Delayed or inaccurate financial reports can degrade credibility and derail strategic decisions. A study analyzed SMEs and found that firms that outsourced accounting tasks exhibited higher reporting quality than firms that kept these tasks in‑house.

Outsourced CFOs support financial reporting by embedding structure, precision, and foresight into the entire process. An outsourced CFO turns the burden of financial statements into a powerful tool for growth and confidence.

1. Dramatic Cost Savings Compared to Full-Time CFOs

Hiring a full-time CFO can be cost-prohibitive for many growing companies. Beyond a base salary often exceeding $400,000, the cost of bonuses, benefits, and stock options can escalate rapidly.

Outsourced CFOs support financial reporting and overall fiscal management at a fraction of that cost, offering the same level of expertise without full-time financial commitment. This cost-efficient model allows businesses and startups to reinvest capital into growth initiatives while benefiting from senior-level financial services.

Source: NOW CFO

2. Proactive Cash Flow Management Prevents Business Failures

Cash flow problems are the silent killer of small businesses. Without clear oversight and forecasting, companies can quickly find themselves strapped for liquidity. That’s where outsourced CFOs shine.

By offering real-time reporting strategies and establishing forward-looking cash flow statements, outsourced CFOs help companies avoid common pitfalls. The result? Better capital planning, fewer surprises, and more confident financial leadership.

Source: Forbes

3. Rapid Adoption of Outsourced CFO Services

The need for flexible, high-level financial leadership is soaring. A 103% increase in demand signals a broader market trend, businesses of all sizes are embracing outsourced CFOs to support financial reporting and executive decision-making.

This surge stems from growing pressure to be audit-ready, optimize capital structure, and prepare for investment rounds. By delivering a CFO reporting structure without the long-term hiring risk, outsourced solutions are becoming the go-to model for companies.

Source: Business Talent Group

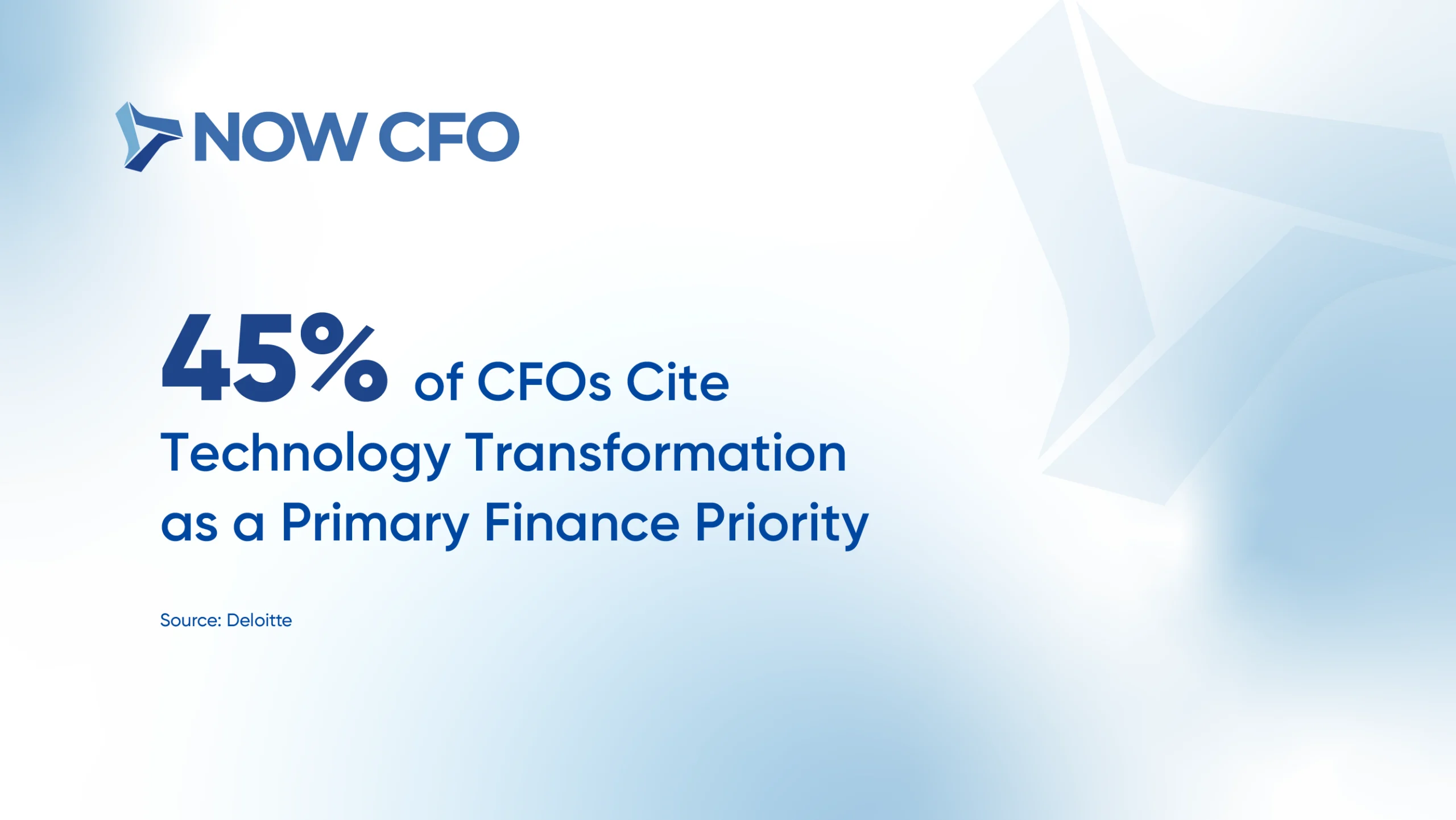

4. Increasing Focus on Technology Investment and Implementation

Today’s CFOs are more than financial stewards; they’re technology champions. Modern outsourced CFOs oversee digital finance transformation from cloud ERPs to automation and AI tools.

This investment pays off. Tech-forward CFOs support accurate financial statements by reducing manual input errors, accelerating close cycles, and delivering real-time financial dashboards. Businesses benefit from more insightful reporting, compliance, and faster decision-making.

Source: PwC

5. Outsourcing Popularity Among SMEs

SMEs increasingly turn to outsourced financial leadership to scale efficiently. With cloud ERP systems and flexible subscription-based pricing models, outsourced CFOs support financial reporting in ways that are now more accessible than ever.

These services offer tailored financial reporting for investor readiness, budgeting, and forecasting. This model delivers enterprise-grade insight at a manageable cost for SMEs with growth ambitions and lean resources.

Source: Global Growth Insights

6. Most Outsourced Finance Tasks for Small Businesses

Financial reporting is one of the top outsourced functions among SMEs, alongside bookkeeping, payroll, and accounts payable. This trend highlights a shift toward fractional expertise, particularly in functions that require precision and compliance.

Outsourced CFOs step in to manage accurate financial statements, prepare for audits, and establish the CFO reporting structure needed for decision-making and fundraising. Their impact extends beyond cost savings; they add strategic value where it matters most.

Source: Clutch

7. Growing Executive Commitment to Outsourced Financial Expertise

Executives are doubling down on outsourced financial leadership to handle today’s fast-evolving regulatory and operational landscape. With growing pressure for audit-ready accuracy, reporting compliance, and timely insights, outsourced CFOs are becoming indispensable.

These experts help businesses scale while strengthening internal controls and preparing financial statements for investors, lenders, and board members. This trend shows no slowing as businesses seek scalable solutions that deliver transparency and financial clarity.

Source: Deloitte

Conclusion

Outsourced CFOs transform how businesses approach financial reporting. They deliver accurate reporting, GAAP-compliant, but also actionable and investor-ready. The result? Faster closings, fewer compliance headaches, and clearer visibility into performance.

If your business is facing delays or gaps in internal controls, an outsourced CFO is the solution. NOW CFO offers flexible engagement models designed to meet you where you are, whether that’s building your first reporting infrastructure or leveling up for a potential acquisition.

Long-term growth requires visionary financial leadership. Around 65% of companies report that outsourcing enables them to focus on core functions.

An outsourced CFOs support and brings high-level financial acumen and objectivity, empowering businesses to construct scalable financial foundations. Through rigorous forecasting, analysis, and capital planning, these financial stewards lay the groundwork for scalable expansion.

Outsourced CFOs Now Lead Broader Strategic Mandates

A recent survey revealed that 93% of CFOs feel their responsibilities today carry far greater significance than in the past. This underscores a paradigm shift; CFOs are no longer limited to financial reporting but are now instrumental in driving long-term business strategy.

This evolution brings clear advantages for companies leveraging outsourced CFOs. These professionals bring enterprise-grade strategic financial leadership to the table, allowing businesses to access high-level insight without full-time commitment.

Source: Accenture

CFOs Remain Optimistic About Long-Term Growth

According to the 2025 Global CFO Report, 72% of CFOs anticipate revenue growth exceeding 10%. This bold outlook demonstrates confidence in data-backed planning and agile execution.

Outsourced CFOs are uniquely positioned to drive this momentum for mid-market companies and startups. Through precise forecasting and business growth planning, they help translate strategic ambition into achievable financial outcomes.

Source: Forensic Technologies International

Rising Appetite for Long-Term Financial Risk

CFOs are willing to increase risk on their balance sheets, rising to 17%, after a 5% jump in quarter-over-quarter. This indicates a growing tolerance for long-term financial risk in pursuit of strategic growth.

This is for companies that want to embrace bold moves, whether investing in innovation or expansion. Building risk models and buffers ensures that calculated decisions align with long-term business strategy. It’s a smart way to innovate without risking the foundation.

Source: Deloitte

Digital Transformation: A Core CFO Priority

SAP CFO research reports that 73% of finance leaders have improved cost control and risk mitigation through digital transformation, demonstrating how technology is a lever for strategic impact.

Outsourced CFOs lead this evolution with a future-focused CFO services approach. From implementing scalable finance models to leveraging automation tools, they optimize operations while monitoring cost efficiency.

Source: SAP CFO

Tech-Driven CFOs Fuel Future Readiness

Nearly half of CFOs (44%) intend to increase technology investment over the next year to reduce costs. This reflects a broader shift in how CFOs leverage innovation to fund long-term growth and operational efficiency.

Outsourced CFOs are at the forefront of this transformation. With expertise in digital finance tools and scalable platforms, they help businesses streamline processes, reduce overhead, and strategically reinvest savings.

Source: PwC

CFO Confidence Hits a Ten-Quarter High

Deloitte’s latest survey reveals that the CFO Confidence Score reached 5.8 in Q4 2024, its highest level in ten quarters. This uptick signals renewed optimism in financial strategy, even amid evolving market pressures.

Outsourced CFOs provide the same strategic foresight for businesses without internal financial leadership, fueling this confidence. Through scenario planning, performance alignment, and capital efficiency, they equip organizations to make bold, data-informed decisions.

