The importance of working capital management underlies robust operations and growth. CFOs who master this discipline avoid cash shortfalls, reduce reliance on high-cost credit, and enhance profitability.

Among 10K SMEs survey, 44 % of small business owners report having less than three months of cash reserves. By tracking receivables, optimizing inventory, negotiating payables, and forecasting cash flow, finance leaders reinforce resilience against market fluctuations.

What is Working Capital Management and Why Is It Important?

CFOs must grasp the importance of working capital management to maintain liquidity and fund operations seamlessly. Before delving into its critical role, let’s clarify what is working capital in financial management, so you can appreciate why this discipline underpins long-term viability.

Defining Working Capital in Financial Management

Working capital equals current assets (cash, accounts receivable, inventory) minus current liabilities (short-term payables, accrued expenses). This metric gauges a firm’s day-to-day liquidity and its capacity to cover immediate obligations. Effective working capital planning ensures companies avoid cash shortfalls and reduce dependence on high-cost borrowing.

According to SBA, community banks held 1,441,109 outstanding commercial and industrial loans, totaling over $94 billion. Such lending highlights how working capital facilitates access to crucial funding and supports financial stability and growth.

Why Effective Working Capital Management is Crucial for Business Health

Working capital management empowers CFOs to optimize cash flow management and liquidity management, reducing reliance on costly debt. Below are key reasons why robust working capital controls drive business health:

- Enhances Liquidity: Maintaining optimal inventory and receivables frees cash, lowering the need for external funding and interest expenses.

- Improves Profitability: Streamlined collections and negotiated payables terms shorten the cash conversion cycle, boosting return on assets.

- Mitigates Risk: Ongoing forecasting and monitoring prevent shortfalls, guarding against operational disruptions.

- Supports Growth: Efficient practices free up cash for strategic investments in marketing, R&D, and expansion.

Key Components of Working Capital Management

CFOs must master four pillars of working capital: accounts receivable, inventory, payables, and cash flow, to sustain liquidity and operational health.

Managing Accounts Receivable and Optimizing Collection

Effective receivables management begins with accounts receivable, where CFOs set clear credit policies, monitor aging schedules, and leverage automated reminders to expedite customer payments. By DSO, businesses shorten the cash conversion cycle, bolstering liquidity and minimizing reliance on short-term financing.

According to the Fiscal Treasury, the Prompt Payment interest rate for January 1–June 30, 2025, stands at 4.625%, a tangible cost of delayed payments. Early payment discounts and strict invoicing protocols encourage timely remittance, improving operational efficiency through working capital.

Controlling Inventory Levels to Balance Cash Flow

Building on strong receivables, CFOs tackle inventory control to optimize capital management.

- Just-in-Time Ordering: Align purchases with production schedules to avoid excess stock and reduce holding costs.

- ABC Analysis: Categorize inventory by value and turnover rate, focusing resources on high-impact SKUs.

- Safety Stock Calculations: Set buffer levels based on demand variability and lead times to prevent stockouts.

- Cycle Counting: Conduct periodic counts to improve accuracy and minimize obsolescence.

The total business inventories-to-sales ratio fell to 1.38 in April 2025 compared to last year, reflecting tighter liquidity management practices to free up working capital.

Managing Accounts Payable and Negotiating Payment Terms

Just as inventory control liberates cash, effective management of accounts payable elevates CFO working capital optimization, allowing firms to defer outflows without straining supplier relationships. Key tactics include:

- Negotiate Extended Terms: Secure 60- or 90-day payment agreements to delay cash disbursements and lengthen the cash conversion cycle.

- Early-Payment Discounts: Weigh discounts (e.g., 2%/10 net 30) against the cost of earlier cash usage to achieve net savings.

- Centralize Processing: Implement e-invoicing and automated approvals to reduce errors and late fees.

- Vendor Financing: Partner on consignment inventory or supply-chain financing to maintain stock while preserving liquidity.

Maintaining Adequate Cash Flow for Operational Efficiency

Maintaining adequate cash flow requires continuous forecasting, scenario planning, and daily liquidity monitoring. CFOs deploy rolling 13-week cashflow projections, stress-test scenarios, and integrate real-time bank feeds to identify potential shortfalls and surpluses.

By centralizing cash management, finance teams can allocate funds dynamically for payroll, supplier payments, and unforeseen expenses. Despite these measures, many firms lack sufficient buffers: only 28% of small businesses have cash reserves to cover three or more months of operations.

The Role of CFOs in Optimizing Working Capital for Success

CFOs align working capital management with growth targets, forecast liquidity, track performance metrics, and implement controls to drive expansion.

Aligning Working Capital Strategies with Business Growth Goals

To sync liquidity with strategic objectives, CFOs craft policies that reflect expansion phases. They initiate growth initiative, embedding capital optimization in corporate roadmaps.

- Define DSO and DPO benchmarks tied to revenue targets and product launches.

- Coordinate cash conversion cycle objectives with capital-raising schedules.

- Incorporate liquidity management metrics into board-level performance reviews.

Forecasting Cash Flow for Better Financial Planning

Accurate projections underpin the importance of working capital management, enabling CFOs to anticipate liquidity gaps and invest wisely. For example, profits from current production rose from $229.8 billion to $281.3 billion in 2024, underscoring volatility CFOs must capture in working capital planning.

Profits from Current Domestic Production rose from $229.8 billion to $281.3 billion in 2024

Source: U.S. Bureau of Economic Analysis (BEA)

They integrate historical data and market indicators.

- Rolling 13-week Forecasts: Update weekly cashflow models to reflect evolving sales patterns, seasonal peaks, and expense timing, reducing surprises.

- Scenario Analysis: Model best, expected, and worst-case cash scenarios to stress-test balances, allocate buffers, and guide cash flow management decisions.

Using Financial Data to Monitor and Adjust Working Capital Performance

CFOs develop real-time dashboards tracking DSO, DPO, inventory turnover, and cash conversion cycle metrics with strategic KPIs. They integrate ERP and treasury data to visualize trends, enabling swift identification of deviations and actionable insights.

Through monthly variance analysis, finance teams compare actual vs. forecast cash flows, refining CFO working capital optimization tactics. They leverage predictive analytics to model the impact of sales, procurement, and payment delays.

Implementing Financial Controls to Mitigate Liquidity Risks

CFOs establish credit approval limits, dual-signature requirements, and automated alerts to enforce liquidity management policies. They segment cash pools by business unit, centralize treasury functions, and conduct regular reconciliations to detect anomalies.

Strategies for Optimizing Working Capital Management

To execute the importance of working capital management, CFOs deploy targeted tactics that accelerate cash inflows, streamline inventory, extend payables, and harness digital tools for sustained financial stability and growth.

Streamlining Accounts Receivable to Reduce Days Sales Outstanding (DSO)

By tightening receivables, CFOs shrink the cash conversion cycle and reinforce working capital management.

- Establish clear credit policies and automated invoicing to cut approval delays.

- Send digital payment reminders and enable online portals for faster collections.

- Review aging reports weekly to prioritize overdue accounts.

- Employ selective receivables financing or factoring to accelerate inflows.

Improving Inventory Turnover for Better Cash Flow Management

Next, boosting inventory turnover complements receivables efforts by converting stock into cash more rapidly. CFOs benchmark against best-in-class metrics to inform working capital planning and CFO working capital optimization.

| Strategy | Avg. Inventory Turnover (times/year) |

|---|---|

| Middle Market Strategy | 27.9 |

| Hybrid Strategy | 14.11 |

| Terminal Market Strategy | 13.99 |

Optimizing Accounts Payable Terms to Maximize Working Capital

By extending payment terms without harming supplier relations, CFOs enhance liquidity management. They negotiate 60- to 90-day terms, aligning disbursements with projected cash inflows.

Centralized e-invoicing and automated approvals streamline processing, reducing manual errors and late-fee risk. Partnering on supply-chain financing lets businesses hold stock while preserving cash, driving operational efficiency through working capital.

Leveraging Technology for Real-Time Cash Flow Monitoring

Finally, CFOs leverage modern platforms for data-driven visibility:

- Treasury Management Systems (TMS): Integrate with ERP for daily cash-position dashboards.

- API-Enabled Bank Feeds: Automate inflow/outflow updates for real-time accuracy.

- AI-Driven Forecasts: Generate predictive alerts on cash shortfalls or surpluses.

Benefits of Effective Working Capital Management

continuous optimization of receivables, inventory, payables, and cash reserves delivers tangible benefits.

Improved Liquidity and Cash Flow Flexibility

CFOs who fine-tune cash flow, shorten the cash conversion cycle, ensuring funds are available for payroll, suppliers, and unexpected expenses. Effective liquidity management via optimized receivables and inventory buffers reduces reliance on revolving credit and enhances operational resilience.

Adopting robust capital planning not only supports liquidity but also fuels financial stability and growth.

Greater Financial Stability and Reduced Dependency on External Financing

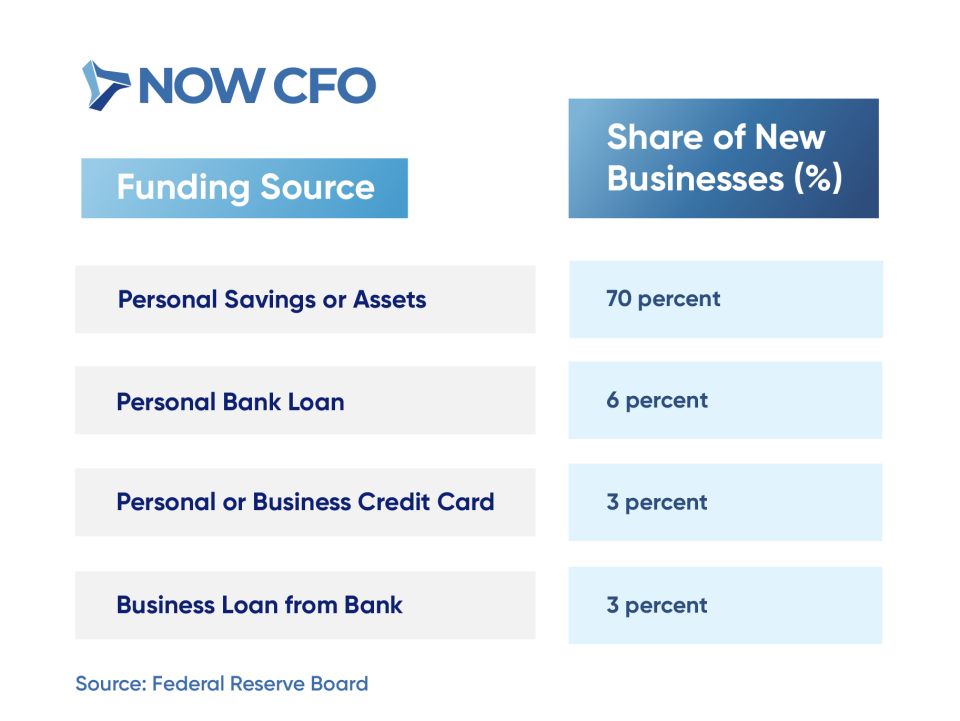

Reducing reliance on debt strengthens balance sheets and shields firms from credit-market volatility.

Source: Federal Reserve Board

Enhanced Operational Efficiency and Cost Control

By streamlining payables, companies lower transaction costs and strengthen supplier partnerships. Key tactics include:

- Centralize Approvals: Automate invoice route to reduce processing time and late fees.

