensure the financial strategy stays aligned with long-term, sustainable growth.

Source: Deloitte

4. Tech Integration Capabilities

65% of accounting firms use cloud-based platforms to reduce costs, streamline workflows, and enhance real-time collaboration. These tools help to work efficiently while clients have immediate access to accurate financial information.

Integrating systems like QuickBooks, Xero, and ERP platforms maximizes operational efficiency. These tools deliver real-time insights and enable proactive financial decision-making.

Source: CPAFMA

5. Scalable Service Model

More than one‑third of small businesses outsource specifically for flexible service models. A good outsourced accounting partner offers flexible service tiers that adjust with business growth. Whether it’s basic bookkeeping or full controller support, scalability ensures businesses get exactly what they need without overpaying.

Source: Clutch

Conclusion

Partnering with an outsourced accounting partner can transform your financial operations. Outsourced bookkeeping offers industry-relevant experience, accuracy, scalability, and a dedicated point of contact.

Want to explore how NOW CFO’s tailored finance partnership to elevate your business? Start with a quick strategy session. Choose what suits you best, and start building your competitive advantage.

Frequently Asked Questions

What to Look for in an Outsourced Accounting Partner?

Choose a provider with proven industry experience, transparent pricing, scalable services, and advanced technology integration. Clear communication and alignment with your strategic goals are essential for long-term success.

How Much Do Outsourced Accounting Services Typically Cost?

Outsourced bookkeeping and accounting usually cost 0.5% to 1.5% of annual revenue. This cost is often far less than the expense of hiring a full-time, in-house team.

Can Outsourced Accounting Help My Business Grow?

A strategic outsourced accounting partner provides financial insights, forecasting, and KPI tracking to support informed decision-making. These services help reduce costs and direct resources toward growth opportunities.

Why is Tech Integration Important in Outsourced Accounting?

Cloud-based accounting platforms increase efficiency and reduce costs. They also give you real-time access to accurate financial data for better decision-making.

Will I Have a Dedicated Point of Contact with Outsourced Accounting?

A dedicated consultant consistently communicates and is accountable to each client. The consultant also tailors support to fit the business’s specific needs.

SME owners hesitate to outsource accounting due to uncertainty or perceived complexity. They spend over six hours weekly on accounting, time better used for growth and strategy.

Before outsourced bookkeeping steps begin, the accounting outsourcing process starts with a structured assessment that sets clear expectations.

Understanding Your Current Financial Structure

In this phase, financial experts review your entire accounting environment. They map workflows, assess the chart of accounts, audit volumes, access controls, technology, data quality, and cash flow cycle, and document ERP and cloud system integrations to ensure compatibility and security.

Identifying Key Pain Points and Goals

With your baseline established, the next step is to identify critical challenges and define objectives. Hiring a new in-house accountant typically costs 1.25 to 1.4 times their salary, making outsourcing affordable.

- Cost Control: Pinpoint excessive spending on in-house resources.

- Scalability: Determine where manual processes hinder growth.

- Accuracy: Highlight areas prone to errors or compliance risk.

- Technology Gaps: Assess reporting tool limitations that impede efficiency.

Outlining a Customized Service Scope

After goals are clear, the provider formalizes a tailored engagement plan. This plan details deliverables, timelines for the steps involved in outsourced accounting, and communication protocols.

It defines responsibilities across bookkeeping, reporting cadences, and compliance checks. It also establishes SLAs and KPIs to measure success over time.

Data Gathering and System Integration

Once they define the service scope, the outsourcing team gathers data and integrates systems to build a solid technical foundation for efficient accounting operations.

Collecting Financial Records and Documentation

At this stage, providers compile essential financial artifacts from multiple sources:

- Export general ledger and trial balance reports

- Gather 12 months of bank and credit card statements

- Obtain accounts receivable and payable aging schedules

- Compile payroll journals, tax filings, and vendor agreements

- Digitize invoices, receipts, and expense logs

- Deliver fixed asset registers with depreciation details

- Provide variance analyses for prior fiscal periods

Setting Up Secure Software Access and Integrations

Next, the outsourced team configures your accounting platforms by establishing role-based permissions and implementing two-factor authentication. They integrate SSO for centralized access control and set up encrypted API connections for bank feeds, payment gateways, and payroll services.

Middleware tools automate data synchronization, while test transactions and validation scripts confirm integrity. Robust integration framework illustrates how outsourced accounting works, streamlining real-time data flow and reducing manual uploads.

Establishing Communication Workflows

Once the technical setup is complete, defining communication protocols prevents delays and misalignment:

- Assign primary contacts and escalation paths

- Schedule recurring check-ins (daily stand-ups, weekly reviews)

- Set response SLAs (e.g., 24-hour email turnaround)

- Use collaboration tools (Slack channels, Teams workspaces)

- Share calendars for deadline visibility

- Archive meeting notes in a central repository

- Employ ticketing systems for task tracking

Transitioning Accounting Responsibilities

Transitioning helps preserve workflow, access, and institutional knowledge so the team can deliver uninterrupted value.