Source: Deloitte

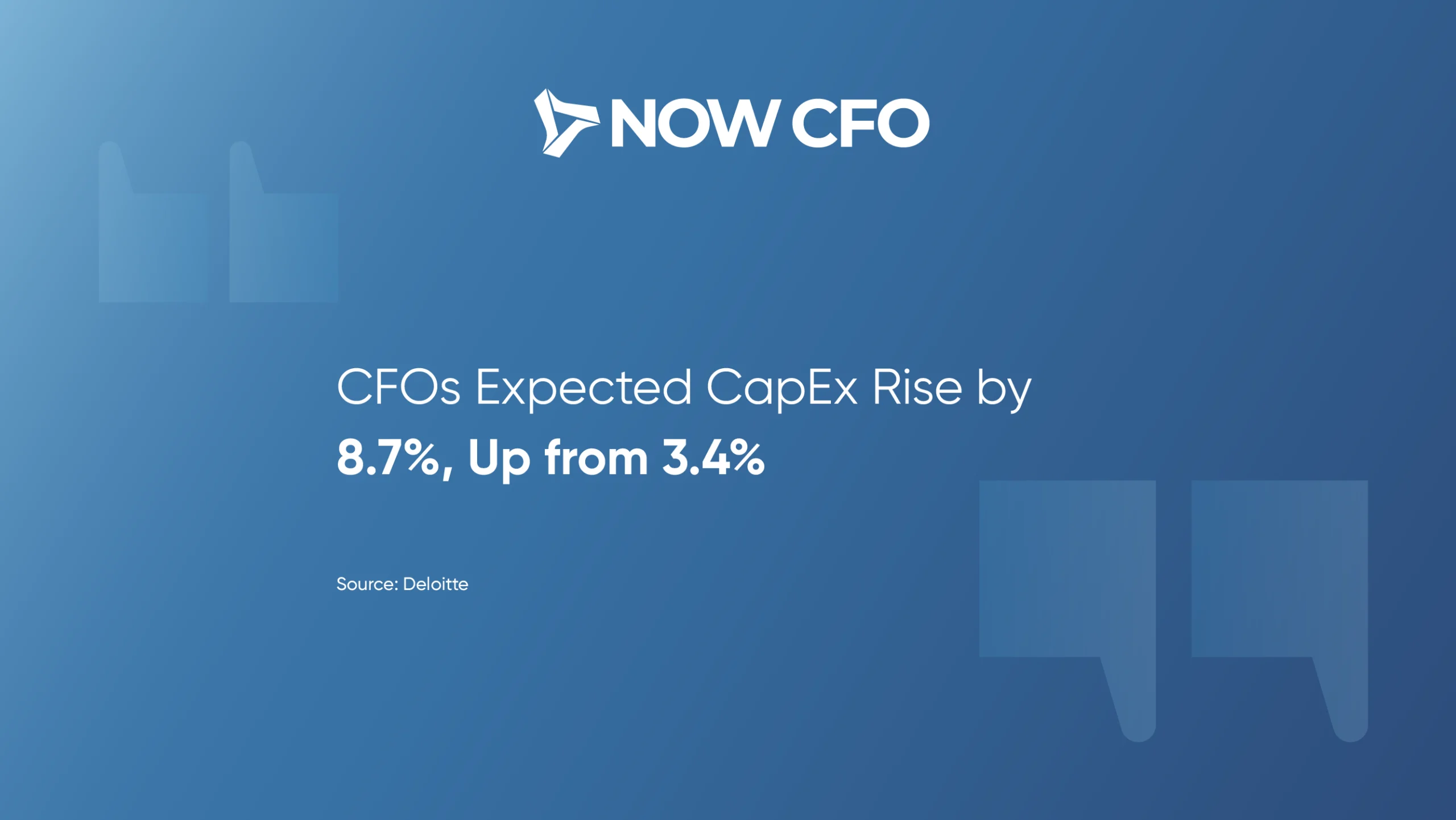

Capital Investments Accelerate in 2025

CFOs anticipate a significant rise in capital expenditure, up 8.7%, indicating a shift from defensive tactics to growth-oriented investments. This transition marks a renewed focus on long-term value creation.

Outsourced CFOs play a key role in this pivot. They align capital planning with strategic business goals, ensuring every dollar deployed supports scalable outcomes. Whether guiding expansion, upgrading systems, or entering new markets, outsourced CFOs bring discipline and direction to capital strategies that matter most for long-term success.

Source: Deloitte

Conclusion

Outsourced CFOs are strategic architects who help embed sustainable growth into an organization’s DNA. By establishing scalable systems with performance-aligned metrics, they ensure a better tomorrow.

If you’re ready to elevate from managing challenges to designing tomorrow’s success, NOW CFO offers tailored, growth-focused financial leadership. Reach out for a no-pressure free strategy session.

Frequently Asked Questions

How do Outsourced CFOs Support Long-Term Business Planning?

Outsourced CFOs Support & provide strategic financial leadership that aligns a company’s financial operations with its long-term goals. They create a roadmap for sustainable growth through forecasting, budgeting, and scenario planning.

What Financial Strategies Help with Sustainable Growth?

Key strategies include scalable finance models, strategic capital planning, and aligning KPIs with long-term objectives. A fractional CFO strategy ensures these practices are tailored to your unique growth stage and industry, supporting strategic business growth planning from the inside out.

Can an Outsourced CFO Help Plan an Exit Strategy?

Yes, fractional CFOs specialize in preparing financials for M&A activity or business exits. By structuring the company’s financial health and creating valuation-boosting strategies, they ensure your business is exit-ready well in advance, maximizing outcomes when the time comes.

Why is Financial Forecasting Important for Long-Term Success?

Forecasting enables future-focused CFO services that anticipate cash flow needs, growth constraints, and market shifts. Businesses that engage in quarterly forecasting are more likely to meet their long-term goals and respond proactively rather than reactively.

What Role Does an Outsourced CFO Play in Capital Strategy?

An Outsourced CFO aligns debt, equity, and reinvestment decisions with the company’s vision. Strategic capital planning ensures you access the right capital at the right time, fueling expansion while maintaining financial health. This is a cornerstone of how CFOs support long-term vision alignment.

Behind every transformative financial decision lies a foundation built on data. 85% of CFOs now view data analytics as indispensable for strategic decision-making. For business leaders, simply tracking revenues and expenses provides only a surface-level view; real insight comes from deeper, actionable metrics.

We’ll explore metrics outsourced CFOs use to drive financial decisions, metrics that go beyond the balance sheet to reveal operational efficiency, customer profitability, and forecast reliability.

By mastering these key performance indicators, you’ll be equipped to make data-backed choices on pricing, investment, and growth strategies, ensuring your organization doesn’t just survive but thrives.

Lets look at the 8 metrics outsourced CFOs use to drive financial decisions for your business.

Gross Profit Margin

Gross profit margin measures how efficiently a company turns revenue into profit by subtracting the COGS from total revenue and dividing the result by revenue. A high gross profit margin indicates strong pricing power and effective cost control, reflecting the core profitability of products or services.

Monitoring gross profit margin enables outsourced CFOs to refine pricing strategies, optimize supply-chain costs, and pinpoint underperforming product lines. By drilling into this metric, they can negotiate better supplier agreements, reallocate resources toward higher-margin offerings, and set more accurate sales targets.

Source: The CFO

Operating Cash Flow (OCF)

OCF reveals how much cash a business generates from its core operations, excluding financing and investing activities. It’s one of the most critical CFO dashboard metrics, offering a clear view of liquidity and short-term financial health.

Outsourced CFOs use OCF to make informed decisions about reinvestment, debt repayment, and cost optimization. By tracking this weekly metric, they identify patterns in inflows and outflows, ensuring that cash is available to meet obligations and capitalize on growth opportunities.

Source: GTreasury

EBITDA

EBITDA is a vital performance metric CFOs monitor to assess a company’s profitability. It strips away the effects of financial and accounting decisions, offering a cleaner picture of core earnings power.

Outsourced CFOs use EBITDA to benchmark company performance, evaluate acquisition targets, and support debt and equity financing strategies. With nearly half of CFOs at large firms prioritizing the Debt/EBITDA ratio, this metric plays a critical role in managing leverage and maintaining financial stability.

Source: Journal of Finance via Wiley Online Library

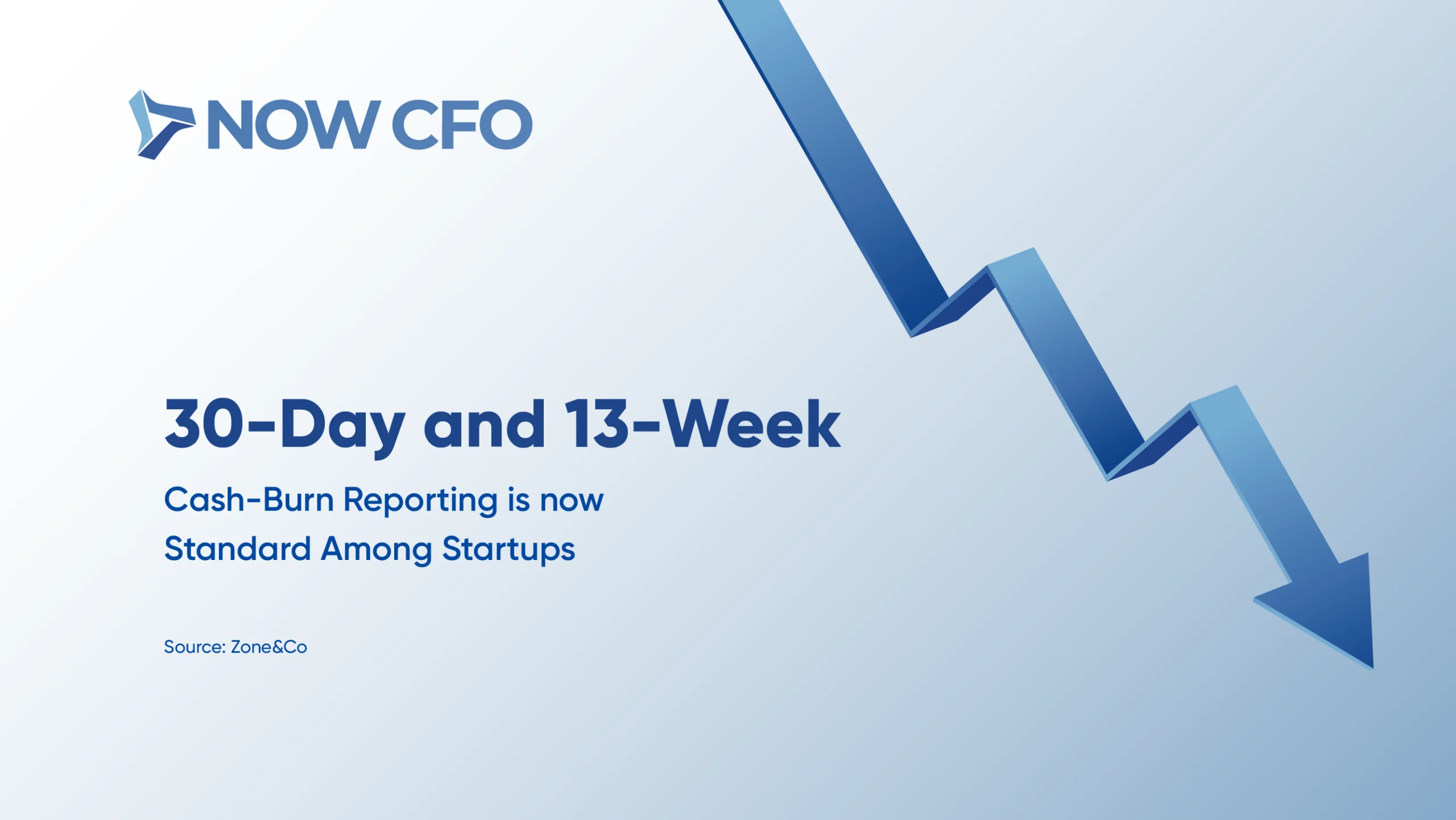

Burn Rate (for Startups)

Burn rate tracks how quickly a company spends its cash reserves, making it a crucial metric for startups navigating uncertain growth phases. The shift toward standard 30-day and 13-week cash-burn reporting reflects the heightened need for precision in managing runway and funding cycles.

Outsourced CFOs rely on this metric to monitor financial health and swiftly adjust hiring, marketing, or operational spending. Keeping a close eye on burn rate, they help startups stretch capital further, improve investor confidence, and avoid liquidity crises.