- Dynamic Discounting: Leverage early-payment discounts aligned with cash-flow forecasts.

- Consignment Inventory: Shift holding costs to suppliers while maintaining stock availability.

- Supply-Chain Financing: Partner with platforms that extend payment terms without supplier strain.

Ability to Fund Growth Initiatives and New Investments

CFOs maintain robust working capital planning by establishing cash buffers, rolling forecasts, and centralized treasury controls to track inflows and outflows daily. This disciplined cash flow management approach empowers teams to deploy surpluses for core activities and reduces dependence on external credit.

How CFOs Drive Business Growth Through Working Capital Optimization

Building on these benefits, CFOs leverage robust capital management to propel expansion and strategic investment. They align liquidity cushions with growth plans, ensuring that funding for new projects never lags operational needs.

Notably, the credit availability remains a challenge for over a quarter of small businesses, underscoring the need for internal cash optimization over external financing.

Supporting Expansion Plans with Adequate Working Capital

CFOs ensure that expansion strategies never stall for lack of funds. They establish target liquidity cushions and secure flexible credit to back growth initiatives.

- Set a target current ratio (e.g., 1.5–2.0) to underwrite new locations or product launches.

- Maintain committed lines of credit or SBA-backed facilities to bridge timing gaps.

- Allocate surplus cash to high-ROI expansion projects rather than low-yield reserves.

- Use asset-based lending to release capital tied up in receivables and inventory.

- Integrate working capital planning into annual budgeting cycles.

Managing Risk While Scaling Operations

As firms scale, CFOs balance liquidity management with prudent risk controls. They stress-test cashflow models under varying growth scenarios to identify pinch points. By centralizing treasury operations, finance teams detect emerging shortfalls and adjust operational efficiency through working capital levers before they escalate.

Identifying Opportunities to Free Up Cash for Strategic Investments

To fund new ventures without external borrowing, CFOs mine existing operations for liquidity. They systematically review processes to uncover hidden cash sources:

- SKU Rationalization: Eliminate slow-moving products to reduce inventory carrying costs.

- Vendor Rebates: Renegotiate contracts for volume or early-payment discounts.

- Bank Account Consolidation: Implement sweep accounts to concentrate idle balances.

- Dynamic Discounting: Offer suppliers accelerated payments in exchange for price reductions.

- Sale-and-Leaseback: Monetize owned equipment without disrupting operations.

- Contract Renegotiations: Extend payment terms to align outflows with inflows.

Ensuring Long-Term Financial Health with Strong Liquidity Management

Effective cash flow management underpins ongoing importance of working capital management by embedding liquidity controls into daily routines. CFOs deploy rolling cash-flow forecasts and real-time bank integrations to spot deviations within hours, not days.

They tier cash into operational, strategic, and contingency buckets to prevent overspending. Regular balance-sheet stress tests ensure reserves withstand market disruptions, cementing the firm’s ability to invest, innovate, and outlast competitors.

How to Choose the Right CFO for Working Capital Management

Selecting a CFO with deep liquidity expertise cements the importance of working capital management in your organization’s DNA. The ideal candidate combines proven capital planning skills with formal credentials.

Look for Expertise in Cash Flow and Liquidity Management

CFO selection begins by prioritizing candidates with proven expertise in cash flow management. Their hands-on experience ensures the company maintains operational flexibility and controls borrowing costs.

- Confirm they have built and maintained rolling cash forecasts and stress-tested liquidity scenarios.

- Verify they have led CFO working capital optimization projects to sustain uninterrupted operations.

Assess Their Ability to Manage Accounts Receivable and Payable

As accounts receivable and payable are pivotal to working capital management, assess each candidate’s track record in shortening the cash conversion cycle. Strong CFOs establish clear credit policies to reduce DSO and negotiate favorable DPO terms

They centralize invoicing, leverage automated reminders, and monitor aging reports to enforce discipline.

Verify Their Track Record in Supporting Business Growth Through Working Capital Optimization

Begin by examining tangible outcomes: look for CFOs who have translated working capital improvements into growth funding.

- Documented reductions in cash conversion cycle.

- Case studies demonstrating freed-up cash deployed to new product launches or market expansions.

- Measurable improvements in liquidity ratios.

Ensure Strong Analytical Skills and Financial Insight

Effective CFOs dissect large datasets to uncover cash-flow drivers, using advanced analytics to optimize cash flow management. They build customized dashboards tracking DSO, DPO, and inventory turnover, enabling proactive adjustments.

Their financial insight guides scenario planning and sensitivity analyses, ensuring the company can navigate volatility. Candidates should demonstrate proficiency with ERP systems and BI tools, translating raw data into actionable working capital strategies.

Conclusion: Driving Business Success Through Strategic Working Capital Management

As CFOs implement these strategies, the importance of working capital management becomes clear: improved liquidity supports growth, risk mitigation, and sustainable profitability. By mastering accounts receivable, inventory management, payables, and forecasting, finance leaders can convert working capital into a strategic asset.

To discuss how these principles apply to your organization, schedule a complimentary consultation with our experts. At NOW CFO, we combine deep financial analysis with practical guidance to elevate your efforts.

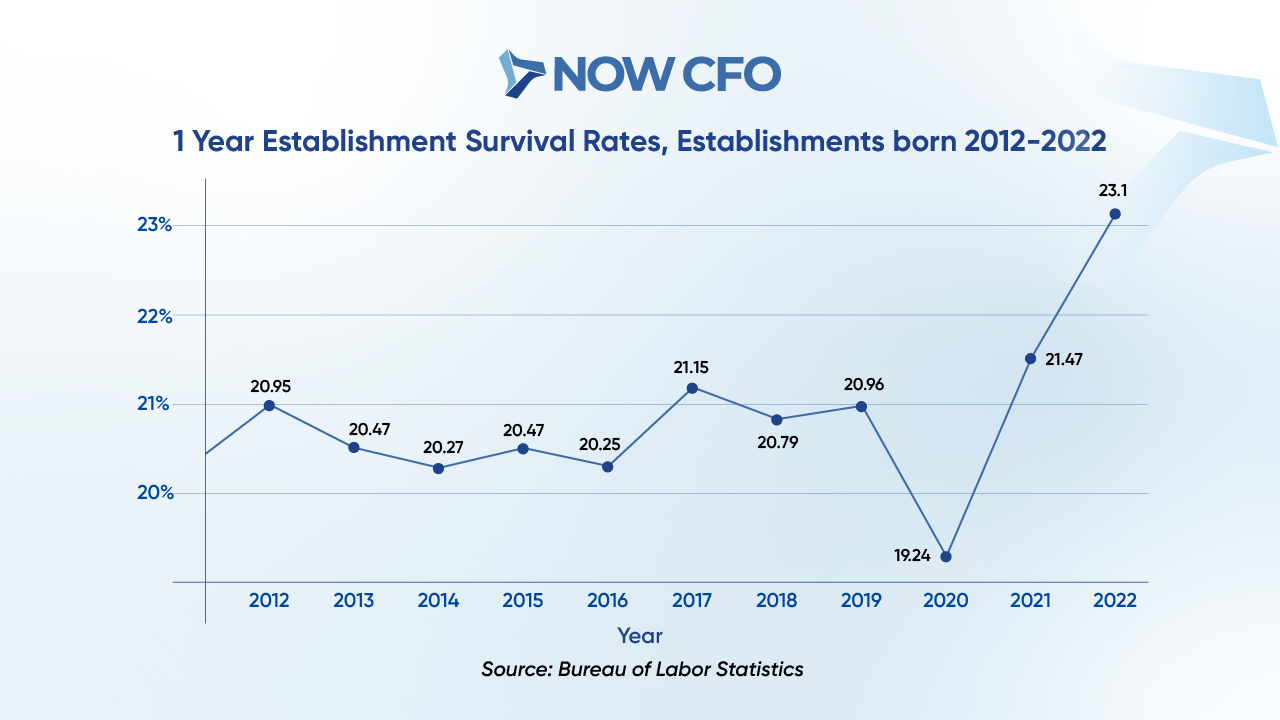

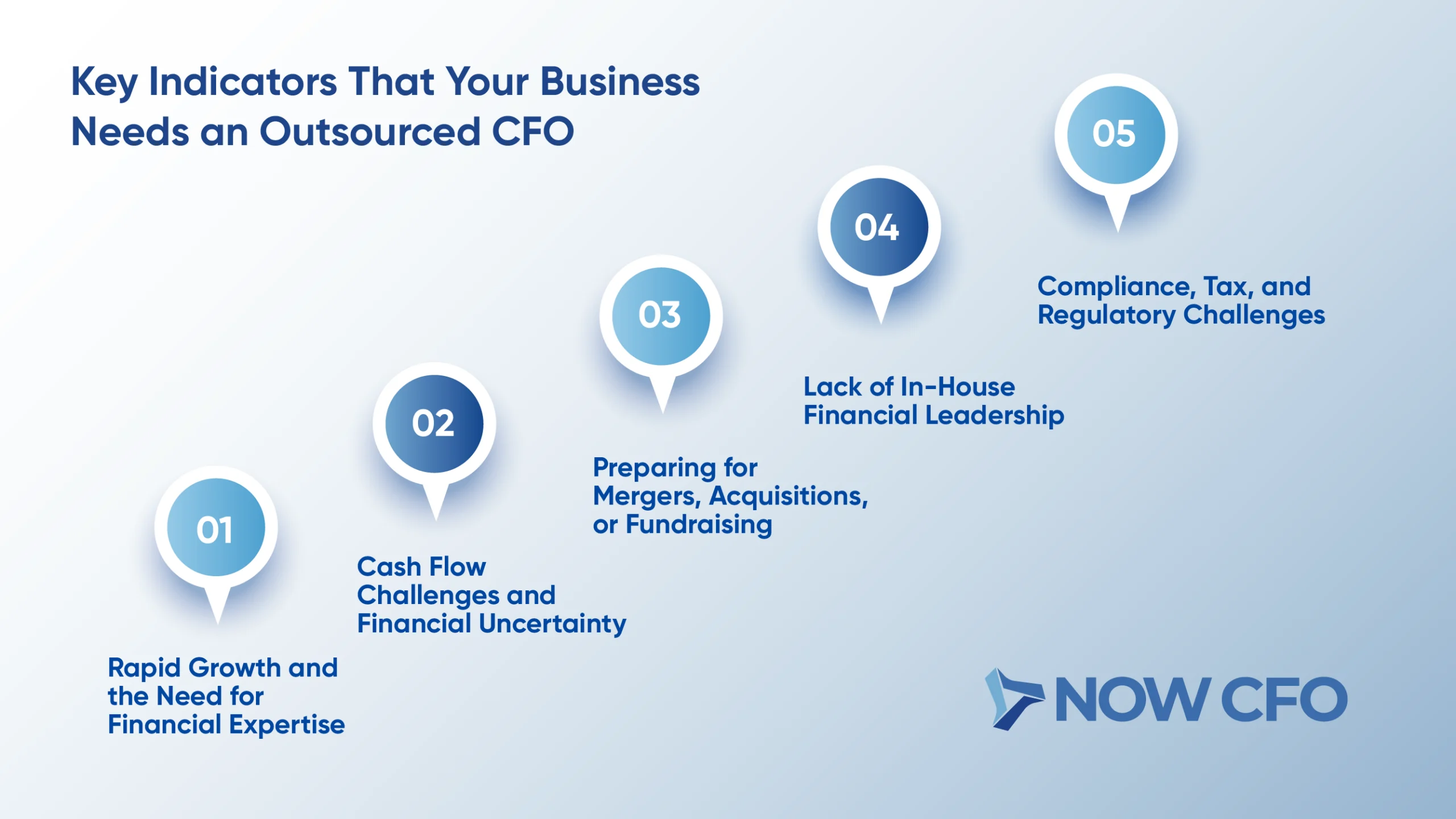

Businesses today face rapid change, increased competition, and thinner margins, making growth both essential and challenging. A survey from Business Talent Group reports that demand for interim CFOs surged by 103% year-over-year, underscoring how organizations increasingly rely on agile financial leadership during key growth phases.

