Financial visibility is more than just a reporting function; it is a growth strategy. Yet, many businesses operate without the financial leadership they need to thrive. According to QuickBooks, 68% of SMEs face cash flow challenges, and many lack the internal resources to manage finances.

As business owners struggle with rising costs, tighter margins, and complex reporting requirements, they often ask: What is an outsourced CFO? It’s a scalable solution that gives companies access to executive-level financial expertise without the full-time overhead.

Whether you’re scaling a startup or preparing for funding, outsourced CFOs provide financial clarity, operational insight, and strategic planning. Unlike bookkeepers or controllers, they focus on long-term business performance and serve as financial architects.

Understanding the Role of an Outsourced CFO

Companies increasingly seek flexible financial leadership today. This shift has led many to explore the benefits of outsourcing CFO functions. Understanding the role of an outsourced CFO is essential for organizations considering this strategic move.

Definition and Core Responsibilities

An outsourced CFO is a financial expert contracted externally to provide high-level strategic guidance without commitment to a full-time position. These professionals bring a wealth of experience, offering services tailored to a company’s needs. Key responsibilities include:

- Strategic Financial Planning: Developing comprehensive financial strategies aligned with the company’s long-term objectives.

- Cash Flow Management: Analyzing and optimizing cash flow to ensure financial stability.

- Budgeting and Forecasting: Creating accurate budgets and financial forecasts to guide decision-making.

- Financial Reporting: Ensuring timely and precise financial reporting for stakeholders.

- Risk Management and Compliance: Identifying financial risks and ensuring adherence to regulatory standards.

How an Outsourced CFO Differs from an In-House CFO

While both outsourced and in-house CFOs aim to enhance a company’s financial performance, they differ in several key aspects:

- Cost Efficiency: Outsourced CFO services typically range from $3,000 to $10,000 per month, offering significant savings compared to the average annual salary of a full-time CFO.

- Flexibility: Outsourced CFOs provide services on an as-needed basis, allowing businesses to scale financial expertise up or down based on current requirements.

- Diverse Experience: External CFOs often possess a broad range of industry experience, bringing fresh perspectives and best practices from various sectors.

These distinctions make outsourced CFOs an attractive option for companies seeking strategic financial leadership without the long-term commitment of a full-time executive.

The Growing Demand for Outsourced CFO Services

The demand for outsourced CFO consulting services has surged in recent years. According to BTG, the demand for interim CFOs increased by 103% year-over-year, highlighting the growing reliance on flexible financial leadership.

Key Industries That Benefit from Outsourced CFOs

Outsourced CFO services offer versatile benefits across various industries. Sectors that particularly gain from these services include:

- Startups and SMEs: These companies often lack the resources for a full-time CFO but require strategic financial guidance to support growth and attract investors.

- Nonprofits: With unique financial challenges and regulatory requirements, nonprofits benefit from outsourced CFOs who provide specialized expertise without straining limited budgets.

- Manufacturing Firms: Part-time CFOs assist in managing complex supply chains, cost structures, and capital investments, optimizing financial performance in a competitive market.

Common Misconceptions About Outsourced CFOs

Despite their advantages, several misconceptions about outsourced CFOs persist:

- Limited Commitment: Some believe outsourced CFOs lack dedication to the company. However, reputable professionals invest time in understanding the business deeply, offering tailored strategies and ongoing support.

- High Costs: While an investment is involved, the cost is often lower than hiring a full-time CFO. Virtual CFO solutions provide access to top-tier financial expertise without the expenses associated with a full-time executive salary and benefits.

- Restricted Scope: Contrary to the belief that outsourced CFOs handle only basic tasks, they offer comprehensive services, from strategic planning to risk management, tailored to the company’s evolving needs.