Source: Zone&Co

Customer Acquisition Cost (CAC)

CAC calculates the average expense a business incurs to acquire a new customer. It’s a core KPI used by outsourced CFOs to assess the efficiency of marketing and sales strategies. In sectors like SaaS and B2B, where CACs can run high, $702 and $536, respectively, tracking this metric is essential for optimizing ROI.

Outsourced CFOs use CAC to evaluate spending effectiveness and determine whether customer acquisition efforts are sustainable. When combined with Customer Lifetime Value (LTV), CAC insights can guide pricing, retention, and channel strategies. A well-managed CAC ensures that marketing investments fuel profitable, scalable growth.

Source: Userpilot

Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) estimates the total revenue a customer will generate over their entire relationship with a company. Measuring against CAC reveals how efficiently a business turns marketing spend into long-term value. In healthy SaaS businesses, LTV/CAC ratios typically range from 3:1 in Business Services to 7:1 in Adtech, with most industries averaging between 4:1 and 6:1.

Outsourced CFOs monitor this metric closely to guide pricing models, improve retention strategies, and determine customer acquisition budgets. A strong LTV enhances profitability and signals product-market fit and customer satisfaction, making it a vital metric for sustained growth and strategic decision-making.

Source: Eqvista

Forecast Accuracy

Forecast accuracy measures how closely actual results align with projected financials. It’s a vital decision-making metric that reflects the reliability of a company’s planning and budgeting processes. High forecast accuracy allows leadership to anticipate future conditions and adjust proactively and confidently.

Outsourced CFOs use this metric to refine scenario modeling, improve budget variance tracking, and strengthen strategic alignment. According to Deloitte, 42% of CFOs are now prioritizing enterprise risk management and digital transformation initiatives that rely heavily on accurate forecasting.

Source: Deloitte CFO

Accounts Receivable Turnover

AR turnover measures how efficiently a company collects payments from customers. A higher turnover ratio indicates that receivables are collected quickly, directly strengthening cash flow and working capital.

Outsourced CFOs implement centralized AR strategies to streamline billing, accelerate collections, and resolve disputes faster. According to McKinsey, this approach can free up to 30% more working capital, which can be reinvested into operations, R&D, or growth initiatives.

Improving AR turnover is one of the most actionable performance metrics CFOs monitor to boost liquidity and reduce reliance on external financing.

Source: McKinsey & Company

Conclusion

These metrics form the cornerstone of data-driven decision-making. Outsourced CFOs bring technical know-how to calculate these KPIs and the strategic perspective to interpret trends, identify opportunities, and mitigate risks.

Ready to turn your financial data into confident business actions? Book a one-on-one consultation with NOW CFO and design a metrics framework that aligns with your goals. Discover how partnering with an outsourced CFO can transform raw numbers into strategic insights.

Frequently Asked Questions

What are the Top Metrics CFOs Track?

Outsourced CFOs use a blend of key financial KPIs like gross profit margin, operating cash flow, and EBITDA to get a holistic view of business health. These decision-making metrics go beyond surface numbers to reveal cost efficiency, profitability trends, and liquidity status, ensuring strategic financial oversight.

How do Outsourced CFOs use Metrics to Make Decisions?

Fractional CFO analytics hinge on real-time CFO dashboard metrics. By monitoring metrics such as burn rate, CAC, and LTV, outsourced CFOs can adjust investments, pricing strategies, and expense controls to drive optimized growth and mitigate risk.

What KPIs Improve Financial Performance?

Performance metrics CFOs monitor, like accounts receivable and inventory turnover, directly impact working capital efficiency. By shortening receivables cycles and aligning inventory with demand, CFOs free up cash for reinvestment, boost profitability, and strengthen balance-sheet resilience.

Why is EBITDA Important for Decision-Making?

As a core valuation metric, EBITDA strips out interest, taxes, depreciation, and amortization to highlight underlying profitability. Outsourced CFOs leverage EBITDA to benchmark against industry peers, support M&A activities, and inform capital-raising strategies with precise, comparable performance data.

How Can Cash Flow Metrics Help with Strategic Planning?

Metrics like OCF and cash conversion cycle give CFOs clarity on liquidity and capital efficiency. Tracking OCF weekly or monthly enables data-driven scenario modeling, which guides debt management, reinvestment timing, and budgeting decisions to ensure sustainable growth.

What Financial Metrics do CFOs Track for Forecasting Accuracy?

Forecast accuracy is a critical decision-making metric that compares projected vs. actual results. Outsourced CFOs aim for over 90% forecast accuracy, using variance analysis and rolling forecasts to refine budgeting, plan for contingencies, and support long-term strategic planning.

When business leaders fixate on skyrocketing revenue, they often overlook the real measure of success: return on investment. An outsourced CFO can shift that focus and deliver tangible results.

Yet, many organizations underutilize outsourced CFOs or treat them merely as number crunchers. This blog aims to change that perception by showcasing five high-impact, result-oriented strategies that fractional CFOs employ to transform businesses. Let’s look at 5 proven strategies Outsourced CFOs Use to enhance ROI for your business.

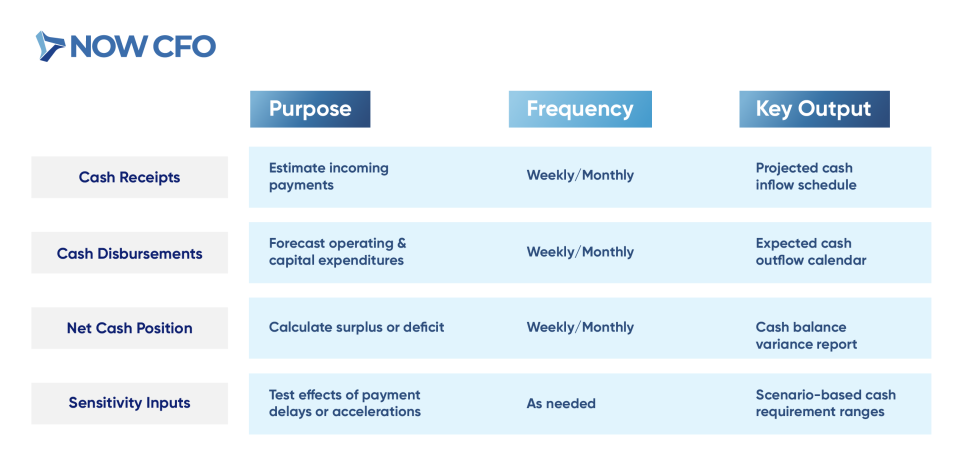

Strategic Cash Flow Forecasting

Cash flow forecasting evaluates the timing and amount of inflows and outflows to help businesses maintain adequate liquidity and avoid cash crunches. Accurate forecasting ensures that companies can meet obligations, plan investments, and reinvest wisely for growth.

Outsourced CFOs enhance financial strategy execution by deploying tools and models that improve forecast accuracy and adaptability. Their proactive planning helps clients manage seasonality, prepare for downturns, and optimize capital usage, essential components in improving ROI with outsourced CFOs.

Source: EY Parthenon

Cost Structure Optimization

Cost structure analysis breaks down a company’s fixed and variable expenses to uncover inefficiencies and reduce unnecessary spend. A leaner cost structure directly improves margins and creates headroom for strategic reinvestment.

Fractional CFOs use financial performance optimization techniques to evaluate vendor contracts, eliminate waste, and centralize expenses for better visibility. These CFO ROI strategies contribute to scalable, long-term cost savings while maintaining operational strength.

Source: Deloitte

Revenue Stream Diversification & Pricing Strategy

Revenue diversification spreads risk across multiple income sources, while smart pricing strategy ensures maximum profitability from each transaction. When managed effectively, both drive stronger, more sustainable returns.

Outsourced CFOs use data-driven financial strategy to explore new revenue models and refine pricing tactics. These business growth financial tactics help companies attract higher-value customers and reduce dependence on any single channel.

Source: Bain & Company

Financial KPI Alignment with Business Goals

Financial KPIs like EBITDA, ROI, and working capital turnover must map directly to strategic business outcomes. When KPIs are siloed from vision, leadership can’t measure progress or pivot effectively.

CFOs apply ROI-driven financial leadership to align every department’s financial metrics with growth priorities. This alignment improves decision-making and ensures that each initiative contributes to overall return on investment.

Source: PicoSmart

Scenario Planning & Risk Management

Scenario planning tests a business’s response to best-case, worst-case, and status quo financial outcomes. It helps organizations proactively mitigate risk and strengthen resilience.

By leveraging forecasting models and advanced analytics, outsourced CFOs reduce volatility and ensure the business is prepared for disruption. This reduces financial shocks, supports strategic cost management, and ultimately boosts ROI.

Source: Verecol

Conclusion

Outsourced CFOs drive strategic financial initiatives that improve capital efficiency, reduce costs, and align performance with long-term goals. They empower businesses to not just grow, but grow profitably and with purpose.

Ready to see the difference strategic financial leadership can make? Let’s discuss how a fractional CFO tightens your profit margins or uncover new revenue opportunities. A detailed ROI report, or a peer case study that mirrors your situation, NOW CFO is here to support your journey toward smarter, ROI-driven growth.

FAQs

How Can a CFO Improve Business ROI?

A CFO enhances ROI by implementing ROI-driven financial leadership, aligning strategy with key metrics, and optimizing capital allocation. Outsourced CFOs bring proven strategies that focus on cost efficiency and smarter growth planning.

What ROI Strategies do Fractional CFOs Use?

Fractional CFOs use CFO ROI strategies like cash flow forecasting, cost structure optimization, and KPI alignment with business goals. These financial performance optimization tactics drive measurable gains in profitability and efficiency.

Can Outsourced CFOs Help with Cost Management?

Yes, outsourced CFOs apply strategic cost management techniques to identify inefficiencies and streamline operations. By reviewing expenses and improving spending allocation, they play a key role in improving ROI with outsourced CFOs.

What KPIs are Best for Tracking ROI?

Effective ROI tracking includes KPIs such as net profit margin, customer acquisition cost, return on assets, and cash conversion cycle. CFOs ensure these financial strategy execution metrics directly support long-term business growth financial tactics.

How Does Financial Planning Increase Return on Investment?

Comprehensive financial planning boosts ROI by guiding smarter investments, improving liquidity, and preparing for market volatility. Using financial strategy to drive ROI ensures sustainable and scalable outcomes for businesses.

Outsourced accounting has surged in popularity over the past two decades. The global market for alternative finance was estimated at US$8.6 billion in 2024 and is projected to reach US$11.6 billion by 2030, growing at a CAGR of 5.0% from 2024 to 2030.

Outsourced accounting services provide scalable solutions that replace costly in-house hires and support solid financial control. SMEs leverage these arrangements for outsourced bookkeeping, remote accounting services, and virtual accounting teams, freeing internal teams to focus on business growth.

What are Outsourced Accounting Services?

When exploring outsourced accounting, it’s helpful to break down what it includes, who engages in it, and which industries gain the most strategic advantage.

Core Services Provided

Businesses contract third-party firms to handle essential accounting services such as:

- Bookkeeping: Recording transactions, reconciliations, and journal entries

- Accounts Payable/Receivable (AP/AR): Invoice processing, vendor payments, collections

- Payroll Management: Employee pay, benefits, tax filings

- Month-End Close/Reconciliations: Ensuring all accounts are accurate

- Financial Statement Preparation: Balance sheets, P&L reports

- Controller Oversight: Reviewing and validating financial processes

- Integration with CFO Services: Aligning numbers with strategic decisions

Who Typically Uses Outsourced Accounting?

Many SMEs and startups leverage outsourced accounting to fill gaps when internal capacity is limited or costly. Founders who need financial clarity without the expense of full-time hires turn to outsourced bookkeeping and remote accounting services.

Even larger firms in transitional phases, such as M&A or rapid expansion, use these external accounting services to supplement in-house teams during peak periods.

