Companies face increasing financial complexities that demand expert oversight. However, not all businesses can afford or require a full-time CFO. This is where outsourced CFO services come into play, offering strategic financial leadership flexibly.

Recent trends indicate a significant shift towards the outsourced CFO model. According to WSJ, over 80% of early-stage businesses in the U.S. don’t have a CFO, leaving them vulnerable to cash flow issues and missed growth opportunities. Let’s understand how to overcome common challenges when hiring an outsourced CFO.

Understanding the Need for an Outsourced CFO

As businesses grow, the demand for strategic financial leadership intensifies. According to a survey by CPA.com and Bill.com, 80% of businesses reported that outsourced accounting services gave them more time to focus on their core operations, highlighting the efficiency of outsourcing financial functions.

Many organizations, especially SMEs, find themselves at a crossroads, needing expert financial guidance without the overhead of a full-time executive. This is where the concept of an outsourced CFO becomes invaluable.

Why Businesses Turn to Outsourced CFO Services

Agility and expertise are vital in the current business scenario. Companies often face financial challenges that require seasoned professionals. Engaging an outsourced CFO allows businesses to access top-tier financial acumen tailored to their needs.

Moreover, the flexibility of outsourced arrangements means companies can scale services up or down based on current requirements, ensuring cost-effectiveness. This model is particularly beneficial for startups and growing businesses that need strategic financial oversight without the commitment of a full-time hire.

The Role of an Outsourced CFO in Modern Business

An outsourced CFO plays a multifaceted role, adapting to each organization’s unique needs. Key responsibilities include:

- Strategic Financial Planning: Developing long-term financial strategies aligned with business goals.

- Budgeting and Forecasting: Creating detailed budgets and financial forecasts to guide decision-making.

- Cash Flow Management: Monitoring and optimizing cash flow to ensure operational stability.

- Financial Reporting: Providing accurate and timely financial reports for stakeholders.

- Risk Management: Identifying financial risks and implementing mitigation strategies. In addition, risk management in CFO outsourcing includes a thorough evaluation of contracts, performance KPIs, and legal safeguards.

- Compliance Oversight: Ensuring adherence to financial regulations and standards.

- Investor Relations: Communicating financial performance and strategies to investors.

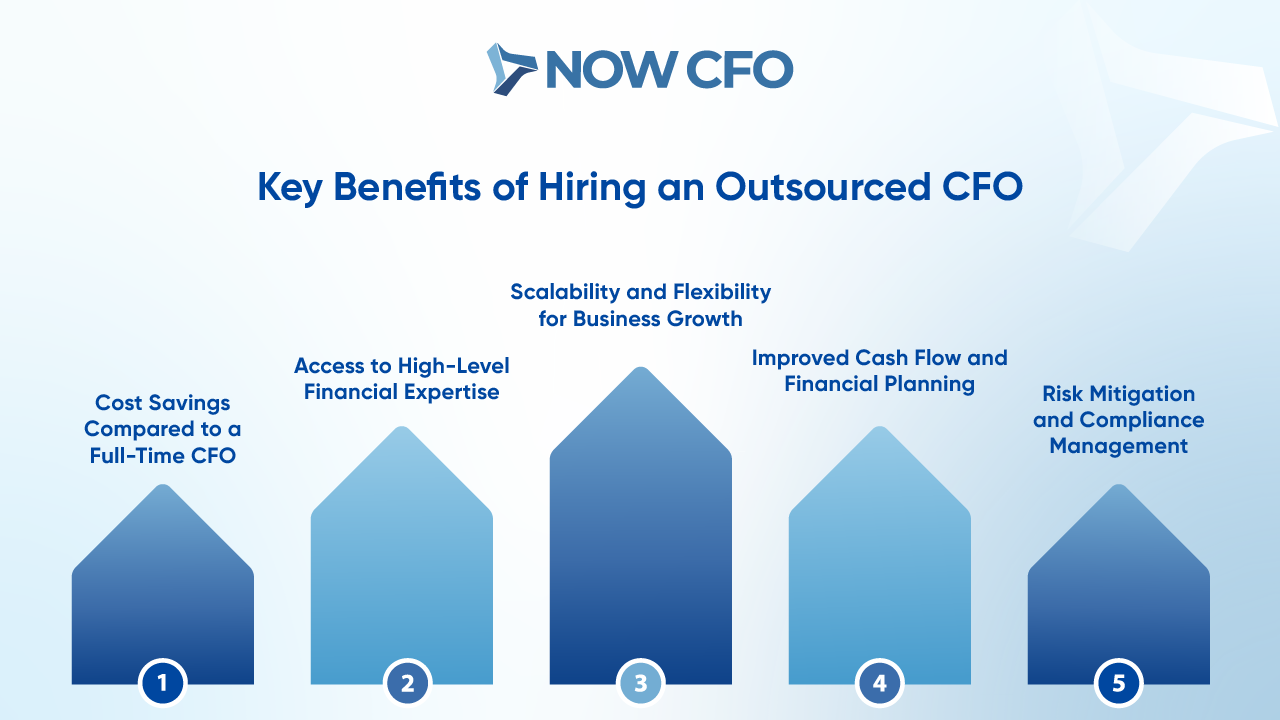

Key Benefits of Hiring an Outsourced CFO

Engaging an outsourced CFO offers several advantages:

- Cost Efficiency: Access to high-level financial expertise without the expense of a full-time executive.

- Flexibility: Services can be tailored and scaled according to business needs.

- Objective Perspective: An external CFO brings unbiased insights, aiding in impartial decision-making.

- Access to Expertise: Benefit from a professional with diverse industry experience and knowledge.

- Enhanced Financial Strategy: Improved financial planning and analysis capabilities.

- Time Savings: Allows business owners to focus on core operations while financial matters are expertly managed.

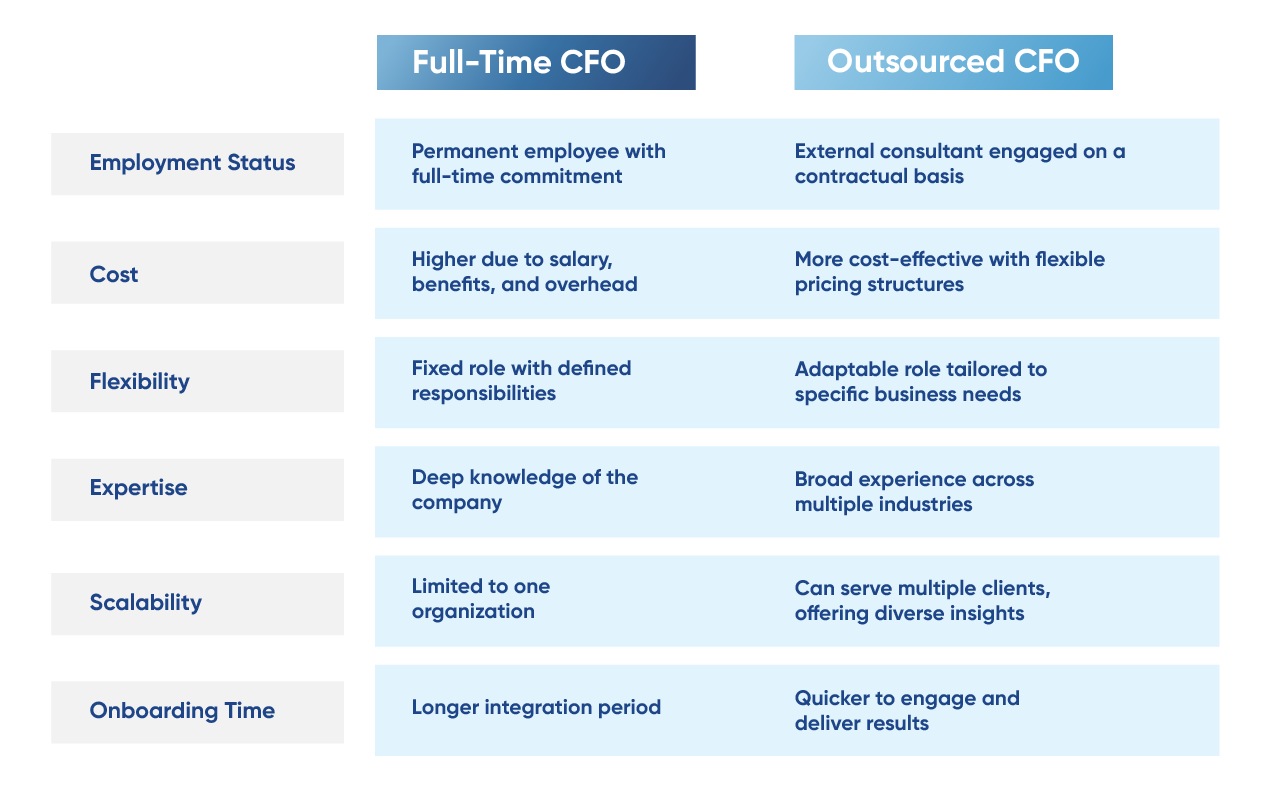

The Difference Between a Full-Time CFO and an Outsourced CFO

The table below compares key aspects of a full-time CFO and an outsourced CFO to understand the practical differences better.

When to Consider Outsourcing CFO Functions

Businesses should contemplate engaging an outsourced CFO under several circumstances. Rapid growth phases often demand sophisticated financial oversight that internal teams are not ready to handle.

Similarly, the expertise of an external CFO can be invaluable during periods of financial restructuring or when preparing for investment rounds. Additionally, startups and SMEs that cannot justify the cost of a full-time CFO can still benefit from high-level financial guidance through outsourcing.

The Common Challenges When Hiring an Outsourced CFO

Engaging an outsourced CFO offers numerous advantages, yet the process has hurdles. Understanding outsourced CFO hiring challenges is crucial for businesses aiming to make informed decisions and maximize the benefits of outsourcing financial leadership.

