The Benefits of Outsourcing Your CFO Services: Why It’s a Smart Business Decision

Traditional financial management models often fall short in terms of addressing the complexities and rapid changes businesses face. This is where the benefits of outsourcing your CFO services become evident. By leveraging external expertise, companies can access high-level financial leadership without the overhead of a full-time executive.

A recent survey highlights this trend, revealing that 90% of CFOs are now outsourcing at least some of their accounting functions to enhance efficiency. This shift underscores the growing recognition of outsourcing as a strategic tool for financial management.

Outsourced CFO services offer a range of advantages, including cost savings, scalability, and access to specialized expertise. Businesses can tailor these services to their specific needs, whether it’s for strategic planning, financial reporting, or navigating complex regulatory environments.

Why Businesses are Turning to Outsourced CFO Services

Companies are increasingly exploring alternatives to traditional financial leadership. One such alternative to gaining traction is outsourcing CFO services. This shift is driven by several compelling factors, including escalating costs, the need for adaptable financial leadership, and the complexities of regulatory compliance.

Rising Costs of Hiring a Full-Time CFO

The financial commitment required to board a full-time CFO is substantial. The annual salary of a full-time CFO can easily surpass $400,000. However, this figure doesn’t account for additional expenses such as benefits, bonuses, and other employment-related costs.

In contrast, engaging in a fractional CFO can be a more economical choice. Businesses might expect to pay a fractional CFO between $5,000 to $10,000 monthly, depending on the engagement’s scope and depth. This flexibility makes it cost-effective CFO services for startups and small businesses.

Key Financial Considerations:

- Salary Expectations: Full-time CFOs command high salaries, often exceeding $400,000 annually when including bonuses and benefits.

- Recruitment and Onboarding Costs: The process of hiring a full-time CFO involves significant recruitment expenses and time investments.

- Operational Overheads: Maintaining a full-time CFO includes costs related to office space, equipment, and other resources.

- Opportunity Costs: Delays in hiring can lead to missed strategic opportunities and financial inefficiencies.

- Flexibility: A fractional CFO offers flexibility to scale services according to business needs, providing cost-effective financial leadership.

The Need for Flexible and Scalable Financial Leadership

Modern businesses operate in an environment characterized by rapid change and uncertainty. In such a setting, the ability to adapt quickly is paramount. Traditional full-time CFOs may not always provide the agility required to navigate these challenges.

Outsourced CFO services offer a solution by providing access to seasoned financial professionals who can be engaged on a flexible basis. This model allows businesses to scale financial leadership up or down as needed, aligning with growth phases, market fluctuations, or specific projects.

Moreover, outsourced CFOs bring a wealth of experience from working with diverse industries and business models. This broad perspective can be invaluable in strategic planning and decision-making processes.

Increasing Complexity of Financial Regulations

The regulatory outlook for businesses has become increasingly intricate, with new laws and compliance requirements emerging regularly. This complex environment demands specialized knowledge and constant vigilance.

Outsourced CFOs are well-equipped to manage these challenges. They stay updated of the latest regulatory developments and ensure that businesses remain compliant, thereby mitigating risks associated with non-compliance.

For example, regulations for SMEs have grown increasingly complex, particularly with the introduction of the Corporate Transparency Act (CTA). Effective January 1, 2024, the CTA mandates that many SMEs, including LLCs and corporations with 20 or fewer full-time employees and less than $5 million in annual revenue, report detailed beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN).

This requirement aims to enhance transparency and combat illicit financial activities. However, it also introduces new compliance challenges for SME owners who must now navigate intricate reporting processes and deadlines. Failure to comply can result in significant penalties, underscoring the need for specialized financial oversight.

Outsourced CFOs are well-equipped to manage these challenges. They stay updated on the latest regulatory developments and ensure that businesses remain compliant, thereby mitigating risks associated with non-compliance.

What are the Benefits of Outsourcing CFO Services

Companies are increasingly recognizing the benefits of outsourcing your CFO services. This strategic move not only offers cost savings but also provides access to high-level financial expertise, improved financial planning, and advanced technological tools.

Let’s look into the strategic advantages of hiring a fractional CFO:

Significant Cost Savings with Outsourced CFO

Engaging an outsourced CFO can lead to substantial financial savings. According to SBA, the actual cost of an employee is typically 1.25 to 1.4 times their salary, accounting for benefits and other expenses. By outsourcing, businesses can avoid these additional costs, paying only for the services they need.