Virtual accounting teams offer scalable support in sectors with seasonal fluctuations or cyclical revenue without adding permanent headcount. Additionally, businesses encountering regulatory changes or hiring challenges benefit from expertise packed into CFO accounting support.

Industries That Benefit Most

Certain sectors find outsourcing particularly compelling:

- Professional & Business Services: 17.6% of output is outsourced, the highest among industries.

- Retail Trade: 16.2% of gross output comes from outsourcing.

- Healthcare & Education: Consistent use of external finance teams improves compliance.

- Manufacturing: Streamlines overhead, enabling focus on production

- Tech Startups: Get rapidly scalable accounting outsourcing solutions without hiring delays.

These industries benefit most because outsourced providers reliably handle transaction volume, help with compliance, and favorably support the in-house vs. outsourced accounting comparison by cutting costs and increasing flexibility.

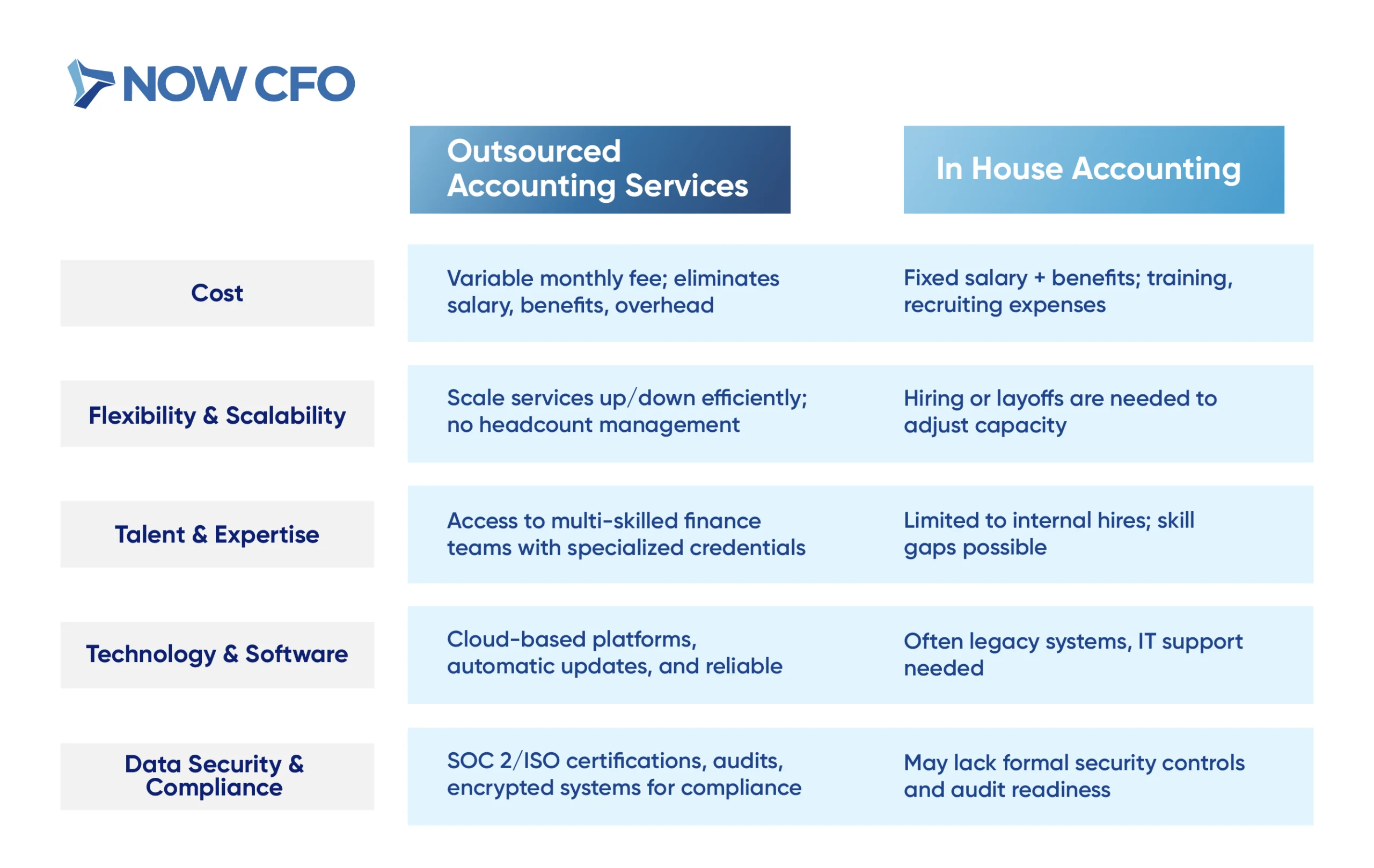

Outsourced Accounting vs. In-House Accounting

When weighing outsourced accounting against in-house teams, it’s crucial to compare cost, flexibility, talent access, technology, and security.

Cost Differences

Outsourcing eliminates fixed salaries, benefits, and overhead tied to in-house staff. Companies typically pay monthly fees or per-task rates. Compared to hiring a full-time controller, outsourced providers cost significantly less while delivering high-quality CFO accounting support and external accounting services.

Firms avoid recruitment and training expenses, and scale services up or down to match their needs. The cost of outsourced accounting is far below full-time equivalents.

Flexibility and Scalability

Outsourced providers adjust quickly to business volatility, scaling up during peak season or down when demand recedes. Companies avoid managing fluctuating headcount or staff burnout. You gain responsive support without overhead with outsourced bookkeeping and remote accounting services.

Also, finance teams can flex service levels monthly or annually based on growth, ensuring virtual accounting teams and accounting outsourcing solutions align with business cycles and goals.

Talent and Expertise Access

Outsourced partners assemble teams with specialized expertise covering the full finance spectrum. You benefit from collective knowledge, workflows, and continuous training. In contrast, in-house teams often lack depth, especially in regulatory compliance or advanced reporting.

Outsourced accounting provide access to accounting outsourcing solutions designed by experts accustomed to multiple clients and industries. This ensures your company receives up-to-date best practices without investing in certifications or systems internally.

Technology and Software Use

Outsourced providers typically operate on cloud-based platforms to deliver seamless, centralized reporting. The IRS emphasizes that cloud-computing contractors benefit from lower costs, automatic upgrades, and multi-region reliability.

This means clients avoid upfront IT investment, software licensing, and maintenance. Their data is backed up, version-controlled, and accessible anytime. Meanwhile, in-house setups often lag due to budget constraints or lack of IT support, making accounting outsourcing solutions more technologically advanced.

Plus, providers integrate add-ons, such as AP/AR automation, payroll modules, and real-time dashboards, offering a full-stack finance toolset that in-house teams rarely achieve without significant investment.

Data Security and Compliance

Security is critical. Reputable outsourced firms implement SOC 2 and ISO 27001 controls, encrypted data transfers, and role-based access. These safeguards often exceed in-house capabilities.

For example, IRS Publication 4812 mandates strict cloud data protection for all subcontractors. Compliance is built in; firms handle tax filings, payroll regulations, and audit-ready documentation. In contrast, internal teams may lack formal security policies or expert oversight, increasing the risk of breaches, fines, or inaccuracies.

Benefits of Outsourced Accounting Services

When evaluating the benefits of outsourced accounting, it becomes clear how they significantly reduce costs, improve accuracy, boost focus, and drive efficiency. Here’s how each advantage contributes to business success and strategic growth.

Reduced Overhead and Fixed Costs

By outsourced accounting, you transition from fixed payroll expenses to a predictable monthly fee. This eliminates salaries, benefits, workspace, and training overhead.

Typical full-time mid-size finance roles cost $80K—$120K/year + 20–30% benefits, totaling over $100K to $140K annually, plus indirect costs like equipment and software licensing. In contrast, outsourced accounting usually ranges from $3,000 to $7,500/month for small to mid-size businesses.

- Outsourcing cuts internal headcount by 1–2 full-time staff equivalents.

- It negates recruiting, onboarding, and ongoing training expenses.

- You avoid hardware, software, and office space costs tied to in-house teams.

Better Accuracy and Financial Reporting

Outsourced accounting use structured workflows, dual review systems, and cloud tools, raising accuracy and timeliness across financial reporting. Standardized processes reduce errors and inconsistencies, ensuring reliable data.

Providers often maintain checklists and automate reconciliations, minimizing manual mistakes. Clients gain access to timely, clean financials, facilitating better strategic decisions, smoother audits, and improved bank or investor confidence. This enhances accounting outsourcing solutions by delivering reliable metrics and promoting robust financial governance.

Increased Focus on Core Operations

By outsourcing routine finance tasks, leadership teams free up time for strategic priorities, like growth, customer acquisition, and innovation. Entrepreneurs and CEOs no longer manage day-to-day bookkeeping or payroll.

This shift improves business agility and responsiveness. When outsourced bookkeeping and remote accounting services handle the details, executives channel energy into expanding offerings, improving processes, and strengthening client relationships.

With financial operations offloaded, companies also enhance internal collaboration, team members focus on revenue-driving functions rather than transactional tasks. This sharper focus on core activities supports better long-term performance and customer satisfaction.

Faster Financial Close and Reporting Cycles

Outsourced accounting accelerates month-end close and reporting through dedicated teams operating in structured schedules. Instead of ad hoc internal timelines, cloud-based systems and automation streamline reconciliations and consolidations.

Faster closes deliver timely insights, improved forecasting, and compliance readiness. Real-time access improves decision-making, helping firms pivot swiftly amid market changes.

Real-Time Visibility and Dashboards

Outsourced providers often integrate live dashboards and financial portals, enabling real-time access to KPIs like cash flow, revenues, and expenses. This proactive reporting turns data into action, supporting fast responses to trends or anomalies.

By using accounting outsourcing solutions that sync with cloud platforms, executives receive automatic alerts and visual reports without waiting for monthly statements. Teams can monitor metrics daily, supporting agile decision-making and cash management.

Custom Solutions for Every Growth Stage

Outsourced accounting services adapt as your business evolves:

- Startup: Focus on core setup; basic bookkeeping, payroll, and cash flow tracking

- Growth Phase: Add AP/AR automation, month-end close structure, and financial dashboards

- Mature Phase: Introduce controller info, budget planning, tax readiness, integration with CFO accounting support

- Scale/Expansion: Optimize multi-entity consolidations, compliance modules, and ERP integrations

Learn More: Outsourcing Accounting Growth

Types of Services Offered in Outsourced Accounting

When detailing the services offered in outsourced accounting, it’s essential to understand each function’s role in supporting strategic financial management.

Bookkeeping

Outsourced providers handle daily ledger entries, categorize transactions, and reconcile bank accounts, ensuring reliable financial data. They use cloud-based platforms to track income and expenses promptly.

Accounts Payable/Receivable

Teams manage vendor invoices, payment approvals, and client billing, streamlining cash flow cycles. Automated reminders reduce late payments, while digital records maintain audit trails.

Payroll Management

Outsourced payroll services handle wage calculations, tax withholdings, deductions, and filings across jurisdictions. Providers ensure compliance with federal and state regulations, reducing employer liability.

Month-End Close and Reconciliations

Dedicated teams complete month-end close processes, reconcile all ledgers, and verify adjustments. This structured cycle typically closes books within five business days, improving the efficiency of accounting services.

Financial Statement Preparation

Outsourced providers generate GAAP-compliant balance sheets, income statements, and cash flow reports. They include narrative context and benchmarks to support strategic decision-making.

Controller Oversight

Providers assign experienced controller-level professionals to oversee accounting operations, ensuring data accuracy, internal controls, and best practices. These experts supervise processes, mentor staff, and provide escalation points.

Integration With CFO Services

Providers link accounting functions with high-level CFO advisory. The integration enables monthly financial reviews, budgeting, forecasting, and strategic insights. This seamless service layer ensures that outsourcing evolve into strategic finance partnerships.