Outsourced CFOs help identify and capitalize on emerging opportunities by delivering strategic financial planning, insightful modeling, and expert fundraising guidance. By tapping into financial growth strategies and leveraging CFO expertise in business expansion, these leaders empower entrepreneurs and executives to scale confidently.

The Role of an Outsourced CFO in Identifying Growth Opportunities

An outsourced CFO is pivotal in revealing factors that fuel business expansion. They guide companies toward scalable growth by applying financial acumen and strategic insights. Below are detailed breakdowns of their methods:

Conducting Comprehensive Financial Assessments

An outsourced CFO begins with a comprehensive financial assessment, reviewing historical data, profit and loss statements, balance sheets, and cash flow reports. They identify hidden inefficiencies and then benchmark performance against industry standards.

The CFO helps businesses implement financial growth strategies by aligning metrics with future goals, improving resource allocation, and reducing risk. According to BLS, 50% of small businesses fail by the fifth year, often due to poor planning.

Analyzing Key Financial Metrics to Identify Expansion Potential

CFO uses key metrics as growth indicators. They analyze EBITDA margins, ROIC, revenue per customer, and customer acquisition costs. They highlight metrics such as:

- Profit Margin Trends: Measuring operational scalability.

- Working Capital Ratios: Evaluating liquidity for investments.

- Cash Runway: Determining how long the business can sustain growth before needing funding.

Assessing Market Trends and Competitive Positioning

Moving forward, CFOs assess external factors that influence growth. They collect market size, growth rates, customer behavior, and competitive dynamics data. They use tools like SWOT and Porter’s Five Forces to understand market barriers and growth gaps.

For example, if market demand grows 8% annually, CFOs recommend strategic expansion in high-potential segments.

- Segment Growth Rates: Identifying rising markets.

- Pricing Benchmarks: Assessing competitiveness.

- Competitive Trends: Understanding rivals’ moves and differentiation.

Uncovering Internal Operational Efficiencies for Growth

CFOs link internally to identify cost-saving and productivity signals. They audit processes, systems, and workflows to find bottlenecks. They evaluate labor efficiency, tech usage, and supply chain performance using benchmarks.

CFOs recommend:

- Process Mapping: Identifying delays.

- Technology Integration: Automating manual tasks.

- Resource Allocation: Shifting capacity from low-value to high-impact work.

Aligning Financial Goals with Growth Strategies

With complete diagnostics, the CFO ensures that financial targets and strategic ambitions coincide. They have shepherd goal settings and define KPIs tied to growth, such as revenue growth rate, cost-to-revenue ratio, and capital efficiency.

They craft roll-out plans aligning quarterly goals with expansion milestones, product launches, markets, or partnerships. This alignment fosters accountability and clarity across teams. Using financial planning to capitalize on growth opportunities, leaders track progress dynamically and pivot as needed.

Key Strategies Outsourced CFOs Use to Capitalize on Growth Opportunities

Outsourced CFOs employ targeted financial techniques to build on strategic planning that allows companies to identify and capitalize on growth triggers more effectively.

Optimizing Cash Flow to Support Business Expansion

Effective cash flow management ensures liquidity for growth initiatives. CFOs stabilize inflows, accelerate receivables, and selectively extend payables.

They also build cash reserve targets aligned with expansion needs. Key tactics include:

- Receivables On Time: Implementing discount strategies can cut days sales outstanding (DSO) by 15–20%.

- Payables Strategy: Negotiating extended payment terms frees up working capital.

- Reserve Buffer: Ensuring that at least three months of forecasted expenses remain liquid.

- Liquidity Monitoring: Weekly dashboards track cash balances, burn rate, and runway.

Developing Scalable Financial Models for Growth

Outsourced CFOs build modular models that scale with the business, incorporating dynamic drivers such as pricing, volume, and costs. These models allow real-time scenario analysis and adapt to new offerings or regions.

This makes expansion more transparent and predictable. CFOs use these models to align forecasting with Outsourcing CFOs, Help Identify and capitalize strategies, and ensure financial planning for capitalizing on growth opportunities remains agile and evidence-based.

Identifying and Securing Investment or Financing for Growth

CFOs evaluate optimal financing aligned with expansion goals. They prepare investor-ready financials, valuation models, and pitch decks. They also manage negotiations, term sheets, and structure funding rounds.

By targeting appropriate sources, they ensure that capital supports strategic initiatives. Their due diligence ensures deals reinforce financial growth strategies, helping businesses identify and capitalize without compromising control or margins.

Creating Budget Plans that Align with Expansion Objectives

The CFO designs budget blueprints anchored in growth goals to convert strategy into action.

- Budget Attribution: Mapping funds to each expansion initiative—marketing campaigns, product dev, hiring.

- Contingency Setup: Classifying 10–15% reserve for route corrections.

- Milestone-based Release: Allocating funds at each KPI checkpoint.

- Variance Reviews: Monthly checks compare budget vs. actual and trigger pivot actions.

Leveraging Financial Data to Inform Strategic Decision-Making

Connecting from budgeting to tactical insights, CFOs deploy data systems that guide leadership towards informed decisions.

| KPI | Purpose | Frequency | Threshold Alert |

|---|---|---|---|

| CAC (Customer Acquisition Cost) | Understand the cost-efficiency of customer acquisition | Weekly | +10% over plan |

| Churn Rate | Gauge retention, health, and revenue sustainability | Monthly | 5% MoM rise |

| Gross Margin | Track profitability per product or service | Monthly | <3% drop |

| Segment Revenue Mix | Identify high-growth areas vs. underperformers | Quarterly | >15% variation |

How Outsourced CFOs Help Drive Strategic Growth Planning

Outsourced CFOs guide strategic expansion planning with precision and foresight to build on identifying and capitalizing growth. They construct robust frameworks that enable outsourced CFOs to help identify and capitalize on growth opportunities.

Establishing Long-Term Financial Goals Aligned with Growth

An outsourced CFO leads goal setting by connecting aspirational growth targets with measurable financial KPIs. They define 3–5-year revenue targets, margin improvements, and ROI metrics.

This table clarifies how financial planning for capitalizing on growth opportunities aligns with each goal.

Creating Actionable Plans for Expanding Products, Services, or Markets

Having set long-term goals, outsourced CFOs break them into executable plans. They:

- Conduct market sizing to prioritize segments, e.g., targeting regions growing at 10% annually.

- Define financial projections per initiative, detailing revenue, costs, and breakeven timelines.

- Assign resource plans, outlining budgets, headcount, and marketing investments.

- Schedule phased roll-outs—pilot → scale → full launch—reducing risk.

- Map accountabilities, who owns each milestone and KPI.

Monitoring and Managing Financial Risk as the Business Scales

As growth accelerates, financial exposure increases. Outsourced CFOs establish risk frameworks that adapt as scale increases. They categorize risk, market, operational, liquidity, and assign weightings.

They implement rolling forecasts and cash flow stress tests to preempt challenges. CFOs then trigger action plans when risks breach thresholds. This proactive stance ensures that strategic financial planning remains resilient under scale, allowing companies to identify and capitalize on opportunities without exposing the business to unmanaged risk.

Identifying Mergers, Acquisitions, or Partnership Opportunities

Outsourced CFOs scout M&A or partnership targets aligned with growth themes. They use financial models to evaluate synergies: cost savings, revenue enhancements, or market entry upside.

They build pro forma models to forecast combined performance against standalone paths. CFOs define valuation methodologies and evaluate financing options: cash, debt, equity, or earn-outs.

Supporting Leadership with Data-Driven Insights for Expansion

Outsourced CFOs ensure leadership teams receive real-time, actionable insights for informed decision-making. They deploy BI dashboards that track KPIs like customer acquisition cost, churn rate, and segment profitability. They set up automated reports for weekly, monthly, and quarterly intervals to maintain transparency on growth trajectories and triggers.

Financial Tools and Techniques Outsourced CFOs Use to Unlock Growth

These techniques enable organizations to effectively identify and capitalize on growth levers through strategic financial planning to ensure structured growth.

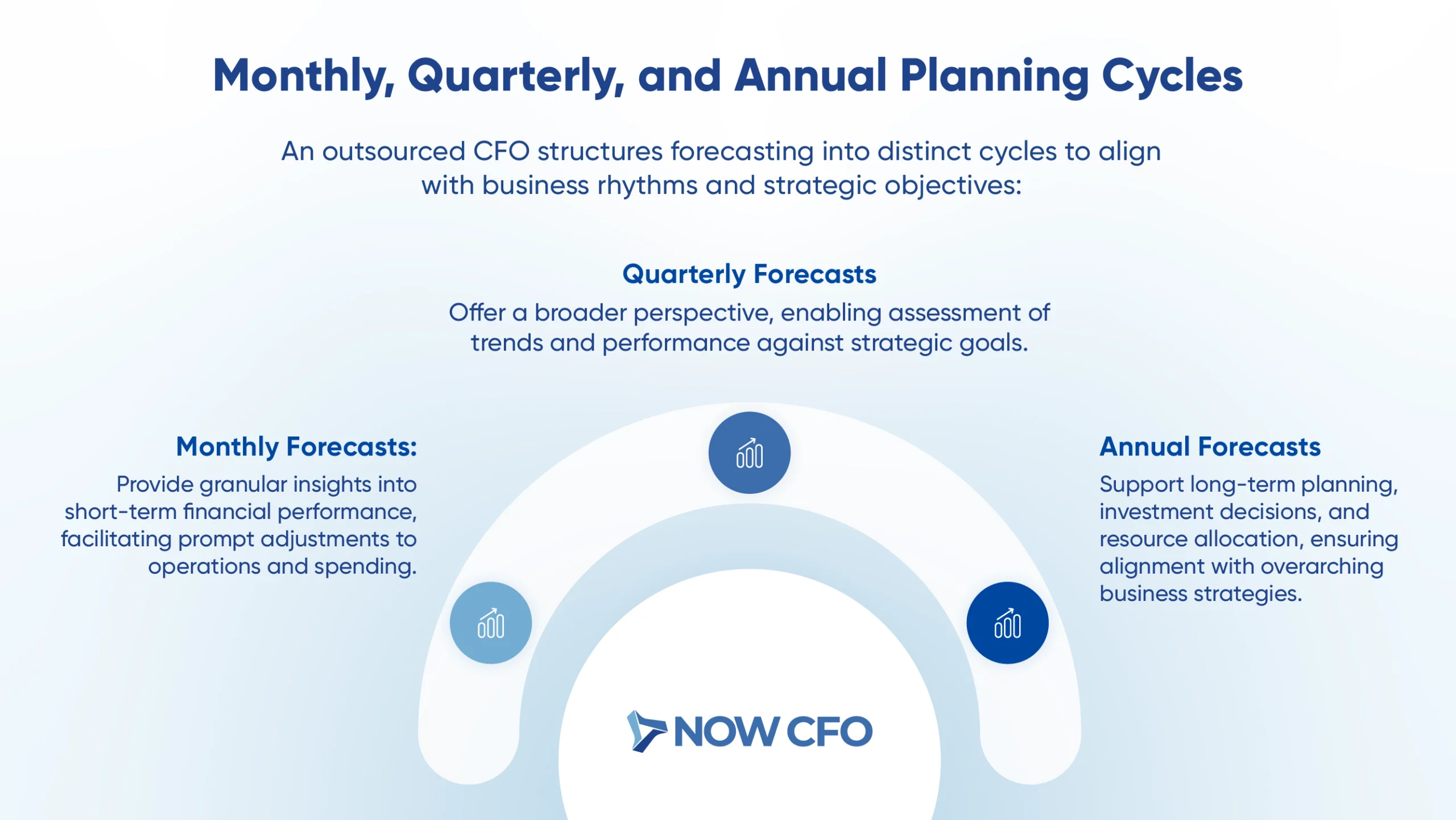

Utilizing Financial Forecasting and Modeling

Outsourced CFOs lead with robust forecasting and modeling to anticipate financial trajectories. Creating multi-year revenue, cost, and cash-flow models, they help businesses visualize the implications of different growth choices.