Businesses can avoid costly setbacks by being aware of the common mistakes when hiring a CFO, such as neglecting to clarify expectations or underestimating cultural misalignment.

Finding a CFO with the Right Industry Experience

Identifying an outsourced CFO who possesses relevant industry experience is a significant challenge. Each industry has unique financial dynamics, regulatory requirements, and market conditions.

A CFO with specific industry knowledge can provide tailored insights and strategies that align with the company’s goals. Without this expertise, businesses face a steep learning curve, leading to potential missteps in financial planning and execution.

Ensuring Clear Communication and Collaboration

Effective communication is the backbone of any successful partnership, which is true when working with an outsourced CFO. Outsourced CFO hiring challenges often arise due to differences in time zones, communication styles, and expectations.

Establishing clear communication channels and setting regular check-ins can mitigate misunderstandings and ensure that both parties are aligned. Additionally, leveraging collaborative tools and platforms can facilitate seamless interaction and information sharing.

Managing Expectations and Deliverables

To effectively manage expectations and deliverables when hiring an outsourced CFO, consider the following:

- Define Clear Objectives: Establish specific goals and outcomes expected from the CFO’s engagement.

- Set Realistic Timelines: Agree on achievable deadlines for deliverables to ensure timely execution.

- Regular Progress Reviews: Schedule periodic evaluations to assess performance and address any concerns promptly.

- Document Agreements: Maintain written records of responsibilities, expectations, and deliverables to avoid ambiguities.

- Feedback Mechanisms: Implement channels for continuous feedback to foster improvement and alignment.

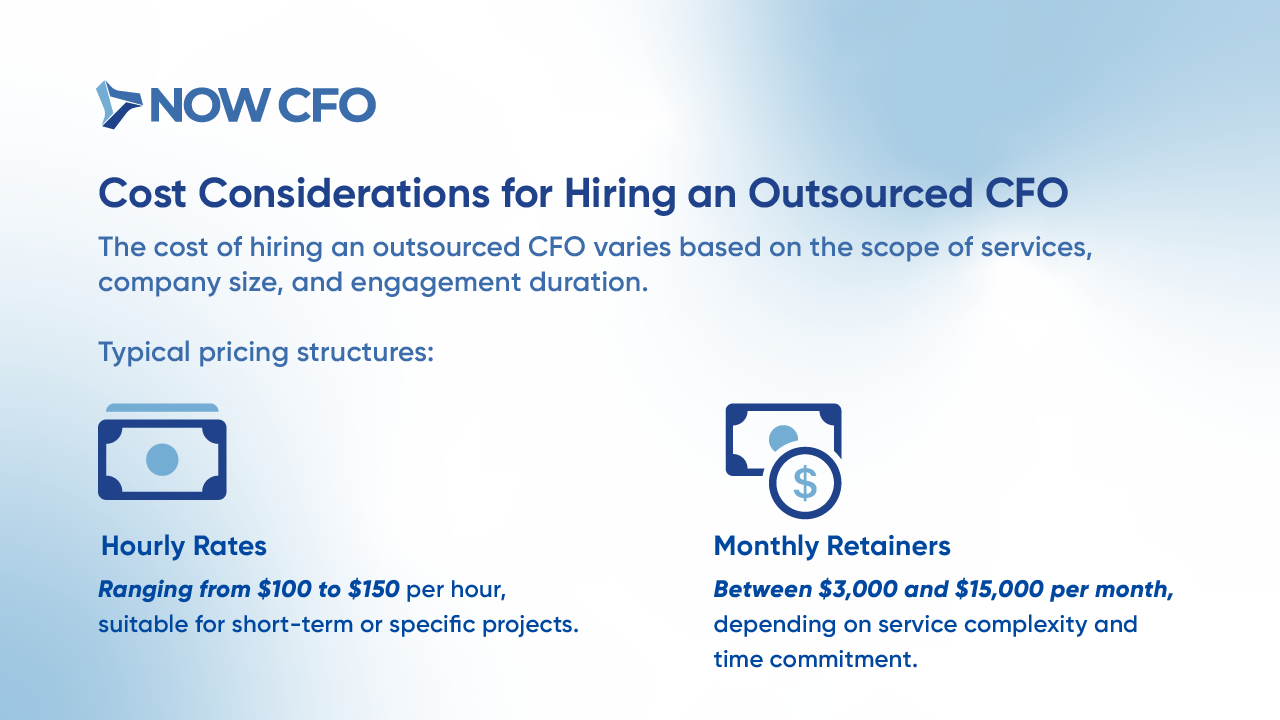

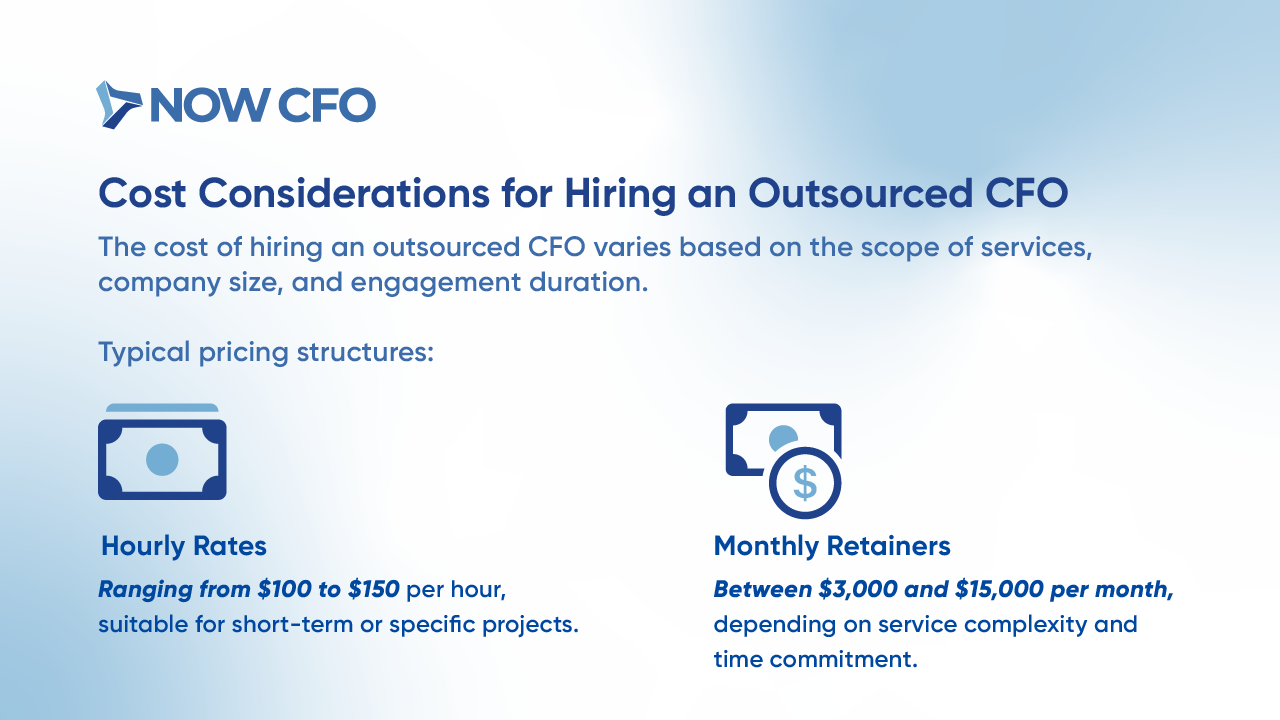

Understanding Cost Structures and Pricing Models

Outsourced CFO services’ cost structures and pricing models can be complex. It’s essential to comprehend the various components that contribute to the overall cost:

- Hourly Rates vs. Fixed Fees: Determine whether the CFO charges or offers a fixed service fee by the hour.

- Scope of Services: Understand what services are included in the pricing and any additional costs for extra services.

- Contract Duration: Long-term contracts offer cost savings but require a longer commitment.

- Performance-Based Fees: Some CFOs offer pricing models tied to performance metrics or outcomes.

- Hidden Costs: Be vigilant about potential hidden costs, such as travel expenses or software subscriptions.

Aligning Strategic Goals with Financial Leadership

Integrating a solid financial strategy and outsourced CFO services enables leadership teams to base every major decision on real-time data and strategic foresight. This alignment ensures financial strategies support overarching business goals, facilitating growth and stability.

Challenges arise if the CFO lacks a comprehensive understanding of the company’s vision, leading to misaligned priorities. Regular strategic planning sessions and open communication can bridge this gap, ensuring that the CFO’s financial guidance propels the company towards its desired outcomes.

How to Successfully Integrate an Outsourced CFO

Integrating an outsourced CFO into your organization requires a strategic approach to ensure alignment with your company’s goals and culture. This process involves clear communication, defined roles, and the effective use of technology to facilitate collaboration.

Setting Clear Roles and Responsibilities

To establish a productive relationship with an outsourced CFO, it’s essential to:

- Define Scope of Work: Clearly outline the CFO’s responsibilities, including financial planning, reporting, and strategy development.

- Establish Decision-Making Authority: Determine the CFO’s level of authority in financial decisions to avoid confusion.

- Set Performance Metrics: Identify key performance indicators (KPIs) to measure the CFO’s effectiveness.

- Clarify Reporting Structure: Specify who the CFO reports to and how often updates are expected.

- Document Expectations: Create a written agreement detailing all roles and responsibilities to ensure mutual understanding.

Establishing Effective Communication Channels

Effective communication is crucial for the success of an outsourced CFO partnership. To facilitate this:

- Regular Meetings: Schedule consistent meetings to discuss financial performance and strategic initiatives.

- Use Collaborative Tools: Implement platforms like Slack or Microsoft Teams for real-time communication.

- Shared Document Access: Utilize cloud-based services such as Google Drive for easy access to financial documents.