Choosing the Right Outsourced Accounting Provider

When selecting outsourced accounting services, a structured evaluation ensures you choose a provider that delivers value, is professional, and aligns with your business goals.

Questions to Ask During Vetting

When interviewing prospective firms, ask detailed, outcome-driven questions:

- What is your team composition and experience?

- Which cloud platforms do you support?

- What are your standard workflows and reporting timelines?

- How do you handle compliance and audits?

- How do you report pricing and fee structure?

- How do you handle onboarding and transition?

What Qualifications and Tools to Look For

To ensure high standards, evaluate provider credentials and technology stack:

- Certifications: Ensure team members hold CPA credentials, and the firm is SOC 2 or ISO 27001 compliant. These standards underpin effective accounting services and the reliability of external accounting services.

- Technology Platforms: Look for proficiency in QuickBooks Online, Xero, Sage Intacct, and other advanced tools. Integrated cloud platforms support real-time data and scalability.

- Process Automation: Firms should utilize AP/AR automation, automated reconciliations, and workflow tools to reduce error rates and improve efficiency in accounting outsourcing solutions.

- Training and Continuing Education: Providers should invest in ongoing staff development, keeping teams current with accounting updates, tax law changes, and SaaS innovations.

- Security and Data Protection: Evaluate encryption standards, backup procedures, access controls, and compliance audits, aligning with IRS cloud security guidelines.

Challenges and How to Overcome Them

Addressing the challenges of outsourced accounting services starts with recognizing potential hurdles to ensure a smooth and efficient experience.

Data Privacy and Secure Access

Outsourcing raises concerns around sensitive information. Many firms now consider data privacy/security practices critical when selecting partners. Ensure providers encrypt data, limit access, and conduct regular audits per IRS and GDPR standards. Points to ensure security:

- Implement role-based access control and two-factor authentication

- Enforce data encryption at rest and in transit

- Require SOC 2 or ISO 27001 compliance certifications

- Schedule regular vulnerability scans and third-party audits

Communication And Time Zone Issues

When teams operate across regions, synchronizing communication becomes complex. Research shows that a 1-hour time zone gap reduces real-time interactions. This impacts timely decision-making and creates delays. To address this:

- Set core overlapping hours for synchronous calls

- Use collaborative tools (Slack, Asana) to manage async updates

- Record meetings so remote staff can catch up asynchronously

Integration With Internal Teams

Seamless onboarding with internal staff is vital. Lack of coordination can cause delays or duplicate tasks. Virtual teams face barriers in informal communication, leading to misunderstandings.

Best practices include:

- Define roles and handoff procedures clearly

- Use shared project management tools for transparency

- Schedule regular check-ins to align tasks and deadlines

Resistance to Change

Internal teams may resist new processes or fear job displacement when introducing outsourced services. To overcome this:

- Involve employees early, communicate benefits clearly

- Provide training on new workflows and cloud tools

- Highlight efficiency gains, reduced error rates, and strategic focus

Transition and Onboarding Process

A smooth transition is critical. Effective onboarding includes:

- Detailed process mapping of current accounting workflows

- Secure data migration to cloud-based systems

- Joint kickoff meetings with key stakeholders

- Defined milestones with accountability checkpoints

- Regular status updates during the first 60 days

Learn More: When to Outsource Your Accounting?

How NOW CFO Can Help with Outsourced Accounting Services

When partnering with NOW CFO for outsourced accounting services, you gain structured support, seasoned talent, and scalable finance solutions that align with your growth objectives.

Custom Engagement Models

NOW CFO provides tailored hourly, project-based, or retainer arrangements that fit your needs and budget. We adapt service levels as your business evolves. You can scale down during slow periods or ramp up ahead of growth initiatives.

- Flexible pricing tied to outcomes, not headcount

- Service bundles aligned with your growth stage

- On-demand CFO accounting support for strategic financial needs

National Team of Accounting Experts

NOW CFO’s outsourced services are powered by a national network of certified professional CPAs, controllers, payroll specialists, and automation experts. Your organization gains advanced skills beyond in-house limits by tapping into this collective expertise.

Each expert brings deep experience in technology, healthcare, and retail sectors. That sector-specific knowledge enhances compliance, speeds financial close, and boosts reporting quality. Clients benefit from best practices refined across the country.

Scalable Solutions for Fast Growth

NOW CFO aligns your accounting with business speed. We proactively scale staffing and systems during expansion phases.

- Fast deployment of additional resources before peak periods

- Modular add-ons like financial dashboards, AP/AR automation, and forecasting

- Flexible adjustment of service tiers based on monthly volume

Transparent Reporting and Communication

NOW CFO emphasizes clear, proactive communication. You receive:

- Consolidated monthly reports, KPIs, and commentary

- Real-time dashboards are accessible anytime via cloud platforms

- Regular video or phone check-ins to review results and recommendations

Partnership With Your Leadership Team

NOW CFO embeds itself within your executive team to become a strategic finance partner. They:

- Attend leadership meetings to represent finance

- Align KPIs with your company’s growth and strategic plan

- Offer scenario modelling, budgeting, and long-term forecasting support

- Serve as an extension of your leadership, providing guidance on investment, cash flow, and compliance

Conclusion

The case for outsourced accounting services is clear: they reduce costs, improve accuracy, accelerate reporting, and allow your team to concentrate on strategic initiatives. From startups to mid-sized companies, outsourcing offers tailored, flexible financial solutions, transforming accounting from a burden into a growth enabler.

If you’re ready for more than just standard bookkeeping, NOW CFO is prepared to build a finance partnership that scales with your ambition. Let’s explore how NOW CFO can support your success by scheduling a complimentary strategy session. Your next growth chapter begins with confident, reliable accounting at your side.

83% of business leaders agree that financial transparency is essential for earning trust from investors, stakeholders, and internal teams. Yet, many growing companies still grapple with inconsistent reporting, unclear data, and limited financial visibility.

Without standardized processes and real-time finance data, even the most promising businesses can face critical blind spots. That’s where outsourced CFOs come in.

These experienced financial leaders bring proven systems, strategic oversight, and objective insight to enhance financial transparency.

Revenue Growth Through Financial Expertise

Partnering with external financial advisers can significantly boost business revenue. A study published by The Times found that companies leveraging outside financial expertise experienced an average increase of 11.5% in annual sales.

This uplift stems from improved financial strategy, sharper forecasting, and access to high-level decision-making insights; benefits typically associated with seasoned CFO leadership without the full-time cost burden.

Source: The Times

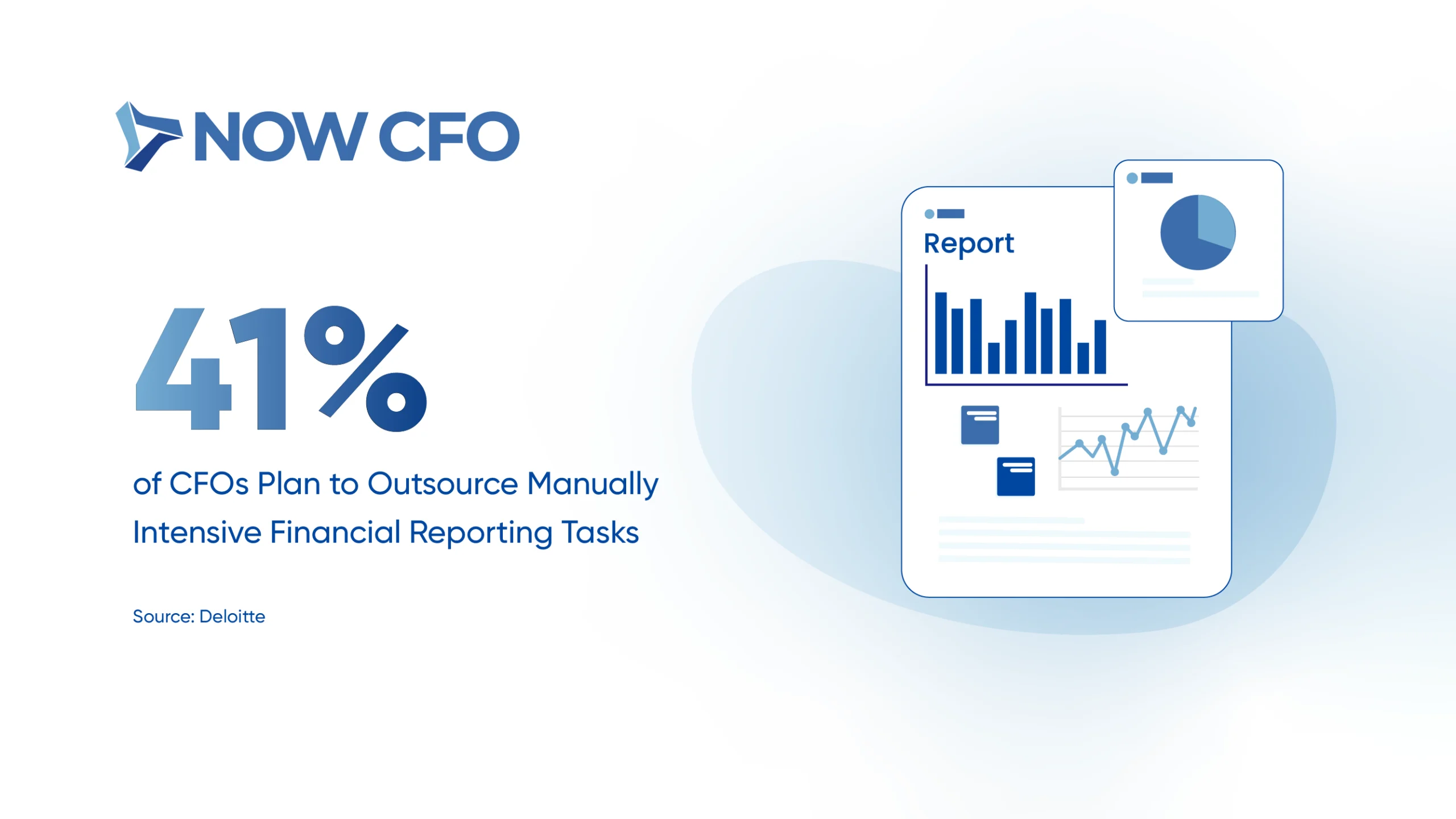

Efficiency Gains Through Outsourced Reporting

Manual financial tasks can drain resources and hinder strategic focus. According to Deloitte, 41% of CFOs intend to outsource these time-consuming processes, such as data compilation, reconciliations, and basic reporting.

By delegating routine financial work to outsourced professionals, in-house teams can redirect efforts toward high-value analysis, forecasting, and growth initiatives, enhancing overall finance team performance.

Source: Deloitte

Cost Reduction as a Primary Driver for Outsourcing

Outsourced CFO services allow companies to avoid the hefty overhead of a full-time executive, including salary, benefits, and recruitment. This strategic move not only lowers operational expenses but also provides access to experienced finance professionals on a flexible basis, delivering more value per dollar spent.

Source: Deloitte

Modernizing Finance with Technology

In the evolving finance landscape, technology adoption is critical. Deloitte reports that 45% of CFOs prioritize technology transformation to replace outdated systems with modern tools that enable transparent reporting and faster decision-making.

Outsourced CFOs play a key role in this shift, bringing expertise in integrating dashboards, automation tools, and reporting platforms that improve visibility, reduce manual errors, and support agile operations.

Source: Deloitte

Transparency and Efficiency Drive Outsourcing Decisions

Efficiency isn’t just a benefit; it’s a leading reason for outsourcing. Deloitte research reveals that 44% of CFOs use outsourced strategic finance services to improve productivity and enhance financial transparency.