Key Financial Benefits:

- Reduced Overhead: No need for full-time salaries, benefits, or office space.

- Scalable Services: Pay for services as needed, aligning with business growth.

- Access to Expertise: Gain high-level financial insight without the full-time cost.

Access to High-Level Financial Expertise Without Full-Time Costs

Transitioning to outsourced CFO services provides businesses with unparalleled access to seasoned financial professionals. These experts bring a wealth of experience from various industries, offering insights that might be unavailable internally.

Advantages Include:

- Diverse Experience: Outsourced CFOs often have backgrounds in multiple sectors, providing a broad perspective.

- Strategic Planning: They assist in long-term financial planning, ensuring sustainable growth.

- Risk Management: Their expertise aids in identifying and mitigating potential financial risks.

Improved Financial Planning and Cash Flow Management

Effective financial planning and cash flow management are critical for business success. A study published in the National Center for Biotechnology Information highlighted that efficient cash flow management significantly enhances a firm’s financial performance.

Benefits of Outsourced CFOs in This Area:

- Accurate Forecasting: They provide precise financial forecasts, aiding in budgeting and investment decisions.

- Cash Flow Optimization: Implementing strategies to ensure positive cash flow, vital for daily operations.

- Financial Reporting: Timely and accurate reports help in tracking financial health and making necessary adjustments.

Stronger Compliance and Risk Mitigation Strategies

Navigating the complex landscape of financial regulations is a daunting task for many businesses. Outsourced CFOs play a pivotal role in ensuring compliance and mitigating risks.

Key Contributions:

- Regulatory Compliance: Staying updated with changing laws and ensuring the business adheres to them.

- Risk Assessment: Identifying potential financial risks and developing strategies to address them.

- Internal Controls: Implementing systems to prevent fraud and financial mismanagement.

Enhanced Decision-Making Through Data-Driven Insights

Incorporating data analytics into financial decision-making processes has become increasingly important. HBS reports that highly data-driven organizations are three times more likely to report significant improvements in decision-making compared to those who rely less on data.

Outsourced CFOs Facilitate This By:

- Analyzing Financial Data: Interpreting complex data to provide actionable insights.

- Strategic Recommendations: Using data to guide investment and operational decisions.

- Performance Monitoring: Tracking key performance indicators to assess business health.

This data-driven approach enables businesses to make informed decisions, enhancing efficiency and profitability.

Increased Efficiency with Advanced Financial Tools and Technology

Embracing modern financial tools and technology is essential for staying competitive. Outsourced CFOs bring expertise in utilizing these tools to streamline financial processes.

Technological Advantages:

- Automation: Implementing software to automate routine tasks, reducing errors and saving time.

- Real-Time Reporting: Access to up-to-date financial data for timely decision-making.

- Cloud-Based Solutions: Facilitating remote access and collaboration, enhancing flexibility.

How an Outsourced CFO Can Drive Business Growth

Leveraging the benefits of outsourcing your CFO services can be a strategic move to foster growth. Outsourced CFOs bring a wealth of experience and expertise, enabling businesses to make informed decisions, manage financial complexities, and scale effectively.

Supporting Business Expansion and Investment Decisions

As businesses aim to expand, they encounter various financial challenges and opportunities. An outsourced CFO plays a pivotal role in navigating these complexities, ensuring that expansion efforts are financially sound and strategically aligned.

- Strategic Financial Planning: Outsourced CFOs assist in developing comprehensive financial strategies that align with business goals. They analyze market trends, assess financial risks, and create detailed forecasts to guide expansion decisions.

- Investment Readiness: Preparing for investment requires meticulous financial documentation and a clear understanding of the company’s financial health. Outsourced CFOs help businesses become investment-ready by ensuring accurate financial reporting, optimizing capital structures, and presenting compelling financial narratives to potential investors.

Helping with Mergers, Acquisitions, and Business Valuation

M&A are complex processes that require thorough financial analysis and strategic insight. An outsourced CFO provides invaluable support throughout the M&A lifecycle, from initial evaluation to post-merger integration.

- Due Diligence: Outsourced CFOs conduct comprehensive due diligence, assessing the financial health of target companies, identifying potential risks, and evaluating synergies. This rigorous analysis ensures informed decision-making and mitigates the risk of unforeseen liabilities.

- Valuation Expertise: Accurate business valuation is critical in M&A transactions. Outsourced CFOs employ various valuation methods, such as discounted cash flow analysis and comparable company analysis, to determine fair market value.