- Feedback Mechanisms: Establish channels for continuously providing and receiving feedback to improve collaboration.

Aligning Business Strategy with Financial Insights

An outsourced CFO is pivotal in aligning financial management with business strategy. The CFO can provide insights that inform strategic decisions, such as market expansion or cost optimization, by analyzing financial data. This alignment ensures financial planning supports the company’s long-term goals and enhances overall performance.

Leveraging Technology for Seamless Collaboration

Technology facilitates efficient collaboration with an outsourced CFO. Key tools include:

- Cloud Accounting Software: Platforms like QuickBooks Online allow real-time access to financial data.

- Project Management Tools: Applications such as Asana or Trello help track financial projects and deadlines.

- Secure File Sharing: Services like Dropbox Business ensure safe and organized document exchange.

- Video Conferencing: Tools like Zoom facilitate face-to-face meetings, fostering better communication.

Monitoring Performance and Key Financial Metrics

Regular monitoring of financial performance is essential when working with an outsourced CFO. Focus areas include:

- Budget Adherence: Tracking actual spending against budgeted figures to identify variances.

- Cash Flow Analysis: Assessing the timing and amounts of cash inflows and outflows.

- Profitability Metrics: Evaluating gross and net profit margins to gauge financial health.

- ROI: Measuring the effectiveness of investments and strategic initiatives.

How NOW CFO Helps Overcome Common Challenges When Hiring an Outsourced CFO

At NOW CFO, we understand that hiring an outsourced CFO comes with its own set of challenges. That’s why we’ve developed comprehensive solutions to address common challenges when hiring an outsourced CFO, ensuring seamless integration.

Tailored CFO Solutions for Different Business Needs

Recognizing that every business has unique financial requirements, we offer customized CFO services to align with your goals. Our approach includes:

- Fractional Engagements: Providing part-time CFO services for businesses that need strategic financial oversight without the commitment of a full-time executive.

- Project-Based Support: Assisting with specific financial projects such as mergers, acquisitions, or system implementations.

- Interim Leadership: Stepping in during transitional periods to maintain financial stability and continuity.

Experienced CFOs with Industry-Specific Expertise

Our team comprises seasoned CFOs with extensive experience across various industries, including technology, healthcare, manufacturing, and non-profit. We take pride in thoroughly evaluating CFO experience and expertise before assigning any consultant.

This industry-specific knowledge allows us to:

- Provide Relevant Insights: Understanding the nuances of your industry enables us to offer tailored financial strategies.

- Ensure Compliance: Staying abreast of industry regulations to keep your business compliant.

- Drive Growth: Leveraging industry trends to identify opportunities for expansion and profitability.

Transparent Pricing and Scalable Engagement Models

We openly address CFO outsourcing risks and solutions, ensuring our clients are informed and empowered to make strategic decisions that minimize uncertainty.

We believe in clarity and flexibility when it comes to pricing. Our models include:

- Hourly Rates: Ideal for short-term projects or consultations.

- Monthly Retainers: Providing ongoing support with predictable costs.

- Project-Based Fees: Tailored pricing for specific initiatives.

Hands-On Support and Personalized Financial Guidance

Our commitment goes beyond numbers; we immerse ourselves in your business to provide:

- Strategic Planning: Collaborating on long-term financial goals and roadmaps.

- Operational Support: Assisting with day-to-day financial operations to ensure efficiency.

- Decision-Making Assistance: Offering insights and analysis to inform critical business decisions.

Our hands-on approach is key in overcoming financial leadership gaps, especially for organizations in transition or restructuring phases.

Key Considerations Before Hiring an Outsourced CFO

Engaging an outsourced CFO can be transformative for your business. It offers strategic financial leadership without the overhead of a full-time executive.

However, evaluating several key factors is crucial before maximizing the benefits and mitigating potential risks.

Assess Your Business’s Financial Needs

Before seeking an outsourced CFO, assess your company’s current finances. Further, determine whether you require cash flow management, budgeting, financial forecasting, or strategic planning assistance.

For instance, if your business is experiencing rapid growth, you need a CFO skilled in scaling operations and securing funding. Conversely, a CFO with turnaround experience would be more appropriate if you’re facing financial challenges.

Choosing the Right Level of CFO Engagement

Determining the appropriate level of engagement with an outsourced CFO depends on your business’s size, complexity, and financial goals. Options include:

- Fractional CFO: Ideal for small businesses needing strategic guidance without a full-time commitment.

- Project-Based CFO: Suitable for specific initiatives like mergers, acquisitions, or system implementations.

- Interim CFO: This is best for transitional periods, such as searching for a permanent CFO.

Learn More: Outsourced CFO Vs Fractional CFO

We also offer virtual CFO services, enabling flexible support for companies that need remote financial leadership without geographical limitations.

Assessing the Track Record and Reputation of a CFO Provider

Understanding how to find the right outsourced CFO involves vetting credentials, assessing cultural fit, and aligning expertise. When evaluating potential outsourced CFO providers, consider the following:

- Client Testimonials: Seek feedback from current or past clients to gauge satisfaction and performance.

- Industry Experience: Ensure the provider has experience in your specific industry to understand unique challenges and regulations.

- Certifications and Credentials: Verify professional qualifications, such as CPA or CMA designations.

- Case Studies: Review documented successes in similar business scenarios.

- References: Request and contact references to validate the provider’s reliability and effectiveness.

Thoroughly, vetting providers helps mitigate common challenges when hiring an outsourced CFO.

Ensuring Compatibility with Your Company Culture

Cultural alignment between your business and the outsourced CFO is vital for a harmonious working relationship. Consider:

- Communication Style: Does the CFO’s approach align with your team’s preferences?

- Decision-Making Process: Is their decision-making collaborative or authoritative, and does this fit your organizational style?

- Adaptability: Can the CFO adjust to your company’s pace and work environment?

- Values Alignment: Do their professional values resonate with your company’s mission and ethics?

Making a Smooth Transition to an Outsourced CFO

Successful CFO transition planning includes onboarding procedures, knowledge transfer, system integration, and cultural alignment protocols.

Some steps you can take are:

- Begin by clearly defining the CFO’s role, responsibilities, and objectives.

- Establish communication protocols and integrate them into your existing financial system.

- Provide access to necessary data and resources to enable informed decision-making.

- Additionally, key stakeholders should be involved in onboarding to facilitate acceptance and cooperation.

- Regularly review performance and provide feedback to ensure alignment with your business goals.

A structured transition plan enhances the effectiveness of the outsourced CFO and supports your company’s financial health.

Conclusion: Common Challenges When Hiring an Outsourced CFO

Engaging an outsourced CFO offers a cost-effective solution, providing expert financial guidance tailored to your company’s needs. Businesses can harness the full potential of outsourced CFO services by addressing common challenges and implementing strategic solutions.

At NOW CFO, we deliver customized financial strategies that drive growth and stability. Our team of experienced professionals is dedicated to helping you counter common challenges when hiring an outsourced CFO.

Ready to elevate your financial strategy? Schedule a free consultation with our experts today and discover how NOW CFO can support your business’s success.

The demand for flexible and strategic financial leadership has never been higher. Companies are increasingly seeking cost-effective solutions without the overhead of a full-time executive.

This shift has significantly increased the adoption of outsourced CFO consulting services. The demand for outsourced CFOs has surged by 103% year-over-year since 2023 and is increasing. This trend presents a unique opportunity for seasoned finance professionals to leverage their expertise flexibly and impactfully. Let’s look into how to become an outsourced CFO.

What is an Outsourced CFO?

Many startups and SMEs turn to an outsourced CFO for hire when they need strategic financial oversight but aren’t ready for a full-time executive. This section delves into the role of an outsourced CFO, the types of businesses that benefit from their services, and how they differ from fractional CFO jobs.

Defining the Outsourced CFO Role

An outsourced CFO is a financial expert contracted to provide high-level financial management, strategic planning, and advisory services to businesses on a part-time or project basis.

Unlike in-house CFOs, outsourced CFOs offer flexibility. They can be engaged as needed, making them an ideal solution for companies requiring financial expertise without a full-time executive’s overhead.

Key responsibilities include:

- Developing and implementing financial strategies

- Managing budgeting and forecasting processes

- Overseeing financial reporting and compliance

- Providing insights for investment and growth opportunities

Industries and Businesses That Use Outsourced CFOs

Outsourced and virtual CFO services are utilized across various sectors, particularly by SMEs that need strategic financial oversight without the cost of a full-time CFO.

Industries that commonly engage outsourced CFOs include:

- Technology and startups

- Healthcare and medical practices

- Manufacturing and distribution

- Non-profit organizations

- Professional services firms

Difference Between Outsourced and Fractional CFOs

While both outsourced CFOs and fractional CFO jobs provide part-time financial leadership, their engagement models differ.

Outsourced CFO

- Engaged on a project or on an as-needed basis

- Focuses on specific financial challenges or initiatives

- Offers flexibility regarding engagement duration

Fractional CFO

- Works with a company on a recurring, part-time schedule

- Provides ongoing financial oversight and strategic planning

- Becomes an integral part of the management team

Understanding these differences helps businesses choose the right financial leadership model to suit their unique needs.

Who Should Consider Becoming an Outsourced CFO?

As the demand for strategic financial leadership grows, many finance professionals are exploring becoming an outsourced CFO. This role offers a unique blend of autonomy, diverse client engagements, and the opportunity to apply seasoned expertise across various industries.

Ideal Background and Experience

Professionals best suited for the outsourced CFO role typically possess:

- Extensive Financial Expertise: A solid foundation in accounting principles, financial analysis, and strategic planning.

- Leadership Experience: Previous roles in financial leadership positions, such as controllers or finance directors.

- Industry Versatility: Exposure to multiple industries enhances adaptability and broadens the scope of potential client engagements.