By shifting finance functions to external experts, businesses streamline workflows, reduce bottlenecks, establish consistency, and boost financial reporting accuracy. The result is greater operational focus and more reliable decision-making data.

Source: Deloitte

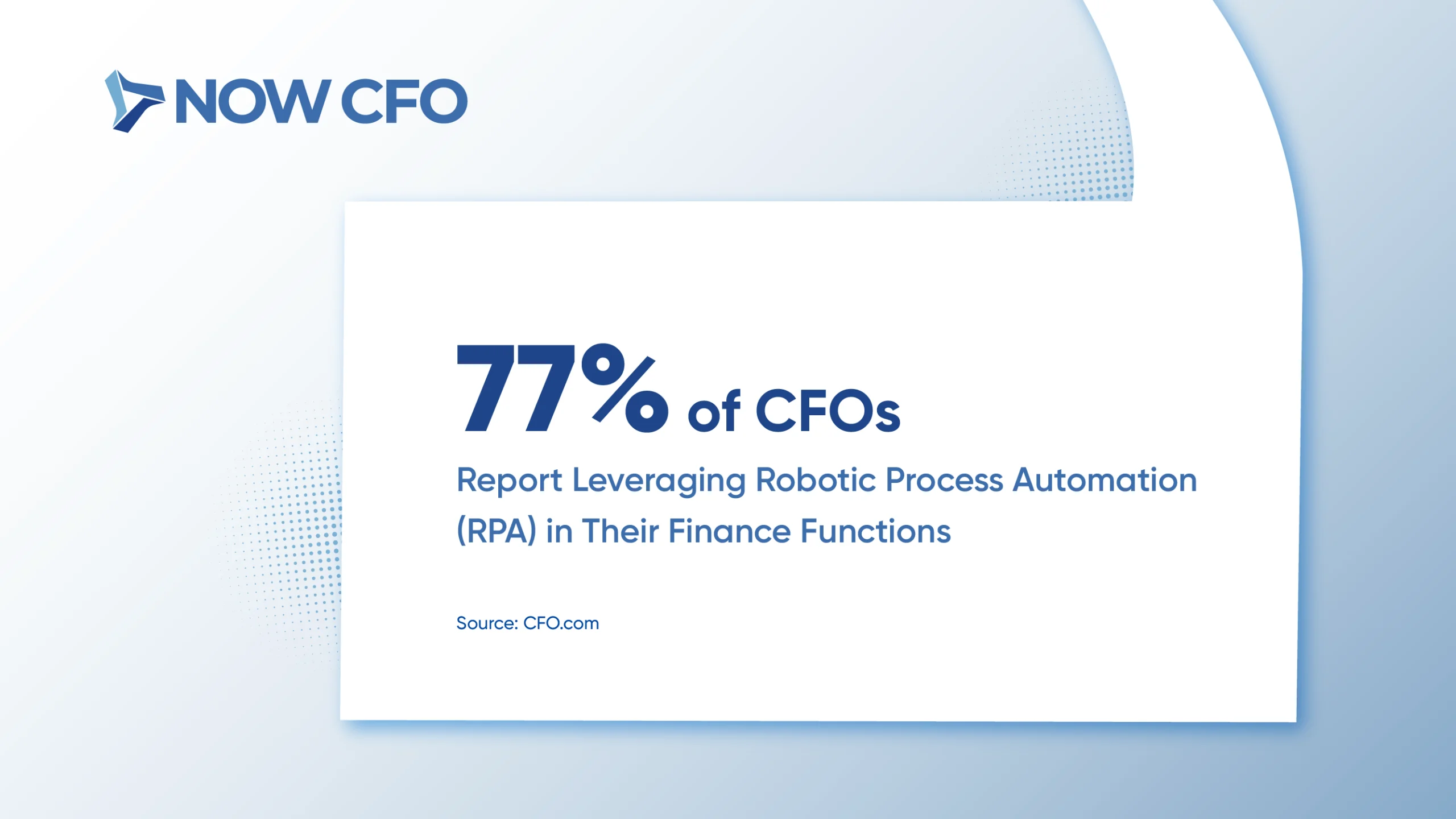

Automation Enhances Accuracy and Availability

Robotic Process Automation (RPA) is reshaping modern finance departments. According to CFO.com, 77% of CFOs already use RPA to eliminate manual errors and accelerate financial data availability.

Outsourced CFOs often lead these technology implementations, deploying automation tools that improve reporting accuracy, increase efficiency, and reinforce transparent financial operations.

Source: CFO.com

Strategic Focus Enabled by Outsourcing

A growing number of finance leaders are embracing outsourced models. CFO.com reports that 65% of CFOs now outsource at least one core finance function, allowing their internal teams to focus more on strategic planning and transparent reporting.

Outsourced CFOs help refine processes, implement real-time dashboards, and improve audit readiness, giving companies a clearer financial picture while staying lean and focused.

Source: CFO.com

Automation Cuts Close Times, Boosts Transparency

PwC research indicates that 30% to 40% of time spent on core finance tasks, such as reconciliations, closing the books, and reporting, can be automated.

This slashes cycle times and enhances financial transparency by reducing human error and delivering faster, more accurate reports. Outsourced CFOs are well-versed in implementing automation strategies that optimize internal workflows and support better decision-making.

Source: PwC

Conclusion

Financial transparency empowers leadership with the tools and insights to make informed, confident decisions. From standardized reporting practices to real-time dashboards and policy enforcement, the outsourced CFO role is crucial for creating a culture of accountability and clarity.

As you prepare for growth, audits, or investment, an outsourced CFO can provide the systems, structure, and strategic oversight needed to enhance financial transparency and build long-term trust with your stakeholders.

Want to build a more transparent financial system for your business? Contact NOW CFO today to schedule a free consultation and explore how expert financial leadership can drive your next phase of success.

FAQs

How do outsourced CFOs help with financial transparency?

Outsourced CFOs implement structured systems, internal controls, and consistent reporting practices that enhance financial transparency. They provide accurate and timely financial data, ensuring compliance and enabling business leaders to make informed decisions with confidence.

What tools do CFOs use to improve reporting accuracy?

CFOs use financial dashboards, forecasting software, and ERP systems to deliver transparent reporting. These tools enable real-time KPIs, budget variances, and cash flow tracking —key components of maintaining financial clarity.

Can a part-time CFO handle audits and compliance effectively?

Yes, many outsourced CFOs specialize in audit readiness and compliance. They prepare GAAP-compliant reports, standardize documentation, and create audit trails to ensure smoother, faster external audits.

How does real-time reporting improve decision-making?

Real-time financial reporting gives leadership up-to-date insights into business performance. This visibility supports agile budgeting, helps identify risks early, and enhances department accountability.

What does transparent financial management mean?

Transparent financial management entails clear, accurate, and timely reporting that all stakeholders can easily understand. It reduces guesswork, fosters trust, and aligns everyone’s financial health and direction.

Ensuring operational efficiency and financial integrity is no longer optional for SMEs; it’s essential. At the heart of these efforts lies the role of internal controls, a system of policies, processes, and monitoring tools designed to safeguard assets, promote transparency, and prevent costly errors or fraud.

For business owners, CFOs, and entrepreneurs, understanding and implementing effective internal controls is key to building a resilient organization that can withstand evolving risks. 69% of board members rank internal controls among their top three priorities for organizational resilience.

What are Internal Controls and Why are They Important?

Strong governance begins with a clear grasp of the role of internal controls today. By defining what these controls entail and examining their tangible effects, organizations can appreciate how internal controls for business operations underpin financial integrity and risk mitigation.

Defining Internal Controls in Business

Internal controls are the policies, procedures, and mechanisms that an organization puts in place to ensure the accuracy of its financial reporting, safeguard assets, and promote operational efficiency. They establish standardized workflows that deter errors and detect discrepancies.

These controls form the backbone of a company’s internal control systems, guiding employees through predefined checks and balances. A robust control environment begins with management’s commitment: setting a “tone at the top” that emphasizes accountability and ethical behavior.

The Impact of Internal Controls on Business Operations

Internal controls extend beyond mere compliance; they reshape an organization’s daily operations. When controls align with strategic objectives, they enhance transparency and instill stakeholder confidence. Consider these key operational benefits:

Automated reconciliations and dual-approval processes reduce errors in ledgers and financial statements.

Enhanced Risk Management

- Proactive risk assessments identify potential vulnerabilities before they materialize.

- Embedding risk checkpoints into workflows helps organizations adapt controls as business needs evolve.

Streamlined Compliance

- Standardized control activities ensure adherence to regulations such as Sarbanes–Oxley and industry-specific mandates.

- Continuous monitoring simplifies audit processes, reducing compliance costs.

Operational Transparency and Accountability

- Clear documentation of control procedures promotes employee accountability and reduces conflicts of interest.

- Real-time dashboards give executives visibility into transaction flows, supporting data-driven decision-making.

Fraud Prevention and Detection

- Detective controls: such as periodic transaction reviews—catch irregularities quickly.

- Preventive measures, like mandatory vacations for finance staff, deter collusion.

Key Functions of Internal Controls in Business

Examining their core functions is vital to appreciate the role of internal controls. These functions, from ensuring financial accuracy with internal controls to fraud prevention, form a cohesive system that underpins every facet of operations.

Financial Accuracy and Integrity

Accurate financial reporting begins with well-designed controls that verify transaction data at each step. The role of internal controls mandates dual approvals, systematic reconciliations, and clear audit trails to catch errors before they affect the general ledger.

By enforcing standardized documentation, organizations can consistently produce reliable financial statements. Effective controls also facilitate timely adjustments, reducing the need for disruptive restatements.

Fraud Prevention and Detection

To counteract fraudulent schemes, organizations must integrate both preventive and detective measures. Internal controls prescribe proactive strategies to deter misconduct. Once deployed, detective controls such as transaction monitoring and exception reporting identify anomalies quickly, enabling swift investigation.

- Preventive Controls: Segregate authorization and record-keeping duties to eliminate single-point vulnerabilities. Enforce mandatory leave policies to reveal hidden collusion.

- Detective Controls: Implement real-time transaction reviews to spot irregular patterns. Use data analytics to flag outliers and reconcile discrepancies.

Risk Management and Mitigation

Robust risk management transforms potential threats into manageable scenarios. Internal controls integrate risk assessments into daily workflows, ensuring emerging risks receive timely attention.

- Risk Assessment: Regularly identify and rank risks by likelihood and impact, guiding control prioritization.

- Risk Response: Develop action plans; avoidance, transfer, or acceptance, aligned with organizational risk appetite.

- Ongoing Monitoring: Review control effectiveness and adapt to new risk landscapes.

Regulatory Compliance and Governance

Meeting regulatory mandates demands systematic control frameworks. Internal controls ensure policies reflect current laws and that every transaction meets established criteria. Continuous governance reviews keep the organization audit-ready.

- Policy Enforcement: Embed regulatory requirements into workflows and approval matrices.

- Documentation & Reporting: Maintain audit-quality records to satisfy regulators and external auditors.

- Governance Reviews: Conduct periodic board-level oversight to validate compliance posture.

Protecting Business Assets and Resources

Safeguarding organizational assets relies on layered control defenses. Internal controls mandate physical safeguards (e.g., access controls, CCTV) and digital protections (e.g., restricted permissions) to prevent asset loss.

Companies often deploy:

- Physical Controls: Secure storage, surveillance, and inventory counts.

- Digital Controls: Role-based access, encryption, and cybersecurity protocols.

- Periodic Reviews: Asset audits and surprise inspections to detect misappropriation.

How Internal Controls Strengthen Business Operations

Building on the core functions, the role of internal controls extends into tangible operational enhancements that drive efficiency and accuracy across the organization. Below, we explore how these internal controls for business operations translate into real-world improvements.

