The Growth and Expansion Stage of the Business Lifecycle is an exciting stage, as your business is finally seeing revenue come in and the customer base has expanded and established itself. These factors then make the business more attractive to investors and will be a good time to do so.

What is the Growth and Expansion Stage?

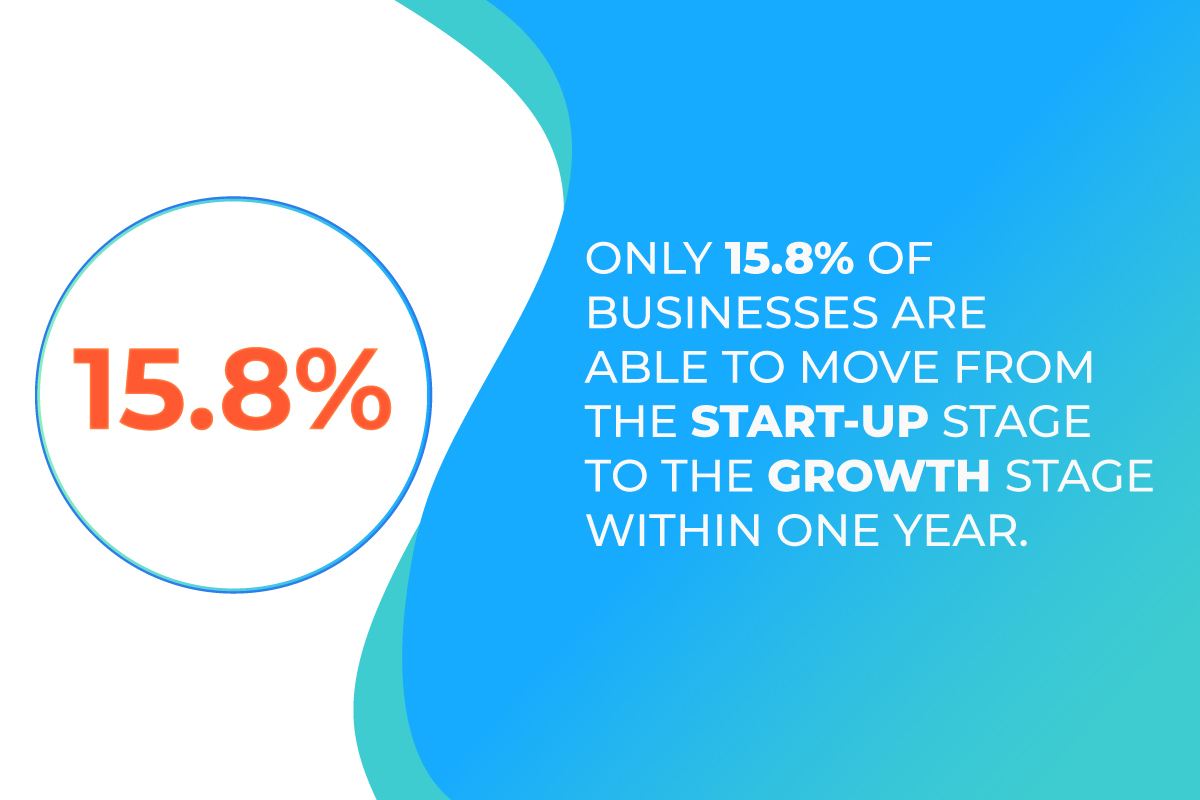

The Growth and Expansion stage is one of the more notable stages of the business lifecycle. It comes after the launch and start-up stage when the business has officially picked up momentum. The name speaks for itself, there is substantial amounts of growth and expansion into new markets or services, but only 15.8% of companies are able to move from the start-up stage to the growth stage within a year.

However, with this growth comes challenges, but with those challenges comes more opportunities. Profits are solid, but the competition is emerging more and more, and there must solutions in place to rise above and beyond them.

What Are The Challenges of the Growth Stage?

The biggest challenge companies in the growth and expansion stage face is dealing with the endless range of issues including striving for more time and money. Effective management is required in this stage, as well as a possible new and improved business plan including addressing the product lifecycle. It will be a big learning curve navigating the new growth and development in this phase.

Businesses in the growth life cycle are focused on running the business in a more formal fashion to deal with increased sales and customers. Better accounting and management systems will have to be implemented and the team will expand significantly to keep up with the demand. Consistent research on competitors will also be necessary in this stage to decide if it will be the right move to develop a new product or move into new markets.

During this stage, the option of leaving the business by merging with or selling to another organization will need to be discussed. Or, if that is not something that is in mind for the business owner, there might be strong desires to go public or raise more funding to be able to develop new products and services. We can help with either of these options for your company since we know this is a stressful transition in the business lifecycle.

What Rounds of Funding are Involved in the Growth Stage?

At this stage, the company is looking to advance through funding rounds since a foundation has already been made. This stage will typically range between A, B and eventually C funding rounds.

Series A– This round of funding typically raises between $2 million and $20 million. Investors in this round are looking for companies not only with great ideas, but a strong strategy for the future to turn into a robust money-making business. Firms going through Series A funding typically have valuations of up to $25 million.

Series B- A Series B round is used to take businesses to the next level and expand their market reach. A series B funding round typically raises around $30 million. Companies’ valuations are between $30 million and $60 million and are well established. Series B funding usually comes from venture capital firms, often the same investors who led the previous round.

How to be Financially Ready to Raise

When it comes to raising capital, early preparation is key toward moving through the due diligence and eventual deal speedily and efficiently. There are steps to ensure you are “funding ready”:

- Be sure to have the necessary compliance and financing documents prepared for investors.

- Understand your current cash burn as well as projected post-raise spending

- Create a post-funding financial plan

- Include information about hiring needs as well as development and product improvements

How NOW CFO Can Help

If you have questions about these rounds of funding and how to be prepared, taking your company smoothly through the Expansion stage in general, or what financial services will be needed, then give us a call and our Consultants can help. We have teams that are experts with audit preparation, due diligence, financial models, projections, and pitch decks.

Get Your Free Consultation

Gain Financial Visibility Into Your Business

We provide outsourced CFO, fractional CFO, and temporary CFO, Controller, and operational Accounting services that suit the needs of your business.

- Hourly Rates

- No Hidden Fees

- No Long Term Requirements

NOW CFO provides the highest level of expertise in finance and operational accounting to accelerate results and achieve strategic objectives for sustainable growth and success.

After completing the form, a NOW CFO Account Executive will reach out and learn more about your needs so that we can pair you with the right Partner.

Learn More: Top 5 Reasons Your Business Should Get a Financial Audit