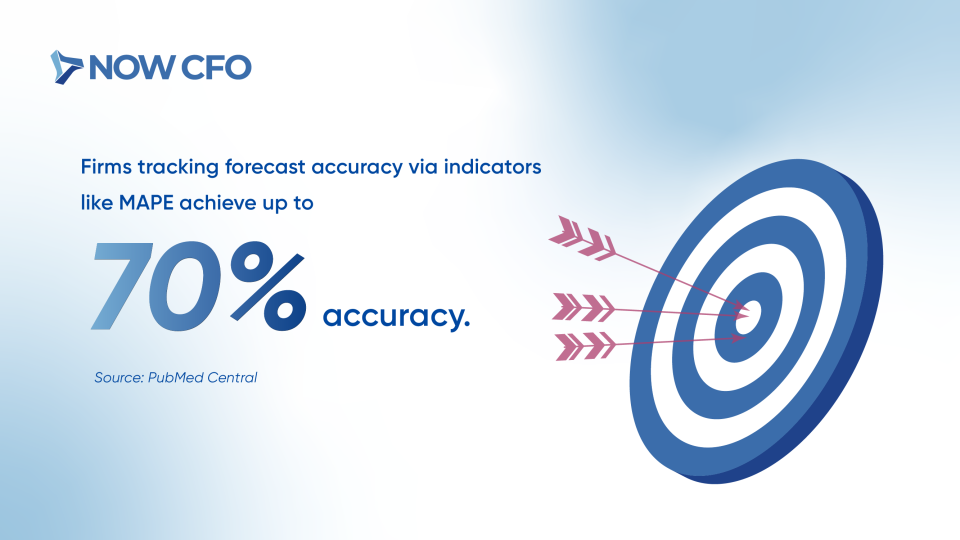

Forecasts break down into key drivers: sales volume, average price, and cost per unit, making them dynamic tools for decision-making. A study by PMC shows that firms tracking forecast accuracy via indicators like MAPE achieve up to 70% accuracy, guiding better decisions.

Firms tracking forecast accuracy via indicators like MAPE achieve up to 70% accuracy.

Source: PubMed Central

Implementing Performance Tracking Tools

Connecting from forecasting to real-time monitoring, performance tracking tools keep the growth engine on course. CFOs implement dashboards and scorecards to track KPIs tied to CFO business expansion, such as:

- Leading Indicators: Sales pipeline velocity and CAC.

- Lagging Indicators: Revenue, gross margin, EBITDA margin.

Balanced scorecard frameworks measure that are timely, comparable, and strategically aligned. Key features include:

- Real-Time Dashboards: Visualize week-to-date performance

- Alerts & Thresholds: Trigger notifications when metrics deviate

- Benchmark Comparisons: Compare against industry standards

- Cross-Functional Visibility: Ensure teams see performance links across operations, finance, and sales

Using Scenario Analysis to Assess Growth Risks and Rewards

Scenario analysis is at the core of prudent expansion. Under varying assumptions, CFOs create best-case, base-case, and worst-case scenarios to assess revenue, cost, and cash flow. They stress-test forecasts around key variables, such as economic shifts, supplier disruptions, and margin fluctuations.

For instance, a base-case projects revenue growth at 12%, best-case at 18%, and worst-case at 8%. CFOs then evaluate the capital buffer required under each scenario. Research from Mass.gov shows that multi-year financial forecasts serve as early warning tools.

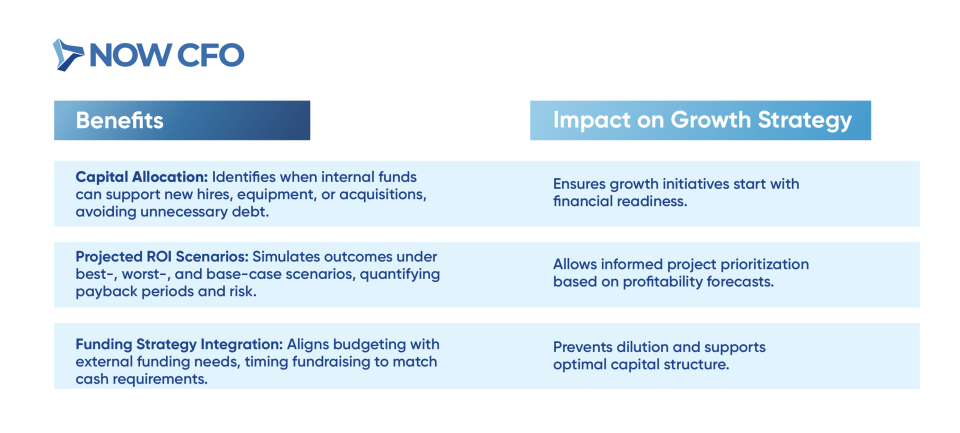

Optimizing Capital Allocation to Maximize Growth Potential

Linking tracking and modeling, CFOs ensure capital targets high-return growth areas. They:

- Analyze ROI per project, compare investing in a new product vs. market development.

- Prioritize capital requests based on NPV and payback.

- Allocate budgets to high-impact initiatives, like marketing rather than legacy ops.

- Defer or eliminate low-value spend; e.g., expensive software with low usage.

Supporting Decision-Making With Real-Time Financial Data

Outsourced CFOs embed real-time data flows into leadership dashboards; linking ERP, CRM, and accounting systems. This integration offers minute-by-minute visibility into cash position, sales trends, customer metrics, and departmental expenditures.

They implement tools like Power BI or cloud-native dashboards that update automatically. Leadership teams can spot cost overruns, sales dips, or cash flow variances as they occur. They also receive push reports, such as daily cash balance or weekly sales vs. forecast.

Benefits of Outsourced CFOs for Business Growth

An outsourced CFO brings strategic expertise and cost efficiency, enabling businesses to scale more effectively.