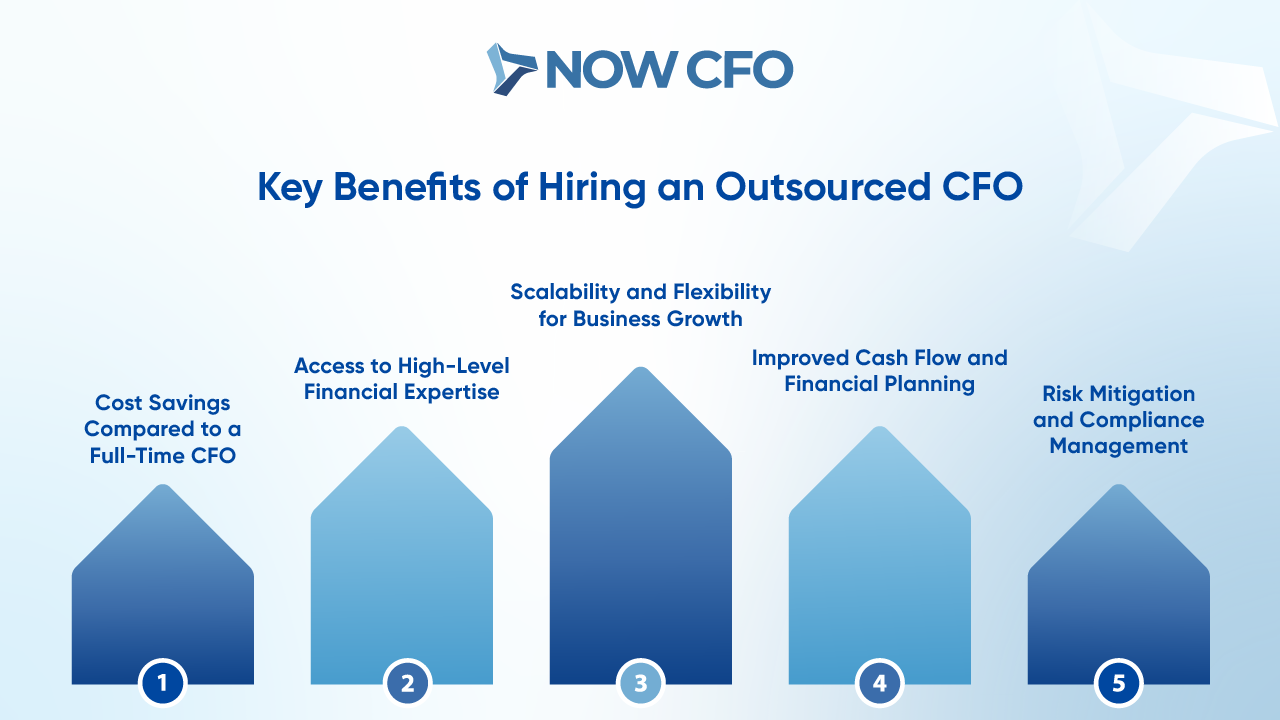

Key Benefits of Hiring an Outsourced CFO

Companies continually seek strategies to enhance financial management without incurring the substantial costs of full-time executive hires. One effective solution is engaging an interim CFO, which offers several advantages.

Cost Savings Compared to a Full-Time CFO

Hiring a full-time CFO involves considerable expenses, including salary and benefits, bonuses, and other compensation. In 2025, the median annual wage for a CFO is around $450K.

In contrast, CFO outsourcing services allow businesses to access high-level financial expertise at a fraction of the cost. This approach eliminates expenses related to full-time salaries, benefits, and bonuses, making it a financially sound choice for SMEs.

Access to High-Level Financial Expertise

An outsourced CFO provides businesses access to seasoned professionals with extensive industry experience. These experts offer strategic insights and advanced financial management skills that might be unattainable for SMEs.

Businesses can leverage their extensive knowledge to enhance decision-making processes, optimize financial performance, and effectively counter financial issues.

Scalability and Flexibility for Business Growth

As companies grow, their financial management needs fluctuate. Outsourced CFO services offer unmatched scalability and flexibility, allowing businesses to adjust to their financial needs.

Improved Cash Flow and Financial Planning

Effective cash flow management is critical to the sustainability and growth of any business. Outsourced CFOs specialize in developing and implementing strategies that enhance cash flow, ensuring companies have the necessary liquidity to meet obligations and seize opportunities.

Risk Mitigation and Compliance Management

Financial regulations and compliance standards can be daunting for many businesses. Outsourced CFOs bring a deep understanding of regulatory requirements, ensuring companies adhere to necessary guidelines and mitigate risks.

Their intuitive approach to risk management safeguards the company’s assets and reputation, allowing business leaders to focus on core operations confidently. By offering cost-effective access to high-level expertise, flexibility, and robust risk management, outsourced CFOs play a vital role in driving business success.

