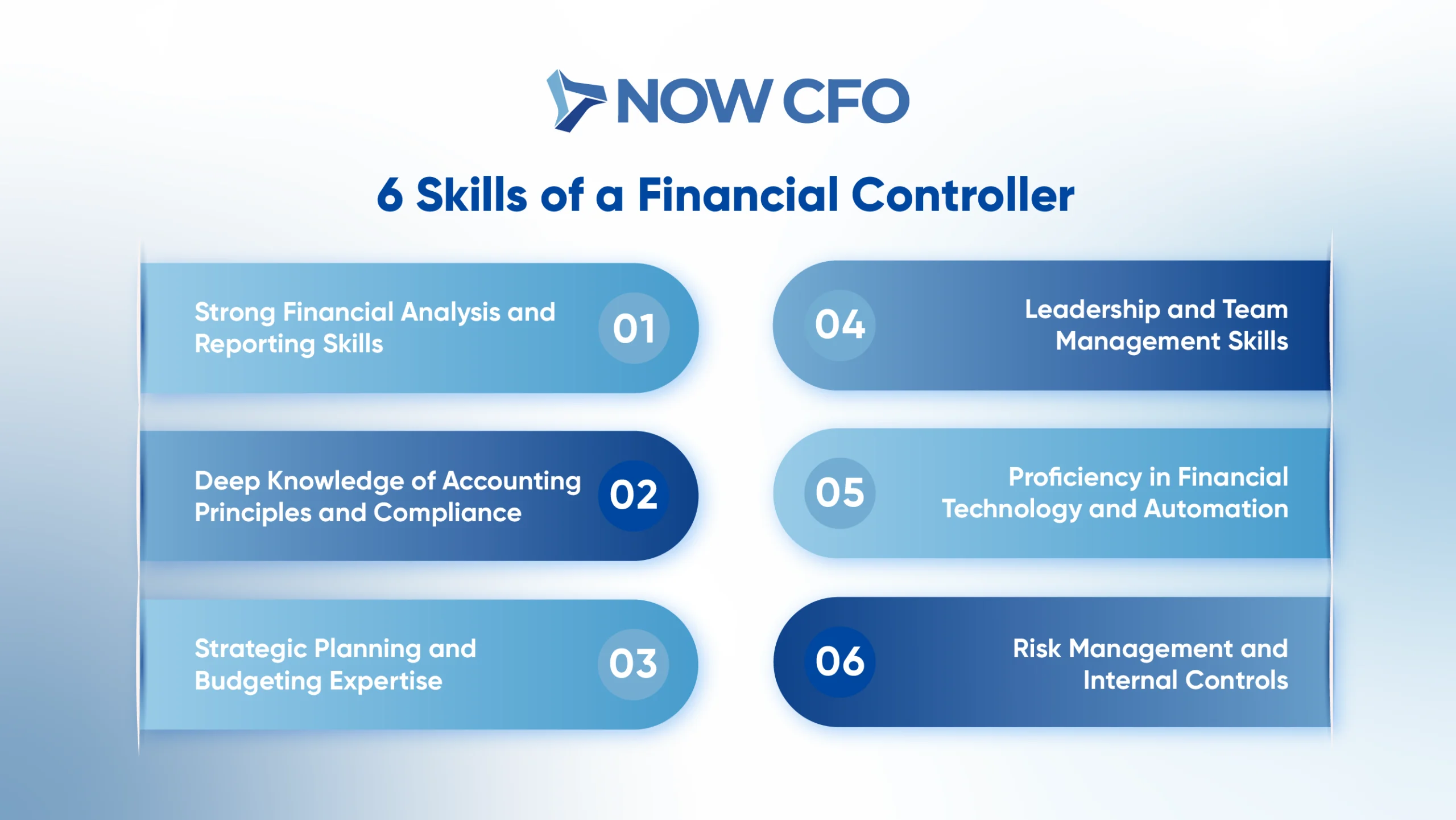

What Are the Necessary Skills of a Financial Controller

A financial controller is the cornerstone of an organization’s financial integrity, overseeing all accounting operations and ensuring compliance. This role encompasses the management of financial reporting, budgeting, and internal controls, providing accurate financial data that informs strategic decision-making.