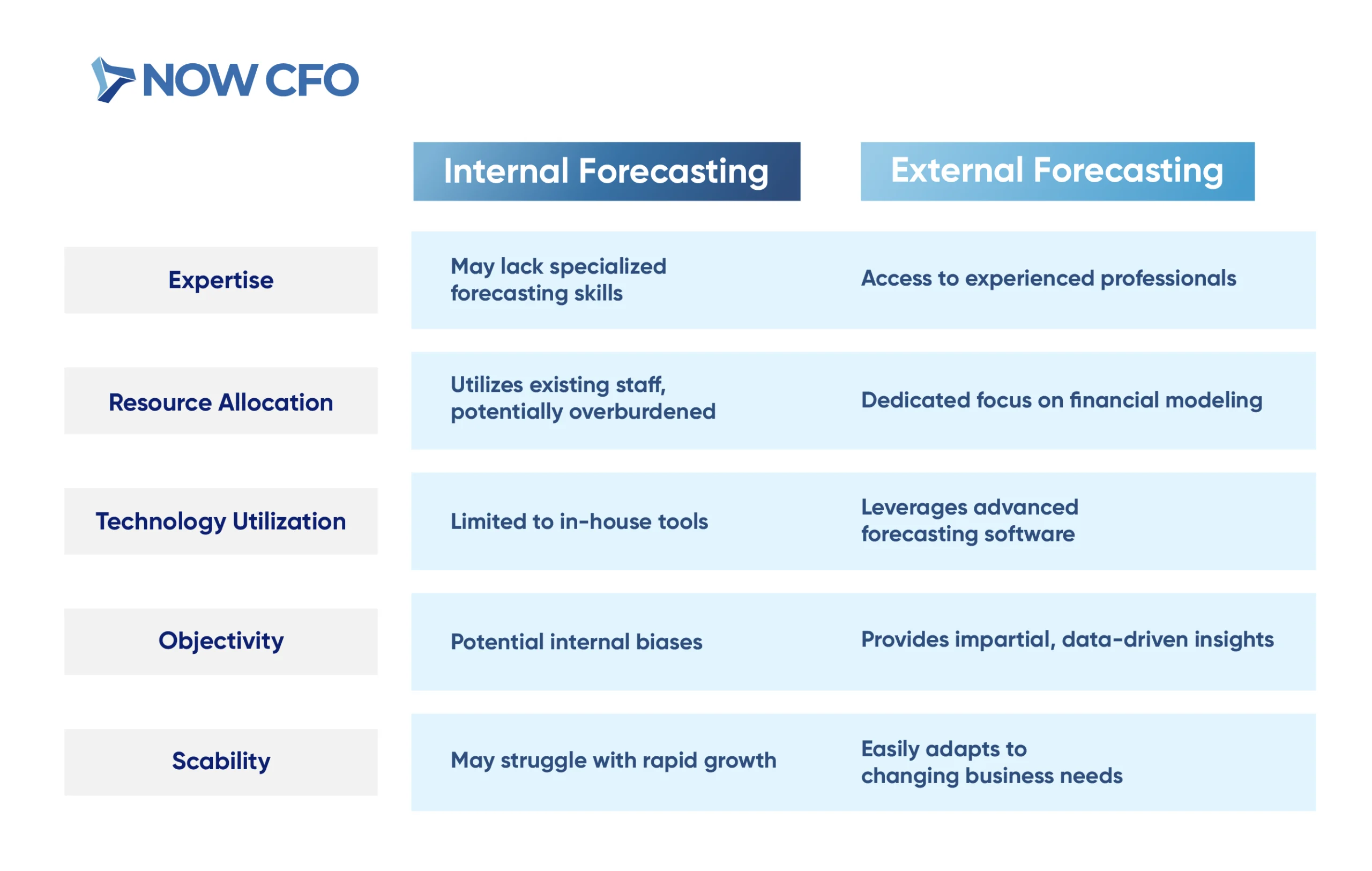

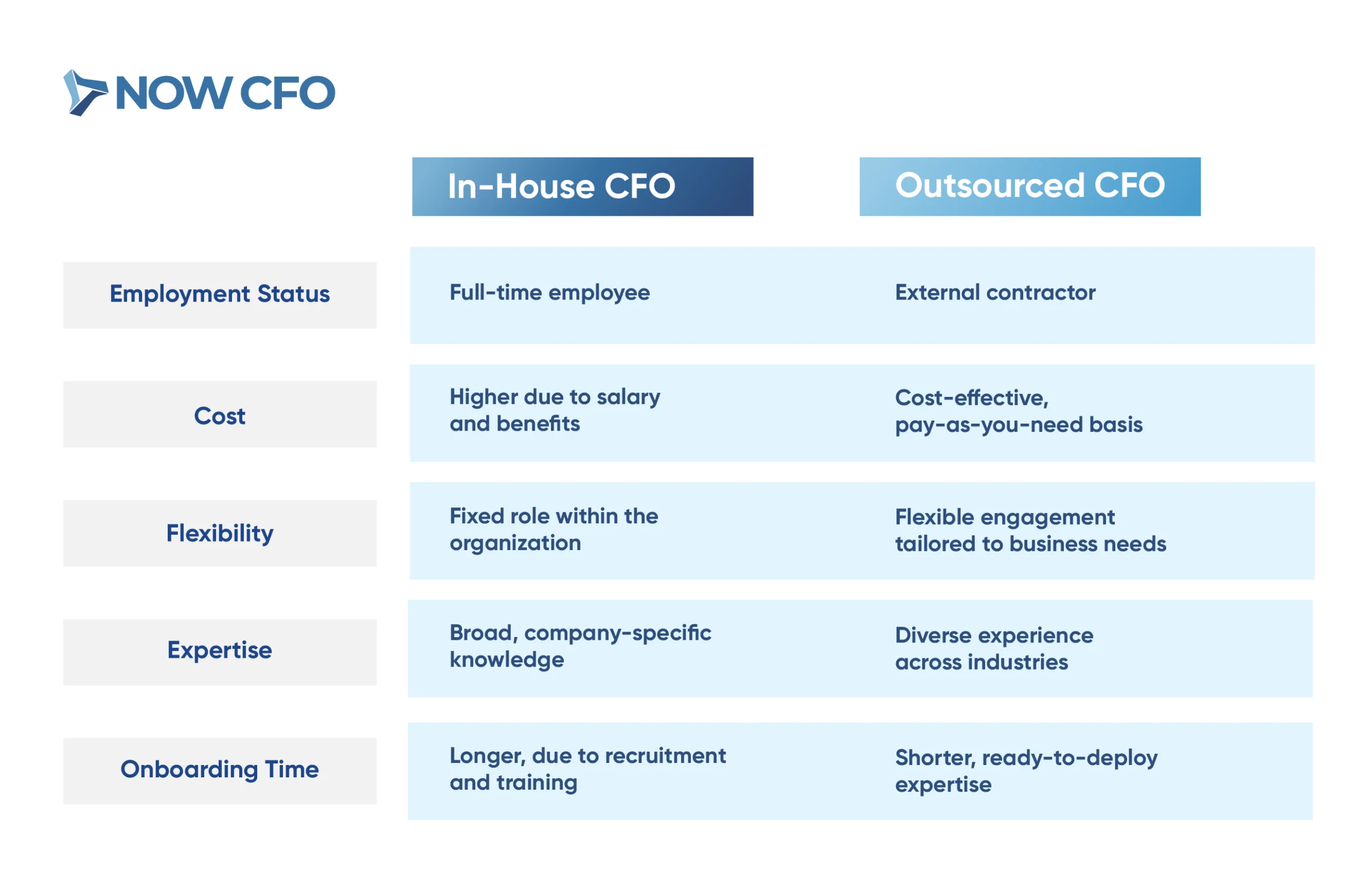

Access to Expertise Without the Full-Time CFO Costs

Companies gain access to seasoned financial leadership without the burden of a full-time CFO salary and benefits. Outsourced CFOs typically charge a scalable, predictable fee, offering flexibility aligned with business needs.

By leveraging outsourced CFOs, businesses tap high-level expertise only when needed. Small firms save significant leadership costs through fractionally outsourced executives.

Improved Financial Planning and Resource Allocation

Implementing structured planning boosts organizational agility and focus:

Financial Budgeting Frameworks

- Outsourced CFOs build rolling budgets aligned with strategic financial planning, reallocating funds toward high-growth initiatives, like product development or marketing channels.

- They embed contingency buffers to absorb market shifts, preserving stability during expansion.

Resource Allocation Optimization

- They analyze cost-to-value ratios across departments, prioritizing investments where ROI exceeds the threshold.

- Outsourced CFOs reassign resources from low-impact areas to fund strategic initiatives, reinforcing business growth and expansion.

Objective Analysis to Identify Growth Opportunities

Gathering unbiased insight is critical in strategic planning. An outsourced CFO offers impartial financial assessment unclouded by internal bias. They:

- Deploy benchmarking tools to compare KPIs against industry norms.

- Conduct zero-based reviews to question all expenditures, ensuring alignment with Outsourced CFO growth opportunities.

- Facilitate decision-making sessions using data trends rather than anecdotal evidence.

Greater Flexibility in Adapting to Market Changes

Outsourced CFOs enable nimble responses to evolving market conditions. As cost-effective, on-demand advisors, they can scale support up or down based on needs, from high-intensity growth phases to consolidation periods. They routinely re-evaluate forecasts, shifting capital between initiatives to match external trends.

This flexibility empowers businesses to pivot without being locked into fixed overhead. By harnessing outsourced CFOs to help identify and capitalize on adaptive financial governance, firms maintain resilience and remain capable of swift, competitive moves.

Enhanced Decision-Making with Accurate Financial Insights

Bridging strategy and execution, outsourced CFOs supply leadership with high-fidelity financial intelligence:

- Timely Reporting: Deliver weekly dashboards on metrics like gross margin, burn rate, and AR days, enabling real-time responses.

- Scenario Modeling: Generate predictive insights (e.g., “If we reduce CAC by 10%, how does unit economics improve?”), aiding resource prioritization.

How to Choose the Right Outsourced CFO for Identifying Growth Opportunities

Selecting the right outsourced CFO is critical for enabling your business to identify and capitalize on growth opportunities.

Look for Experience in Growth Planning and Strategy

Seek out outsourced CFOs with a track record in scaling businesses and executing financial growth strategies. Ask for examples of how they guided companies through revenue ramp-up, market entry, or product expansion. Look for familiarity with modeling growth scenarios, fundraising, and KPI implementation.

Assess Their Track Record in Helping Businesses Scale

Connecting experience to outcomes, evaluating measurable impact. Ask for case studies detailing growth targets versus results, e.g., revenue increase, margin improvement, capital raised. Verify the figures: Did revenue grow by 20% YOY? Did EBITDA margin expand by 5 points post-engagement? Did ROI exceed 12% on new investments?

Review:

- Revenue Growth Achievements: Specific percentages and timeframes.

- Cost Savings or Margin Expansion: Quantifiable improvements.

- Fundraising or Financing Outcomes: Dollars raised and valuation uplift.

- Speed of Scale: Time taken to reach milestones.

Verify Their Ability to Analyze Financial Data for Growth

Connecting expertise with execution, confirm their prowess in data-driven analysis. Inquire about the tools they use: ERP integrations, BI platforms, scenario modeling. Review their ability to extract insights from P&L, balance sheets, and cash flow; generate dashboards and forecasts; and translate data into actionable growth plans.

Check:

- Depth of Modeling Skills: Can they create multi-variable growth scenarios?

- Dashboard Experience: Have they deployed real-time KPI tools for leadership?

- Data Interpretation: Ask for examples where data uncovered unexpected growth levers.

- Decision Support: How often have they enabled pivots based on financial insights?

Ensure Strong Strategic Thinking and Problem-Solving Skills

Outsourced CFOs must think strategically and resolve complex issues. Look for consultants who ask incisive questions, propose multiple growth pathways, and test assumptions. They should demonstrate the ability to break down ambiguous challenges, design frameworks, and recommend clear, prioritized actions.

Evaluate their thought process during interviews: do they analyze the competitor landscape? Consider external trends? Plan resource in/outflows?

Confirm Their Alignment with Your Business’s Growth Vision

Culture fit and shared vision enhance collaboration. Discuss your long-term ambition, market position, product roadmap, and desired financial metrics during vetting. Gauge their enthusiasm and understanding.

Look for:

- Vision Mapping: Did they outline alignment exercises?

- Communication Approach: Do they articulate ideas clearly and listen well?

- Adaptability: Can they shift focus when growth conditions change?

Conclusion: Achieving Business Expansion with Outsourced CFO Support

Ultimately, outsourced CFOs Help Identify and capitalize on growth opportunities by combining virtual CFO expertise with advanced financial acumen. They guide businesses through developing strategic financial goals, executing expansion tactics, and managing risk with agility.

Ready to elevate your growth trajectory? Schedule a free consultation or a call and connect with our experts who align perfectly with your vision. Let’s unlock your growth potential; reach out today to start scaling smarter.

Effective budgeting and forecasting are critical foundations for business success. Compellingly, small businesses have created over 70% of net new jobs since 2019, underscoring their economic influence.

Companies can access elite financial forecasting strategies, cash flow planning, and budget management services by partnering with an outsourced CFO.

What Is Budgeting and Forecasting?

Connecting the broad concept of budgeting and forecasting to actionable business planning sets the stage for more profound insight.

Understanding the Difference Between Budgeting and Forecasting

Budgeting is a detailed financial road map for expected income and expenses. It is grounded in historical data and conservative estimates. It outlines what your business plans to achieve and where resources will go.

In contrast, forecasting and financial modeling involve projecting future trends based on real-time data, market shifts, and predictive analytics. Forecasts are updated regularly, ensuring your numbers stay relevant as conditions change.

Why Accurate Budgeting and Forecasting Are Crucial for Business Success

Accurate budgeting and forecasting are essential for businesses to operate confidently and strategically. Here are the key reasons:

- Cash Flow Planning & Liquidity: Reliable forecasts help ensure you always have enough cash to cover payroll, supplier bills, and unexpected costs.

- Informed Decision-Making: With precise forecasts, entrepreneurs can identify when to expand, hire, or tighten belts, supporting strategic financial planning that aligns with long-term goals.

- Risk Reduction & Contingency: Businesses with accurate forecasts spot potential downturns early, allowing proactive budget adjustments or cost-saving moves.

- Investor & Lender Confidence: Firms that routinely deliver on budgets build credibility.

- Resource Optimization: Knowing likely outcomes prevents over- or under-investment in inventory, marketing, or staffing.

How Outsourced CFO Services Enhance Budgeting and Forecasting

Outsourced CFOs bring specialist skills that elevate both planning and predictive financial performance.

Providing Expertise in Financial Modeling and Forecasting Techniques

Outsourced CFOs apply advanced financial forecasting strategies and forecasting and financial modeling methods to improve your planning accuracy. They build robust models to project various business scenarios and assess potential risks.

These professionals continuously refine models by integrating real-time market data, enabling you to see outcomes under different conditions (e.g., price changes, demand shifts). Their modeling incorporates historical performance and predictive analytics to simulate results, improving strategic decision-making with greater confidence.