Handing Off Bookkeeping and Reporting Tasks

The first transfer involves the full scope of recurring accounting duties. The outsourced team assumes responsibility for categorizing transactions, reconciling accounts, processing invoices and expenses, and preparing standard financial statements.

They efficiently use automation tools and remote access to mirror your internal accounting cycle. Using your chart of accounts and reporting timelines, they produce management reports such as balance sheets, profit and loss statements, and cash flow summaries.

Ensuring Continuity with Minimal Disruption

To maintain continuity, the outsourced accountant maps your existing accounting cycle to the new workflows established during onboarding. They follow SLAs to process tasks like invoicing, vendor payments, and payroll on time, and they document fallback procedures to handle errors or delays.

Outsourced teams guide you through process maps, close calendars, and GL reconciliation methods. They also create backup schedules, set rollback points, and log each transition step to ensure a smooth handover.

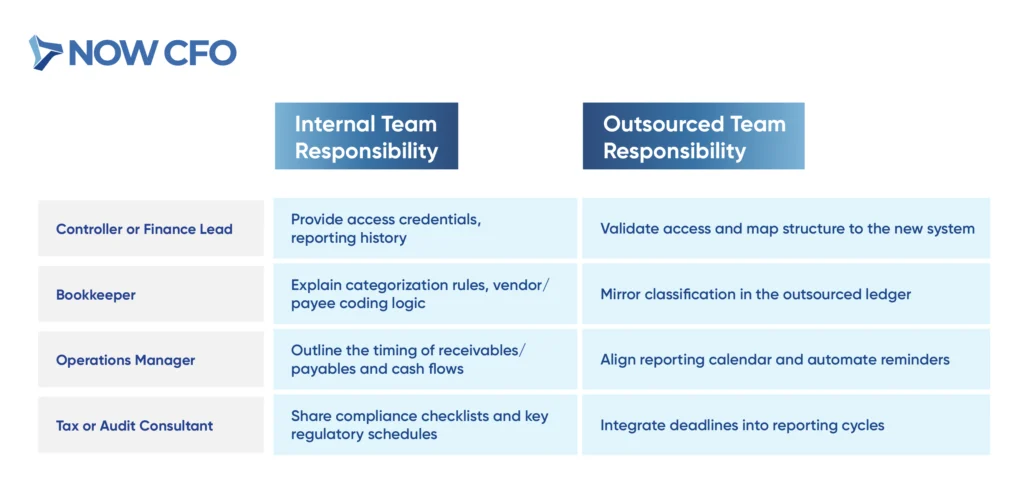

Internal Team Collaboration During Handover

Your internal team plays a pivotal role in the transition, using their institutional knowledge to bridge gaps between data and daily operations.

Ongoing Services Provided by an Outsourced Accounting Team

Once onboarding and handovers are complete, your business enters the most productive phase. Your outsourced partner manages transactions, analysis, and compliance at this stage.

Bookkeeping and Transaction Categorization

Bookkeeping is the daily operational core of any outsourced engagement. The provider records transactions in real time, adhering to a predefined chart of accounts and GAAP standards. Categorization includes tagging income and expenses, reconciling statements, and coding vendor payments.

They review each transaction for accuracy and consistency. Automation handles most tasks, but it also ensures compliance and manages exceptions. Clean books let them forecast, file taxes, and complete audits accurately.

Payroll Processing and Vendor Management

Bookkeeping, payroll, and vendor functions are typically the most time-sensitive areas after bookkeeping. Though transactional, these activities must be timely, compliant, and seamless for operations to run smoothly.

- Payroll Processing: Outsourced teams manage pay schedules, tax deductions, benefits allocations, and year-end reporting (e.g., W-2s, 1099s). They integrate platforms like Gusto or ADP to ensure accuracy and tax compliance.

- Vendor Management: AP teams schedule payments, track due dates, resolve discrepancies, and maintain updated vendor records. Many implement early-payment discount programs and monitor vendor performance metrics, reducing costs while enhancing procurement alignment.

Monthly Financial Reporting and Analysis

The outsourced team compiles standardized financial reports monthly, including P&L statements, balance sheets, and cash flow reports. These outputs follow a strict calendar, often within 5–7 days of the month’s end. Variance analysis highlights budget deviations, while trend comparisons reveal performance insights.

Reports are built to support stakeholders and can include dashboards customized for KPIs relevant to your industry. With data aggregated from real-time feeds, business leaders can use these reports to make informed decisions.

Budgeting, Forecasting, and Compliance Checks

Your outsourced team can take on strategic functions with reliable reporting, including forward-looking planning and regulatory assurance.

- Build rolling budgets and 12-month forecasts.

- Align forecasts to revenue models, hiring plans, and capital expenditure

- Scenario plan for best-case, worst-case, and mid-case growth

- Monitor compliance calendars (e.g., tax filing dates, GAAP checklists)

- Perform internal control reviews and transaction audits

- Prepare for board reporting or investor diligence cycles

How Communication Works with an Outsourced Partner

After they delegate tasks, they maintain alignment, accountability, and transparency through clear roles, consistent reporting, and real-time visibility, reducing uncertainty.

Regular Check-Ins and Reporting Cadence

An outsourced provider typically initiates recurring syncs to ensure timely updates and clarify deliverables. These include weekly check-ins for transaction status, bi-weekly financial reviews, and monthly reporting meetings aligned with your internal close cycle.