Transitioning from Controller or Corporate CFO Roles

Moving from a traditional corporate role to an outsourced CFO position involves a shift in mindset and operations:

- From Internal to External: Instead of serving a single organization, you’ll manage multiple clients with distinct challenges and goals.

- Entrepreneurial Approach: Building a personal brand, marketing services, and establishing a client base become integral parts of the role.

- Flexible Engagements: Engagements may range from short-term projects to long-term advisory roles, requiring adaptability and proactive client management.

Benefits of Working Independently

Embracing the outsourced CFO model offers several advantages:

- Autonomy: Control your schedule, client selection, and service offerings.

- Diverse Experiences: Exposure to different industries and business models enhances professional growth.

- Financial Rewards: Potential to earn competitive compensation while managing workload and engagements.

Common Client Types and Engagements

As an outsourced CFO, you’ll collaborate with a variety of clients, including:

- Startups: Assisting with financial modeling, fundraising strategies, and establishing financial systems.

- SMEs: Providing ongoing financial oversight, budgeting, and strategic planning.

- Non-Profit Organizations: Ensuring compliance, managing grants, and optimizing financial operations.

Earning Potential and Flexibility

An outsourced freelance CFO career path is lucrative and flexible:

- Competitive Compensation: According to ZipRecruiter, the average annual salary of a work-from-home outsourced CFO is around $250,000.

- Flexible Scheduling: Ability to set your hours and choose engagements that align with your expertise and interests.

- Scalable Opportunities: Potential to expand services, build a team, or specialize in niche markets to increase income streams.

Skills and Qualifications You Need

As the duties of financial leadership evolve, professionals aiming to become an outsourced CFO must cultivate a diverse skill set beyond traditional accounting. This role demands technical proficiency, strategic insight, and effective communication to deal with complex financial terrains and drive growth.

Core Technical Finance Skills

An outsourced CFO must possess robust technical skills to analyze financial data, develop budgets, and cash flow strategies. Financial reporting and forecasting proficiency are essential to provide accurate insights and guide strategic decisions.

These skills enable the CFO to identify trends, assess risks, and recommend actionable solutions that align with the company’s objectives.

Strategic Planning and Decision-Making

Beyond number crunching, an outsourced CFO is pivotal in shaping business strategy. This involves conducting market analyses, evaluating investment opportunities, and implementing risk management practices.

Communication and Advisory Skills

Effective communication is crucial for an outsourced CFO to convey financial insights to non-financial stakeholders. This includes simplifying complex data, engaging with stakeholders, and providing strategic advice.

Strong interpersonal skills foster collaboration and informed decision-making across the organization.

Knowledge of Accounting Automation Tools

Proficiency in modern accounting systems enhances efficiency and accuracy. An outsourced CFO should be adept at:

- ERP Systems: Utilizing platforms like QuickBooks or NetSuite for integrated financial management.

- Automation Tools: Implementing software to streamline repetitive tasks and reduce errors.

- Data Analytics: Leveraging analytical tools to derive actionable insights.

Optional Certifications and Licenses (CPA, CMA, MBA)

While not mandatory, specific certifications can enhance credibility:

- Certified Public Accountant (CPA): Demonstrates expertise in accounting principles.

- Certified Management Accountant (CMA): Focuses on financial planning and analysis.

- Master of Business Administration (MBA): Provides a broad understanding of business operations.

According to a survey, 50% of CFOs in Fortune 500 and S&P 500 companies hold MBA degrees, 35% have CPA credentials, and 11.2% hold both designations.

Familiarity with GAAP, Compliance, and Reporting

GAAP ensures transparency and consistency in financial reporting. An outsourced CFO must ensure compliance with financial regulations, implement internal controls, and prepare accurate reports.

GAAP compliance is crucial for building stakeholder confidence and securing financing.

Steps to Becoming an Outsourced CFO

Transitioning into the role of an outsourced CFO involves a strategic approach to establish a successful practice. This section outlines the essential steps to guide professionals through this journey.

Assessing Your Readiness and Career Goals

Before becoming an outsourced CFO, evaluating your skills, experience, and objectives is crucial.

- Self-Assessment: Determine if you possess financial acumen, leadership qualities, and adaptability to manage multiple clients.

- Goal Setting: Define your career aspirations, whether achieving work-life balance, financial independence, or industry specialization.

Creating a Services Framework and Pricing Model

Establishing a clear framework for your services and pricing is vital.

- Service Offerings: Identify the specific services you’ll provide, such as financial planning, budgeting, or compliance.

- Pricing Strategy: Develop a pricing model that reflects the value of your services and meets market expectations.

Setting Up Your Business Legally and Financially

Properly establishing your business ensures legal compliance and financial stability.

- Legal Structure: Choose an appropriate business structure (e.g., LLC, sole proprietorship) and register accordingly.

- Financial Systems Integration: Set up accounting systems, banking arrangements, and tax identification numbers.

Marketing Yourself to Attract Clients

Effective marketing strategies are essential to build your client base.

- Brand Development: Create a professional brand identity, including a logo, website, and marketing materials.

- Online Presence: Utilize digital platforms like LinkedIn and industry-specific forums to showcase your expertise.

37% of SMEs outsource at least one business process, highlighting a significant market for outsourced CFO consulting services.

Building a Network Through Referrals and Partners

Networking plays a pivotal role in expanding your reach.

- Professional Associations: Join industry groups and attend events to connect with potential clients and collaborators.

- Referral Programs: Establish partnerships with other professionals who can refer clients to your services.

These connections can lead to new opportunities and sustained growth for your outsourced CFO practice.

Managing Multiple Client Engagements Efficiently

Balancing multiple clients requires adequate time and resource management.

- Workflow Systems: Implement project management tools to track tasks and deadlines.

- Client Communication: Maintain regular updates and meetings to ensure alignment and satisfaction.

Efficient management ensures high-quality service delivery across all client engagements.

Tools and Technology Every Outsourced CFO Needs

Today, an outsourced CFO must leverage advanced tools and technologies to deliver strategic financial insights and drive organizational growth. This section explores essential platforms and software that enhance efficiency and decision-making capabilities.

Accounting and ERP Platforms (QuickBooks, NetSuite, etc.)

A robust accounting or ERP system is fundamental for an outsourced CFO to manage financial operations effectively.

- QuickBooks: Preferred by most small business accountants for its user-friendly interface and comprehensive features.

- NetSuite: Recognized as the most utilized ERP for small businesses, offering scalability and cloud-based deployment.

FP&A Tools for Forecasting and Modeling

Financial Planning and Analysis (FP&A) tools are critical for creating accurate forecasts and financial models.

- Data rails: Offers AI-powered features like FP&A Genius, enhancing budgeting and strategic forecasting processes.

- Vena Solutions: Provides AI-driven solutions to streamline FP&A tasks and improve data analysis.

Document Management and Collaboration Platforms

Efficient document management and collaboration tools are essential for maintaining organized records and facilitating teamwork.

- Microsoft SharePoint: Enables secure document storage and real-time collaboration.

- Google Workspace: Offers cloud-based solutions for document creation and sharing. The rise of cloud-based tools has made it easier than ever for a remote CFO business to support clients across different time zones and industries.

Approximately 79% of employees use document management systems with collaborative features to enhance teamwork.

CRM Systems for Client Management

CRM systems help outsourced CFOs maintain client information and track interactions.

- Salesforce: Provides comprehensive tools for managing client relationships and sales pipelines.

- HubSpot: Offers user-friendly CRM solutions suitable for small to medium-sized businesses.

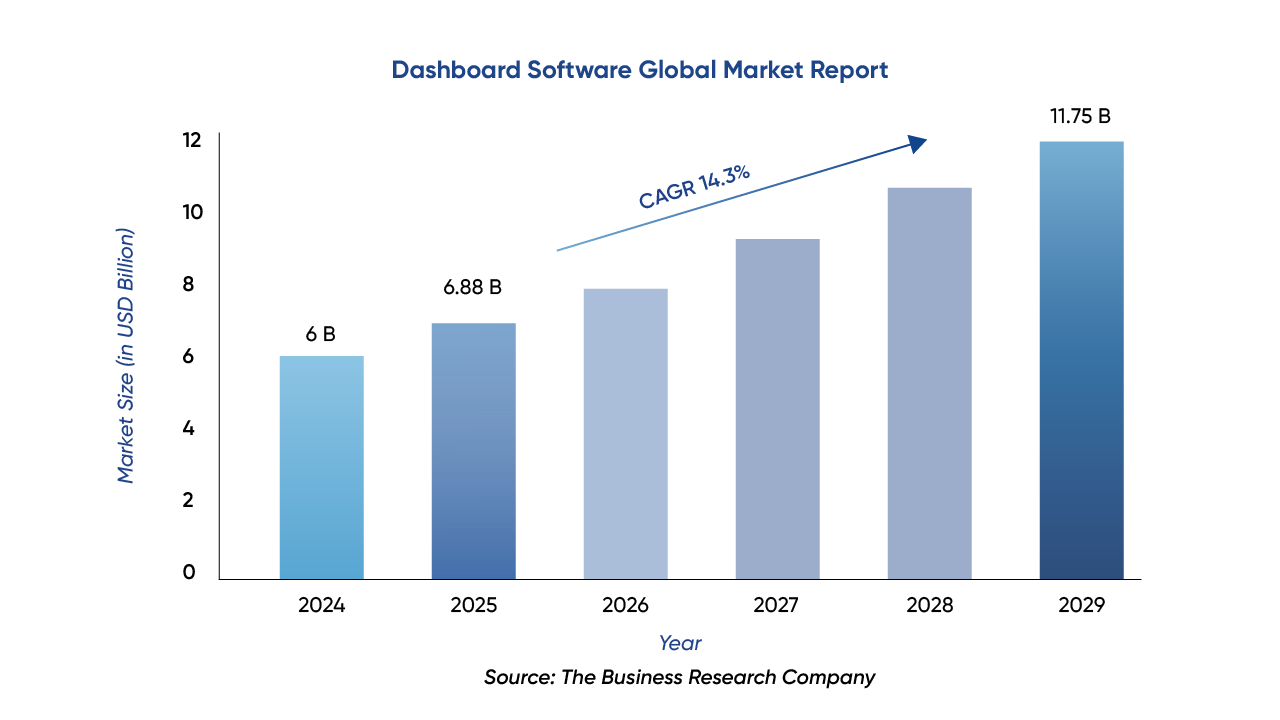

Reporting and Dashboard Solutions

Effective reporting and dashboard tools enable outsourced CFOs to present financial data clearly and make informed decisions.