Developing Accurate and Realistic Budgets for Business Growth

Outsourced CFOs craft budgets that align closely with growth objectives. Their process includes:

- Deep Analysis of Past Data: Using historical trends to set realistic projections.

- Targeted Forecasting: Incorporating seasonality, market expansion, and cost inflation.

- Stakeholder Collaboration: Ensuring budgets reflect operational realities and growth goals.

- Sensitivity Tests: Assessing how variations like a 10% sales dip or wage hikes affect cash flows.

- Periodic Reviews: Adjusting quarterly to stay informed and adaptive.

Improving Financial Decision-Making with Data-Driven Forecasts

Outsourced CFOs embed financial forecasting strategies into operations to shift decision-making from intuition to evidence. They deliver clear dashboards tracking key metrics such as revenue per product line, margins, and expense ratios. That visibility helps leadership quickly identify trends.

They also run scenario analyses, evaluating the outcomes of price changes, hiring plans, or investment decisions. Your team can make clear decisions by quantifying impacts on cash flow and profitability. In addition, comparing forecasts vs. actual results highlights forecasting accuracy over time, enabling continuous refinement.

Streamlining Cash Flow Management Through Better Planning

In addition to improved forecasts, outsourced CFOs enhance cash flow planning by:

- Analyzing cash conversion cycles and liquidity patterns.

- Designing cash flow forecasts that predict monthly/quarterly inflows and outflows.

- Advising on Net 30/60 terms to speed up receivables and optimize payables.

- Identify seasonal dips and implement lines of credit or savings buffers in advance.

- Automating cash tracking and metrics reporting for real-time insights.

Aligning Financial Plans with Long-Term Business Goals

Outsourced CFOs bridge day-to-day finance with strategic milestones:

- Interpret your vision: expansion, acquisitions, or innovation, and translate it into financial terms.

- Develop multi-year forecasts that map budget allocations, investment needs, and funding strategies.

- Conduct break-even and ROI analyses to prioritize initiatives that offer the best returns.

- Establish financial KPIs tied to growth in drivers (e.g., revenue per client, capital ROI).

- Track progress monthly, adapting forecasts to reflect new market trends, regulatory changes, or performance feedback.

Key Benefits of Outsourcing CFO Services for Budgeting and Forecasting

Building on the foundation of better budgeting and forecasting, outsourcing CFO services delivers tangible advantages.

Access to Specialized Expertise and Financial Insights

Outsourced CFOs bring a wealth of specialized expertise and actionable financial insights that internal teams often lack. They stay current on emerging financial forecasting strategies and regulatory updates.

Detailed Benefits:

- Niche Skill Sets: Outsourced CFOs are versed in advanced analytical tools—Monte Carlo simulations, scenario planning, and variance analysis, ensuring that your budgeting and forecasting reflect real-world dynamics.

- Cross-Industry Perspective: Having worked across sectors, they introduce best practices and benchmarks, giving you a competitive edge.

- Real-Time Advisory: Their insights help refine forecasts, optimize cost structures, and identify revenue opportunities before issues escalate.

- Technical Credibility: They bring credibility for stakeholder engagements—from investors to lenders, backed by rigorous, data-driven reports.

Cost-Effective Solution Compared to In-House CFOs

Outsourced CFOs provide financial leadership at a fraction of a full-time executive’s cost.

| Comparison | In-House CFO | Outsourced CFO |

|---|---|---|

| Base Salary + Benefits | $400K/year + perks | Pay-as-you-go model |

| Recruitment Costs | $30–$50K upfront | Included in service fees |

| Training & Software | Own training and licenses | Included or subsidized |

| Flexibility | Fixed cost regardless of workload | Adjust to business needs |

| ROI | Costly during slow growth | Scales revenue-to-cost ratio |

Flexibility to Scale Services as Business Grows

Outsourced CFOs adapt to your evolving needs. Whether launching new products, expanding markets, or navigating rapid growth, they adjust their focus and resources accordingly.

- Modular Engagements: Scale services up or down, say, during fundraisers or seasonal peaks, without overhead.

- Custom Expertise: Tap into specialists for debt structuring, M&A, or SaaS metrics as required.

- On-Demand Support: Get extra capacity during audits, budgeting cycles, or strategic initiatives, then scale back during quieter periods.

- Geographic Reach: Access financial talent with global or local nuances, ideal for international expansion.

Improved Forecasting Accuracy Through Advanced Analytics

Outsourced CFOs leverage advanced analytics to significantly enhance forecast precision, driving more accurate budgeting and forecasting.

Key Enhancements:

- Predictive Modeling: They incorporate statistical tools like ARIMA and LSTM, which reduce forecasting errors by up to 84–87% compared to traditional methods.

- Real-Time Data Integration: Forecasts continuously pull from ERP, CRM, and market APIs, enabling rolling forecasts that adapt swiftly.

- Dashboards & KPIs: Custom dashboards visualize key indicators (e.g., CAC, LTV, AR turnover), making trends visible at a glance.

- Anomaly Detection: Automated systems flag deviations early, preventing budget overruns and cash crunches.

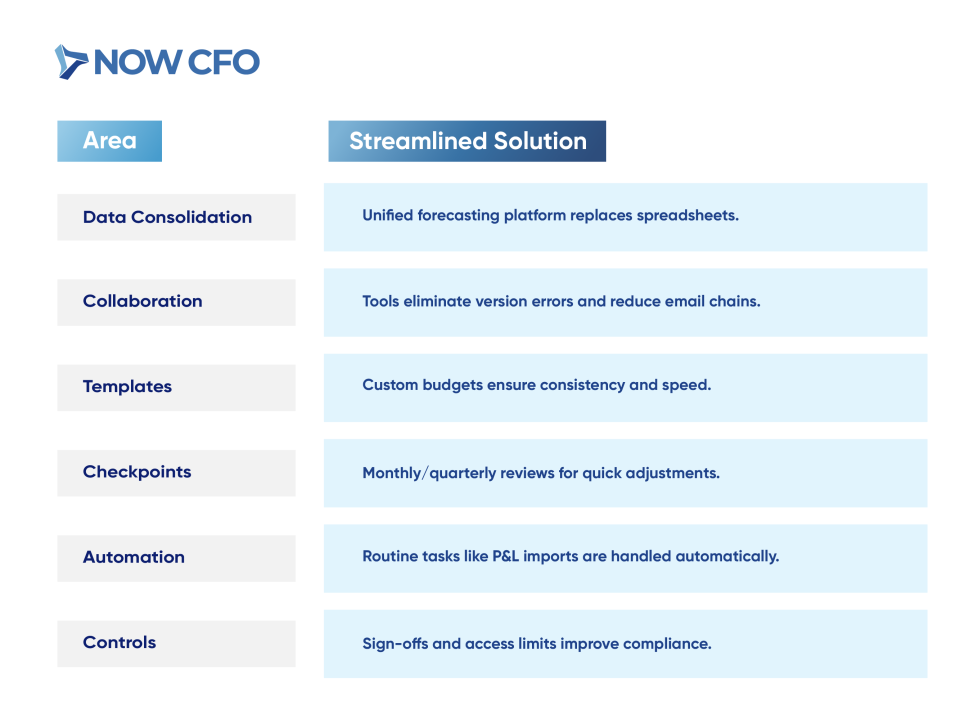

More Efficient Budget Management with Streamlined Processes

Outsourced CFOs transform budgeting into a streamlined, efficient process:

Learn More: Benefits of hiring an outsourced CFO.

How Outsourced CFOs Help Optimize Cash Flow Through Better Budgeting

Outsourced CFOs sharpen cash flow management by embedding detailed projections, controls, and contingency plans into your financial strategy.

Monitoring and Adjusting Cash Flow Projections

Outsourced CFOs continuously monitor cash flow planning by comparing actual inflows and outflows against forecasts. They conduct weekly or monthly variance analysis, tracking discrepancies in receivables, payables, and operating costs.

They also refine cash flow models based on trends, such as shifting customer payment behavior or supplier pricing changes. Updating the budgeting and forecasting with live data prevents liquidity shortfalls.

Identifying Cost-Saving Opportunities and Reducing Expenses

A proactive outsourced CFO doesn’t just watch cash; they uncover savings and cut waste.

Key tactics:

- Vendor Negotiation: Renegotiate payment terms, volume discounts, or bundled services; even a 5% reduction can save tens of thousands annually.

- Expense Audits: Review recurring services (e.g., software, subscriptions), cancelling dormant accounts, and ensure utilization aligns with value.

- Process Automation: Implement low-cost automation (e.g., accounts payable workflows) to reduce manual errors and associated late fees.

- Headcount Efficiency: Use forecasting to identify underutilized labor costs and realign staffing to peak periods.

- Energy & Overhead: Evaluate utility usage, lease agreements, and facility costs—minor optimizations often yield measurable savings.

Improving Cash Flow Forecasting for Greater Liquidity

Outsourced CFOs enhance financial forecasting strategies to ensure your business maintains sufficient liquidity. They integrate more dynamic data sources into cash flow models to predict tight periods in advance.

They also apply stress-testing scenarios: What happens if sales drop 20% or a major receivable is delayed? This forecast identifies minimum liquidity thresholds and required financing.

Implementing Financial Controls to Manage Cash Flow More Effectively

Outsourced CFOs establish controls that safeguard cash. They set approval thresholds, mandate dual signoffs for large disbursements, and tighten bill payment timetables. They also segregate duties, ensuring that no single employee handles invoice creation, approval, and payment, reducing fraud risk.

Automated reminders for receivables reduce aging balances, while scheduled reviews flag anomalies immediately. Regular reconciliation of bank and cash accounts becomes routine, ensuring accuracy and preventing leaks.

Creating Financial Contingency Plans for Unexpected Costs

Outsourced CFOs prepare you for the unexpected by building contingency budgets tied to worst-case scenarios. They allocate a percentage of monthly revenue to reserves or credit line capacity. They also map out triggers for deploying those reserves: major equipment failures, supplier disruptions, or economic shocks.

They prepare action plans, such as renegotiating supplier terms, delaying non-essential capital expenditures, or drawing on reserves. These strategies become part of your strategic financial planning toolkit, ensuring you can maintain operations and payroll even under stress.

Steps to Improve Budgeting and Forecasting with an Outsourced CFO

Outsourced CFOs guide businesses through a step-by-step process to enhance budgeting and forecasting accuracy and agility.

Conducting a Comprehensive Financial Assessment

Outsourced CFOs begin with a thorough financial assessment to establish a solid baseline. They identify trends in revenue, expense patterns, and working capital cycles, revealing areas for efficiency gains or structural improvement.

- Ratio & Trend Analysis: Calculate gross margin, operating margin, current ratio, and debt-to-equity to benchmark financial health.

- Cash Flow Evaluation: Examine receivables, payables, and inventory turnover to pinpoint liquidity bottlenecks.

- Forecast vs. Actual Review: Compare past projections with outcomes, measuring forecast accuracy through metrics like MAPE (Mean Absolute Percentage Error).

- Stakeholder Interviews: Engage management to understand drivers, pain points, and strategic priorities.

- System Audit: Assess current tools (ERPs, forecasting platforms) for data integrity and integration readiness.

Setting Realistic Budgeting Goals Based On Historical Data

Outsourced CFOs leverage past performance to define achievable goals. They analyze seasonal patterns, revenue volatility, and expense fluctuations over multiple cycles. Adjusting for outliers and one-time events, they craft budget targets rooted in business behavior.