Learn More: Benefits of hiring an outsourced CFO

How an Outsourced CFO Helps Businesses

Companies increasingly recognize the value of an outsourced CFO in driving growth and enhancing financial performance. These seasoned professionals offer tailored services to support business expansion and sustainability.

Developing Strategic Financial Plans

An outsourced CFO collaborates with business leaders to craft comprehensive financial strategies aligned with the company’s long-term objectives. This process involves:

- Assessing Current Financial Health: Evaluating financial statements to identify strengths and areas for improvement.

- Setting Financial Goals: Establishing clear, measurable objectives that support overall business ambitions.

- Formulating Actionable Plans: Outlining steps to achieve financial targets, including resource allocation and timeline development.

Optimizing Cash Flow and Budgeting Processes

Effective cash flow management and budgeting are critical for maintaining liquidity and funding operations. An outsourced CFO assists by:

- Analyzing Cash Flow Patterns: Identifying trends and forecasting future cash positions to prevent shortfalls.

- Implementing Efficient Budgeting: Developing budgets that reflect realistic income and expenditure projections.

- Monitoring Financial Performance: Regularly review financial data to adjust strategies.

Preparing for Fundraising, Mergers, and Acquisitions

Navigating complex financial transactions requires expertise that an outsourced CFO provides. Their role includes:

- Fundraising Support: Identifying potential investors, preparing financial documents, and presenting compelling business cases.

- Mergers and Acquisitions Guidance: Conducting due diligence, valuing entities, and structuring deals to align with strategic goals.

Implementing Financial Forecasting and Risk Management

Anticipating future financial scenarios and mitigating risks are vital for sustainable growth. An outsourced CFO contributes by:

- Financial Forecasting: Utilizing historical data and market analysis to predict future financial outcomes.

- Risk Assessment: Identifying potential financial risks and developing strategies to minimize impact.

Leveraging Data Analytics for Smarter Decision-Making

Data-driven decisions are crucial in today’s competitive landscape. An outsourced CFO leverages data analytics to:

- Analyze Market Trends: Interpreting data to understand market dynamics and consumer behavior.

- Evaluate Performance Metrics: Assessing key performance indicators to inform strategic adjustments.

Outsourced CFO vs. In-House CFO: What’s the Difference?

In financial leadership, businesses often confuse employing a full-time CFO and an outsourced CFO. Each option presents distinct advantages and considerations across various dimensions.

Cost Comparison and Budget Considerations

Financial implications play a pivotal role in this decision. Hiring a full-time CFO comes with substantial expenses, costing a business between $300K and $500K yearly.

Alternatively, outsourced CFO services offer a more economical alternative. Monthly fees for outsourced CFOs typically range from $3,000 to $10,000, depending on the scope of services and company size.

This cost disparity makes outsourcing an attractive option for businesses aiming to optimize their financial leadership within budgetary constraints.

Level of Financial Oversight and Engagement

The degree of involvement differs notably between the two models. An in-house CFO is deeply embedded within the company, offering continuous oversight and immediate responsiveness to financial matters.

Conversely, an outsourced CFO provides expertise on a part-time or contractual basis, focusing on strategic initiatives and high-level financial management. While they may not be present for daily operations, their specialized knowledge can effectively address critical financial needs.

Strategic vs. Operational Focus in Decision-Making

Full-time CFOs often balance strategic planning with operational duties, such as managing internal teams and overseeing daily financial activities. Outsourced CFOs, however, primarily concentrate on strategic objectives, including economic forecasting, risk assessment, and long-term planning.

Flexibility and Scalability for Growing Businesses

Flexibility is crucial for organizations experiencing growth or fluctuating financial demands. Outsourced CFO services offer scalable solutions, allowing companies to adjust the level of financial expertise as needed.

This adaptability is particularly beneficial for startups and SMEs that may not require or afford a full-time CFO but still need strategic financial guidance.

Which Option is Best for Your Business?

Determining the appropriate choice depends on several factors:

- Company Size and Resources: Larger organizations with complex financial structures benefit from the constant presence of an in-house CFO. While smaller companies will find outsourced services more cost-effective.

- Financial Complexity: Businesses with intricate financial operations require the dedicated attention of an in-house professional, whereas those with less complexity can effectively utilize outsourced expertise.