Leadership reviews are often quarterly to evaluate KPIs, cash forecasts, and budget variances. Each meeting has a defined agenda, and supporting documents are shared beforehand.

Who Handles What: Defining Roles Clearly

Defining responsibilities early is essential when outsourcing accounting. An RACI matrix helps clarify who handles documents, approvals, and reporting.

For example:

- Your internal team retains responsibility for invoice approvals and treasury decisions.

- The outsourced team handles categorization, reconciliations, reporting, and regulatory tracking.

- Controllers or CFOs (internal or fractional) validate accuracy and align reports to board requirements.

Tools Used for Collaboration and Transparency

Outsourced accounting teams leverage cloud-based systems and integrations that support transparency and real-time collaboration for smooth coordination. These tools are selected based on the client’s workflow complexity and volume:

- Slack, Microsoft Teams: Used for real-time communication and file sharing.

- Asana, Trello, or ClickUp: Task tracking with deadlines and responsibility tagging.

- Google Workspace or Microsoft 365: Collaborative document editing and shared calendars.

- Xero, QuickBooks Online, or NetSuite: Accounting platforms with shared dashboards.

- Secure file portals (e.g., ShareFile, Egnyte): For encrypted upload and storage of financial documents.

- Loom or Zoom: For recorded walkthroughs and review calls with screen sharing.

Milestones and Reporting You Can Expect

For businesses that outsource accounting, visibility doesn’t end at onboarding. A well-structured reporting schedule allows stakeholders to track deliverables across timeframes.

Weekly, Monthly, and Quarterly Deliverables

Most providers outline a structured timeline for deliverables post-handover. These outputs are built into the accounting calendar and tailored to each client’s size, industry, and regulatory needs. Below is a breakdown of typical deliverables by reporting cycle:

Year-End Support and Audit Readiness

As year-end approaches, they compile trial balances, reconcile accounts, post closing journal entries, and assemble GAAP-compliant financial statements. They also generate or organize tax documents for the CPA to review.

They often maintain a permanent audit folder containing each quarter’s invoices, contracts, and reconciliations to streamline review. If your company undergoes an audit, the team facilitates data pulls, auditor requests, and management representation letters.

Continuous Insights for Decision-Making

Beyond static reports, account outsourcing services include dashboards and real-time analytics that empower leadership with timely insights. These forward-facing outputs are significant when scaling or pivoting a strategy. To help maximize the impact, they use a data-driven approach that supports strategic decisions.

Key insight outputs include:

- Revenue trends by product, service, or client segment

- Cash runway forecasts and burn rate tracking

- Scenario modeling based on growth or cost shifts

- A/R collection cycle timeframes

- Expense-to-revenue ratio trends over rolling periods

- Monthly breakeven point analysis

Addressing Common Concerns About Outsourcing

Even when the benefits are clear, many business leaders hesitate to outsource their accounting. Addressing these upfront helps clarify what happens when you outsource accounting.

Is My Financial Data Secure?

Security is among the most frequently asked questions when businesses consider outsourcing. Reputable firms adhere to industry-grade cybersecurity protocols to safeguard sensitive financial data from unauthorized access and breaches.

They encrypt data both in transit and at rest. They also manage access through role-based permissions, multi-factor authentication, and IP-restricted login portals. Client records stay secure on SOC 2 and ISO 27001 compliant servers like AWS and Azure.

For added assurance, many firms sign BAAs/NDAs to govern how data is accessed and handled.

Will I Lose Control Over My Finances?

Concerns over control often surface during outsourcing accounting. However, outsourcing is structured around transparency and shared authority, not whole delegation without oversight.

Here’s how you maintain control:

- You approve all outgoing payments and payroll

- You have 24/7 access to real-time dashboards and general ledger data

- You receive scheduled reports and variance alerts

- You define workflows for reviews, escalations, and reconciliations

- You hold monthly check-ins to assess performance and adjust scope

What if I Outgrow the Service?

Another common concern is whether the model can evolve alongside your company. When appropriately designed, outsourced accounting arrangements are built to scale, not to constrain.

Here’s how outsourced financial operations flex to meet complexity:

- Modular Service Tiers: Upgrade from bookkeeping-only to complete controller oversight or CFO support.

- Specialized Add-Ons: Integrate cash flow forecasting, fundraising decks, or board reporting as needs change.

- Industry Expertise: Many firms assign specialists by sector (e.g., SaaS, construction, eCommerce) as you expand.

When Outsourcing Makes the Most Sense

Outsourcing is a strategic move made at critical growth junctures. Recognizing when to outsource can help prevent bottlenecks, avoid costly hiring missteps, and increase long-term operational efficiency.

You’re Scaling Rapidly and Need Expert Support

As companies scale, financial complexity increases. Growth introduces new revenue streams, evolving tax obligations, and stakeholder reporting demands that exceed the capacity of generalist bookkeepers.

Outsourcing provides immediate access to experts in fundraising, GAAP, and compliance. It eliminates the need to pause growth for recruiting and onboarding internal staff. With flexible engagement models, businesses can start with foundational support and expand to strategic advisory.