Implementing Advanced Forecasting Tools and Technologies (≈330 words)

To elevate accuracy, outsourced CFOs introduce robust forecasting tools and tech solutions. They implement software integrating accounting platforms, CRM, sales, and market data.

Key Elements:

- Integrated data pipelines

- Scenario modeling features

- Dashboard visualization

- Collaboration tools

- AI-enhanced forecasting

Monitoring Key Financial Metrics and Performance Indicators

Once systems are in place, outsourced CFOs continuously monitor essential metrics. They build dashboards tracking:

Critical Metrics:

- Cash burn rate & Cash runway

- Gross and operating margin

- Days Sales Outstanding (DSO) & Days Payable Outstanding (DPO)

- Forecast accuracy metrics

- Working capital ratio

Adjusting Budgets and Forecasts as Market Conditions Change

When markets shift, outsourced CFOs steer timely budget revisions and forecast updates.

| Trigger Condition | Adjustment Action |

|---|---|

| Sudden revenue drop (>10%) | Reforecast cash flow, pause discretionary spending |

| Cost inflation (+5–8%) | Update expense budgets, adjust pricing assumptions |

| New product or expansion | Integrate new revenue/cost lines and capital needs |

| Regulatory change | Model compliance cost impacts on margins |

| Seasonal deviation (±15%) | Refresh forecasts and budgets to match current trends |

Benefits of Accurate Budgeting and Forecasting for Business Growth

Enhancing business growth begins with robust budgeting and forecasting, establishing stability, and fueling strategic expansion.

Improved Financial Stability and Profitability

Accurate budgeting and forecasting help secure a stable financial foundation by realistically aligning spending with revenue.

1. Predictable Cash Flow Buffer: Businesses avoid sudden shortfalls by projecting inflows and matching them to expenses.

2. Margin Improvement through Expense Management: Forecast-driven budgets highlight cost inefficiencies, allowing targeted cuts.

Enhanced Ability to Plan for Future Investments and Growth

Accurate forecasts empower strategic investment decisions by aligning forecasts and capital planning.

Reduced Financial Risk Through Proactive Planning

Forecast-driven budgets help companies anticipate and manage risk before it escalates. Businesses can establish contingency actions by simulating external pressures, like tightening variable costs or drawing down credit lines.

This budgeting and forecasting approach reduces risk by enabling early detection of red flags. When revenue underperforms, contingency budgets can delay non-essential spending, preventing crises.

Better Decision-Making with Reliable Financial Projections

Reliable forecasts turn budgeting into a strategic tool, not just a reporting exercise.

- Informed Operational Choices: Based on forecasted ROI, CFOs can determine optimal hiring timelines, marketing investment levels, or production scale-up.

- Scenario-Based Planning: When contemplating new market entry or pricing changes, projections help quantify the impact on revenues and margins.

- Comparative Results: Forecast vs. actual reporting highlights model accuracy and informs improvements in forecasting and financial modeling frameworks.

Stronger Investor Confidence Through Transparent Financial Reporting

Investors and lenders value clarity and consistency. Presenting detailed, transparent budgets and forecasts backed by credible assumptions strengthens credibility. When investors see robust budgeting and forecasting tied to KPIs and scenario paths, confidence in management grows.

Outsourced CFOs elevate this process by translating complex models into accessible narratives and dashboards, ensuring stakeholders understand assumptions, risks, and strategies. This reinforces governance and positions your company as investment-ready.

How to Choose the Right Outsourced CFO for Budgeting and Forecasting

Selecting the ideal outsourced CFO ensures your budgeting and forecasting efforts translate into real strategic value and growth.

Look For Expertise in Financial Planning and Analysis

Begin by evaluating a candidate’s depth in financial planning and analysis. They should master preparing detailed budgets, conducting variance analysis, and modeling cash flow scenarios.

Ask for examples of summary dashboards or monthly reports they’ve produced. FP&A expertise ensures your budgeting and forecasting are grounded in analytical rigor, improving resource allocation and aligning spending with strategy.

Assess Their Ability to Develop Custom Financial Models

An outsourced CFO must excel at building forecasting and financial modeling tailored to your business. Inquire about model complexity; do they create multi-scenario projections, break-even analyses, or funding-growth ROI dashboards?

Ask to review samples or walk through a model. Models should be dynamic (e.g., allowing pricing or volume tweaks) and transparent, enabling you to adjust assumptions independently.

Verify Their Track Record in Improving Forecasting Accuracy (≈240 words)

Ask for metrics on forecast precision. A top-performing CFO should provide historical comparisons. Third-party certifications (e.g., CFA, FP&A) or case studies add credibility.

Firms with structured forecasting (like rolling forecasts) reduce variance. This reflects mastery in budgeting and forecasting, boosting confidence that their interventions produce measurable gains.

Ensure They Have Experience in Managing Cash Flow and Budgets

Thorough cash flow planning and budget control experience matters. Verify they’ve handled working capital cycles, receivables/payables optimization, and contingency budgets.

- Cash Cycle Management: Ask how they improved DSO/DPO ratios in previous roles.

- Budget Control Systems: Explore their use of approval workflows, zero-based budgeting, or rolling forecasts to maintain discipline.

- Real-Time Monitoring: They should know how to set up dashboards with key metrics (e.g., burn rate, runway, variance alerts).

- Crisis Response: Ask for examples where they protected liquidity during downturns or surprise expenses.

Confirm Their Alignment with Your Business’s Financial Goals

Your outsourced CFO must share your vision and understand industry specifics.

- Strategic Fit: Gauge whether they prioritize your growth areas, such as geographic expansion, product development, or margin improvement.

- Customization Flexibility: Can they adapt models and reporting to reflect your market seasonality, customer dynamics, or regulatory environment?

- Communication Style: Ensure they can translate complex budgeting and forecasting models into clear visual tools and actionable summaries for stakeholders.

- Cultural Alignment: Evaluate whether their process matches your company’s pace and decision-making preferences.

- Long-Term Vision: They should propose multi-year plans and funding strategies linked to your business objectives, not just short-term budgets.

Learn More: Outsourced CFO vs Full-Time CFO

Conclusion: Achieving Financial Success with Outsourced CFO Services for Budgeting and Forecasting

Investing in accurate budgeting and forecasting through an outsourced CFO offers transformative results. Businesses gain a strategic edge and operational discipline by integrating cutting-edge analytics, customized financial modelling, and adaptive budget frameworks.

If you’re ready to elevate your financial planning and propel your business forward, connect with NOW CFO. You can schedule a complimentary consultation to explore tailored CFO solutions.

Growth rarely happens by accident; companies that scale predictably start with a clear financial playbook. A robust financial strategy in business growth pulls every lever into one cohesive roadmap that converts raw ambition into workable numbers.

The U.S. Census Bureau reports that the share of firms qualifying as high growth fell from nearly 20 percent in 1978 to under 13 percent in 2020. Against this backdrop, finance leaders must proactively identify where profit is generated, determine how aggressively to reinvest, and safeguard liquidity.

What is Financial Strategy and Why is it Important for Business Growth?

Building on the introduction, we explore financial strategy in business growth by clarifying its meaning and why it is indispensable to scale any enterprise.

Defining Financial Strategy

A financial strategy is the deliberately crafted roadmap that aligns a company’s capital structure, revenue targets, and risk profile with its long-term objectives. It dictates how leaders deploy equity, debt, and retained earnings, and how they adapt to market shifts through proactive cash flow optimization and cost management.

Critically, the strategy is not a static document; it evolves through periodic forecasting, variance analysis, and scenario planning to keep the company’s trajectory on course.

Only 34.7 % of businesses started in 2013 are still operating a decade later. Meanwhile, a Liberty University study found firms with post-formation business plans were 20 % more likely to survive than peers.

The Relationship Between Financial Planning and Business Expansion

Precise planning converts vision into executable steps, creating the bridge between strategy and day-to-day growth initiatives. Robust financial planning for business growth structures capital needs, timelines, and performance milestones.

| Financial Planning Activity | Expansion Outcome |

|---|---|

| Detailed revenue forecasting | Identifies funding gaps early, allowing timely capital raises |

| Scenario analysis & stress testing | Shields growth plans from market shocks by quantifying downside risks |

| Rolling budgets updated quarterly | Keeps resource allocation synced with evolving sales pipelines |

| KPI dashboards tied to strategic goals | Enables faster pivots when metrics drift from targets |

Key Components of a Financial Growth Strategy

To translate vision into execution, leaders break financial strategy in business growth into actionable building blocks that guide every dollar, forecast, and decision.

Financial Planning and Budgeting for Growth

A disciplined plan turns ambition into numbers that the team can hit.

- Build rolling 12-to-18-month budgets that flex with market shifts.

- Align revenue targets with cost baselines and long-term financial planning models.

- Use zero-based reviews each quarter to re-justify spend.

- Tie department budgets to enterprise KPIs so variances surface fast.

If done well, this planning frame will keep the broader financial strategy in business growth on course while freeing capital for innovation.

Cash Flow Management and Optimization

Growth stalls when liquidity dries up. Strong working-capital controls; dynamic cash forecasting, inventory turns benchmarking, and tight receivables follow-up—sustain momentum.

According to Penn State Extension, 82 % of business failures trace back to poor cash flow management

Source: Penn State Extension

Proactive monitoring, coupled with a CFO financial strategy that balances credit terms with supplier discounts, guards against those shocks and supports expansion funding.

Risk Management and Contingency Planning

Risk discipline converts surprises into solvable equations.

- Map strategic, operational, and financial risks against probability-impact grids.

- Pre-approve credit lines for downturn scenarios.

- Draft decision trees that trigger cost freezes or capital redeployments when metrics flash red.

Investment and Capital Allocation for Business Expansion

Smart capital deployment fuels scale. Allocate funds using hurdle-rate screening, NPV ranking, and portfolio balance across core, adjacent, and transformational bets.

Blend retained earnings with selective debt to optimize WACC, and revisit capital projects quarterly to re-route underperforming funds; an agile stance is central to a forward-looking financial strategy in business growth.

Performance Metrics and Financial Tracking

Finally, real-time dashboards, cash conversion cycle, ROIC, forecast accuracy, and customer acquisition cost close the loop between strategy and outcomes. Weekly variance reviews let leaders pivot before small drifts become margin bleeds, ensuring every decision reinforces the company’s overarching financial plan in business growth.

Learn More: Benefits of Hiring an Outsourced CFO

How Financial Strategy Drives Business Growth

Leaders turn vision into velocity when they make financial strategy in business growth the lens for every spending, investment, and hiring decision. Companies ensure that expansion strengthens the balance sheet by hard-wiring finance into operations.

Optimizing Resource Allocation to Support Growth

Strategic allocation moves capital from low-return tasks to high-return initiatives. Start by mapping each cost line to revenue potential, then rank projects against hurdle-rate thresholds to be sure funds flow to the best financial strategies for growing businesses rather than legacy habits.

A disciplined loop of forecast, spend, and review keeps the broader financial strategy for business growth tuned to market shifts and frees cash for innovation.

Managing Cash Flow to Ensure Stability During Expansion

A robust liquidity playbook keeps growth from outrunning cash.

- Build 13-week rolling forecasts that update daily sales and payables data.

- Shorten receivables cycles with early-payment incentives.

- Layer in a revolving credit facility sized at two months’ operating expenses.