- Integration Planning: Post-merger integration is often the most challenging phase of M&A. Outsourced CFOs develop integration plans that align financial systems, consolidate operations, and streamline processes.

Optimizing Financial Processes for Sustainable Growth

Sustainable growth requires efficient financial processes and robust internal controls. Outsourced CFOs play a crucial role in optimizing these processes, ensuring that businesses can scale effectively while maintaining financial stability.

They assess existing financial workflows, identify inefficiencies, and implement best practices to enhance productivity. This involves automating routine tasks, improving financial reporting accuracy, and establishing KPIs to monitor progress.

By streamlining financial operations, businesses can reduce costs, improve cash flow management, and make data-driven decisions that support long-term growth. Additionally, outsourced CFOs provide training and support to internal teams, fostering a culture of financial accountability and continuous improvement.

How Outsourced CFOs Improve Financial Reporting and Forecasting

Outsourcing your CFO services can significantly enhance financial reporting and forecasting capabilities. Outsourced CFOs bring specialized expertise and advanced tools to ensure accuracy, timeliness, and strategic insights into financial management.

Enhancing Accuracy and Timeliness in Financial Reports

Accurate and timely financial reporting is crucial for informed decision-making and maintaining stakeholder confidence. Outsourced CFOs streamline reporting processes, ensuring that financial statements are not only precise but also delivered promptly.

Key Advantages:

- Standardization of Processes: Implementing consistent reporting frameworks reduces errors and enhances comparability across periods.

- Automation of Routine Tasks: Utilizing financial software to automate data entry and reconciliation minimizes manual errors and accelerates report generation.

- Real-Time Data Access: Providing stakeholders with up-to-date financial information facilitates proactive decision-making.

Using Data Analytics for Better Financial Predictions

Predictive analytics has revolutionized financial forecasting by enabling businesses to anticipate trends and make data-driven decisions. Outsourced CFOs leverage advanced analytical tools to enhance the accuracy of financial predictions.

Implementation Strategies:

- Time Series Analysis: Employing models like ARIMA and LSTM to forecast future financial performance based on historical data.

- Scenario Planning: Developing multiple financial scenarios to prepare for various market conditions and uncertainties.

- Key Performance Indicators (KPIs): Monitoring KPIs to assess financial health and predict future outcomes.

Identifying Financial Risks and Opportunities Proactively

Proactive risk management and opportunity identification are essential for sustainable business growth. Outsourced CFOs play a pivotal role in these areas by implementing robust financial strategies.

Risk Management:

- Enterprise Risk Management (ERM): Applying frameworks like COSO ERM to identify, assess, and manage financial risks.

- Compliance Monitoring: Ensuring adherence to financial regulations to mitigate legal and financial penalties.

Opportunity Identification:

- Market Analysis: Evaluating market trends to identify potential areas for expansion or investment.

- Financial Benchmarking: Comparing financial metrics against industry standards to uncover areas for improvement.

When Should Your Business Consider Outsourcing CFO Services?

Determining the right time to leverage the benefits of outsourcing your CFO services is crucial for optimizing financial management and strategic growth. Recognizing specific signs and understanding industry-specific advantages can guide businesses in making informed decisions.

Signs That Indicate You Need CFO Expertise

Identifying the need for CFO expertise is the first step towards enhancing your company’s financial health. Here are key indicators:

- Rapid Business Growth: Experiencing swift expansion can lead to complex financial challenges that require expert oversight.

- Financial Uncertainty: Facing fluctuating revenues or unexpected expenses necessitates strategic financial planning.

- Preparing for Investment or Sale: If considering attracting investors or selling your business, a CFO can prepare your financials for due diligence.

- Lack of Financial Expertise in Your Team: Operating without a dedicated financial expert can hinder informed decision-making.

- Cost-Effective Solution: Hiring a full-time CFO may be financially burdensome; outsourcing offers flexibility and expertise without the overhead.

Industries That Benefit the Most from CFO Outsourcing

Certain industries find significant value in outsourcing CFO services due to their unique financial complexities:

- Technology and SaaS: Rapid innovation cycles and subscription-based models require dynamic financial strategies.

- Healthcare: Navigating regulatory compliance and managing diverse revenue streams benefit from specialized financial oversight.

- Manufacturing: Managing supply chains, inventory, and production costs necessitates precise financial planning.

- Nonprofits: Ensuring compliance with funding requirements and maximizing resource allocation are critical.