- Growth Stage: Startups and rapidly growing companies often prefer the scalability of outsourced CFO services to align with their evolving needs.

How NOW CFO Provides Expert Outsourced CFO Services

At NOW CFO, we pride ourselves on delivering outsourced CFO services that empower businesses to achieve financial clarity and strategic growth. Our comprehensive approach encompasses tailored financial strategies, hands-on oversight, seamless team integration, advanced reporting, and industry-specific expertise.

Tailored Financial Strategies for Businesses of All Sizes

Understanding that each business has unique financial needs, we develop customized strategies to align with your goals. Our services include:

- Annual Operating Plans: Crafting detailed plans to guide your financial year.

- Financial Forecasting: Predicting future financial trends to inform decision-making.

- Capital Raise and M&A Support: Securing funding and navigating mergers or acquisitions.

Hands-On Financial Oversight from Experienced Professionals

Our team of seasoned professionals provides in-depth operational and strategic experience. We focus on your short- and long-term business goals, developing plans with attainable benchmarks. This hands-on approach ensures that your financial operations are managed effectively, allowing you to concentrate on core business activities.

Seamless Integration with Internal Teams

We believe that effective collaboration is key to financial success. Our consultants integrate seamlessly with your internal teams, working alongside existing staff to enhance financial processes without disrupting daily operations. This partnership fosters a cohesive environment where financial strategies are implemented smoothly and efficiently.

Advanced Financial Reporting and Performance Metrics

Access to accurate and timely financial information is crucial. We provide advanced reporting and performance metrics, including:

- Custom Management Reporting: Delivering tailored reports to meet your specific needs.

- SEC Compliance and Reporting: Ensuring adherence to regulatory standards.

- Audit Preparation: Assisting in preparing for and navigating audits.

Industry-Specific Financial Expertise

With experience across various industries, we offer specialized knowledge tailored to your sector. Our understanding of industry-specific challenges and opportunities enables us to provide relevant and practical financial guidance.

By partnering with NOW CFO, you can access a team dedicated to enhancing your financial health. Our commitment is to support your business in achieving its economic objectives with precision and professionalism.

Overcoming Common Challenges When Hiring an Outsourced CFO

Engaging an outsourced CFO can significantly enhance a company’s financial management capabilities. However, addressing several challenges that may arise during the engagement is crucial to reap the benefits fully.

Ensuring a Smooth Onboarding and Transition Process

A well-structured onboarding process is vital for integrating an outsourced CFO into your organization. To facilitate this transition:

- Develop a Detailed Onboarding Plan: Outline the CFO’s responsibilities, KPIs, and expected outcomes. A comprehensive 90-day plan can set clear expectations and milestones.

- Provide Essential Resources: Share critical documents such as financial statements, strategic plans, and budgets to familiarize the CFO with your company’s economic landscape.

- Organize Training Sessions: Schedule meetings to introduce the CFO to internal systems, processes, and team members, ensuring they have the necessary tools and knowledge to perform effectively.

Maintaining Clear Communication and Collaboration

Effective communication is the cornerstone of a successful partnership with an outsourced CFO. To achieve this:

- Establish Regular Check-Ins: Schedule consistent meetings to discuss progress, address concerns, and align objectives.

- Define Communication Channels: Determine preferred communication methods, such as email, phone calls, or video conferences, to ensure timely and efficient interactions.

- Foster Open Dialogue: Encourage transparency and candid discussions to build trust and facilitate collaborative problem-solving.

Addressing Data Security and Confidentiality Concerns

Outsourcing financial functions involves sharing sensitive information and prioritizing data security. To mitigate risks:

- Implement Robust Security Measures: Ensure your organization and the outsourced CFO use secure systems and protocols to protect data integrity.

- Establish Confidentiality Agreements: Draft and sign non-disclosure agreements (NDAs) to legally safeguard sensitive information.

- Regularly Review Security Practices: Conduct periodic assessments of data handling procedures to identify and address potential vulnerabilities.

Defining Roles and Expectations for Success

Clarity in roles and expectations prevents misunderstandings and aligns efforts toward common goals. To establish this clarity:

- Outline Specific Responsibilities: Delineate tasks and decision-making authority between the outsourced CFO and internal team members.