Your Internal Team Is Overworked or Underqualified

Suppose your current staff struggles to keep up with month-end closes, vendor communications, or accurate reconciliations. In that case, it’s a strong sign that it’s time to consider outsourced accounting. When finance teams are overextended, errors increase, reporting delays pile up, and morale suffers.

Outsourcing eases pressure by supplementing your team with skilled professionals who bring process maturity and tool-based efficiencies. Businesses retain control while eliminating backlogs, improving compliance accuracy, and standardizing financial processes.

You Want Real-Time Reporting Without Full-Time Costs

For startups and SMBs, hiring a full-time controller or CFO can cost upward of six figures annually. Yet the need for timely, accurate financial reporting persists. Outsourced accounting bridges the gap between resource constraints and data expectations.

With outsourced solutions, you gain access to real-time dashboards, KPI monitoring, and scenario modeling at a fraction of the cost of building an in-house team. These tools integrate during onboarding and are updated continuously, giving leadership visibility into burn rates, revenue shifts, and performance trends.

Conclusion

When outsourcing, you’re building a more intelligent financial engine. Outsourcing brings structure to chaos, improves compliance, and empowers strategic growth with expert insights and transparent reporting.

Ready to outsource your accounting to capable hands? Start by scheduling a free session with NOW CFO’s senior consultants. Find the best-fit model for your team, no pressure, no pushy sales, just clarity.

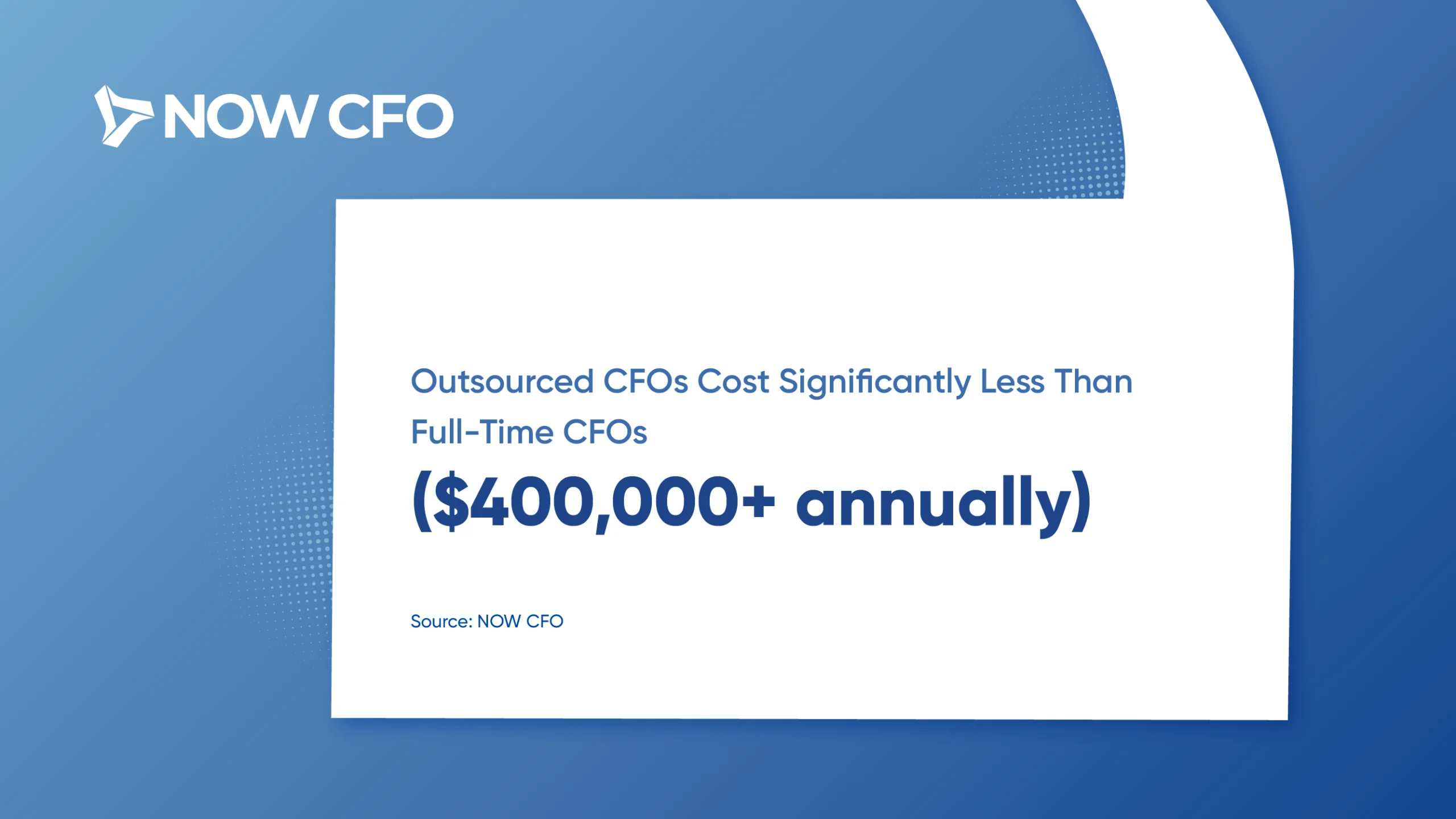

Hiring a full-time CFO often puts small to mid-sized companies in a financial bind. With an average base salary of over $400K annually, these roles can quickly become a significant line-item expense.