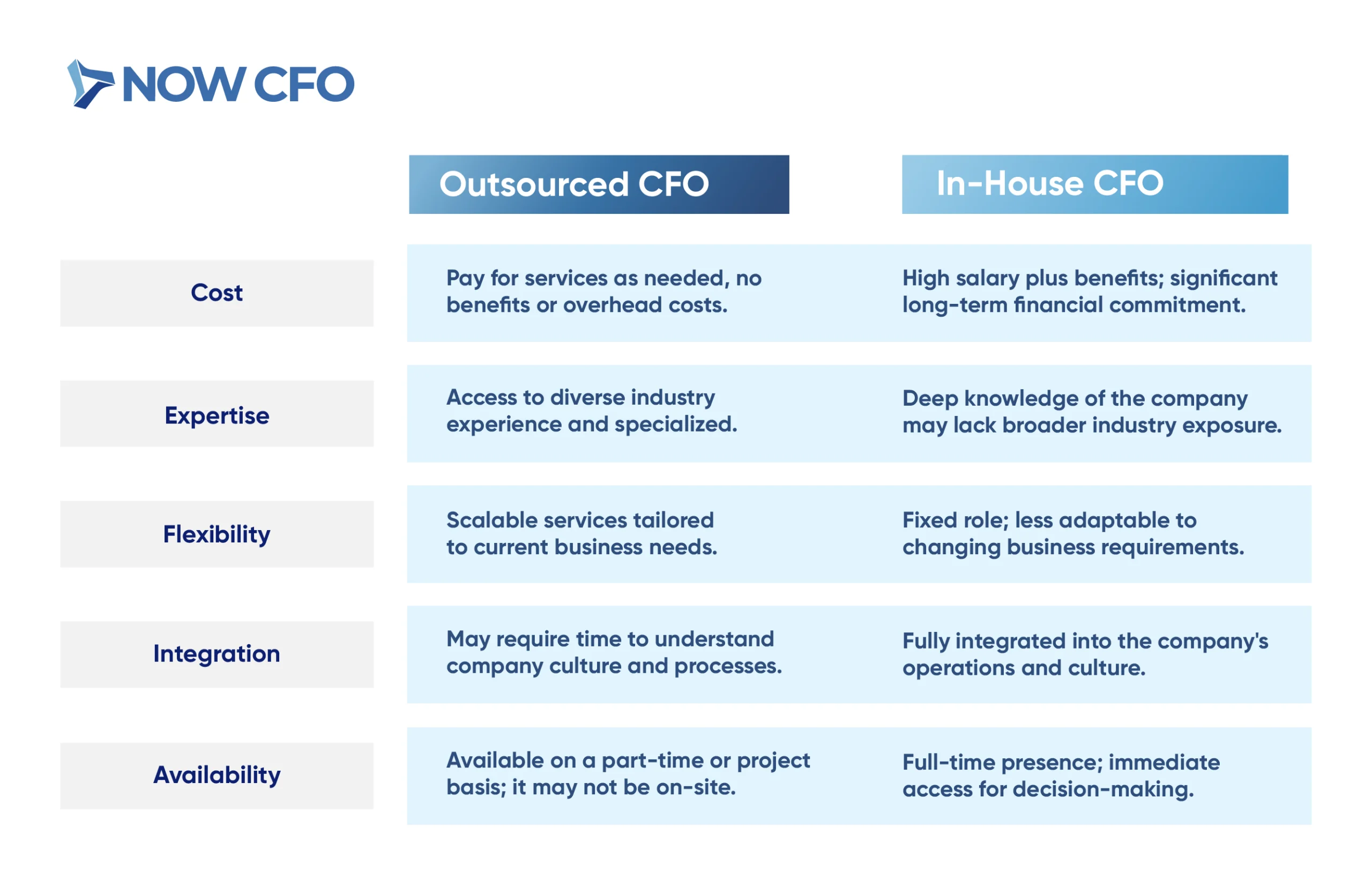

Comparing Outsourced CFO vs. In-House CFO Services

Choosing between an outsourced and in-house CFO depends on various factors, including cost, expertise, and flexibility. The following outsourced CFO services vs. hiring a full-time CFO comparison table highlights the key differences:

Learn More: Outsourced CFO vs In-house CFO

The Role of an Outsourced CFO in Crisis Management

In times of economic uncertainty, the benefits of outsourcing your CFO services become crucial. Outsourced CFOs provide strategic financial leadership, helping businesses navigate challenges and maintain stability.