- Set Measurable Objectives: Define clear, quantifiable goals the CFO expects to achieve within specified timeframes.

- Document Agreements: Record all roles, responsibilities, and expectations in a formal agreement that will serve as a reference point throughout the engagement.

Measuring the ROI of Outsourced CFO Services

Evaluating the ROI ensures the engagement delivers tangible benefits. To measure ROI:

- Track Financial Performance: Monitor key financial metrics before and after the CFO’s involvement to assess improvements.

- Evaluate Strategic Contributions: Assess the CFO’s impact on strategic initiatives, such as successful fundraising efforts or operational efficiencies.

- Solicit Stakeholder Feedback: Gather insights from team members and stakeholders regarding the CFO’s effectiveness and the value added to the organization.

Is an Outsourced CFO Right for Your Business?

Determining whether an outsourced CFO fits your business correctly involves assessing your current financial management needs and growth objectives. You can make an informed decision by understanding and evaluating the associated costs and benefits.

Signs Your Business Needs Financial Leadership Support

As businesses evolve, specific indicators suggest the need for enhanced financial oversight:

- Rapid Revenue Growth: Experiencing a surge in revenue often leads to increased operational complexity, necessitating strategic financial management to maintain profitability.

- Declining Profit Margins Despite Increased Sales: If revenues are rising but gross profit margins are decreasing, it may indicate inefficiencies in cost management or pricing strategies.

- Lack of Strategic Financial Planning: Business decisions can hinder long-term success and growth without a clear financial strategy.

Evaluating the Benefits and Costs of Outsourced CFO Services

When considering an outsourced CFO, it’s essential to weigh the financial implications:

- Cost-Effectiveness: Outsourcing provides access to top-tier financial expertise at a fraction of the cost of a full-time CFO, eliminating expenses related to salaries, benefits, and bonuses.

- Flexible Engagement: Businesses can tailor the level of service to their specific needs, scaling up or down as required without the commitment of a permanent hire.

- Diverse Industry Experience: Outsourced CFOs often bring a breadth of experience across various sectors, offering innovative solutions and insights.

How an Outsourced CFO Can Solve Common Financial Challenges

An outsourced CFO addresses several financial hurdles:

- Strategic Planning: They provide high-level guidance to optimize revenue growth and identify new opportunities.

- Cash Flow Management: Implementing effective cash flow strategies ensures sufficient liquidity for operations and investments.

- Risk Mitigation: They help navigate regulatory compliance and implement controls to minimize financial risks.

Real-World Examples of Businesses Succeeding with Outsourced CFOs

Many companies have leveraged external CFO services to achieve significant improvements:

- Enhanced Financial Reporting: Businesses have experienced more accurate and timely financial reports, leading to better decision-making.

- Successful Fundraising: Fractional CFOs have guided companies through fundraising processes, securing necessary capital for expansion.

- Operational Efficiency: By streamlining financial operations, companies have reduced costs and improved profitability.

Steps to Finding the Right Outsourced CFO for Your Needs

To select an outsourced CFO that aligns with your business objectives:

- Assess Your Financial Needs: Identify the areas where you require expertise, such as strategic planning, cash flow management, or compliance.

- Research Potential Providers: Look for firms with experience in your industry and a track record of success.

- Evaluate Credentials: Ensure the virtual CFO has relevant qualifications and a history of delivering results.

- Discuss Expectations: Clearly outline your goals, expectations, and the scope of work to ensure alignment.

- Review Engagement Terms: Understand the terms of engagement, including fees, duration, and confidentiality agreements.

Conclusion: Unlock Business Success with an Outsourced CFO

Whether you aim to increase profitability, plan for long-term growth, or improve operational efficiency. Instead of juggling strategy, compliance, reporting, and forecasting all at once, business leaders can rely on outsourced financial leadership to do what they do best, steer the business forward.

At NOW CFO, we don’t believe in one-size-fits-all solutions. We embed ourselves into your team, understand your goals, and build custom financial strategies that support smarter decisions and measurable results. Our experts offer real-time insights, forward-looking forecasts, and hands-on support that adapts to your pace of growth.

Still, what is an outsourced CFO, and whether it’s the right move for your business? Let’s find out together. Schedule a free financial consultation. The next stage of your financial transformation starts with a single conversation. Let NOW CFO help you lead it.