Understanding the Reasons Outsourced CFOs Are More Affordable can help businesses make better financial decisions.

In contrast, outsourced CFOs are a fraction of that cost, delivering strategic leadership with far less financial strain. It’s no wonder that outsourcing is gaining traction as a more intelligent choice for firms with limited burn budgets yet real needs for financial oversight.

1. No Full-Time Salary or Benefits Package

Hiring an in-house CFO often costs over $400,000 annually, and once bonuses and benefits are factored in, that number rises to nearly $500,000. This executive compensation level can be unsustainable for businesses with constrained budgets.

Outsourced CFOs are more affordable than in-house CFOs because they provide the same strategic expertise without ongoing salary and benefits obligations. With outsourced financial leadership, companies get top-tier financial oversight at a fraction of the cost, freeing up capital for operations, product development, or market expansion.

Source: NOW CFO

2. Flexible Engagement Models (Hourly, Monthly, or Project-Based)

Flexibility is one key advantage when comparing CFO hiring costs. Unlike traditional hires locked into full-time roles, outsourced CFOs offer hourly, monthly retainer, or project-based pricing.

Companies can adjust services to match their needs, especially during audits, fundraising, or rapid growth. As more companies prioritize cost control and operational agility, the pay-as-you-go CFO model delivers financial flexibility unmatched by in-house hiring.

Source: Deloitte

3. No Equity or Long-Term Executive Contracts

Full-time CFOs frequently negotiate stock options or performance-based equity, adding long-term dilution and complexity to the business. Outsourced CFOs are more affordable than in-house CFOs because they operate under service agreements with no equity requirements, legal entanglements, or board approvals.

You maintain control of your cap table while accessing strategic insight. For startups and mid-sized firms looking to preserve ownership, outsourced financial leadership offers a clean, scalable alternative without sacrificing quality.

Source: Harvard Law School

4. Reduced Recruitment and Onboarding Costs

Hiring a full-time CFO isn’t just expensive in salary terms; it starts with hefty recruitment fees. Retained search firms can charge $100,000 or more to place a candidate. Add in onboarding time, ramp-up periods, and the risk of poor fitness, and costs increase even higher.

Outsourced CFOs are more affordable than in-house CFOs because they eliminate these upfront hiring costs. Most are ready to contribute immediately, which means faster results, minimal onboarding, and significant savings in both time and resources.

Source: Hunter Recruiting

5. Improved ROI Through Strategic, High-Impact Work

Outsourced CFOs focus on strategic deliverables like cash flow forecasting, KPI development, capital allocation, and projects that move the business forward.

Companies direct outsourced CFOs’ time toward high-impact work instead of the routine executive calendar. This focused contribution boosts ROI, making them more cost-effective than in-house CFOs. Businesses invest in tangible results rather than just executive presence..

Source: Deloitte

Conclusion

From affordable salary, scalable engagement, and high-impact strategic work, it’s clear that outsourced CFOs are more affordable than in-house CFOs. You benefit from expertise, flexibility, and measurable outcomes, all without the overhead of hiring, onboarding, equity, and grants.

If you’re ready to streamline executive overhead but don’t want to compromise on strategic financial insight, NOW CFO is prepared to help. Kick things off by scheduling a complimentary cost-benefit analysis.

Frequently Asked Questions

How Much Does an Outsourced CFO Cost vs an In-House?

While in-house CFOs can command total compensation packages of $400,000 or more, outsourced CFOs often cost between $5,000 and $15,000 per month, depending on scope.

Is Outsourcing a CFO More Affordable for Small Businesses?

For SMEs managing tight margins, outsourcing a CFO provides fractional CFO savings with flexible terms. It removes the burden of executive compensation and delivers financial leadership on a budget.

What do Outsourced CFOs Offer That Justifies Their Cost?

Outsourced CFOs bring strategic financial outsourcing benefits such as forecasting, cash flow management, investor reporting, and budget planning. Their value comes from the ability to focus on high-impact outcomes while adapting their involvement to your business stage and goals.

Do Fractional CFOs Provide the Same Value as Full-Time Ones?

Fractional CFOs offer the same strategic insight as in-house counterparts without long-term contracts or equity grants. The pay-as-you-go CFO model lets you access top-tier expertise exactly when and where you need it.

What are The Hidden Costs of Hiring a Full-Time CFO?

Beyond salary, full-time CFOs come with recruitment fees, onboarding time, bonuses, equity packages, and administrative support costs. These hidden costs inflate executive overhead significantly, making the cost difference between outsourced and in-house CFOs even more stark.

SMEs rely on outsourced financial support to fuel growth. 71% of businesses outsource some or all of their accounting and finance functions. Understanding how outsourced accounting services support business growth enables founders and executives to leverage bookkeeping as a growth driver.