The significance of strong financial management skills in this role cannot be overstated. Controllers must have a deep understanding of accounting principles, economic analysis, and risk management. These skills are essential for identifying financial trends, forecasting future performance, and developing strategies that align with organizational goals.

According to the BLS, employment of financial managers, including controllers, is projected to grow by 17% from 2020 to 2030, which is much faster than the average growth rate for all occupations. This growth underscores the increasing demand for professionals with strong financial management skills.

1. Strong Financial Analysis and Reporting Skills

Analyzing and reporting financial data is one of the essential skills for financial controllers, and it is pivotal in steering an organization toward its strategic objectives. These skills transform raw financial data into actionable insights.

Interpreting Financial Data for Decision-Making

Effective interpretation of financial data is crucial for making informed business decisions. Financial controllers must adeptly analyze financial statements to identify trends, assess performance, and forecast future financial positions. This analytical prowess supports strategic planning and helps in allocating resources efficiently.

- Trend Analysis: Controllers can identify patterns and trends that inform long-term strategic decisions by examining financial data over multiple periods. For instance, consistent revenue growth might indicate a successful product line, while declining margins could signal the need for cost control measures.

- Ratio Analysis: Utilizing financial ratios such as return on equity or current ratio allows controllers to assess the company’s financial health and operational efficiency. These metrics provide insights into profitability, liquidity, and solvency, which stakeholders need.

- Budget Variance Analysis: Comparing actual financial outcomes with budgeted figures helps identify discrepancies and understand their causes. This analysis is vital for maintaining financial discipline and making necessary adjustments to operations or strategy.

- Forecasting: Projecting future financial performance based on historical data enables proactive decision-making. Accurate forecasts assist in planning for capital expenditures, managing cash flows, and setting realistic financial goals.

Ensuring Accurate Financial Reporting and Compliance

Accurate financial reporting is fundamental to maintaining stakeholder trust and complying with regulatory requirements. Financial controllers play a key role in ensuring that applicable accounting standards and regulations prepare financial statements.

- Adherence to Accounting Standards: Controllers must ensure that financial reports comply with GAAP or IFRS, depending on the jurisdiction. This compliance ensures consistency and comparability with financial information.

- Internal Controls: Implementing robust internal control systems helps prevent errors and fraud in financial reporting. These controls include segregation of duties, authorization procedures, and regular reconciliations.

- Regulatory Compliance: Controllers must stay updated with changes in financial regulations and ensure that the company complies with laws such as the Sarbanes–Oxley Act, which mandates accurate financial disclosures and imposes penalties for non-compliance.

- Audit Coordination: Preparing for and coordinating with external auditors is critical. Controllers must ensure that all financial records are accurate and readily available for audit purposes, facilitating a smooth audit process.

2. Deep Knowledge of Accounting Principles and Compliance

Financial controller skills are deeply rooted in a comprehensive understanding of accounting principles and regulatory compliance. This expertise ensures that financial reporting is accurate, transparent, and adheres to established standards.

Understanding GAAP, IFRS, and Other Standards

Mastery of frameworks like GAAP and IFRS is essential for ensuring consistency and comparability in financial statements across different jurisdictions.

- GAAP: In the USA, GAAP provides a comprehensive set of rules and guidelines for financial reporting. Established by the FASB, GAAP ensures that financial statements are consistent, comparable, and transparent. Adherence to GAAP is crucial for maintaining investor confidence and meeting regulatory requirements.

- IFRS: Adopted by over 140 countries, IFRS offers a principles-based approach to financial reporting, emphasizing transparency and comparability. For multinational corporations, understanding IFRS is vital for consolidating financial statements and facilitating cross-border operations.

- Convergence and Adaptation: The ongoing convergence between GAAP and IFRS aims to harmonize accounting standards globally. Financial controllers must stay abreast of these developments to ensure compliance and leverage best practices in financial reporting.

A deep understanding of these standards enables controllers to uphold the key competencies for financial controllers, ensuring that financial reports are accurate, reliable, and compliant with applicable regulations.