- Automate AP scheduling to smooth weekly outflows.

Creating Scalable Business Models with Financial Projections

Before adding headcount or sites, management should test scalability assumptions.

- Use driver-based models that link revenue to customer-acquisition cost and churn.

- Stress-test margins under 10 %, 25 %, and 40 % growth scenarios.

- Model variable vs. fixed-cost breakpoints to time capacity investments.

- Feed results into funding schedules so capital raises happen before runway compresses.

Enhancing Decision-Making with Data-Driven Financial Insights

Dashboards that marry operational and financial KPIs accelerate action. When finance teams pipe real-time gross margin, cohort retention, and cash conversion cycle data to the C-suite, leaders pivot faster than rivals.

Small businesses generated 71% of net private-sector job gains in the current expansion. An outsourced CFO can institutionalize this rigor without adding full-time overhead.

Identifying Growth Opportunities Through Financial Analysis

Capital-efficient expansion starts with forensic finance reviews.

- Compare product-line gross margins to pinpoint categories ripe for upsell.

- Run market-sizing models to reveal underserved geographies.

- Use variance analysis to surface cost redundancies that can fund R&D.

- Track competitor benchmarking to expose pricing gaps.

The Role of a CFO in Developing a Financial Growth Strategy

A best-in-class CFO turns financial strategy in business growth from a spreadsheet into a living system, ensuring every operational choice accelerates revenue without compromising resilience.

Aligning Financial Strategy with Business Objectives

A proactive CFO starts by translating the board’s vision into quantifiable targets. In practice, she maps margin goals, market-share ambitions, and ESG commitments onto integrated forecasts, ensuring capital outlays, hiring plans, and pricing moves reinforce each objective.

Managing Financial Risks to Support Sustainable Growth

Risk oversight is not a compliance afterthought; it is the shock absorber that lets companies speed up safely. Modern CFOs institute enterprise-wide risk registers, quantify exposures in economic-value-at-risk terms, and build safeguard buffers into long-term financial planning models.

Yet the 2023 NC State ERM report shows only 28 % of firms deem their key risk indicators robust enough for strategic choices. By elevating risk dashboards to board level, finance chiefs close that gap and protect the role of financial management in business expansion.

Implementing Investment and Financing Strategies

A CFO’s capital playbook supplies fuel just when growth initiatives need it most.

- Prioritize projects with IRRs above the weighted-average cost of capital.

- Mix equity, term debt, and mezzanine tranches to keep leverage within covenant headroom.

- Sequence fundraising around milestone-based valuations to minimize dilution.

- Channel proceeds into investment strategies for business growth such as automation or go-to-market acceleration.

Analyzing Financial Data to Forecast Growth Potential

CFOs convert raw numbers into foresight by embedding analytics in everyday workflows:

- Real-time gross-margin tracking spots emerging profit pools.

- Cohort-based lifetime-value models size upsell potential.

- Monte-Carlo simulations test how to create a financial growth plan under volatile rate environments.

- Competitive-benchmark dashboards reveal pricing headroom before market share slips.

Monitoring and Adjusting Financial Plans as the Business Scales

Growth rarely follows a straight line, so CFOs institute rolling forecasts and monthly variance reviews to recalibrate quickly. When sales outpace production, they unlock emergency capex; when costs creep, they trigger zero-based scrub-downs.

By funneling insights from the field back into budgets, an outsourced CFO or in-house chief ensures capital stays aligned with opportunity and that contingency reserves remain intact, all while preserving stakeholder confidence in the overarching financial strategy for business growth.

Best Financial Practices to Support Business Growth

Sustaining momentum requires converting high-level financial strategy principles into daily habits that protect liquidity, fund innovation, and manage risk.

Prioritizing Cash Flow and Liquidity Management

Healthy cash is the oxygen of any expansion. Finance teams forecast weekly inflows and outflows, tighten collection terms, and stagger payables so working capital never dips below a two-month threshold.

Alarmingly, 50 % of SMEs hold fewer than 15 cash-buffer days; proof that vigilance matters. Anchoring policies to rigorous financial planning for business growth ensures short-term shocks do not derail scale-up plans.

Reinvesting Profits Into Growth-Oriented Projects

Profits should not idle in low-yield accounts; they must power financial growth strategies.

- Allocate a fixed share of after-tax earnings to product R&D and new-market pilots.

- Use hurdle-rate screens so only initiatives above the firm’s WACC receive funding.

- Establish “innovation tranches” that release capital once milestones are met, preserving flexibility.

Leveraging Debt and Equity for Expansion

External capital magnifies returns when balanced wisely.

- Tap term debt for asset purchases that throw off steady cash.

- Issue equity for long-cycle bets where early cash flow is limited.

- Maintain leverage below covenant cushions and stress-test coverage ratios quarterly.

Building Reserves for Growth and Risk Mitigation

Robust reserves turn shocks into speed bumps. Expansion initiatives should be backed by a liquidity cushion covering three months of fixed operating costs plus any committed capex. Reserves work best when segregated from daily cash and parked in laddered Treasury bills or high yield sweep accounts that can be liquidated within 72 hours.

Finance leaders should revisit target balances for each quarter, aligning them with evolving risk scenarios and broader long-term financial planning models. Automating weekly transfers from operating cash to the reserve fund keeps discipline high, while board-approved drawdown protocols prevent ad-hoc raids.

Continuously Reviewing and Refining Financial Strategies

Markets shift; so must your tactics.

- Run rolling forecasts and variance dashboards every 30 days.

- Hold quarterly war-room sessions to recalibrate pricing, cost curves, and capital priorities.

- Benchmark KPIs against top-quartile peers to trigger corrective action early.

Learn More: How to build a finance team with an outsourced cfo

Benefits of Implementing a Strong Financial Strategy for Growth

When companies embed a disciplined financial strategy, they harvest tangible, bottom-line advantages that compound year after year. The following benefits illustrate why a robust framework outperforms ad-hoc decision-making.

Increased Profitability and Business Stability

A data-driven plan boosts margins by steering resources toward the highest-return products and markets while trimming waste. U.S. corporate profits climbed 7.9 % in 2024 as firms tightened capital allocation and expense controls.

Consistent gains strengthen cash reserves, raise creditworthiness, and create a shock-absorbing cushion that keeps operations steady through economic swings.

Improved Financial Decision-Making and Planning

With structured dashboards and rolling forecasts, leaders replace intuition with evidence.

- Scenario modeling quantifies the upside and downside of proposed initiatives.

- Dynamic budgets tie spending to real-time KPIs, elevating the CFO’s financial strategy from gatekeeper to growth architect.

- Cross-functional planning sessions align sales, operations, and finance on shared milestones, driving financial strategies to support sustainable business growth.

Proactive Risk Management for Long-Term Success

A robust strategy embeds early-warning indicators; liquidity ratios, covenant headroom, hedging thresholds. This forward stance reduces earnings volatility, safeguards investor confidence, and preserves enterprise value, proving that risk prevention is itself a profit center.

Better Alignment of Financial Goals with Growth Objectives

Clear financial guardrails ensure that expansion targets mesh with liquidity needs and capital-structure limits. When revenue syncs with funding timelines, teams avoid overextension, and strategic bets receive timely support.

Alignment also clarifies accountability; every department knows which metrics define success and how they relate to enterprise-level goals.

Access to Capital for Expansion and Innovation

Funders reward transparency. A polished plan with investment strategies for business growth lowers perceived lender risk, unlocks favorable terms, and accelerates deal cycles, giving innovators the capital runway they need to outpace competitors.

Learn More: Outsourced CFO Improves Financial Planning

How to Develop a Financial Strategy That Drives Growth

Turning ambition into action begins with a structured process that embeds growth into every forecast, budget, and course-correction.

Conducting a Financial Assessment and Setting Growth Goals

A rigorous baseline analysis clarifies where the enterprise stands and how far it must travel. he matrix below delivers that snapshot by pairing each critical KPI with its current performance, an ambitious yet attainable target, a clear deadline, and a single accountable owner.

| Assessment Area | Current Metric | Target Metric | Timeline | Owner |

|---|---|---|---|---|

| Liquidity Ratio | 1.6× current liabilities | ≥ 2.0× | 12 months | Controller |

| Gross Margin | 34 % | 40 % | 18 months | VP Ops |

| Debt-to-Equity | 1.4× | ≤ 1.0× | 24 months | CFO |

| Customer Churn | 8 % monthly | 4 % | 9 months | CRO |

| R&D Spend | 3 % of revenue | 6 % | 12 months | CTO |

Creating a Detailed Financial Plan for Expansion

Next, finance leaders draft multi-scenario projections that link revenue drivers to resource needs. They layer capital-expenditure schedules, hiring ramps, and marketing outlays onto sales pipelines, then sync funding events with cash-flow inflection points.

Implementing Financial Controls to Ensure Accountability

Effective controls deter fraud and surface variances early:

- Segregate duties in receivables, payables, and payroll.

- Automate reconciliations with exception alerts to management.

- Dual authorization is required on payments above preset thresholds.

Using Financial Metrics to Track Growth Progress

Dashboards convert plans into real-time insight. Key metrics: cash-conversion cycle, forecast-to-actual variance, customer-lifetime value, stream directly to decision-makers, enabling mid-course pivots before minor drifts threaten margins.

Adapting the Strategy as the Business Evolves

Markets move; plans must follow.

- Schedule monthly variance reviews to recalibrate budgets.

- Re-rank investment pipelines every quarter against updated hurdle rates.

- Refresh risk scenarios semi-annually to capture new macro headwinds.

Conclusion: Empowering Business Growth with Effective Financial Strategy

Financial mastery is an ongoing discipline that transforms everyday decisions into compounding value. By embedding a rigorously monitored financial strategy in business growth, you convert uncertainty into opportunity, ensure cash is always on call, and maintain the credibility that lenders, investors, and employees rely on.

The frameworks outlined above equip you to avoid costly detours and accelerate toward bold revenue targets. Now it’s your move. Choose the next step that matches your urgency: schedule a complimentary consultation with a NOW CFO expert.

Effective debt oversight forms the backbone of a financially healthy enterprise. Proactively managing business debt bolsters liquidity and reduces financing costs, critical in an era when the small business loan default rate climbed to 3.0 percent in December 2023, up from 2.0 percent the previous year.

The Importance of Effective Debt Management for Businesses

It’s clear why effective debt oversight is vital for long-term resilience and growth. Let’s explore the impact of poor debt management on business growth, then examine how debt affects cash flow and financial stability.

Impact of Poor Debt Management on Business Growth

Growth stalls when business debt management strategies are weak because resources get diverted to service high-interest balances. Companies become risk-averse, missing opportunities to invest in expansion, personnel, or innovation.

Poor debt consolidation practices amplify repayment burdens. Debt spirals, and executives lack the bandwidth to manage business debt, pivot strategies, or negotiate terms.

How Debt Affects Cash Flow and Financial Stability

Weak debt management strategies directly hurt cash flow management and financial stability. High monthly debt service reduces available cash, limiting flexibility. Funding essential operations becomes unpredictable.

- Reduced Liquidity: Debt obligations eat into operating cash, making it challenging to cover payroll or supplies.

- Volatile Cash Flow Projections: When interest rates shift, variable-rate debt can suddenly spike payments, disrupting budgets. Businesses that fail to adjust projections risk missing obligations.