- Tableau: Facilitates data visualization and interactive dashboards.

- Power BI: Integrates with various data sources to provide comprehensive business insights.

Growing and Scaling Your CFO Practice

Scaling your outsourced CFO practice requires a strategic approach to identify your niche, streamline operations, build a competent team, client acquisition, and diversify services. This section outlines key steps to achieve sustainable growth.

Identify Your Niche and Ideal Clients

Focusing on a specific industry or client type allows you to tailor your services effectively.

- Industry Specialization: Concentrate on sectors like technology startups, healthcare, or manufacturing to leverage industry-specific knowledge.

- Client Profiling: Determine businesses’ size, revenue, and operational complexity that align with your expertise.

Develop Scalable Processes and SOPs

Establishing standardized procedures ensures consistency and efficiency.

- Documentation: Develop comprehensive SOPs for recurring tasks.

- Automation: Implement tools for automated reporting, invoicing, and data analysis.

These measures facilitate seamless onboarding of new clients and maintain service quality as your practice grows.

Build a Competent Team or Collaborate with Subcontractors

Expanding your team enables you to manage an increased workload and offer diverse services.

- Subcontracting: Engage freelance accountants or analysts for specific projects.

- In-House Hiring: Recruit full-time staff to build a cohesive team.

Retain Clients and Expand Accounts

Maintaining strong client relationships is crucial for long-term success.

- Regular Communication: Schedule periodic reviews to discuss financial performance and address concerns.

- Value Addition: Offer insights and recommendations beyond standard reporting to demonstrate commitment to client growth.

These practices foster trust and encourage clients to engage your services for extended periods.

Diversify Service Offerings

Expanding your range of services can attract a broader client base and increase revenue.

- Advisory Services: Provide strategic planning, risk management, and investment analysis.

- Compliance and Taxation: Offer assistance with regulatory compliance and tax planning.

Implementing these strategies positions your outsourced CFO practice for scalable growth and sustained success.

Common Challenges and How to Overcome Them

The role of an outsourced CFO comes with unique challenges that require strategic approaches to overcome. This section examines common obstacles and offers practical solutions to ensure success in this dynamic position.

Managing Client Expectations and Deliverables

Clear communication is vital when setting client expectations.

- Define Scope Clearly: Establish detailed contracts outlining services, timelines, and responsibilities.

- Regular Updates: Provide consistent progress reports to keep clients informed.

- Feedback Loops: Encourage open dialogue to address concerns promptly.

These practices help prevent misunderstandings and ensure alignment between client needs and deliverables.

Balancing Multiple Clients and Work-Life

Juggling multiple clients requires effective time management and self-care.

- Prioritize Tasks: Use tools like the Eisenhower Matrix to distinguish between urgent and important tasks.

- Set Boundaries: Establish clear working hours and communicate them to clients.

- Delegate When Possible: Assign tasks to team members to distribute workload evenly.

Staying Current with Industry Changes

Staying up to date with the current industry trends requires continuous learning.

- Professional Development: Stay informed by attending workshops, webinars, and conferences.

- Subscribe to Industry Publications: Regularly read journals and newsletters for updates.

- Network with Peers: Engage in professional communities to share knowledge and experiences.

Pricing and Scope Creep

Managing pricing and preventing scope creep is crucial for profitability.

- Transparent Pricing Models: Clearly outline costs and services in contracts.

- Monitor Project Scope: Regularly review project parameters to prevent unauthorized expansions.

- Implement Change Orders: Use formal processes to manage additional requests.

These measures help maintain financial integrity and client satisfaction.

Building Credibility Without a Large Firm Name

Establishing trust as an independent professional requires deliberate efforts.

- Showcase Expertise: Publish case studies and thought leadership articles.

- Leverage Testimonials: Collect and display client feedback to build credibility.

- Engage in Speaking Opportunities: Participate in industry events to enhance visibility.

Building a strong personal brand fosters trust and attracts potential clients.

Conclusion: Taking the Leap into an Outsourced CFO Career

Pursuing a career as a part-time CFO unlocks the opportunity to apply your financial expertise flexibly and impactfully. We hope this guide on how to become an outsourced CFO is insightful.

If you’re ready to take the next step, Now CFO can help you get started. We’ve helped countless professionals transition into outsourced finance leadership roles with the tools, support, and client connections they need to grow. Explore open opportunities or partner with our finance consulting team.

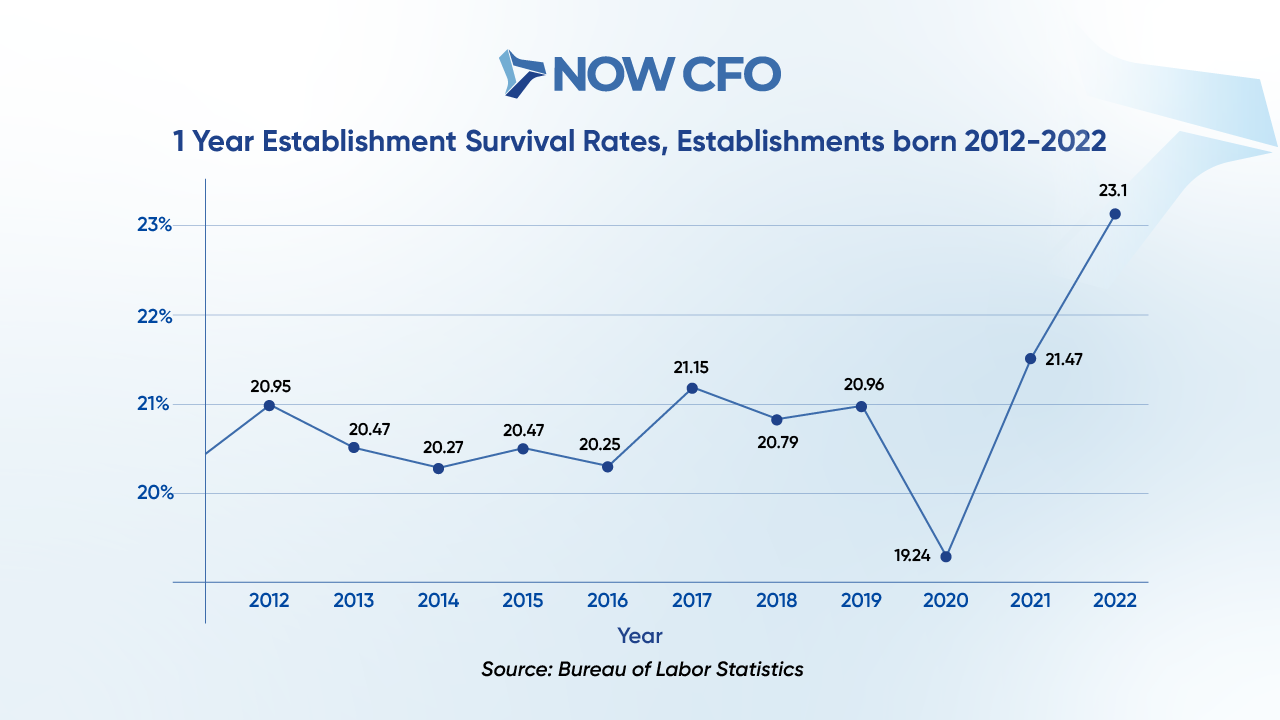

Financial clarity and agility are more crucial than ever. Startups and growing businesses often face resource constraints that limit their ability to manage complex financial functions in-house.

Around 22% of new businesses in the U.S. fail within their first year, with poor financial management ranking as one of the top causes. This statistic alone highlights why many companies use external experts to bridge the financial strategy gap.

Below is the chart showing the US businesses’ year-by-year survival rates from 2012 to 2022.

An outsourced CFO for startups and SMES improves financial planning by bringing seasoned financial leadership and decision-making without the cost of a full-time hire. These professionals help implement systems for cash flow forecasting, budgeting, financial reporting, and strategic decision-making.

The Role of an Outsourced CFO in Strategic Financial Planning

Financial strategy isn’t just about crunching numbers but seeing the whole picture. Once a company understands the value of accurate financial oversight, the next step is to explore how an outsourced CFO improves financial planning by aligning strategy with long-term goals.

Let’s dive into their critical role in building a foundation for intelligent, data-driven decision-making.

How Financial Strategy Outsourcing Helps You

Financial strategies require more than just number crunching; they demand a visionary approach. An outsourced CFO improves financial planning by bringing a wealth of experience and an objective perspective.

They assess your company’s financial health, identify areas of improvement, and craft tailored strategies that align with your business goals.

Key Benefits of Outsourced CFO

- Objective financial assessment

- Customized strategic planning

- Enhanced decision-making capabilities

Creating Accurate Financial Forecasts with Expert Guidance

Transitioning from reactive to proactive financial management is essential for business success. An outsourced CFO improves financial planning by developing precise financial forecasts that inform strategic decisions.

These forecasts consider various factors, including market trends, operational costs, and revenue projections, providing a comprehensive financial outlook. With accurate forecasting, businesses can allocate resources efficiently, plan for growth, and mitigate risks.

Helping Businesses Navigate Financial Challenges

In the face of financial adversity, an outsourced CFO improves financial planning by offering strategic solutions tailored to the company’s unique challenges. They analyze financial data to identify issues such as cash flow shortages or budget overruns and implement corrective measures promptly.