Managing Regulatory Compliance and Risk

Beyond understanding accounting standards, financial controllers must adeptly manage regulatory compliance and associated risks.

- Internal Controls and Risk Management: Effective internal controls are critical for preventing errors and fraud. Controllers must design and monitor control systems that safeguard assets and ensure the integrity of financial reporting.

- Regulatory Compliance: Compliance with laws such as the SOX is non-negotiable. SOX mandates strict oversight of financial reporting and internal controls, holding executives accountable for the accuracy of financial statements.

- Continuous Monitoring and Adaptation: The regulatory environment is dynamic, with frequent updates and new requirements. Financial controllers must continuously monitor these changes, assess their impact on the organization, and adapt policies and procedures accordingly.

3. Strategic Planning and Budgeting Expertise

Financial controllers skills in strategic planning and budgeting are indispensable. These competencies enable organizations to navigate uncertainties, allocate resources efficiently, and align financial practices with overarching business objectives.

Creating Effective Financial Forecasts

Accurate financial forecasting is a cornerstone of strategic planning. It empowers businesses to anticipate future financial conditions and make informed decisions.

- Utilizing Advanced Forecasting Techniques: Modern forecasting methods like rolling forecasts and scenario analysis allow for more responsive and flexible planning. These techniques help in adjusting to market changes and unforeseen events.

- Integrating Cross-Functional Data: Effective forecasts require integrating data from various departments, including sales, marketing, and operations. This holistic approach ensures that forecasts reflect the organization’s comprehensive financial landscape.

- Continuous Monitoring and Adjustment: Regularly reviewing and updating forecasts ensures they remain relevant and accurate. This practice allows organizations to respond promptly to deviations from expected financial performance.

Aligning Budgeting with Business Goals

Aligning budgeting processes with business objectives ensures that financial resources are effectively allocated to support strategic initiatives.

- Strategic Budgeting Practices: Incorporating strategic goals into the budgeting process ensures that financial planning supports the organization’s long-term vision. This alignment facilitates the prioritization of projects and initiatives that drive growth.

- Performance-Based Budgeting: Linking budget allocations to performance metrics encourages accountability and ensures funds are directed toward high-impact areas. This approach promotes efficient resource use and supports continuous improvement.

- Stakeholder Engagement: Involving key stakeholders in budgeting fosters transparency and buy-in. This collaborative approach ensures that budgets reflect various departments’ and teams’ needs and priorities.

4. Leadership and Team Management Skills

Financial controllers skills in businesses extend beyond technical proficiency to encompass robust leadership and team management capabilities. These competencies are vital for steering finance teams toward success and ensuring cohesive collaboration with executive leadership.

Guiding Finance Teams to Success

Financial leadership skills are essential for achieving organizational objectives. Controllers must cultivate an environment that fosters motivation, accountability, and professional growth.

- Establishing Clear Roles and Responsibilities: Defining specific roles within the team ensures clarity and efficiency. When team members understand their responsibilities, they reduce overlap and enhance productivity. This clarity is essential for maintaining a streamlined workflow.

- Promoting Open Communication: Encouraging transparent and open lines of communication allows team members to express ideas, concerns, and feedback. This openness fosters trust and collaboration, leading to a more cohesive team dynamic.

- Providing Continuous Feedback and Support: Regular performance evaluations and constructive feedback help team members understand their strengths and areas for improvement. Offering support through mentorship and training opportunities contributes to individual and team development.

- Recognizing and Rewarding Achievements: Acknowledging individual and team accomplishments boosts morale and motivates continued excellence. Recognition can be formal, such as awards, or informal, like verbal appreciation during meetings.

Collaborating with Executives on Financial Strategies

Beyond managing internal teams, financial controllers must collaborate with executive leadership to develop and implement financial strategies that align with organizational goals.

- Translating Financial Data into Strategic Insights: Controllers analyze complex financial data and present it in a manner accessible to non-financial executives. They do so by providing valuable insights that inform strategic planning and resource allocation.