Definition and Scope of Outsourced Accounting

Outsourced accounting refers to hiring an external provider to manage financial tasks that are traditionally performed in-house. It transforms accounting from an internal cost center to a value-driving strategic service.

Companies contract out bookkeeping, payroll, tax filings, month-end close, and financial analysis. By engaging specialists, outsourced accounting services support business growth through enhanced accuracy and scalability.

Common Services Provided by Outsourced Teams

Outsourced accounting firms offer a comprehensive suite of services beyond basic bookkeeping. Standard outsourced accounting services include:

- AP/AR

- General ledger accounting

- Payroll processing

- Fixed asset tracking

- Budgeting, forecasting, and financial planning

- Cash flow management

- Regulatory compliance

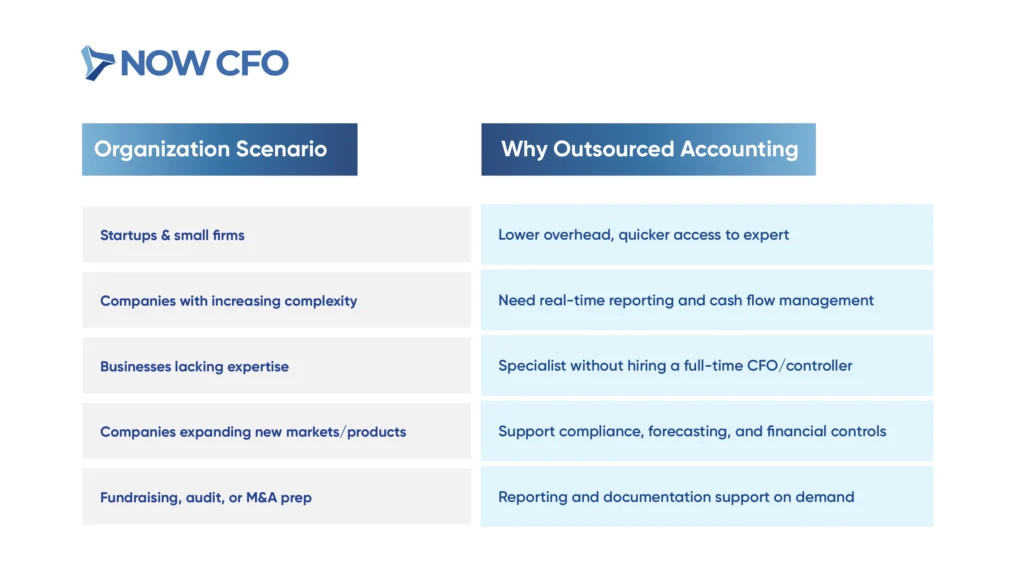

Who Uses Outsourced Accounting and Why?

Organizations across sectors rely on outsourced accounting to fuel strategic growth.

How Outsourced Accounting Accelerates Growth

After understanding the services involved, the next step is recognizing their impact. Here’s how they accelerate scalability, efficiency, and strategic focus across key business functions.

Reduces Overhead and Administrative Burden

Plugging overhead drains and slicing admin load, outsourced accounting cuts hiring, training, benefits, office space, and software costs. Companies report cost savings as the primary driver in the growth of outsourcing decisions.

Outsourcing routine bookkeeping, payroll, AR/AP, and compliance allows leadership to reduce internal headcount while preserving accuracy and control. Clear workflow improves financial efficiency and enables internal teams to focus on core growth.

Provides Accurate, Real-Time Financial Reporting

Efficient outsourced CFO use cloud dashboards to give real-time financial visibility, helping teams respond quickly to change

Key features include:

- Cloud dashboards displaying up-to-date revenue, expenses, and cash position

- Automated ledger closing that reduces manual errors

- Monthly or weekly standardized reports aligned with strategic metrics

- Compliance-check analytics, flagging anomalies or irregularities

Enables Informed Decision-Making Through Expert Insights

Building upon real-time reporting, outsourced teams contribute interpretation alongside raw financial data. They offer:

- Trend analysis identifying areas like cost overruns or revenue dips

- KPI monitoring: gross margin, burn rate, and liquidity metrics

- Scenario modeling for funding rounds, pricing changes, or new investments

- Advisory on budgeting strategies and risk mitigation

Frees Leadership to Focus on Core Business Activities

Outsourced accounting teams handle routine tasks, freeing leaders to focus on strategy while reducing internal distractions.

Key benefits include:

- Elimination of day-to-day accounting distractions

- Time savings on recruiting, onboarding, and supervising finance staff

- Consistent compliance handling and deadline management

- Ability to devote senior management time to core objectives

Learn More: Hire An Outsourced Accounting Service

Key Growth Benefits of Outsourcing Accounting

Beyond immediate operational improvements, outsourced accounting plays a strategic role in driving long-term success.

Scalability Without Hiring Internally

Businesses often face rapid demand spikes as they scale. Outsourced accounting enables companies to handle increased workloads without expanding internal headcount. Companies avoid the recruitment costs and delays tied to hiring qualified finance professionals.

By partnering with outsourced firms, organizations scale operations seamlessly without the overhead of salaries, benefits, and workspace. The flexible model also supports accounting services for growing businesses, enabling teams to level up or down according to revenue cycles or project load.