By addressing these challenges head-on, outsourced CFOs help businesses maintain financial stability and avoid potential pitfalls. Their expertise ensures that companies can adapt to changing market conditions and continue to thrive.

Identifying Growth Opportunities Through Data-Driven Insights

Leveraging data analytics, an outsourced CFO improves financial planning by uncovering growth opportunities that may not be immediately apparent. They analyze key performance indicators, market trends, and financial statements to identify areas where the business can expand or improve.

This data-driven approach enables companies to make informed decisions, invest wisely, and capitalize on emerging market opportunities.

Aligning Financial Goals with Business Objectives

Ensuring that financial goals support overarching business objectives is crucial. An outsourced CFO improves financial planning by aligning budgeting, forecasting, and financial strategies with the company’s mission and vision. This alignment fosters department coherence, enhances operational efficiency, and drives sustainable growth.

Alignment Techniques

- Integrated financial planning

- Cross-departmental collaboration

- Performance monitoring

The Impact of Outsourced CFOs on Cash Flow Management and Profitability

Companies often face financial pressures after establishing a strategic framework, especially with cash flow and cost control.

Streamlining Cash Flow Management With an Outsourced CFO for Business Stability

Maintaining steady cash flow is essential for business stability. An outsourced CFO improves financial planning by implementing effective cash flow management strategies.

They analyze cash inflows and outflows, identify patterns, and forecast future cash needs. This proactive approach ensures businesses can meet their financial obligations and avoid liquidity crises.

By leveraging their expertise, outsourced CFOs help businesses:

- Develop accurate cash flow forecasts

- Implement efficient billing and collection processes

- Manage expenses to align with revenue cycles

Reducing Overhead Costs with Outsourced Financial Leadership

High overhead costs can erode profitability. An outsourced CFO improves financial planning by identifying and eliminating unnecessary expenses. They conduct thorough reviews of operational costs, negotiate better terms with vendors, and implement cost-saving measures.

For private firms, overhead costs can account for approximately 14% of total revenues or 38% of gross profits.

Key strategies include:

- Analyzing fixed and variable costs to identify savings

- Implementing technology solutions to automate processes

- Restructuring staffing models for efficiency

Businesses can allocate resources more effectively by reducing overhead, improving margins, and enhancing competitiveness.

Maximizing Profitability by Optimizing Operational Efficiency

Operational efficiency is a key driver of profitability. An outsourced CFO improves financial planning by streamlining processes and eliminating inefficiencies. They assess workflows, identify bottlenecks, and implement best practices to enhance productivity.

Approaches include:

- Standardizing procedures to reduce errors

- Leveraging data analytics for informed decision-making

- Aligning operations with strategic goals

These efforts lead to cost reductions, faster turnaround times, and improved customer satisfaction, contributing to increased profitability.

Predictive Analysis and Forecasting for Better Cash Flow Decisions

Predictive analysis enables businesses to anticipate financial trends and make proactive decisions. An outsourced CFO improves financial planning by utilizing forecasting tools to model various scenarios. They analyze historical data, market conditions, and business cycles to predict cash flow patterns.

Benefits include:

- Identifying potential cash shortfalls in advance

- Planning for seasonal fluctuations

- Making informed investment decisions

Aligning Business Expenses with Financial Goals for Growth

Aligning expenses with strategic objectives is crucial for sustainable growth. An outsourced CFO improves financial planning by ensuring that spending supports long-term goals. They evaluate budgets, monitor expenditures, and adjust allocations to prioritize high-impact areas.

Key actions include:

- Setting clear financial targets

- Regularly reviewing and adjusting budgets

- Eliminating non-essential spending

How an Outsourced CFO Supports Strategic Decision-Making

With core financial operations in place, making confident, informed decisions becomes essential. That’s where financial leadership steps in. An outsourced CFO improves financial planning not only through execution but by equipping business leaders with the insights needed to make agile, forward-looking decisions.

Here’s how they influence strategic direction through real-time financial guidance.

Leveraging Financial Insights to Drive Business Decisions

To make informed strategic decisions, businesses need accurate and timely financial insights. An outsourced CFO improves financial planning by providing comprehensive analyses that guide decision-making processes. They interpret complex financial data, identify trends, and offer actionable recommendations that align with the company’s objectives.

By leveraging these insights, companies can:

- Allocate resources efficiently

- Identify profitable opportunities

- Mitigate financial risks

How Outsourced CFOs Provide Objective Financial Guidance

An outsourced CFO improves financial planning by offering unbiased financial guidance. Unlike internal staff, outsourced CFOs are not influenced by company politics or internal biases, allowing them to provide objective assessments of financial health and performance.

Their impartial perspective helps businesses:

- Identify areas of inefficiency

- Implement cost-saving measures

- Develop realistic financial goals

Enhancing Budgeting and Forecasting Accuracy for Smarter Decisions

Financial forecasting and outsourced CFO services go hand in hand and are essential for effective financial planning. An outsourced CFO improves financial planning using advanced tools and methodologies to create precise budgets and forecasts. They analyze historical data, market trends, and operational metrics to predict future financial performance.

Benefits include:

- Improved cash flow management

- Informed investment decisions

- Enhanced stakeholder confidence

This precision allows businesses to allocate resources effectively and confidently plan for growth.

Using Financial Reports to Guide Long-Term Business Strategy

Financial reports are vital tools for strategic planning. An outsourced CFO improves financial planning by interpreting these reports to inform long-term business strategies. They analyze income, balance sheets, and cash flow statements to assess financial health and identify trends.

Key uses include:

- Evaluating investment opportunities

- Assessing operational efficiency

- Monitoring progress toward financial goals

Reducing Financial Risks and Improving Business Agility

Managing financial risk is crucial for business agility. An outsourced CFO improves financial planning by identifying potential risks and developing mitigation strategies. They assess market conditions, regulatory changes, and internal processes to anticipate challenges.

By proactively managing risks, businesses can:

- Adapt quickly to market changes

- Maintain financial stability

- Seize new opportunities

Key Metrics to Track When Measuring Growth with an Outsourced CFO

Monitoring specific metrics is crucial to assess the impact of an outsourced CFO. Key performance indicators include:

- Revenue Growth Rate: Measures the increase in sales over a specific period.

- Gross Profit Margin: Indicates financial health by showing the percentage of revenue exceeding the cost of goods sold.

- Operating Cash Flow: Reflects the cash generated from regular business operations.

- Customer Acquisition Cost (CAC): Calculates the cost of acquiring a new customer.

- Customer Lifetime Value (CLV): Estimates the total revenue expected from customers throughout their relationship with the company.

How NOW CFO Supports Businesses in Achieving Financial Growth

NOW CFO offers tailored outsourced CFO services for startups and SMEs to help them achieve financial growth. Their approach includes:

- Strategic Financial Planning: Developing customized financial strategies aligned with business goals.

- Cash Flow Management: Ensuring optimal liquidity to support operations and growth.

- Budgeting and Forecasting: Providing accurate budget management with an outsourced CFO.

- Risk Management: Identifying and mitigating financial risks to safeguard assets.

Overcoming Common Financial Planning Challenges with an Outsourced CFO

While the benefits of an outsourced CFO are clear, many companies are still struggling with core financial obstacles. From cash flow issues to reporting delays, these challenges can slow growth or derail success altogether.

Here’s how an outsourced CFO improves financial planning by solving businesses’ most common pain points.

Addressing Cash Flow Issues with Expert CFO Guidance

Cash flow challenges are a leading cause of business failures. An outsourced CFO improves financial planning by implementing strategies such as:

- Developing cash flow forecasts

- Optimizing accounts receivable and payable

- Identifying cost-saving opportunities

By addressing these areas, businesses can maintain liquidity and avoid financial distress.

Solving Budgeting and Forecasting Gaps with Strategic Financial Planning

Accurate budgeting and forecasting are essential for informed decision-making. An outsourced CFO improves financial planning by:

- Analyzing historical financial data

- Incorporating market trends

- Utilizing advanced forecasting tools

This approach enables businesses to set realistic financial goals and allocate resources effectively.

Managing Scaling Challenges with Expert Financial Oversight

Scaling a business introduces complexities that require expert financial oversight. An outsourced CFO improves financial planning by:

- Assessing financial readiness for expansion

- Identifying funding opportunities

- Implementing scalable financial systems

This guidance ensures that growth initiatives are financially sustainable and aligned with long-term objectives.

Enhancing Financial Reporting Accuracy and Timeliness

Timely and accurate financial reporting is crucial for transparency and compliance. A fractional CFO improves financial planning by:

- Implementing standardized reporting processes

- Ensuring compliance with accounting standards

- Providing real-time financial insights

These practices enhance stakeholder confidence and support strategic decision-making.

Providing Scalable Solutions for Growing Businesses

As businesses grow, their financial needs evolve. A virtual CFO improves financial planning by offering scalable solutions such as:

- Customizing financial strategies to match growth stages

- Integrating flexible financial systems

- Adapting to changing market conditions

Conclusion: Business Growth With Outsourced CFO

Financial clarity is the foundation of business success; exemplary outsourced finance teams are game changers. By aligning operations with economic goals, improving visibility across departments, and forecasting growth opportunities, an outsourced CFO improves financial planning in tangible, measurable ways.

If you’re facing budgeting hurdles, unsure about your scalability, or want more insight into how to drive profitability, NOW CFO has the tools and expertise to help. We’ve helped hundreds of businesses across industries gain strategic clarity and operational control through our tailored outsourced CFO services.

The demand for strategic financial leadership has led many companies to explore flexible solutions. The choice between an outsourced CFO vs fractional CFO hinges on various factors, including business size, economic complexity, budget constraints, and long-term strategic goals.

While both models provide access to seasoned financial professionals, understanding the nuances of each can help businesses make informed decisions that align with their unique needs and objectives.