Financial Restructuring During Economic Downturns

Economic downturns necessitate a reevaluation of financial structures to ensure business continuity. CFO outsourcing for small business play a pivotal role in this process by:

- Assessing Financial Health: Conducting thorough analyses to identify areas of financial strain.

- Debt Management: Negotiating with creditors to restructure existing debts, potentially reducing interest rates or extending payment terms.

- Cost Optimization: Identifying non-essential expenditures and implementing cost-cutting measures without compromising core operations.

- Revenue Enhancement: Exploring new revenue streams or optimizing existing ones to bolster income.

Managing Cash Flow During Business Uncertainty

Maintaining healthy cash flow is vital during periods of uncertainty. Outsourced CFOs assist by:

- Cash Flow Forecasting: Developing detailed projections to anticipate cash needs and identify potential shortfalls.

- Expense Management: Implementing strict controls on expenditures to preserve cash reserves.

- Liquidity Solutions: Exploring financing options, such as lines of credit, to ensure access to necessary funds.

- Accounts Receivable Optimization: Enhancing collection processes to expedite incoming payments.

Developing Contingency Plans for Financial Stability

Preparing for unforeseen events is essential for long-term financial health. Outsourced CFOs contribute by:

- Risk Assessment: Identifying potential financial risks and evaluating their impact on the business.

- Scenario Planning: Creating various financial scenarios to prepare for different potential outcomes.

- Emergency Funding Strategies: Establishing plans to secure funds quickly in case of sudden financial needs.

- Communication Protocols: Developing clear communication plans to keep stakeholders informed during crises.

Best Practices for Choosing the Right Outsourced CFO Service

Selecting the ideal partner to realize the benefits of outsourcing your CFO services requires a strategic approach. By aligning your business’s unique financial needs with the expertise and integration capabilities of a prospective CFO firm.

Identifying Your Business’s Specific Financial Needs

Before engaging an outsourced CFO, it’s essential to pinpoint the precise financial challenges and objectives your business faces. This clarity ensures that the services provided align with your company’s goals.

- Growth Stage Assessment: Determine whether your business is in a startup phase, experiencing rapid growth, or undergoing restructuring. Each stage has distinct financial requirements.

- Complexity of Financial Operations: Evaluate the intricacy of your financial transactions, such as multi-currency operations or regulatory compliance needs.

- Internal Resource Evaluation: Assess the capabilities of your existing financial team to identify gaps that an outsourced CFO could fill.

- Strategic Objectives: Clarify your long-term goals, such as preparing for an IPO, merger, or acquisition, which require specialized financial expertise.

- Budget Constraints: Understand your financial limitations to determine the scope and duration of services you can afford.

Evaluating the Experience and Expertise of a CFO Firm

The proficiency of a CFO firm is pivotal to the success of your financial strategies. A firm with a robust track record can provide insights and solutions tailored to your industry.

Begin by reviewing the firm’s portfolio and case studies to assess their experience with businesses like yours. This evaluation provides insight into their capability to handle industry-specific challenges. Additionally, consider the qualifications and background of their team members, ensuring they possess the necessary certifications and experience.

Furthermore, inquire about the firm’s familiarity with the latest financial technologies and tools. Proficiency in modern financial software can enhance efficiency and accuracy in reporting and forecasting.

Lastly, seek references or testimonials from previous clients to gauge the firm’s reliability and effectiveness. Positive feedback from businesses with similar needs can be a strong indicator of the firm’s suitability.

Ensuring Seamless Integration with Your Existing Team

For an outsourced CFO to be effective, they must integrate smoothly with your current team and processes. This integration ensures consistency and collaboration across all financial operations.

Start by establishing clear communication channels and protocols. Regular meetings and updates foster transparency and alignment of financial goals. It’s also beneficial to define roles and responsibilities explicitly to avoid overlaps and ensure accountability.

Encourage knowledge sharing between the outsourced CFO and your internal team. This collaboration can lead to skill enhancement and a more cohesive financial strategy. Additionally, ensure that the outsourced CFO is familiar with your company’s culture and values, promoting a harmonious working relationship.

Conclusion: Why Outsource CFO Services is a Smart Move

Moreover, outsourcing provides an objective perspective on financial matters, which can be invaluable for decision-making and long-term planning. With the right outsourced CFO, businesses can gain insights that drive growth and improve financial health.

Embracing the benefits of outsourcing your CFO services is a strategic move that positions your business for sustained success. If you’re ready to explore how an outsourced CFO can improve financial strategy, consider scheduling a free consultation with our experts.