- Participating in Strategic Planning Sessions: Active involvement in executive meetings allows controllers to contribute their financial expertise to discussions on company direction, investments, and growth opportunities. Their input ensures that financial considerations are integrated into strategic decisions.

- Aligning Financial Goals with Business Objectives: Controllers ensure financial targets support broader business goals. This alignment facilitates cohesive strategies that drive organizational success.

- Facilitating Cross-Departmental Collaboration: Controllers work closely with other departments to integrate financial planning with operational activities. This collaboration ensures that all facets of the organization work toward common objectives.

5. Proficiency in Financial Technology and Automation

In the digital age, financial controllers skills must encompass a strong command of financial technology and automation tools.

Utilizing ERP and Financial Software

ERP systems and financial software are integral to modern financial management. They offer a centralized platform for managing various business processes, improving efficiency and data consistency.

- Centralized Data Management: ERP systems consolidate data from different departments, providing a single source of truth. This centralization reduces data redundancy and ensures that all stakeholders have access to up-to-date information.

- Process Automation: Financial software automates routine tasks such as invoicing, payroll, and reconciliations. Automation minimizes manual errors and frees up time for controllers to focus on strategic activities.

- Real-Time Reporting: Modern ERP systems offer real-time reporting capabilities, allowing controllers to monitor financial performance continuously. This immediacy supports proactive decision-making and rapid response to financial issues.

Leveraging Data Analytics for Business Insights

Data analytics has become a cornerstone of financial strategy and decision-making, enabling controllers to extract actionable insights from vast datasets. By leveraging analytics, controllers can identify trends, forecast outcomes, and inform strategic planning.

- Predictive Analytics: Utilizing historical data to predict future financial trends allows controllers to anticipate challenges and opportunities. This foresight is crucial for effective budgeting and resource allocation.

- Performance Metrics: Analyzing key performance indicators (KPIs) helps controllers assess the organization’s financial health. Monitoring metrics such as cash flow, profit margins, and return on investment informs strategic adjustments.

- Risk Assessment: Data analytics tools can identify potential financial risks by analyzing patterns and anomalies. Early detection of risks enables timely mitigation strategies, safeguarding the organization’s financial stability.

6. Risk Management and Internal Controls

Risk management and internal controls are vital skills of a controller. These competencies ensure that organizations can identify potential financial threats and implement measures to mitigate them.

Identifying Financial Risks and Mitigation Strategies

Effectively managing financial risks requires a proactive approach to identify potential threats and develop strategies to address them. Controllers play a crucial role in this process, utilizing various techniques to anticipate and mitigate risks.

- Comprehensive Risk Assessments: Conducting risk assessments regularly allows controllers to identify vulnerabilities in financial processes. This includes evaluating market volatility, credit risks, and operational inefficiencies.

- Implementing Risk Mitigation Plans: Controllers develop and implement mitigation plans once risks are identified. These plans may involve diversifying investments, establishing contingency funds, or revising financial policies.

- Continuous Monitoring: Ongoing monitoring of financial activities ensures that risk mitigation strategies remain effective. Controllers must stay informed about changes in the financial landscape that could impact the organization’s risk profile.

Strengthening Internal Controls for Fraud Prevention

Robust internal controls are essential for preventing fraud and ensuring the accuracy of financial reporting. Controllers are responsible for designing and maintaining these controls to protect the organization’s assets.

- Segregation of Duties: Dividing employee responsibilities reduces the risk of fraudulent activities. For example, separating the roles of transaction authorization and record-keeping prevents unauthorized actions.

- Regular Audits and Reviews: Conducting periodic audits helps detect discrepancies and enforce compliance with financial policies. These reviews are vital for identifying weaknesses in internal controls.

- Implementing Control Activities: Establishing control activities, such as approval processes and access restrictions, ensures that financial transactions are conducted appropriately. These measures are integral to maintaining financial integrity.

The role of a financial controller demands more than just accounting expertise. From strategic planning to risk management and technology adoption, the financial controllers skills outlined in this guide are essential.

Ready to elevate your financial operations with expert leadership? Partner with NOW CFO to access experienced financial controllers with the essential skills to drive accuracy, compliance, and strategic growth.