Understanding the Role of a CFO in Business Growth

The CFO role has evolved significantly. No longer confined to traditional financial oversight, CFOs now play a pivotal role in steering strategic initiatives and driving business growth.

Why Businesses Need Strategic Financial Leadership

Strategic financial leadership is essential for businesses to understand markets and achieve sustainable growth. CFOs provide critical insights that inform decision-making, ensuring financial strategies align with overarching business goals.

Moreover, CFOs serve as key advisors to CEOs and boards, translating financial complexities into actionable strategies. Their leadership ensures that financial planning supports innovation and long-term value creation.

Key reasons businesses require strategic financial leadership options:

- Alignment of financial and business strategies: Ensures cohesive planning and execution across departments.

- Risk management: Identifies potential financial pitfalls and implements measures to mitigate them.

- Resource optimization: Allocates capital efficiently to maximize returns.

- Performance monitoring: Tracks financial metrics to assess and improve business performance.

The Evolving Role of CFOs in Modern Companies

The role of CFOs has expanded beyond traditional financial management to encompass strategic planning and leadership. Modern CFOs are instrumental in guiding companies through digital transformations, sustainability initiatives, and global expansions.

They are now involved in:

- Strategic decision-making: Collaborating with other executives to shape the company’s direction.

- Technology integration: Leveraging digital tools to enhance financial reporting and analysis.

- Stakeholder communication: Engaging with investors, regulators, and other stakeholders to convey financial health and strategies.

- Sustainability initiatives: Incorporating ESG factors into financial planning.

CFO Responsibilities in Financial Planning and Analysis

Financial planning and analysis (FP&A) are core responsibilities of CFOs, involving budgeting, forecasting, and financial modeling. These activities enable organizations to allocate resources effectively, anticipate market changes, and make data-driven decisions.

CFOs oversee:

- Budget development: Creating comprehensive budgets that align with strategic objectives.

- Forecasting: Predicting future financial performance based on historical data and market trends.

- Variance analysis: Comparing actual results to forecasts to identify discrepancies and adjust strategies accordingly.

- Performance metrics: Establishing key performance indicators (KPIs) to monitor financial health.

How CFOs Drive Business Profitability and Risk Management

CFOs play a crucial role in enhancing profitability and managing financial risks. By analyzing cost structures and revenue streams, they identify opportunities for margin improvement and operational efficiency.

Strategies employed by CFOs include:

- Cost optimization: Implementing measures to reduce unnecessary expenses without compromising quality.

- Revenue enhancement: Exploring new markets and product lines to increase income.

- Risk assessment: Evaluating financial risks, such as currency fluctuations or credit exposures, and developing mitigation plans.

- Compliance management: Ensuring adherence to financial regulations to avoid penalties and reputational damage.

When a Business Should Consider Hiring a CFO

Determining the right time to hire a CFO depends on various factors, including business size, complexity, and growth trajectory. Companies should consider bringing on a CFO when:

- Rapid growth: Scaling operations requires sophisticated financial oversight.

- Complex financial structures: Managing multiple revenue streams or international operations necessitates expert financial management.

- Strategic planning needs: Developing long-term strategies benefits from CFO’s insights.

- Investor relations: Engaging with investors and securing funding requires credible financial leadership.

What is an Outsourced CFO?

Today, companies seek flexible financial leadership solutions. An outsourced CFO offers a strategic alternative, providing expert financial guidance without the commitment of a full-time executive.

Definition and Scope of an Outsourced CFO

An outsourced CFO is a seasoned financial professional or firm contracted to deliver high-level financial management services on a part-time, interim, or project basis. Unlike a full-time CFO, they offer flexibility and scalability, aligning their services with the business’s specific needs.

Key responsibilities include:

- Financial Strategy Development: Crafting long-term financial plans that align with business objectives.

- Budgeting and Forecasting: Creating detailed budgets and financial forecasts to guide decision-making.

- Cash Flow Management: Monitoring and optimizing cash flow to ensure financial stability. 82% of small business failures are attributed to cash flow mismanagement.

- Financial Reporting: Preparing accurate financial statements and reports for stakeholders.

- Risk Management: Identifying financial risks and implementing mitigation strategies.

When Businesses Benefit from an Outsourced CFO

Engaging an outsourced CFO is advantageous in various scenarios where specialized financial expertise is required without the overhead of a full-time executive.

Ideal situations include:

- Rapid Growth Phases: Scaling operations necessitate strategic financial planning to manage increased complexity.

- Startup and Early-Stage Companies: Limited resources make outsourcing cost-effective for accessing high-level financial guidance.

- Project-Based Needs: Specific initiatives like mergers, acquisitions, or system implementations benefit from temporary CFO expertise.

- Financial Turnarounds: Companies facing financial distress require expert intervention to restructure and stabilize finances.

How Outsourced CFO Services Work Within a Company

Outsourced CFO services integrate seamlessly into existing business structures, collaborating closely with internal teams to enhance financial operations.

Operational dynamics include:

- Collaborative Engagement: Working alongside management to align financial strategies with business goals.

- Customized Service Delivery: Tailoring services to address specific financial challenges and objectives.

- Flexible Scheduling: Providing services on a schedule that suits the company’s needs, whether part-time or project-based.

- Technology Integration: Utilizing advanced financial tools and systems to improve efficiency and accuracy.

Cost Considerations for Hiring an Outsourced CFO

The cost of hiring an outsourced CFO varies based on the scope of services, company size, and engagement duration.

Typical pricing structures:

- Hourly Rates: Ranging from $100 to $150 per hour, suitable for short-term or specific projects.

- Monthly Retainers: Between $3,000 and $15,000 per month, depending on service complexity and time commitment.

The Advantages of an Outsourced CFO Model

Adopting an outsourced CFO model offers numerous benefits that enhance a company’s financial health and strategic positioning.

Key advantages include:

- Cost Efficiency: Access to expert financial leadership without the expense of a full-time executive.

- Strategic Expertise: Informed decision-making guided by seasoned financial professionals.

- Scalability: Services can be adjusted based on business growth and changing needs.

- Objective Perspective: External insights can identify opportunities and challenges overlooked internally.

- Focus on Core Business: Allows internal teams to concentrate on primary business functions while financial experts manage fiscal responsibilities.

What is a Fractional CFO?

In financial leadership, businesses are increasingly turning to fractional CFOs to deal with complex financial challenges without the commitment of a full-time executive. This model offers flexibility and expertise tailored to each organization’s unique needs.

Definition and Scope of a Fractional CFO

A fractional CFO is a seasoned financial professional who provides part-time or project-based services to multiple organizations. Unlike traditional full-time CFOs, fractional CFOs work with various clients, delivering strategic financial guidance without the commitment of a permanent position.

- Financial Strategy Development: Crafting long-term financial plans that align with business objectives.

- Budgeting and Forecasting: Creating detailed budgets and financial forecasts to guide decision-making.

- Cash Flow Management: Monitoring and optimizing cash flow to ensure financial stability.

- Financial Reporting: Preparing accurate financial statements and reports for stakeholders.

- Risk Management: Identifying financial risks and implementing mitigation strategies.

How Fractional CFOs Support Growing Businesses

Engaging a fractional CFO service can be particularly beneficial for growing businesses that require strategic financial oversight without the overhead of a full-time executive. These professionals offer:

- Scalability: Adjusting services based on the company’s growth stage and financial complexity.

- Cost-Effectiveness: Providing expert financial guidance without the expense of a full-time salary and benefits.

- Objective Insights: Offering an external perspective to identify opportunities and challenges.

- Specialized Expertise: Bringing industry-specific knowledge to address unique financial needs.

Fractional CFO Engagement Models and Cost Structures

The engagement models for fractional CFOs are designed to offer flexibility and align with the specific needs of a business. Common models include:

- Hourly Rates: Typically, they range from $100 to $150 per hour, depending on the CFO’s experience and the complexity.

- Monthly Retainers: Fixed monthly fees for ongoing part-time support, often between $3,000 and $15,000.

- Project-Based Fees: Customized pricing for specific projects, such as fundraising or financial system implementations.

These models allow businesses to access high-level financial expertise that aligns with their budget and operational requirements.

Key Benefits of a Fractional CFO vs Full-Time CFO

Choosing between a fractional CFO and a full-time CFO depends on various factors, including the company’s size, growth stage, and financial complexity. Key benefits of hiring a fractional CFO include:

- Cost Savings: Avoiding the expenses associated with a full-time salary, benefits, and overhead.

- Flexibility: Engaging services as needed, allowing adjustments as the business evolves.

- Diverse Experience: Gaining insights from professionals who have worked across multiple industries and business models.

- Quick Implementation: Rapidly addressing financial challenges without the lengthy hiring process of a full-time executive.

When a Business Should Hire a Fractional CFO

Determining the right time to hire a fractional CFO involves assessing the company’s current financial needs and growth trajectory. Situations that may warrant engaging a fractional CFO include:

- Rapid Growth: Scaling operations requires sophisticated financial oversight.

- Complex Financial Structures: Managing multiple revenue streams or international operations necessitates expert financial management.

- Strategic Planning Needs: Developing long-term strategies as part of external CFO benefits.

- Investor Relations: Engaging with investors and securing funding requires credible financial leadership.

Outsourced CFO vs Fractional CFO: Key Differences

Businesses often must choose between an outsourced CFO vs fractional CFO for financial leadership. While both roles offer external financial expertise, understanding their distinctions is crucial for aligning with your company’s needs.

Now, let’s look into the difference between an outsourced CFO and a fractional CFO.

Level of Involvement and Responsibilities

An outsourced CFO typically provides comprehensive financial services, often acting as the company’s finance department. Their responsibilities encompass strategic planning, financial reporting, risk management, and more.

Conversely, a fractional CFO offers targeted financial expertise on a part-time basis. Depending on the company’s immediate needs, they focus on specific areas such as budgeting, forecasting, or fundraising.