Streamlining Financial Reporting and Auditing

Well-designed controls expedite the close process and improve audit readiness. Organizations reduce manual effort and accelerate month-end close by automating reconciliations and embedding approval workflows.

These measures also ensure auditors have direct access to accurate, traceable records, reducing audit queries and facilitating smoother external reviews. When finance teams leverage standardized templates and digital checklists, they eliminate redundancies and focus on high-value analysis rather than data gathering.

Enhancing Decision-Making with Reliable Data

Accurate, timely data is the lifeblood of executive decision-making. Internal controls ensure that performance metrics and financial KPIs derive from validated sources. Controls like automated data feeds, access restrictions, and exception reporting guarantee that leadership reviews only high-integrity information.

With reliable dashboards updated in real-time, CEOs and CFOs can identify trends and respond swiftly to emerging challenges. The National Credit Union Administration provides quarterly Financial Performance Reports within 6–8 weeks of data submission, enabling board members to benchmark performance promptly.

By reinforcing governance and risk management, these controls transform raw numbers into strategic insights.

Ensuring Accountability and Transparency in Operations

The role of internal controls integrates clear ownership and oversight into every process to foster a culture of responsibility.

- Ownership Assignment: Designate responsible individuals for each control activity.

- Documented Workflows: Maintain version-controlled policies and log all approvals.

- Independent Oversight: Conduct periodic, unannounced reviews to verify adherence.

Safeguarding Against Fraud and Errors

Preventing and detecting misstatements requires multi-layered defenses. Internal controls prescribe both preventive measures and detective controls, such as exception reports and variance analyses.

Controls accelerate investigation and resolution by automatically flagging anomalies (e.g., duplicate payments or unusual invoice amounts). In addition, periodic data analytics reviews identify emerging fraud patterns, enabling proactive risk mitigation.

Together, these controls uphold financial accuracy with internal controls and protect organizational assets from intentional and accidental losses.

Reducing Operational Inefficiencies

The effective role of internal controls streamlines workflows by removing redundant tasks and standardizing procedures. Controls like automated invoice matching and electronic approvals replace manual bottlenecks, cutting process cycle times.

By mapping end-to-end processes and embedding controls at key junctures, businesses eliminate handoffs that cause delays. Continuous monitoring dashboards then highlight slow points, guiding targeted improvements.

Best Practices for Implementing Effective Internal Controls

A mature control environment turns theory into action. The following seven best practices translate the role of internal controls into daily habits that fortify operations and inspire stakeholder confidence in your organization’s governance framework.

1. Conduct Regular Risk Assessments

Mapping threats is the first step toward mitigation. Schedule enterprise-wide risk assessments annually, scoring each risk by probability and impact. Engage cross-functional leaders to surface emerging issues and update the risk register immediately after material changes.

Pair qualitative interviews with quantitative data (e.g., variance analyses) to avoid blind spots. Consistent risk reviews align internal controls with strategy and support internal control systems for regulatory compliance by ensuring controls adapt as the business evolves.

2. Establish Clear Policies and Procedures

Policies transform intent into repeatable action. Draft concise, jargon-free process narratives that specify who performs each task, the documentation required, and approval thresholds. Publish these procedures in a centralized, version-controlled repository so employees always consult the latest guidance.

When rules conflict, they escalate to a designated policy steward for rapid clarification. Clarity reduces interpretation errors, which is one of the key best practices for implementing internal controls principle.

3. Segregate Duties to Prevent Conflicts of Interest

To block single-point manipulation, separate authorization, custody, and recording activities. Assign purchase approvals to budget owners, goods receipt to warehouse staff, and invoice entry to accounts payable. Follow up with periodic overlap checks:

- Access-Review Reports: Verify that no user retains incompatible roles.

- Rotation & Mandatory Leave: Force process hand-offs that expose concealed schemes.

- Exception Dashboards: Highlight transactions cleared outside typical paths.

4. Monitor and Review Financial Transactions Continuously

Real-time dashboards convert raw activity into actionable warnings. Configure rules that flag duplicate vendors, round-dollar journal entries, and payments above tolerance limits. Daily exception queues let controllers investigate anomalies long before month-end.

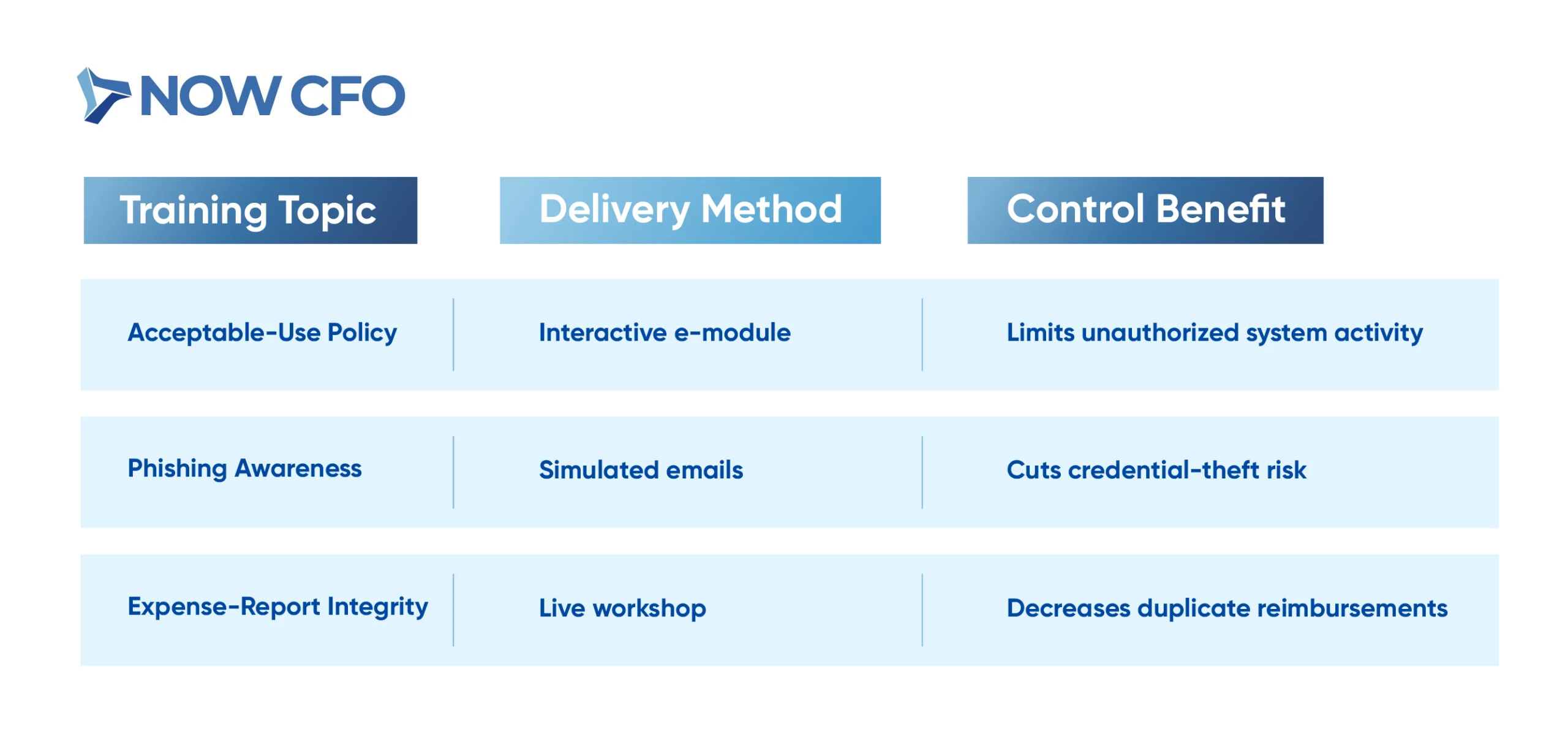

5. Train Employees on Compliance and Fraud Prevention

People are the last and often strongest line of defense. Use blended learning that couples micro-videos with scenario drills, then reinforce lessons through quarterly refreshers.

Institutionalizing learning embeds fraud prevention and internal controls into daily routines.

6. Leverage Technology for Real-Time Monitoring and Reporting

Automation magnifies oversight reach without ballooning headcount. Deploy cloud-based ERPs with built-in control libraries, robotic process automation for three-way-match invoices, and AI anomaly detection that scores transactions by deviation likelihood.

Configure push alerts so executives receive high-risk exceptions instantly. Technology accelerates remediation and supplies immutable logs that satisfy auditors and boosts internal control systems resilience.

7. Perform Regular Internal Audits

Internal audit provides an independent pulse-check on control fitness. Build a rolling audit plan tied to risk rankings, reserving extra hours for volatile processes like revenue recognition or IT change management. Each engagement should:

- Validate control design against objectives.

- Test operating effectiveness via sampling and walkthroughs.

- Recommend pragmatic fixes with clear owners and timelines.

Track findings in a central repository and report quarterly closure rates to the audit committee.

The Role of CFOs in Strengthening Internal Controls

Building on structured best practices, the role of CFOs in strengthening internal controls centers on leadership, strategy alignment, and cross-functional collaboration.

Leading the Design and Implementation of Internal Controls

As chief governance architect, the CFO defines control frameworks, assigns ownership, and oversees rollout across finance and operations. They draft control matrices mapping risks to activities, ensuring every material process has corresponding checks and balances.

CFOs also champion pilot programs to validate workflows before enterprise-wide deployment. Training sessions and regular town halls reinforce the role of internal controls as a strategic priority.

Ensuring Internal Controls Align with Business Strategy

CFOs translate corporate goals into control requirements, embedding financial and operational KPIs within control objectives. They review strategic plans to identify new risk areas, then modify control scopes accordingly. This alignment makes controls enablers rather than roadblocks, supporting agile decision-making.

Using Internal Controls to Support Financial Planning

In financial planning cycles, CFOs leverage controls to validate forecast inputs and scenario analyses. They integrate control checkpoints into budgeting tools, automatically flagging variances beyond tolerance thresholds. This ensures data integrity, instilling confidence in rolling forecasts and long-range models.

During planning workshops, CFOs review control logs from prior periods to refine assumptions, demonstrating governance and risk management in action. By embedding controls into every budgeting stage, they elevate planning from a back-office task to a strategic dialogue.

Collaborating With Other Departments to Maintain Control Integrity

CFOs cultivate partnerships with IT, operations, and HR teams to keep controls robust as business processes evolve. They establish cross-departmental control forums to review system changes, policy updates, and emerging risks.

For example, collaborating with IT ensures that user-access controls mirror procedural policies, while working with HR aligns payroll controls with headcount workflows. Regular joint audits and shared dashboards foster transparency, anchoring risk management through internal controls across functions.

Common Challenges in Internal Control Implementation and How to Overcome Them

Internal controls often stall when practical obstacles arise. Below, we explore four common hurdles and offer targeted strategies to overcome them.

Lack of Employee Buy-In for Internal Controls

Engaging staff is critical for effective internal control systems. When employees view controls as burdensome, compliance drops and errors rise.

- Communicate Purpose: Hold workshops explaining how controls protect the company and individual careers.

- Solicit Feedback: Involve frontline teams in control design to foster ownership and ensure procedures fit real workflows.

- Recognize Compliance: Tie control adherence to performance evaluations and reward contributions to risk mitigation.

Overly Complex Control Systems Leading to Operational Inefficiencies

When controls proliferate unchecked, they can bog down processes and frustrate users.

- Simplify Processes: Map end-to-end workflows, then consolidate redundant approvals and automate routine checks (e.g., three-way invoice matching).

- Tier Controls by Risk: Apply stringent checks only where risk warrants—low-risk transactions receive lighter oversight.

- Regular Rationalization: Quarterly reviews eliminate obsolete controls and streamline decision paths.