Access to a Team of Specialists On-Demand

Seamlessly building on scalability, outsourced partnerships offer immediate access to diverse financial expertise.

Key advantages include:

- Certified Expertise: Outsourced teams often include CPAs, controllers, tax specialists, and financial analysts with broad industry experience.

- Specialist Availability: Businesses that require guidance on complex matters gain access to relevant experts without hiring.

- Tailored Expert Support: Firms benefit from fractional controller-level insight or CFO-level consultation as needed.

Streamlined Systems and Processes

Outsourced accounting transforms fragmented internal processes into standardized, efficient workflows. Providers implement cloud-based accounting platforms, automated reconciliations, and real-time dashboards.

By systematizing tasks, businesses gain:

- Faster Close Cycles: Outsourced teams close books reliably and consistently every period.

- Automated Reconciliations and Alerts: Tools flag discrepancies early, improving accuracy.

- Centralized Document Workflows: Vendors manage AP, AR, and payroll through cloud portals, reducing administrative friction.

Strategic Tax Planning and Compliance

Building on streamlined operations, outsourced accounting also supports strategic tax planning and robust compliance.

Two key elements include:

- Proactive Tax Optimization: Outsourced teams analyze incentive structures, depreciation schedules, and entity structuring to minimize liabilities. Businesses earn credits and deductions as they grow or expand.

- Compliance with Evolving Regulations: Providers monitor and implement regulatory changes, reducing risk and enabling timely filings.

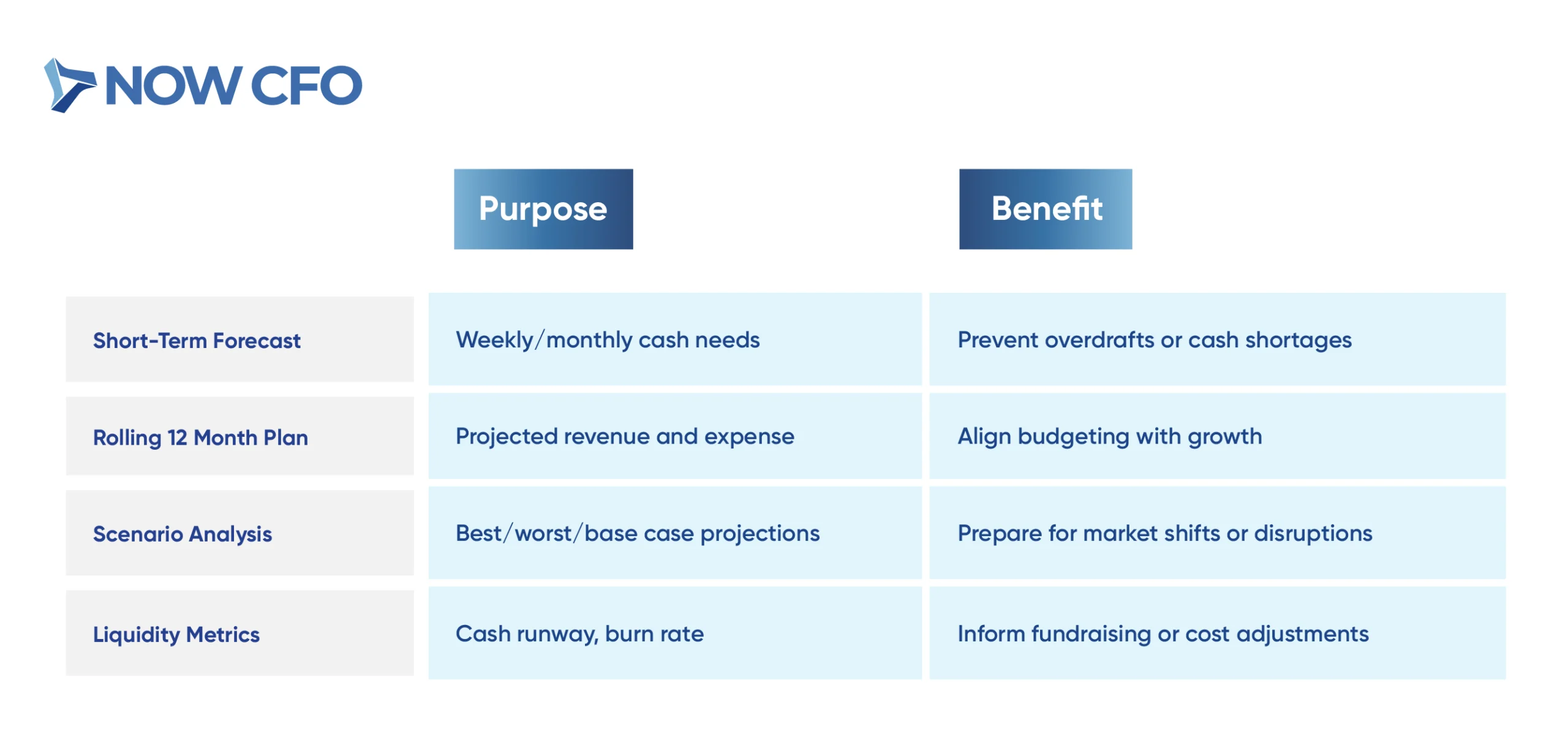

Data-Driven Forecasting and Cash Flow Management

Connecting financial systems and expert planning leads to sophisticated forecasting and cash flow oversight.