Cost Comparison of Fractional vs Outsourced CFOs

Engaging an outsourced CFO often involves a fixed monthly fee, providing predictable budgeting for comprehensive services. This model can be cost-effective for companies needing extensive financial oversight without the overhead of a full-time team.

In contrast, a fractional CFO typically charges hourly rates or project-based fees, offering flexibility for businesses with specific financial tasks or limited budgets. This arrangement allows companies to access high-level expertise as needed, optimizing resource allocation.

Short-Term vs Long-Term Financial Strategy Support

An outsourced CFO is well-suited for businesses seeking long-term financial strategy development and execution. Their ongoing involvement ensures continuity in financial planning and alignment with the company’s growth trajectory.

A fractional CFO, however, is ideal for short-term projects or transitional periods. They provide immediate strategic input, helping businesses counter challenges or bank opportunities without long-term commitments.

Expertise and Industry Specialization Differences

Outsourced CFOs often bring a broad range of experience across various industries, offering versatile solutions adaptable to different business models. Their diverse background equips them to handle complex financial scenarios and regulatory environments.

Fractional CFOs typically possess deep expertise in specific sectors, providing tailored insights and strategies. Their specialized knowledge benefits businesses operating within niche markets or facing unique financial challenges.

Scalability and Flexibility in Financial Leadership

The outsourced CFO model offers scalability, accommodating businesses as they grow and their financial needs evolve. This flexibility ensures continuous support without the constraints of internal staffing limitations.

Similarly, a fractional CFO provides flexibility, allowing businesses to adjust the level of engagement based on current requirements. This adaptability is particularly beneficial for startups or companies experiencing fluctuating financial demands.

Learn More: Fractional CFO Vs Full-Time CFO

Pros and Cons of Hiring an Outsourced CFO

Engaging an outsourced CFO can be a strategic move for businesses seeking expert financial guidance without the commitment of a full-time executive.

Advantages of an Outsourced CFO for Businesses

An outsourced CFO gives businesses access to high-level financial expertise, offering strategic insights that can drive growth and efficiency. Key advantages include:

- Cost Efficiency: Outsourced CFOs offer expert services without the overhead costs of full-time employees.

- Flexibility: Services can be tailored to the specific needs and timelines of the business.

- Expertise: Access to professionals with diverse industry experience and specialized skills.

- Scalability: Ability to adjust services as the business grows or faces new challenges.

How Outsourced CFOs Offer Comprehensive Financial Oversight

An outsourced CFO delivers a broad range of financial services, ensuring comprehensive oversight of a company’s financial health. Their responsibilities often encompass:

- Strategic Planning: Developing long-term financial strategies aligned with business goals.

- Financial Reporting: Preparing accurate and timely financial statements for stakeholders.

- Risk Management: Identifying potential financial risks and implementing mitigation strategies.

- Budgeting and Forecasting: Creating detailed budgets and forecasts to guide decision-making.

Cost Savings and Access to High-Level Expertise

Outsourced CFO hiring strategies can save significant costs while granting access to top-tier financial expertise. This model allows businesses to:

- Reduce Overhead: Eliminate full-time salaries, benefits, and office space expenses.

- Pay for What You Need: Engage services on a part-time or project basis, aligning costs with specific needs.

- Access Specialized Skills: Benefit from professionals with experience in mergers, acquisitions, and fundraising.

Potential Challenges of Outsourcing CFO Services

While there are numerous benefits, outsourcing CFO services also presents potential challenges:

- Limited Availability: An outsourced CFO may not be as readily available as an in-house executive, potentially leading to delays in decision-making.

- Integration Issues: Aligning an external CFO with the company’s culture and processes can be challenging.

- Confidentiality Concerns: Sharing sensitive financial information with an external party requires robust confidentiality agreements.

Finding the Right Outsourced CFO for Your Business

Selecting the appropriate outsourced CFO involves evaluating several key factors:

- Industry Experience: Ensure the CFO has relevant experience in your specific industry.

- Service Scope: Define the required services and confirm the CFO can meet those needs.

- Cultural Fit: Assess whether the CFO’s working style aligns with your company’s culture.

- References and Track Record: Review past client experiences and outcomes to gauge reliability.

Learn More: Outsourced CFO vs In-House CFO

Pros and Cons of Hiring a Fractional CFO

In financial management, businesses often weigh the pros and cons of hiring a fractional CFO. This model offers a blend of strategic expertise and flexibility, catering to the unique needs of growing companies.

Benefits of a Fractional CFO for Growing Companies

Engaging a fractional CFO provides growing businesses with access to high-level financial expertise without the commitment of a full-time executive. This approach allows companies to:

- Strategically plan for growth by leveraging the CFO’s experience scaling businesses.

- Improve financial reporting and compliance, ensuring accurate and timely information for stakeholders.

- Enhance cash flow management, optimizing operational efficiency and profitability.

Cost-Effectiveness and Budget Flexibility

One of the primary advantages of hiring a fractional CFO is the cost savings compared to a full-time hire. According to the Preferred CFO, the average cost of a fractional CFO ranges from $3,000 to $15,000 per month, depending on the scope of work and company size.

Moreover, this model provides:

- Scalable services that can adjust to the company’s growth.

- Access to specialized expertise without the overhead of a full-time salary.

- Budget predictability aids financial planning and forecasting.

When a Fractional CFO Provides the Best Value

A fractional CFO is particularly beneficial for businesses experiencing:

- Rapid growth requires strategic financial planning to scale operations effectively.

- Complex financial challenges, such as mergers, acquisitions, or restructuring.

- Limited internal financial expertise necessitates external guidance for informed decision-making.

Potential Limitations of a Fractional CFO

While the benefits are substantial, there are potential drawbacks to consider:

- Limited availability, as fractional CFOs often juggle multiple clients, which may affect responsiveness.

- Integration challenges, where aligning the CFO with the company’s culture and processes may require additional effort.

- Short-term focus, potentially lacking the long-term commitment of a full-time executive.

Choosing the Right Fractional CFO for Your Business

Selecting the appropriate fractional CFO involves careful consideration of several factors:

- Industry experience, ensuring the CFO understands your sector’s unique challenges and opportunities.

- Track record of success, with references or case studies demonstrating their impact on similar businesses.

- Cultural fit, aligning with your company’s values and working style for seamless integration.

How NOW CFO Provides a Tailored CFO Solution

NOW CFO offers tailored CFO services that adapt to diverse business requirements. We provide strategic financial guidance without the constraints of traditional models.

Customized Financial Leadership Based on Business Needs

NOW CFO’s approach to financial leadership is rooted in customization. Recognizing that each business has distinct financial challenges and goals, we offer tailored services to address these unique circumstances.

Key aspects of our customized services include:

- Scalable Solutions: Whether a startup or an established enterprise, NOW CFO adjusts its services to match the scale and complexity of the business.

- Industry-Specific Expertise: Our professionals bring experience from various sectors, allowing for relevant and actionable insights.

- Flexible Engagement Models: Businesses can choose from fractional, interim, or project-based engagements, ensuring alignment with operational needs.

Full-Service Support from Experienced CFO Professionals

A team of seasoned financial professionals is at the core of NOW CFO’s offerings. Our experts bring a wealth of experience across various industries, providing comprehensive support encompassing all facets of financial management.

Our services include:

- Financial Reporting and Analysis: Delivering accurate and timely financial statements to inform decision-making.

- Budgeting and Forecasting: Developing financial plans that align with business objectives and market conditions.

- Cash Flow Management: Ensuring optimal liquidity to support operations and growth initiatives.

- Risk Assessment and Mitigation: Identifying financial risks and implementing mitigation strategies.

Flexible CFO Solutions Without Long-Term Commitments

NOW CFO offers flexible engagement options that do not require long-term commitments based on business nature. This flexibility allows companies to access high-level financial expertise as needed without the burden of permanent hires.

Benefits of this model include:

- Cost Efficiency: Engaging CFO services on a fractional or project basis can lead to significant savings compared to full-time salaries.

- Adaptability: Services can be scaled up or down based on business needs, ensuring optimal resource utilization.

- Speed to Value: Quick onboarding processes mean businesses can rapidly benefit from financial expertise.

Strategic Guidance for Business Growth and Stability

Beyond operational support, NOW’s CFO emphasizes strategic financial guidance to foster long-term growth and stability. Our CFOs work closely with business leaders to develop strategies that align financial management with overarching business goals.

Strategic services include:

- Growth Planning: Identifying opportunities for expansion and developing financial strategies to support growth initiatives.

- Capital Structuring: Advising on optimal capital structures to balance risk and return.

- M&A Support: Providing financial due diligence and integration planning for M&A activities.

- Succession Planning: Ensuring financial continuity through leadership transitions.

Proven Success in Providing CFO Services to Diverse Industries

NOW CFO’s track record spans various industries, demonstrating their ability to adapt and deliver value across different business contexts. Our experience includes sectors such as technology, manufacturing, healthcare, and professional services.

Success stories highlight their impact in areas like:

- Improving Financial Reporting Accuracy: Enhancing the reliability of financial data to support strategic decisions.

- Streamlining Operations: Identifying inefficiencies and implementing process improvements to boost profitability.

- Facilitating Capital Raises: Preparing financial documentation and strategies that attract investors.

- Regulatory Compliance: Ensuring adherence to financial regulations and standards.

When to Choose an Outsourced CFO vs a Fractional CFO

Choosing between an outsourced CFO vs fractional CFO hinges on various factors. Understanding these distinctions is crucial for businesses to align their financial strategies with organizational needs.

Business Size and Financial Complexity Considerations

The scale and intricacy of a business significantly influence the decision between an outsourced CFO and a fractional CFO.

- Outsourced CFOs: Ideal for larger enterprises or those undergoing complex financial transformations. They offer comprehensive financial oversight, strategic planning, and risk management tailored to intricate business structures.