Inadequate Monitoring of Control Effectiveness

Even well-designed controls fail without ongoing oversight. Organizations must build continuous monitoring into daily operations. Effective monitoring blends automated analytics with periodic manual reviews to validate system performance.

Failure to Adapt Controls to Changing Business Needs

Static controls become obsolete as strategies, technologies, and regulations evolve. To stay current:

- CFOs should reintegrate risk assessments into strategic planning cycles.

- Deploy change-management forums where IT, finance, and operations stakeholders review control impacts before system upgrades.

How Internal Controls Contribute to Risk Management

A key aspect of internal control is its ability to manage business risks proactively. By embedding structured controls into operations, organizations can detect threats early, prevent fraud, and ensure compliance while enhancing accountability.

Identifying and Addressing Potential Risks Early

Early risk detection is essential for effective governance and risk management. Organizations that integrate risk assessments into daily processes can respond before threats escalate.

| Risk Category | Potential Threat | Control Measure |

|---|---|---|

| Financial | Revenue misstatements | Reconciliations, segregation of duties |

| Operational | Supply chain disruptions | Vendor audits, contingency planning |

| Cybersecurity | Data breaches | Access controls, regular system updates |

| Compliance | Regulatory violations | Policy reviews, automated compliance checks |

Establishing Controls to Prevent and Detect Fraud

Fraud undermines financial integrity, erodes trust, and exposes organizations to reputational damage. Robust internal controls for business operations serve as both deterrents and detection mechanisms.

Preventive controls limit opportunities for fraudulent behavior. Meanwhile, detective controls, including exception reporting and transaction monitoring, expose irregularities in real-time.

Ensuring Compliance with Regulatory Requirements

Effective internal control systems for regulatory compliance are vital to avoid penalties and maintain operational licenses. Controls must translate complex regulatory frameworks into daily tasks. Automated systems flag non-compliant activities, while periodic reviews ensure processes reflect current regulations.

In fiscal year 2024, the U.S. Securities and Exchange Commission filed 583 enforcement actions and obtained a record $8.2 billion in financial remedies. This comprised $6.1 billion in disgorgement and prejudgment interest and $2.1 billion in civil penalties, marking the highest recovery in SEC history.

Source: U.S. Securities and Exchange Commission

Enhancing Accountability Across Business Functions

Accountability is the foundation of effective risk management. Through internal controls, businesses ensure that responsibility for risks and controls is distributed across all departments, not just finance.

Key accountability strategies include:

- Role Clarity: Clearly defining control of ownership within each department.

- Integrated Dashboards: Providing executives with cross-functional control status updates.

- Cross-Department Reviews: Conducting joint audits to validate control performance across functions.

Conclusion: Strengthening Business Operations with Effective Internal Controls

Building a strong control environment is one of the most reliable ways to drive operational efficiency and protect your organization. For CFOs, executives, and business owners, investing in robust internal controls means safeguarding your reputation, minimizing fraud risks, and building stakeholder trust.

If your business is ready to take the next step toward operational excellence and financial integrity, NOW CFO is here to help. Schedule a complimentary consultation with our financial experts and request a personalized internal controls assessment. Let’s work together to build your internal control systems for success and resilience.

Acquisitions are the ultimate pathway for growth, expansion, and increased market share. Yet, while managing acquisitions presents significant opportunities, they also introduce complex financial, operational, and regulatory risks.

Research from the University of Virginia reveals that 65% to 85 % of M&A fail to create shareholder value, with nearly a quarter of deals actively destroying value. Without the right financial leadership, these risks can quickly derail even the most promising deal. That’s where an outsourced CFO becomes a game-changer.

Why an Outsourced CFO Is Essential for Managing Acquisitions

When navigating the complexities of mergers, businesses increasingly turn to an outsourced CFO to bridge resource gaps and accelerate deal success. By leveraging specialized financial acumen without the delay of hiring a full-time executive, companies gain critical momentum in planning and execution.

Expertise in Financial Planning and Analysis

An outsourced CFO brings deep proficiency in building robust financial models and stress-testing scenarios, capabilities that many growing companies lack internally. They design pro forma statements that factor in synergies, integration costs, and revenue ramp-ups, ensuring acquirers don’t overpay.

Every year, U.S. firms invest over $2 trillion in acquisitions, yet 70–90 percent of them fail due to flawed assumptions and planning.

Ability to Provide Objective, Unbiased Financial Insights

Engaging a fractional CFO ensures decisions are grounded in data, not internal politics or legacy biases.

- Independent Valuations: They assess targets without revenue cannibalization fears, delivering fair enterprise-value estimates.

- Clear Performance Metrics: By establishing KPIs, including EBITDA accretion, working-capital targets, and ROI thresholds, a fractional CFO highlights deal viability.

- Unvarnished Reporting: Their third-party stance surfaces hidden liabilities that internal teams might downplay.

Cost-Effective Solution Compared to In-House CFOs

For many SMEs, recruiting a full-time CFO can cost over $200,000 annually (salary plus benefits). Instead, outsourcing provides access to senior expertise at a fraction of that:

- Predictable Fees: Monthly retainer models cap costs, allowing firms to budget precisely.

- Avoided Overhead: No recruitment, training, or benefits expenses—your company pays only for hours used.

- Scalable Support: Engage additional project-based resources (tax, treasury, audit) without headcount approvals.

Learn More: Strategic role of a fractional CFO

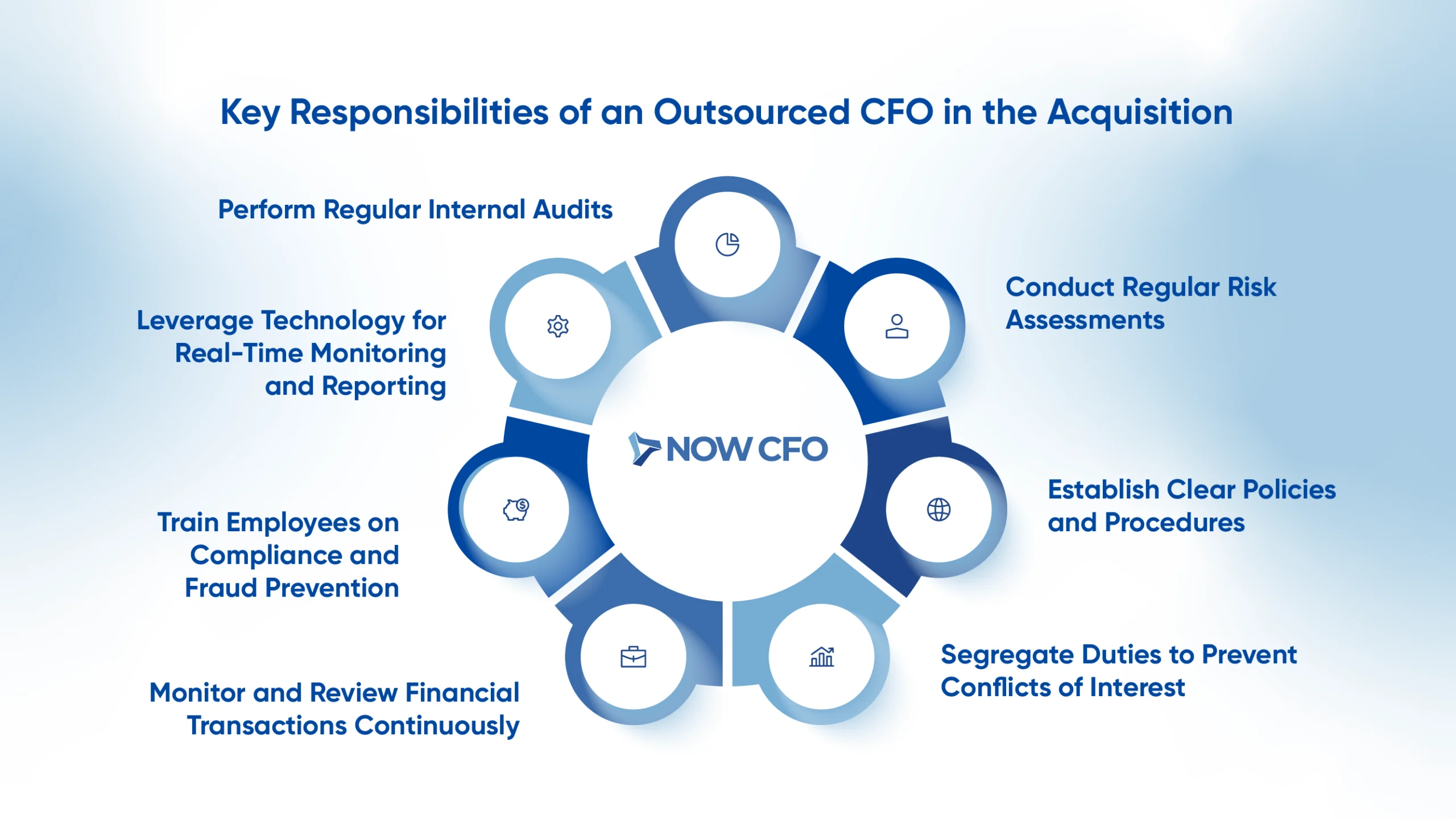

Key Responsibilities of an Outsourced CFO in the Acquisition Process

As companies embark on mergers and acquisitions, they undergo rigorous evaluations, strategic planning, and regulatory scrutiny. An outsourced CFO acquisition management orchestrates each stage to guarantee effective integration and robust financial risk management.

1. Conducting Financial Due Diligence

An outsourced CFO leads comprehensive financial due diligence, examining historical financial statements, cash flows, and debt obligations. They reconcile revenue recognition discrepancies, validate working capital assumptions, and stress-test projections.

By engaging third-party auditors and leveraging digital data rooms, they uncover hidden liabilities, deferred tax exposures, and covenant breaches. They also assess inventory obsolescence and revenue backlog to ensure no material surprises.

2. Assessing Financial Health of Target Companies

An outsourced CFO evaluates the target’s balance sheet, income statements, and cash flow metrics to assess liquidity, leverage, and operational efficiency. They calculate key ratios to benchmark against industry standards.

They identify potential cash flow bottlenecks by examining aging receivables, inventory turnover, and working capital trends. Additionally, analysis of off-balance-sheet items, pension obligations, and contingent liabilities uncover hidden strains.

This assessment of financial health guides deals with pricing and informs post-acquisition integration strategies, ensuring that anticipated synergies are realistic and sustainable. Scrutiny of financial stability at the outset reduces surprises and bolsters confidence in acquisition outcomes.

3. Analyzing Valuations and Deal Structuring

After evaluating target viability, an outsourced CFO advances to analyzing valuations and deal structuring within the M&A framework, ensuring deal terms align with strategic objectives and value drivers.

- Enterprise Value Calculation: Employ comparable-company analysis, precedent transactions, and discounted cash flow models to triangulate fair value.

- Deal Structure Design: Advise on asset vs. stock purchase, earn-outs, contingent payments, tranche structures, and tax-efficient clauses to balance risk and reward.

- Synergy Assessment: Quantify cost and revenue synergies, mapping integration savings to support negotiation levers.

- Deal Economics Modeling: Develop pro forma income statements and balance sheets reflecting financing costs, tax effects, and integration expenses.

- Financing Scenario Planning: Evaluate debt-equity mix, interest rate sensitivity, and covenant impacts to optimize capital structure.

4. Forecasting Future Financial Performance

Building on structured deal terms, the outsourced CFO focuses on forecasting future financial performance, using scenario analysis to validate growth assumptions.

- Revenue Projections: Model base-case, best-case, and worst-case revenue scenarios incorporating market growth and customer retention metrics.

- Cost Forecasting: Forecast operating expenses, integration costs, and synergy realization timelines to predict margin impacts and guide post-acquisition integration budgeting.