Two notable outputs:

| Function | Description | Business Impact |

|---|---|---|

| Scenario-Based Forecasting | Building models using variable assumptions like market shifts, pricing changes, or funding rounds | Helps leadership anticipate future cash needs and make informed investment decisions |

| Cash Flow Monitoring & Alerts | Real-time dashboards track upcoming payables and receivables to flag liquidity risks | Enables proactive working capital management and reduces the chance of shortfalls |

When Growing Businesses Should Consider Outsourced Accounting

To fully understand how outsourced accounting services support business growth, it’s crucial to identify the right moments to make the switch.

Revenue is Increasing, but Books are Delayed

As companies grow, transactional volume often outpaces internal accounting capacity. When revenue surges and the books lag, leadership loses financial visibility and risks missing cash flow issues or compliance deadlines.

In such situations, outsourcing your accounting can restore accuracy and timeliness. Providers update ledgers, reconcile accounts, and report regularly, ensuring financial data reflects real-time activity.

Your Internal Team Lacks Advanced Financial Expertise

When your in-house team handles day-to-day bookkeeping but lacks skills in forecasting, tax strategy, or complex compliance, gaps emerge. Many businesses find that key financial tasks exceed internal capabilities. Only 54% of small business owners report a solid understanding of financial management when they launched their business.

Outsourced accounting brings in-depth expertise, including CPA-level insight, budgeting and forecasting skills, and knowledge of evolving compliance requirements. With this accounting support, leadership clarifies financial strategy, reduces risk, and pushes growth forward.

You’re Entering New Markets or Launching New Products

Expansion into new territories or product lines brings complex financial requirements. Internal teams often lack the bandwidth or know-how to handle the complexity.

Outsourced accounting firms provide experience in cross-border regulations, multi-entity structuring, and scaling systems. They set up a compliant chart-of-accounts, forecast new revenue streams, and implement controls suited for expansion.

You’re Preparing for Funding, Audit, Or M&A

When organizations prepare for major milestones like funding rounds, audits, or mergers, precise financial reporting and clean records become essential. Leadership needs clarity, regulation-ready documentation, and seamless collaboration with investors or auditors at this stage.

Key support includes:

- Audit-ready financial statements and controls

- Investor-grade reporting and valuations

- Due diligence preparation for funding rounds or acquisitions

- Documentation for compliance with GAAP and IFRS

How Outsourced Accounting Aligns with Growth Stages

As financial needs shift with each growth stage, outsourced accounting adapts to match. Here’s how outsourced accounting services support business growth from startup through expansion.

Startup Phase: Bookkeeping, Payroll, Compliance

Foundational tasks like bookkeeping, payroll, and compliance are critical yet resource-intensive in the startup phase. Outsourced accounting services support business growth by efficiently managing these core functions from day one.

Firms receive professional bookkeeping, timely payroll processing, and help implementing compliance systems without hiring staff. Outsourced providers often offer standard compliance support.

By handling these areas, they let leadership focus on product development, market entry, and customer acquisition while ensuring accounting services for growing businesses are in place from the beginning.

Growth Phase: Cash Flow, Forecasting, Budgeting

As businesses enter the growth phase, they focus on managing cash flow, creating forecasts, and budgeting for expansion. Outsourced accounting offers expert support, delivering models, dashboards, and planning frameworks tailored to evolving needs.

Outsourced CFOs use tools that link historical data to upcoming projections. They help build budgets tied to KPIs and adjust forecasts dynamically based on performance.

Expansion Phase: Audit Prep, Investor Reporting, Controller Services

At the expansion phase, businesses prepare for external scrutiny by investors, auditors, or boards. They require audit-ready processes, investor-quality reporting, and controller-level service.

Providers deliver:

- Audit-ready financial statements, reconciliations, and controls

- Investor dashboards, KPI tracking, and valuations

- Virtual controller or fractional CFO services, aligning data with strategic planning

Comparing In-House vs. Outsourced Accounting for Growth

This comparison outlines how the outsourced model differs with in-house models across cost, skills, and risk dimensions.

| Category | In-House Accounting | Outsourced Accounting |

|---|---|---|

| Costs & Resources | $70K to $120K+ annually (salaries, benefits, tools) | 10K–25k/year depending on scope |

| Skillset & Tech | Limited expertise; manual systems, spreadsheets | Access to CPAs, controllers, and cloud-based reporting tools |

| Flexibility & Risk | Vulnerable to turnover, absences, and scaling issues | Team continuity, scalable service levels, and reduced fraud risk |

Cost And Resource Differences

Managing an in-house accounting team demands significant recurring costs: salaries, benefits, training, and software. For instance, an in-house accounting department costs over $100,000 annually, plus onboarding and tools.

In contrast, outsourced accounting typically costs between $10,00 and $25,000 per year, depending on complexity. Outsourcing eliminates fixed overhead: businesses pay for service tiers, not full-time staff.

Skillset And Technology Access